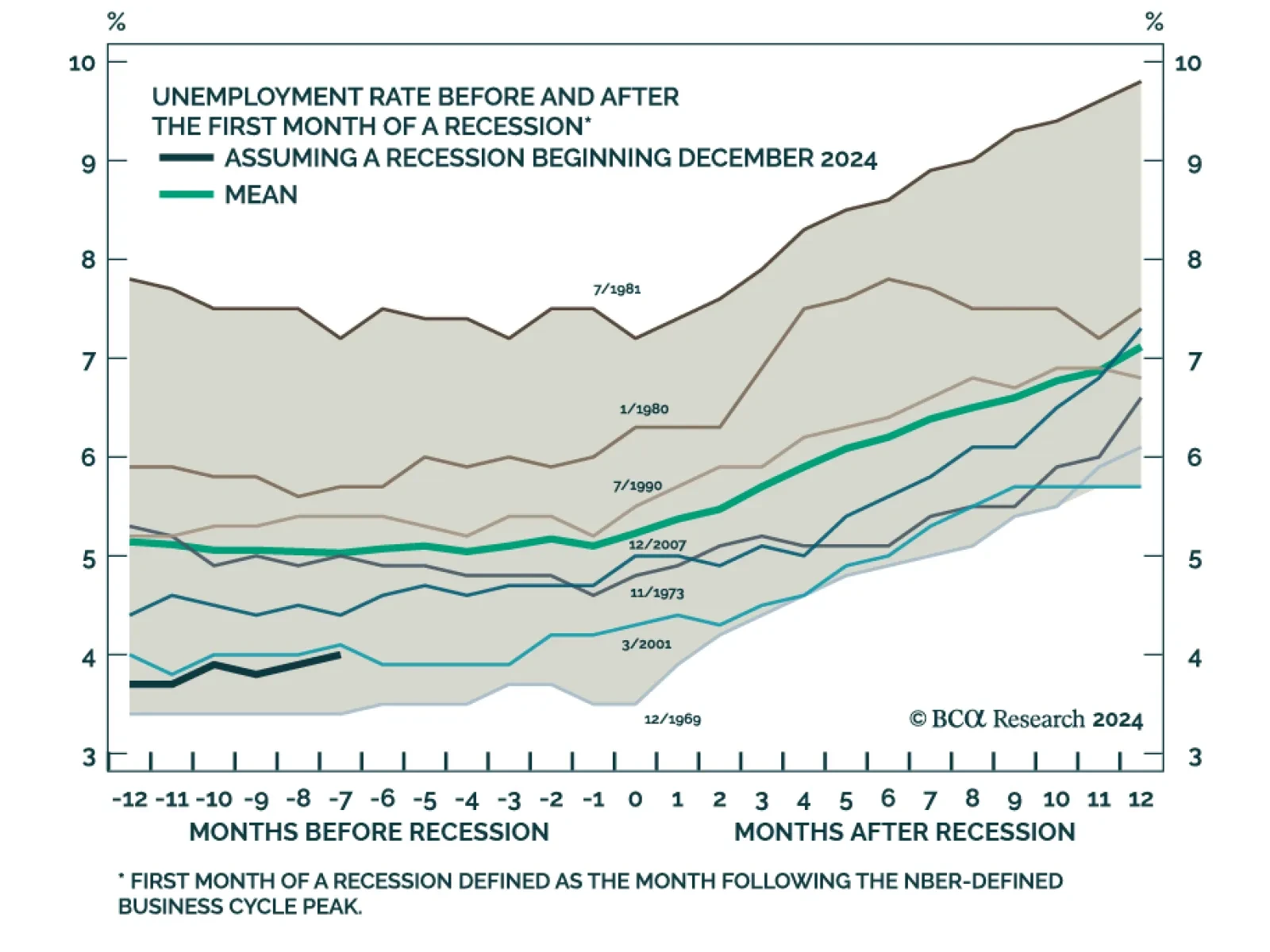

The US unemployment rate stands at just 4.0% today following 27 consecutive sub-4% readings. Does this low unemployment rate guarantee a soft landing in the US economy? Our Global Investment Strategy (GIS) team’s base…

In Section I, we examine some concerning signs of US economic weakness that emerged in June. We also discuss portfolio positioning in the face of falling interest rates and cross-check our recommended US equity overweight in the face…

