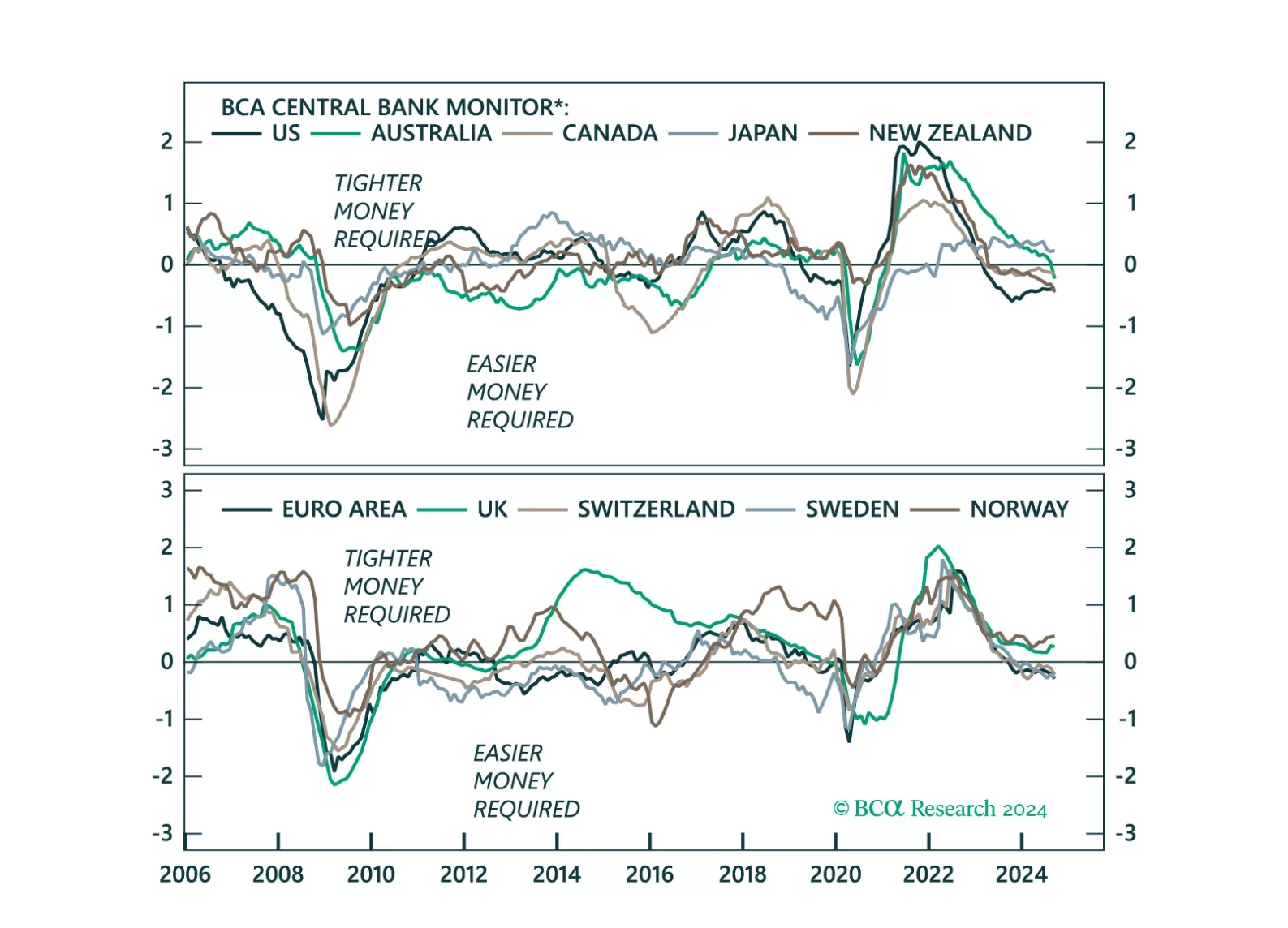

This week, we update our Central Bank Monitors (CBMs), that help us calibrate how monetary policy should