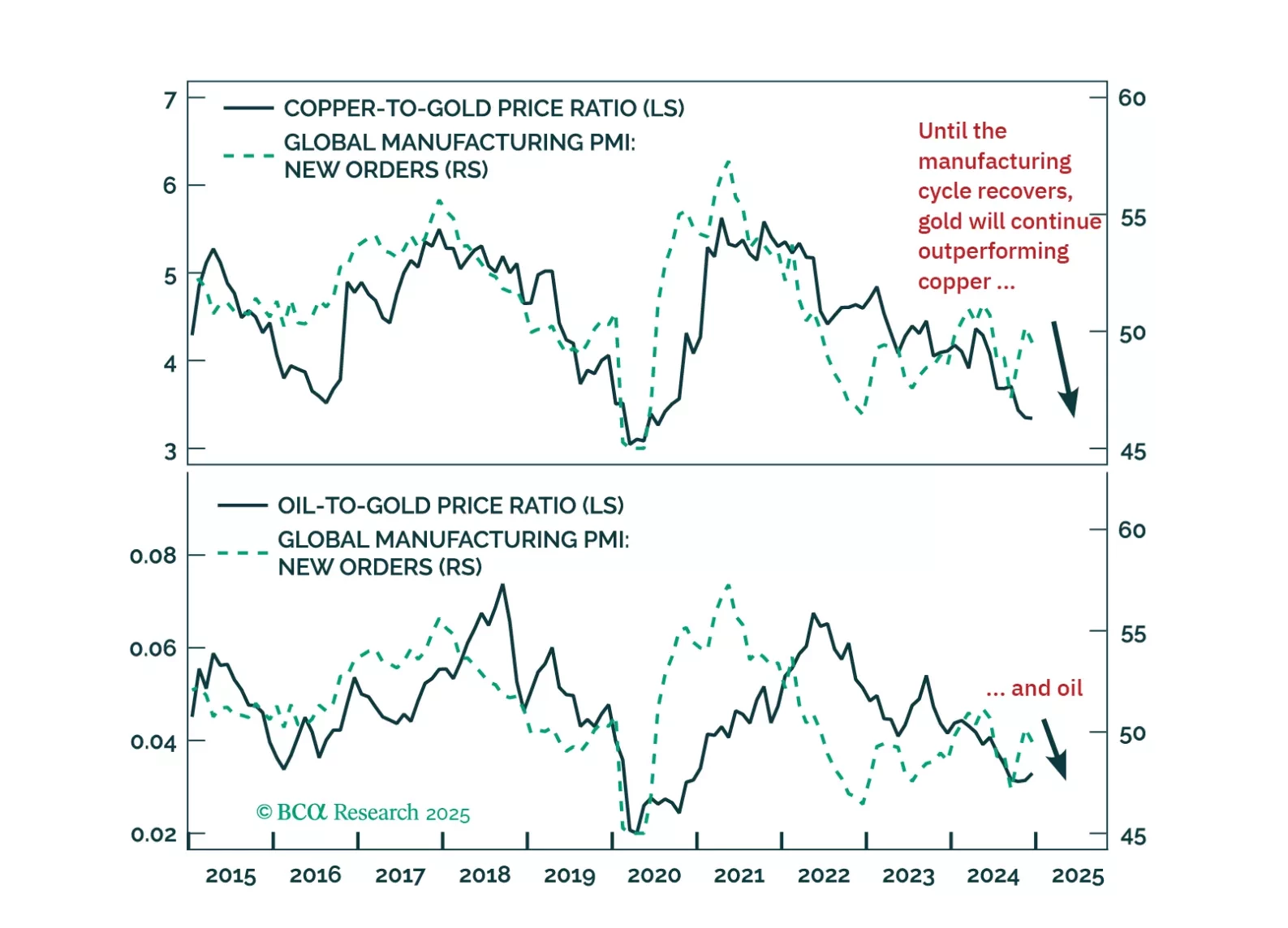

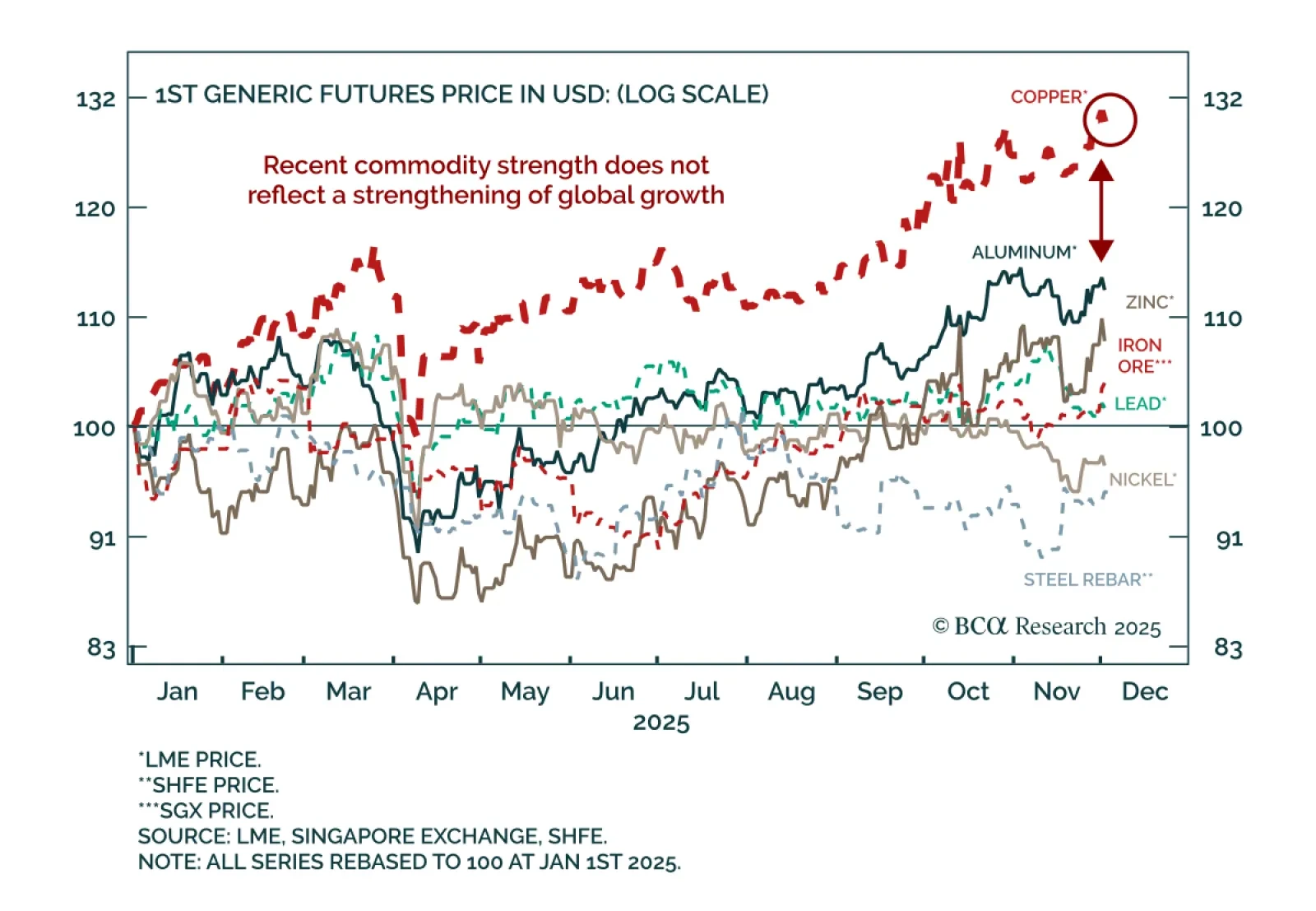

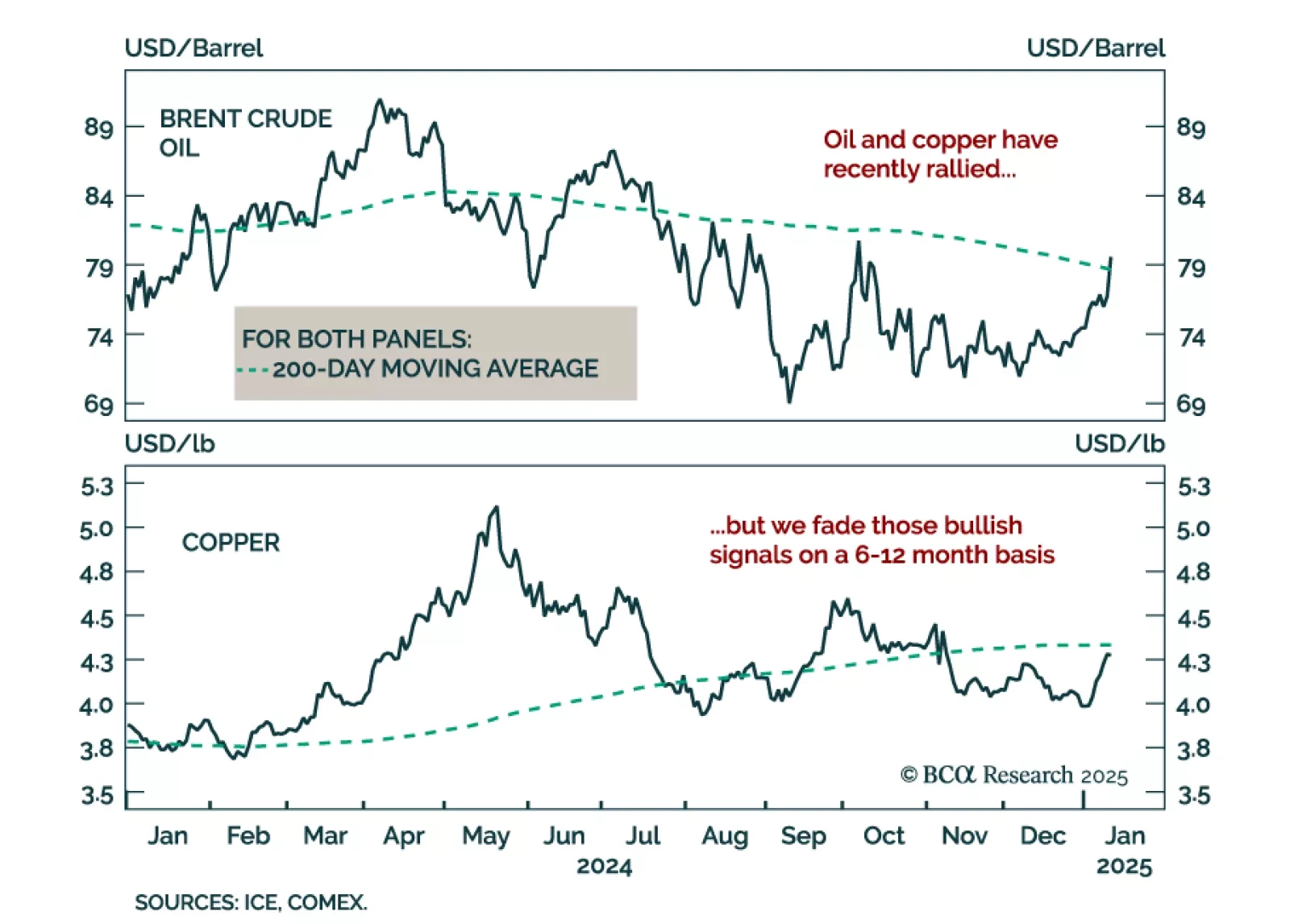

Maintain defensive commodity positioning as recent rallies reflect tariff distortions, not a turn in global growth. Despite soft global growth, copper, silver, gold, and shipping rates have rallied. Our Commodity strategists do not…

