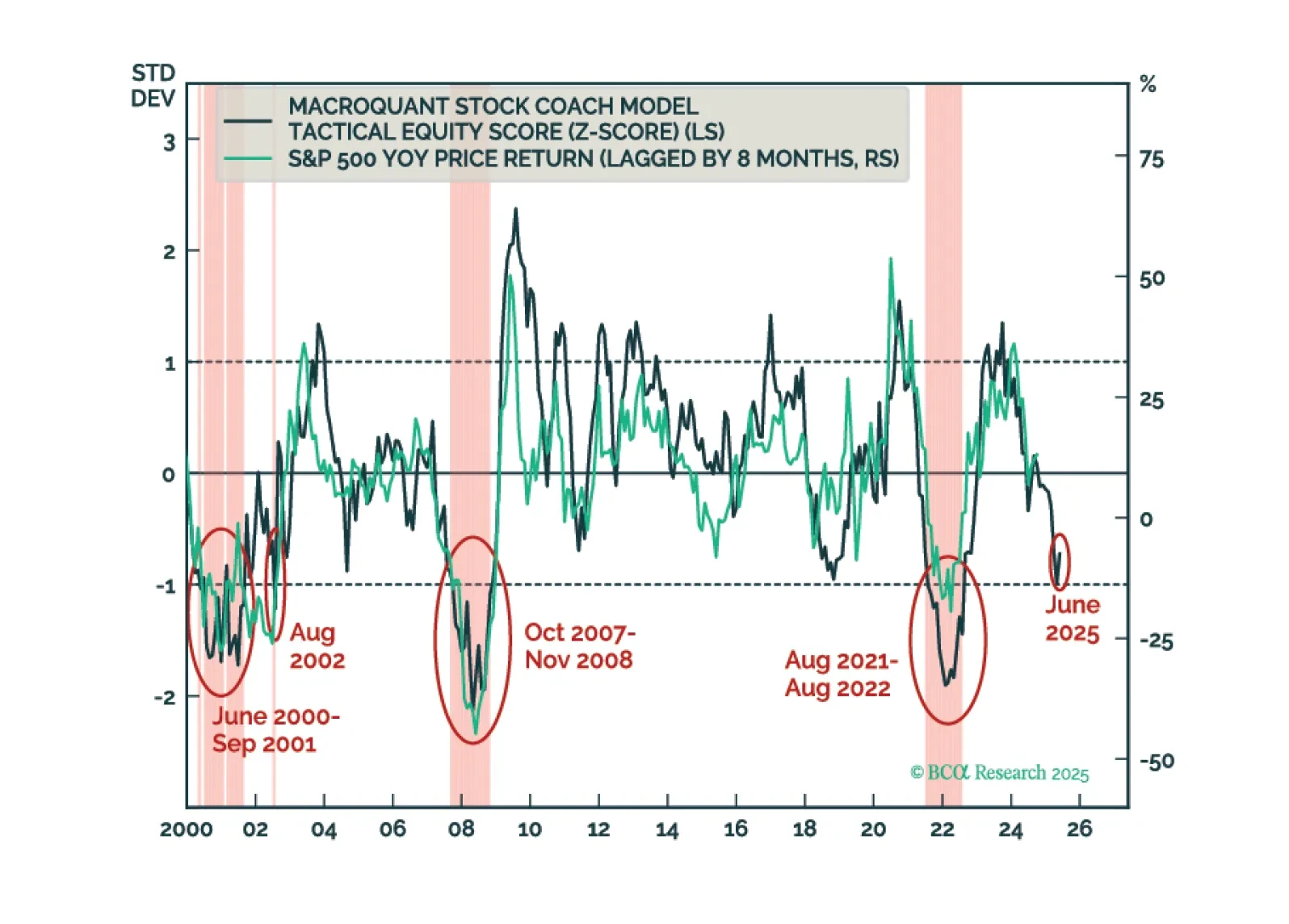

We will only move to a fully defensive stance if the “whites of the recession’s eyes” appear. So far, they have not. We will be increasingly looking to our MacroQuant model for guidance on when the next turning point in markets may…

