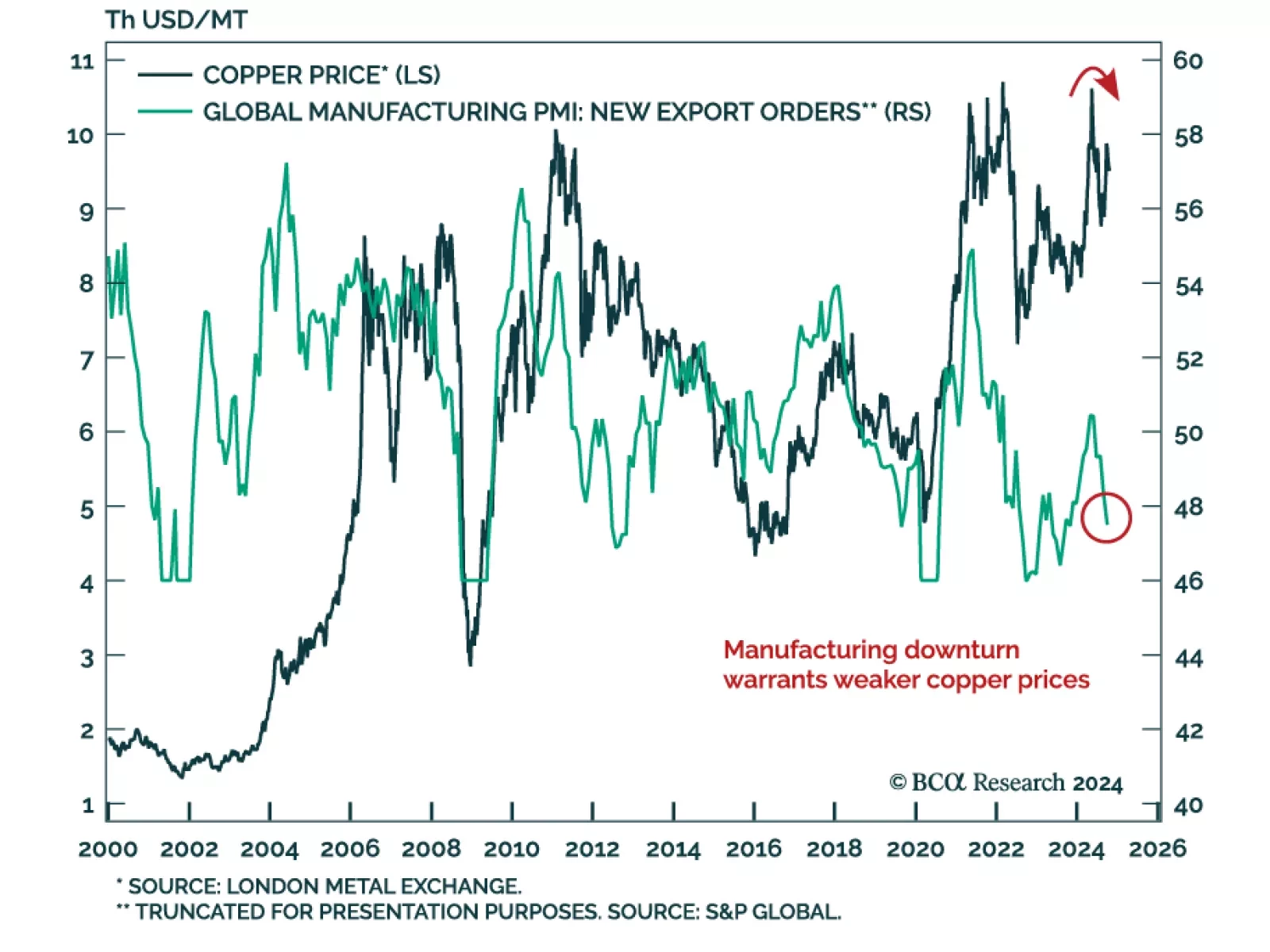

Speculators have supported copper prices as demand growth slowed below the pace of supply growth. Our Commodity and Energy Strategy colleagues believe this does not bode well for the metal. The copper market faces a situation…

