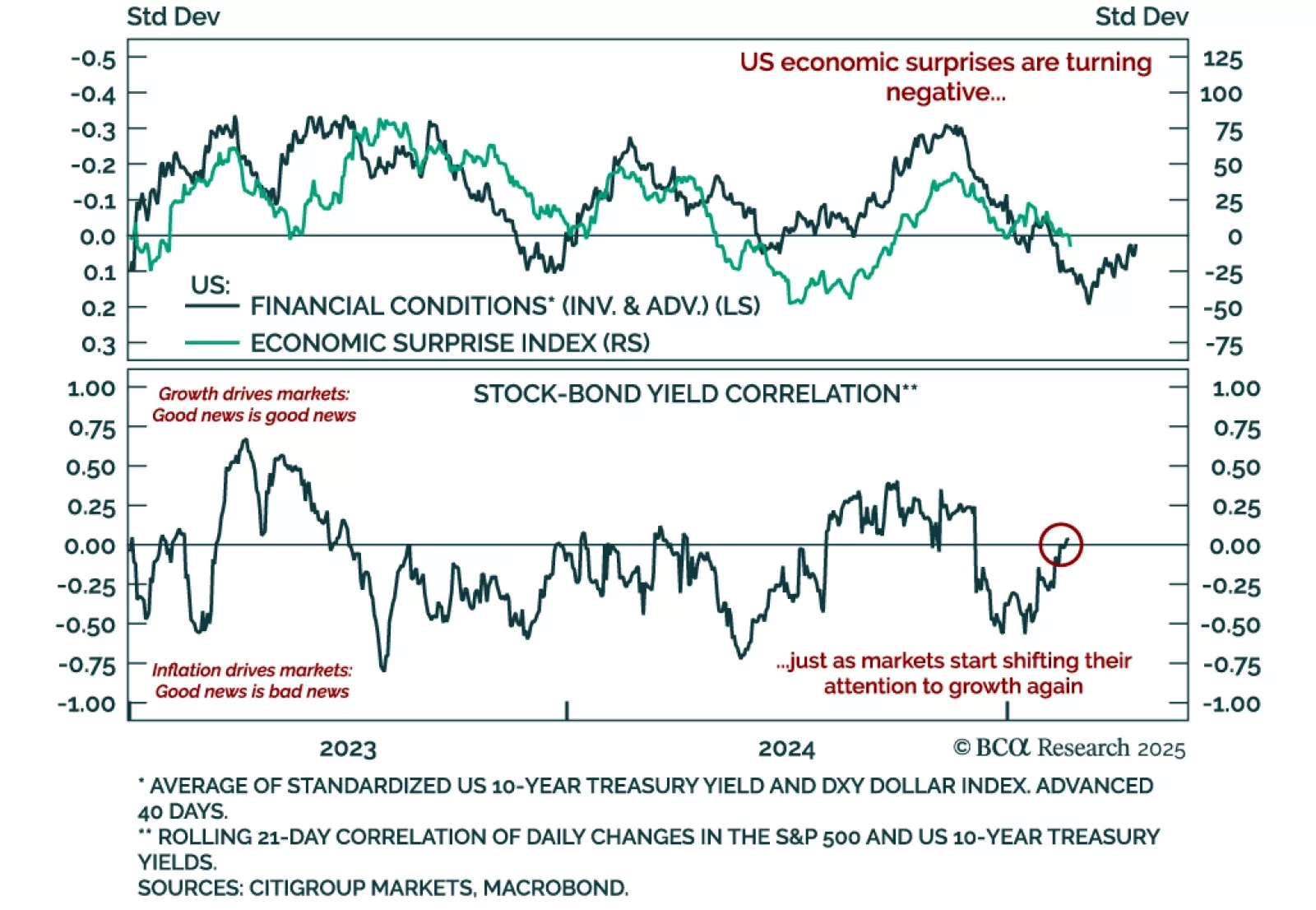

Two of our favorite indicators recently sent important signals. The first one, the short-term stock-bond yield correlation, recently drifted back to neutral territory after being negative. The correlation had been negative since…