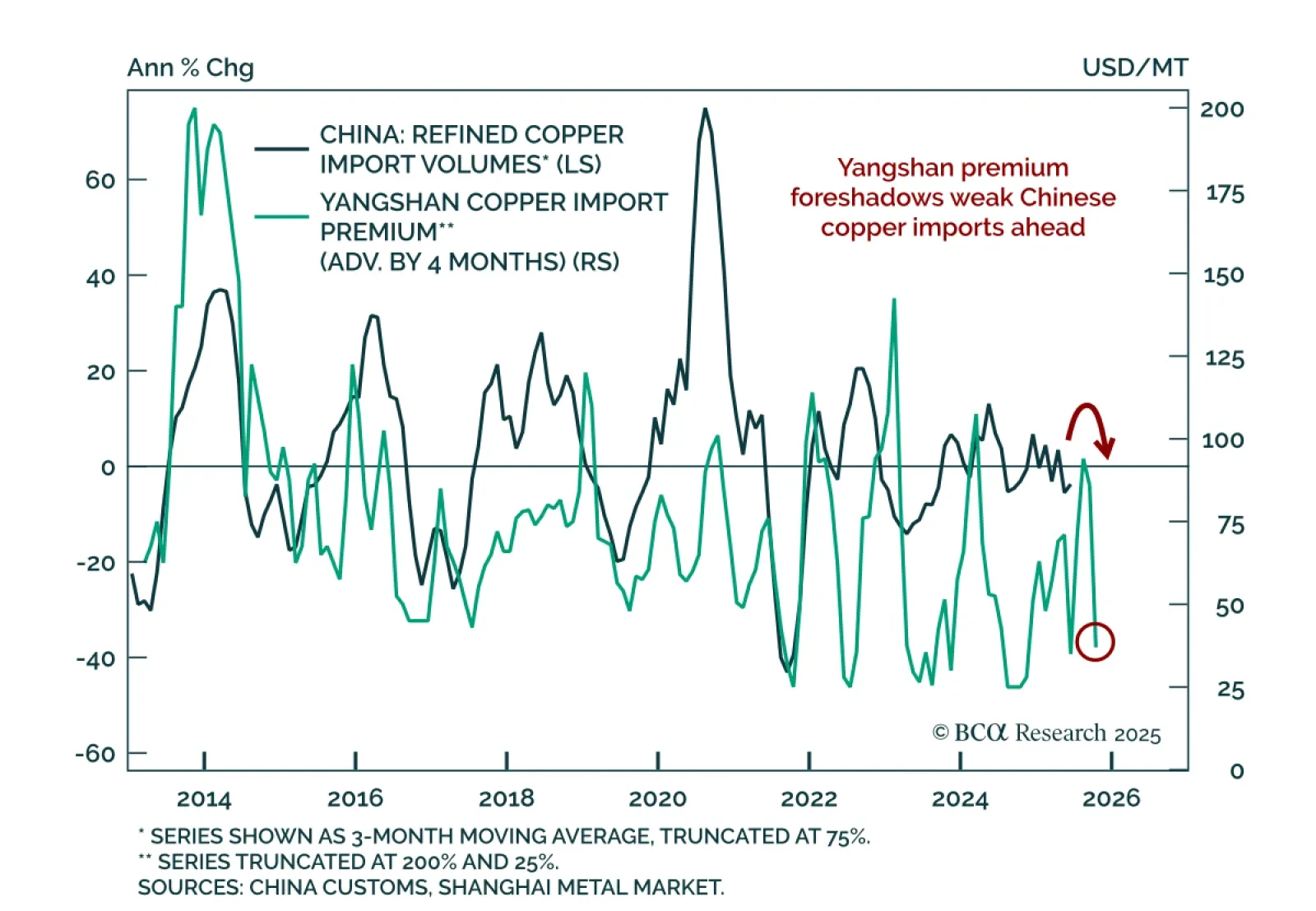

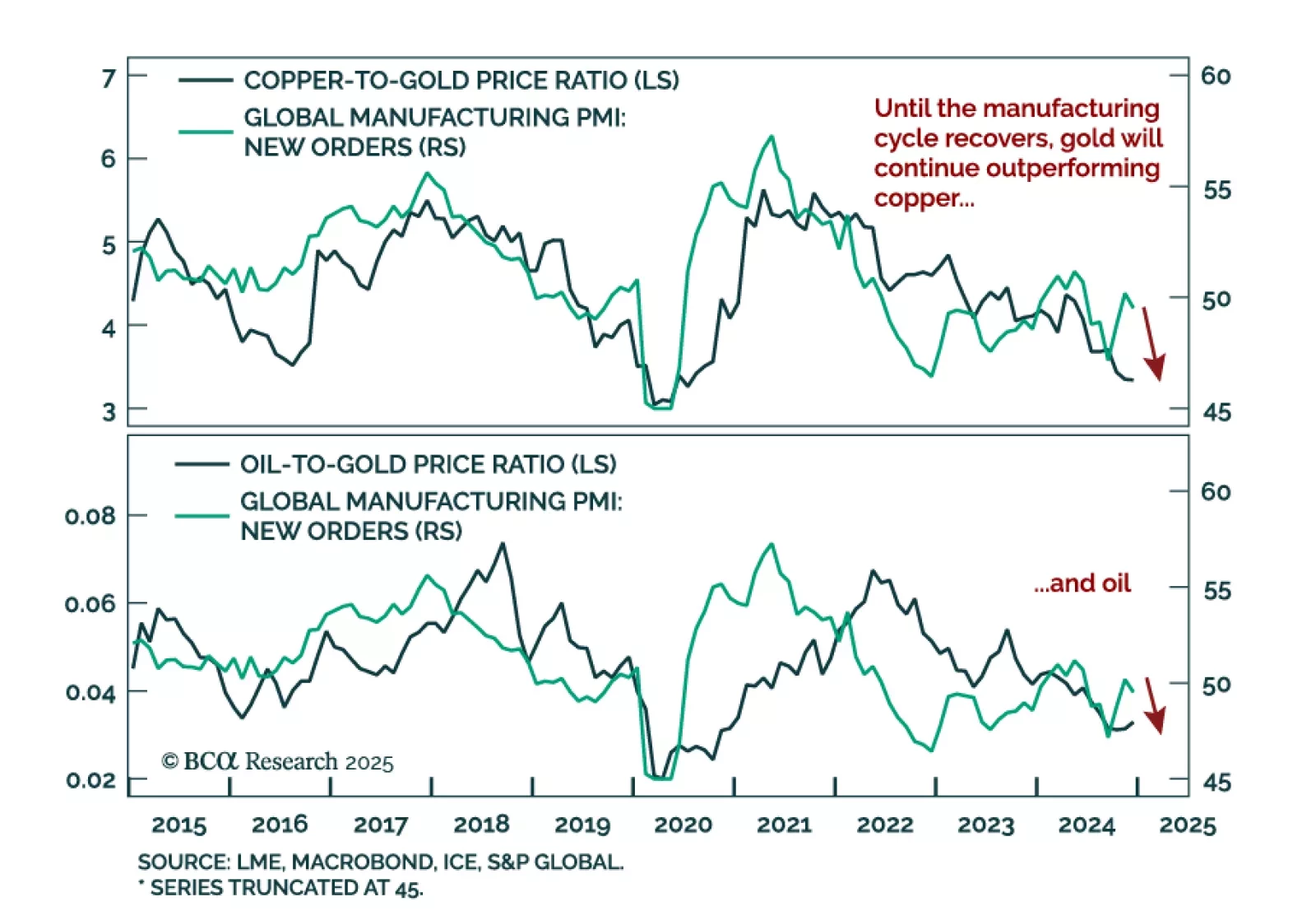

BCA’s Commodity strategists remain long gold/short LME copper and have initiated an outright short in LME copper as a cyclical trade. The US copper tariff will redirect supply away from the US, replenishing depleted inventories…

