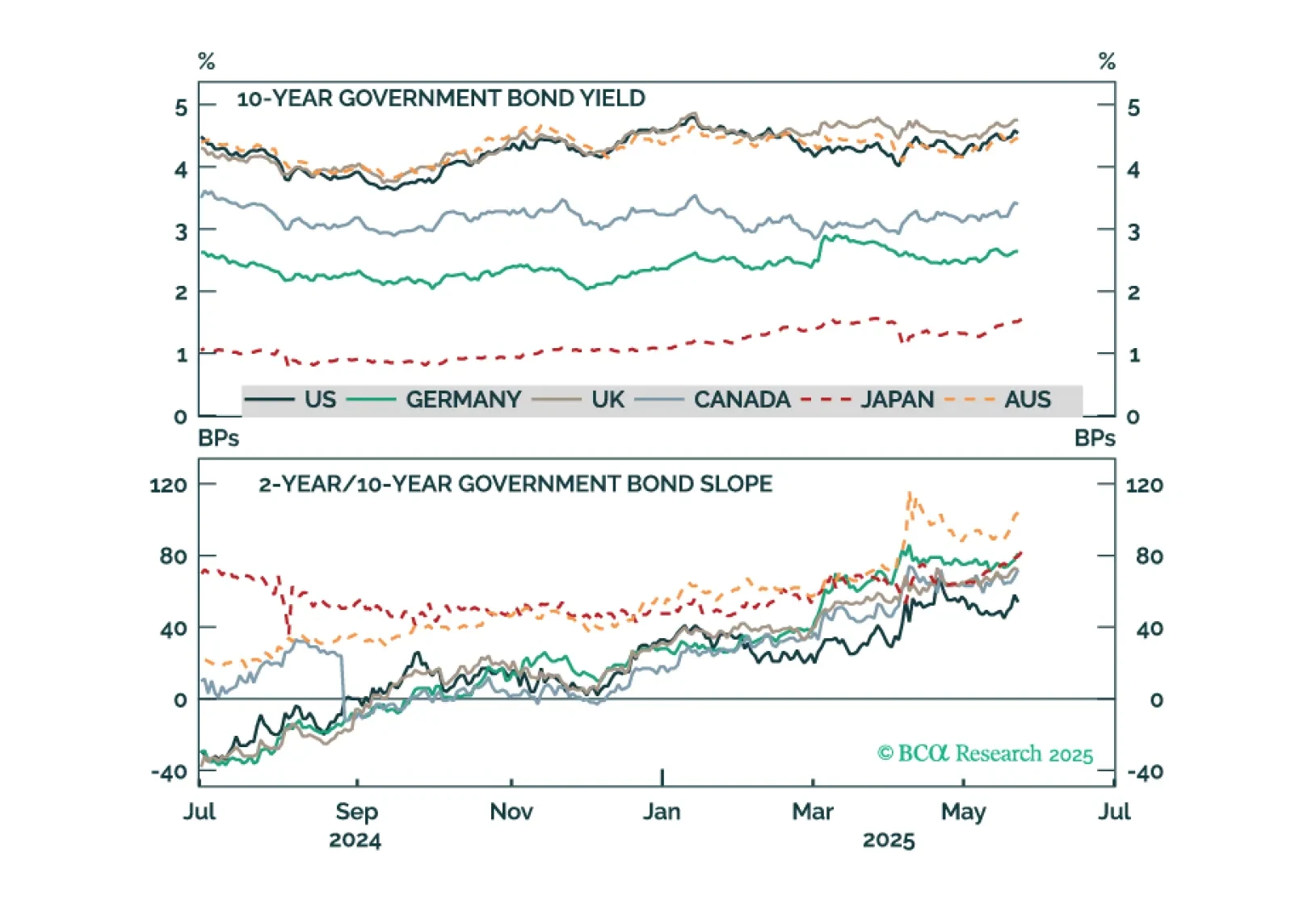

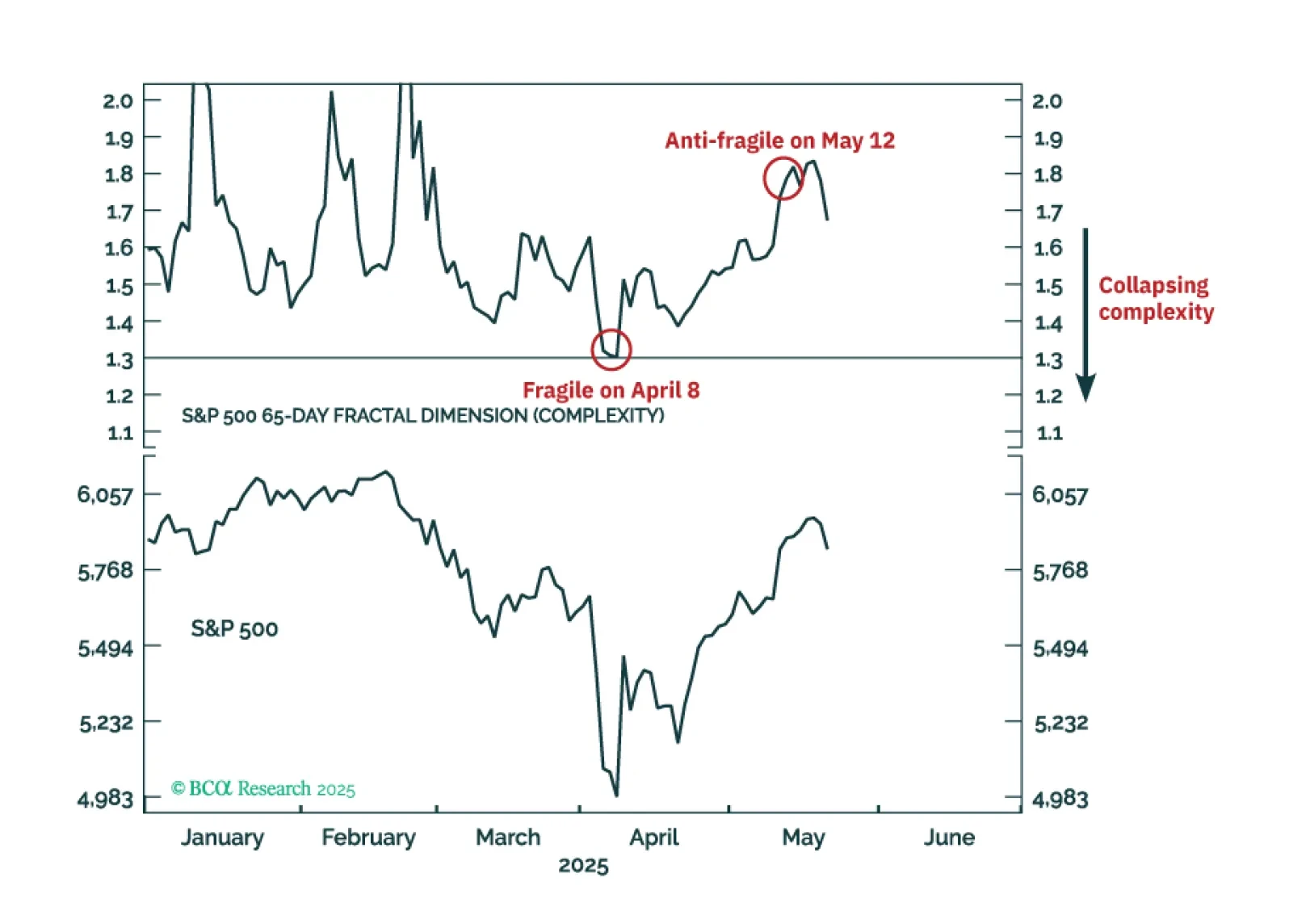

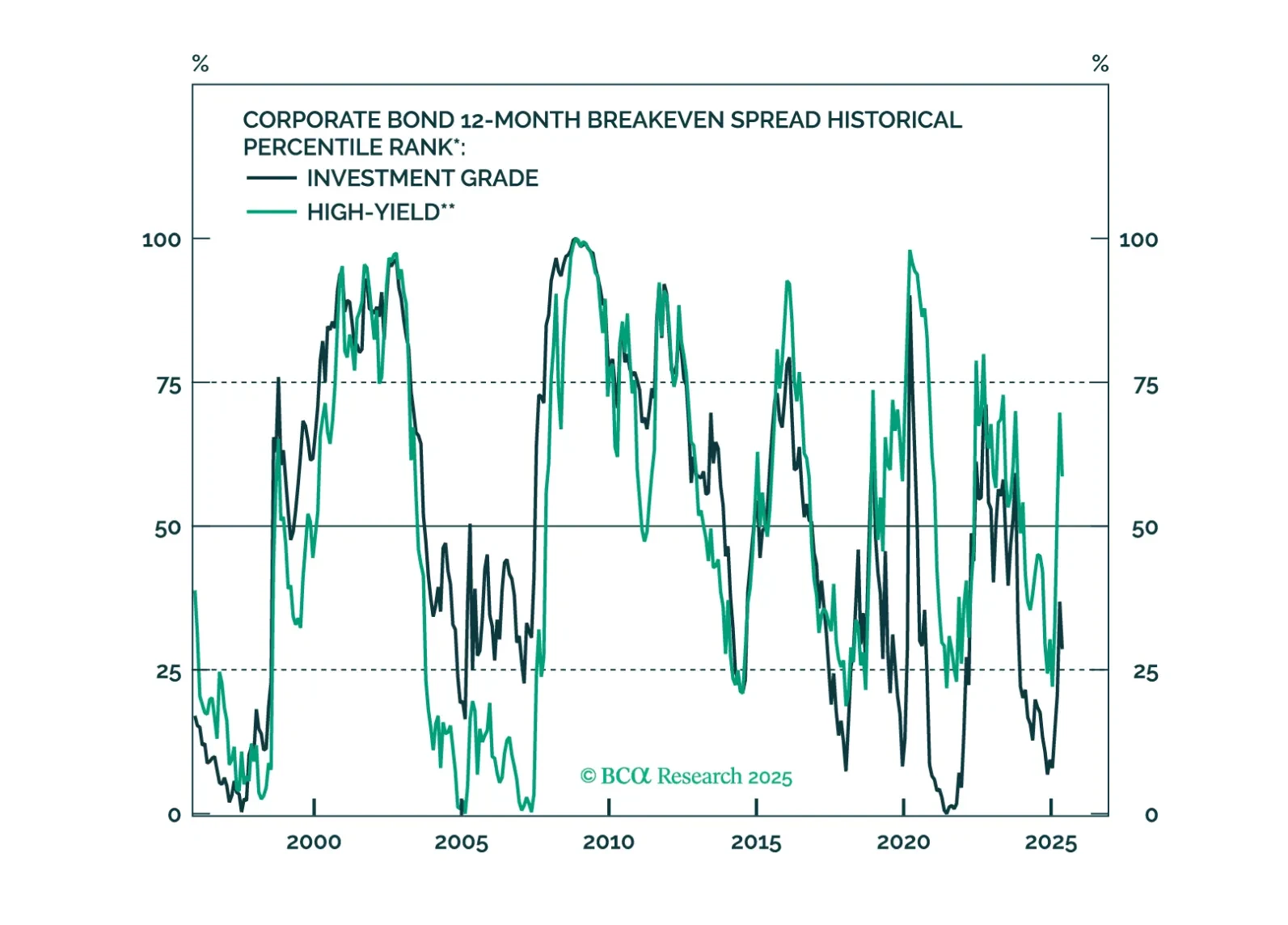

