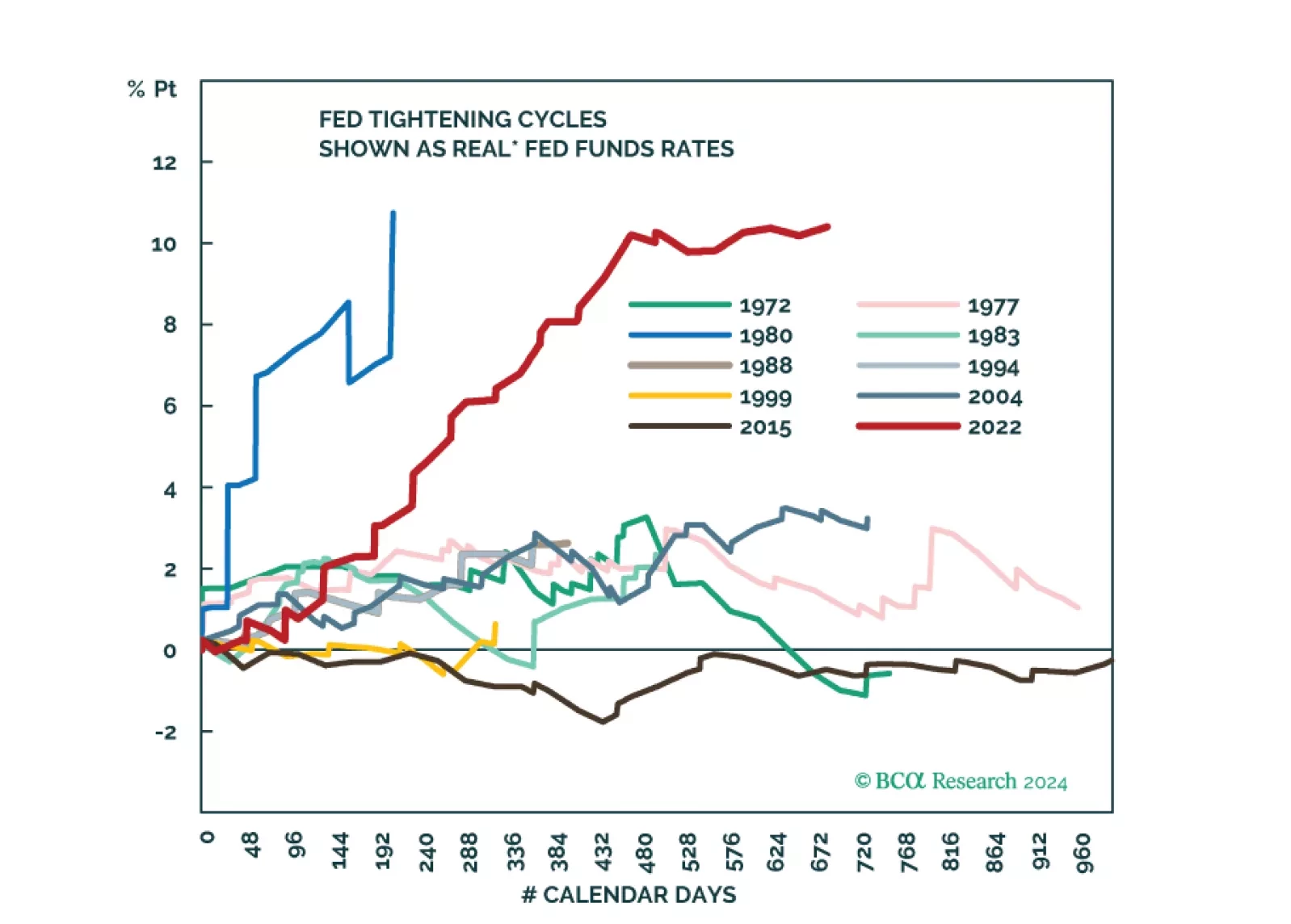

In this Strategy Outlook we examine why, contrary to popular perception, the odds of a global recession over the next 12 months are rising not falling.

