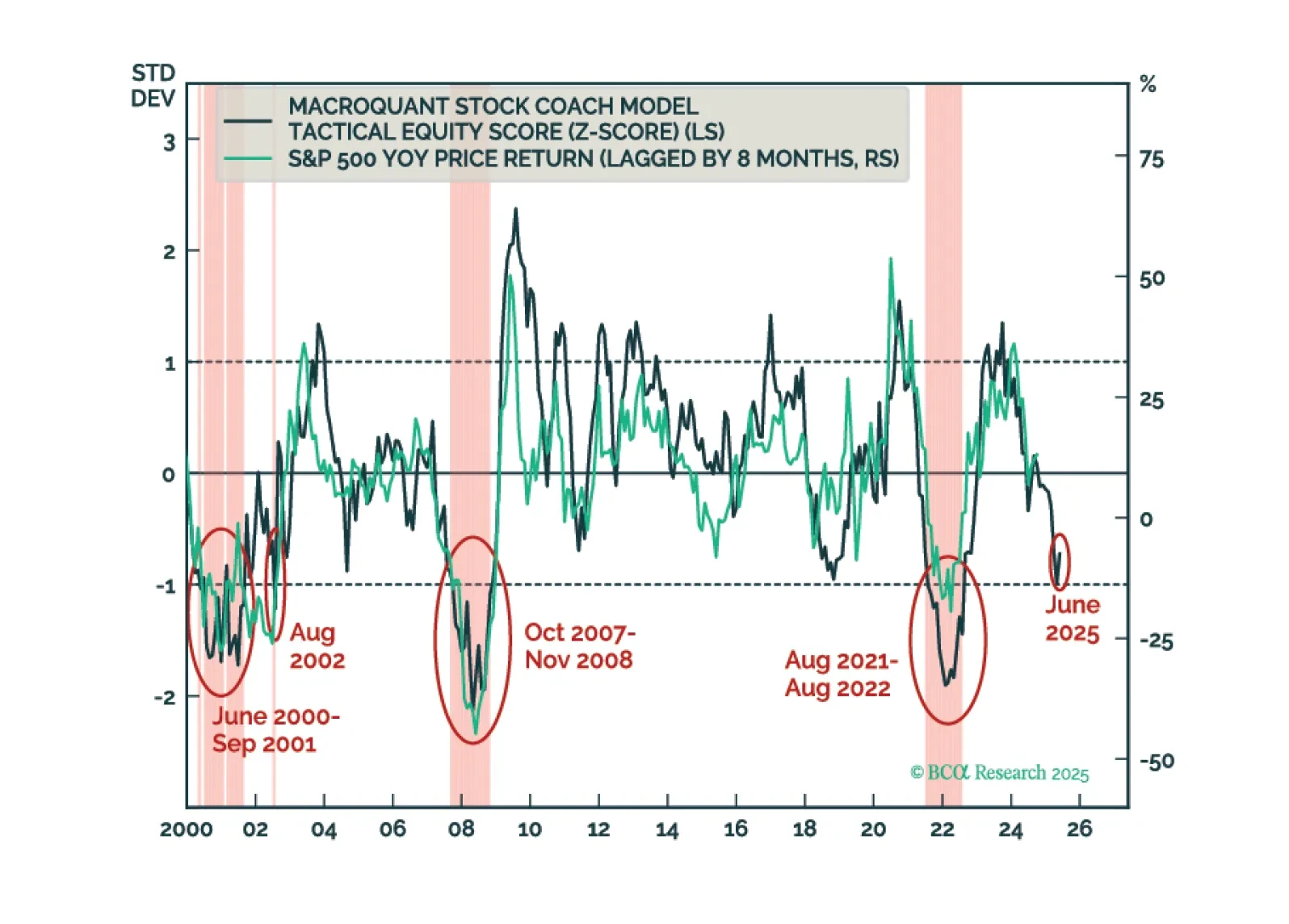

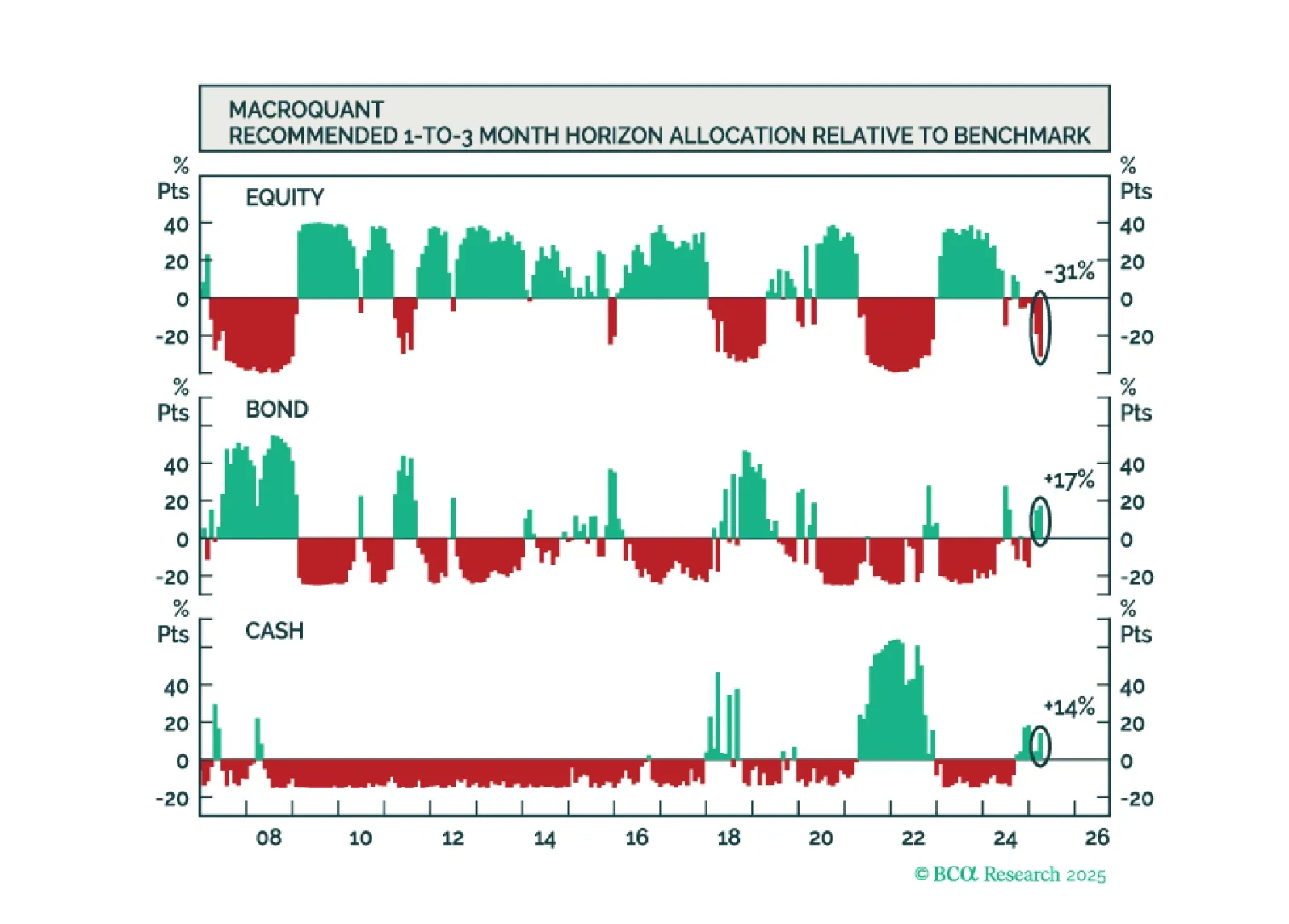

MacroQuant’s US equity z-score is dangerously close to the -1 threshold. Moves below that threshold have reliably coincided with equity bear markets in the past. As such, MacroQuant recommends an underweight on stocks, offset by an…

Investors should modestly underweight equities in their portfolios and look to turn more aggressively defensive once the whites of the recession’s eyes are visible. We think that will happen within the next few months.