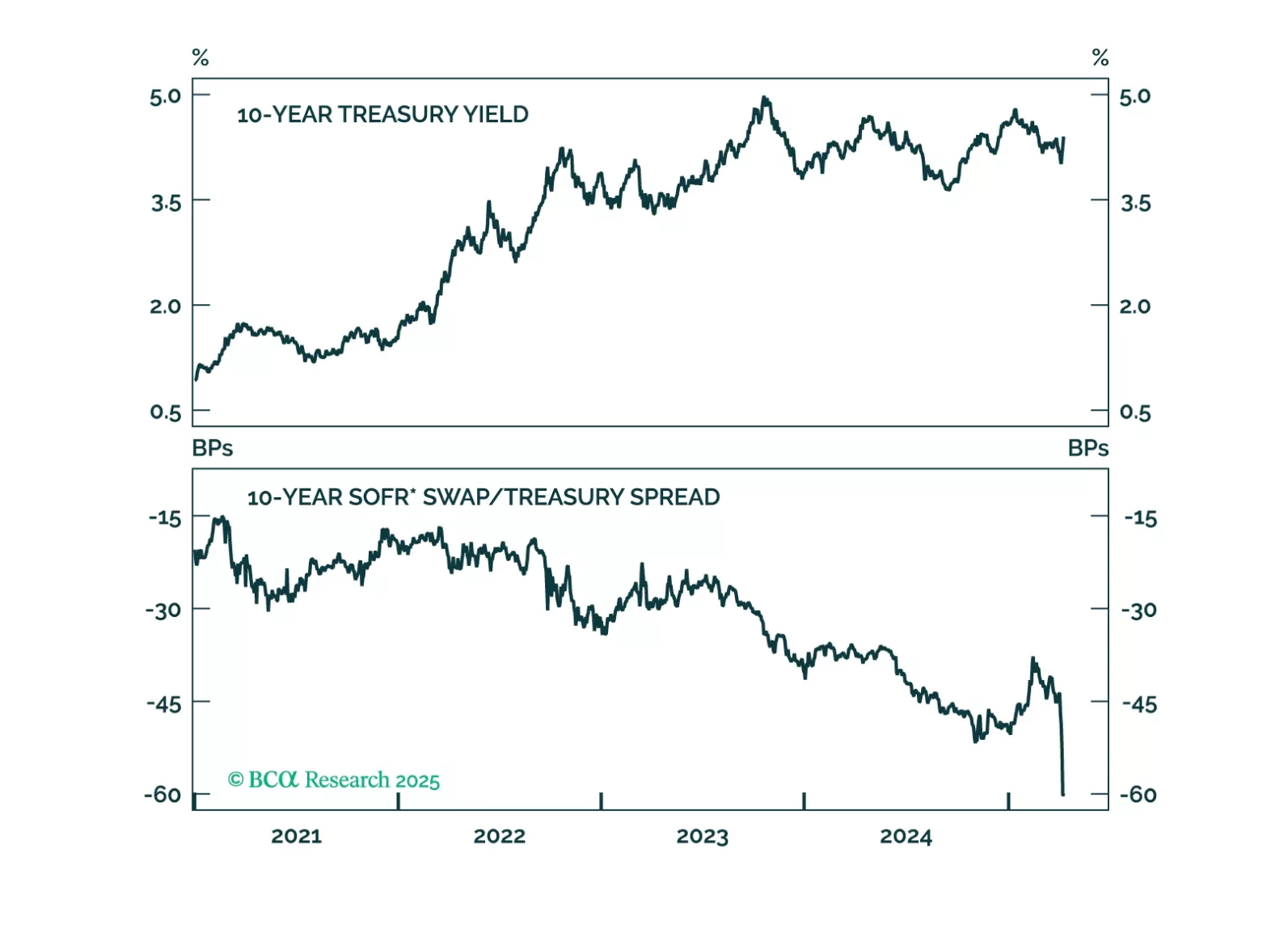

Right now, the major stock and bond markets are more ‘anti-fragile’ than fragile, and the Joshi rule recession indicators signal that a US recession is not imminent. This justifies a neutral, or default, tactical weighting to both…

