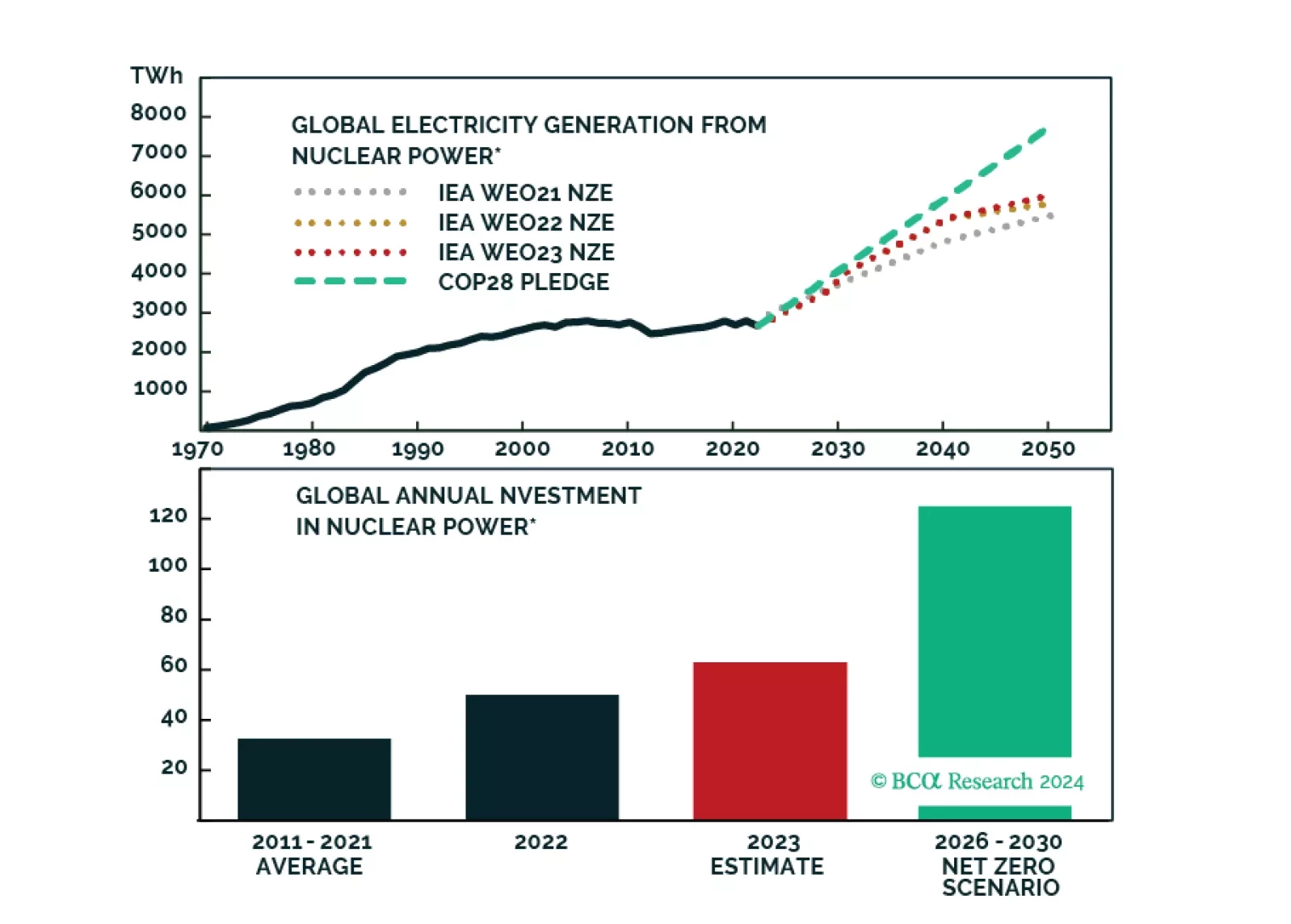

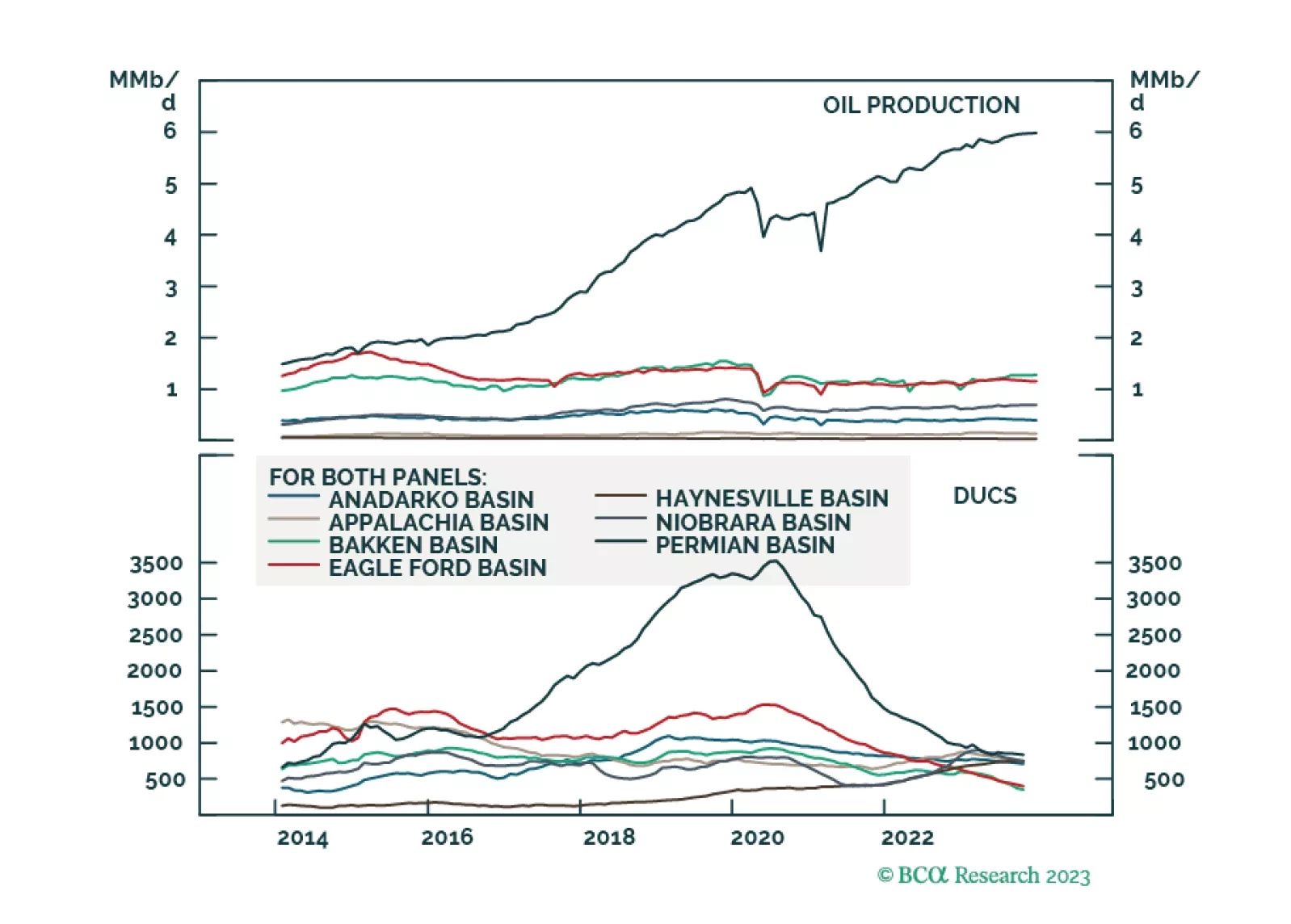

Supply and demand shocks in markets critical to the renewable-energy and defense industries will continue to play havoc with prices, which will negatively impact capex. In the short run, this benefits China given its already-dominant…

A recent slew of macroeconomic data has reassured us that the runway to a recession is longer than many thought. However, that positive realization comes with two caveats. First, the Fed pivot is not imminent, and the magnitude of…