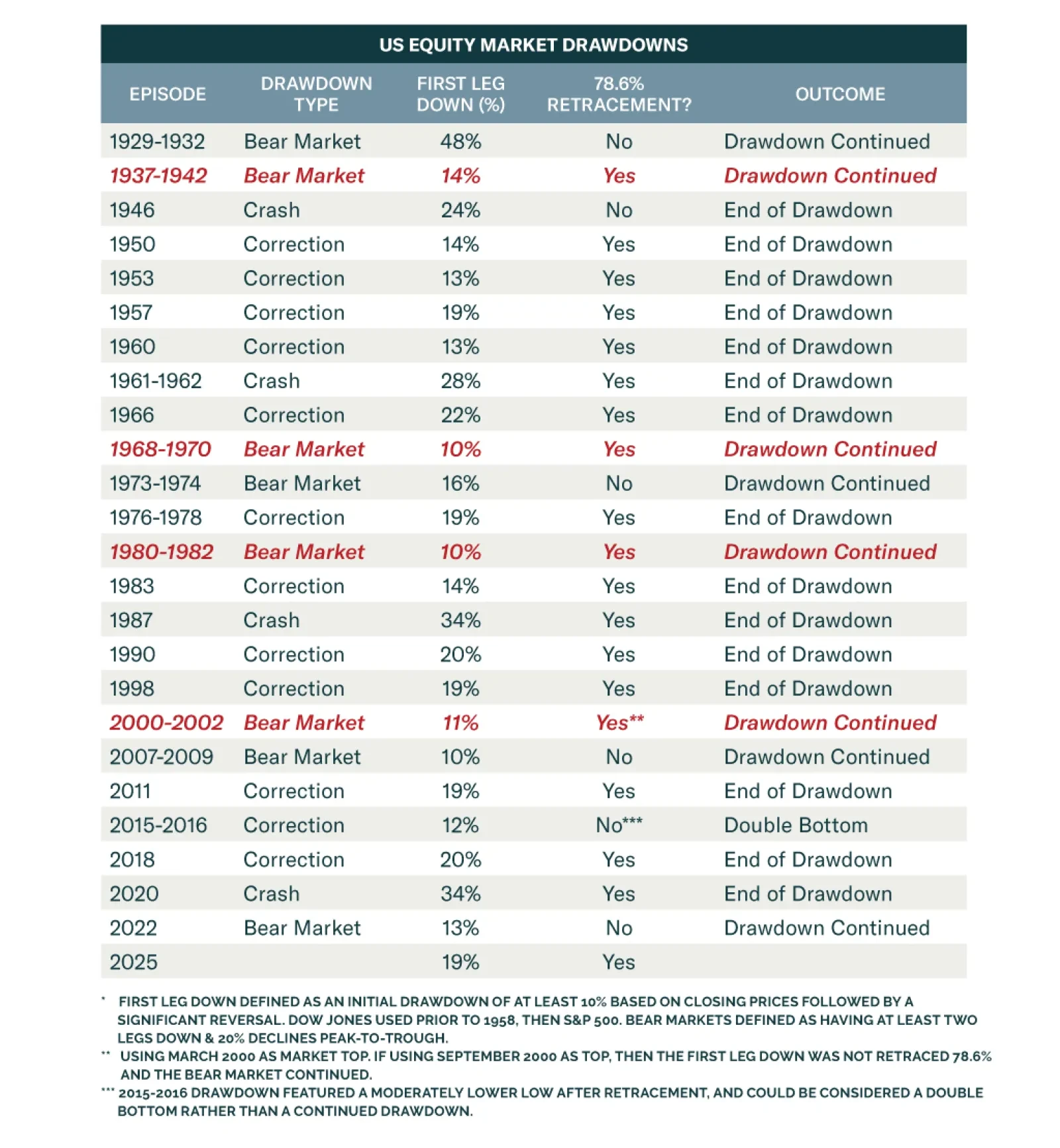

Despite a strong rebound in equities, we remain defensively positioned as recession risks persist and market history warns against premature optimism. The S&P 500 has retraced 78.6% of its initial drawdown, a level that typically…

Our Counterpoint Strategists see no signs of recession or market fragility but remain skeptical of US superstar stocks. Winners of past tech cycles rarely lead the next, making Web 2.0 firms unlikely beneficiaries of the AI-driven…