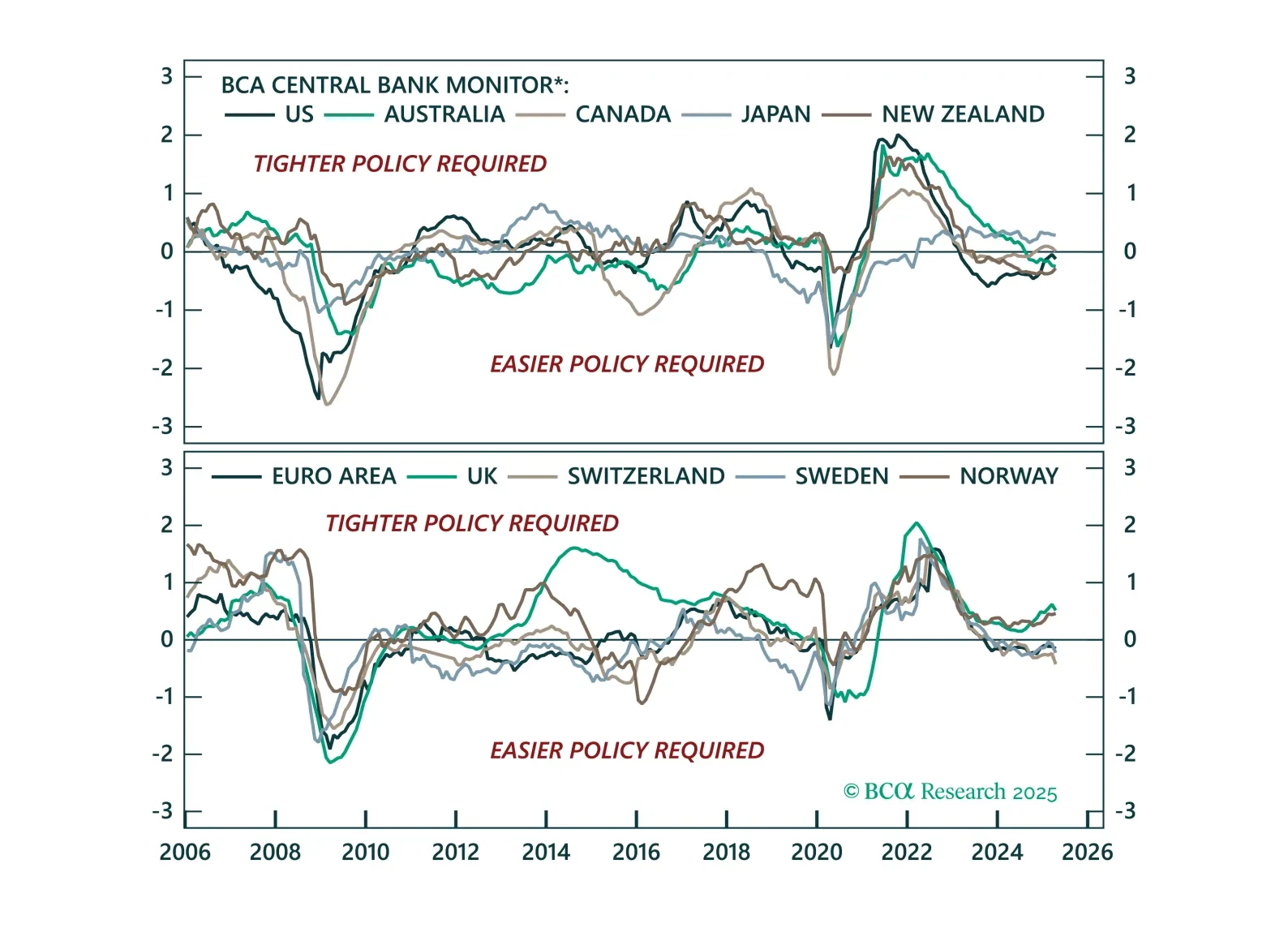

The easing bias remains, but not all central banks are equal. This Central Bank Monitor update reveals who is ready to cut more and who is still pretending not to.

