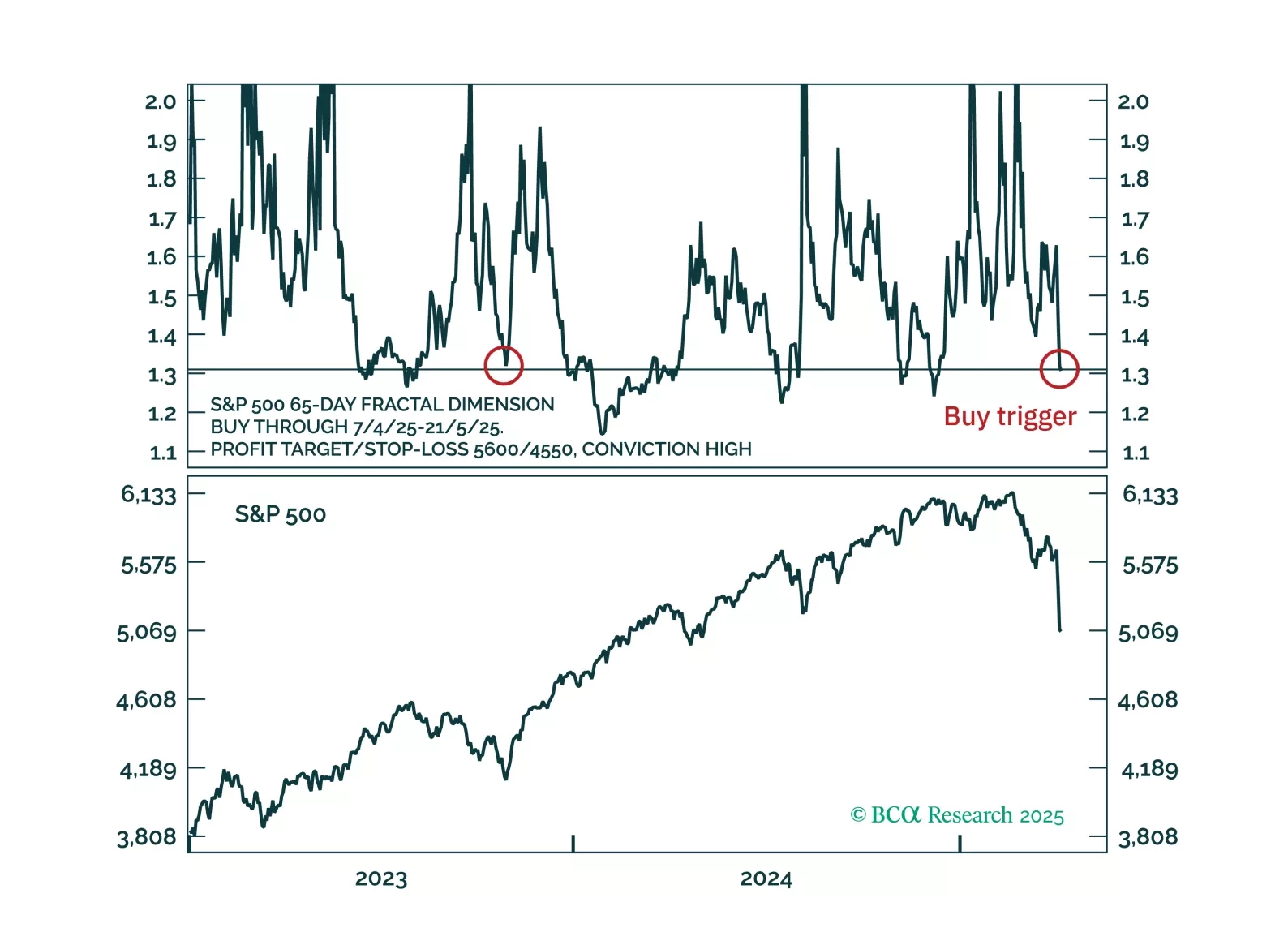

Countertrend buy triggers have been activated for the S&P 500, Nasdaq and Nasdaq versus 30-year T-bond.