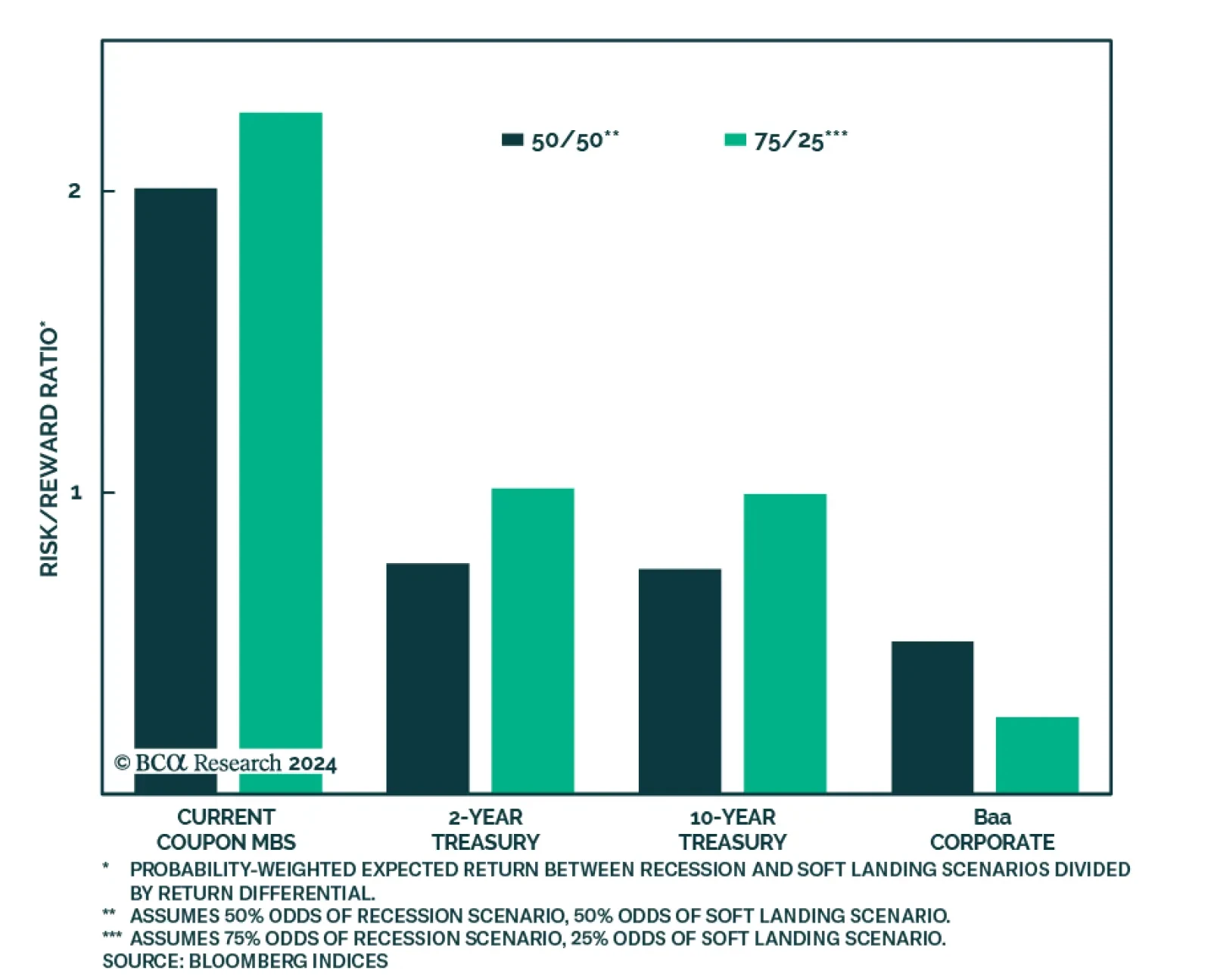

In its latest Special Report, BCA Research’s US Bond Strategy service considers the relative merits of four different fixed income investments in the current economic environment: 2-year Treasuries, 10-year Treasuries, Baa-…