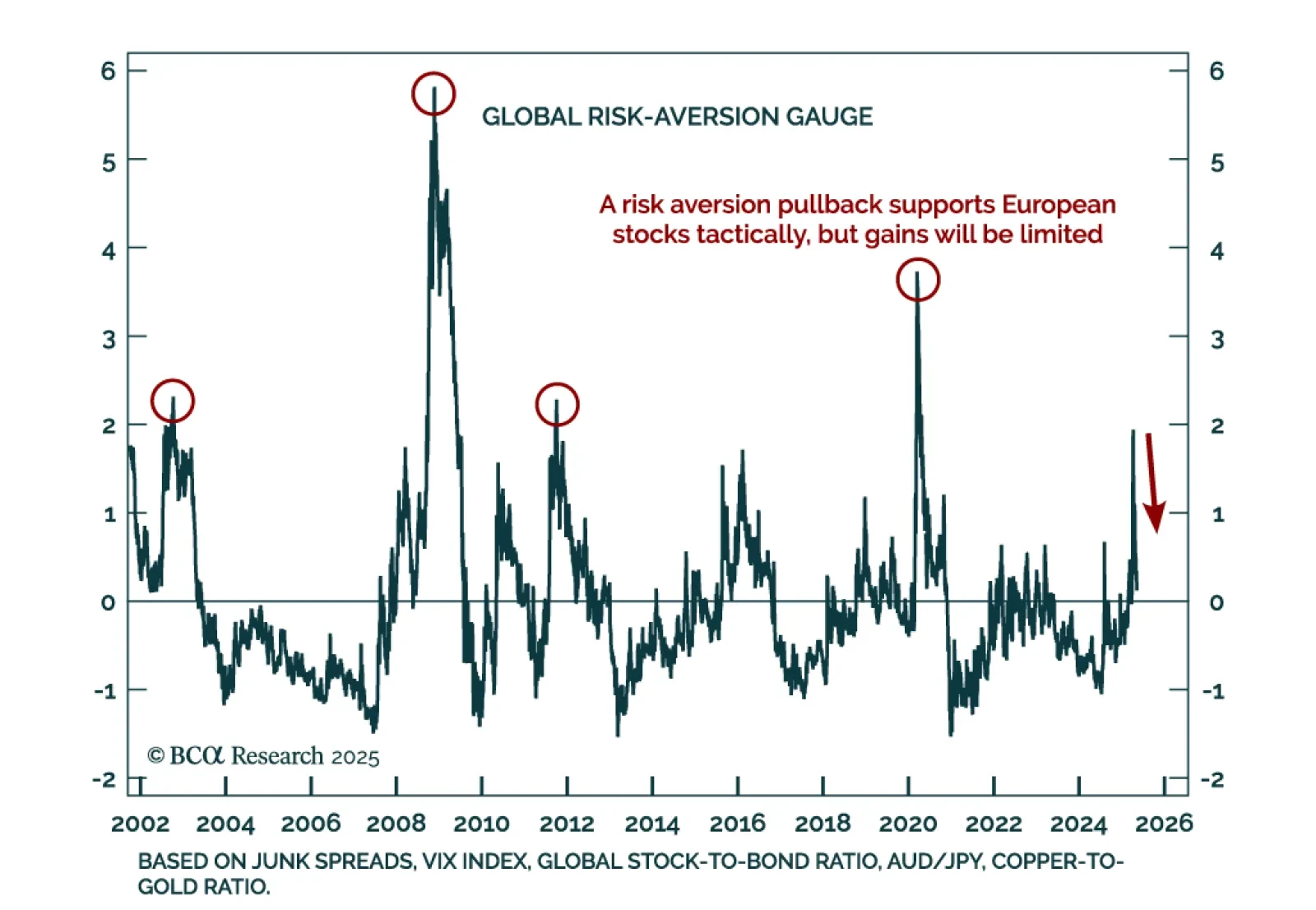

European equities have some short-term support, but global growth risks will cap gains. Our Chart Of The Week comes from Mathieu Savary, Chief European Investment Strategist. Mathieu sees probable but limited upside for European…

Our Portfolio Allocation Summary for May 2025.

