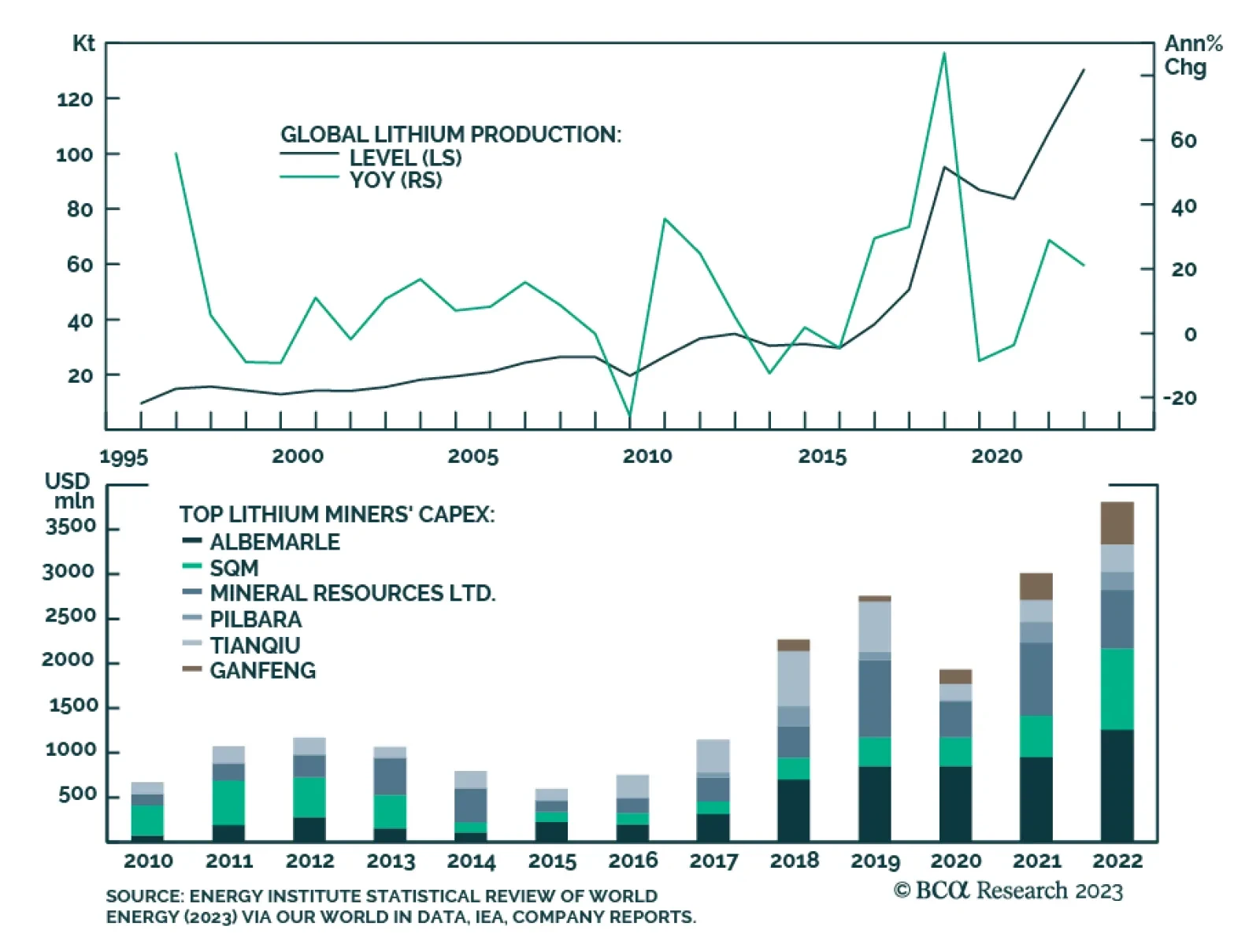

BCA Research's Commodity & Energy Strategy service concludes that lithium demand will rise over the long run. Lithium prices are continuing the selloff that began earlier this year, which was caused by strong…

China’s push to dramatically expand its copper-refining capacity will be complemented by further vertical integration of mining assets. However, surplus refining capacity will push treatment and refining charges lower in the short…