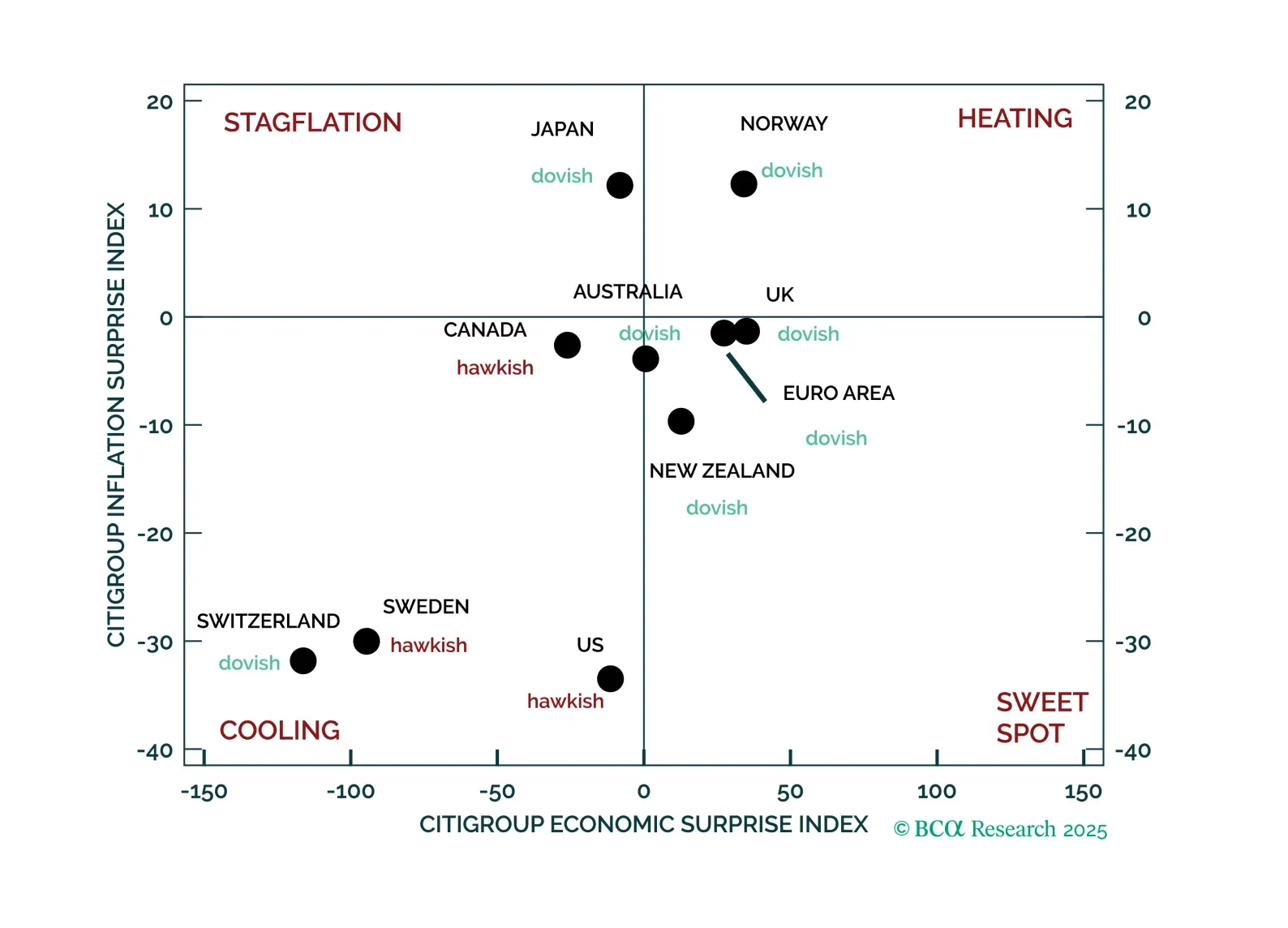

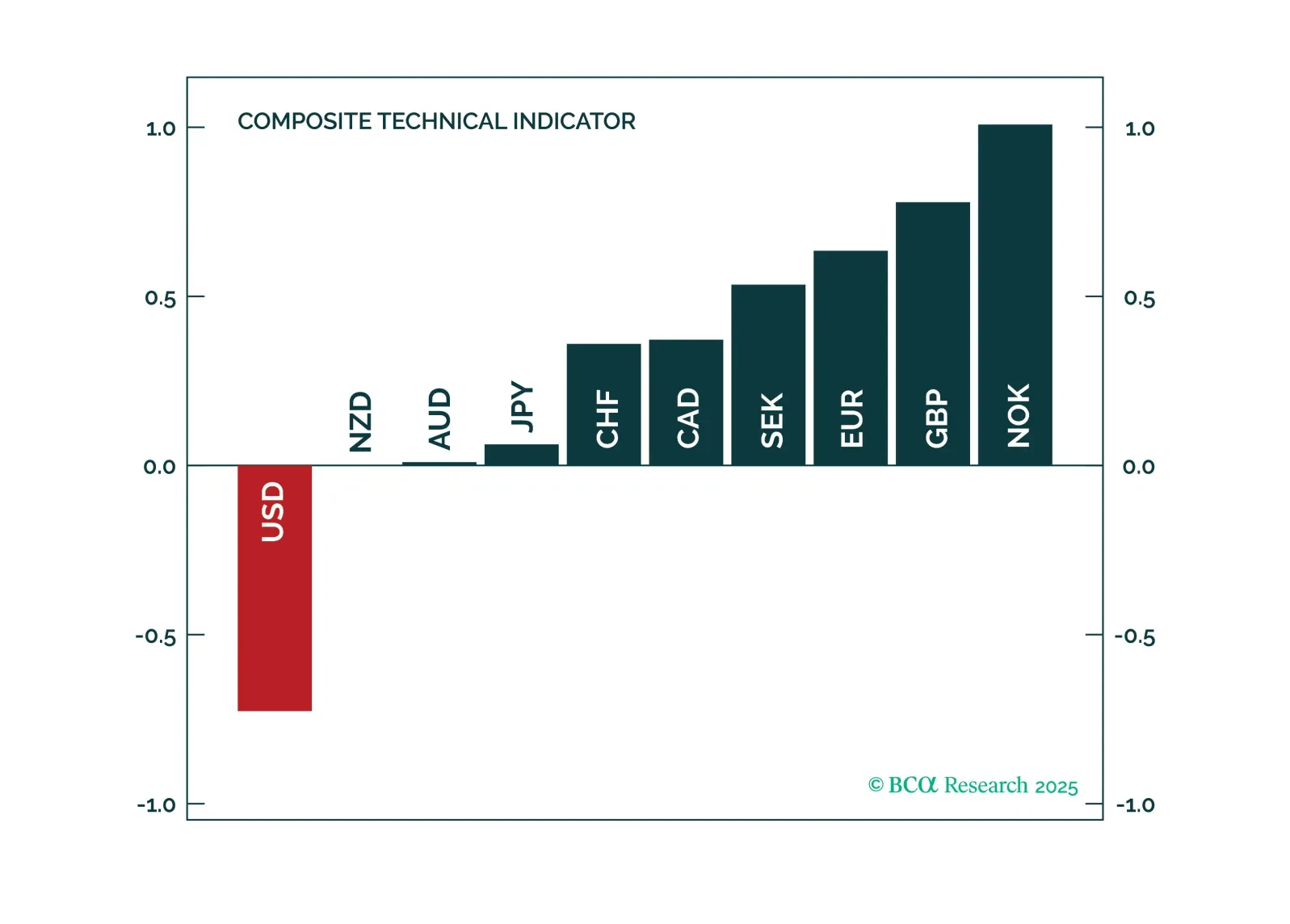

We apply a systematic approach to investing based on economic, inflation, and monetary policy surprises to the foreign exchange market. The signals from this framework are broadly consistent with the tactical views of our FX…

