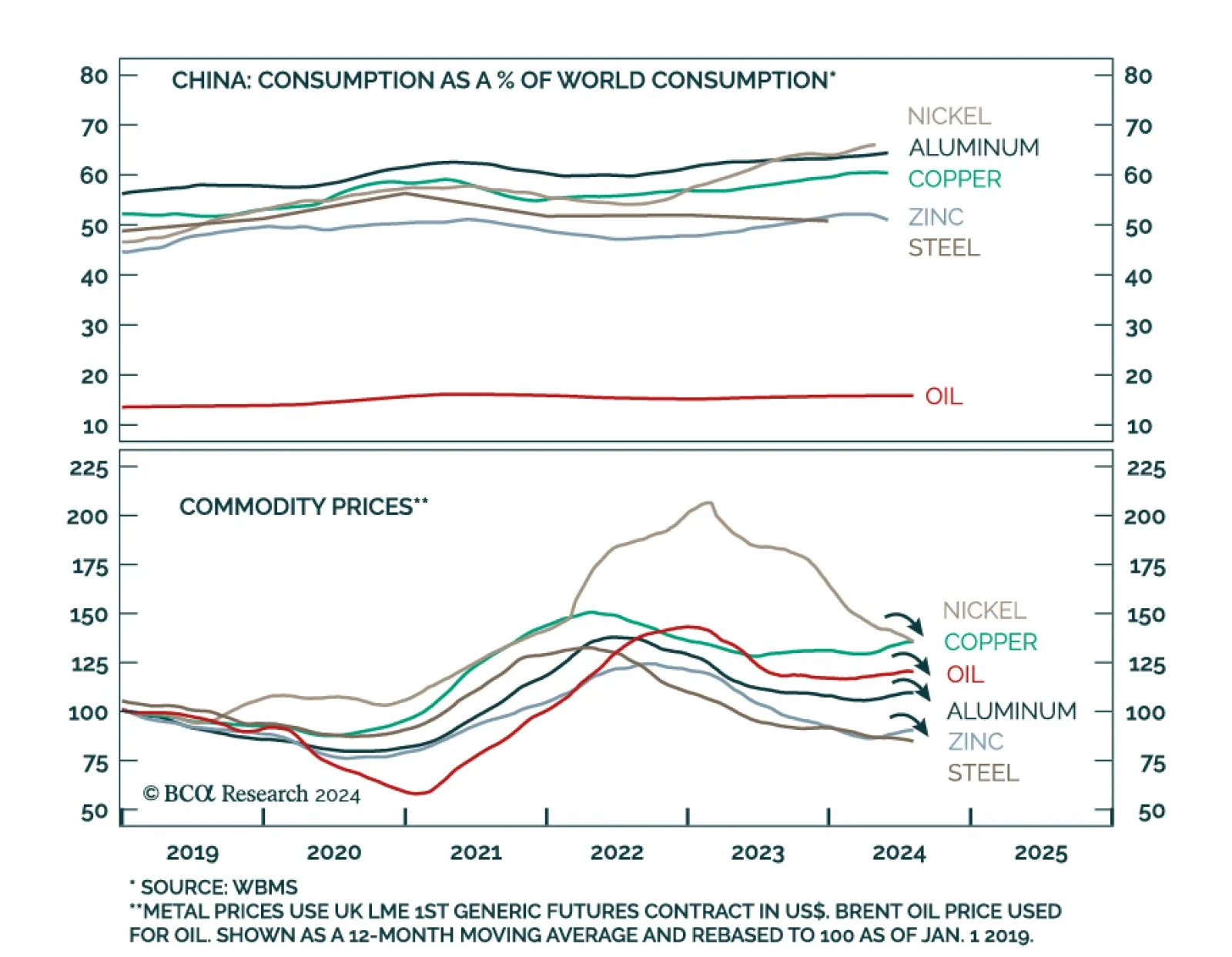

Industrial metals were one of the worst performing asset classes last month. Have prices declined enough to make them an attractive investment? The outlook for industrial commodity prices is bearish over a 12-month horizon…