be adjusted in developed-market economies. Our conclusion is that while overall, easier monetary settings are required, there a…

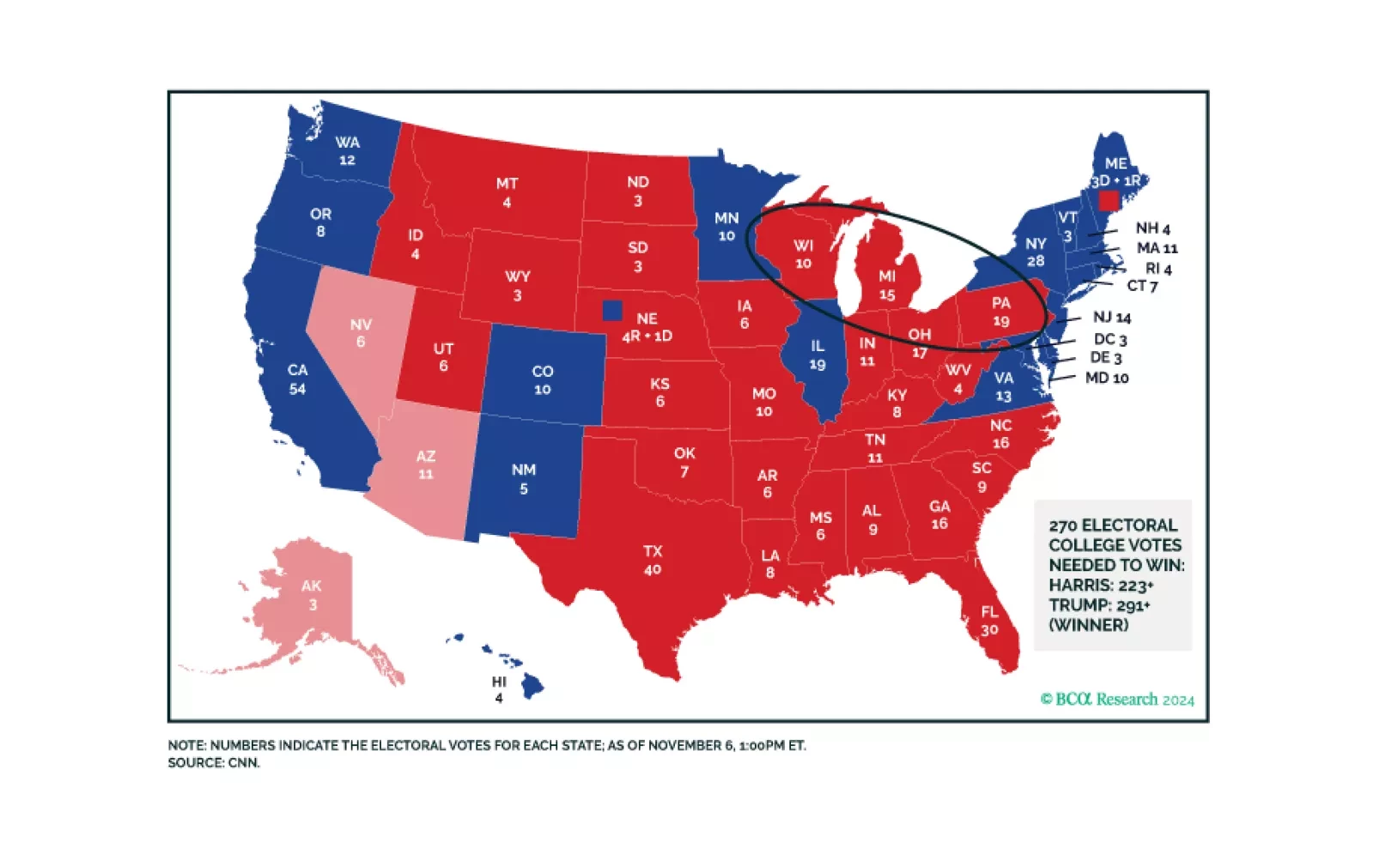

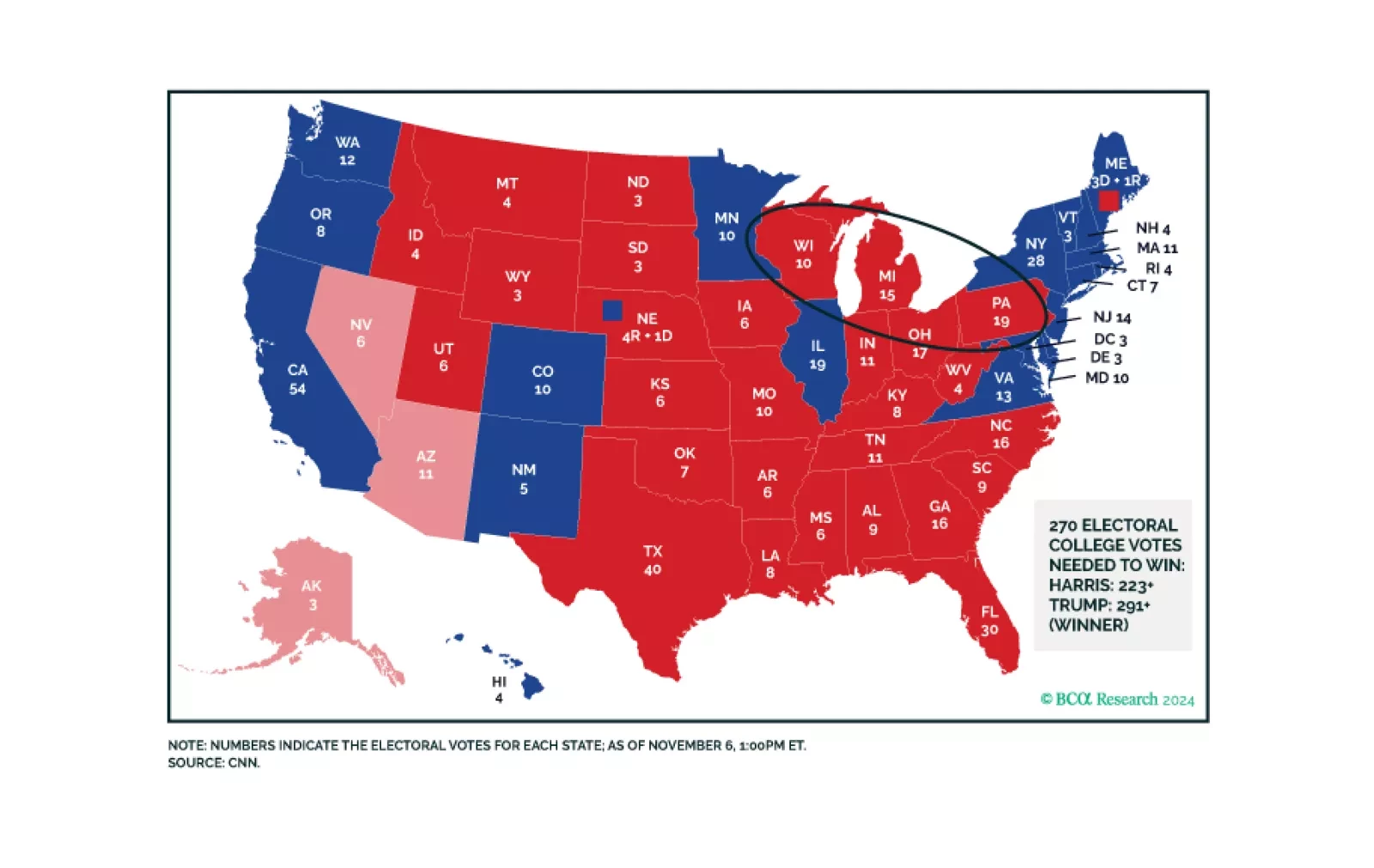

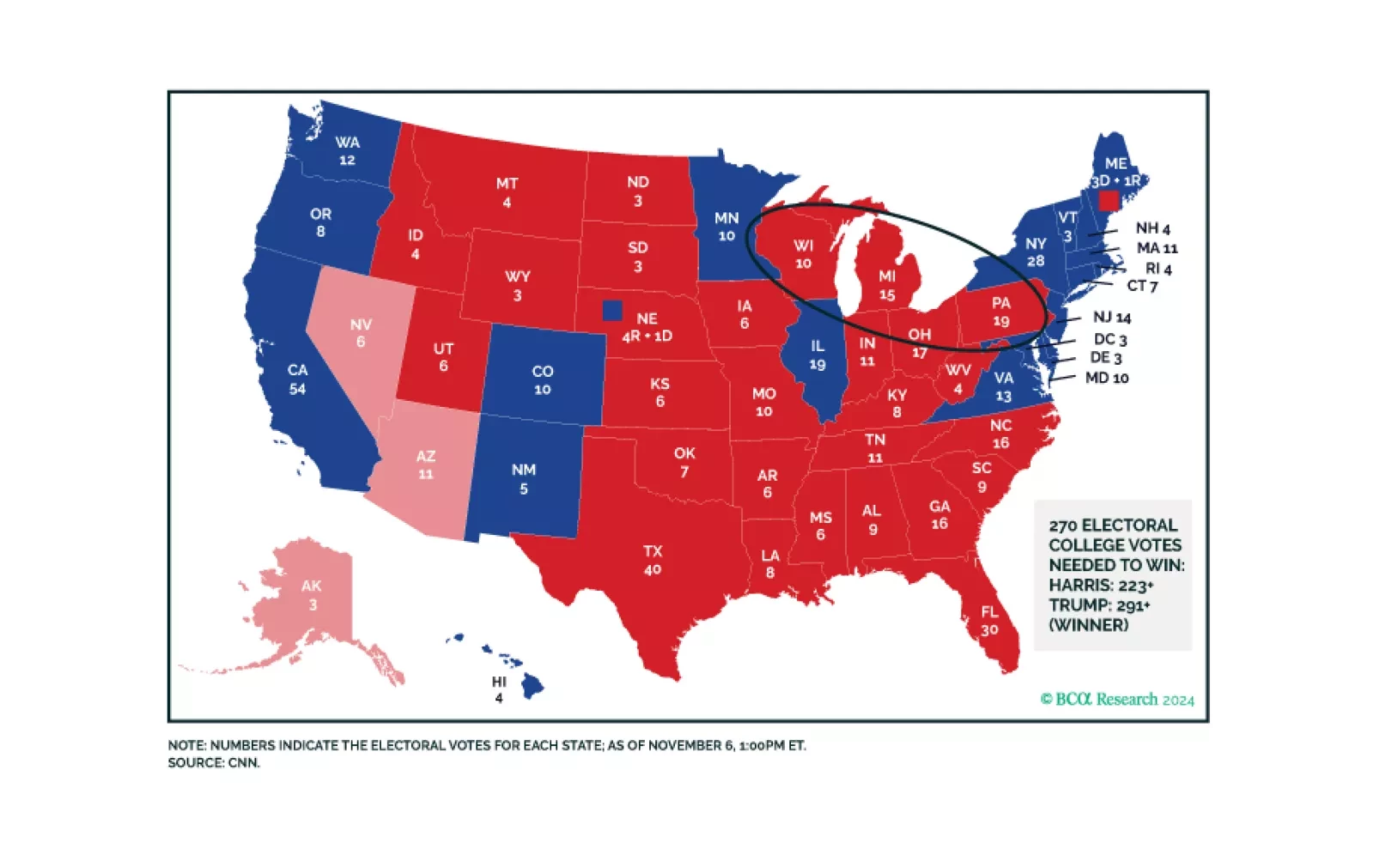

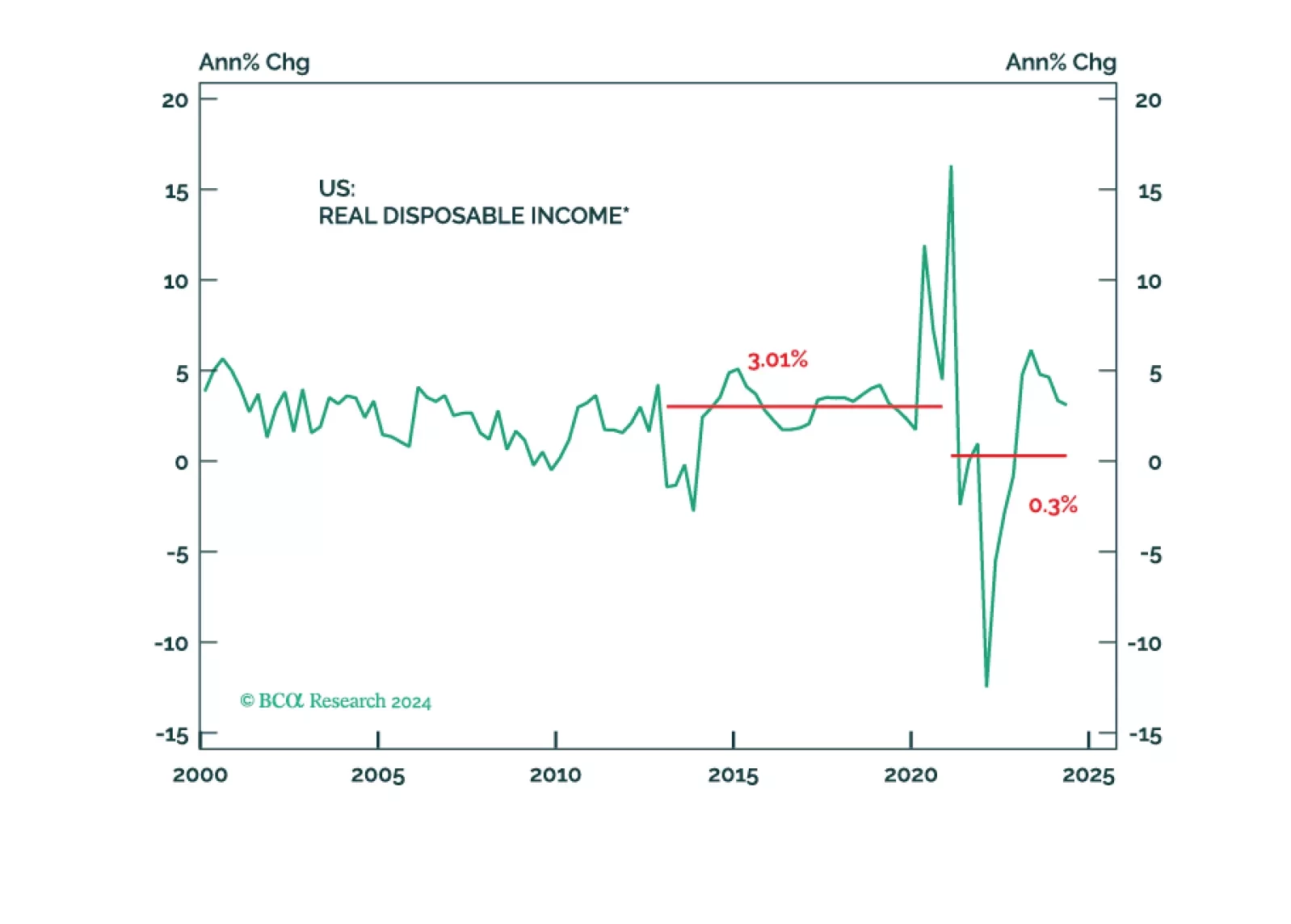