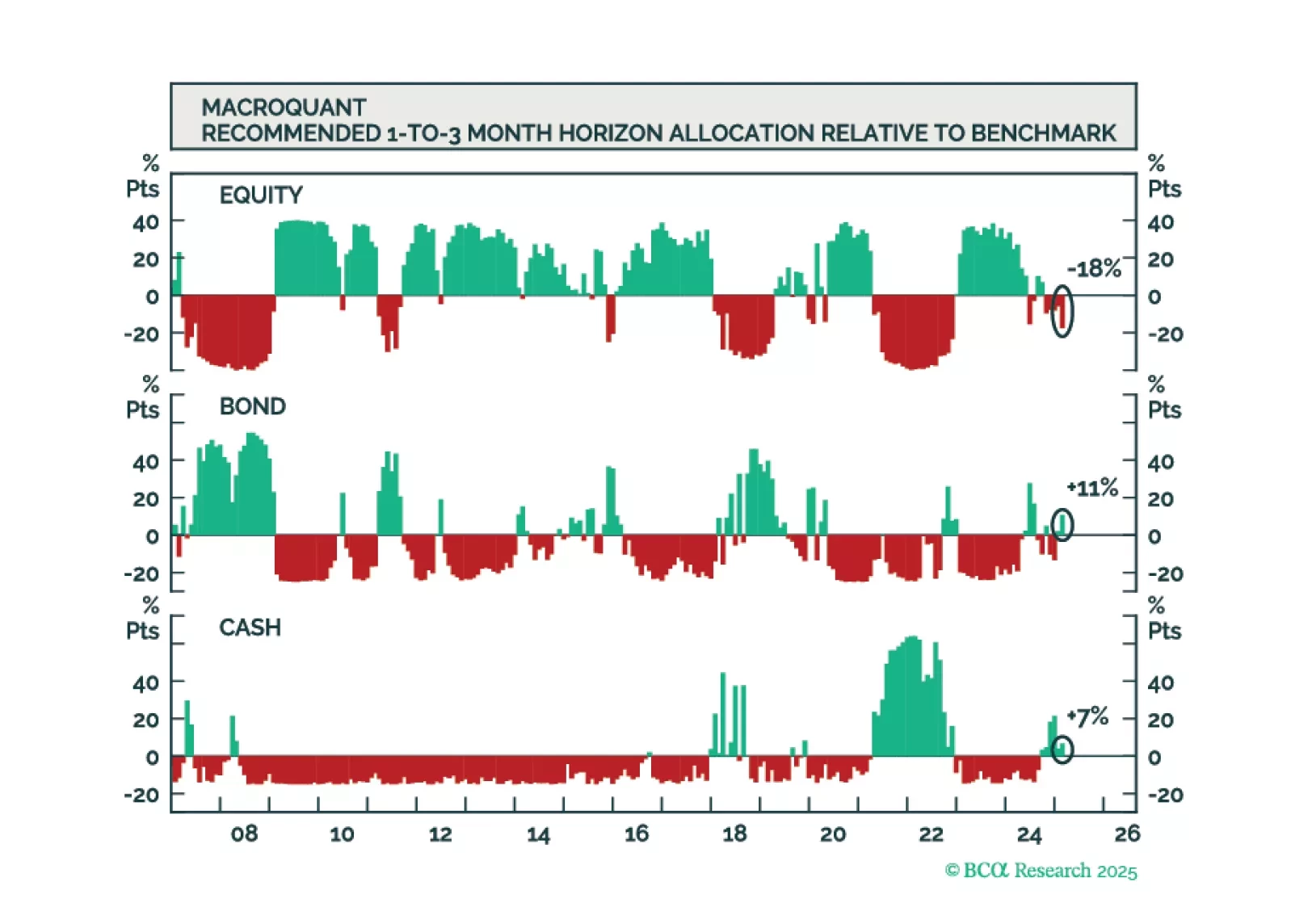

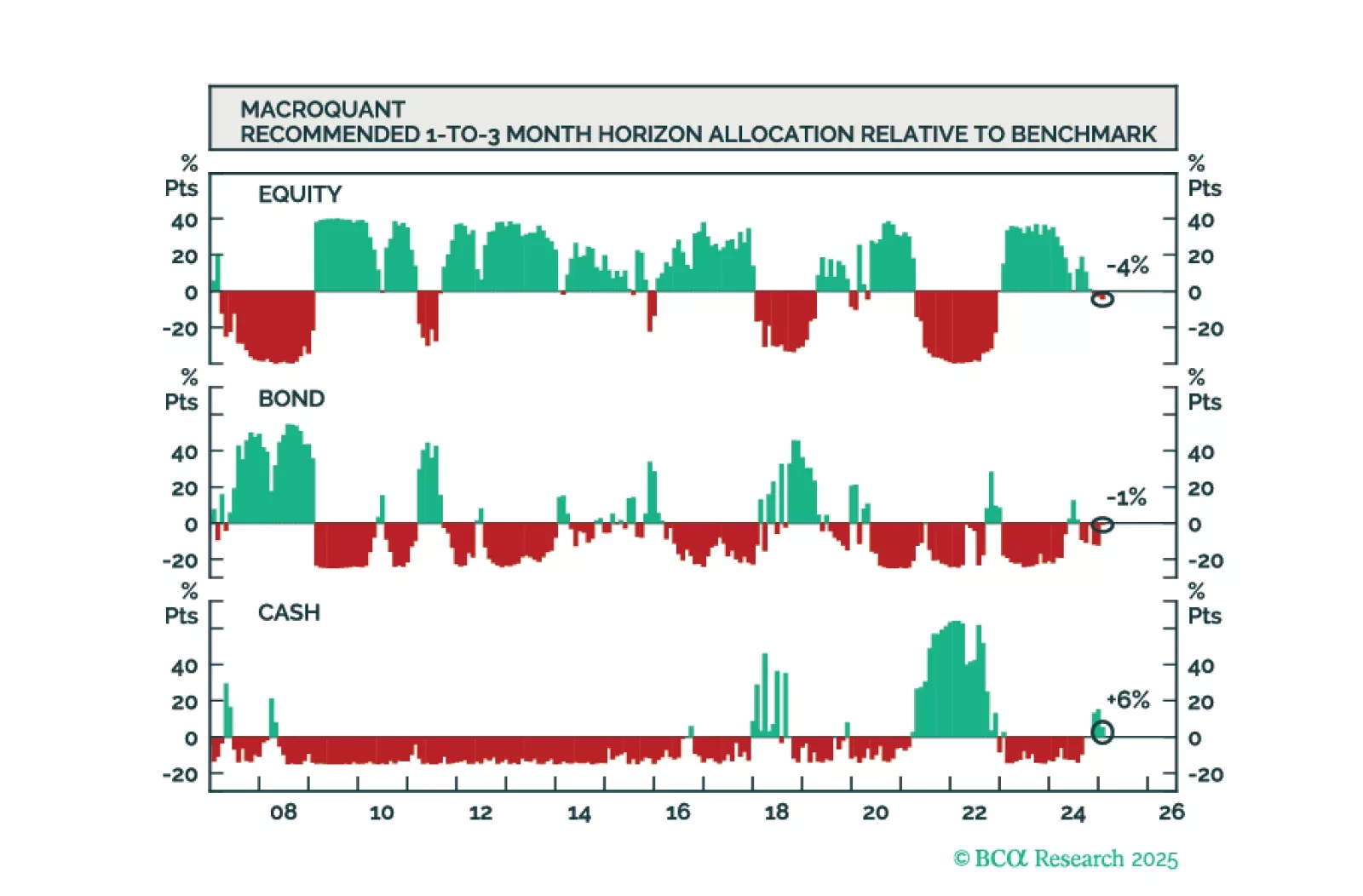

Going into April, MacroQuant recommends a modest underweight on stocks, offset by an overweight on bonds and cash. While MacroQuant is modestly bearish on stocks, we suspect that the downside risks to equities may be greater than…

Going into April, MacroQuant recommends a modest underweight on stocks, offset by an overweight on bonds and cash. While MacroQuant is modestly bearish on stocks, we suspect that the downside risks to equities may be greater than…