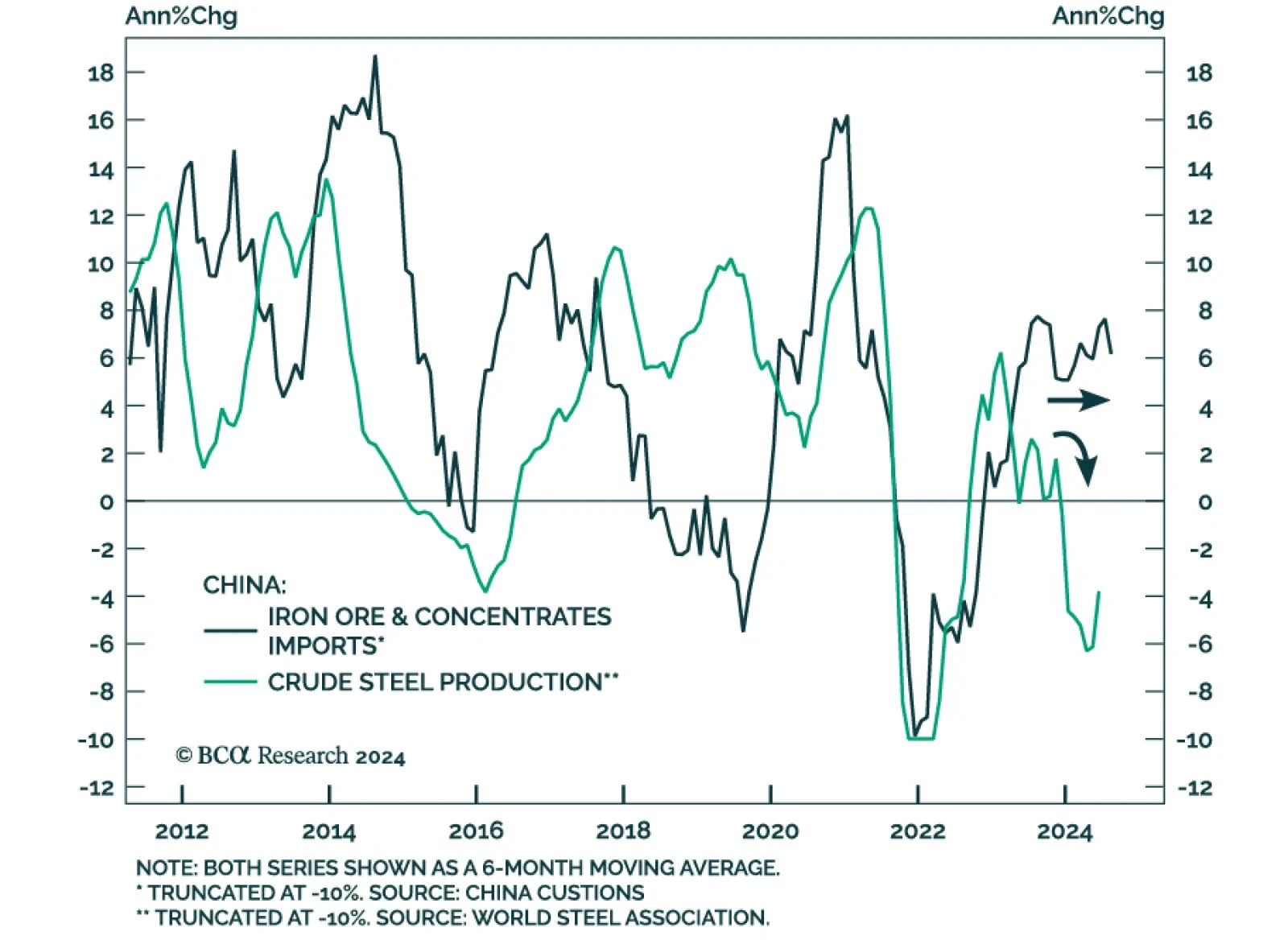

According to BCA Research’s Commodity & Energy Strategy service, robust iron ore imports are sending a false signal about steel demand. Instead, these supplies are being used to restock inventories. By the end of…