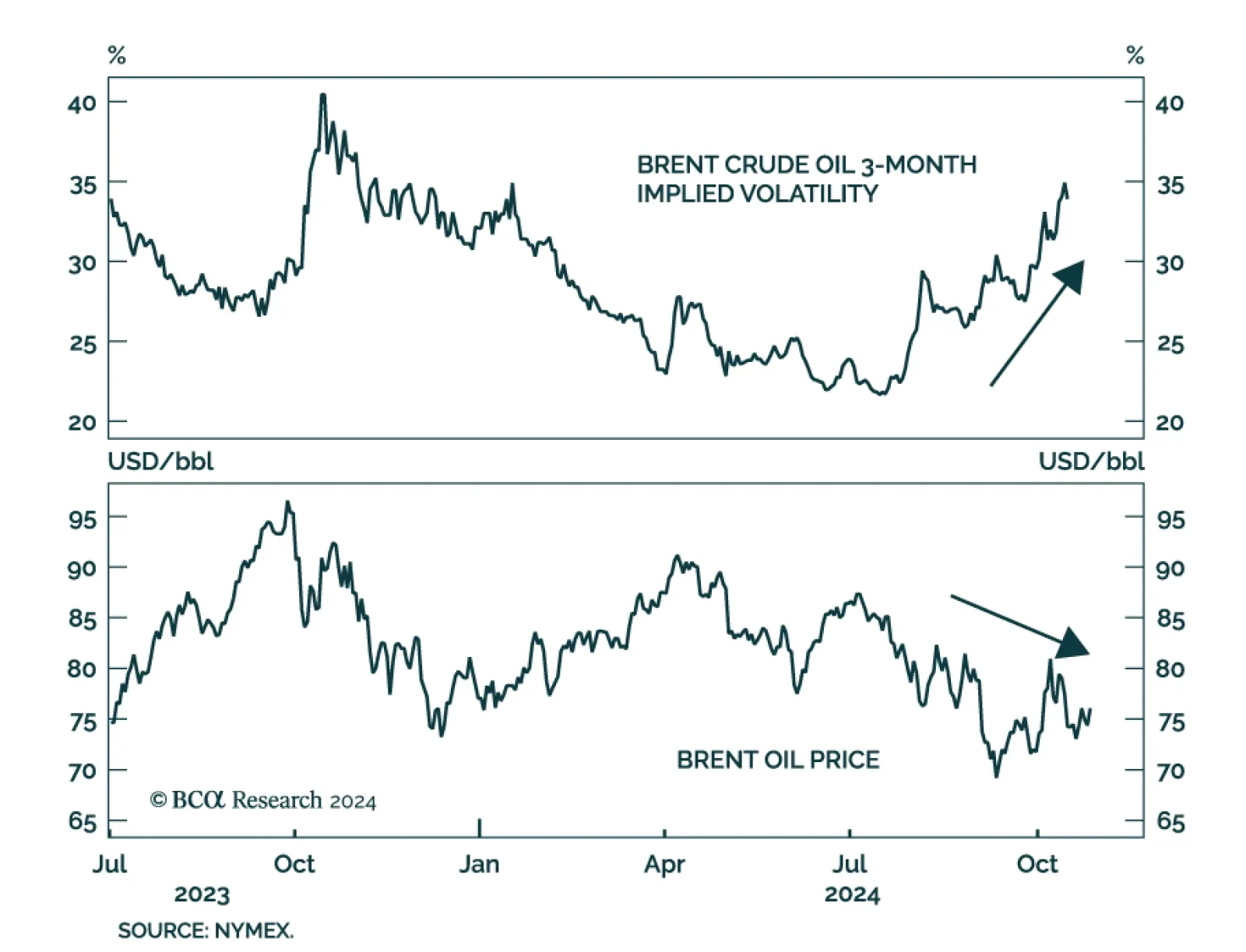

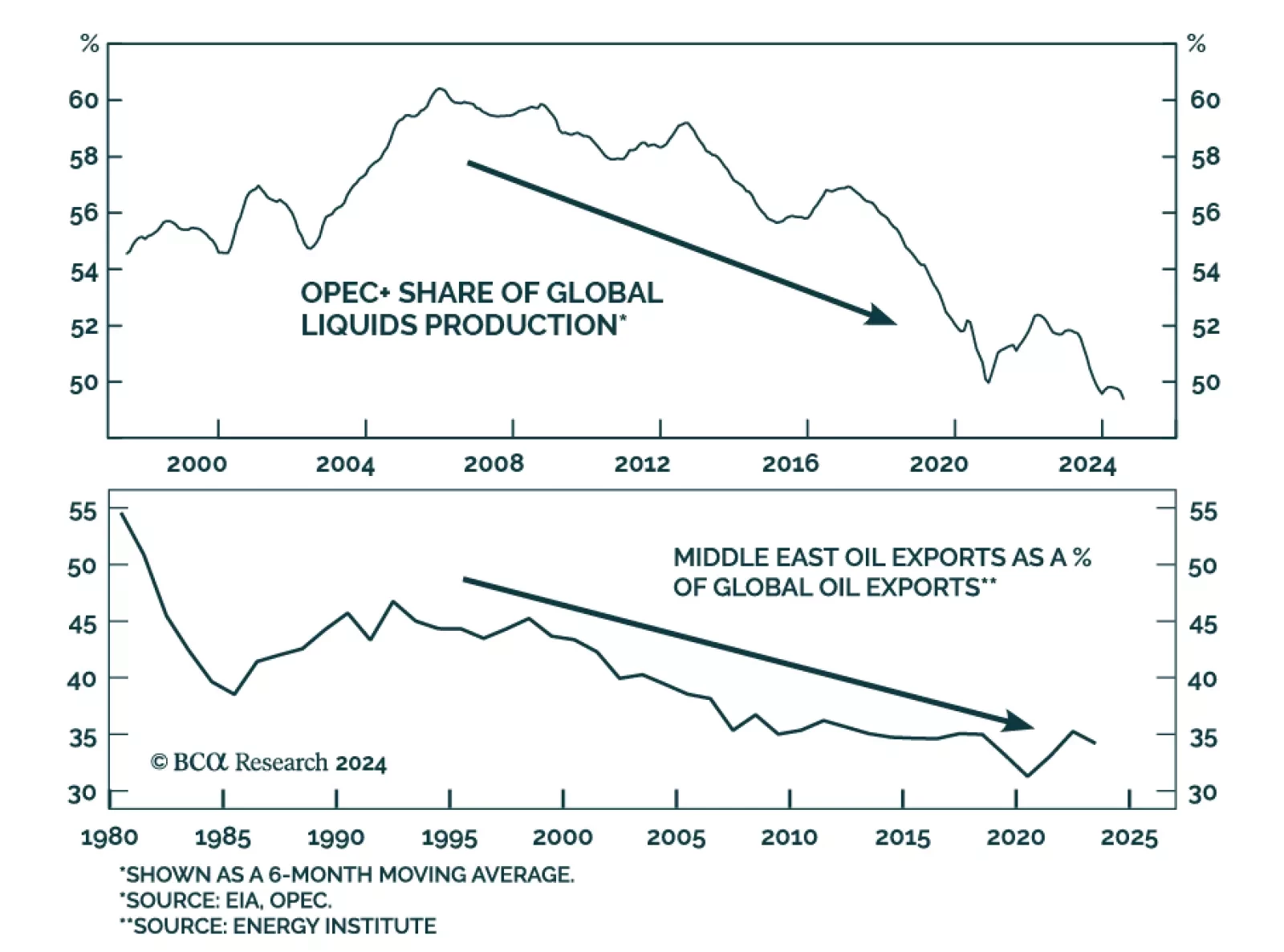

In a trendless yet volatile year for oil, Israel’s retaliatory attack on Iran this weekend is a reminder the outlook is fraught with geopolitical risks. Risks are usually expressed as a geopolitical price premium, but this…