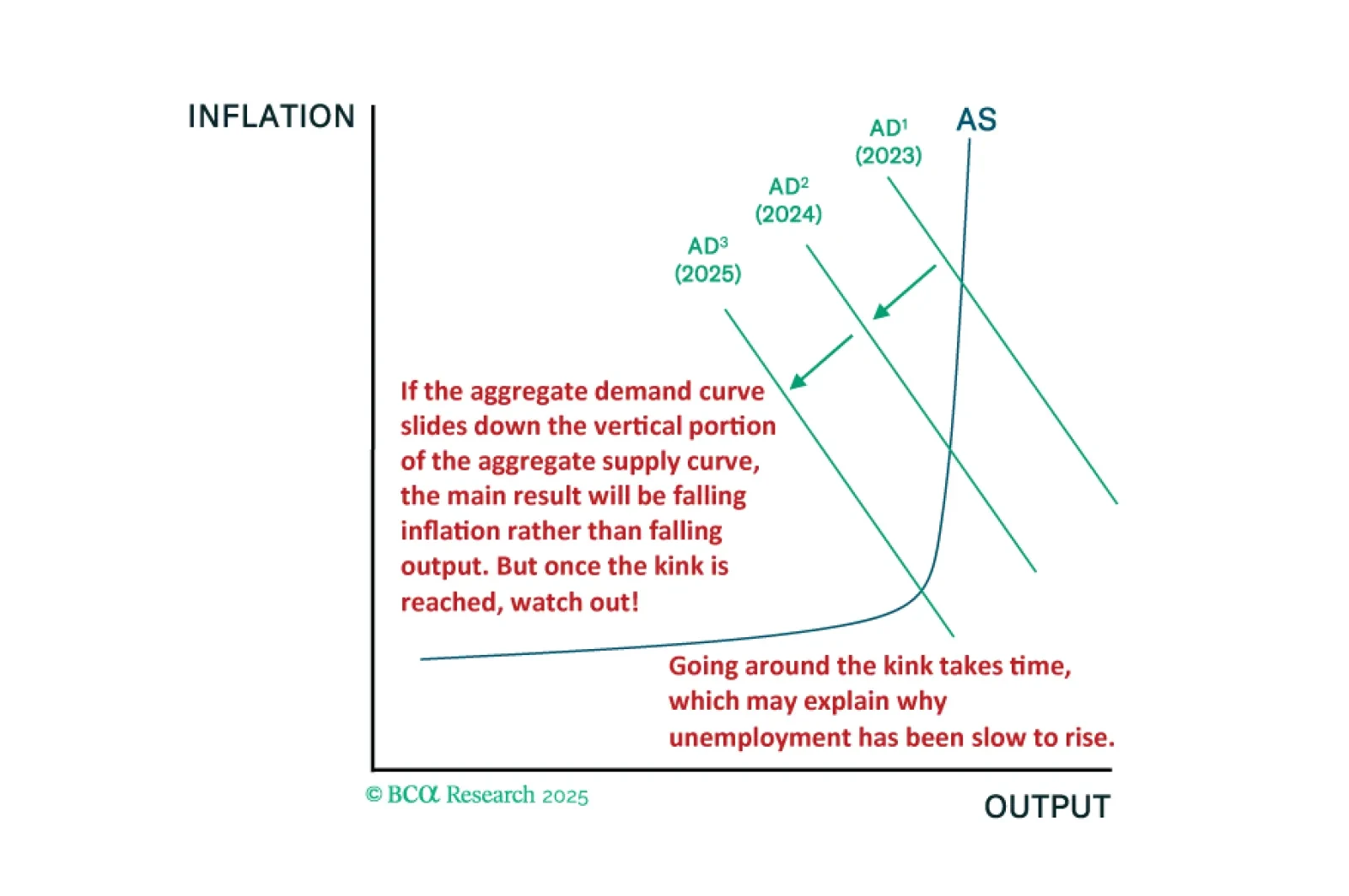

The fact that the US economy has been slower to deteriorate than in past cycles is entirely consistent with our kinked Phillips curve framework. We will be looking to our MacroQuant model for guidance on when to turn fully defensive…