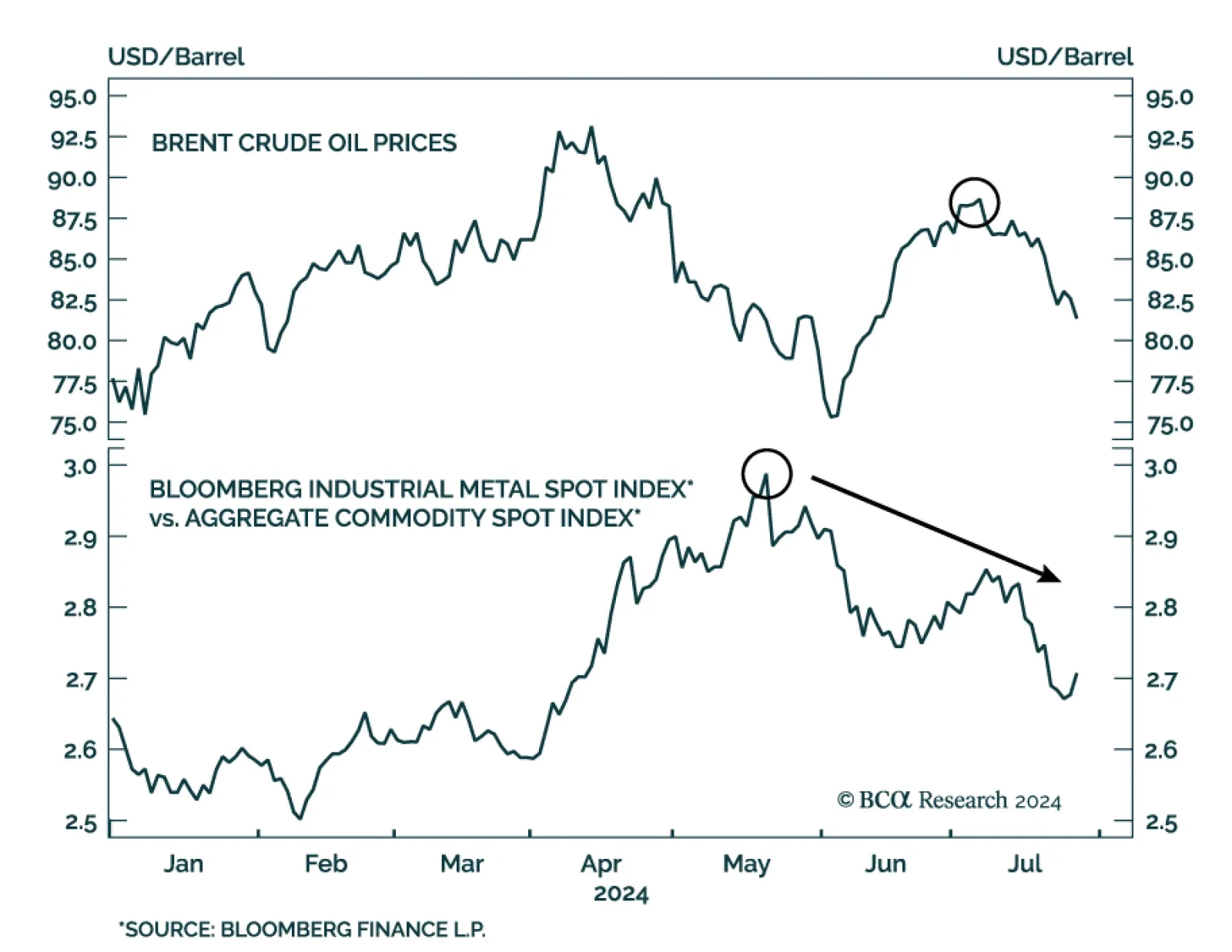

Brent prices have fallen 6% so far in July, reversing their June gains. Interestingly, these losses are occurring despite escalating Middle East tensions and quickening Chinese industrial profit growth in June (see The Numbers…

