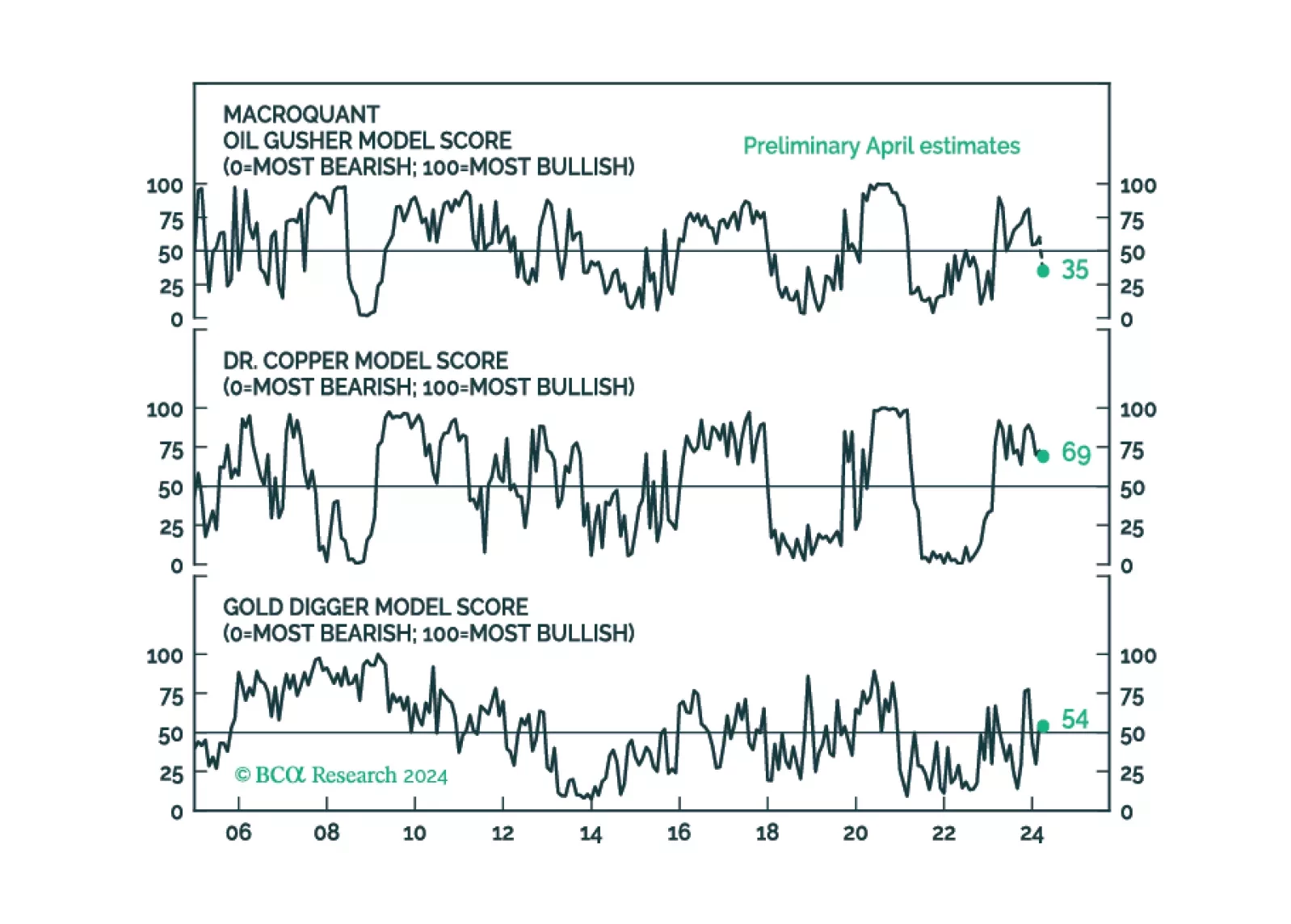

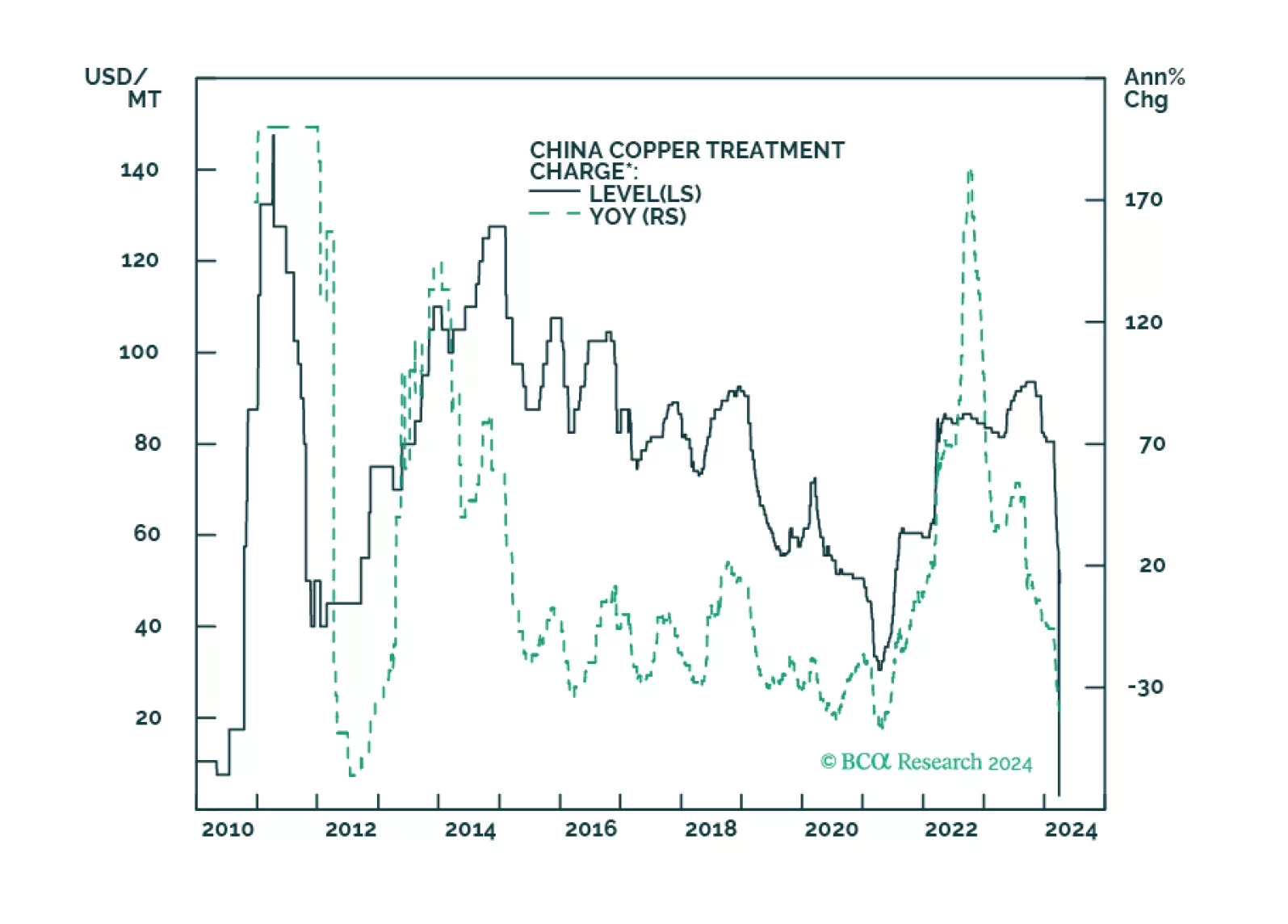

According to BCA Research’s Commodity & Energy Strategy service, the sudden increase in investor optimism about copper and lopsided long positioning has led to a short squeeze. Short squeezes are typically short-lived…