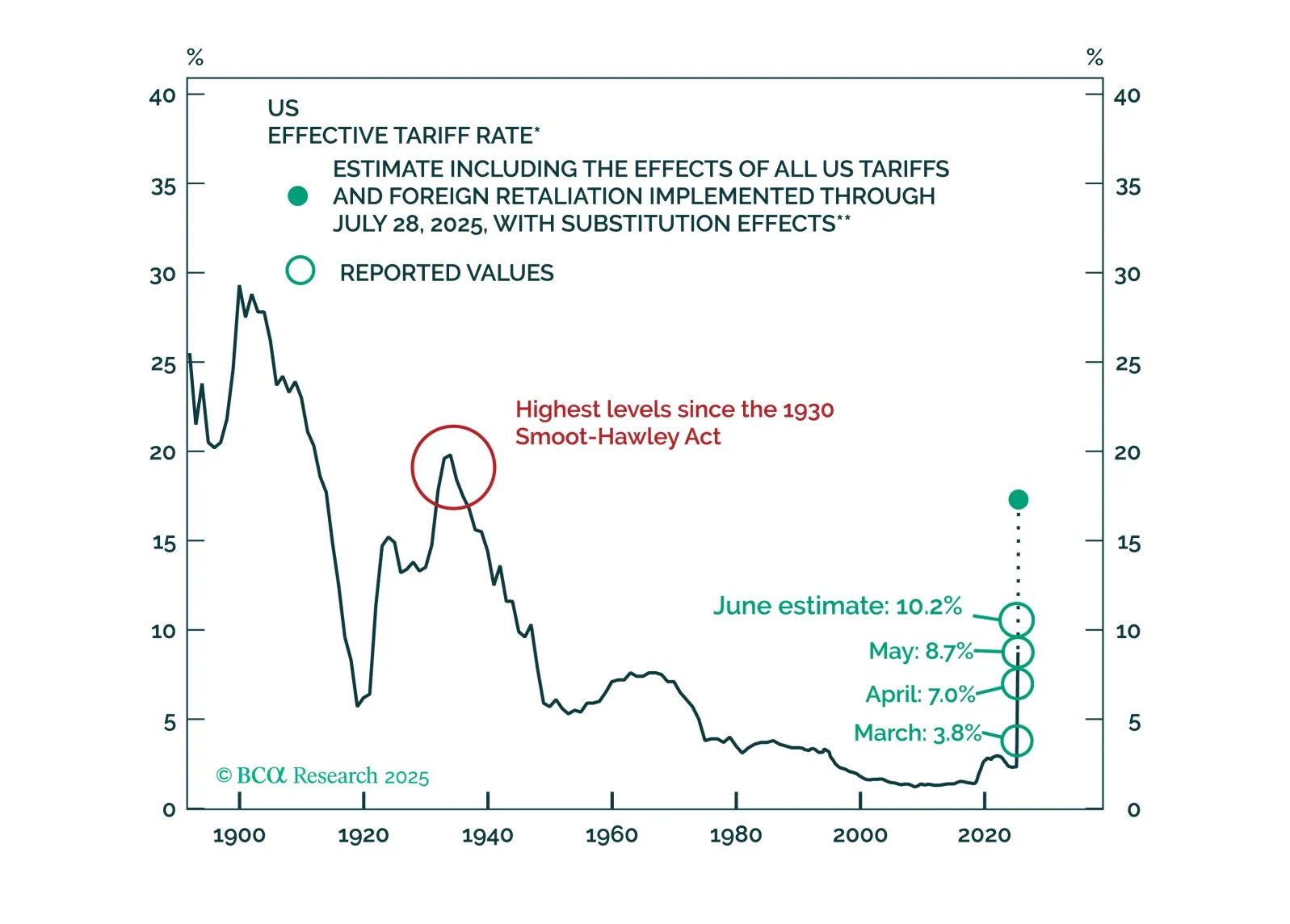

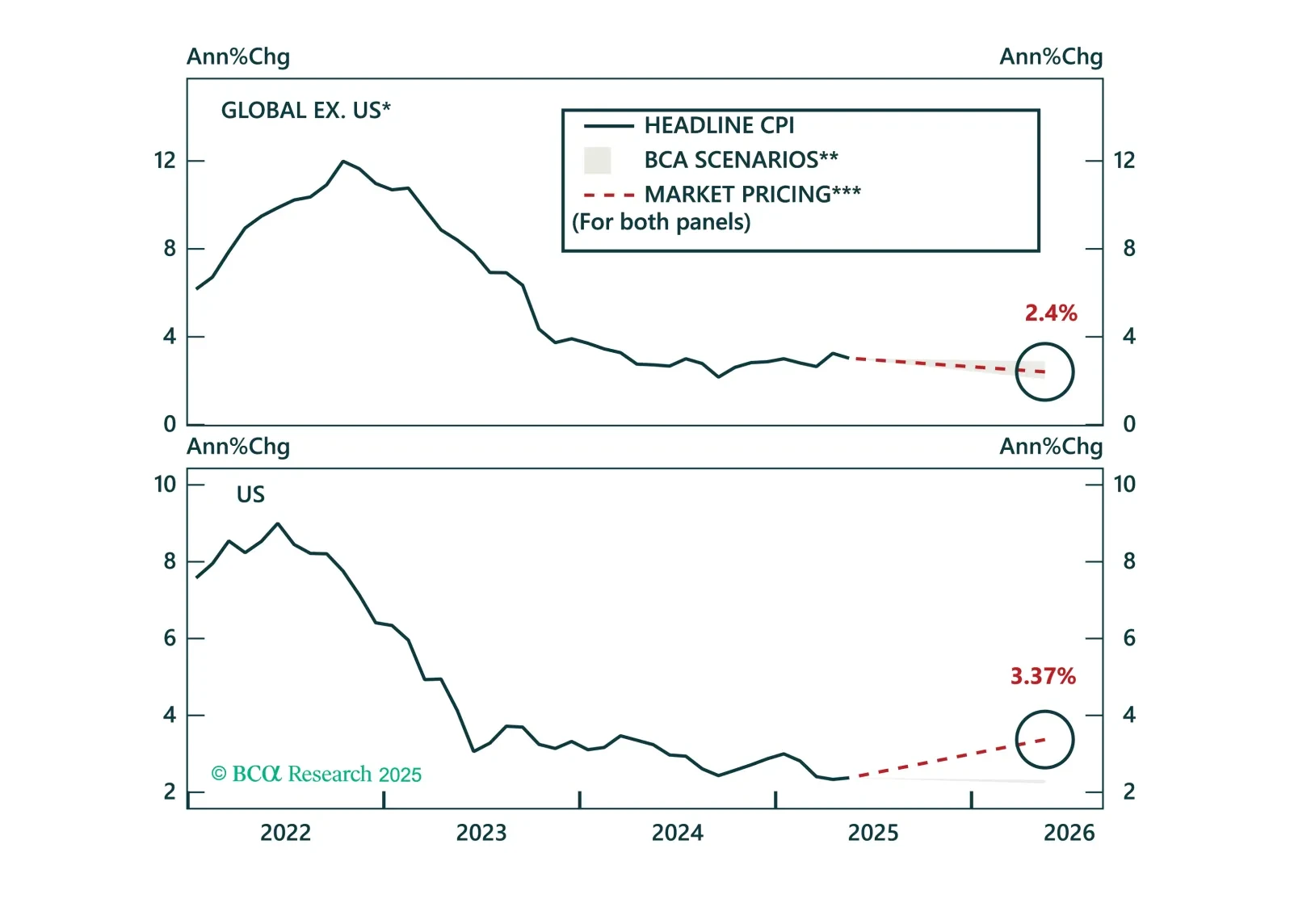

Disinflation continues to unfold globally, and markets are finally catching up. Inflation expectations have broadly realigned with fundamentals, prompting us to shift our global ILB allocation to neutral. While tariff risks are…