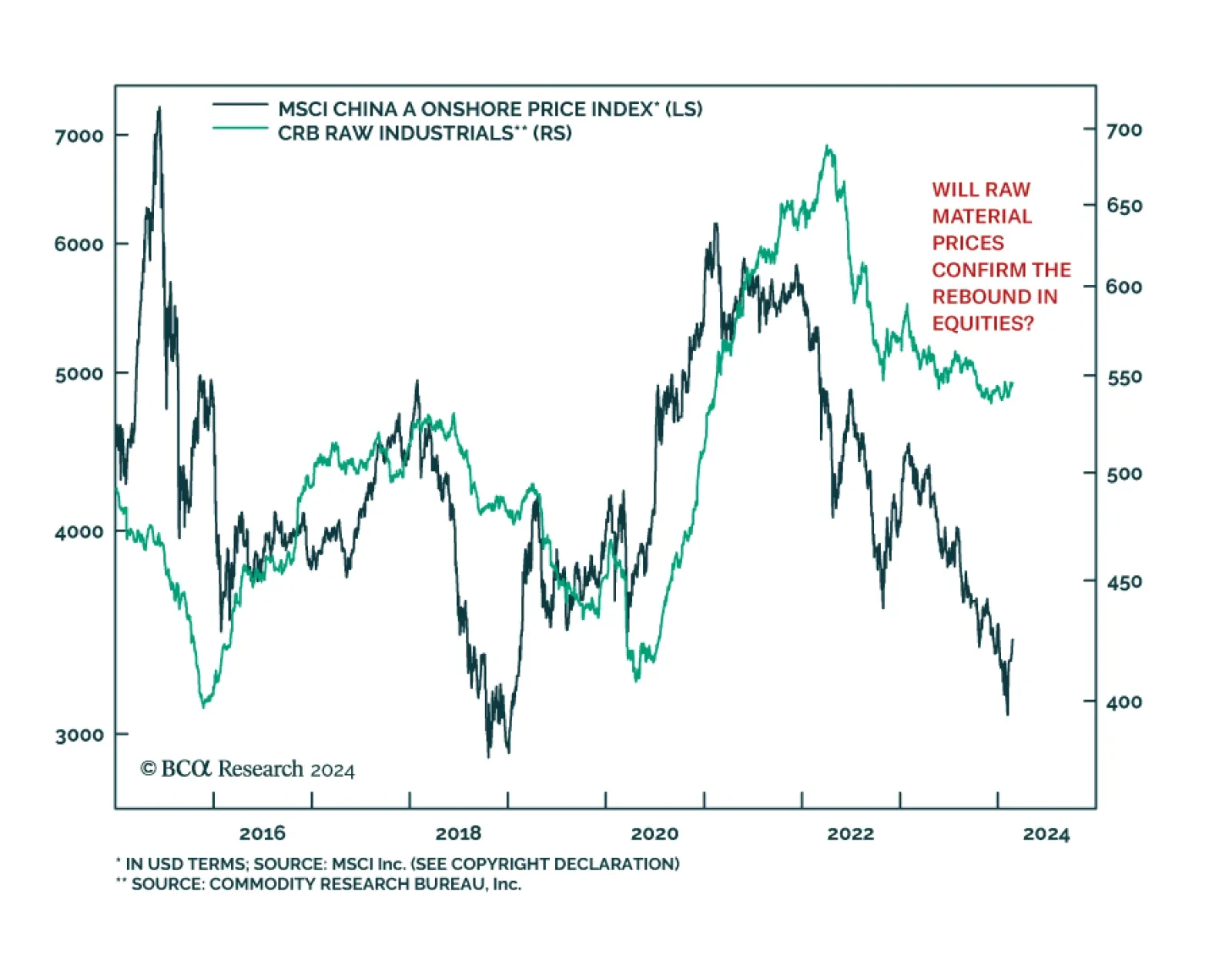

In a recent Insight we highlighted that the selloff in the price of iron ore – which is down 25.4% year-to-date – is sending a pessimistic signal on China’s economy, suggesting that the current rally in Chinese…