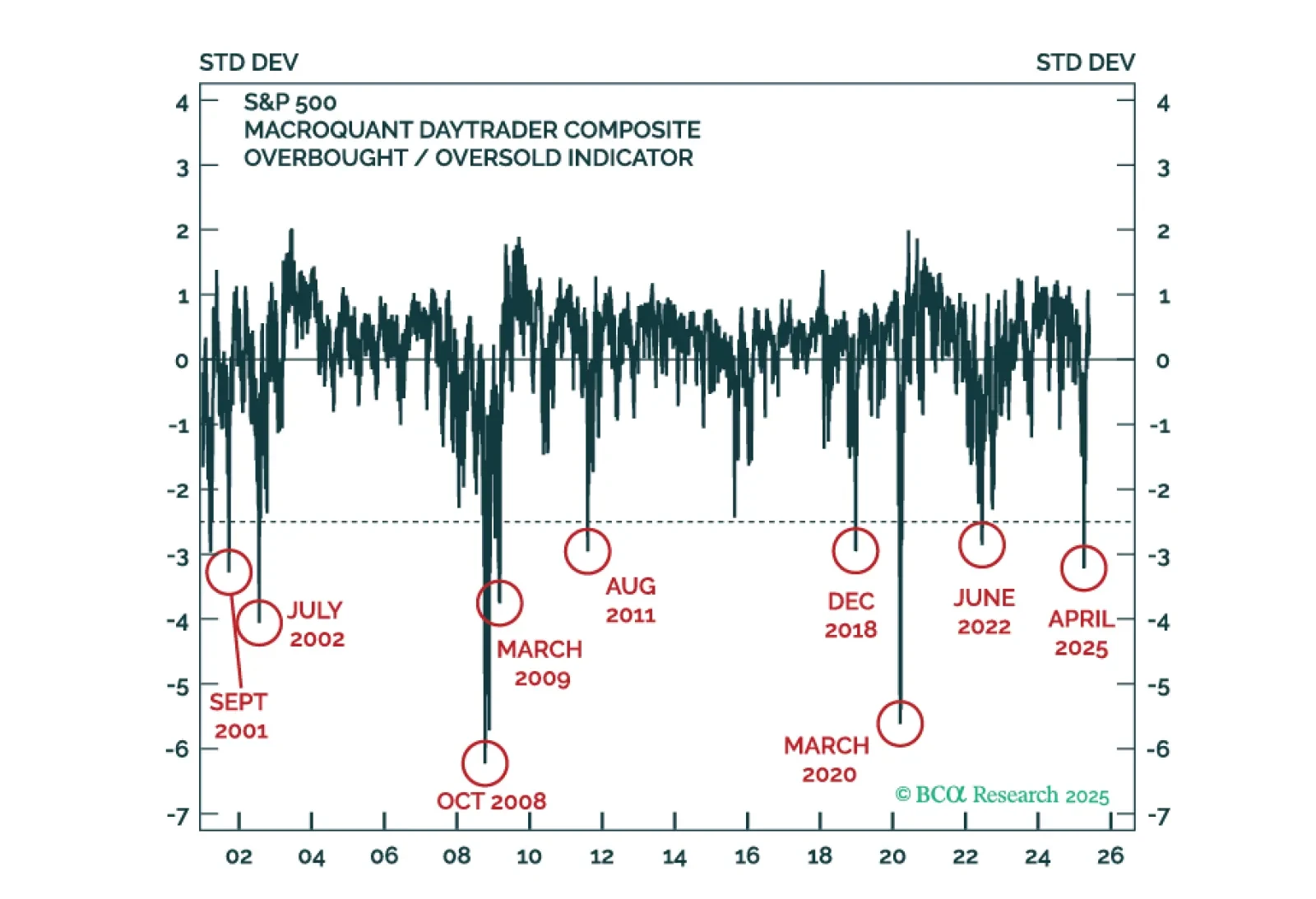

MacroQuant warns that US equities are pricing in very little economic risk. The model is shunning equities and recommends a large overweight to cash.

MacroQuant warns that US equities are pricing in very little economic risk. The model is shunning equities and recommends a large overweight to cash.

