In this report, we present our performance review of the BCA Research Global Fixed Income Strategy (GFIS) model bond portfolio for the Q2/2023, and the outlook and scenario analysis for the next six months. The portfolio return…

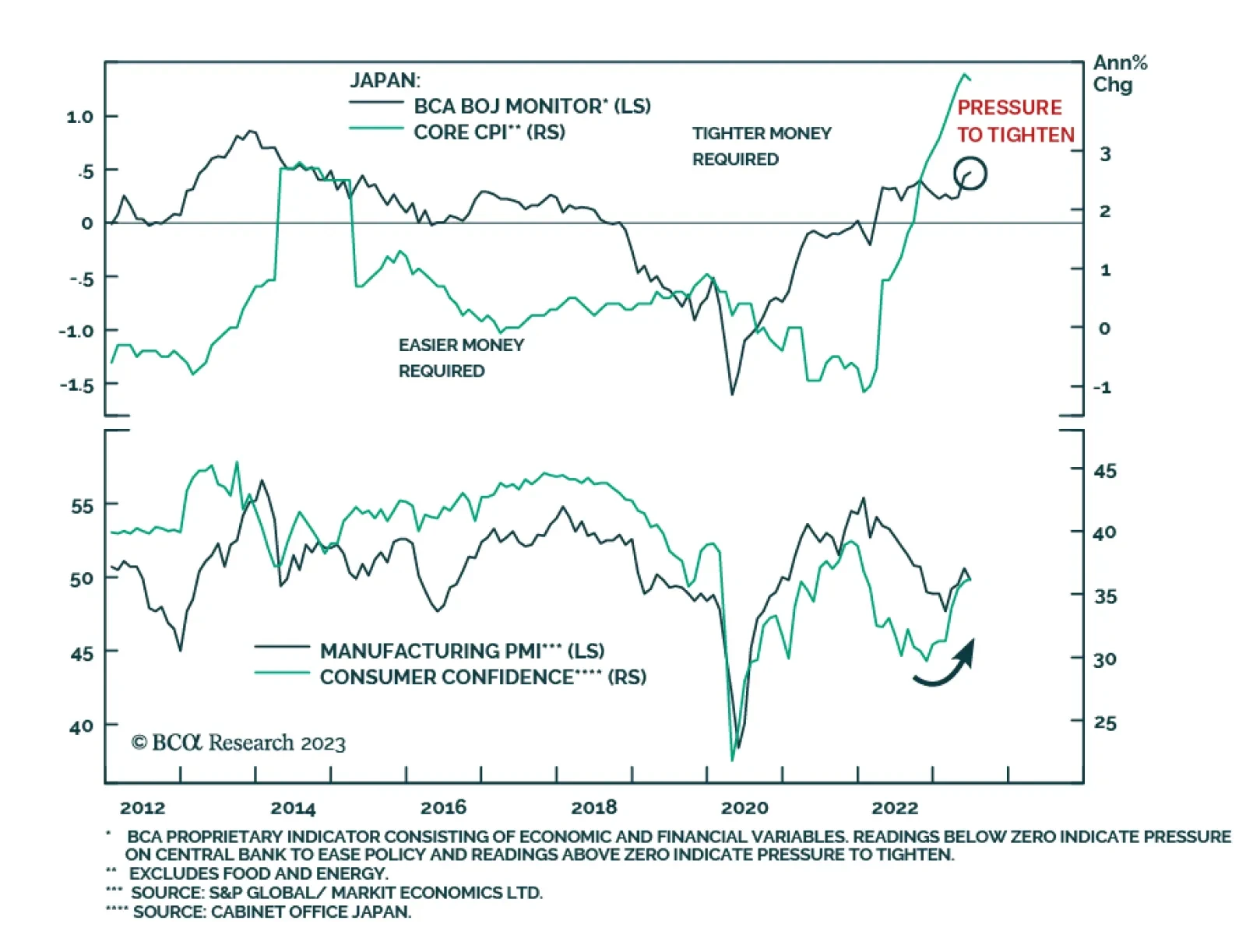

The Japanese yen slid by 2.1% vis-à-vis the US dollar last week, reversing the prior week’s rally. This latest bout of weakness comes on the back of speculation that the Bank of Japan will keep policy unchanged at…