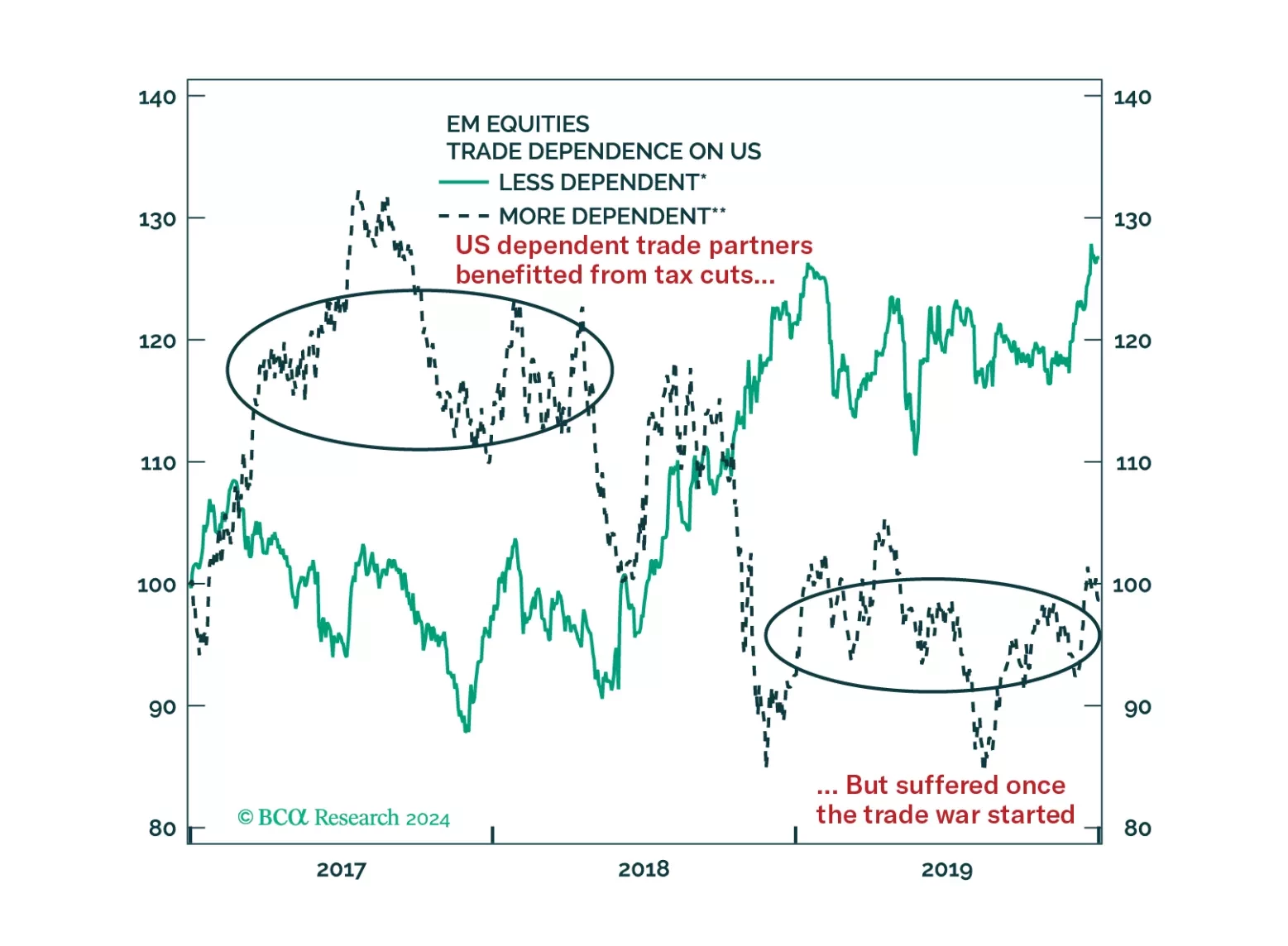

Trump’s resounding victory brings a popular mandate that ensures deregulation and higher trade tariffs. Higher