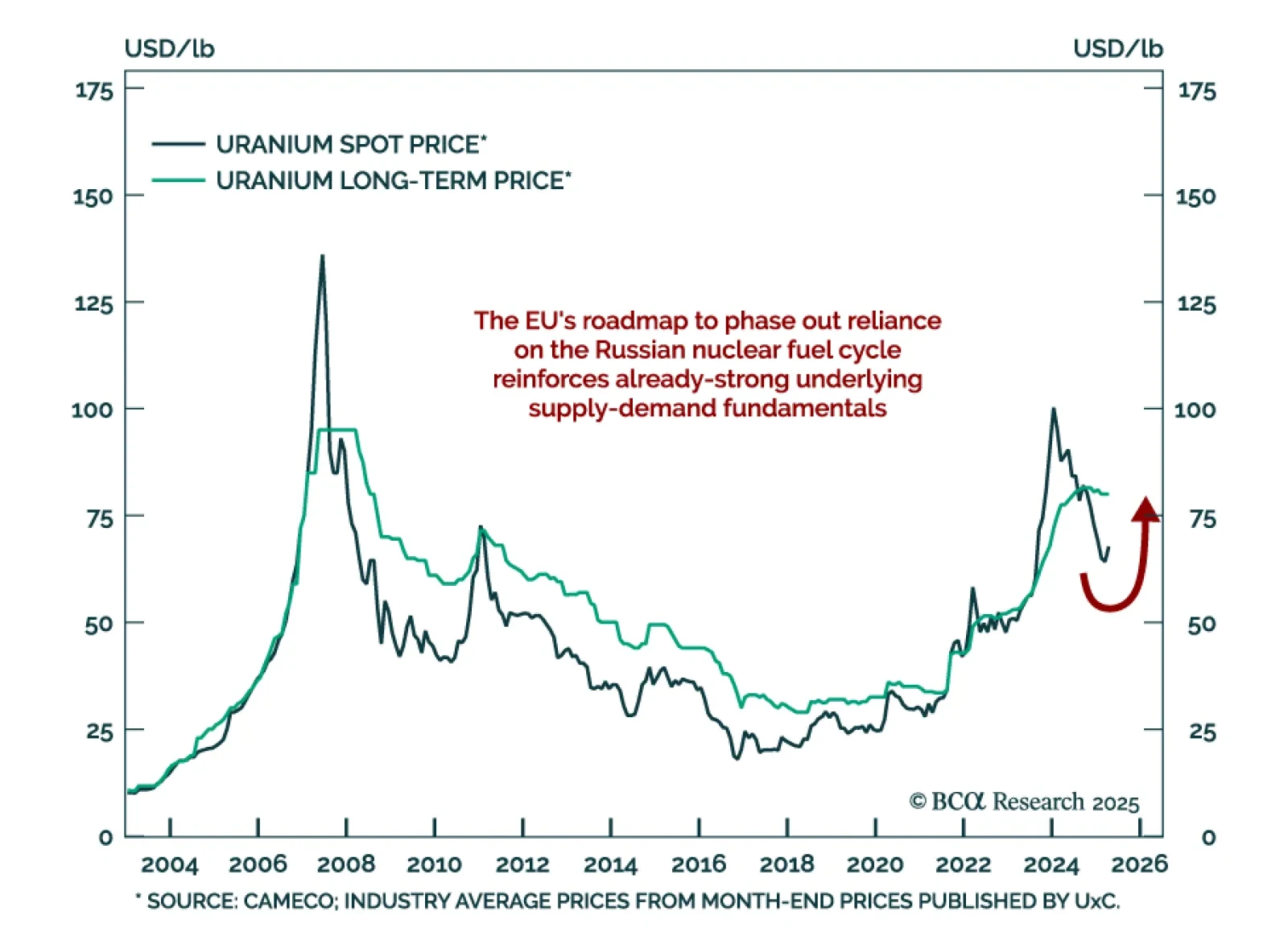

Uranium spot prices may have found a floor after falling to $64/lb from a $107/lb peak in February last year. This drawdown has been unexpected considering the strength of the underlying supply-demand fundamentals for uranium.…

MacroQuant sees the risks to US growth as being to the downside and the risks to inflation as being to the upside. Such a stagflationary brew justifies an underweight on stocks.