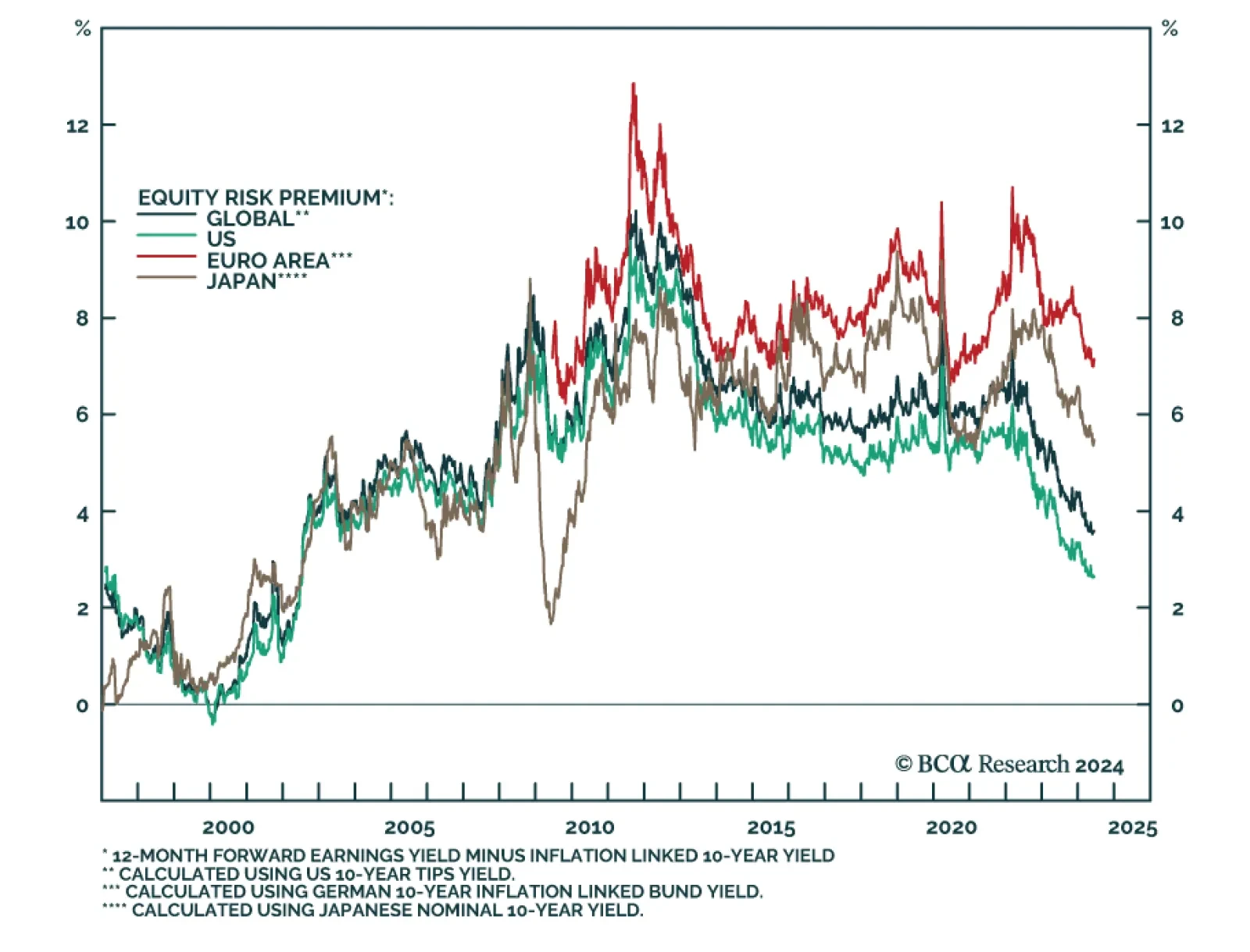

The equity risk premium (ERP) allows investors to assess the additional compensation they are offered as an enticement to assume equities’ incremental risk. The ERP measures equities’ excess return by deduct…

