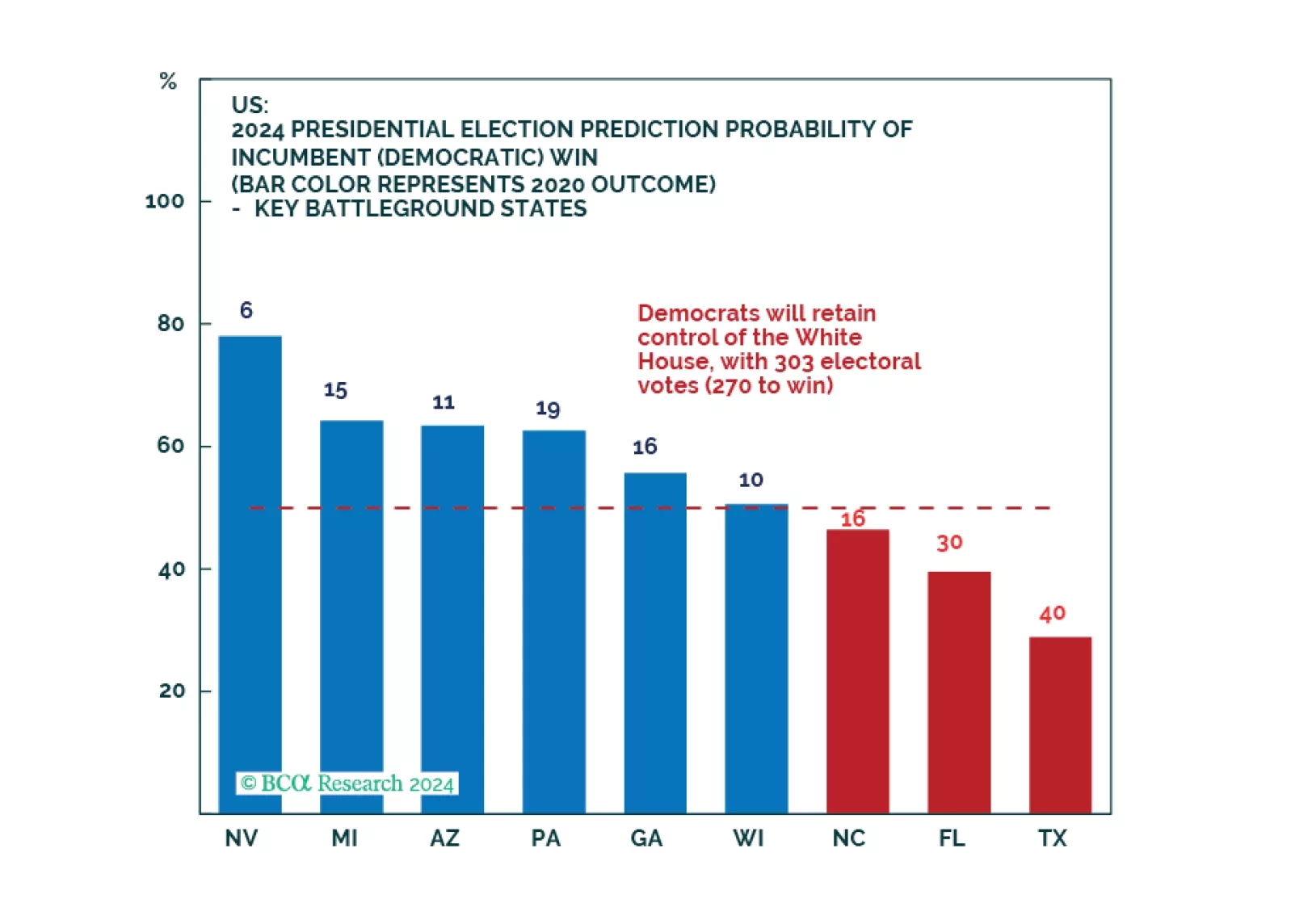

Democrats will not win a full sweep and implement drastic new tax hikes. However, our quant model still favors them to win the White House and just upgraded their odds. While we expect equity volatility around the election, investors…