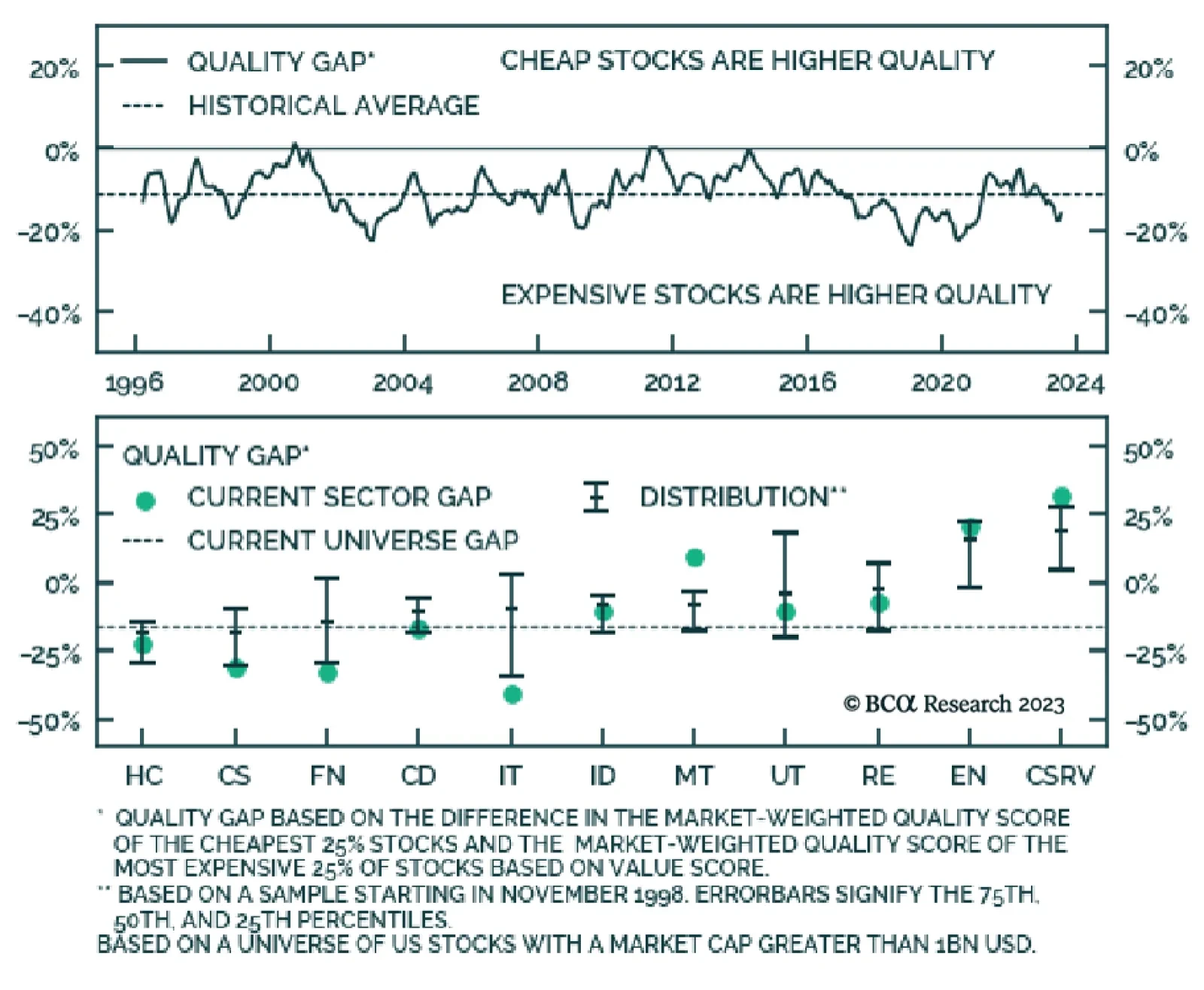

The Equity Analyzer Platform uses a 30-factor model called the BCA Score to help our clients build robust portfolios. Multi-factor models are constructed to avoid the common pitfalls of focusing on one factor dimension, such as…