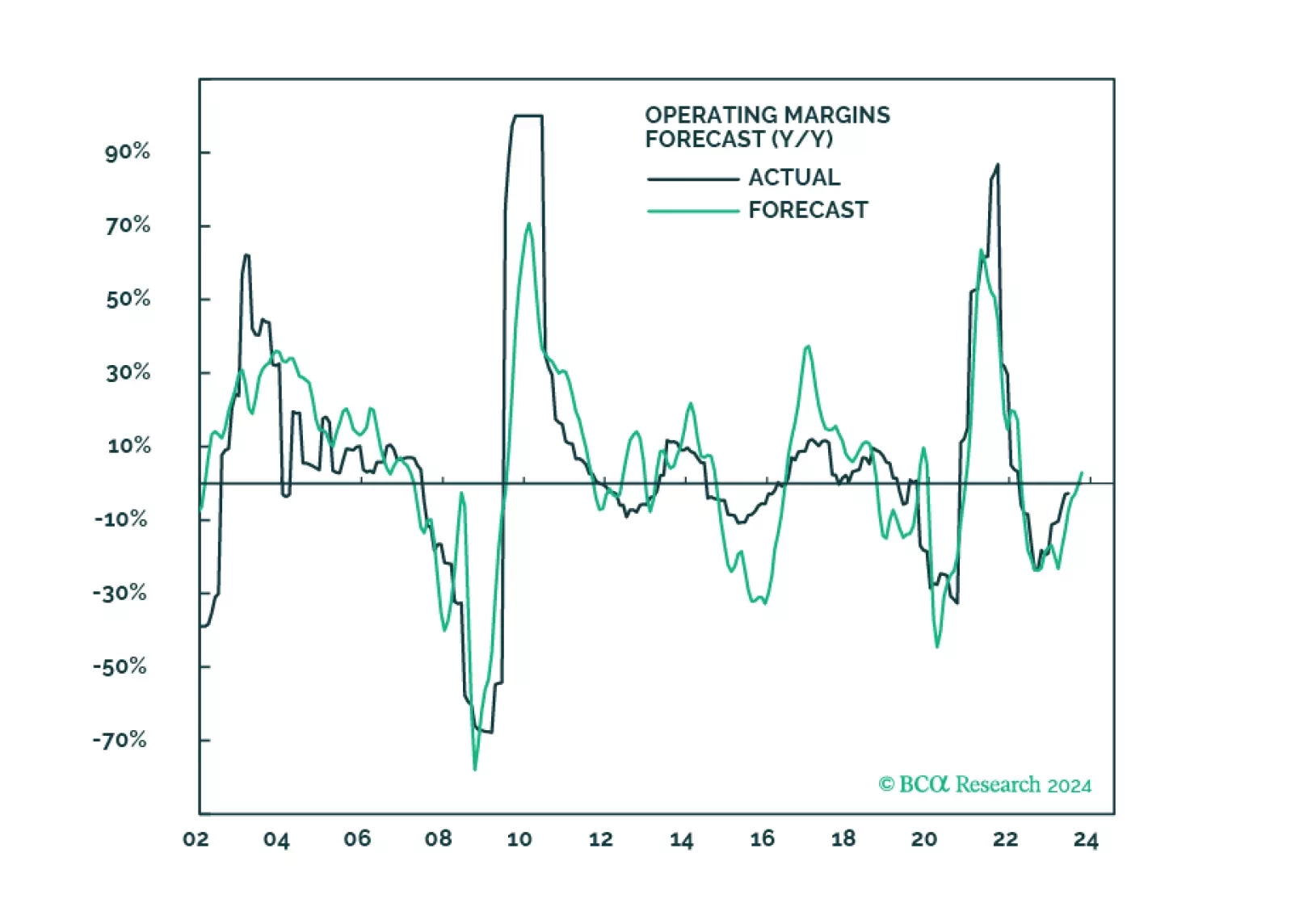

Disinflation coupled with sticky wage growth is likely to result in either a second wave of inflation or layoffs and a recession. In the meantime, market expectations for sales, growth, and margins are overly optimistic and are…