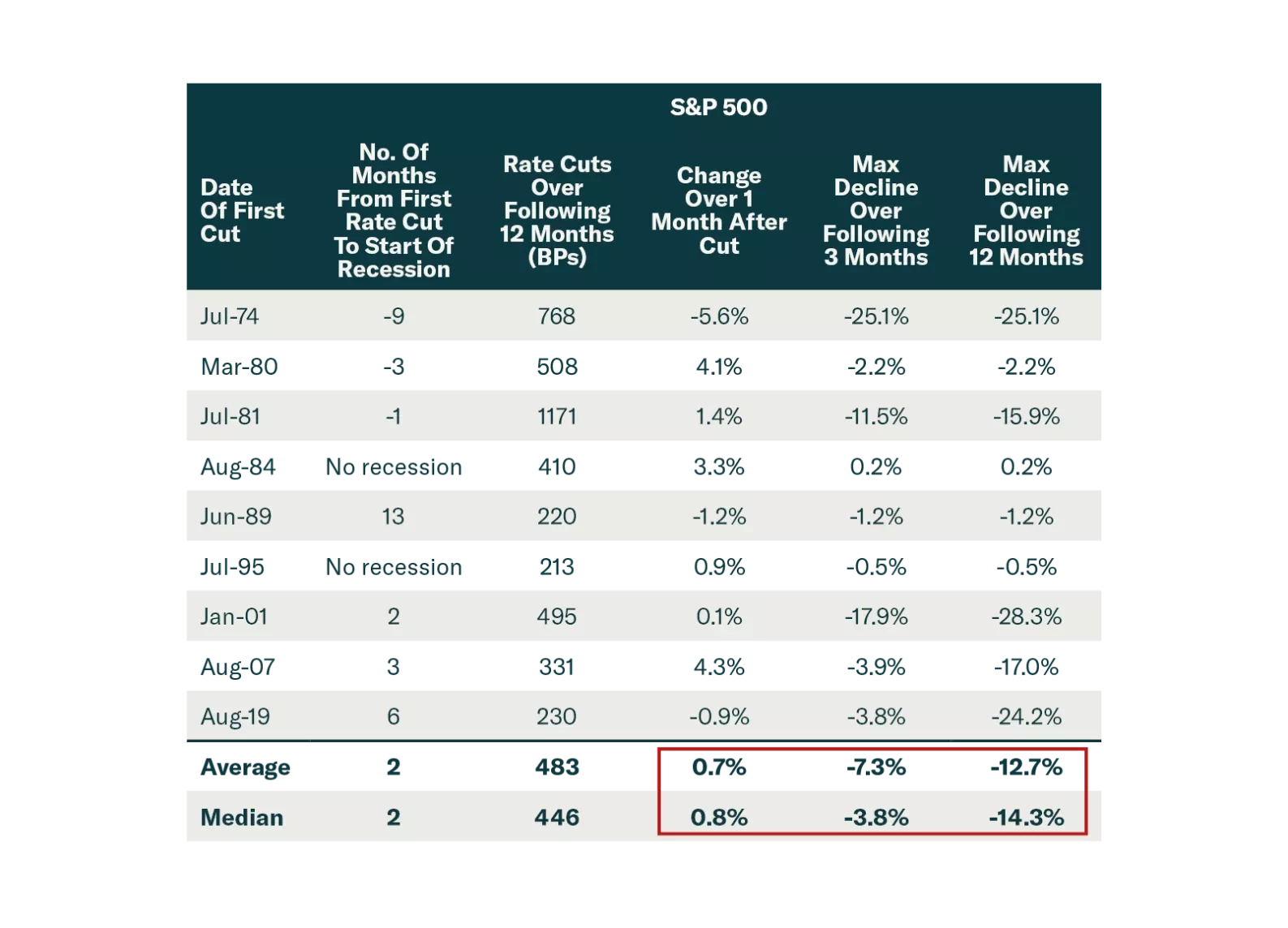

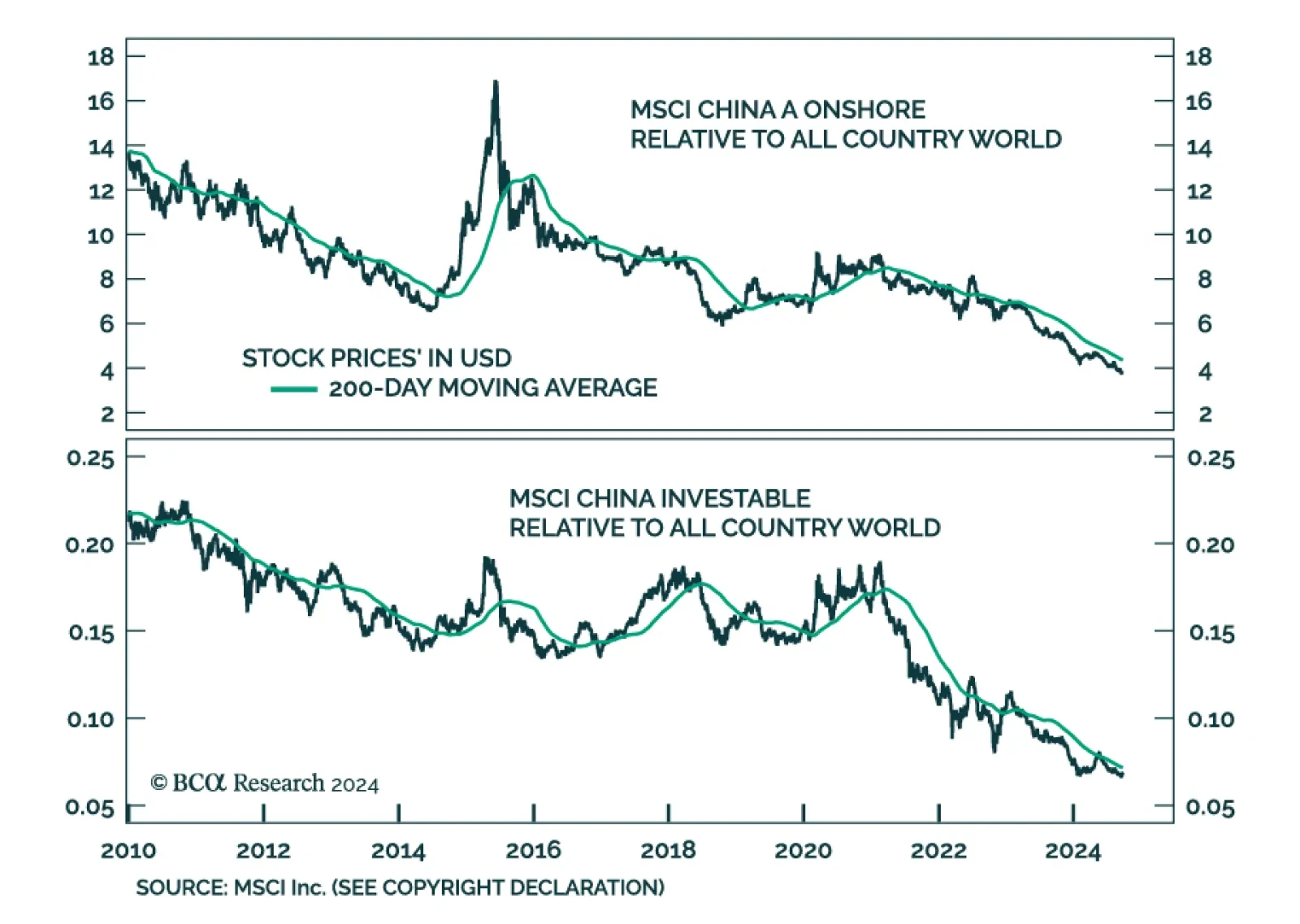

The market got excited by the 50 bps Fed cut and China stimulus. But these are a recognition that economies are slowing significantly. Stocks often rally after the first Fed cut, before falling sharply. Investors should stay…

One commodity that has not reacted to the bullish demand-side news from the Politburo (see The Numbers) is crude oil. Brent shed over 2% on Thursday, in sharp contrast to Copper’s gains. Oil markets seem to be reacting…