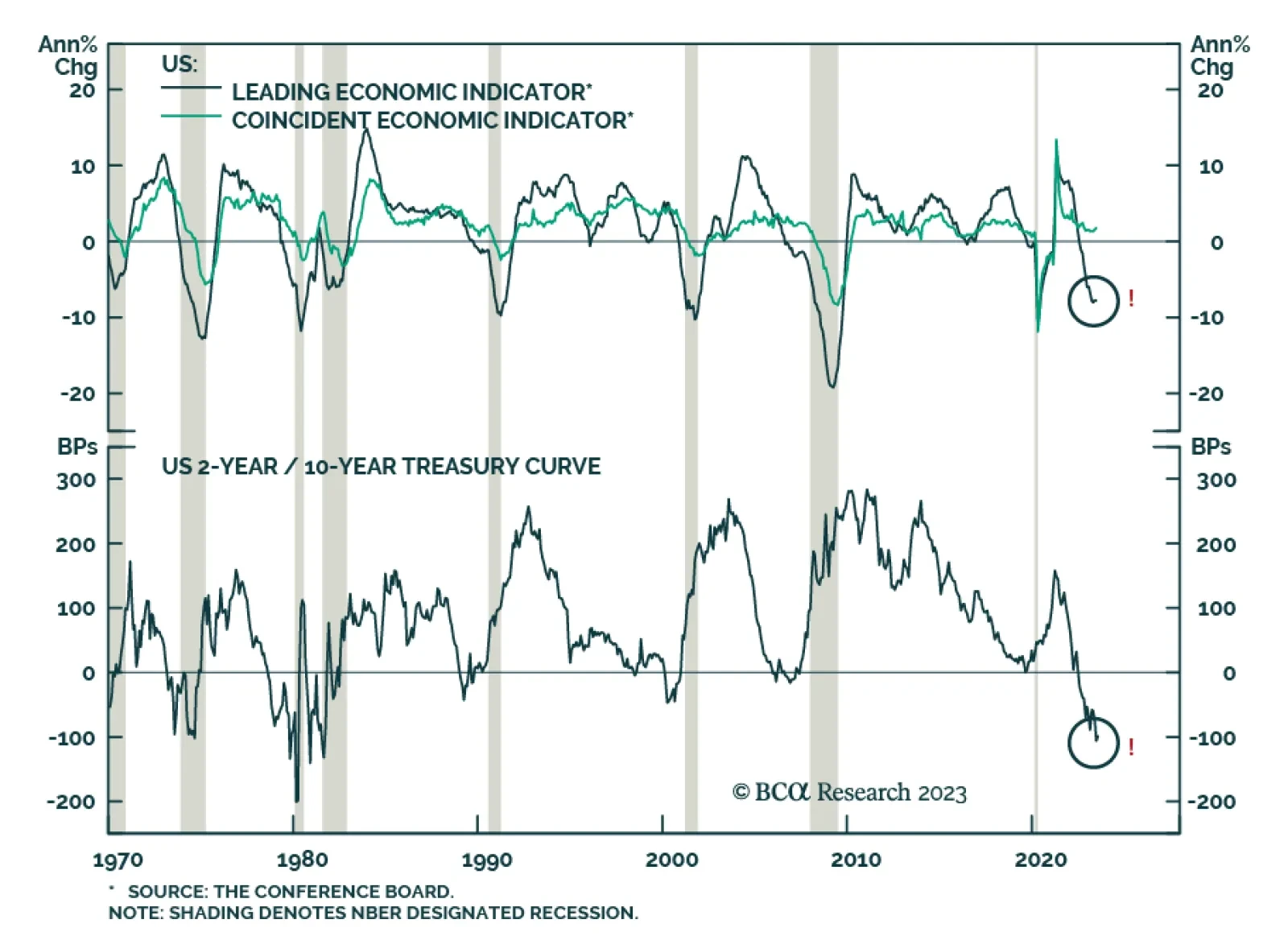

Although not our base case, there is a path for the US economy to avoid a recession over the next few years. We see the risks to stocks as tilted to the upside in the near term but to the downside over a 12-month horizon.