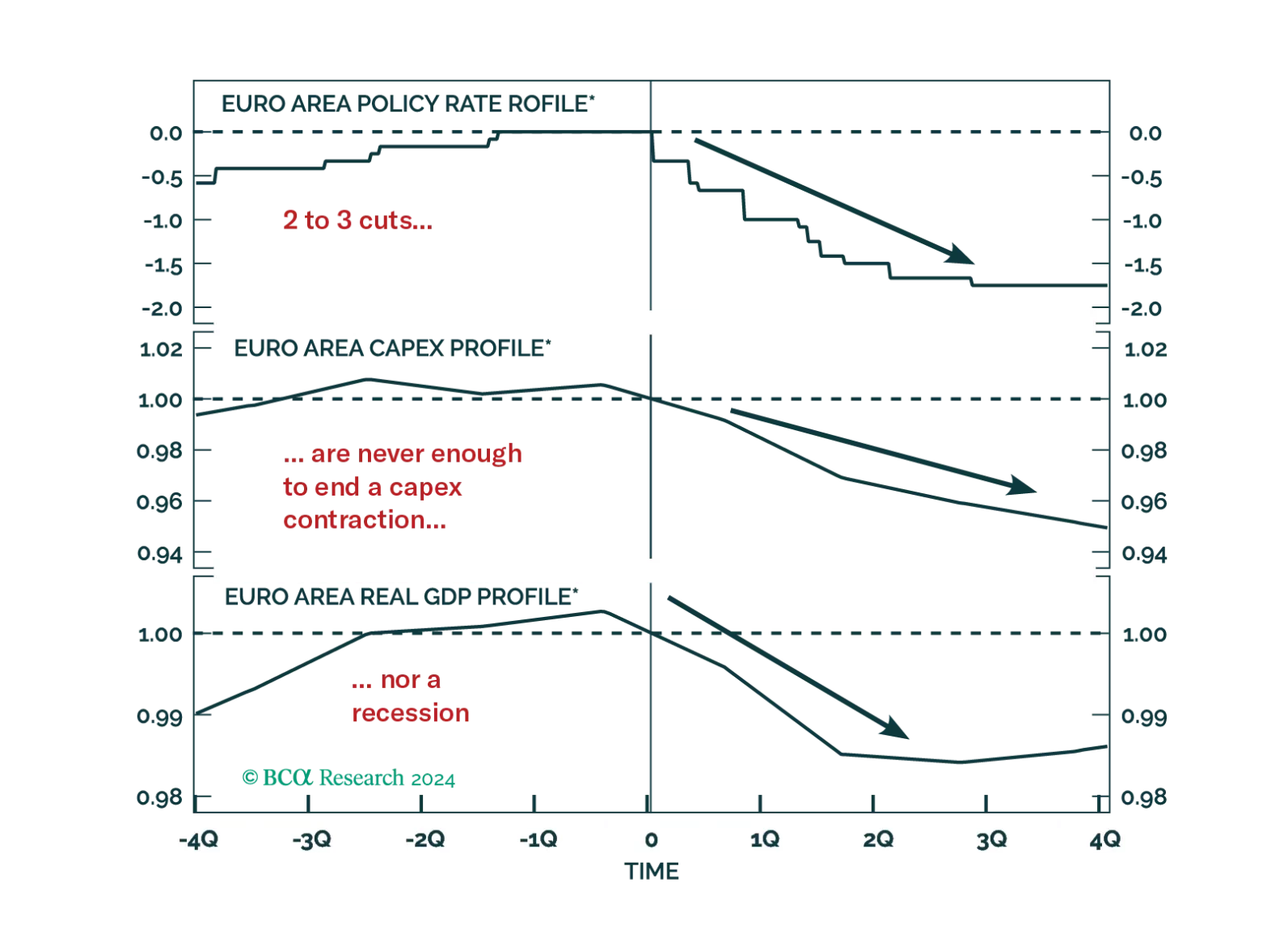

Investors hope that the ECB rate cuts priced into the curve will be sufficient to achieve a soft landing in Europe. History argues against this view, but will this time be different?