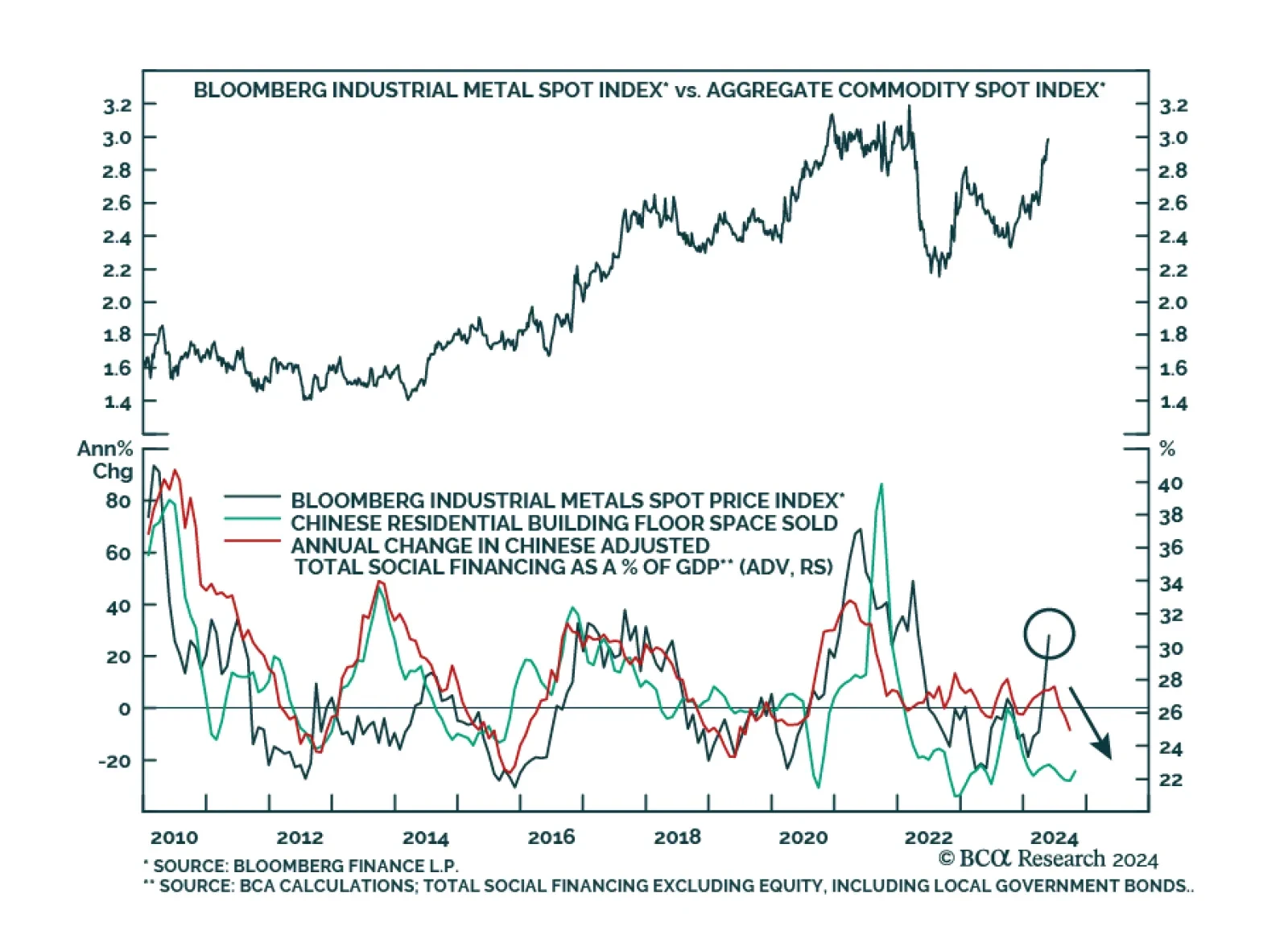

Industrial metals have outperformed the broad commodity complex this year and raced above the broad commodity complex even more meaningfully since the beginning of April. Our Commodity and Energy strategists have highlighted…

The death of the Iranian president reinforces our base case view of Middle Eastern instability and at least minor oil supply shocks. Rapid geopolitical developments in recent weeks are pointing to a new bout of global instability.…