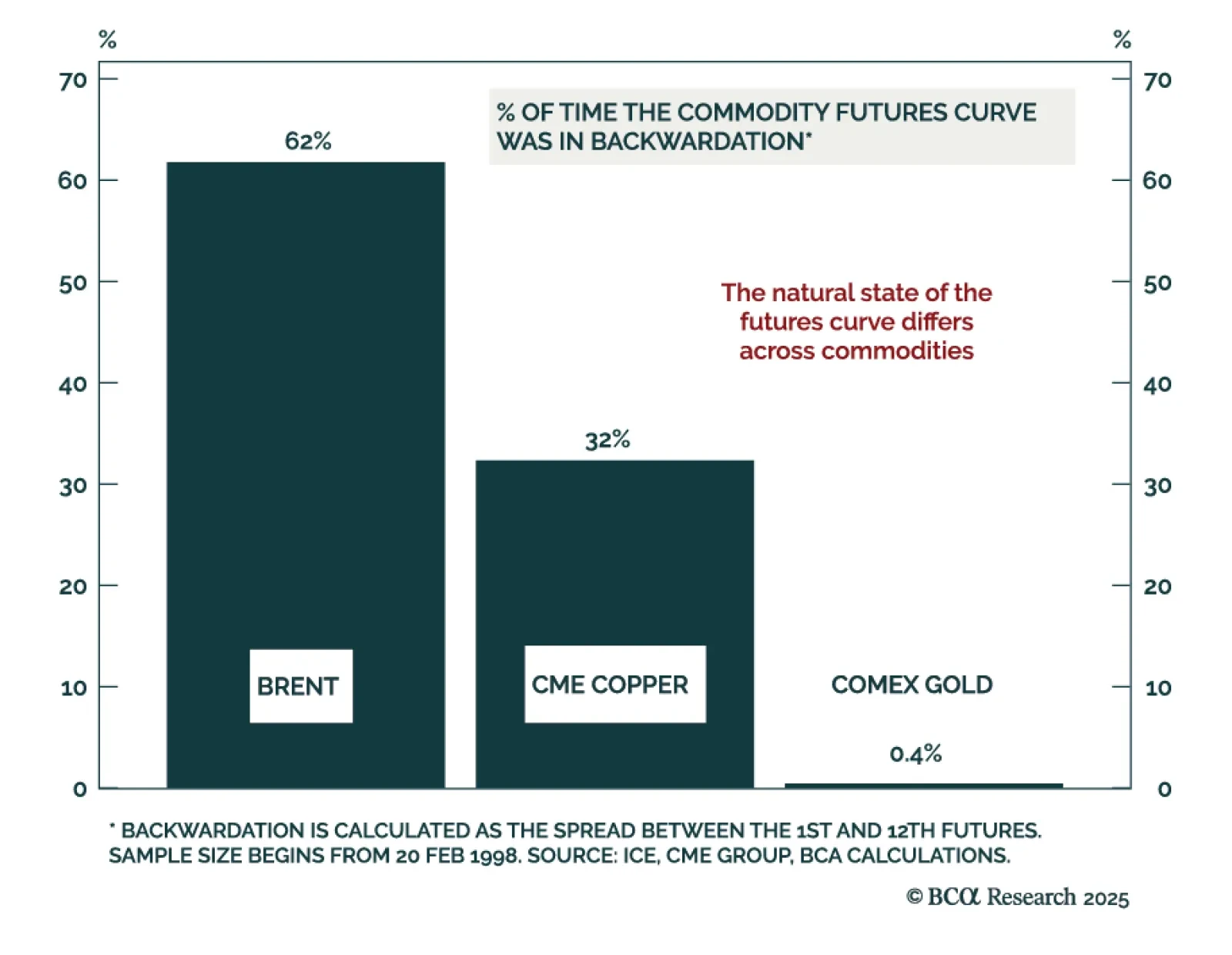

Oil, copper, and gold futures curves have experienced abnormal changes in the past few months, but a bearish global outlook will steepen contango structures across all three. Oil’s curve structure has flipped from backwardation…