Investors have become increasingly more optimistic about the economic outlook. BoA’s Global Fund Manager Survey shows the share of investors surveyed expecting the global economy to experience a soft landing over the next…

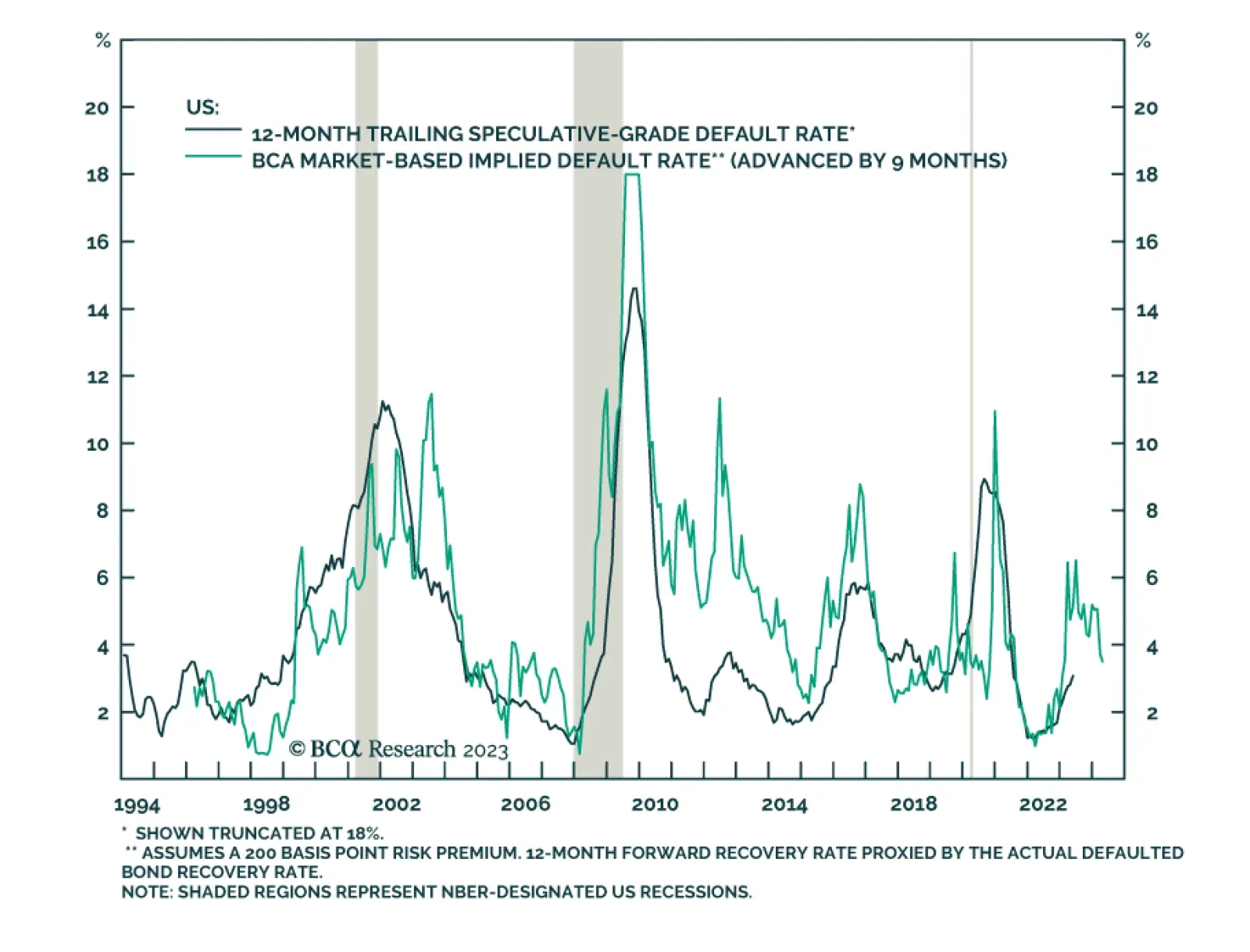

US speculative-grade corporate bond (junk) spreads rose significantly last year in response to a sharp increase in US interest rates and widespread concerns about a US recession. Junk spreads have since come in from their mid-…