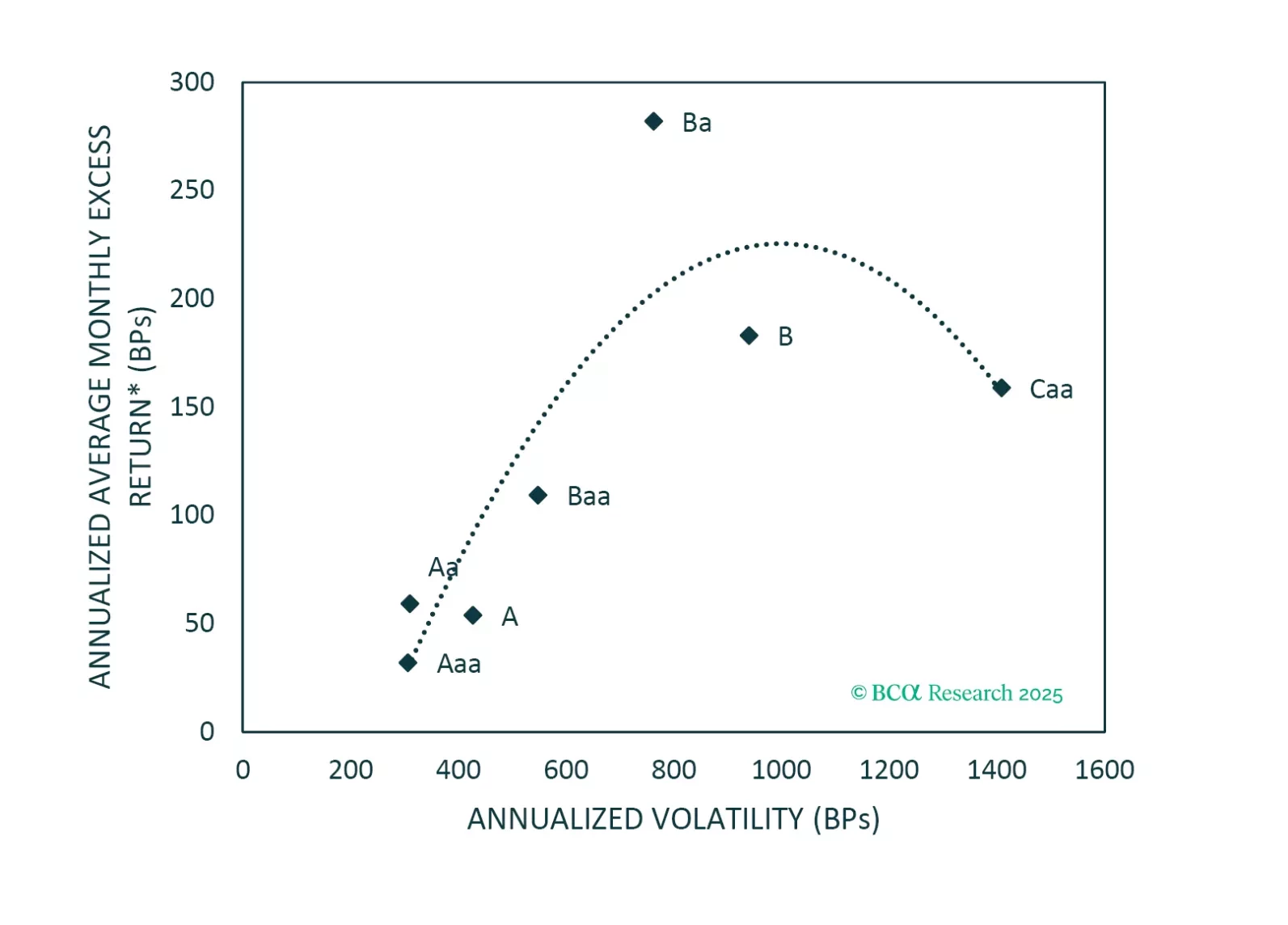

An analysis of historical data shows that Ba-rated bonds outperform other corporate credit tiers in the long-run on a risk-adjusted basis. That said, today’s fragile macro environment warrants a more cautious allocation.