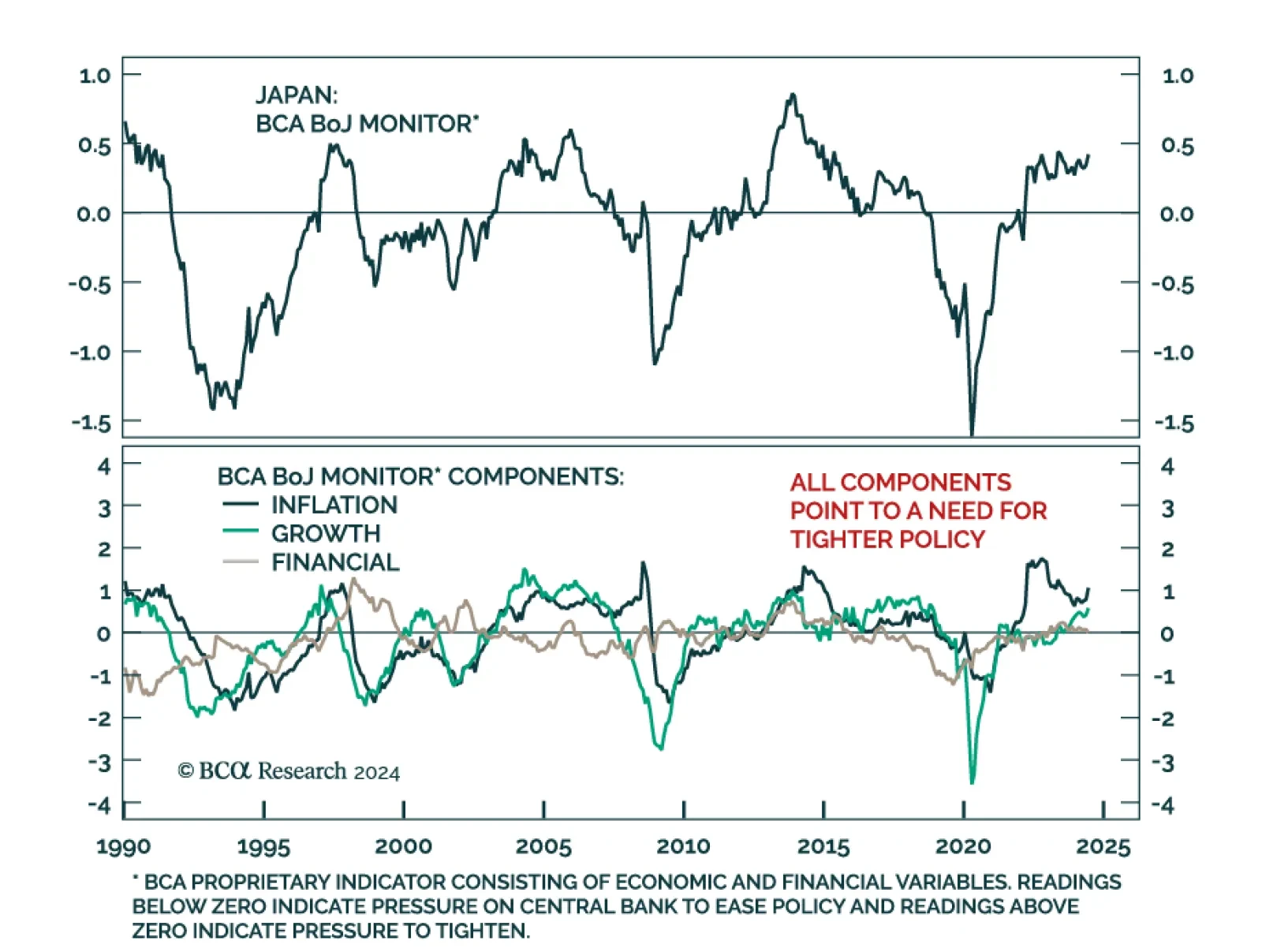

The BoJ delivered a surprise rate hike last week, then proceeded to sending a more dovish signal on Wednesday. Deputy Governor Shinichi Uchida strongly hinted at a central bank that would refrain from hiking further in times of…