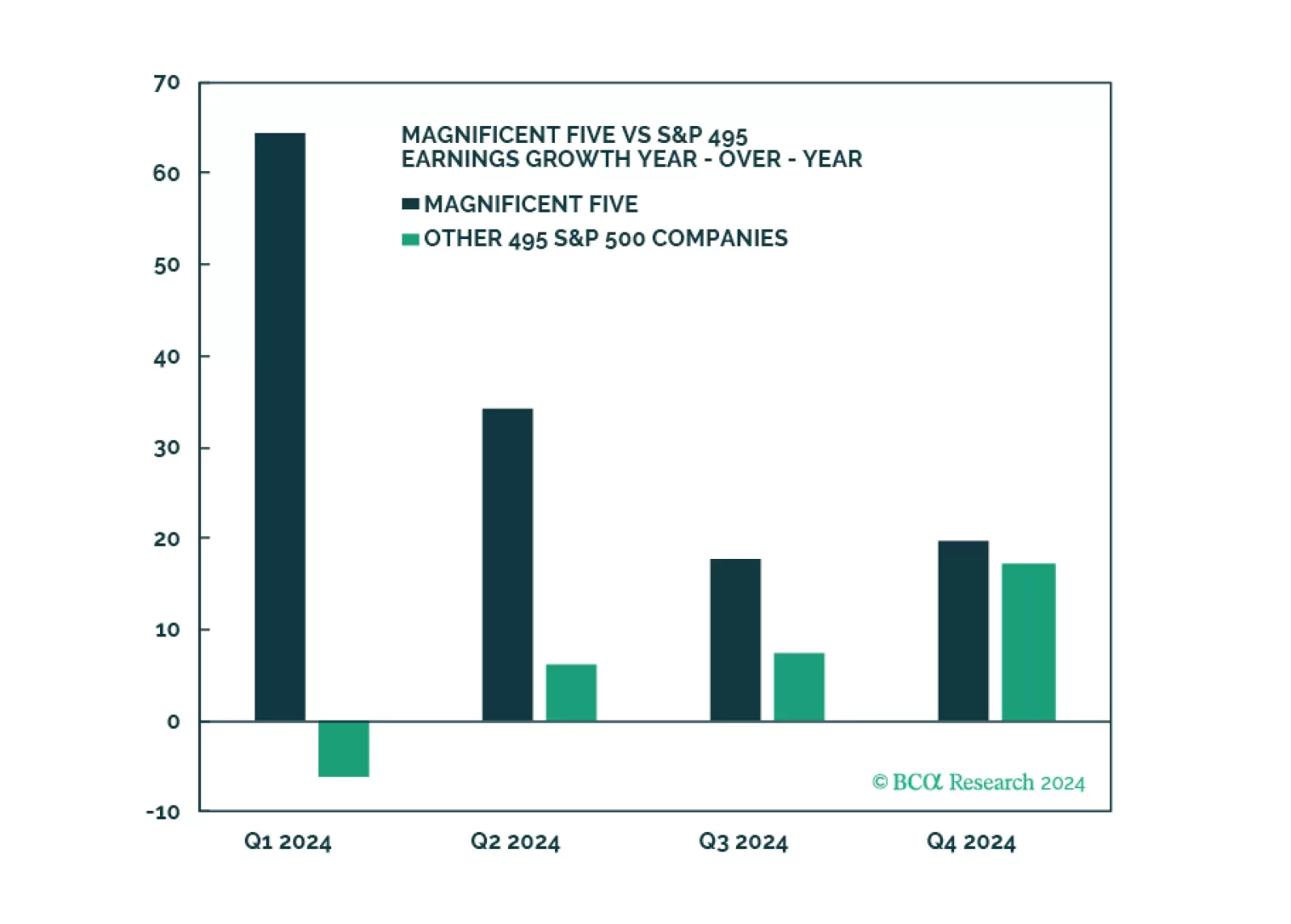

Q1 Earnings and sales growth were strong, but the devil is in the details: Without the Magnificent Five, earnings growth for the index would have been negative. On a positive note, margins have stabilized, and earnings growth is…

The broad market took a significant step backward in April, as market jitters gripped investors, stoking fears of higher for longer monetary policy. However, our roundtable investor poll has demonstrated that the majority remain…