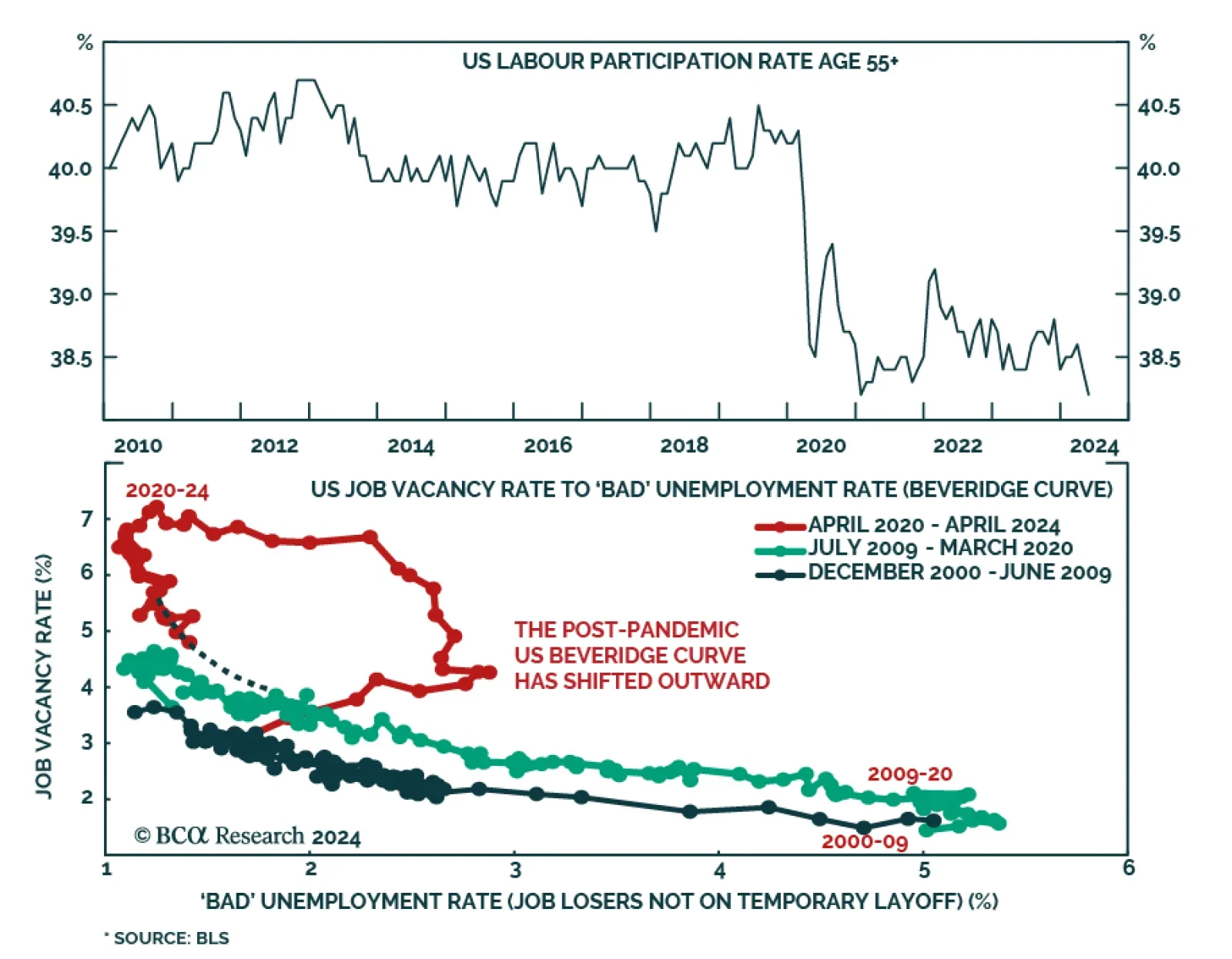

According to BCA Research’s Counterpoint service, job losers not on temporary layoff (‘bad’ unemployment) will need to rise further for the Fed to reach its 2 percent inflation target. Although prime-age…

We continue to expect a recession by early 2025 but assign non-trivial odds to growth surprising to the upside until then. Our Global Investment Strategy team thus recommends investors adopt a barbell equity strategy as a…