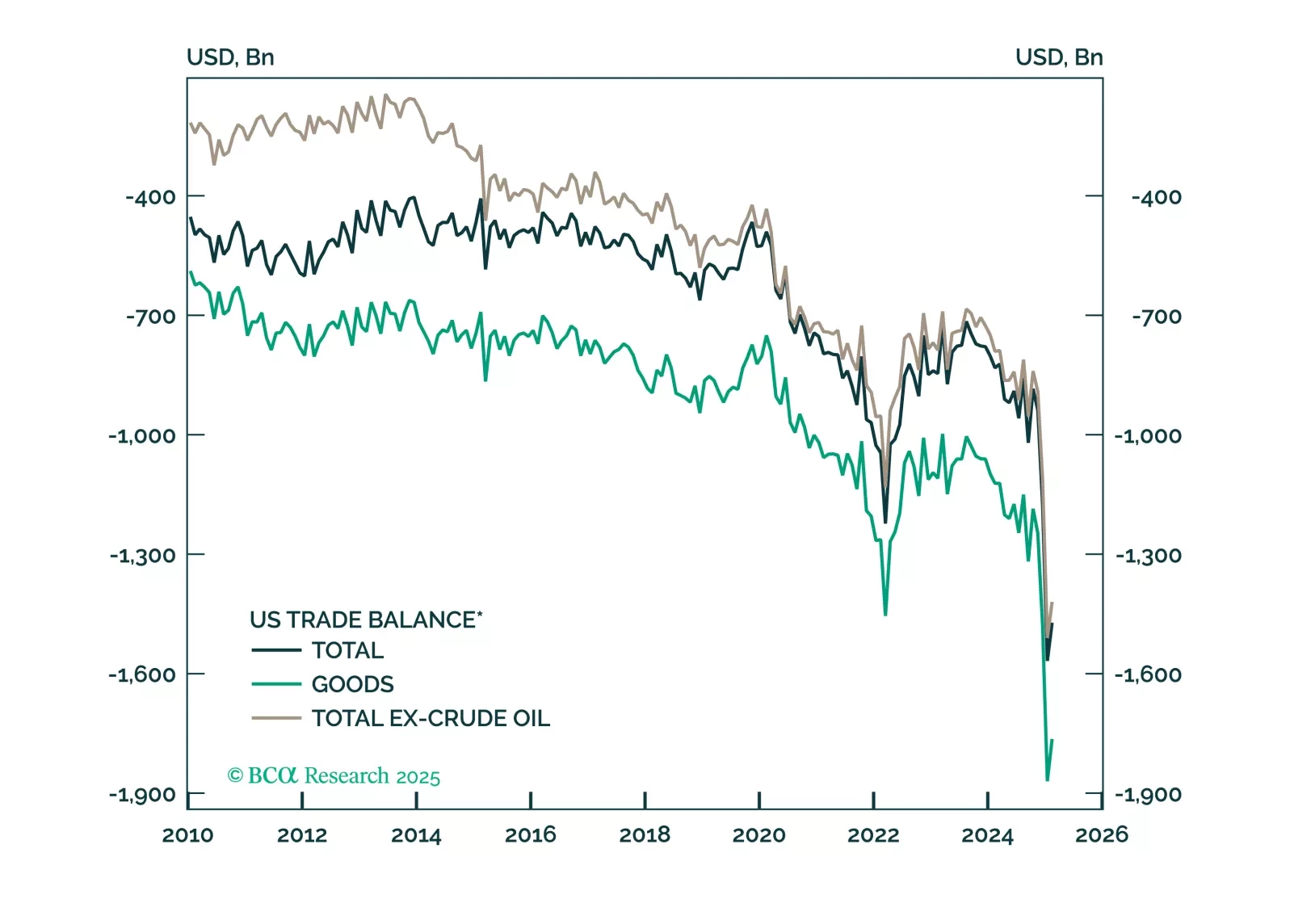

This report looks at the FX implications of the Trump tariffs, and the review of our Q1 trades.