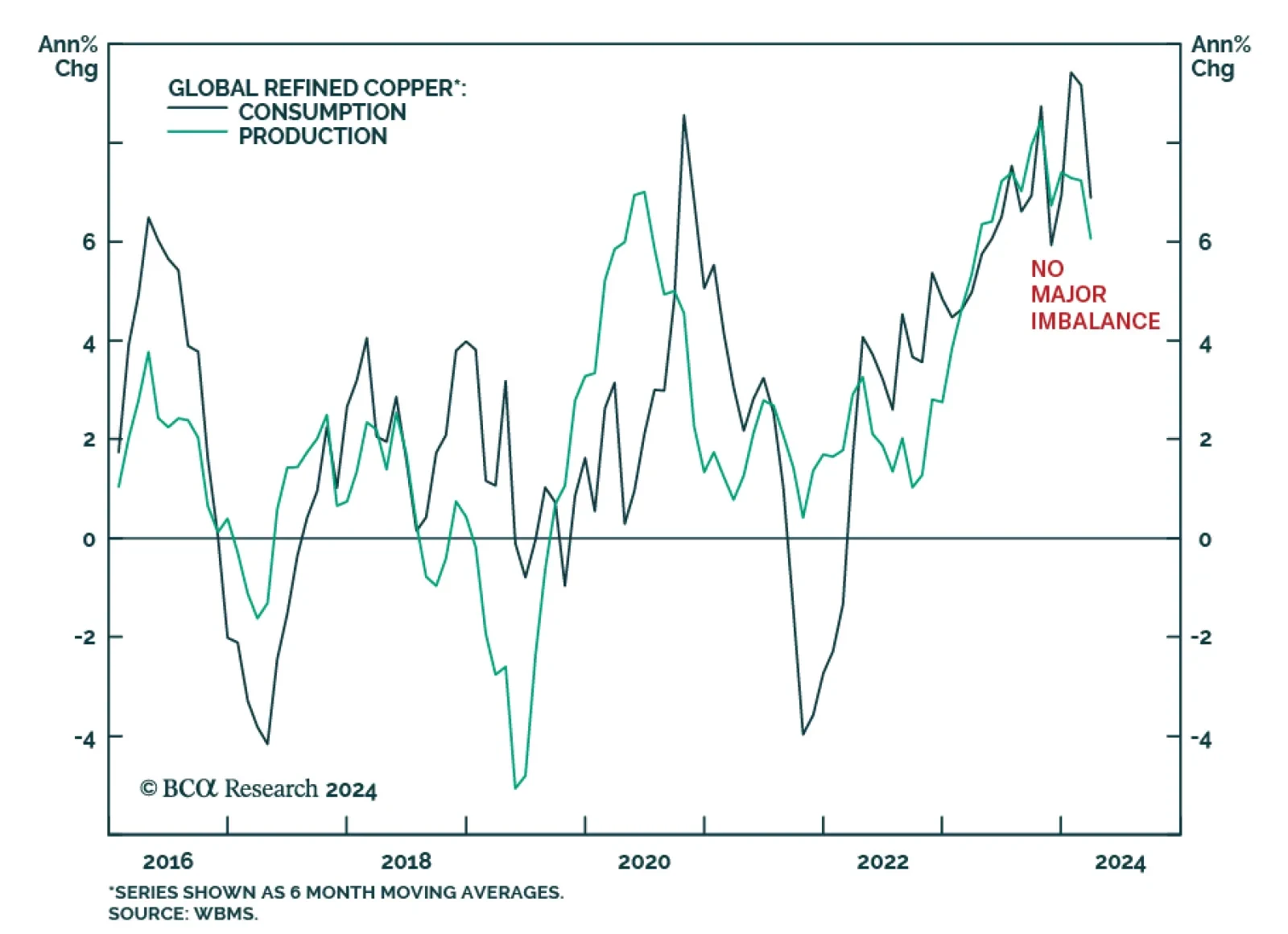

This year’s rise in commodity prices represents a blow-off rally rather than the start of a durable bull market. The global economy is heading for a recession. Stocks, commodities, and other risk assets are vulnerable.