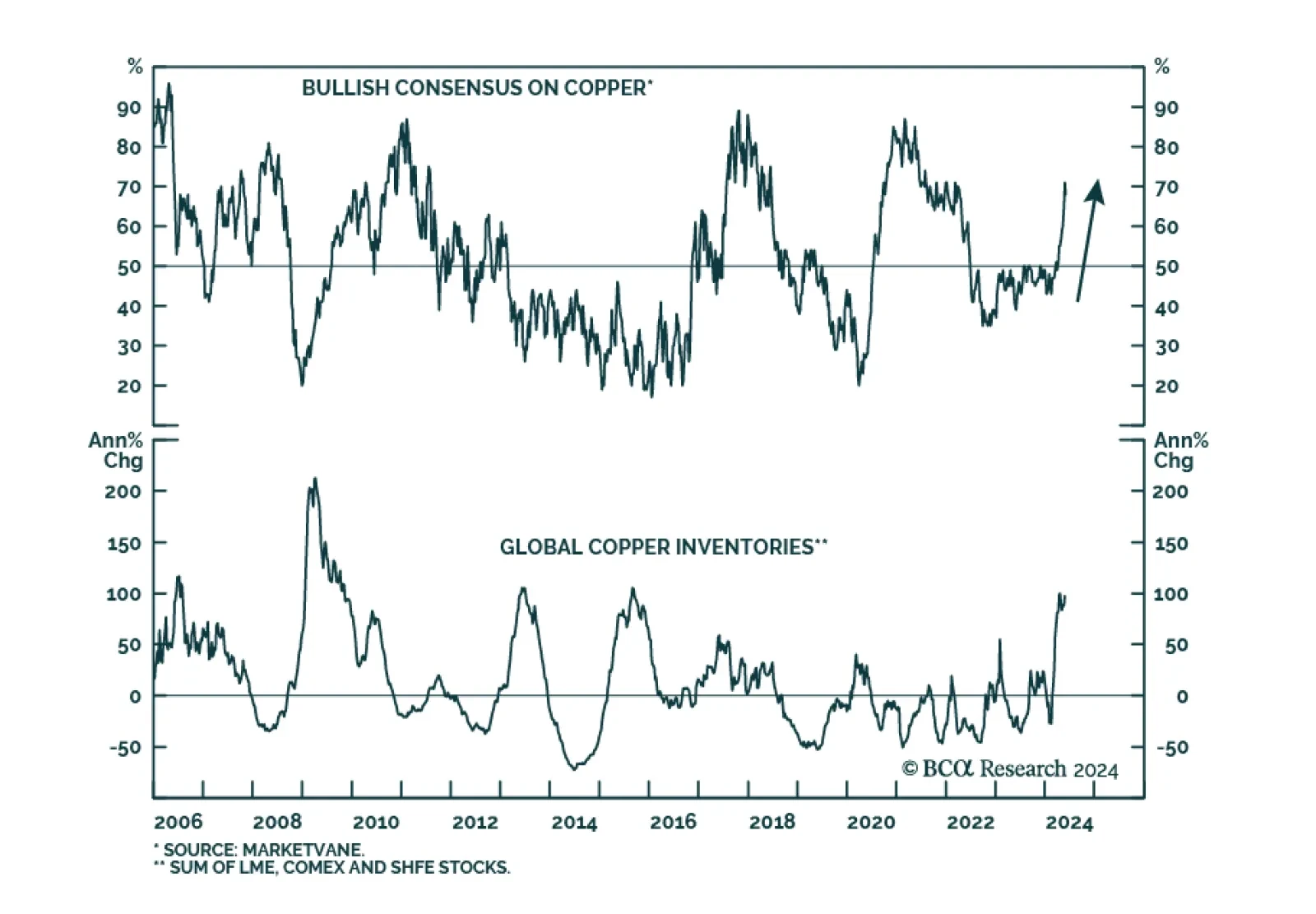

Copper has experienced a roller-coaster ride so far this year, with front-month futures on the Chicago Mercantile Exchange gaining nearly 40% from early February to late May, tumbling nearly 15% in just over five weeks, and…