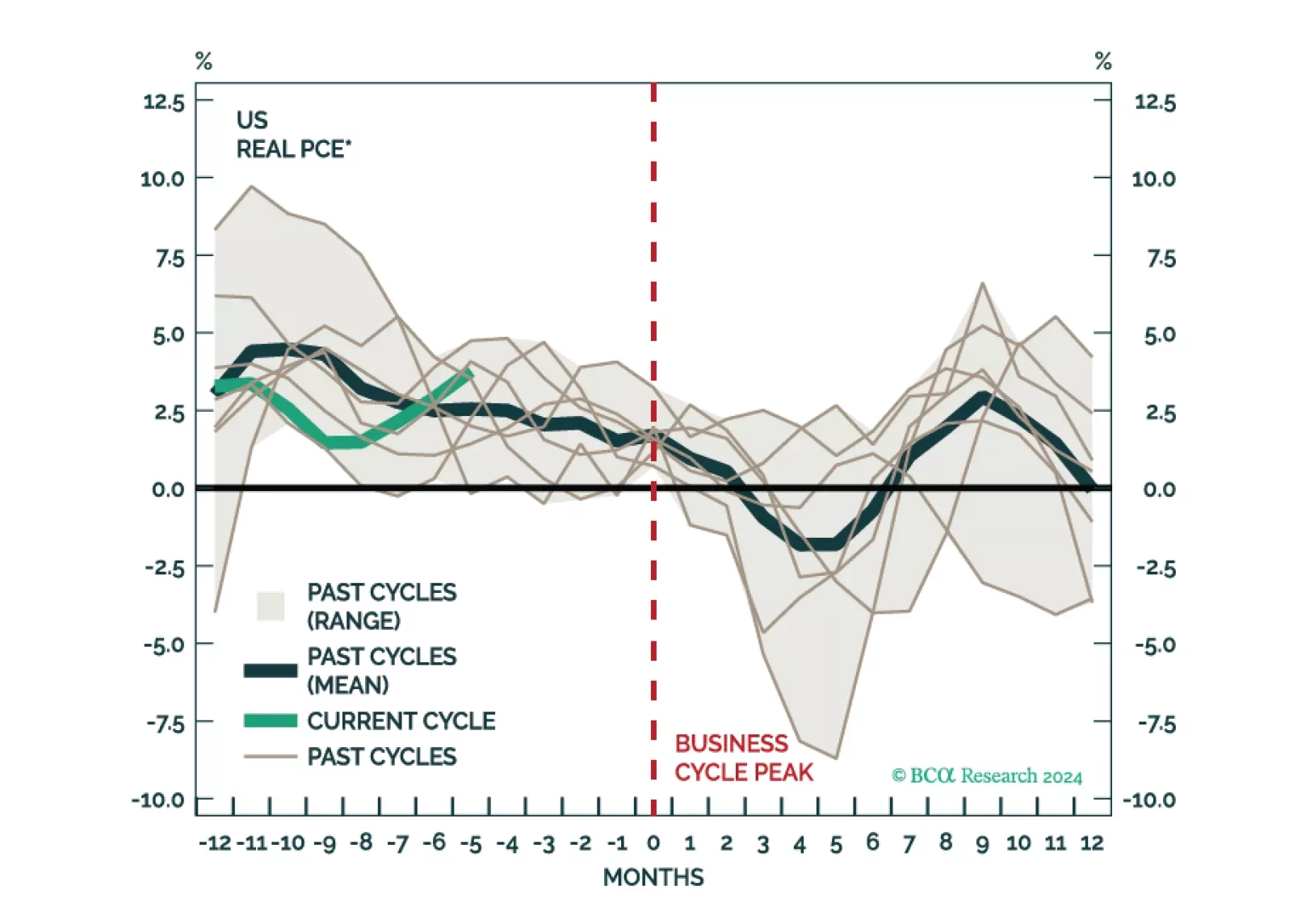

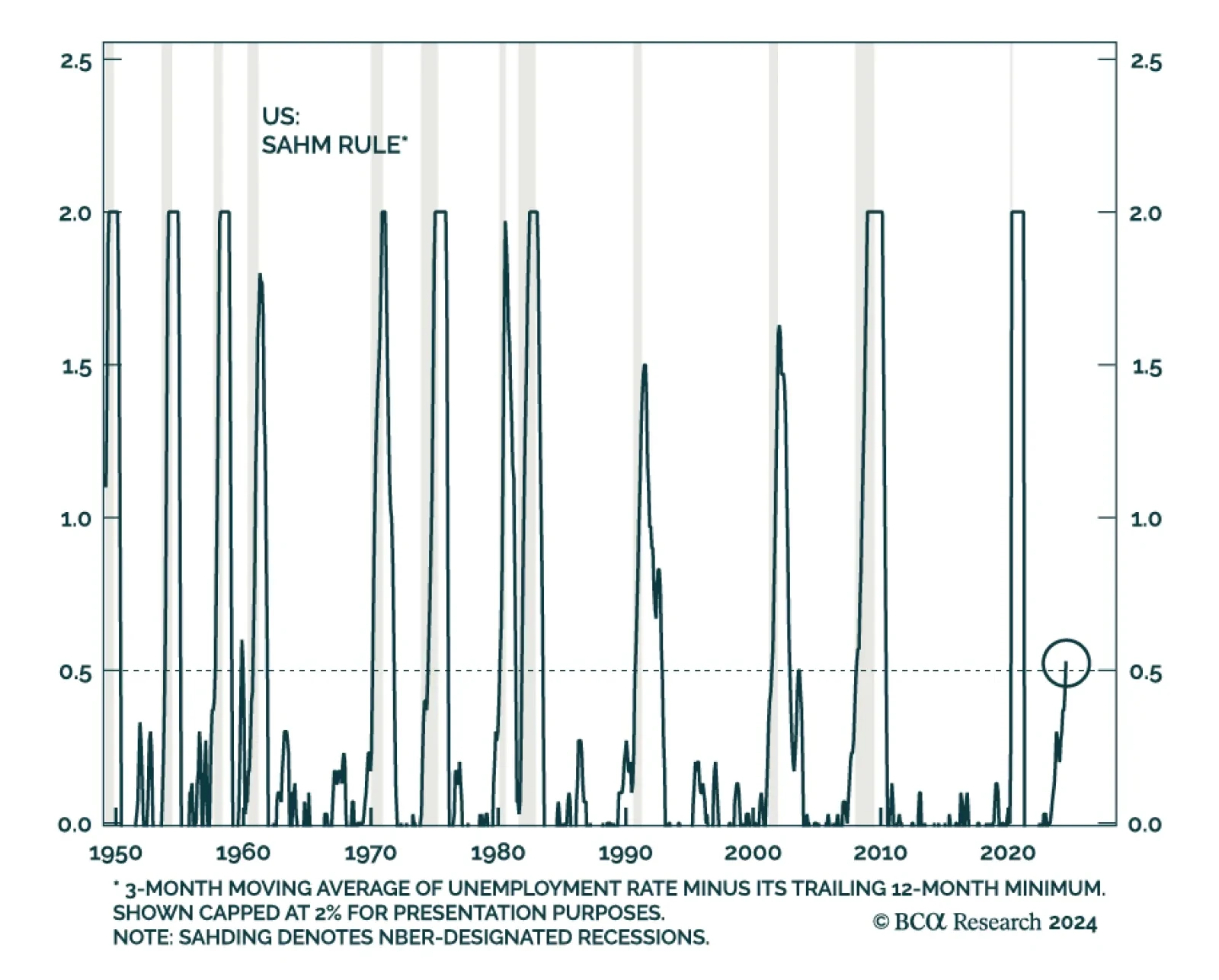

The Sahm Rule – a widely watched real-time recession indicator – signals the early stages of a recession when the 3-month moving average of the unemployment rate rises at least half a percentage point above its past…