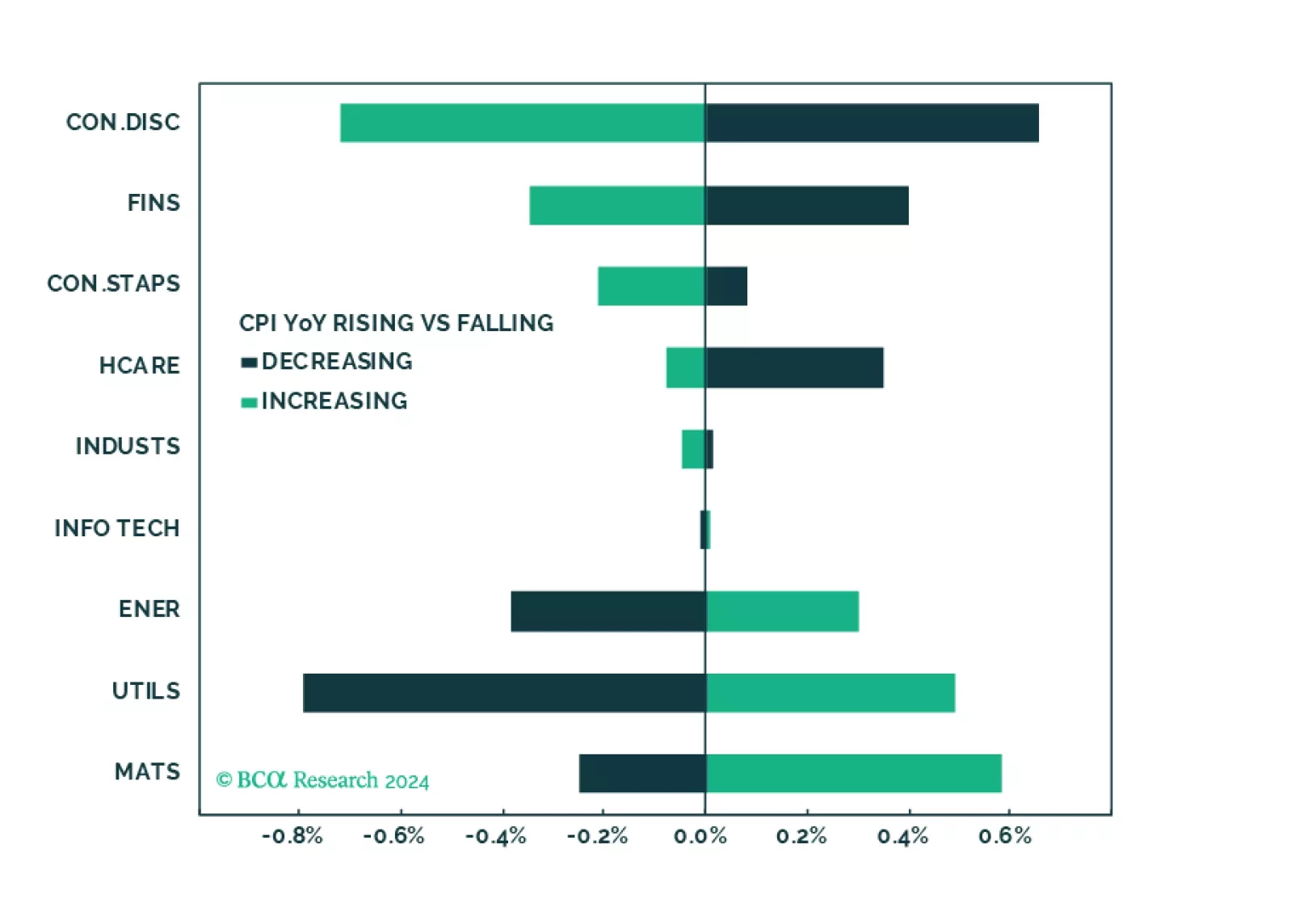

Fears of a hard landing are abating as growth has been surprising to the upside. New worries are emerging, such as the trajectory of disinflation, and the pace and timing of rate cuts. In this environment, it is important to build a…