The PBoC announced further measures to stimulate the economy on Tuesday. It lowered the reserve requirement ratio from 10% to 9.5%, cut the 7-day reverse repo rate by 20 bps (following Monday’s 10 bps cut to the 14-day…

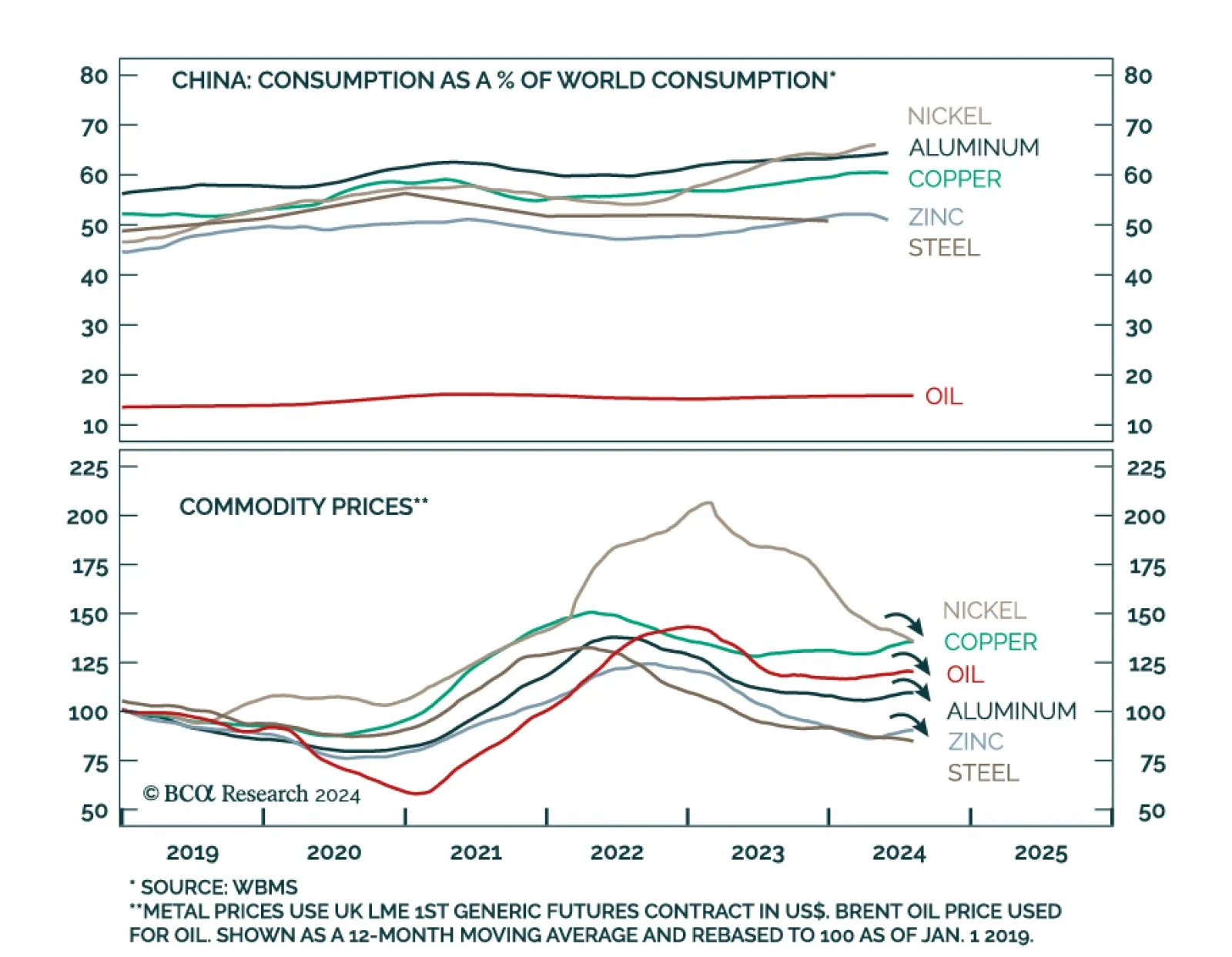

Industrial metals returned a whopping 6% over the past week. Bullish investor sentiment is likely driving these gains. The soft-landing narrative has been gaining traction in recent days with markets pricing in increased odds…