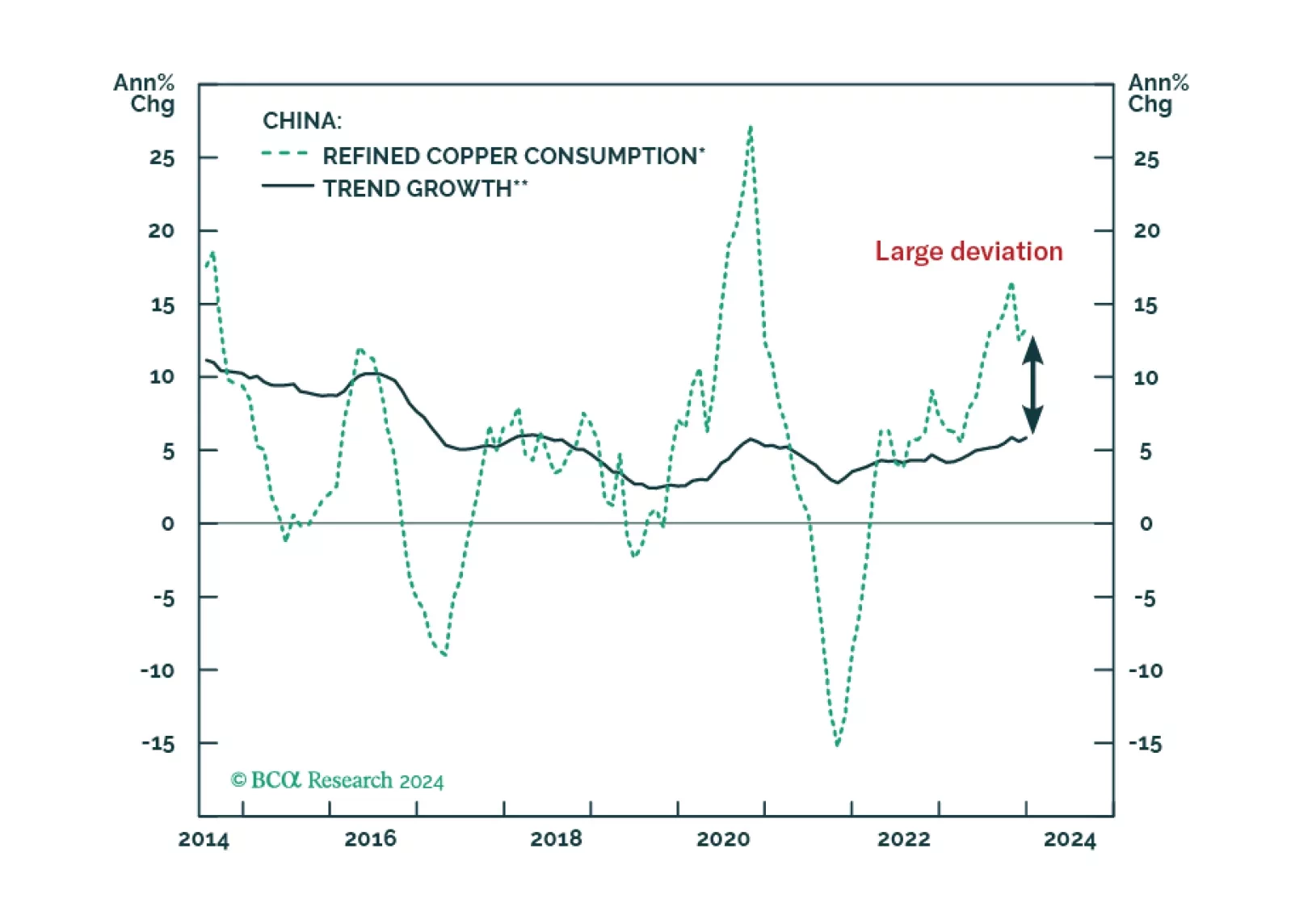

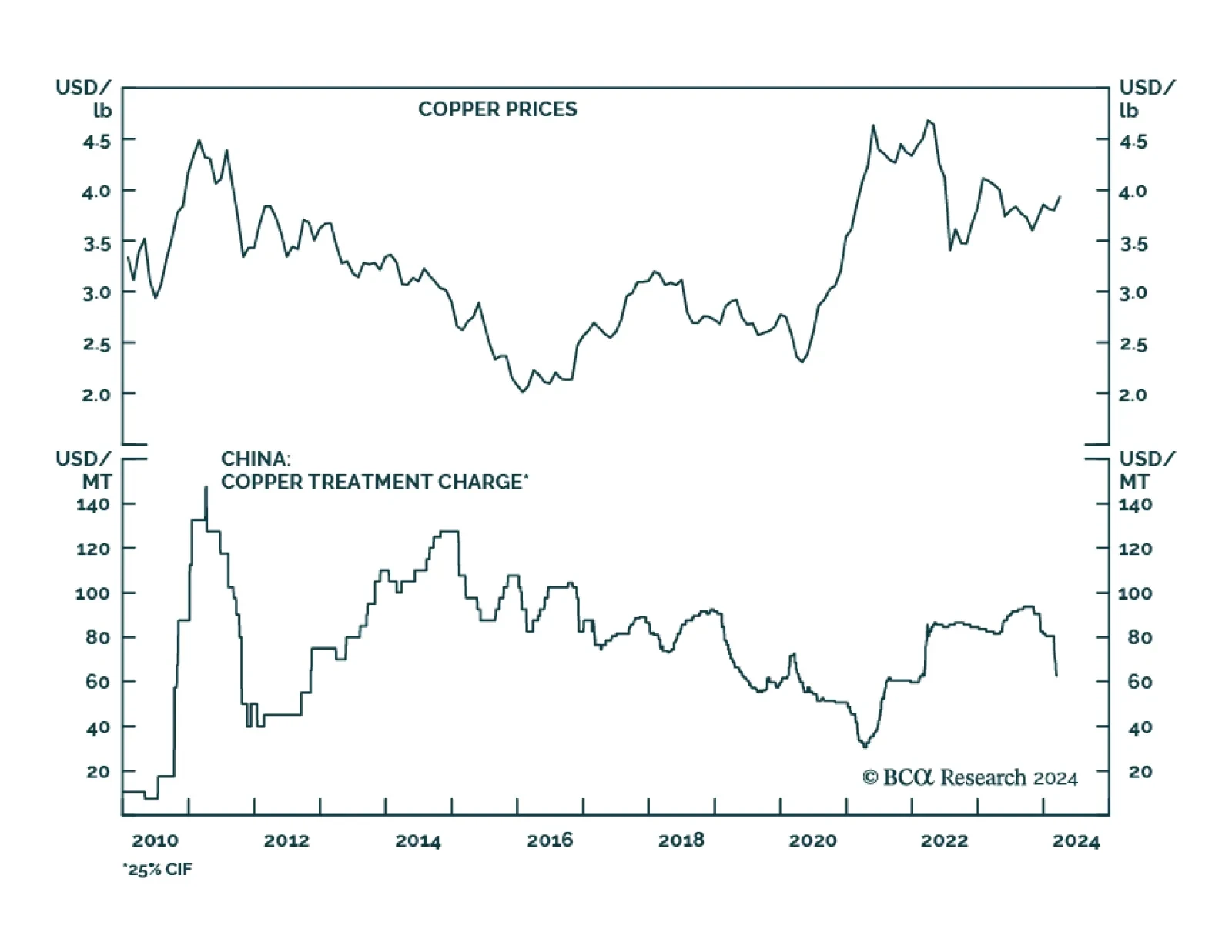

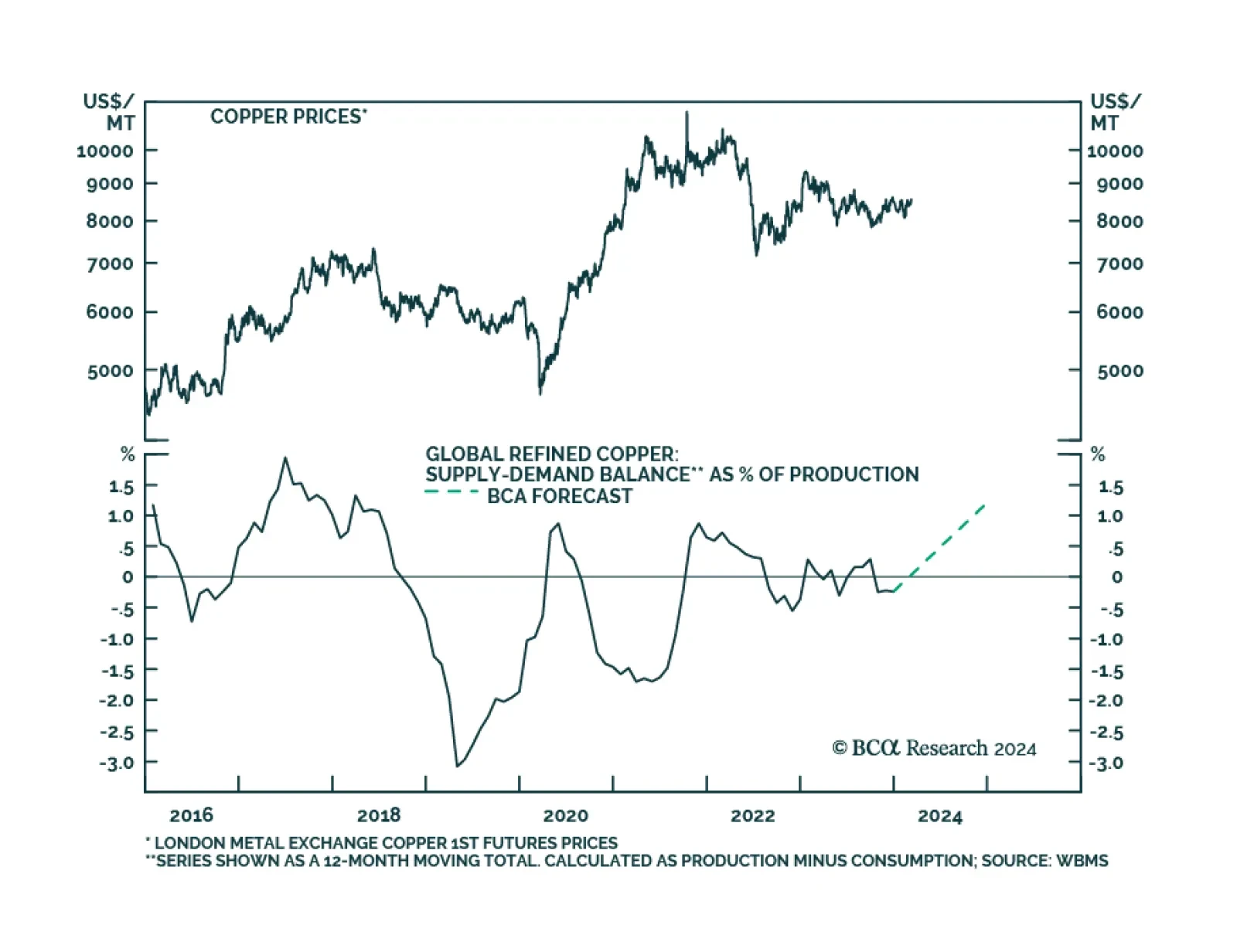

2023 was a year of mystery for the copper market. On the one hand, China’s copper intake boomed last year despite the travails of the mainland economy and shrinking property construction. On the other hand, global copper…