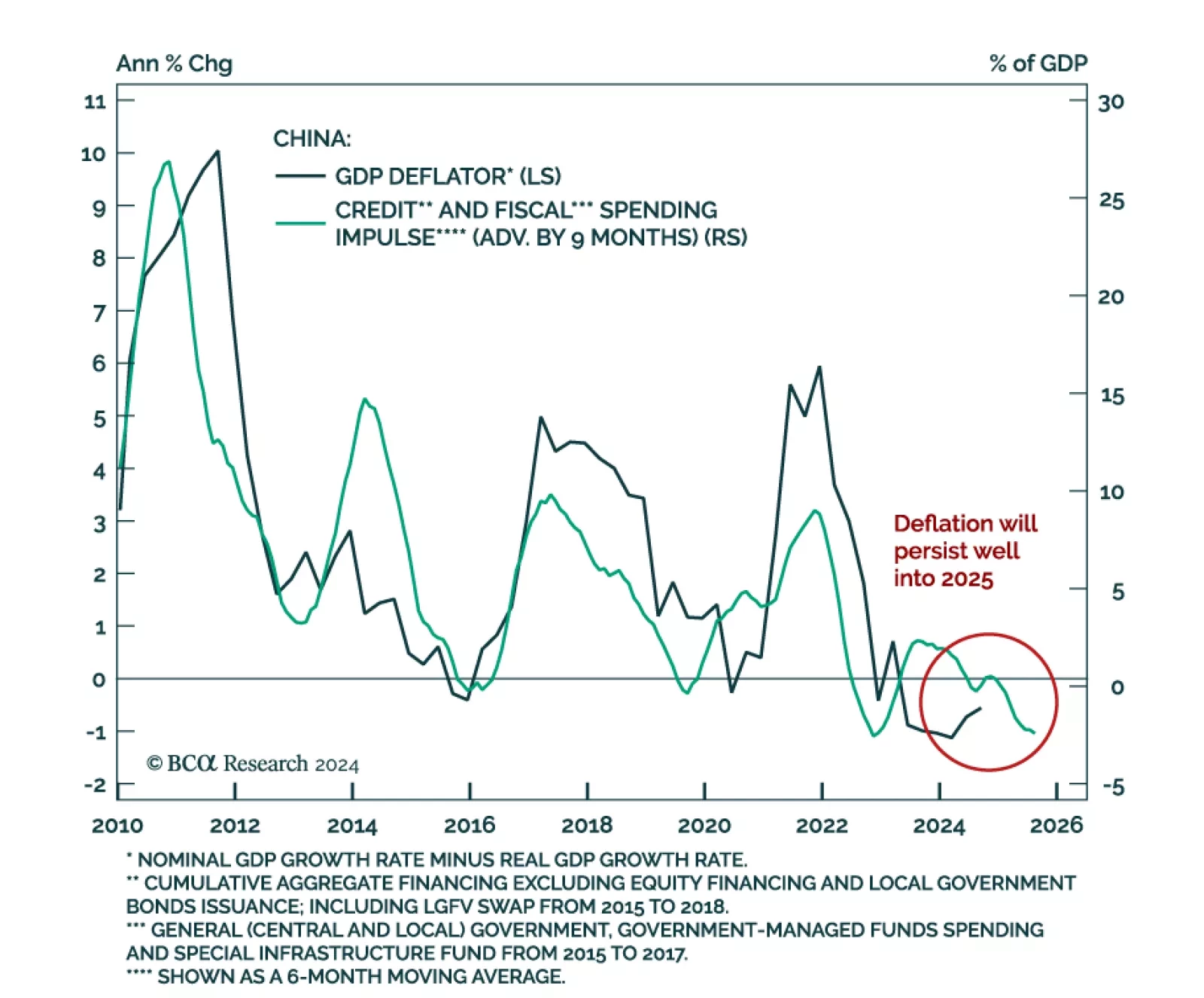

Our Commodities & Energy strategists published a special report outlining three themes they see in the space for 2025. The themes are the following: Sluggish global demand and weak industrial activity will likely weigh…

Despite a strong dollar, rising yields, and falling equities, oil and copper prices have recently risen. Oil has broken out above its 200-day moving average, while copper is currently testing its own. Oil’s bullish price…

Our Emerging Markets, China, and Commodities strategy teams published their 2025 joint outlook. Our colleagues remain bullish on the US dollar for now but see rising odds of the Trump administration actively pursuing greenback…