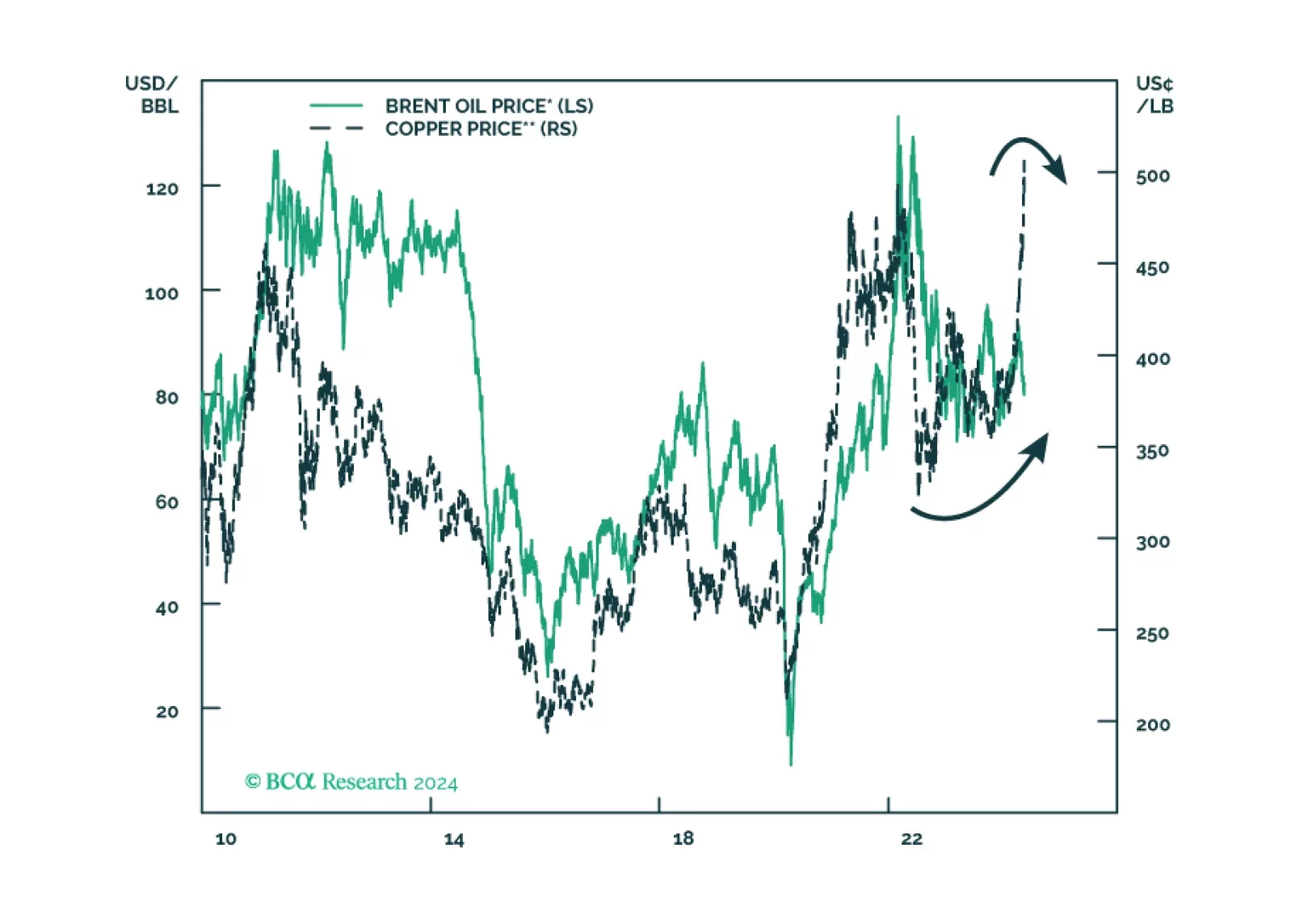

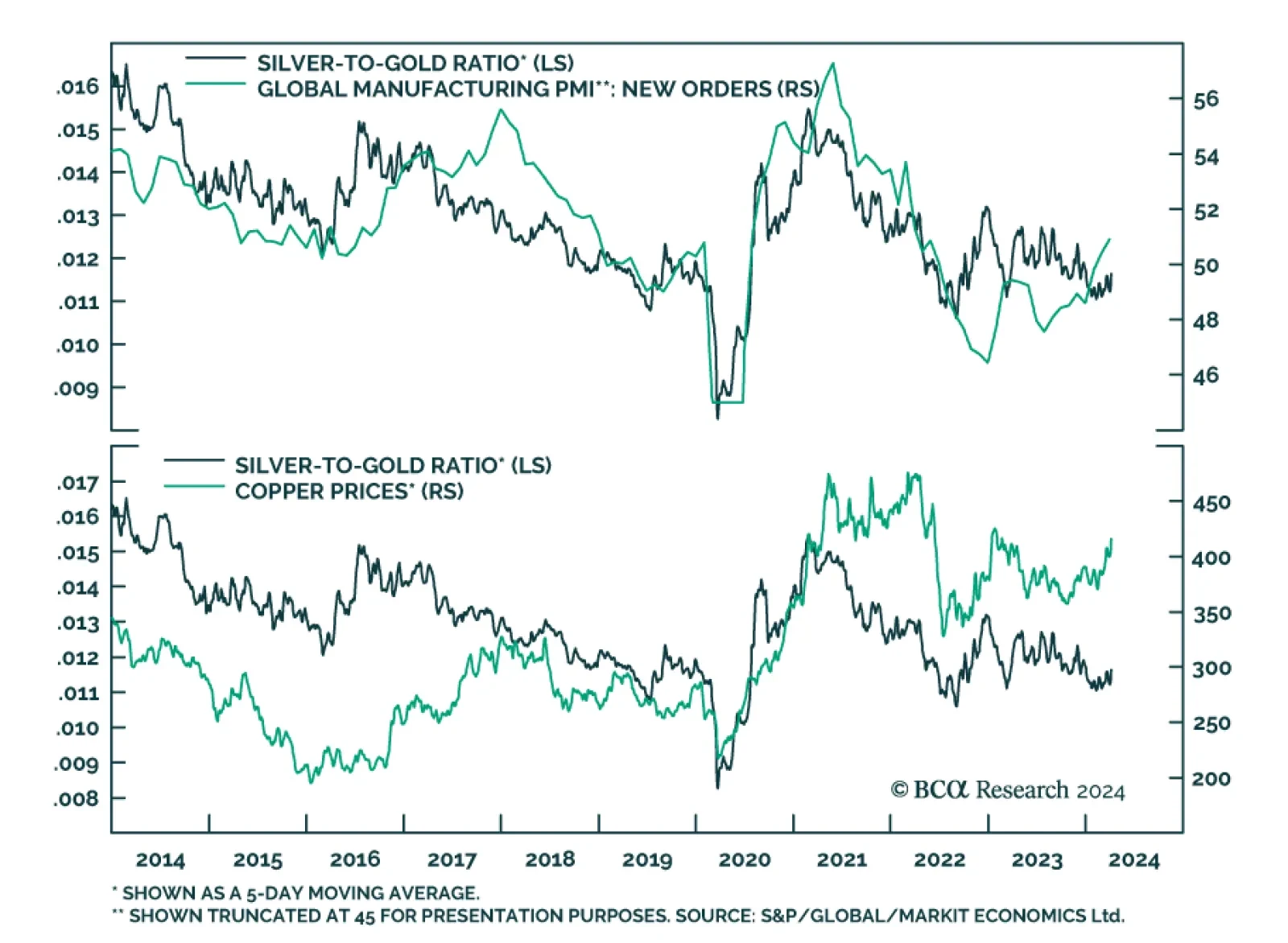

Commodities are making headlines with the prices of crude oil, copper, and gold all making sizeable gains since mid-February. Multiple forces have been cited as drivers of the rally across these commodities. Increased…