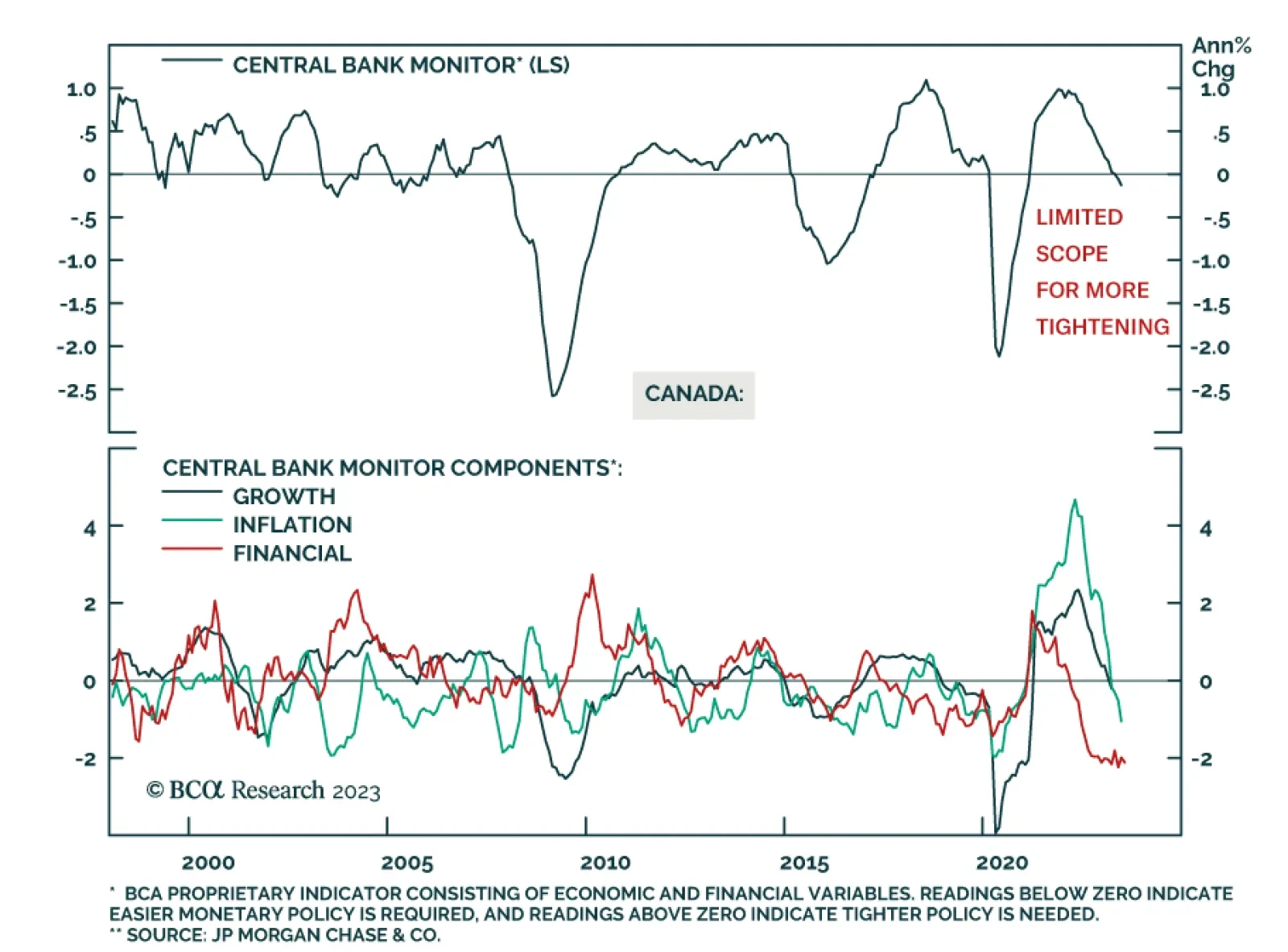

Canada’s CPI release showed headline CPI inflation cooled from 3.4% y/y to 2.8% in June – below estimates calling for a less pronounced moderation to 3.0% y/y. This marks inflation’s first return to the Bank of…