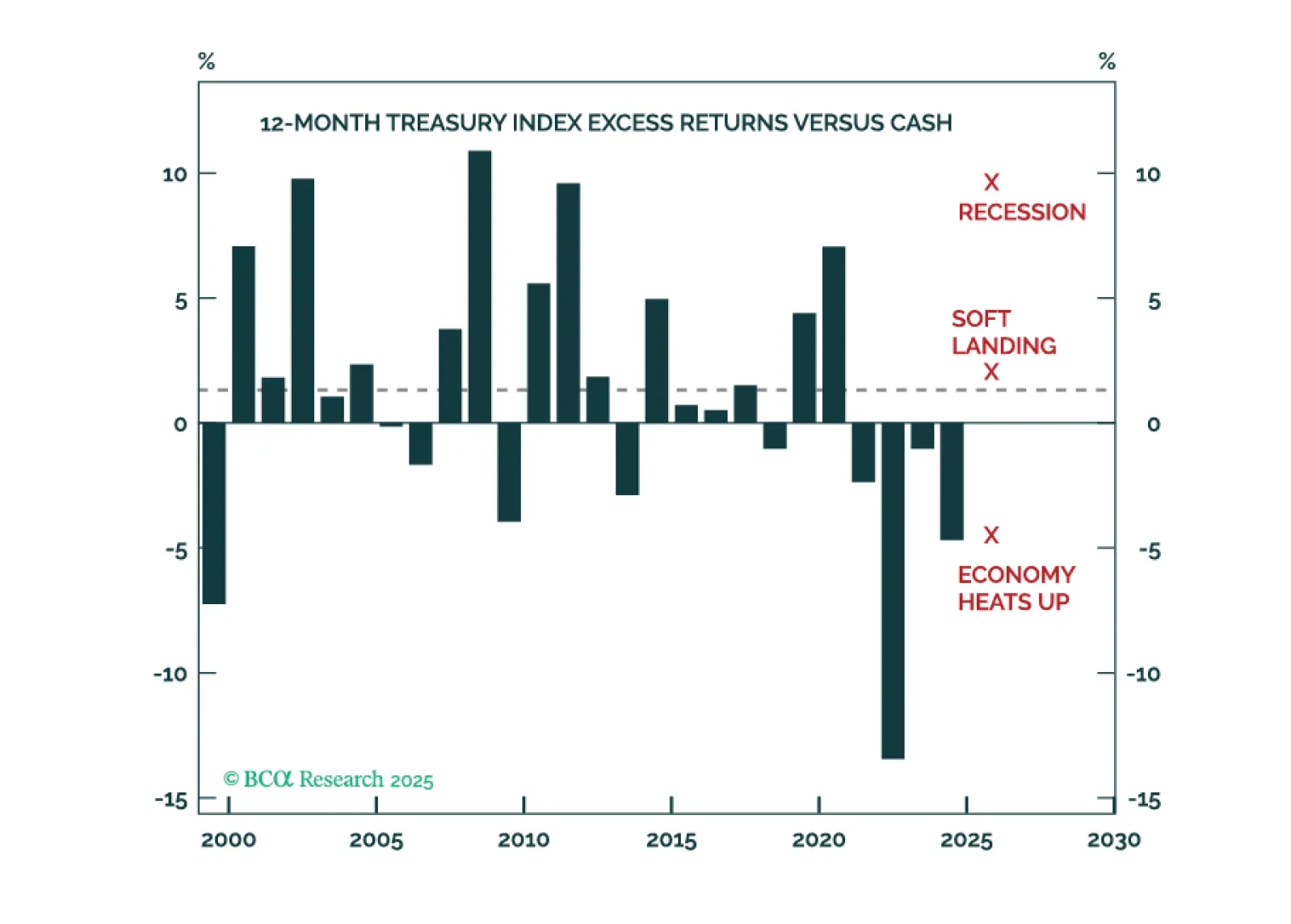

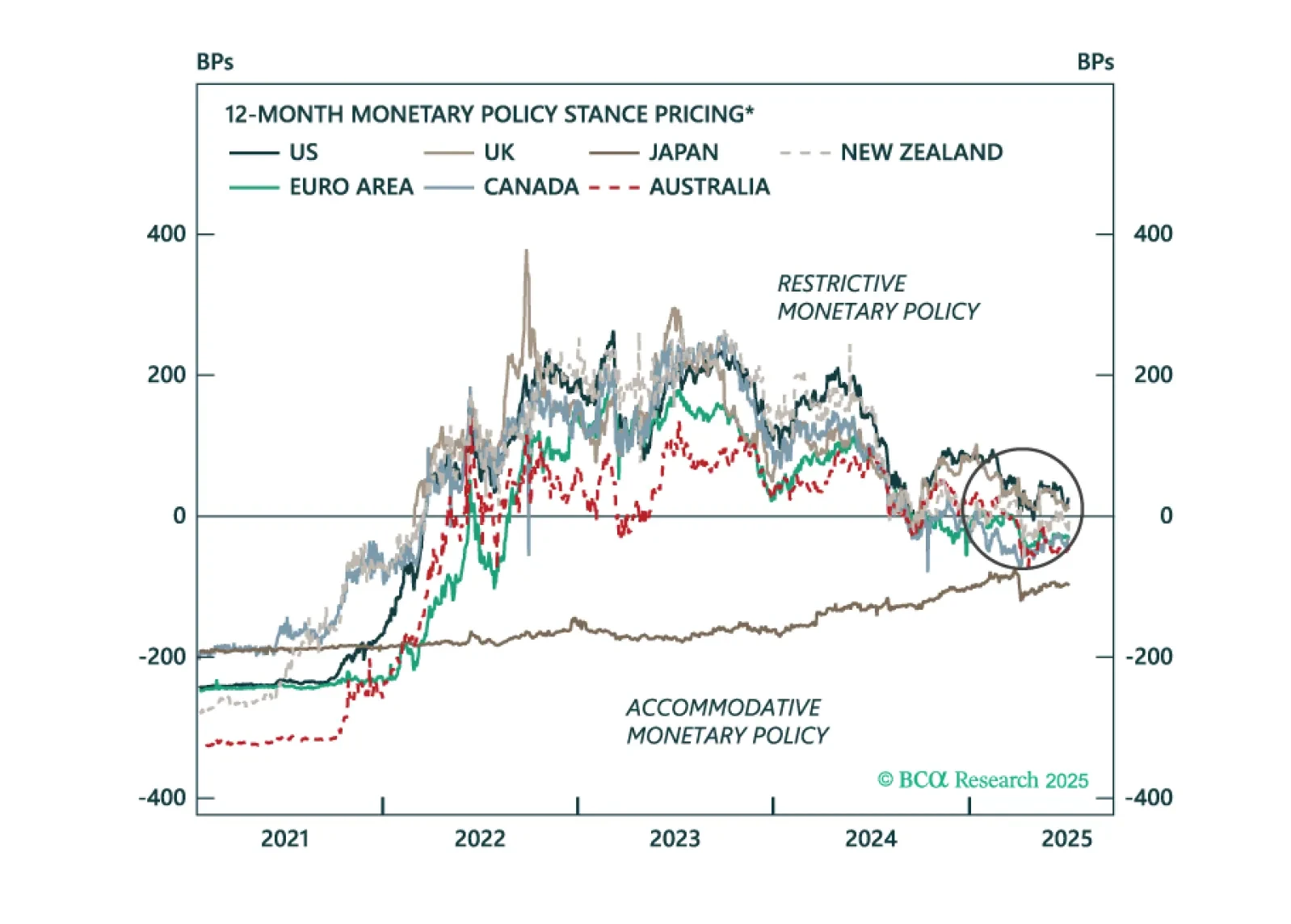

Markets are pricing a return to a neutral policy stance for the major central banks within the next 12 months. However, recession risks still loom amid slowing growth. We unpack where recession risks are underappreciated and what it…

MacroQuant’s US equity z-score is dangerously close to the -1 threshold. Moves below that threshold have reliably coincided with equity bear markets in the past. As such, MacroQuant recommends an underweight on stocks, offset by an…