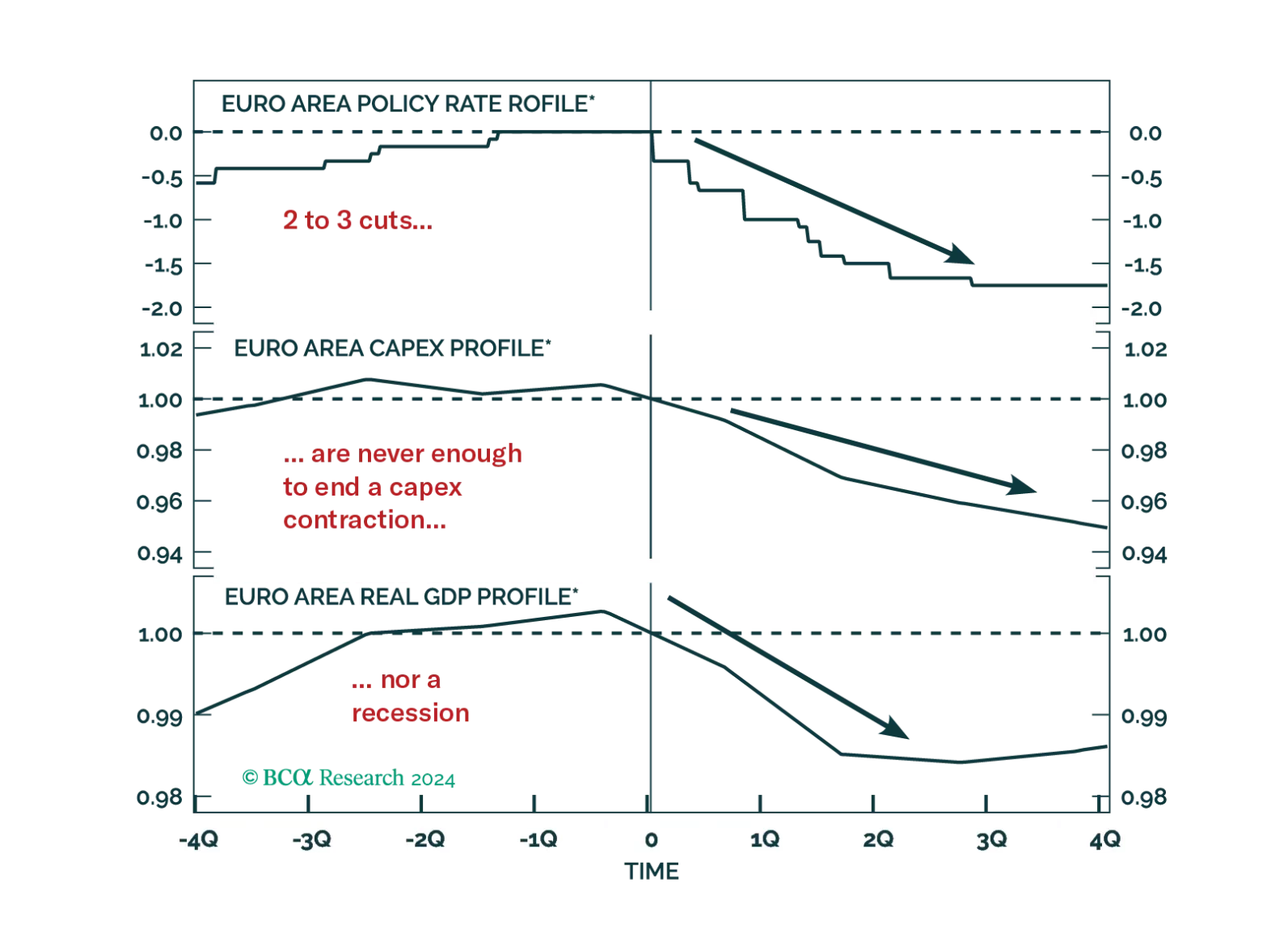

Investors hope that the ECB rate cuts priced into the curve will be sufficient to achieve a soft landing in Europe. History argues against this view, but will this time be different?