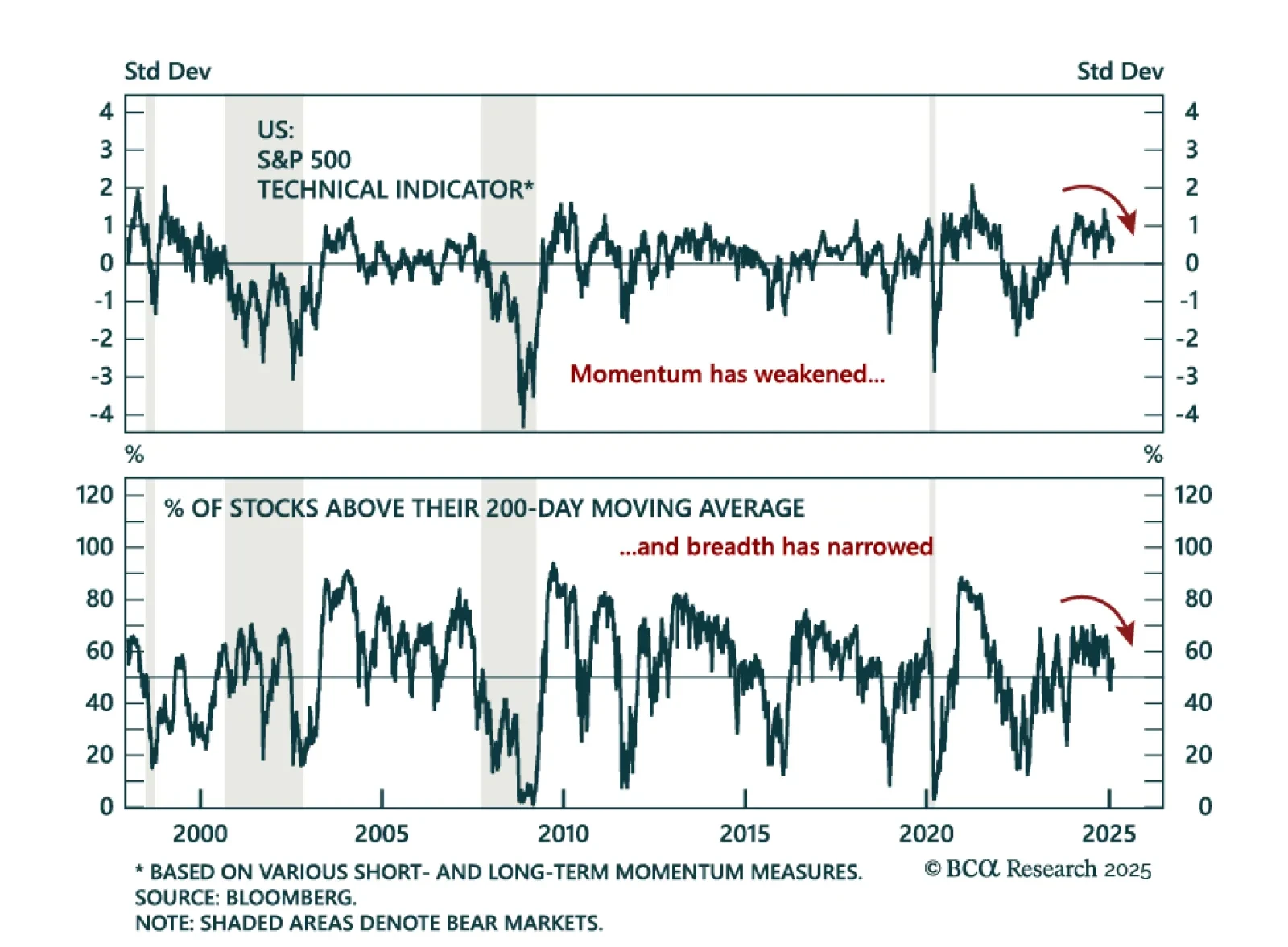

Our Chart Of The Week comes from Melanie Kermadjian, from our Global Investment Strategy team. The S&P 500 has been in a bull market for nearly five years and is currently up 2.5% YTD. A lot has been thrown at the US…