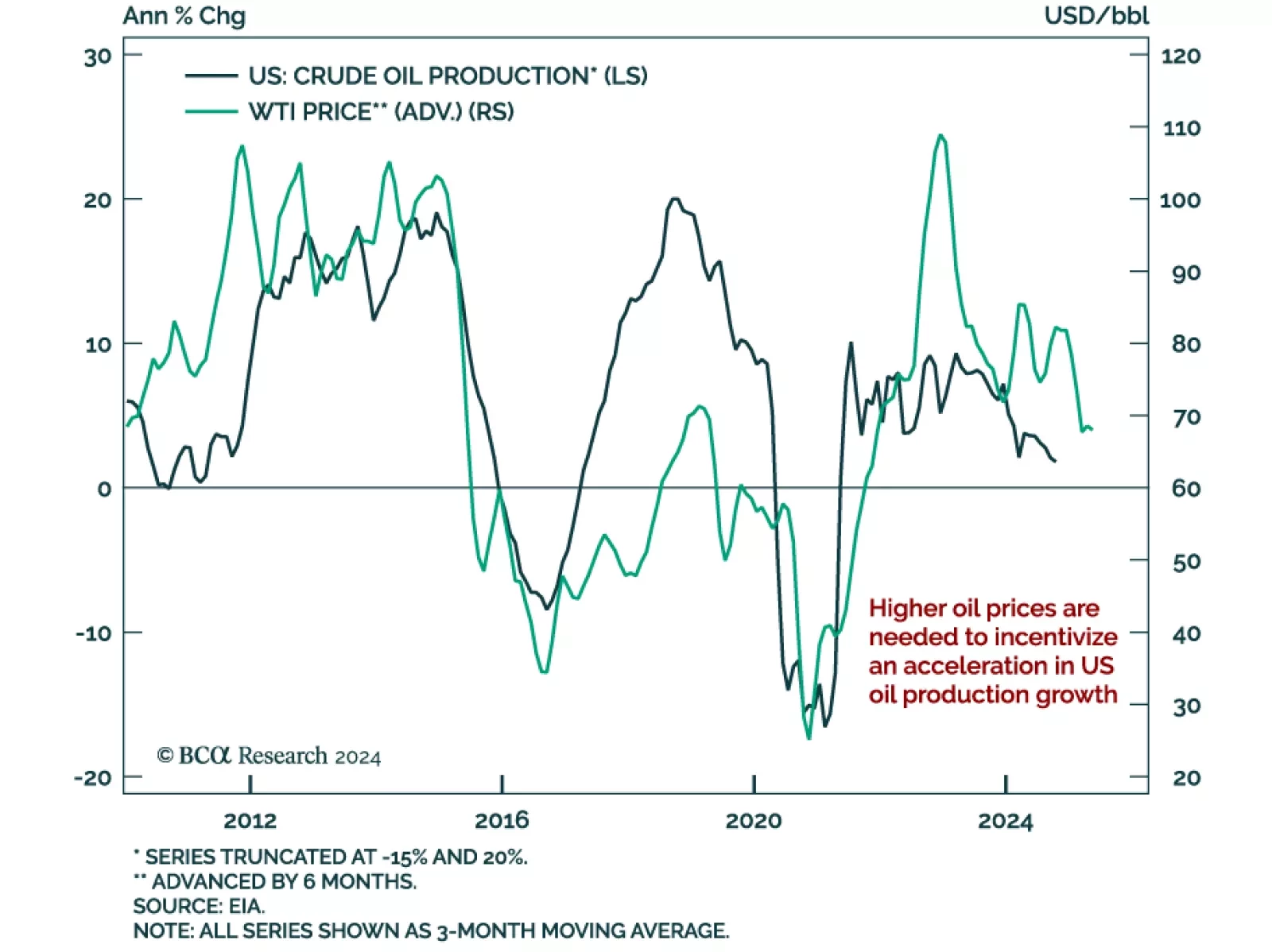

Our Commodity & Energy Strategy team evaluated the impact of president-elect Trump’s policies on commodity markets. Trump’s energy policies, while promoting increased domestic oil production, are unlikely to…