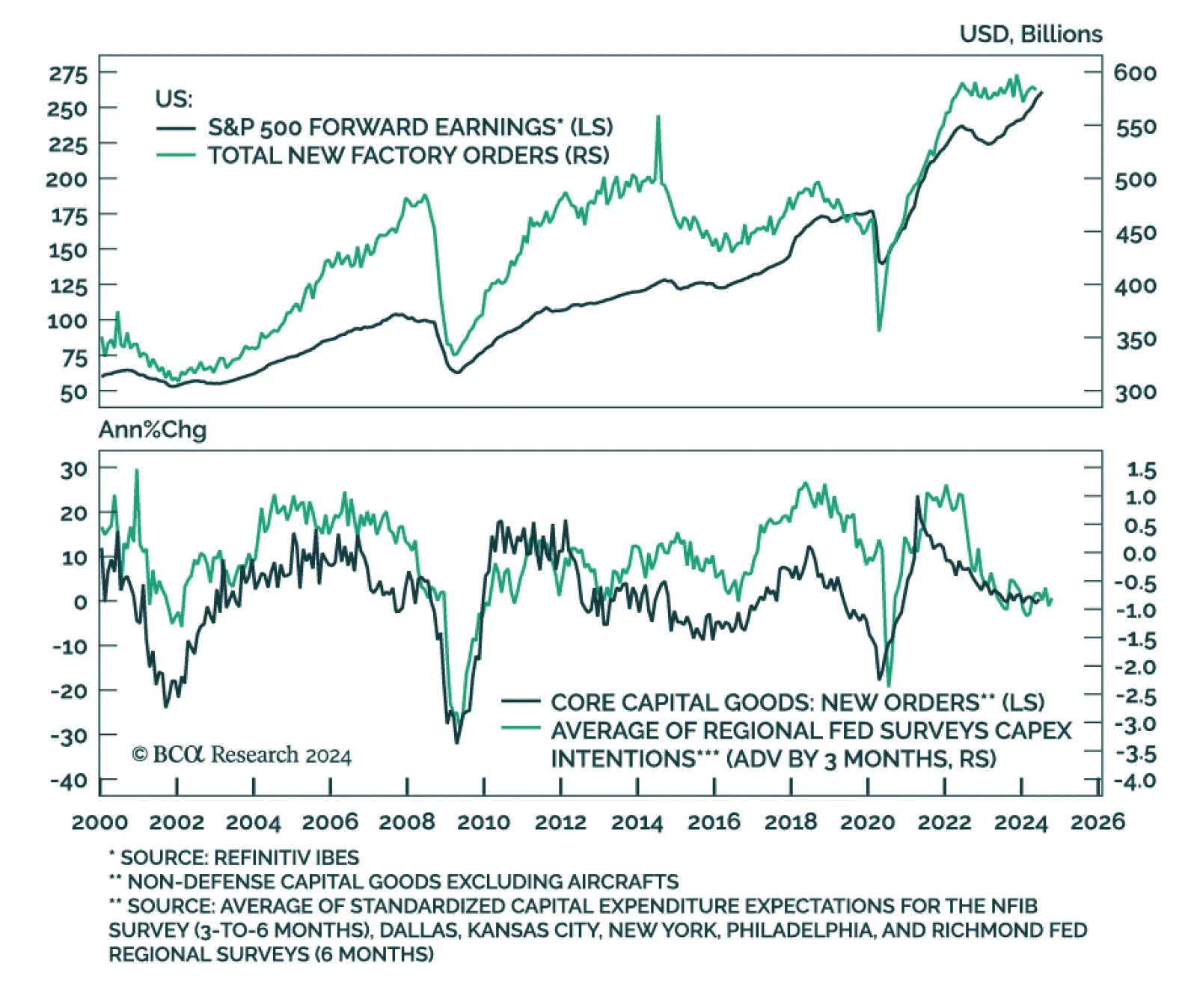

Preliminary estimates suggest that US durable goods orders plummeted in June. They contracted 6.6% m/m, largely disappointing expectations of a faster pace of growth. However, a whopping 127% monthly decrease in highly…