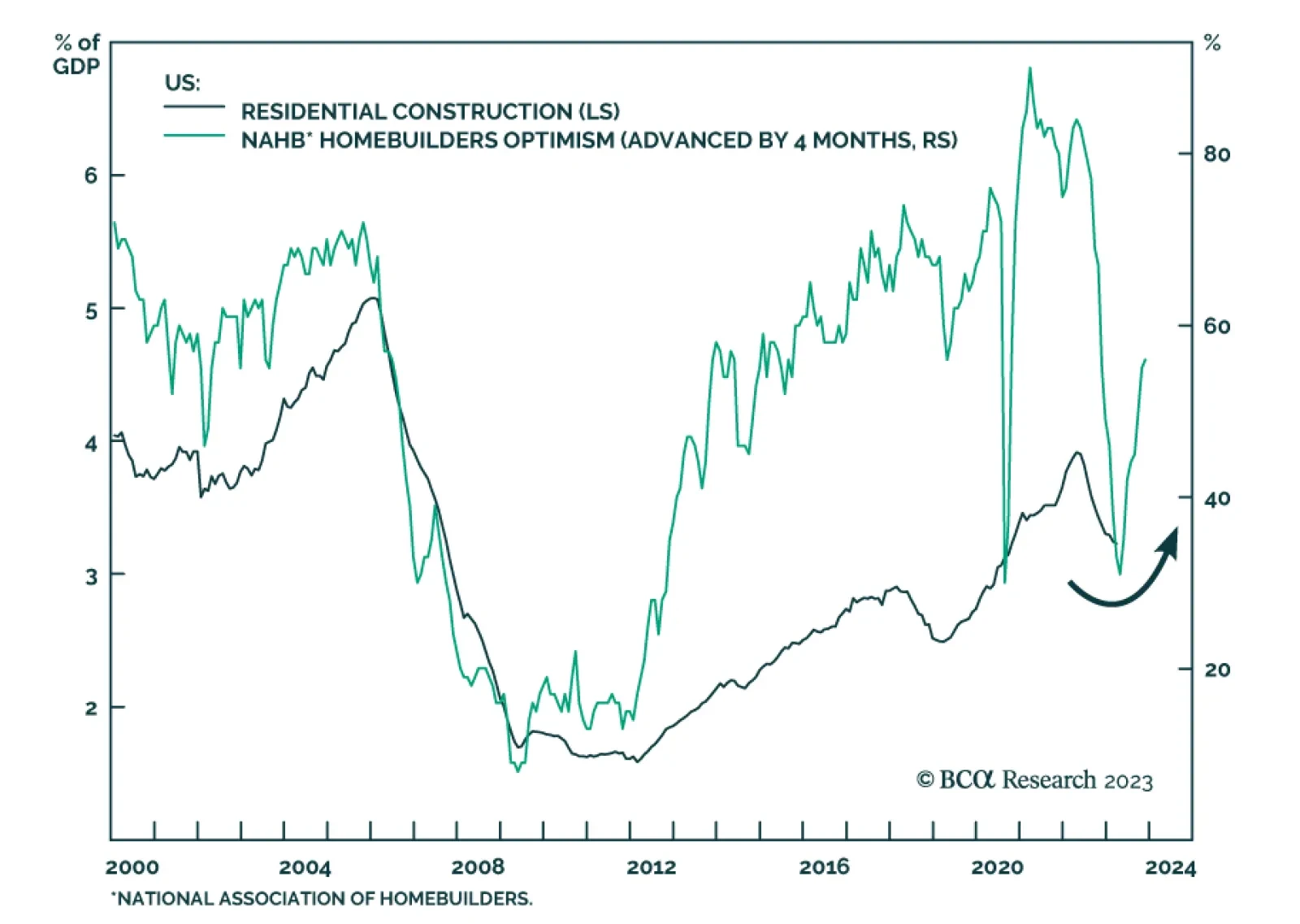

Results of the NAHB survey shows US homebuilder sentiment inched further above 50 to a 13-month high of 56 in July. Its ongoing rise above 50 indicates that net sentiment is becoming increasingly favorable. That said,…