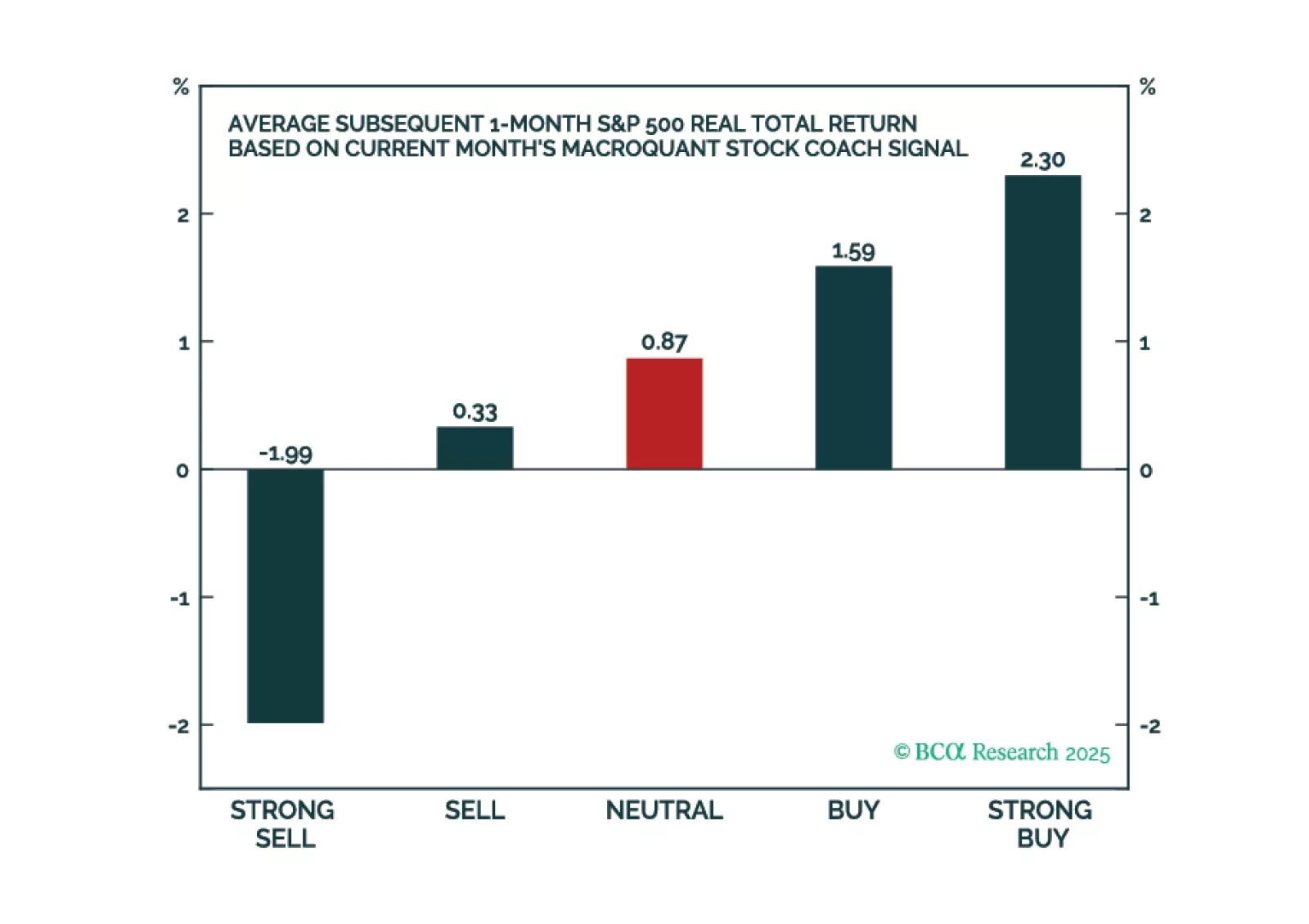

The latest version of the MacroQuant model suggests that the bull market in US stocks is winding down. The model expects Treasury yields to fall later this year but is not ready to go long duration just yet.