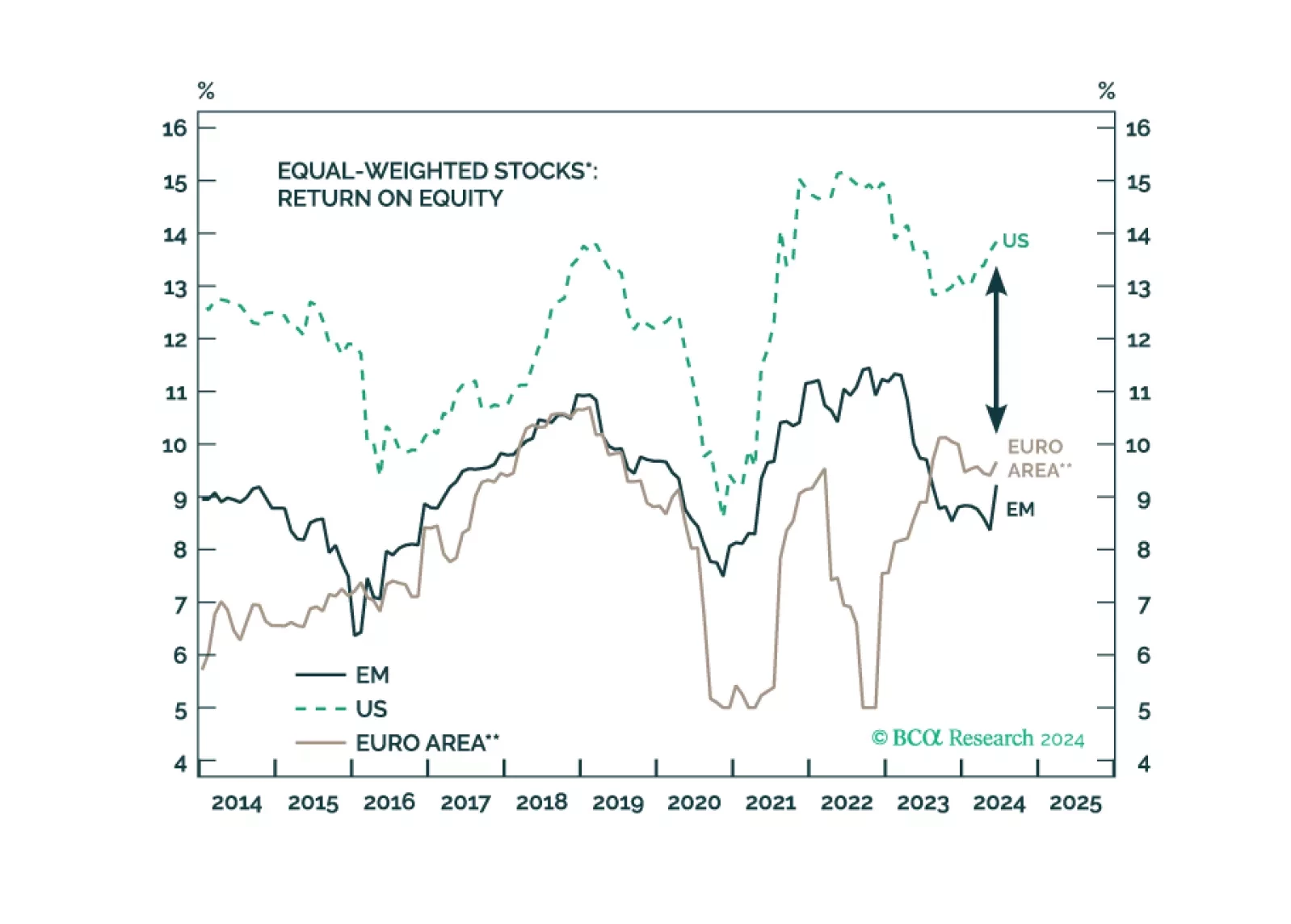

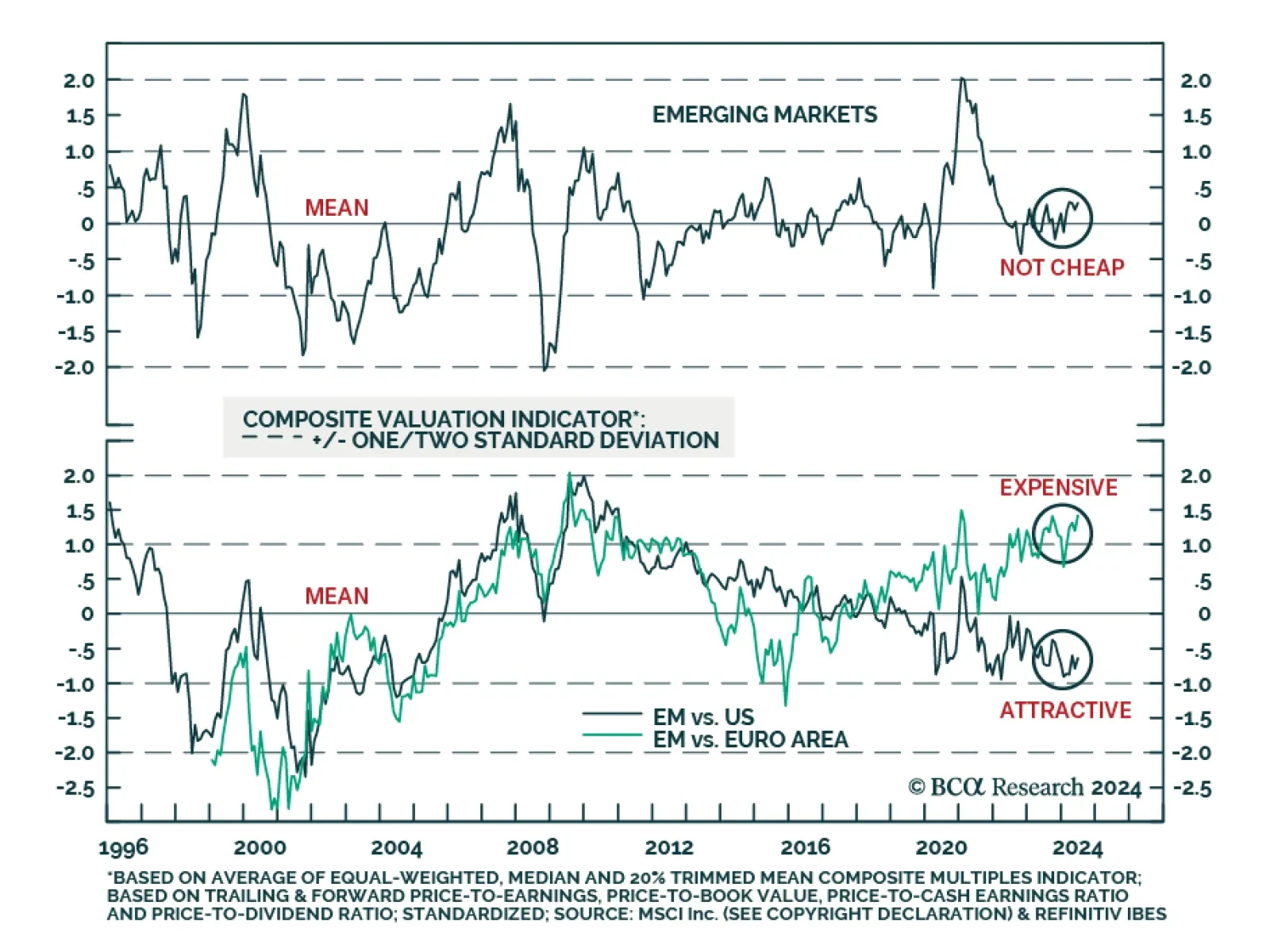

In US dollar terms, the MSCI Emerging Market index has been flat over the past 15 years, dramatically underperforming the S&P 500 and Euro Area equities. The root cause is fundamental; EM earnings per share (EPS) growth has…