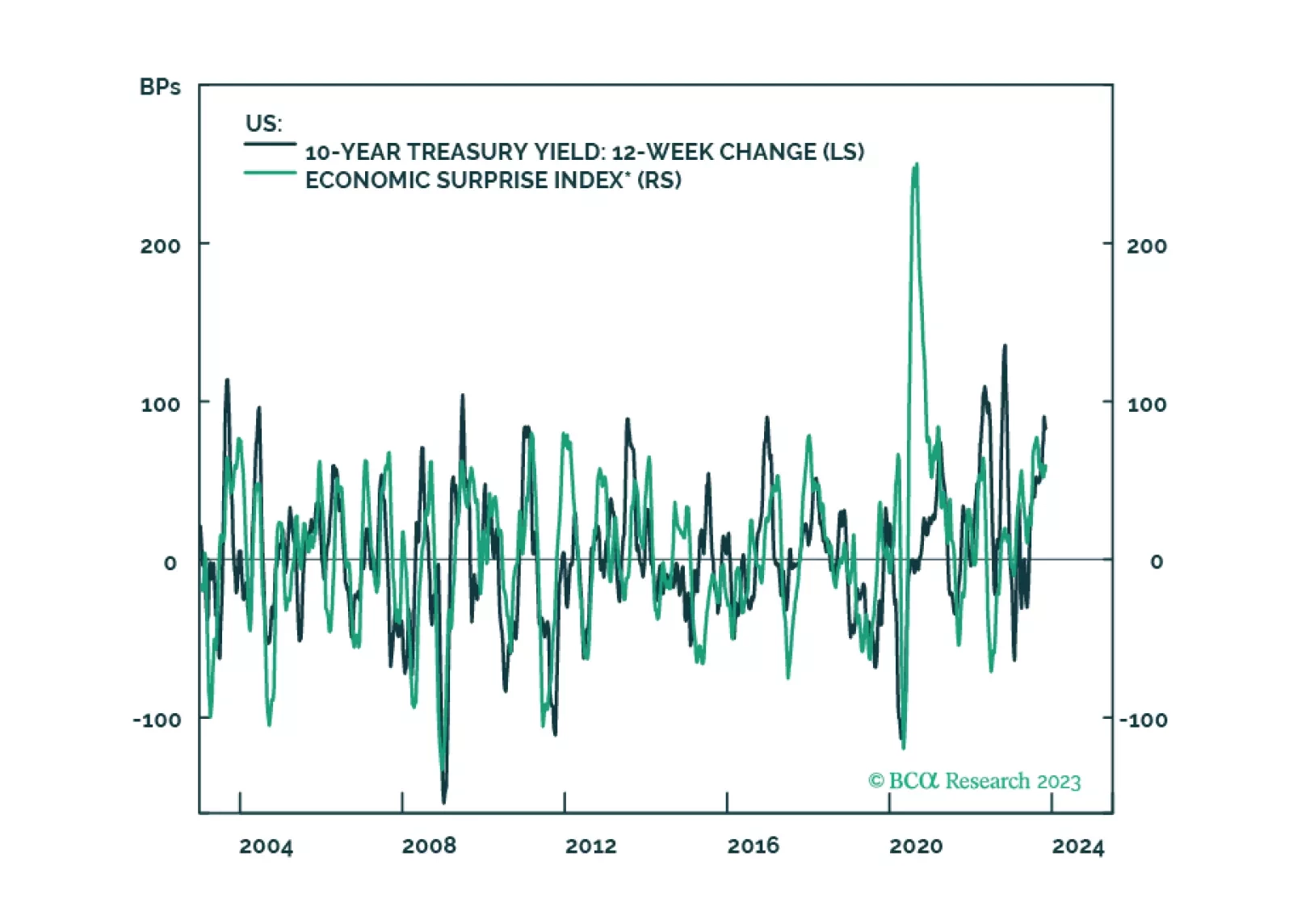

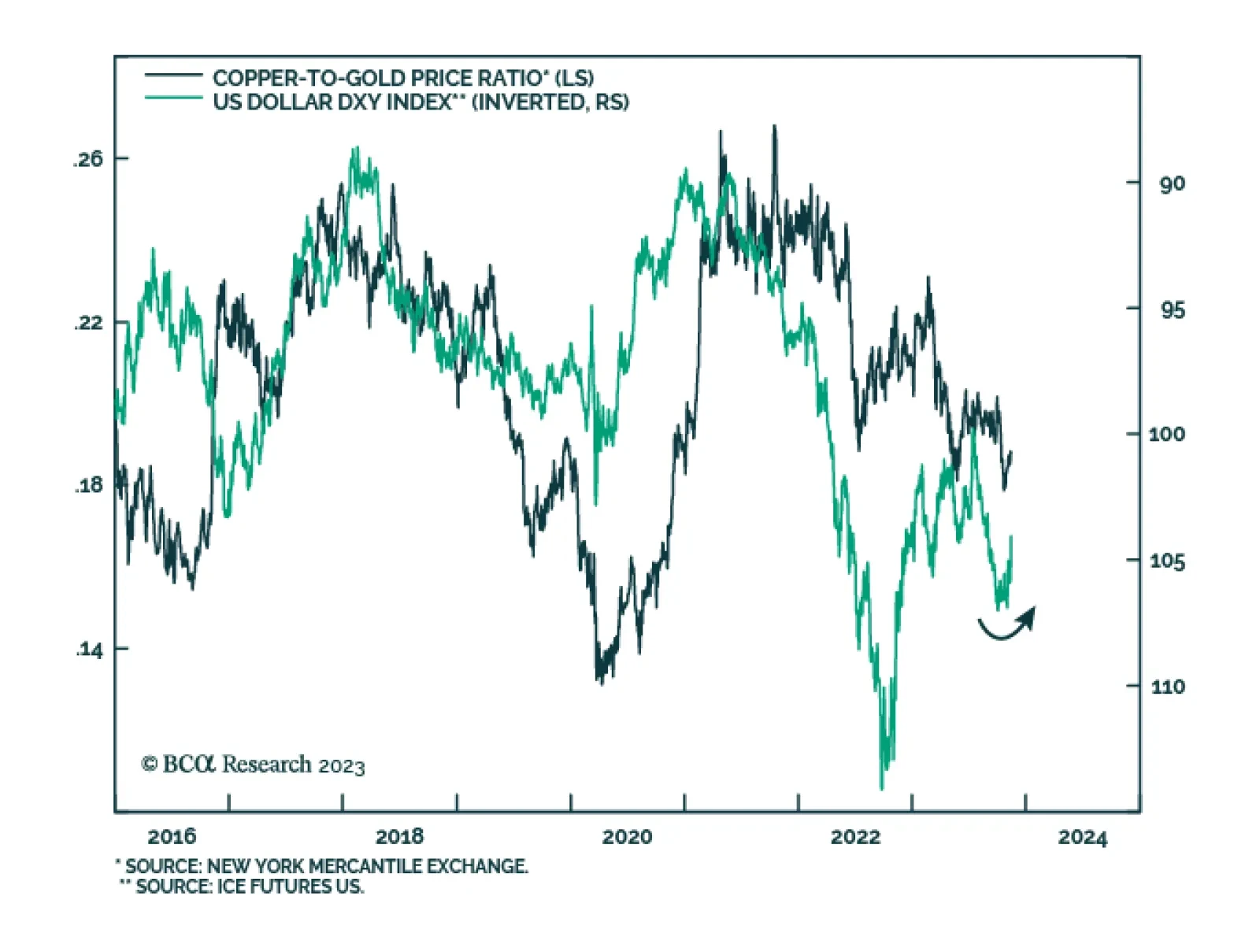

Throughout most of the second half of this year, the copper-to-gold ratio has been relatively stable, gyrating within a tight range. However, it is starting to show some tentative signs of bottoming. After the copper-to-gold…

High interest rates will eventually cause growth to slow. Signs of stress are already starting to show. Stay cautiously positioned.