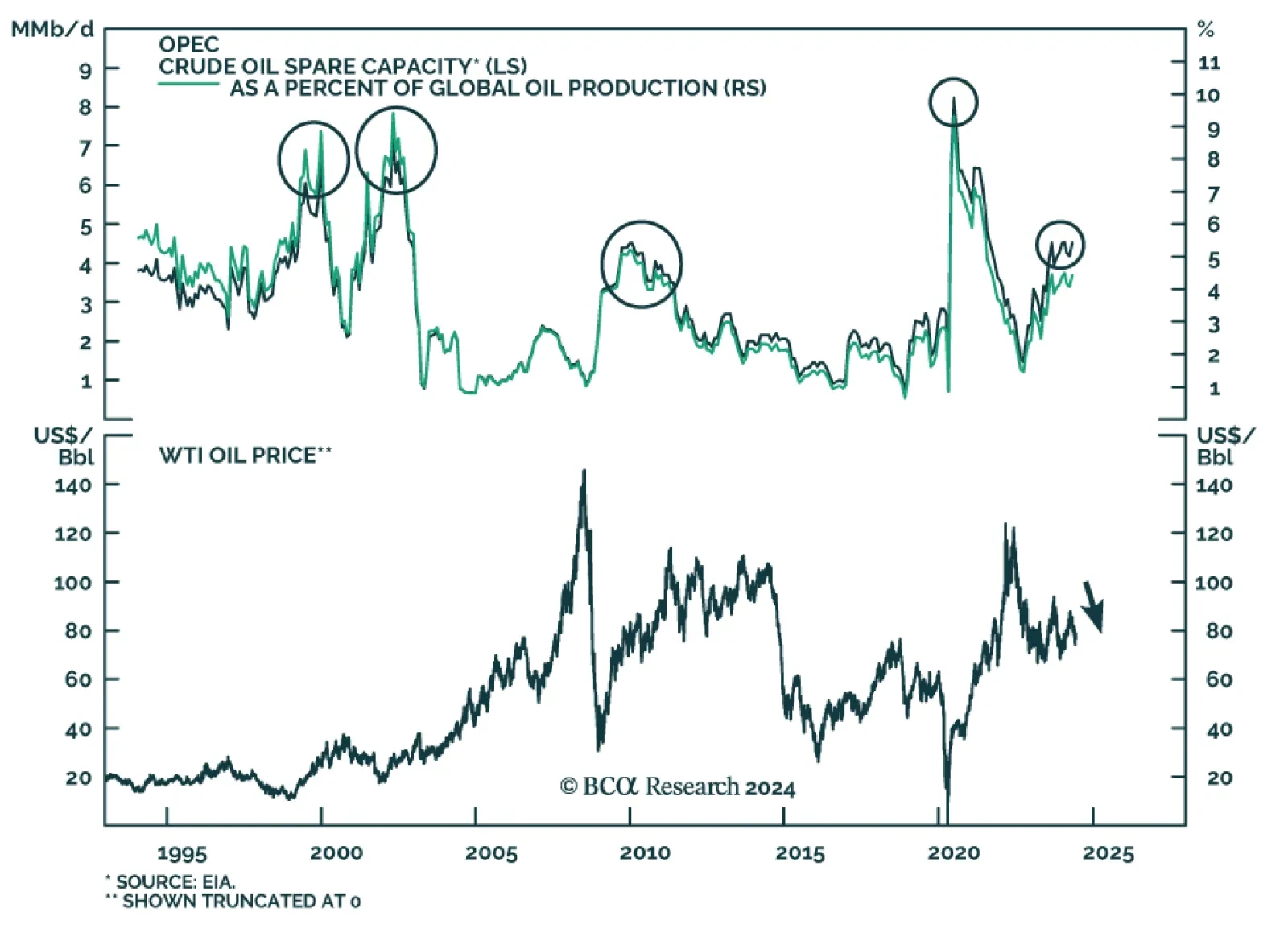

Earlier this year, WTI oil prices peaked on April 5th at $87.69 per barrel. They have since corrected by 12.7%. Should asset managers expect this decline to continue? Our Global Investment Strategy team believes oil prices…