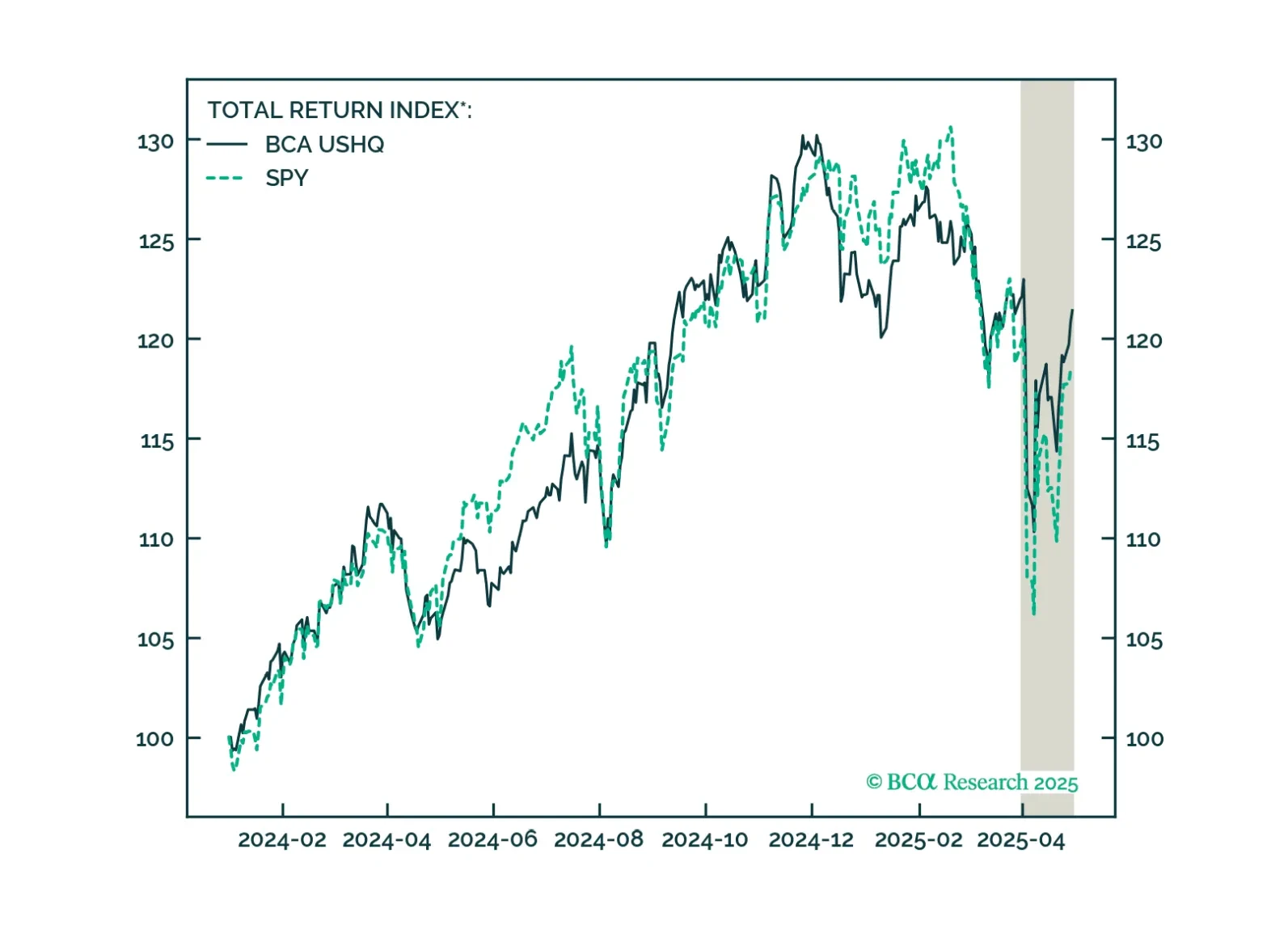

The US High Quality (USHQ) portfolio outperformed on the margin through April, returning -0.6%, whilst its SPY benchmark returned -1.2%. On a trailing three-month basis, performance remains robust vs. benchmark, with USHQ generating…