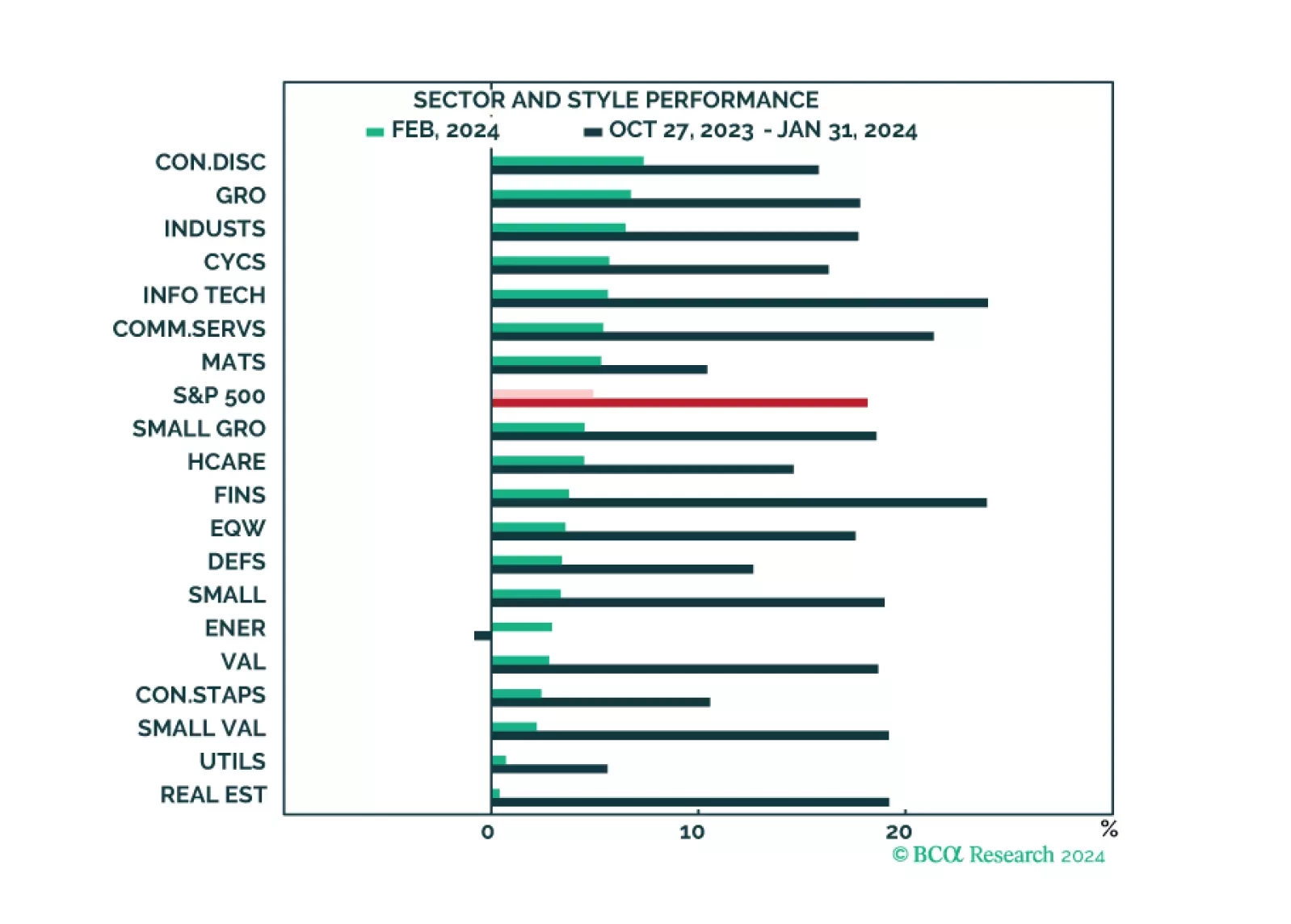

The market narrative continues to be dominated by the Magnificent Six, which drove both market performance and strong Q4 earnings results. While all sectors and styles have recently turned green, the rally is still mostly narrow.…

Amid patchy global growth, the US economy remains resilient. However, tight monetary policy will eventually trigger a recession in the US too. The stock market rally has been very narrow. Stay underweight risk assets.