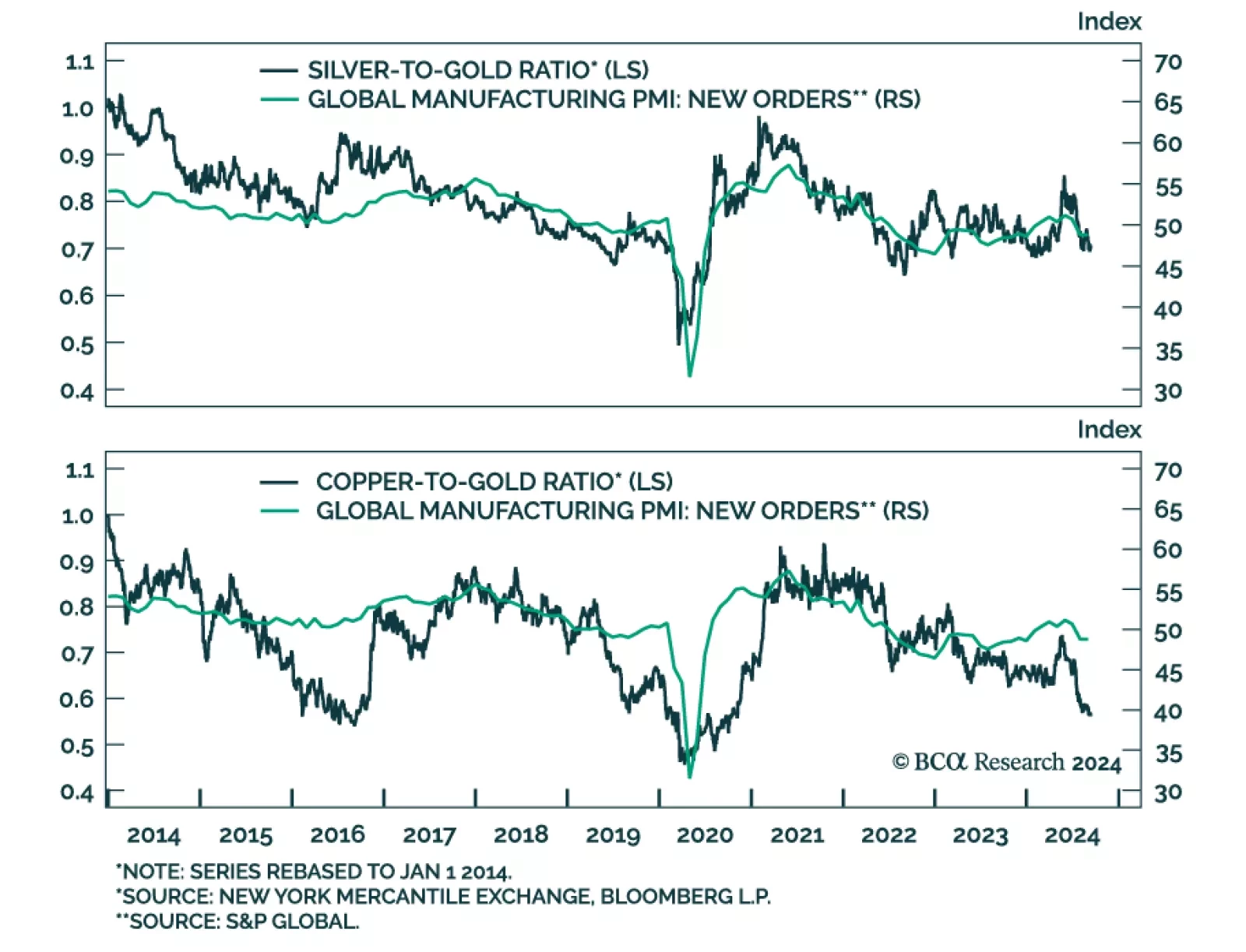

As an industrial metal, copper acts as a barometer of economic activity. Silver and gold are safe-haven assets with inflation-hedging properties, though silver is relatively more sensitive to global growth developments given that…