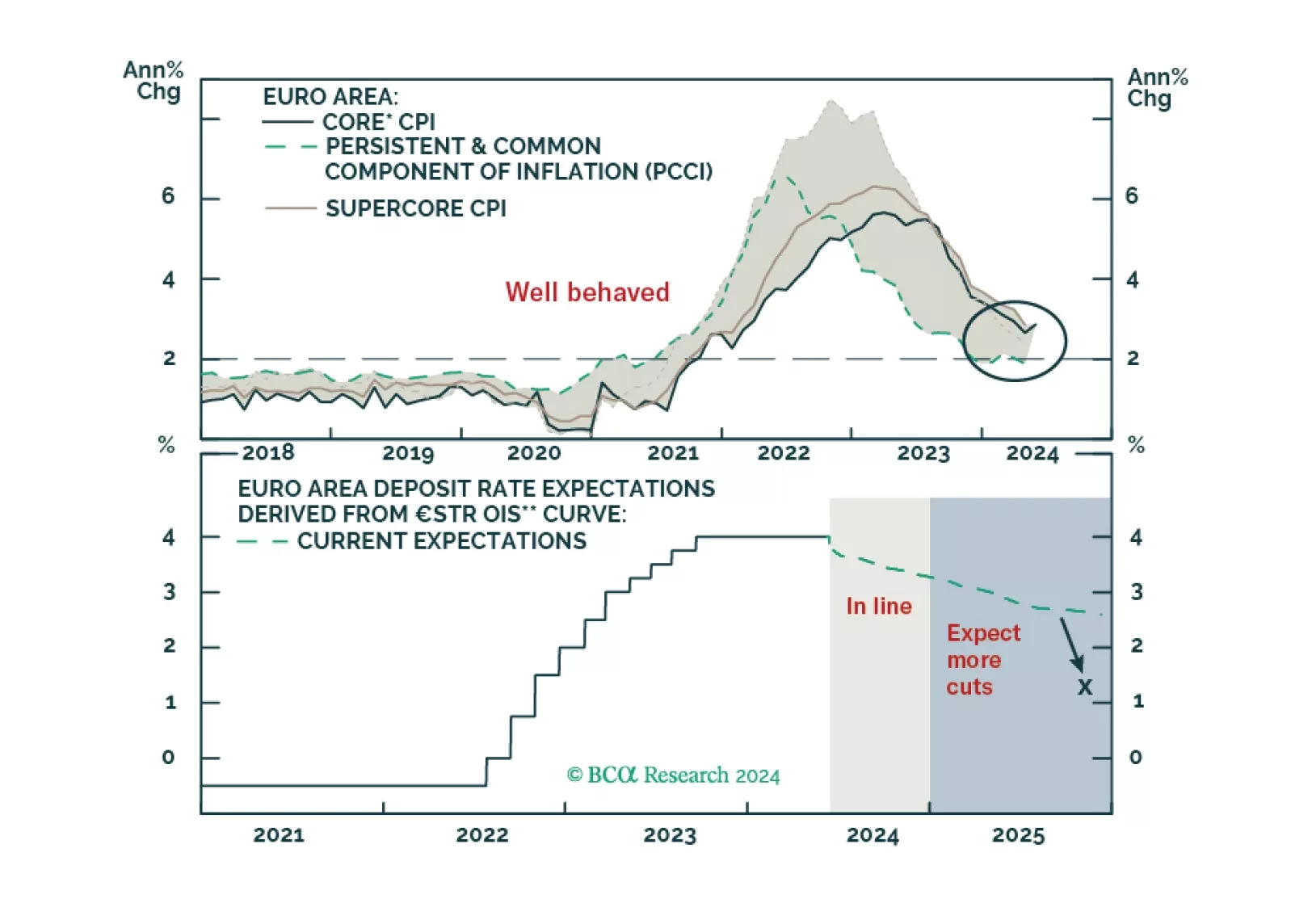

The ECB is now firmly in easing mode, even if it refuses to pre-commit to a specific rate path. What does this data dependency mean for the euro and European yields?