GeoMacro’s monthly Beta Report will typically perform deep dives into the most pressing macro topics of the moment. For its debut, however, it turns the microscope on its own process, explaining the team’s framework…

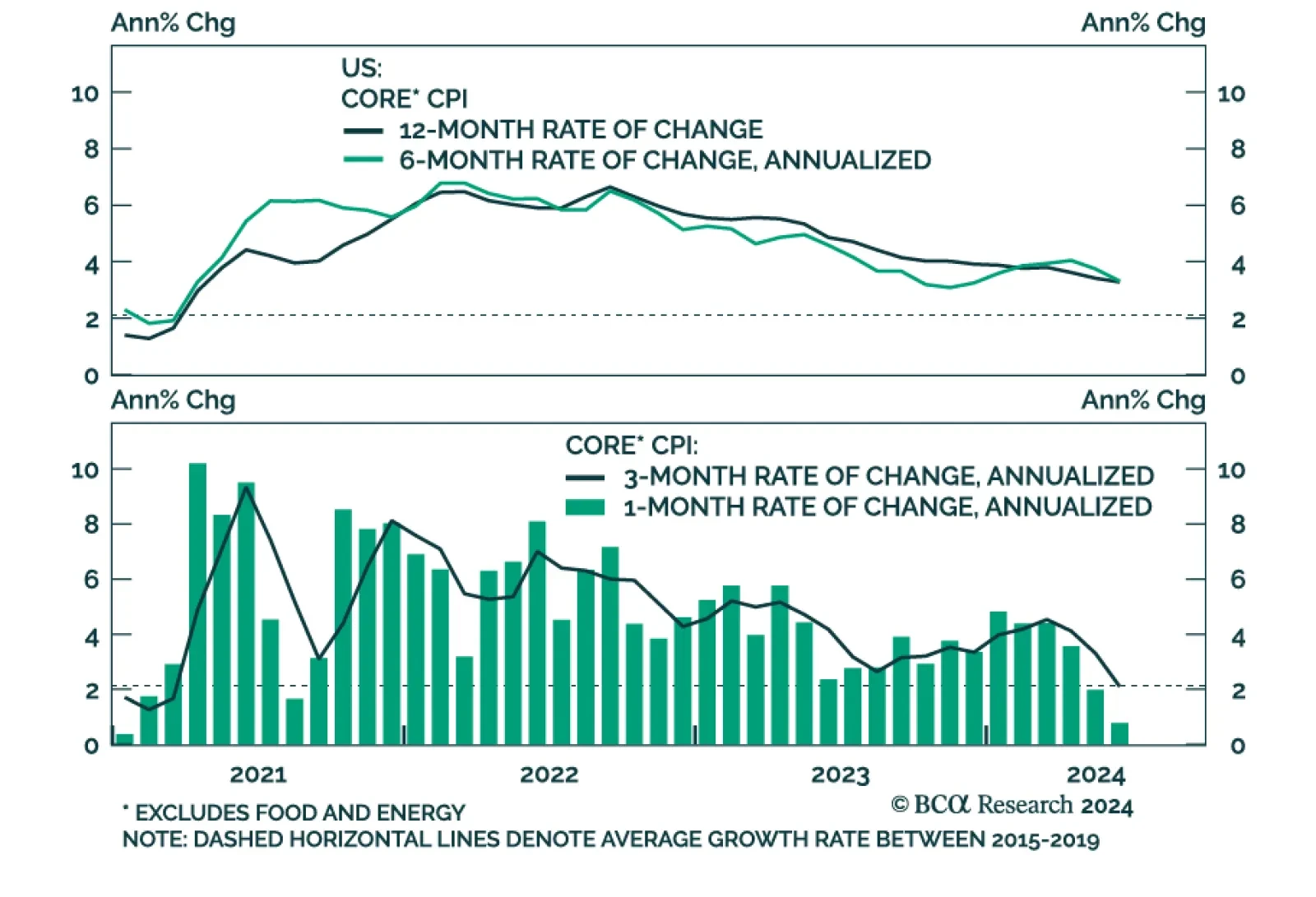

The disinflationary trend in US CPI continued in June as headline CPI dipped to 3% year-over-year, down from 3.3% in May, and core CPI declined by a tick to 3.3%. On a month-over-month basis, headline prices fell by 0.1% and core…