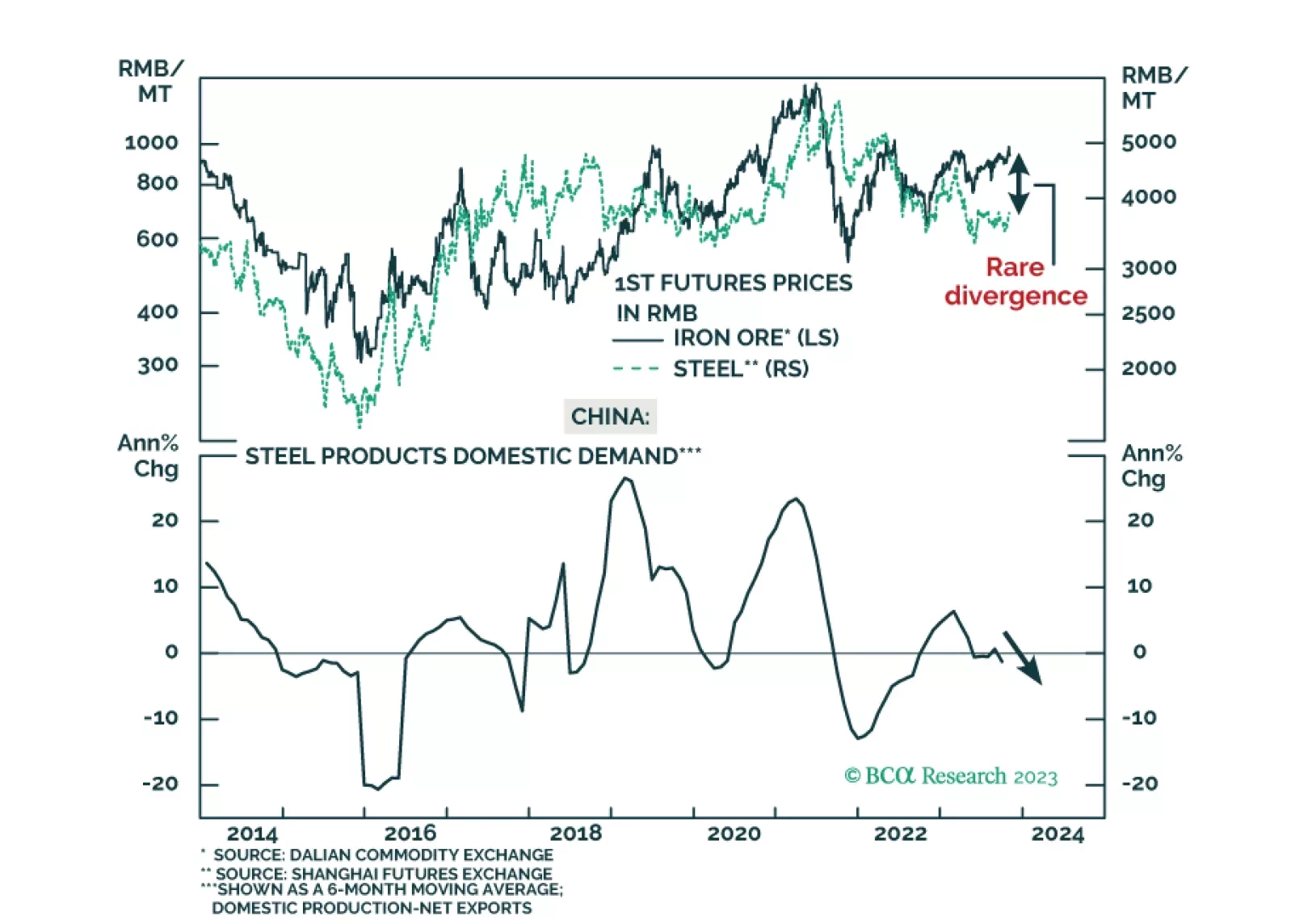

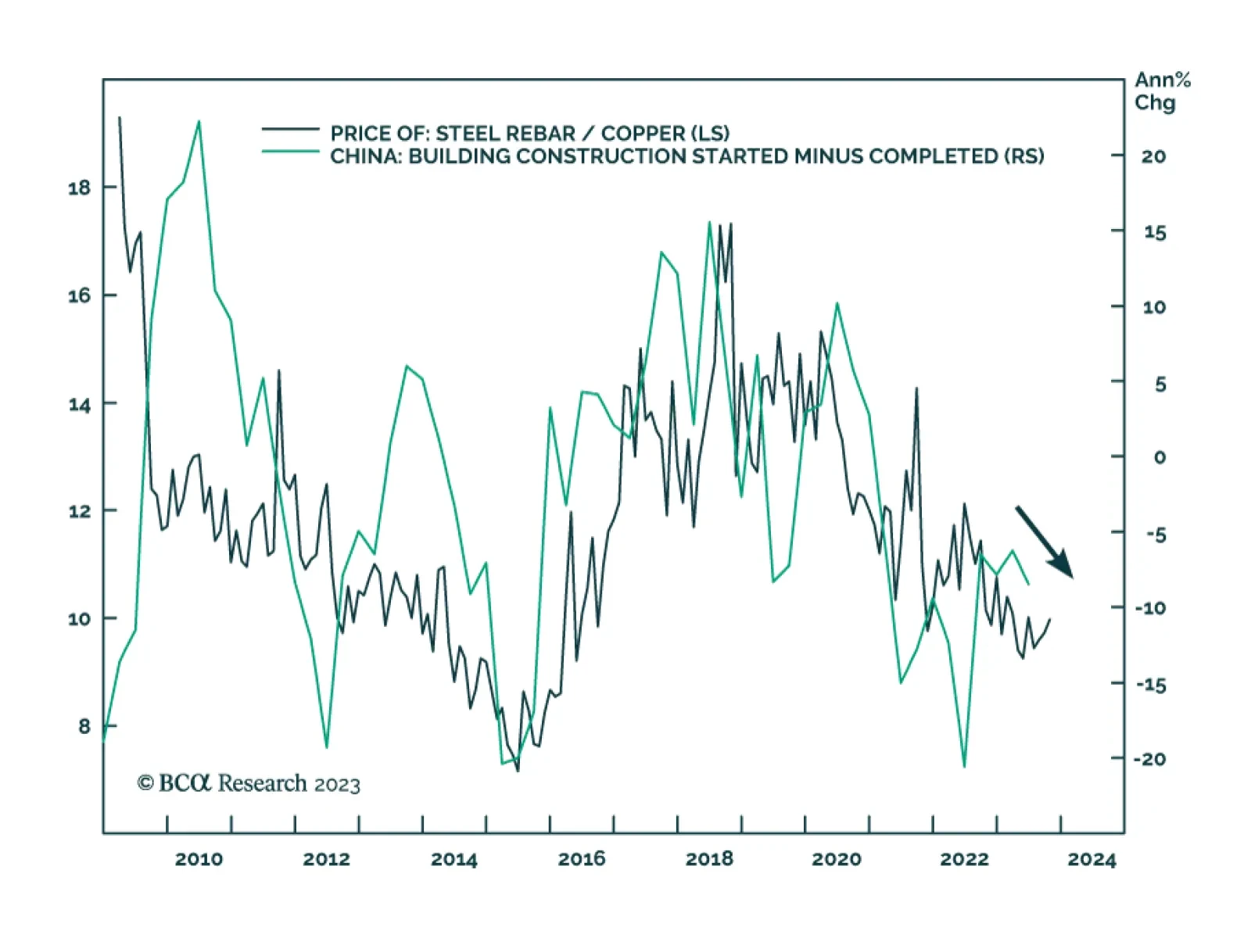

Earlier this year we highlighted that China's property market dynamics pose a greater risk to the price of steel vis-à-vis copper. This view was based on the expectation that Chinese policymakers will direct financing…

The market has been held hostage by surging rates. Zombie companies are “alive” and are multiplying – they are highly sensitive to surging borrowing costs. Underweight Utilities to reduce portfolio duration. Maintain neutral…

Aggressive monetary tightening has always led to recession, although the timing is uncertain. The effects of high interest rates are starting to be felt. Investors should stay risk off and buy government bonds as a safe haven…