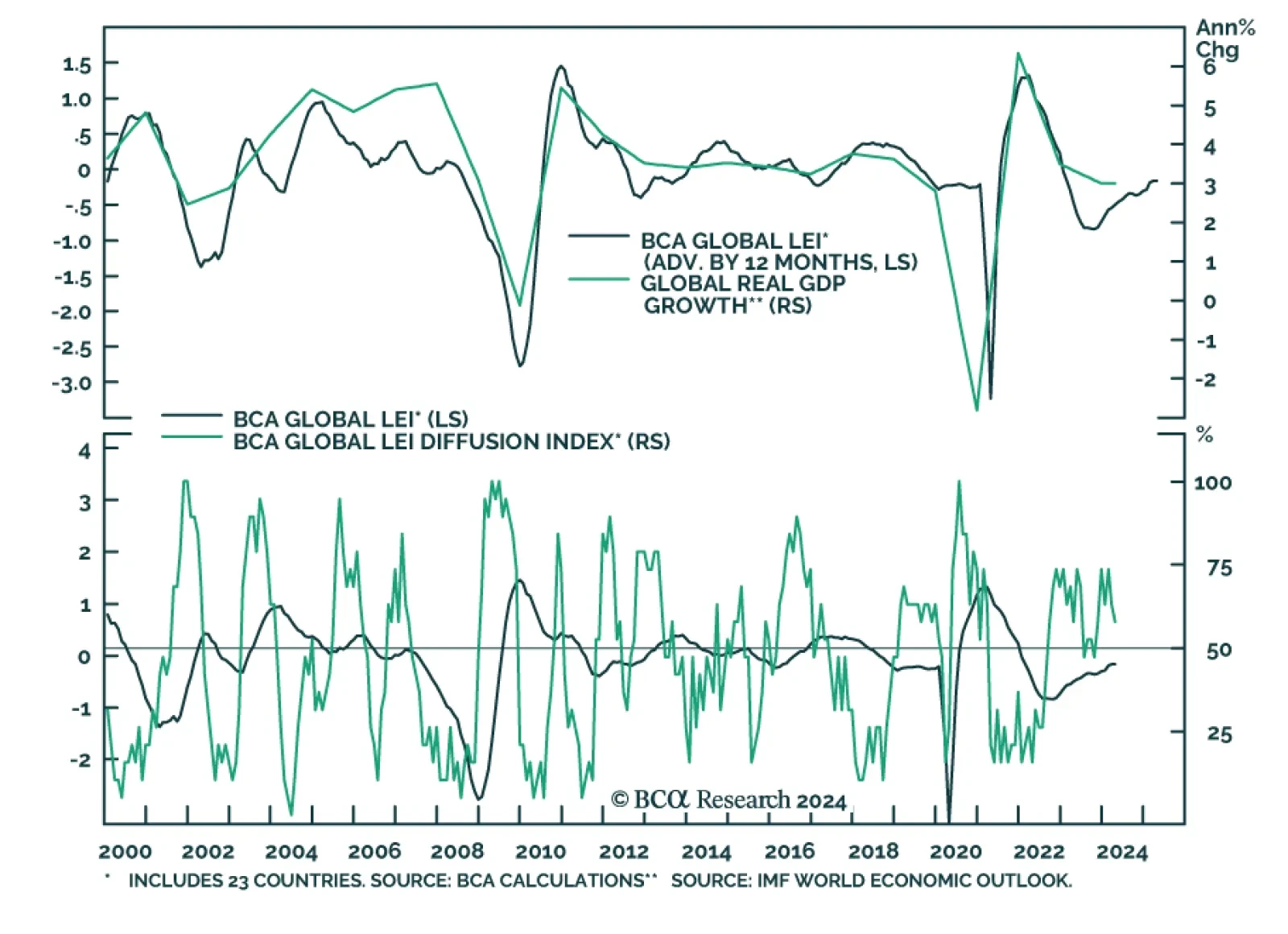

BCA’s Global Leading Economic Indicator has had a good track record of predicting year-on-year changes in the IMF global real GDP growth series. This GDP-weighted average of the standardized leading indicators of 23 DM and…