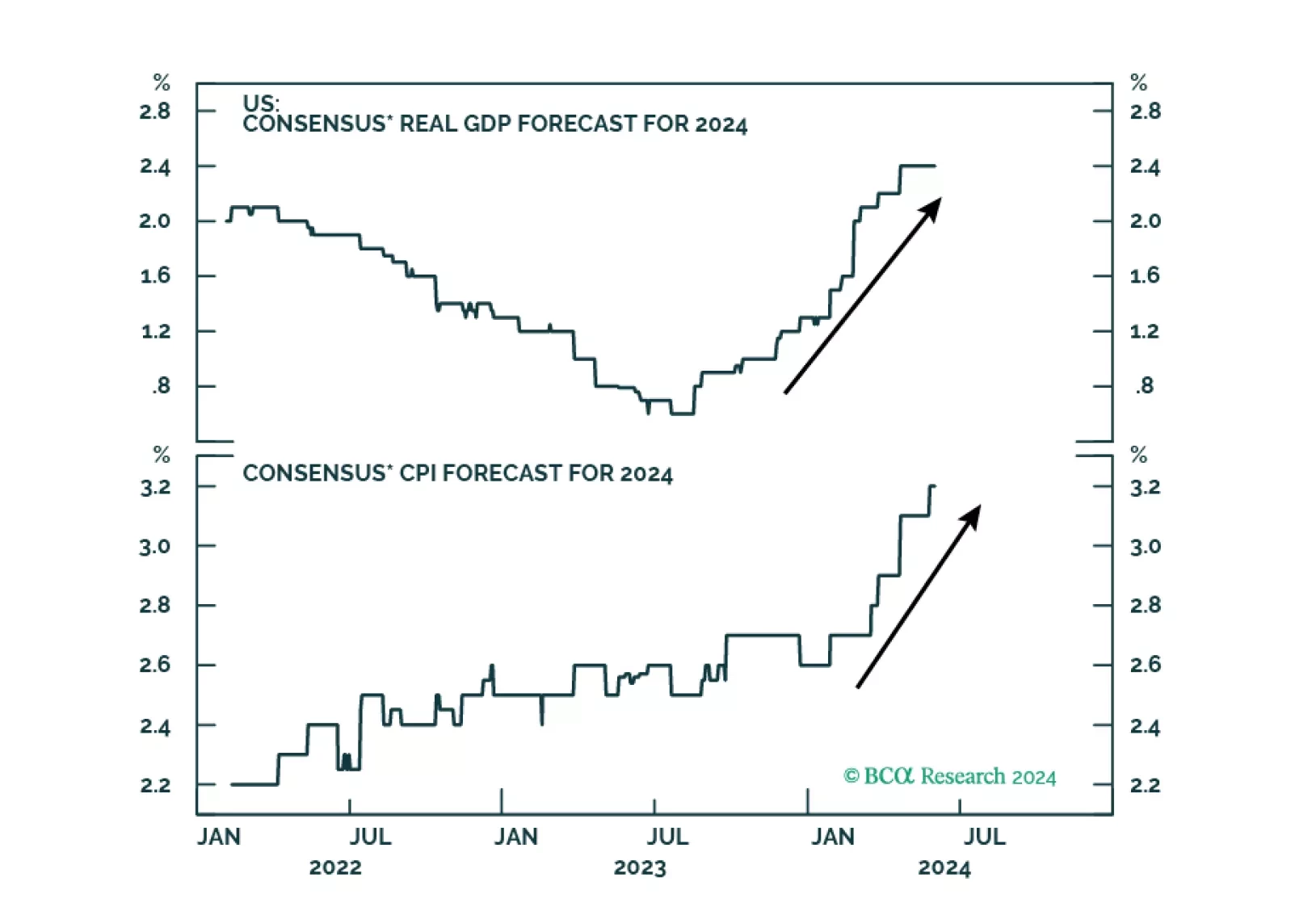

Concerns about the global economy have shifted from sticky inflation to faltering growth. Tight monetary policy is finally starting to bite. We suggest increasing portfolio defensiveness.