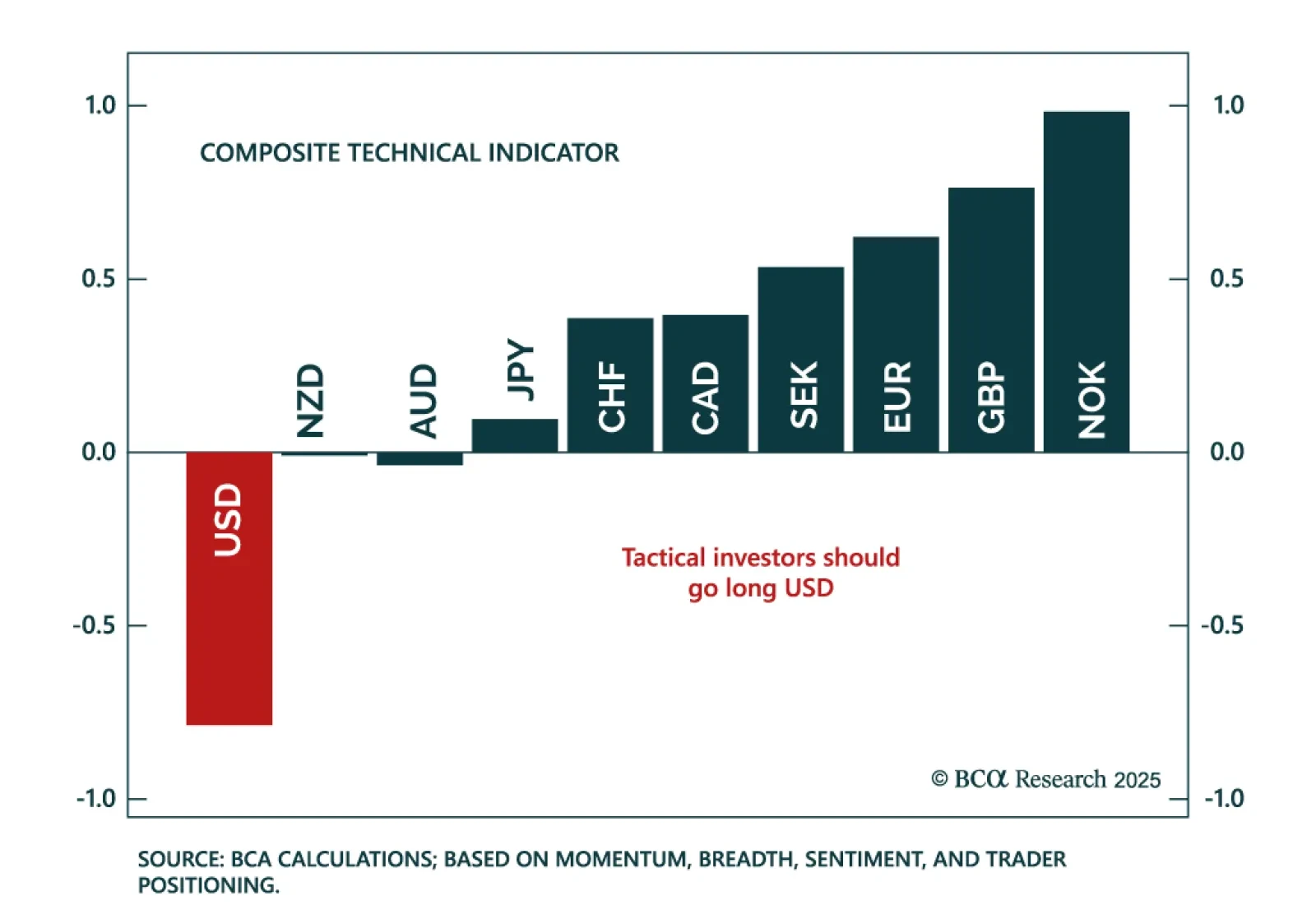

Our Foreign Exchange strategists recommend strategic investors sell the dollar on strength, while tactical investors position for a near-term bounce. The key risk for the dollar today is a potential balance-of-payments crisis.…

In this FX note, we provide a rationale for why it is important to pay attention to technical indicators, while still