budget deficit and immigration reform are also in the cards as the Republicans look like they may squeak a thin margin in…

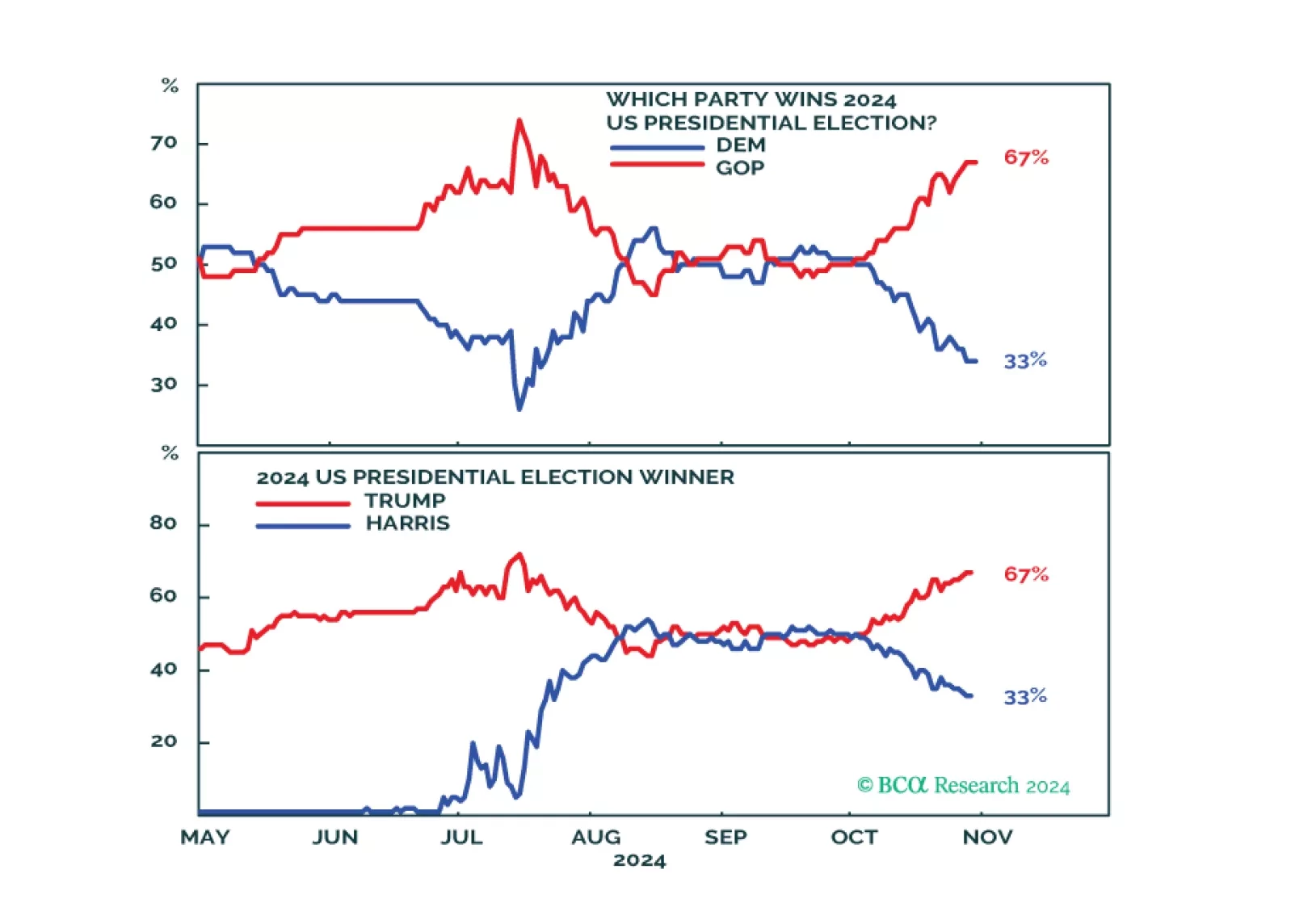

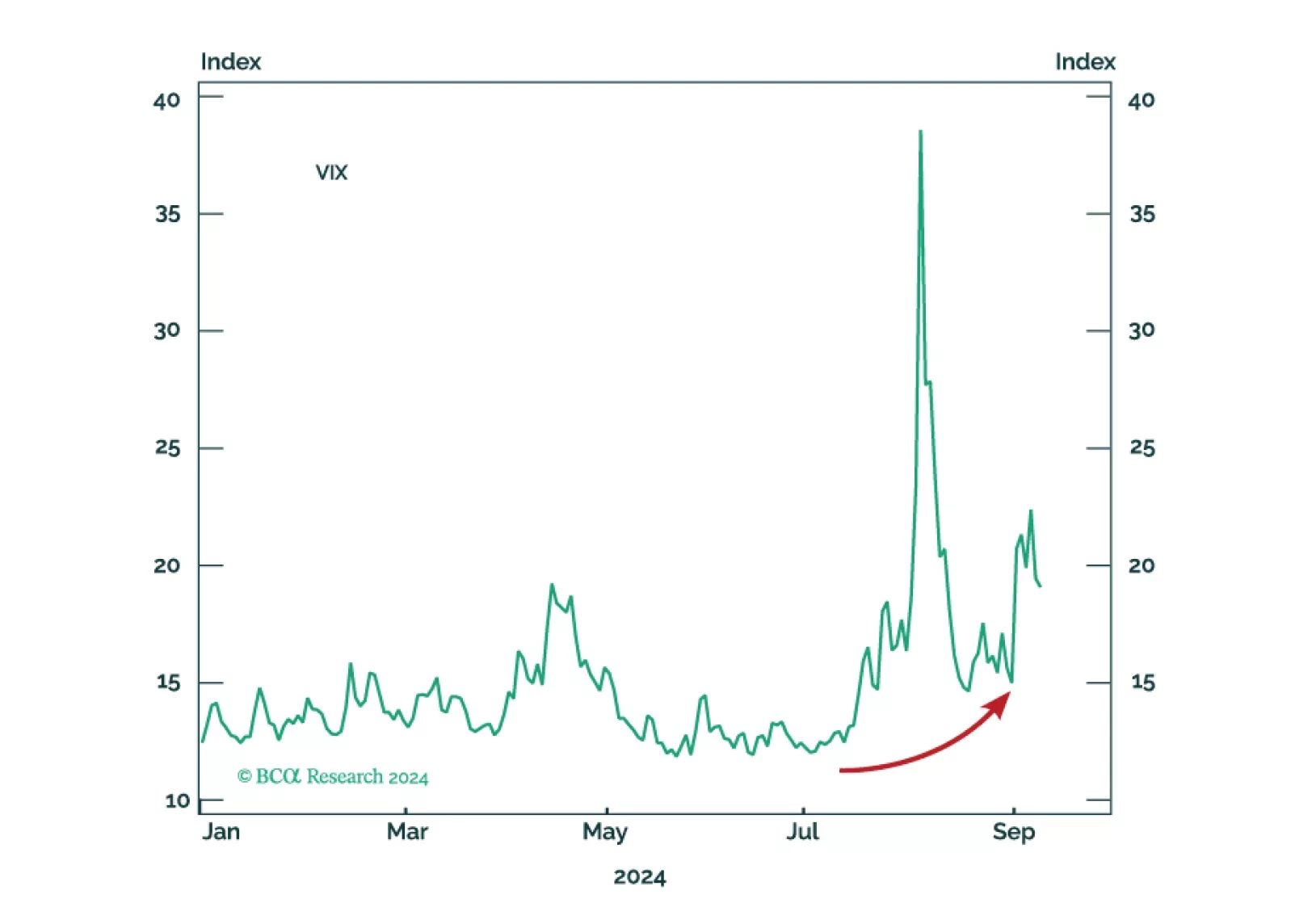

Trump may be favored, but Harris is now underrated. The Senate is highly likely to go Republican – Harris would be gridlocked if she pulled off a victory. If Trump wins it will be a full sweep. Expect volatility in the short term.