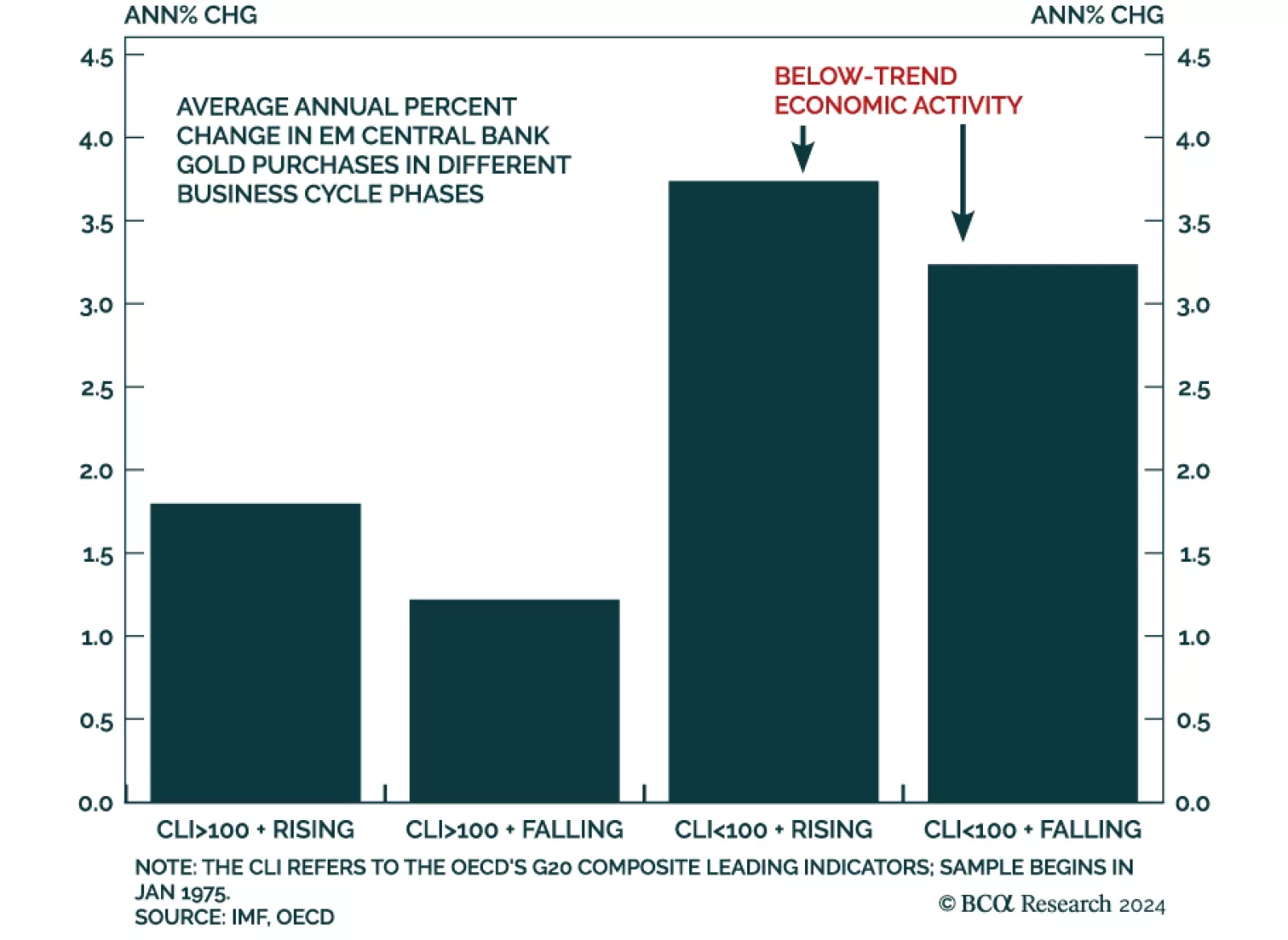

According to BCA Research’s Commodity & Energy Strategy service, central banks will continue to be a key source of gold demand. Central bank purchases in the first half of this year exceeded first-half purchases in…