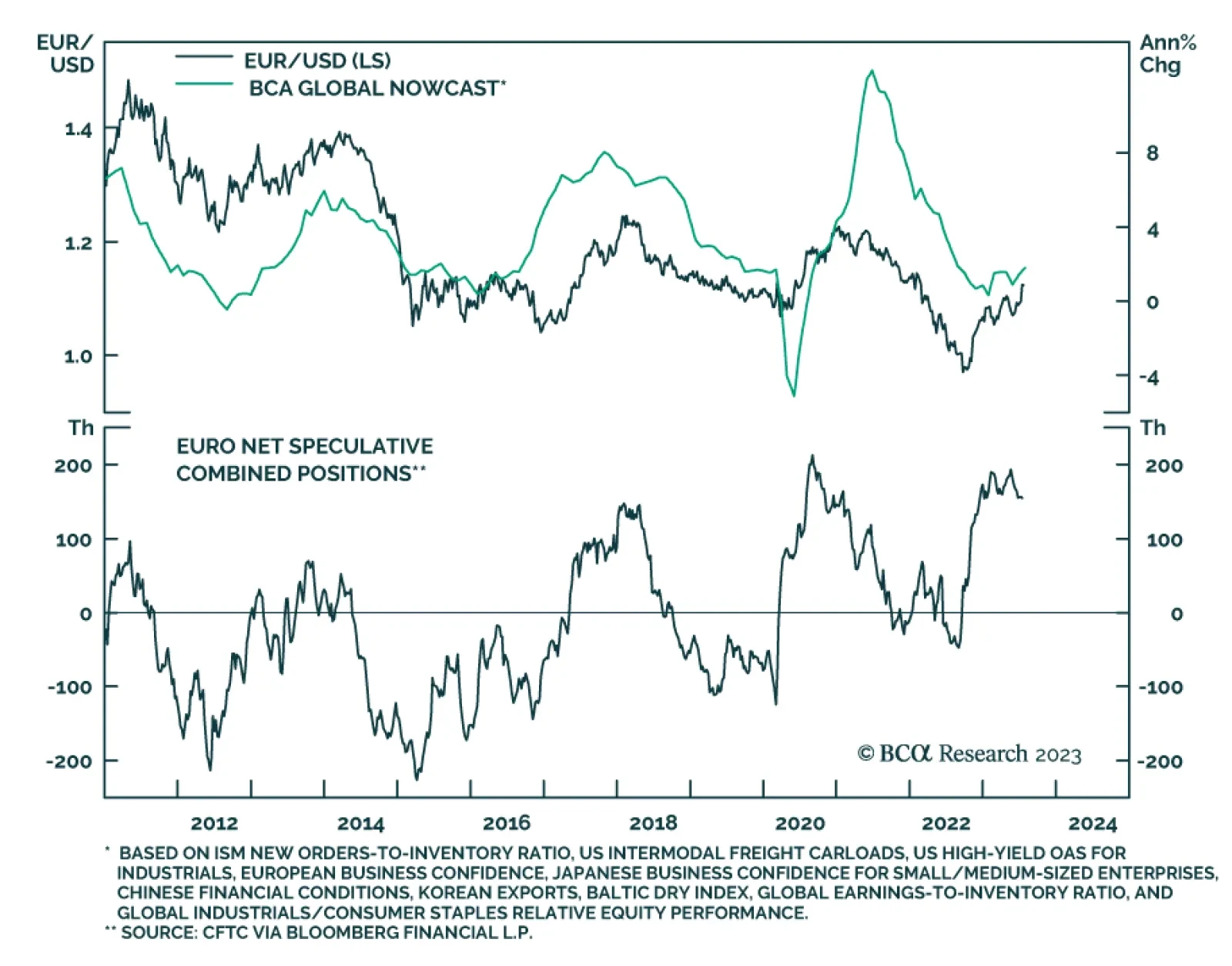

After US inflation slowed down markedly, EUR/USD broke out to 1.12, which constitutes a 16-month high. The euro is benefiting from the market expectation that the Fed will soon be done with its hikes while the ECB’s…