The latest version of the MacroQuant model suggests that the bull market in US stocks is winding down. The model expects Treasury yields to fall later this year but is not ready to go long duration just yet.

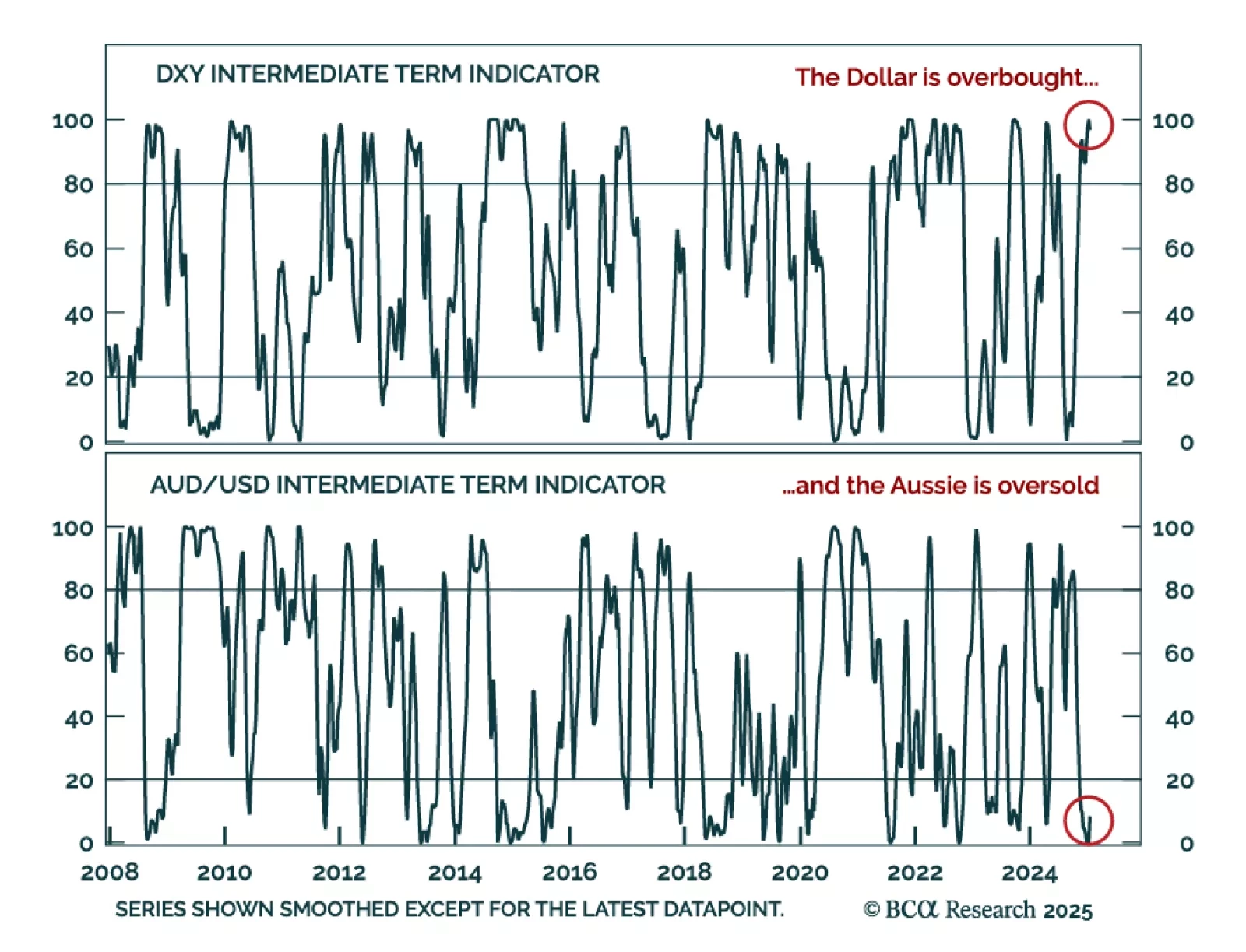

Our Foreign Exchange strategists recently provided an update on their US and Australian dollar views. The US dollar remains overbought and may continue rising as a momentum currency, but cyclical indicators suggest a…

We examine Treasury market valuation and look for indicators that could help us time the next peak in yields. We also update the forecasts from our Treasury yield model.