While efforts by policymakers to stabilize the stock market are buoying Chinese equities, domestic economic data remains soggy. Home prices declined further on both a monthly and annual basis in January, reinforcing the…

Reported earnings for Q4-2023 were rather underwhelming and prone to issues that we have identified over the past few months: Growth is concentrated in just a few sectors and companies, while the profitability of a broad swath of the…

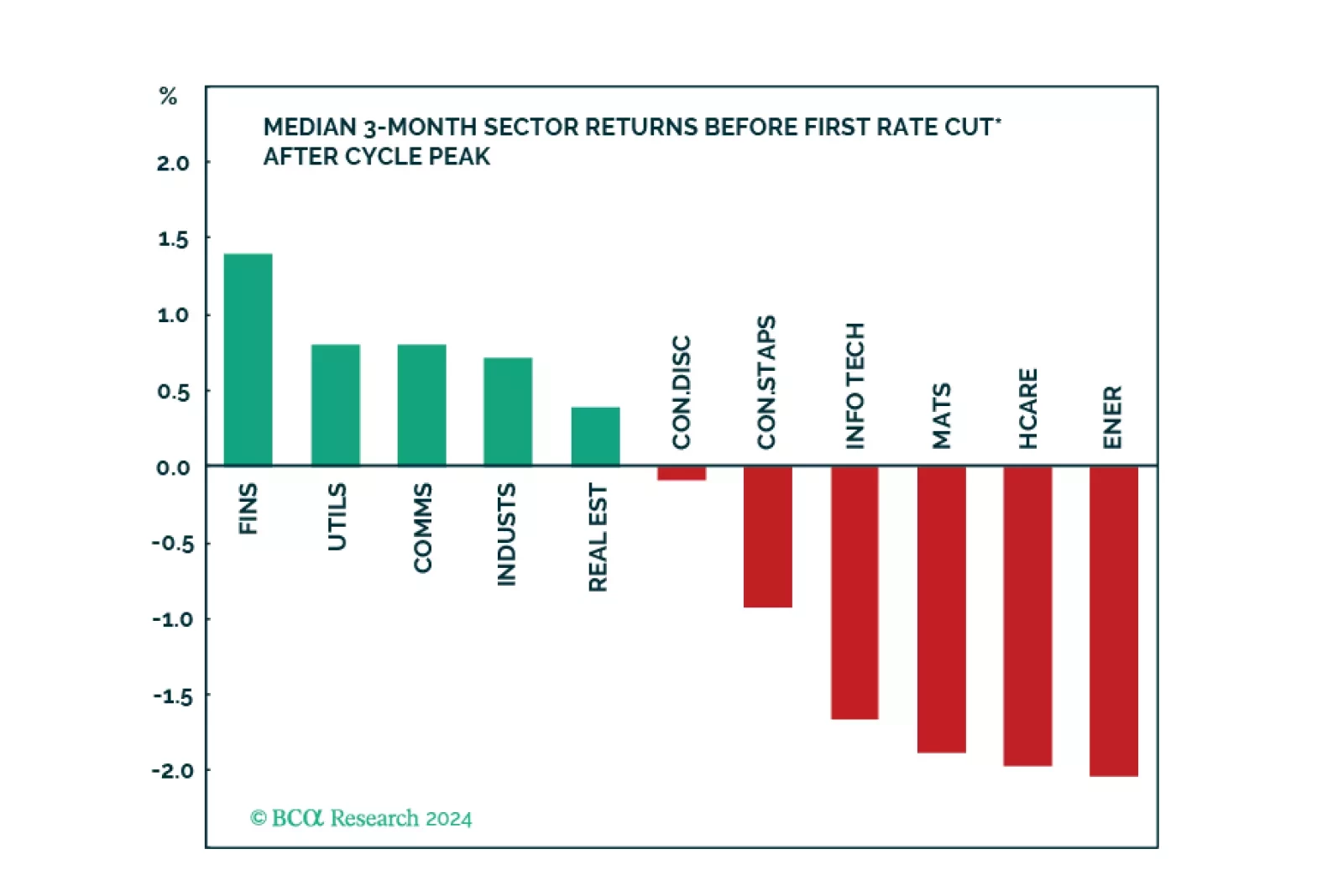

We created a sector selection scorecard based on performance of sectors under various macroeconomic regimes while taking into consideration revisions to expected earnings growth and valuations in a historical context. Our total…

