In our May In Review Insight, we highlighted that last month, industrial metals generated the largest abnormal losses among the major global financial assets we track. This continues a downtrend that started at the beginning of…

The CCP is poised to roll out a re-boot of China’s economy that will focus on its comparative advantage in the processing of base metals – particularly copper – and the export of metals-intensive products like EVs. The re-boot will…

We expect the CCP to pivot toward more fiscal stimulus – and less credit stimulus – this year, which will put a bid under energy and metals prices. On the back of this view, at tonight’s close we are getting long 4Q23 Brent futures…

After a decade of underperforming palladium, platinum prices have started regaining lost ground. While palladium prices have declined by 27% since the end of Q3, platinum prices are up 28%. Multiple forces are at play. Both…

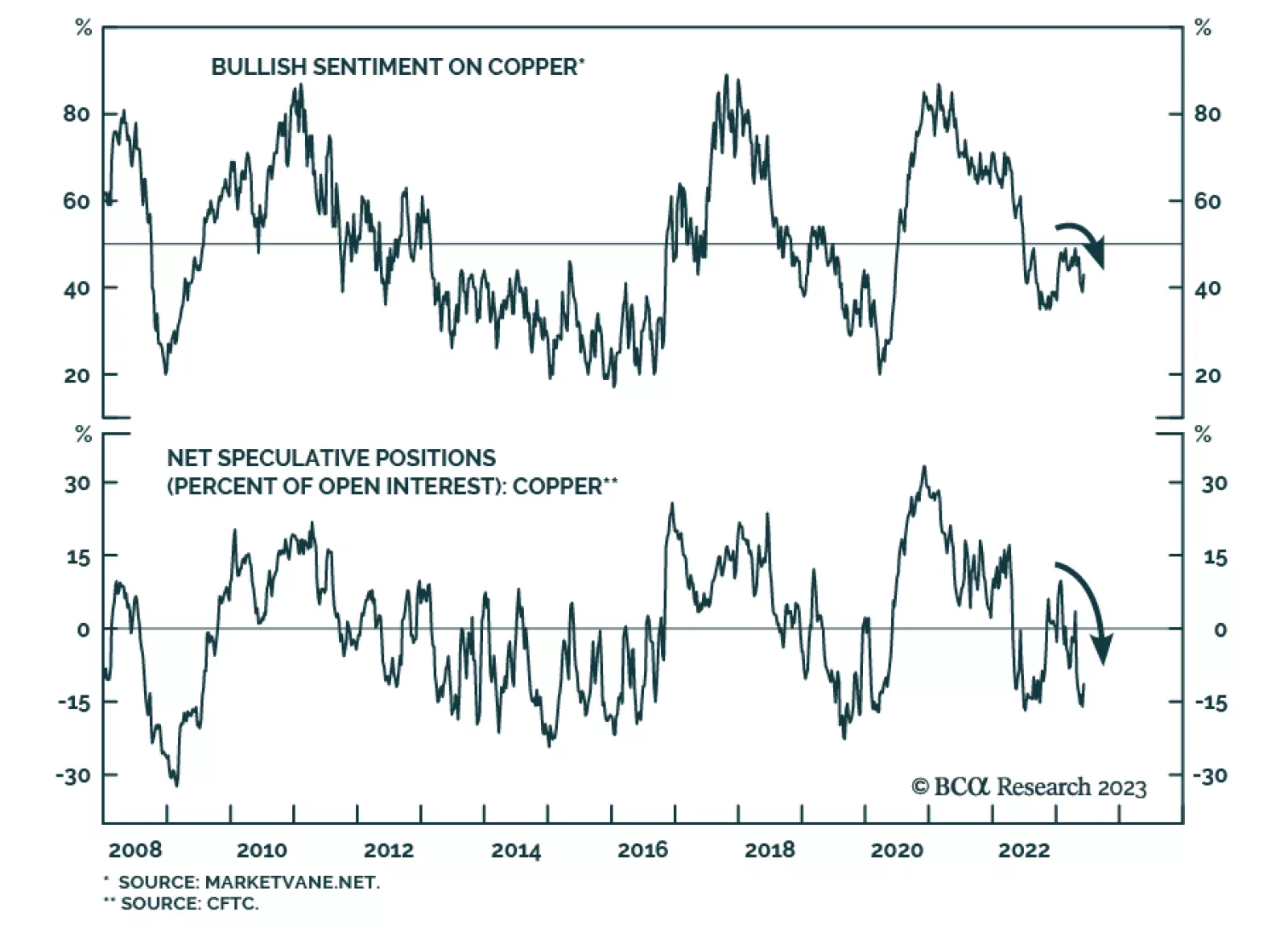

Tight monetary policy will suppress copper capex. Loose fiscal policy, which is lavishing stimulus on energy and defense firms, will stoke copper demand. Constrained copper supply and turbo-charged demand will feed into headline…

Stay defensive in the second quarter. We can see a narrow window for risky assets to outperform but we recommend investors stay wary amid high rates, supply risks, extreme uncertainty, peak polarization, and structurally rising…

In this Strategy Outlook, we present the major investment themes and views we see playing out for the rest of 2023 and beyond.

CCP officials are discussing policy options for breaking out of a deepening liquidity trap. Anything policymakers come up with will be additive to existing spending and to the multi-trillion-dollar fiscal-stimulus packages being…

The development of trading blocs and the rise of economic warfare will lead to the inefficient allocation of resources. Higher fiscal outlays and tight commodity supplies will feed into energy prices driving headline inflation. It…