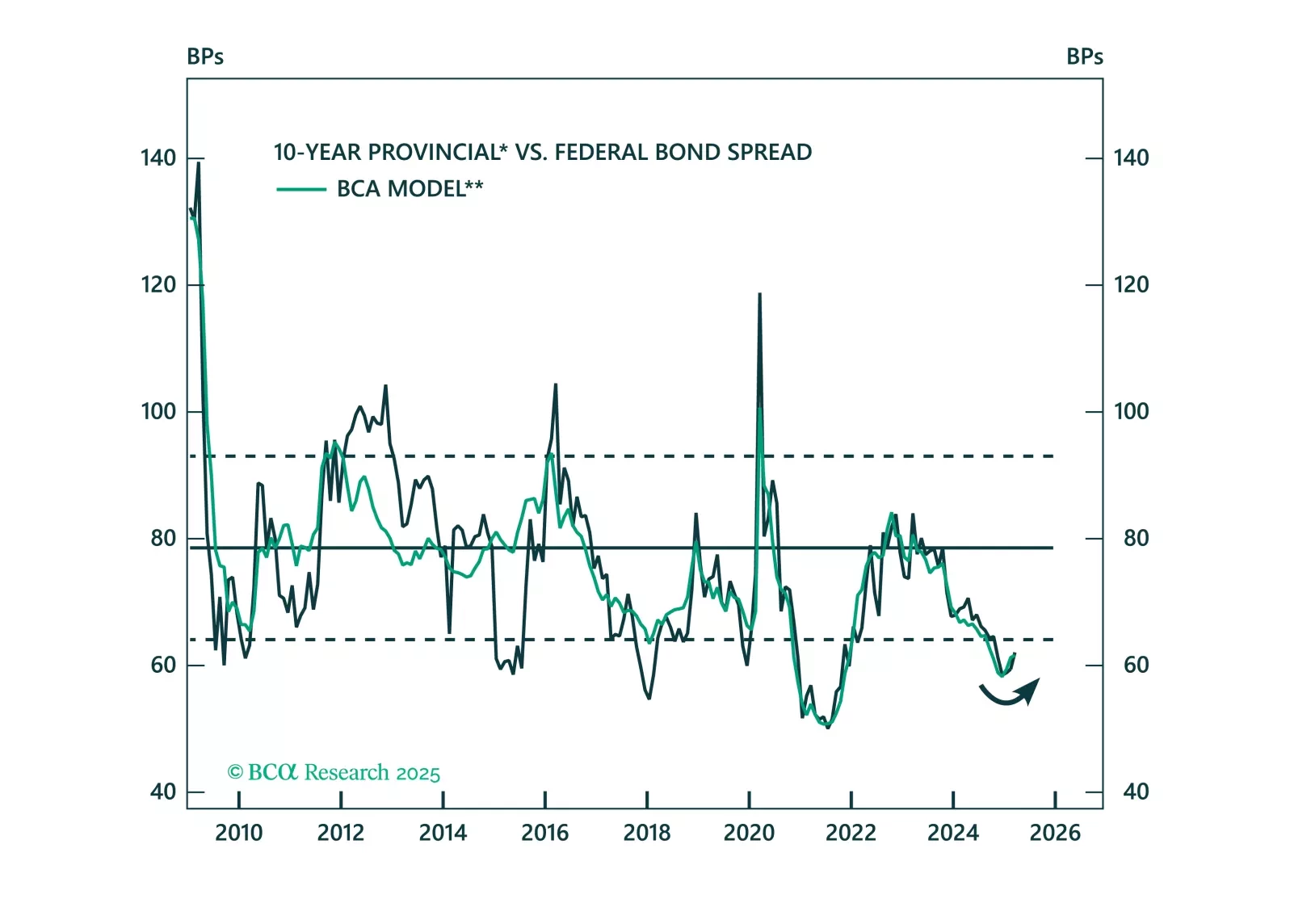

In this report, we explore the Canadian provincial bond market by developing a model to analyze its main drivers and understand the impact of a potential trade war between Canada and the US.