The commodity complex performed exceptionally poorly last year. Industrial metals and crude oil were among the few major financial assets we track that posted negative z-scores in 2023. Indeed, the 12% drop in the Golman Sachs…

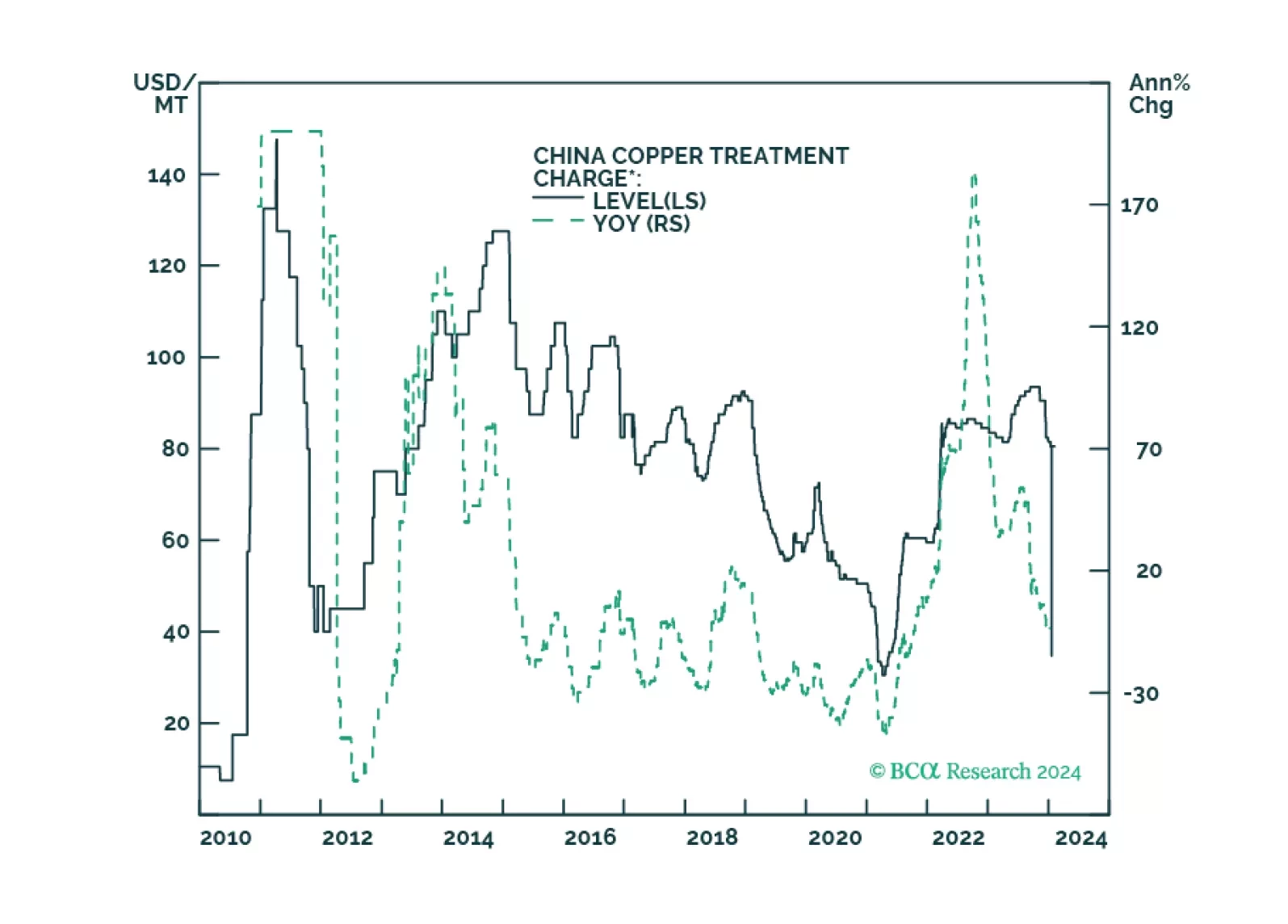

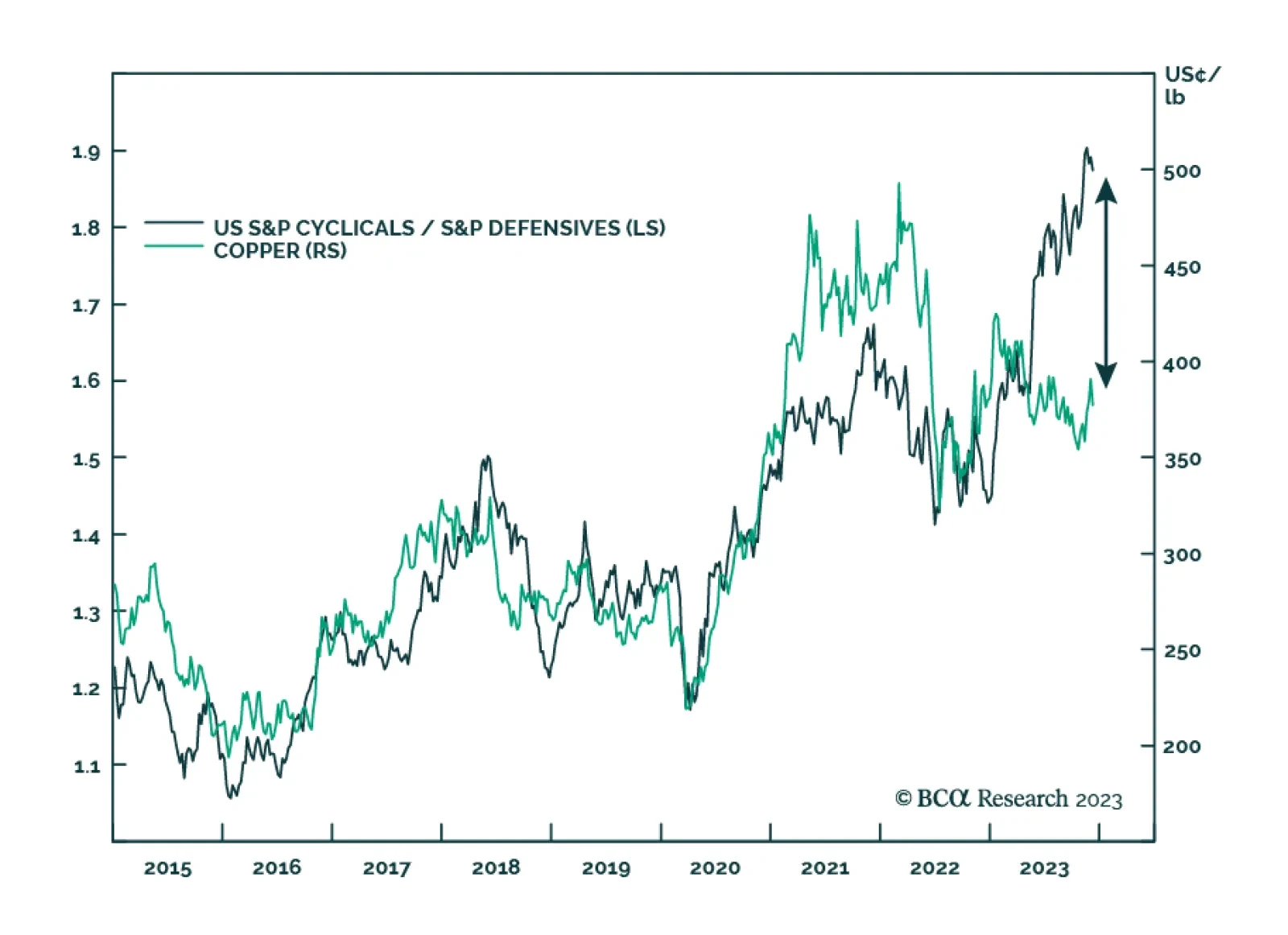

After rallying by 11.2% between October 5 and December 27, the price of copper has since been on a losing streak, falling in each of the subsequent six trading sessions. Notably, this decline has coincided with weakness among…

Copper benefited from the recent improvement in global risk sentiment, participating in the broad-based rally in November. To the extent that the red metal has vast applications across many economic sectors, it is…