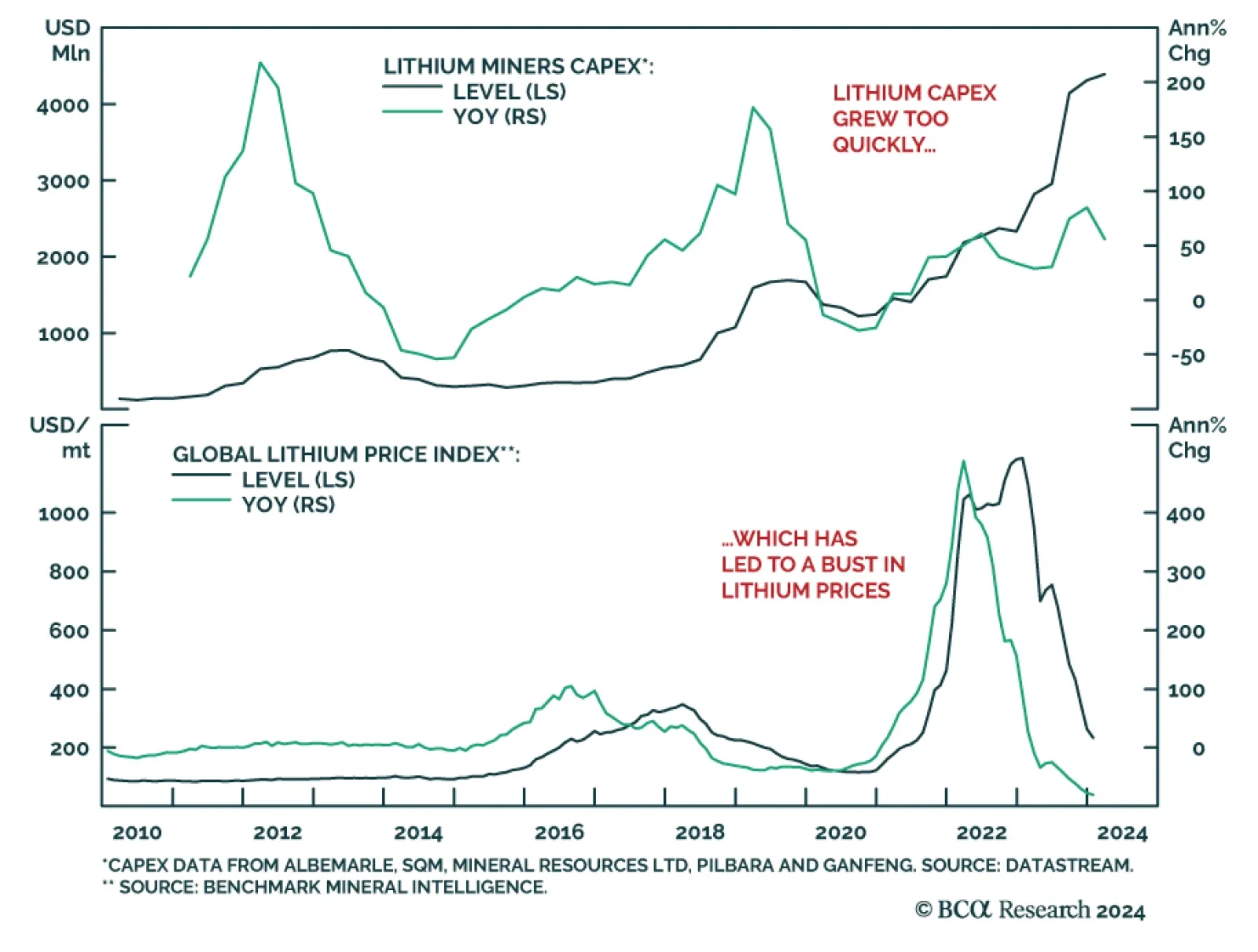

According to BCA Research’s Commodity & Energy Strategy service, after falling 80% over the past year, lithium prices will continue to trade lower. Lithium is critical for green technology and defense equipment,…