MacroQuant sees the risks to US growth as being to the downside and the risks to inflation as being to the upside. Such a stagflationary brew justifies an underweight on stocks.

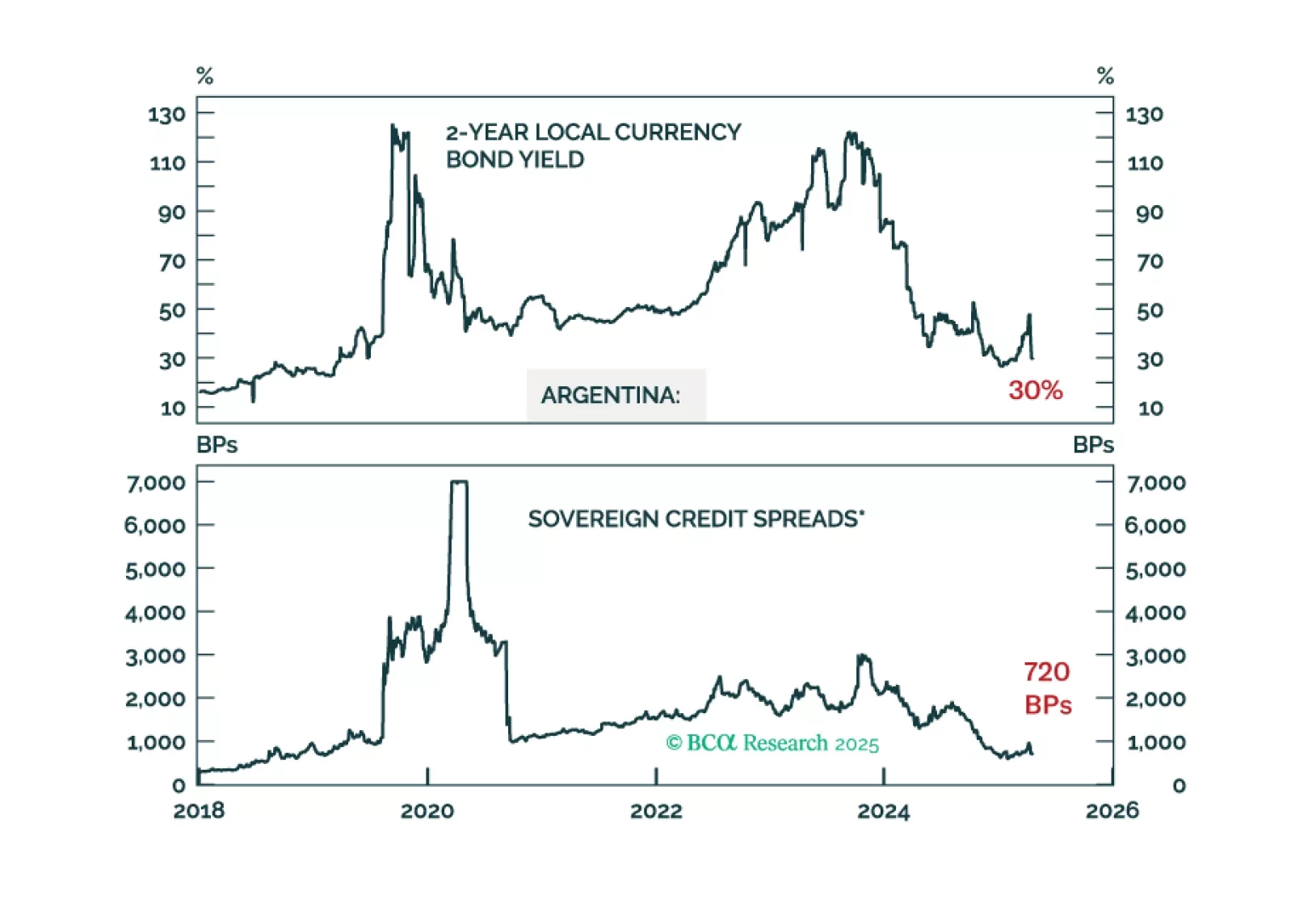

Amid the storm of global financial uncertainty, Argentina stands out as a free-market safe haven. The lifting of currency controls was the last step taken by this country to embrace market mechanisms. We recommend that investors buy…