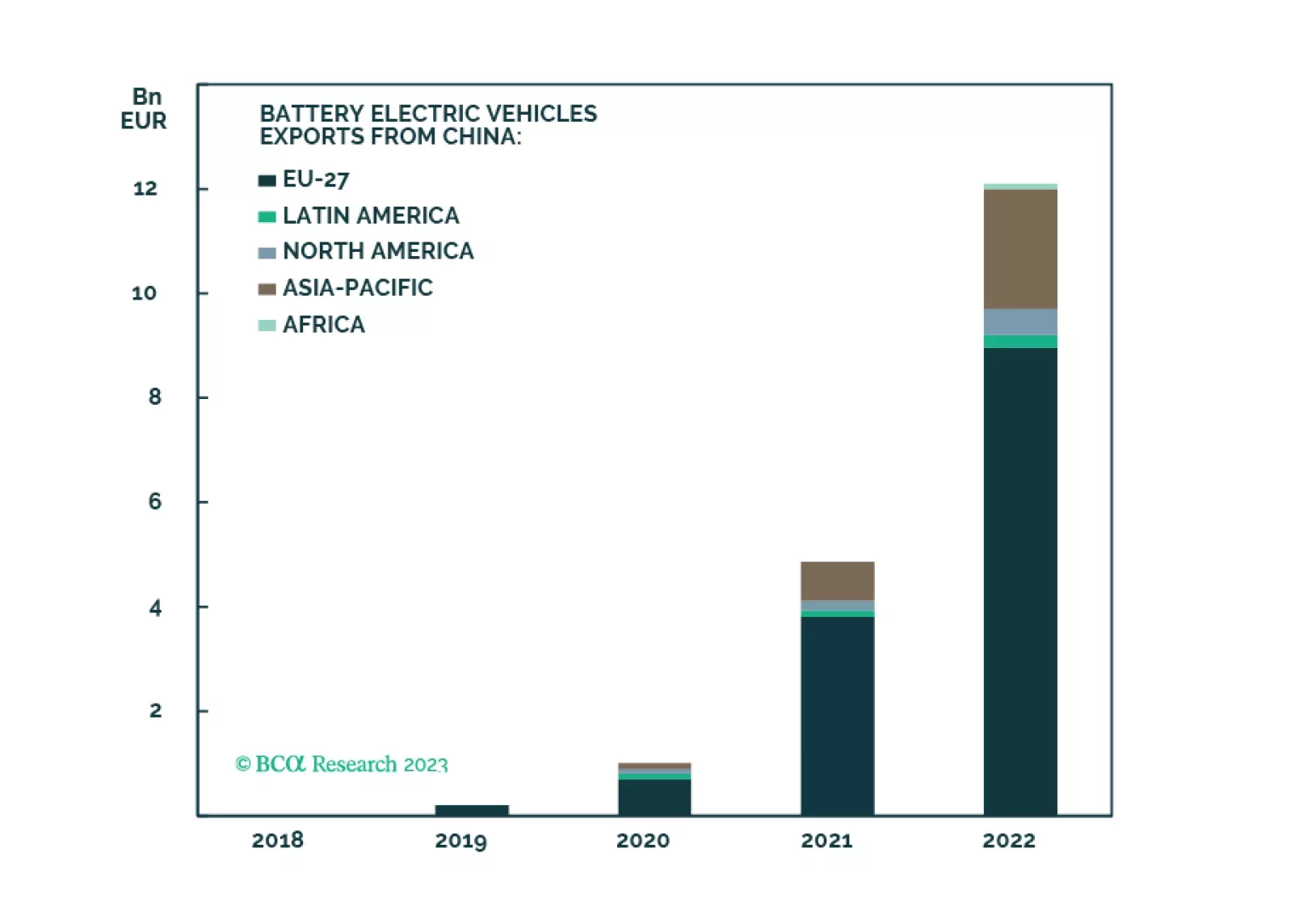

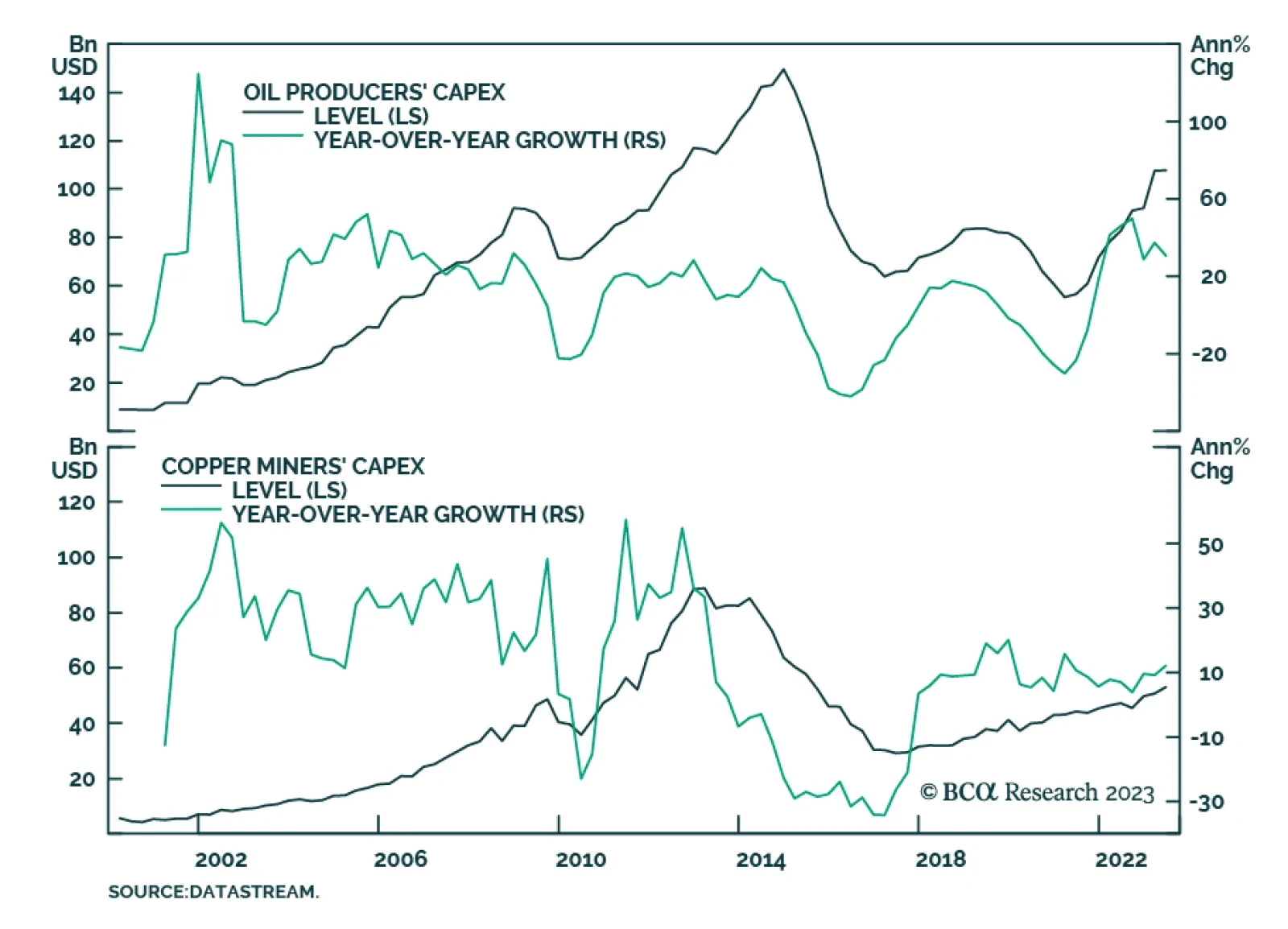

According to BCA Research’s Commodity & Energy Strategy service, the global energy transition will become more disorderly, if oil-and-gas capex growth continues to outpace that of critical minerals. The…

The global energy transition will become more disorderly, if oil-and-gas capex growth continues to outpace that of critical minerals. We remain long exposure to the equities of oil and gas producers via the XOP ETF; the COMT ETF to…