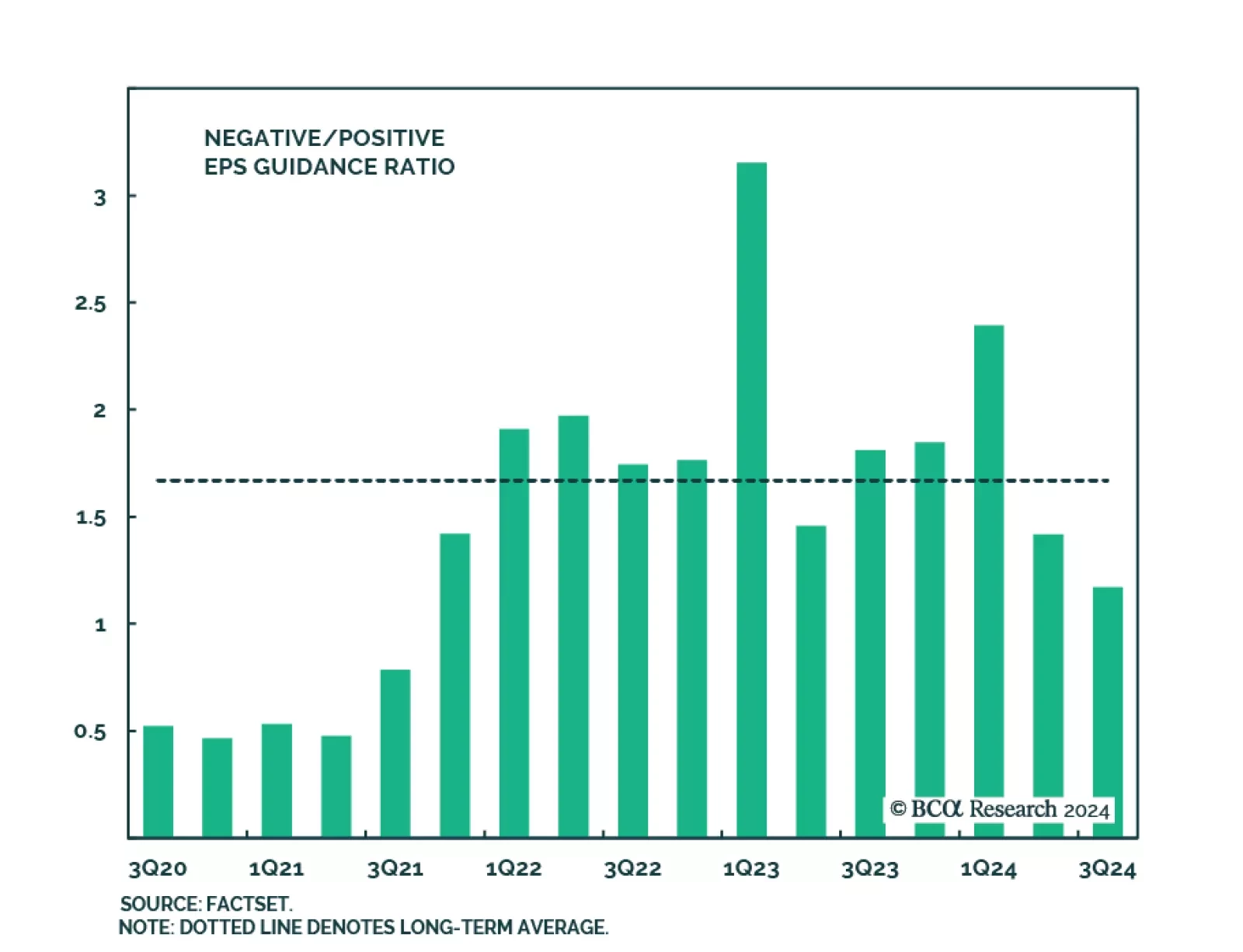

The Q2 2024 earnings season is drawing to a close with 93% of S&P 500 companies having reported results as we go to press. Nearly 80% (60%) of companies have topped earnings (sales) expectations in Q2, according to Factset…

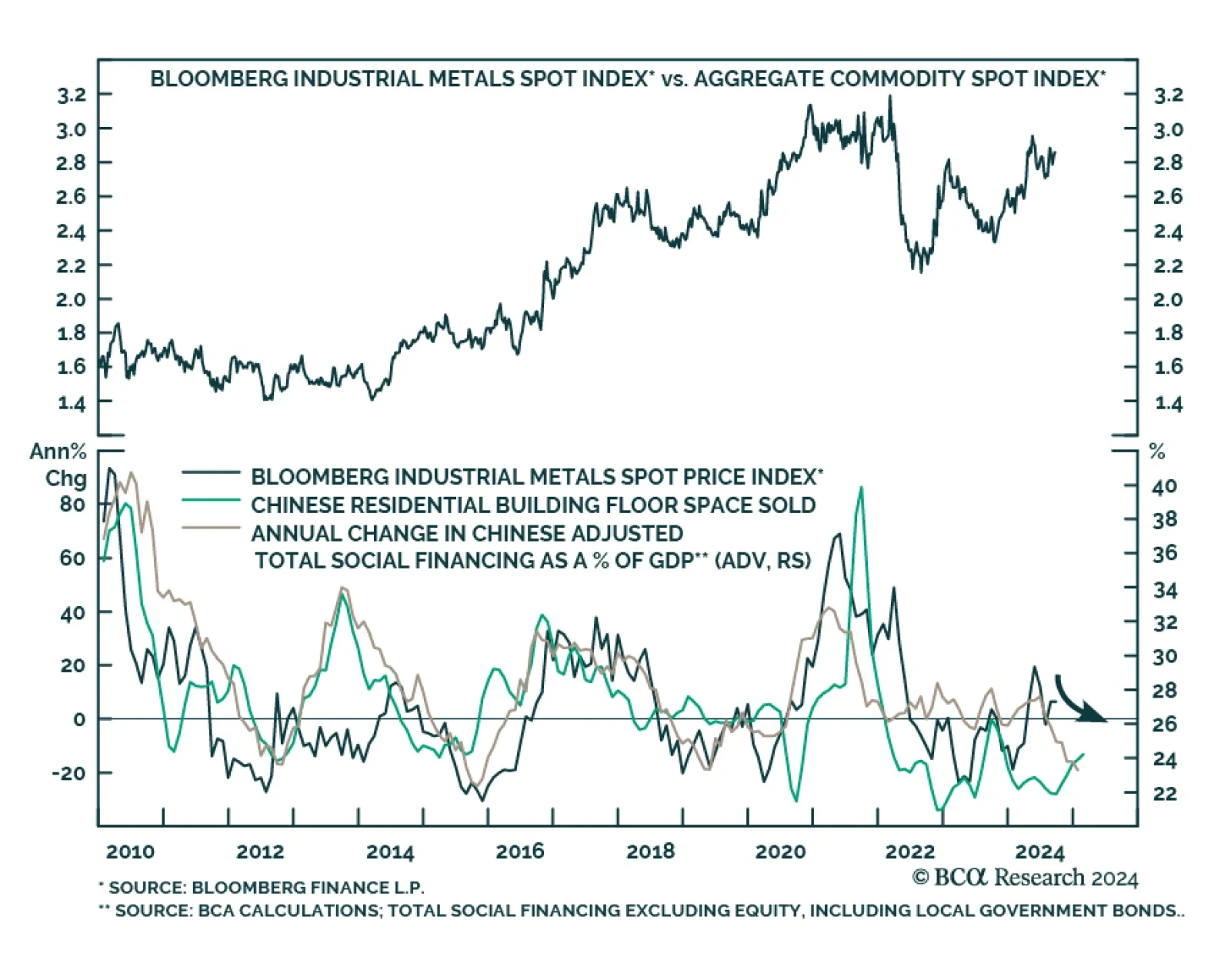

Industrial metals were one of the worst performing asset classes last month. Have prices declined enough to make them an attractive investment? The outlook for industrial commodity prices is bearish over a 12-month horizon…