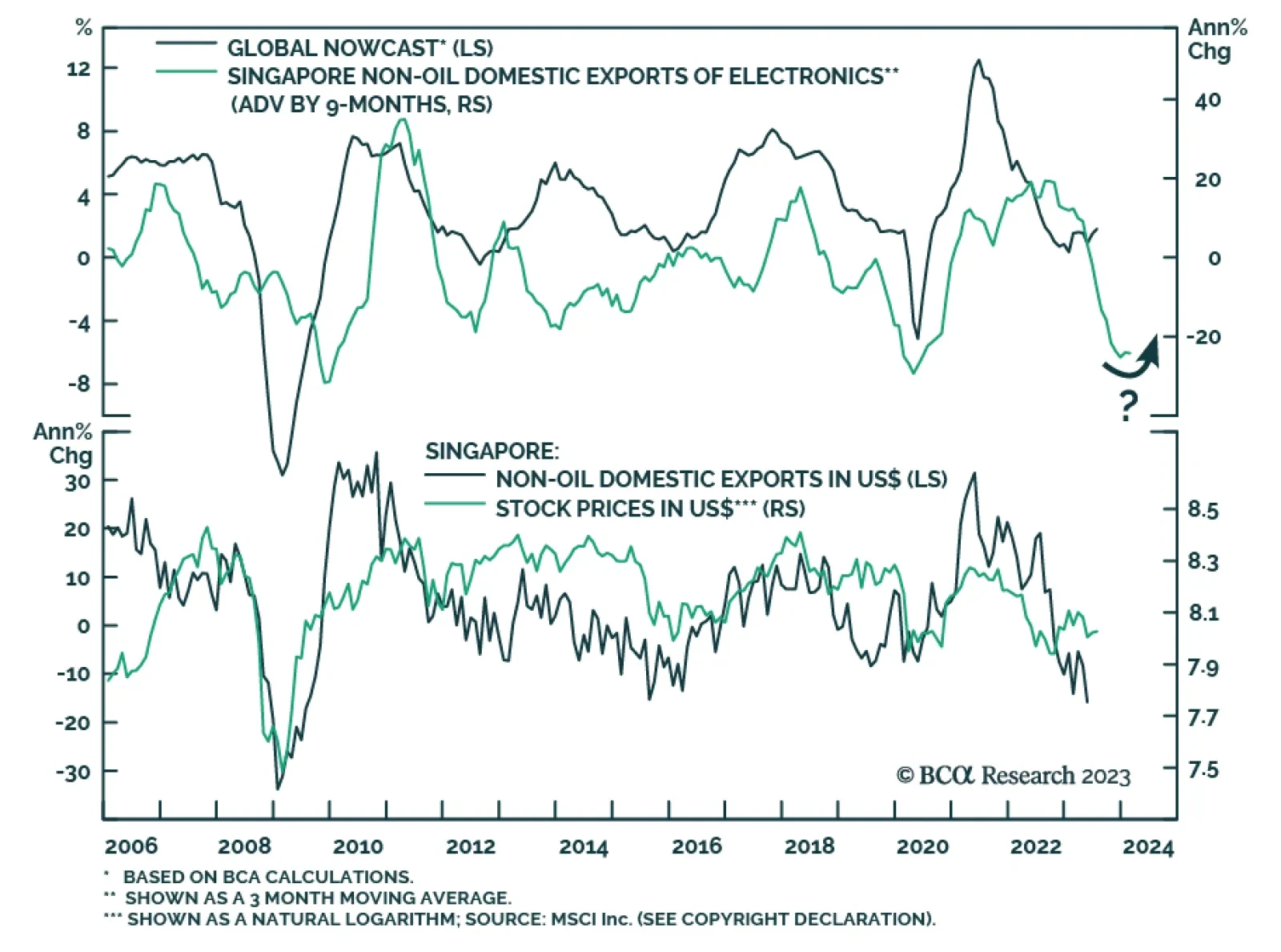

Singapore’s trade data continue to send a pessimistic signal about global manufacturing conditions. The year-over-year contraction in non-oil domestic exports (NODX) deepened to -15.5% y/y in June from -14.8% y/y –…