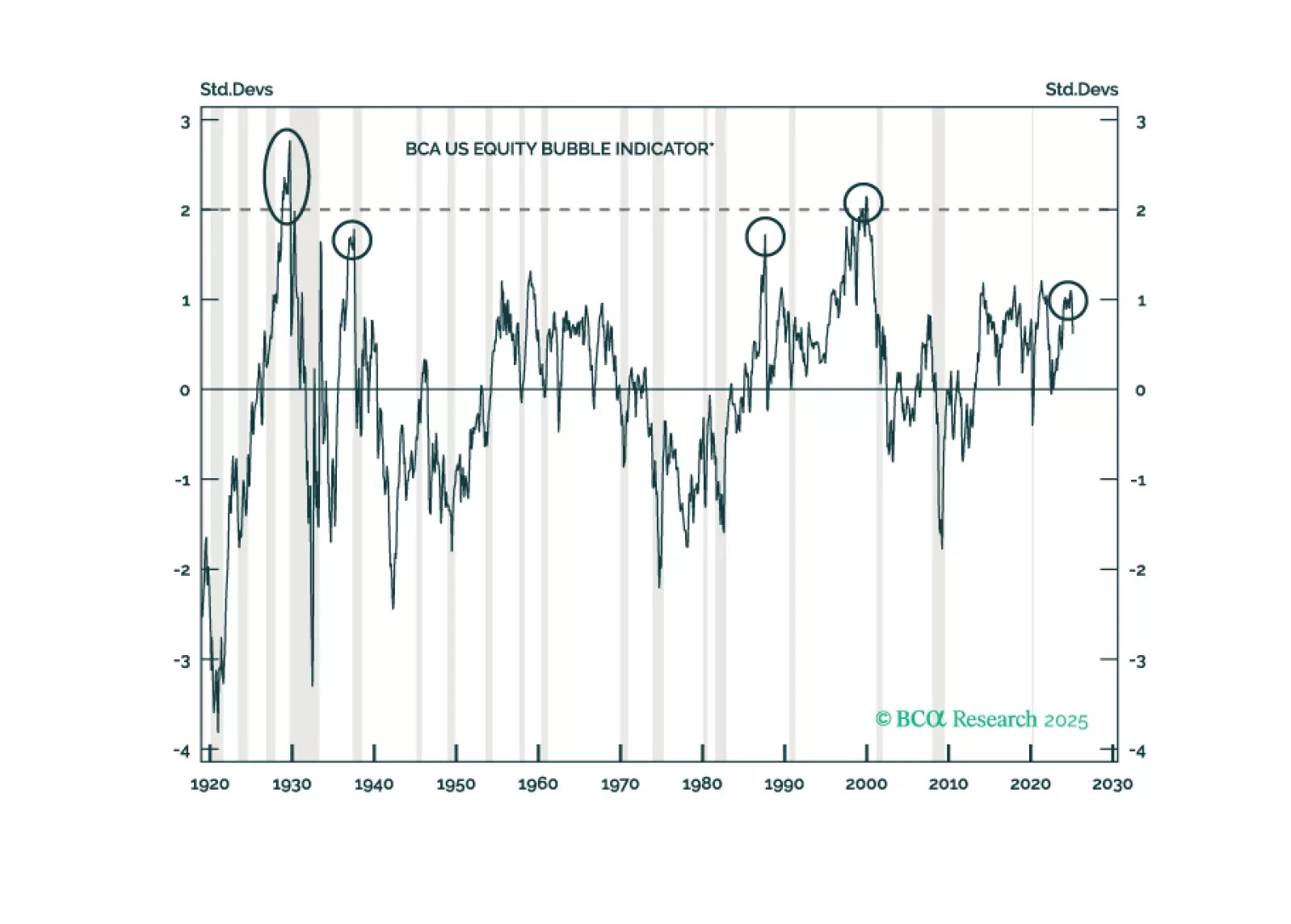

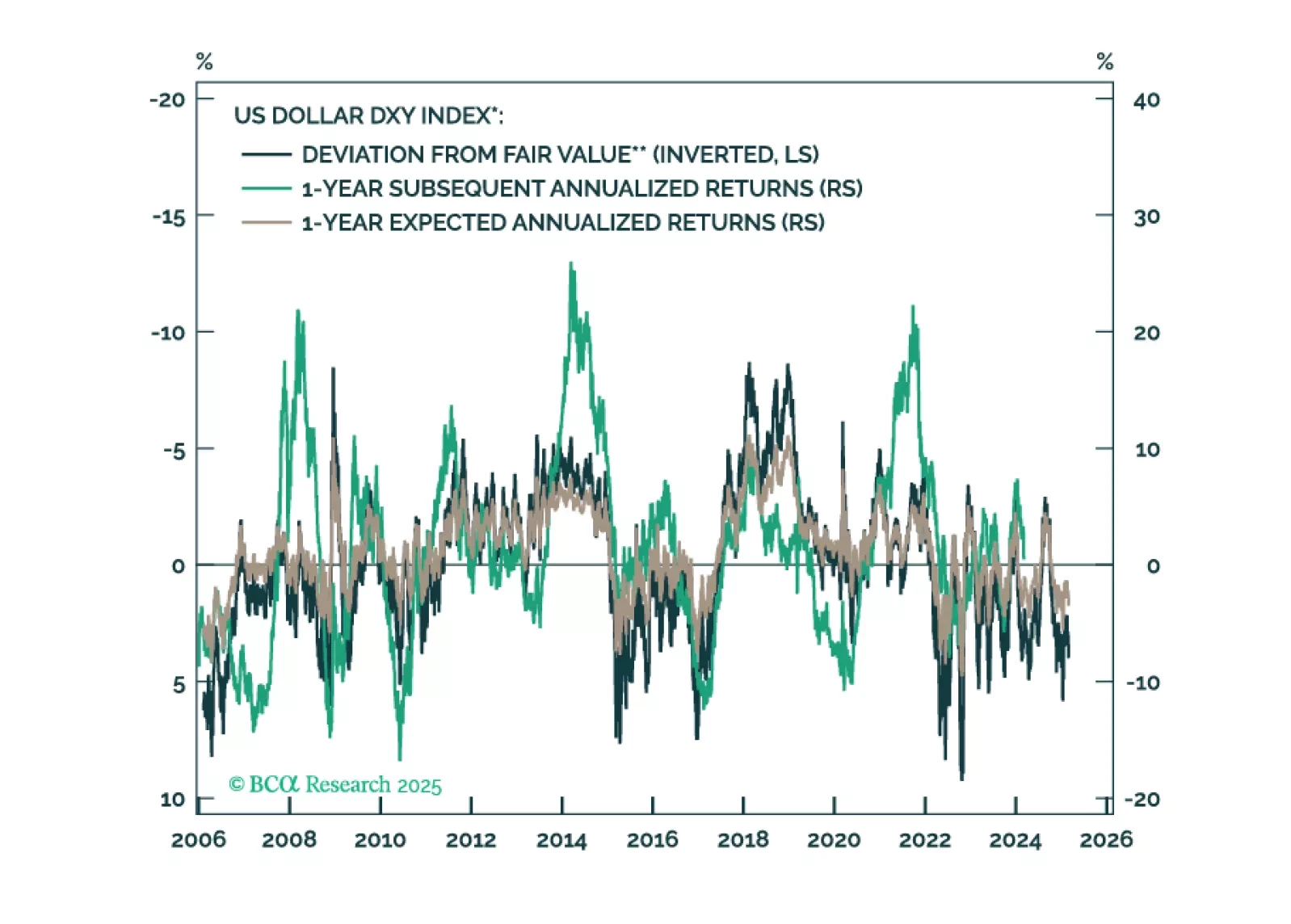

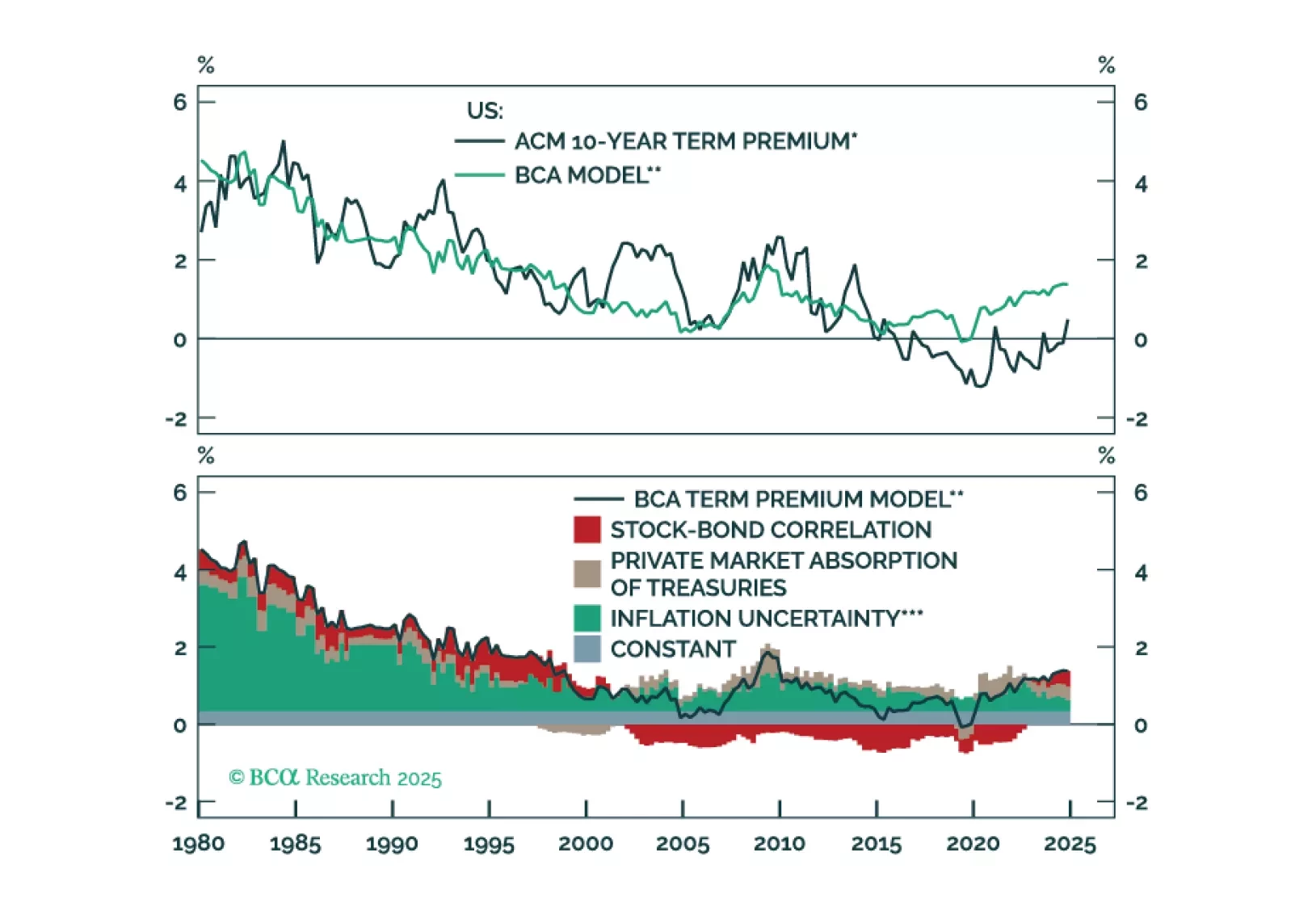

This report is our Part III series on valuation and subsequent returns, where we recalibrate our short-term models to emphasize signals over the next nine-to-twelve months. We will henceforth call these models STTM: Short Term Timing…

The MacroQuant model is no longer bullish on stocks but is not yet prepared to turn underweight. Subjectively, the Global Investment Strategy team is more bearish on equities than the model.

The MacroQuant model is no longer bullish on stocks but is not yet prepared to turn underweight. Subjectively, the Global Investment Strategy team is more bearish on equities than the model.