Our Q3 portfolio was defensive, which we believe will be the appropriate stance in the next six-to-twelve months. Data coming out of the US has remained robust which could cause US bond yields to temporarily overshoot. An overshoot…

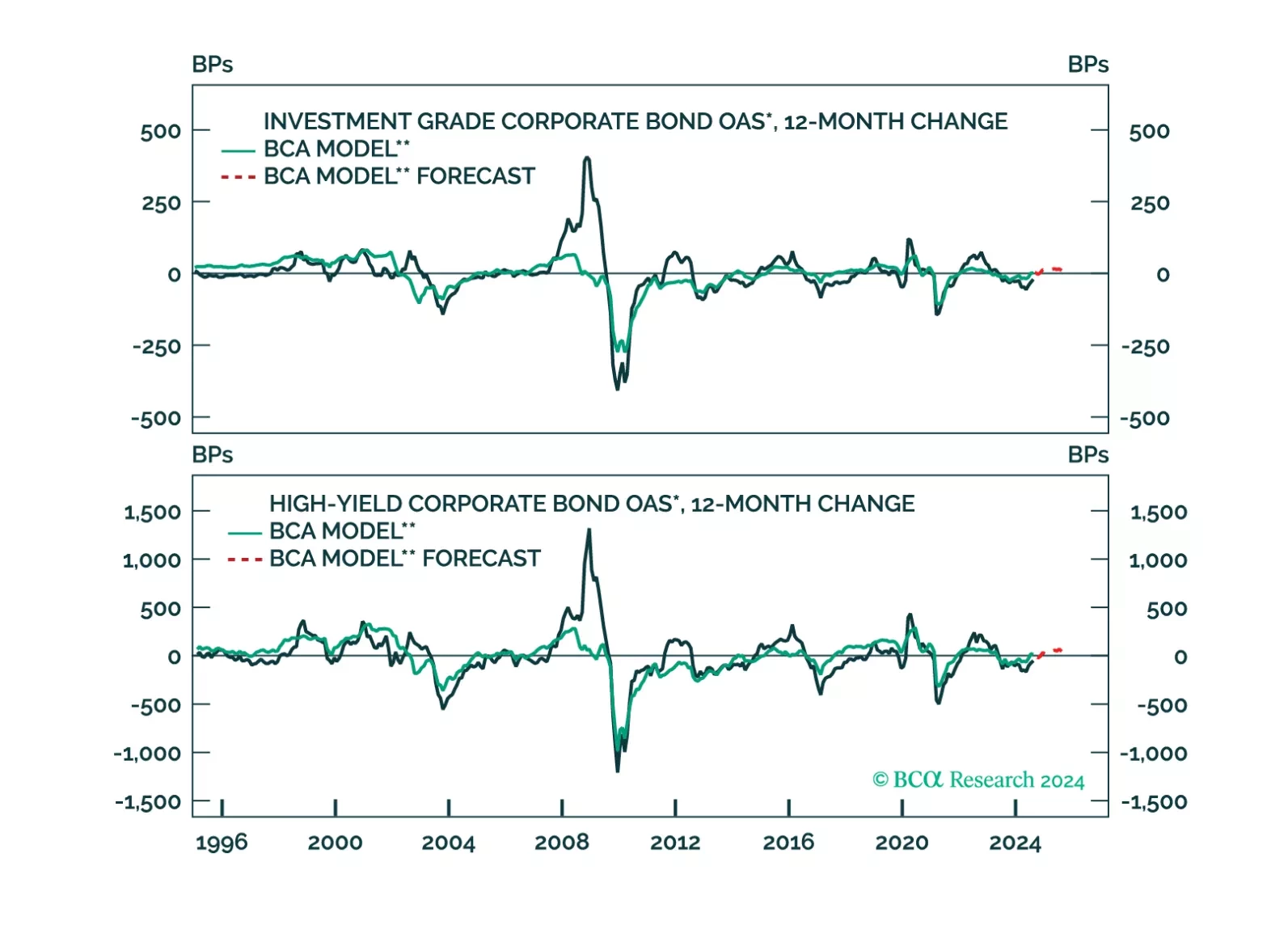

We update our corporate default rate model and consider the implications for corporate bond spreads.

Despite the disastrous performance by former President Trump in the debate with Vice President Kamala Harris, there are still paths for him to come back to power. The economy and global instability could flare up anytime between now…