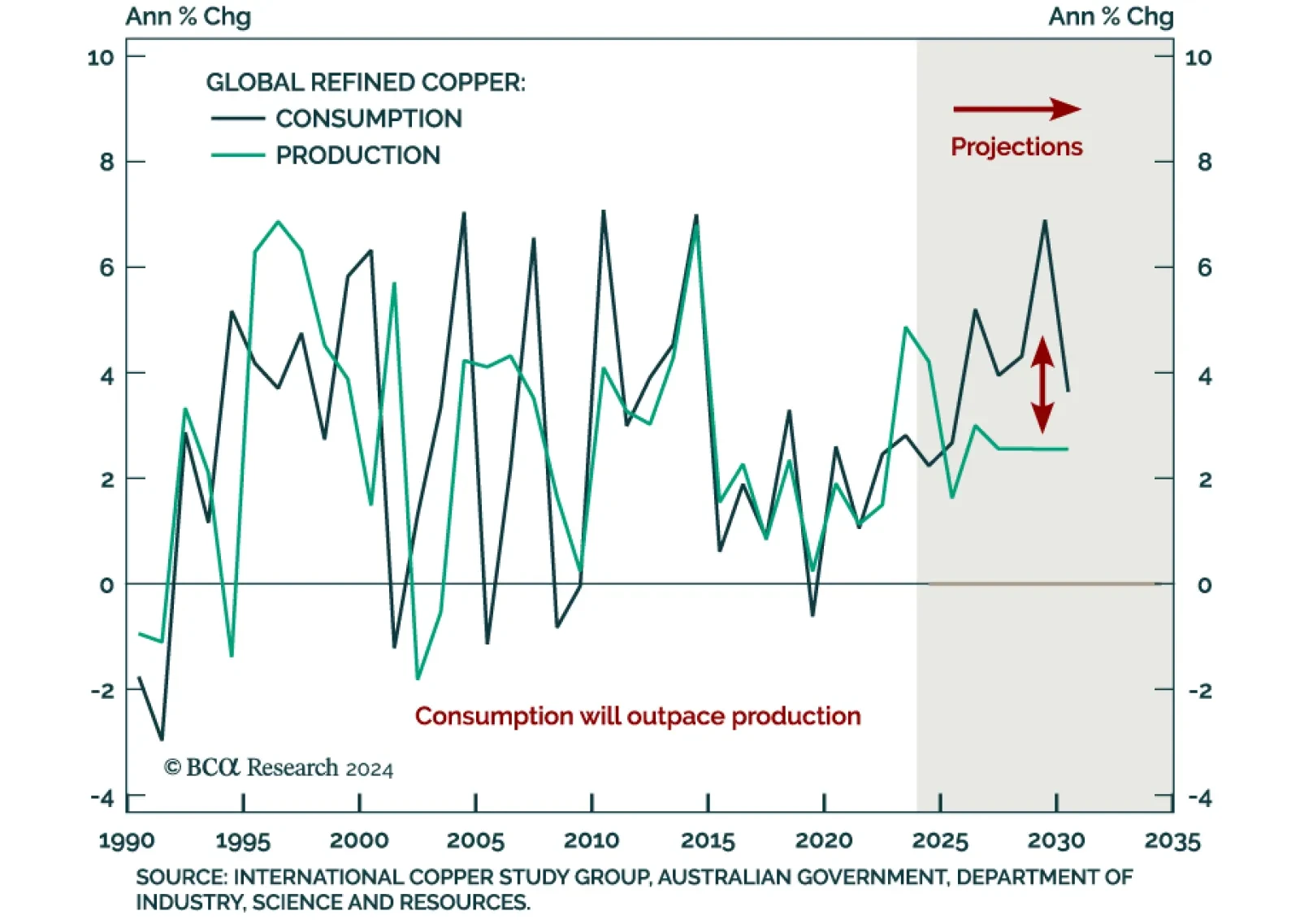

Our Commodity and Energy strategists believe a supply-demand deficit will emerge in 2026, and widen into the end of the decade. Copper demand is set to grow over 4% annually between 2025 and 2030, fueled by the green energy…