keeping your eyeball on the structural factors that drive currencies. This report answers the following questions:…

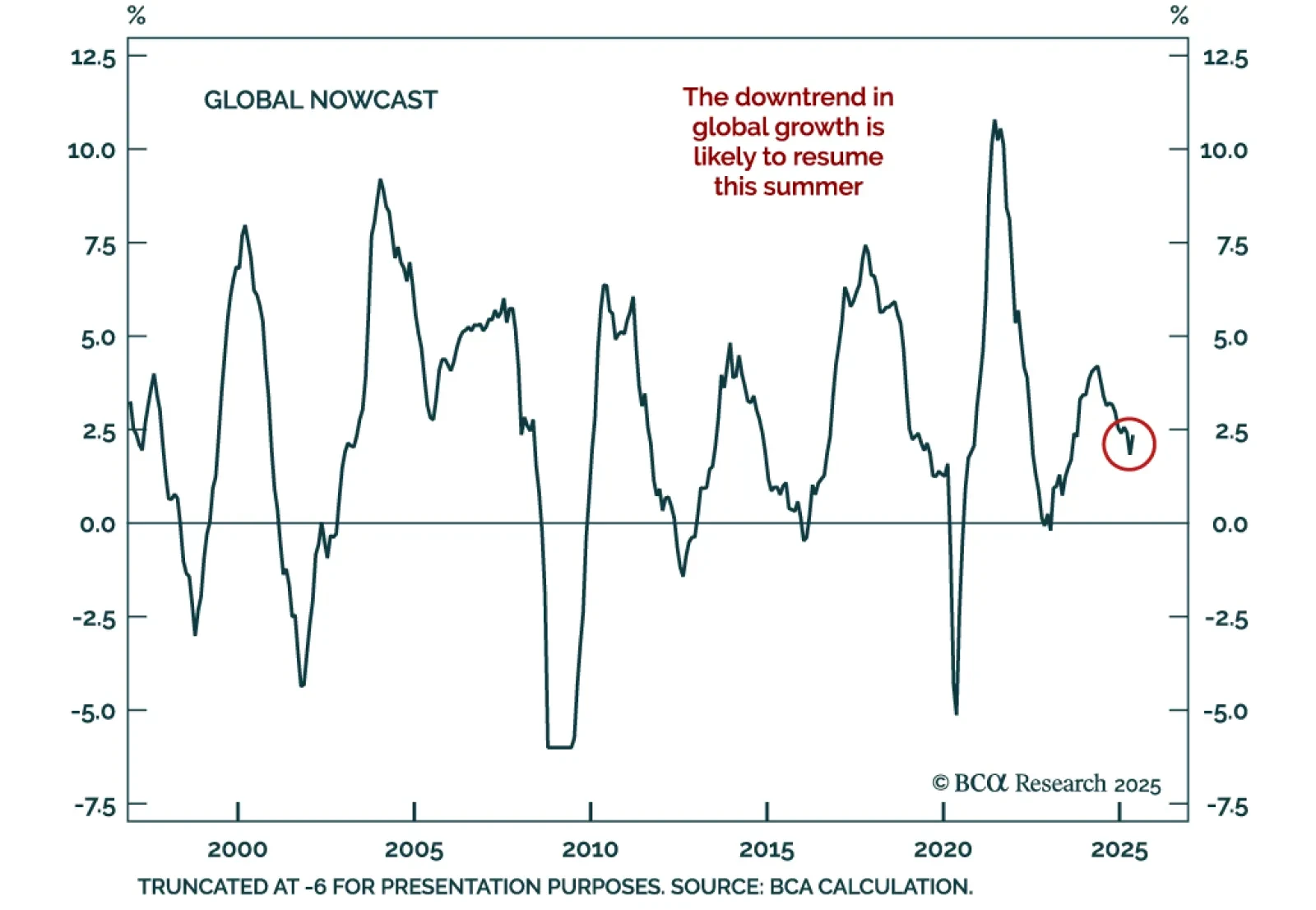

Global growth showed tentative signs of improvement in May, but it is too early to call it a turning point. Our Chart Of The Week comes from Mathieu Savary, Chief European Investment Strategist. BCA’s nowcast for global industrial…