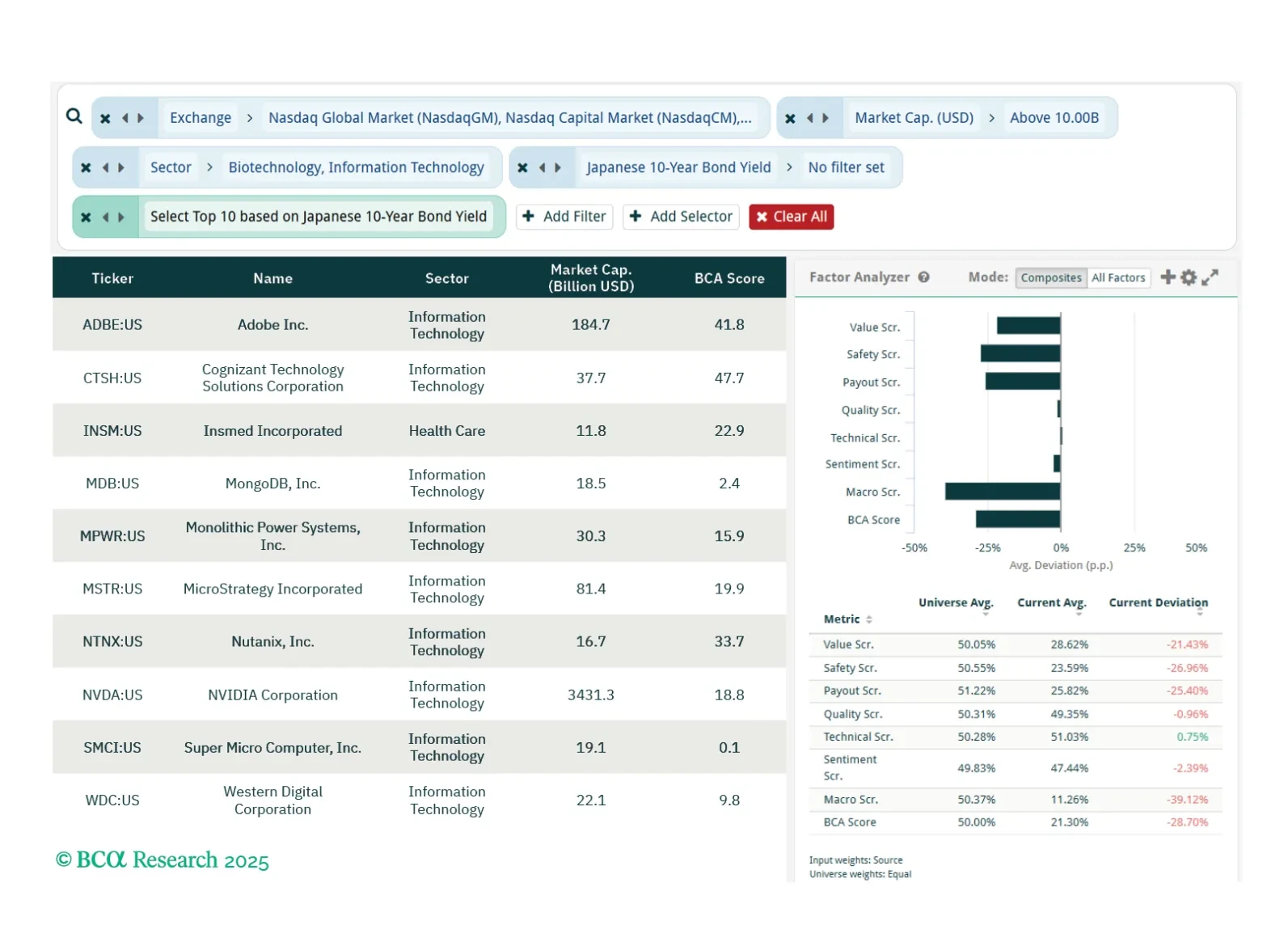

To kick start our new research agenda at Equity Analyzer, we welcome you to our weekly screener report. Each week we will deliver three screeners highlighting stocks exposed to various macro and investment views and themes, that have…