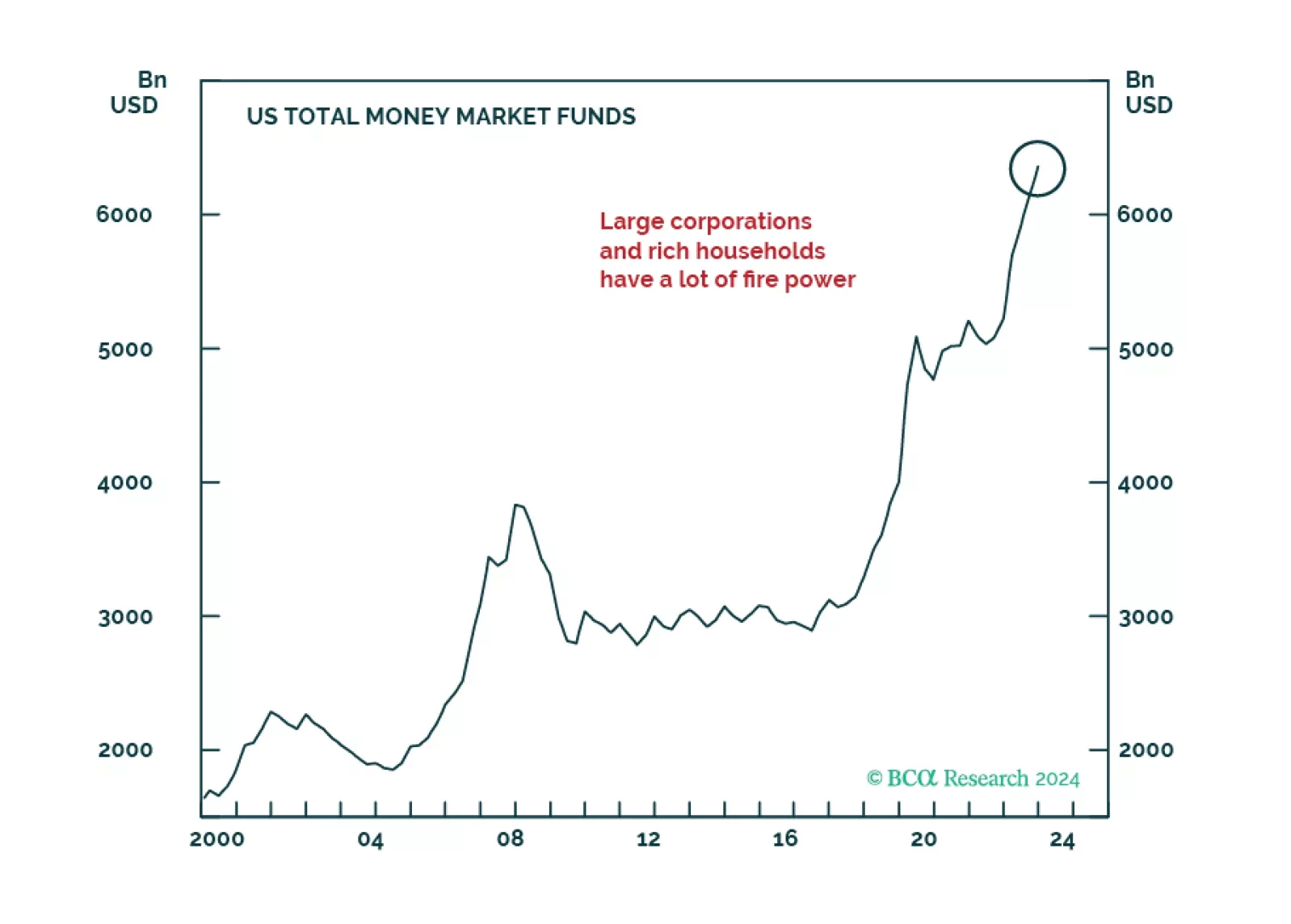

Generative AI-related rally resumed in May. Much of the recent market gains are down to excess liquidity that was begotten by the massive pandemic stimulus, creating a dichotomy between multiple economic challenges and exuberant…

The US economy is in the “Overheating” phase, so stronger growth brings higher inflation. Tight monetary policy means recession is still likely over the next 12 months. Stay defensive.

Copper prices have returned a whopping 25.6% YTD, briefly breaking above USD 5 earlier this month. The red metal accounts for a large share of industrial metals indices and it is being buoyed by the same late-cycle dynamics as…