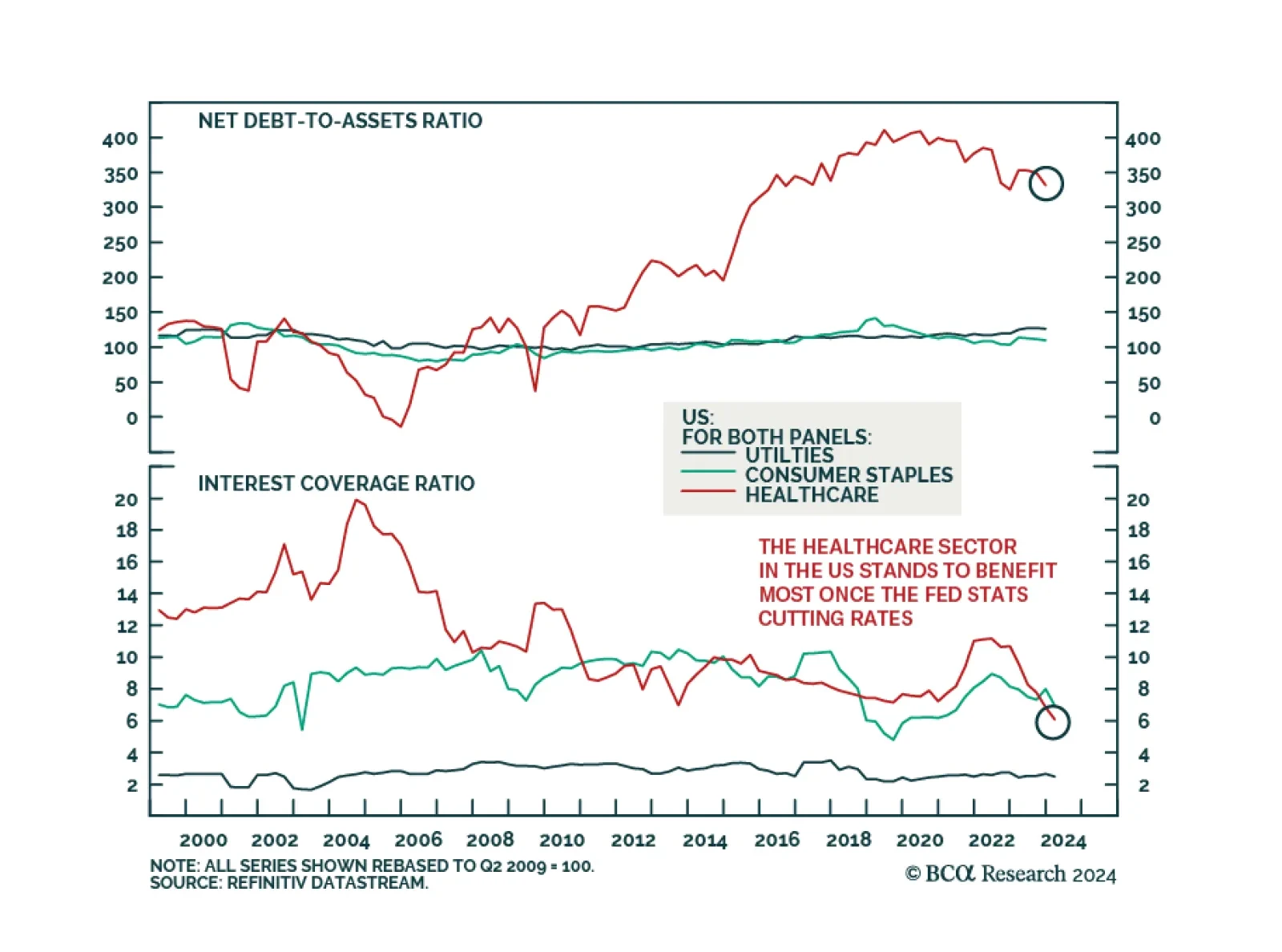

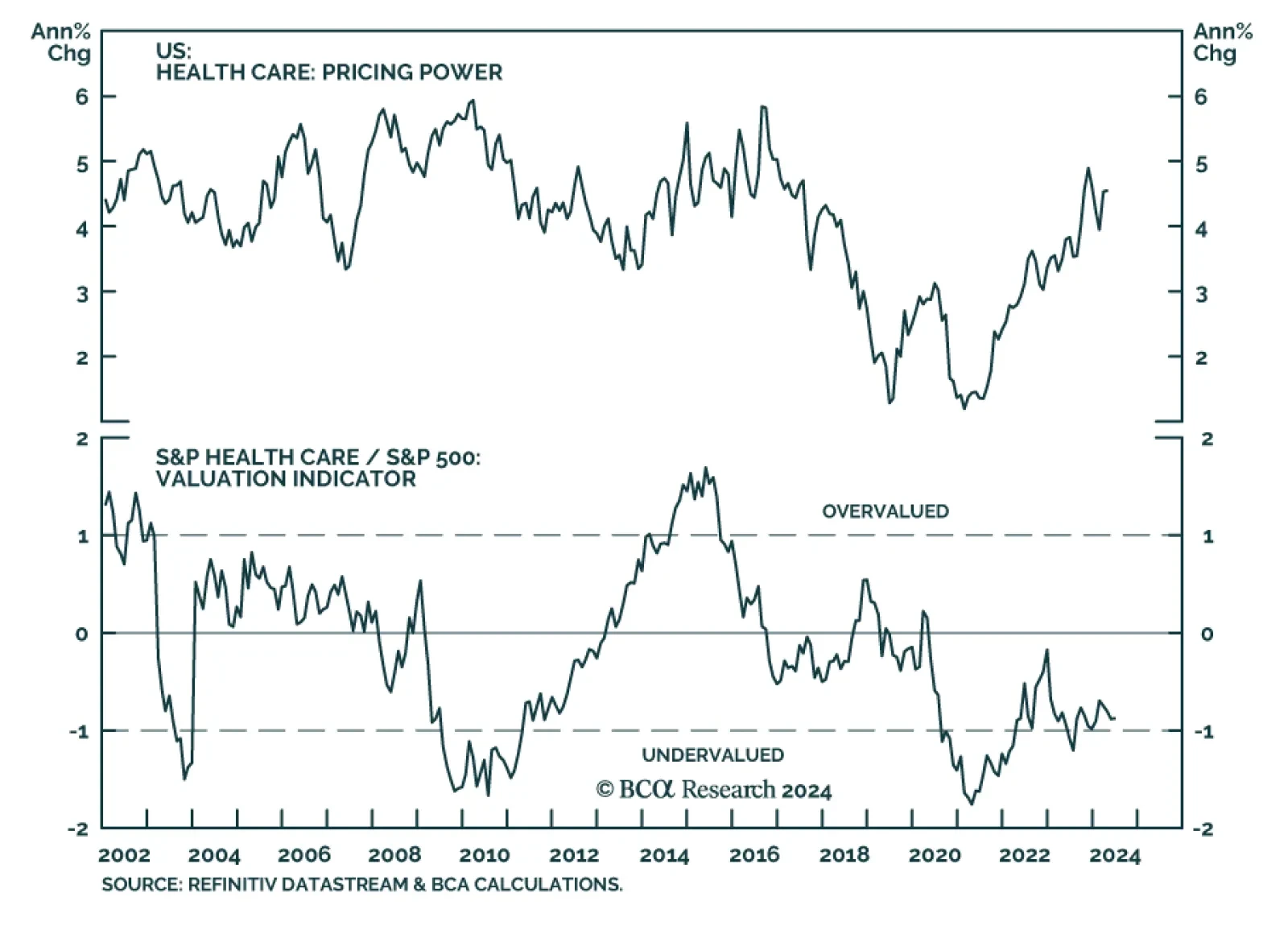

Healthcare has underperformed the S&P 500 by 23% since early 2023. Profit margins have been squeezed since the pandemic revenue windfall dried up and because long-term contracts prevented companies from raising prices in line…