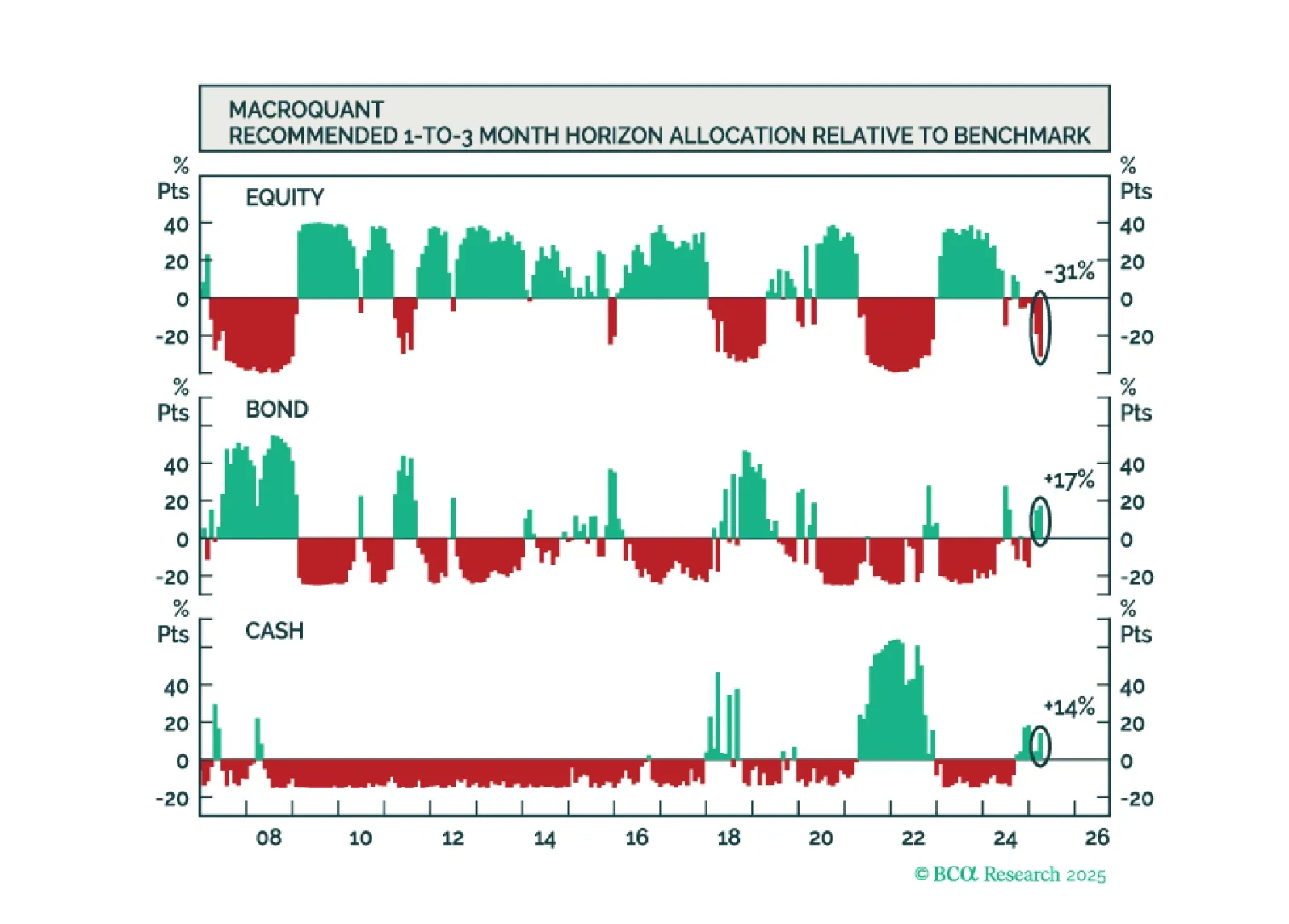

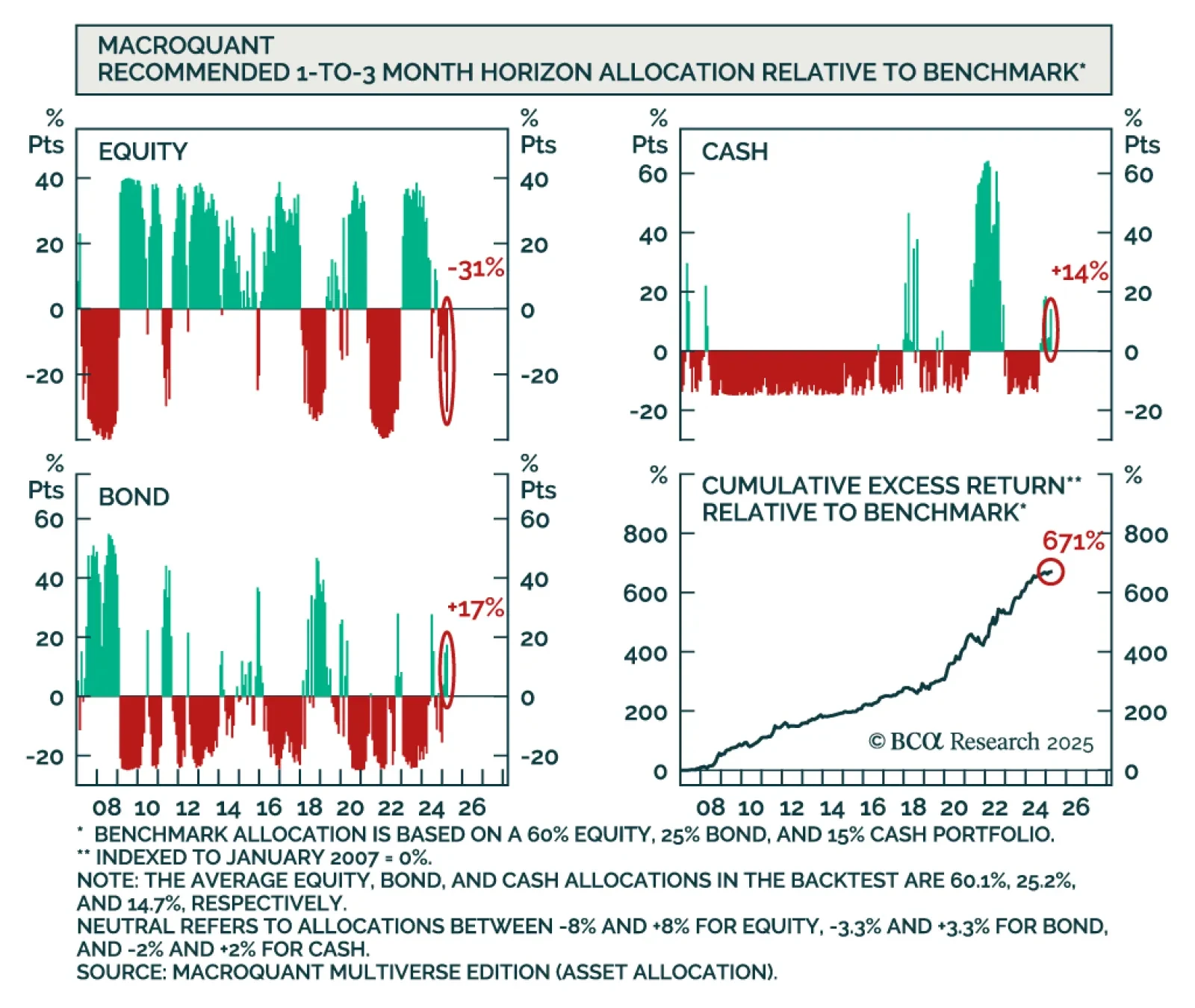

BCA’s MacroQuant model sees downside risks to US growth and upside risks to inflation. Our Chart Of The Week comes from Chanhyuck Lee in our Global Investment Strategy team. The model tracks hundreds of leading indicators and applies…

MacroQuant sees the risks to US growth as being to the downside and the risks to inflation as being to the upside. Such a stagflationary brew justifies an underweight on stocks.

MacroQuant sees the risks to US growth as being to the downside and the risks to inflation as being to the upside. Such a stagflationary brew justifies an underweight on stocks.

Our Portfolio Allocation Summary for April 2025.