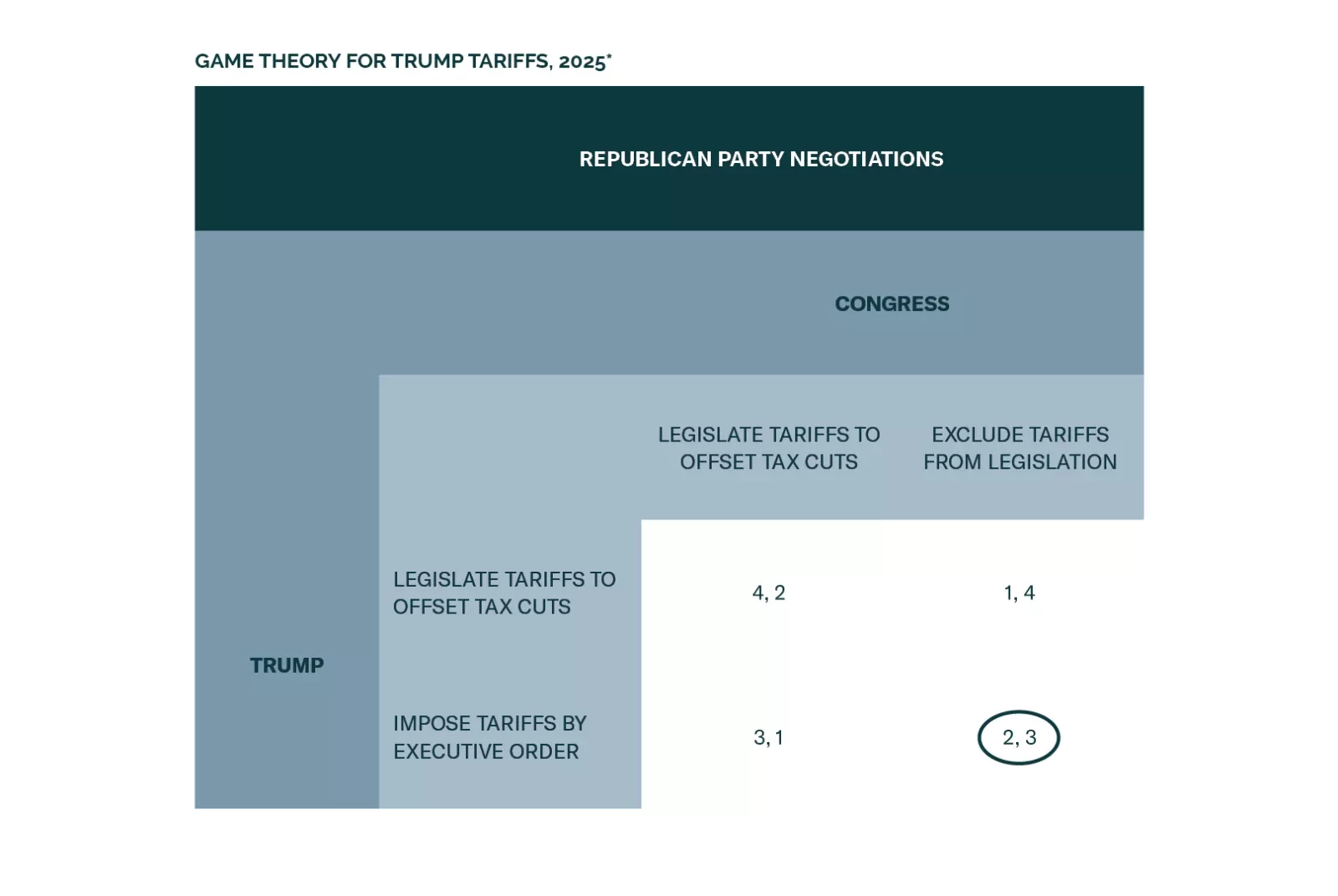

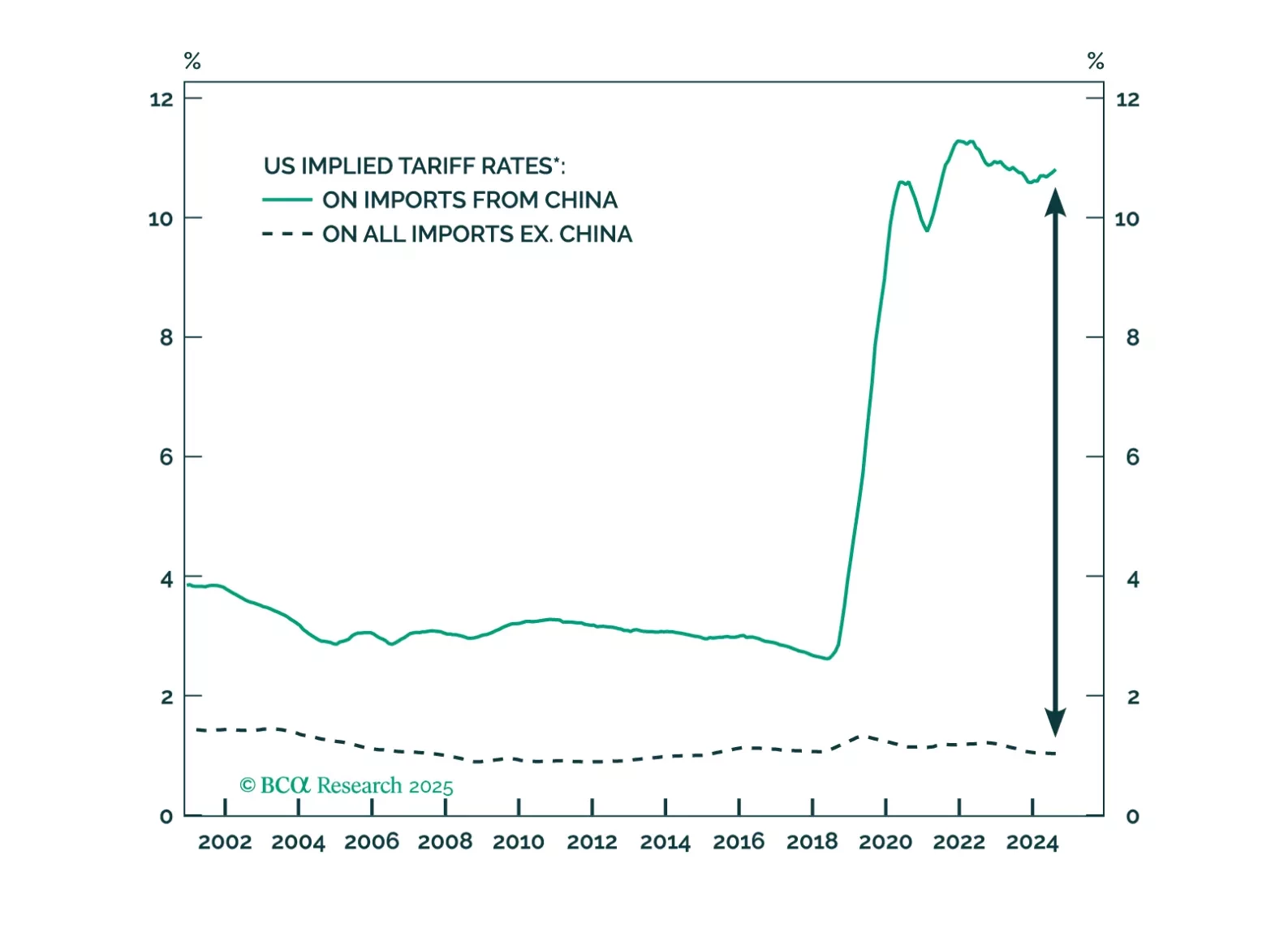

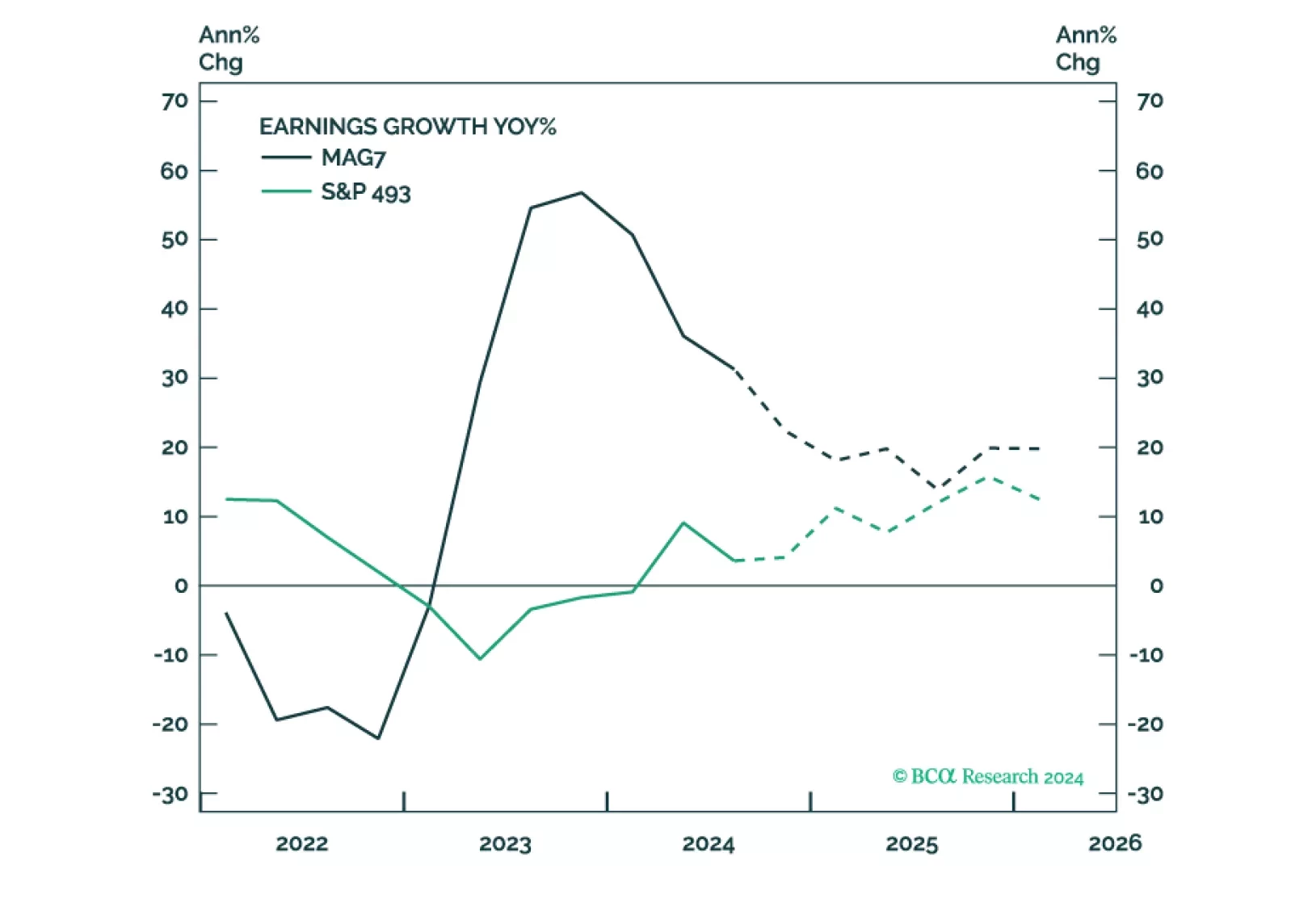

Trump's policies aim to support domestic producers and will be pro-growth and inflationary, at least initially. This environment is supportive of equities. Earnings will likely be strong, but elevated valuations make equities prone…