Copper markets are fast approaching a price breakout, as Chinese smelters scramble to find ore to meet increasing refined-copper demand in the wake of a global manufacturing rebound. We are holding fast to our expectation of $4.50/lb…

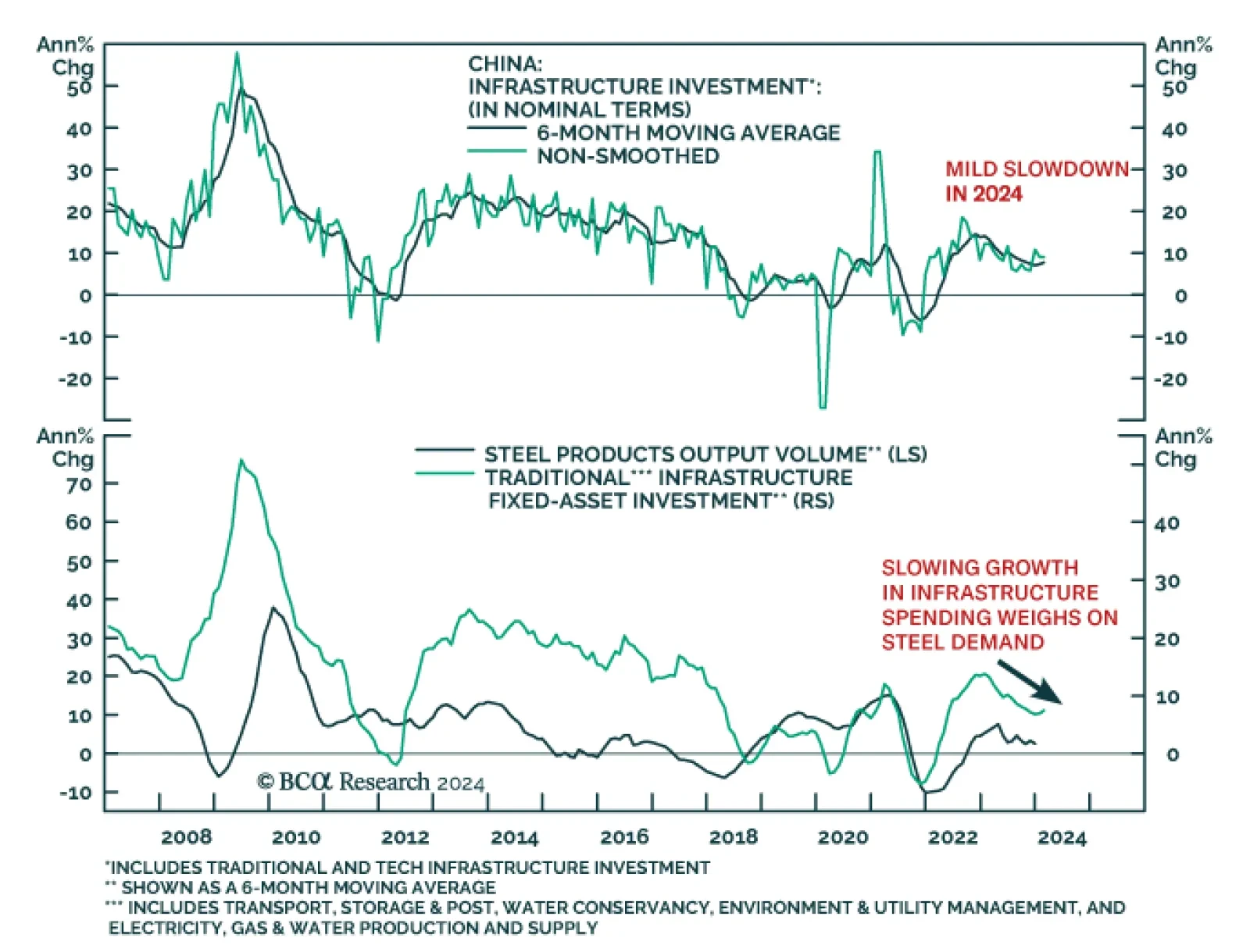

According to BCA Research’s China Investment Strategy service, the growth rate of China’s infrastructure investment will likely slow from a nominal 9% last year to about 6% this year. Funding constraints will limit…