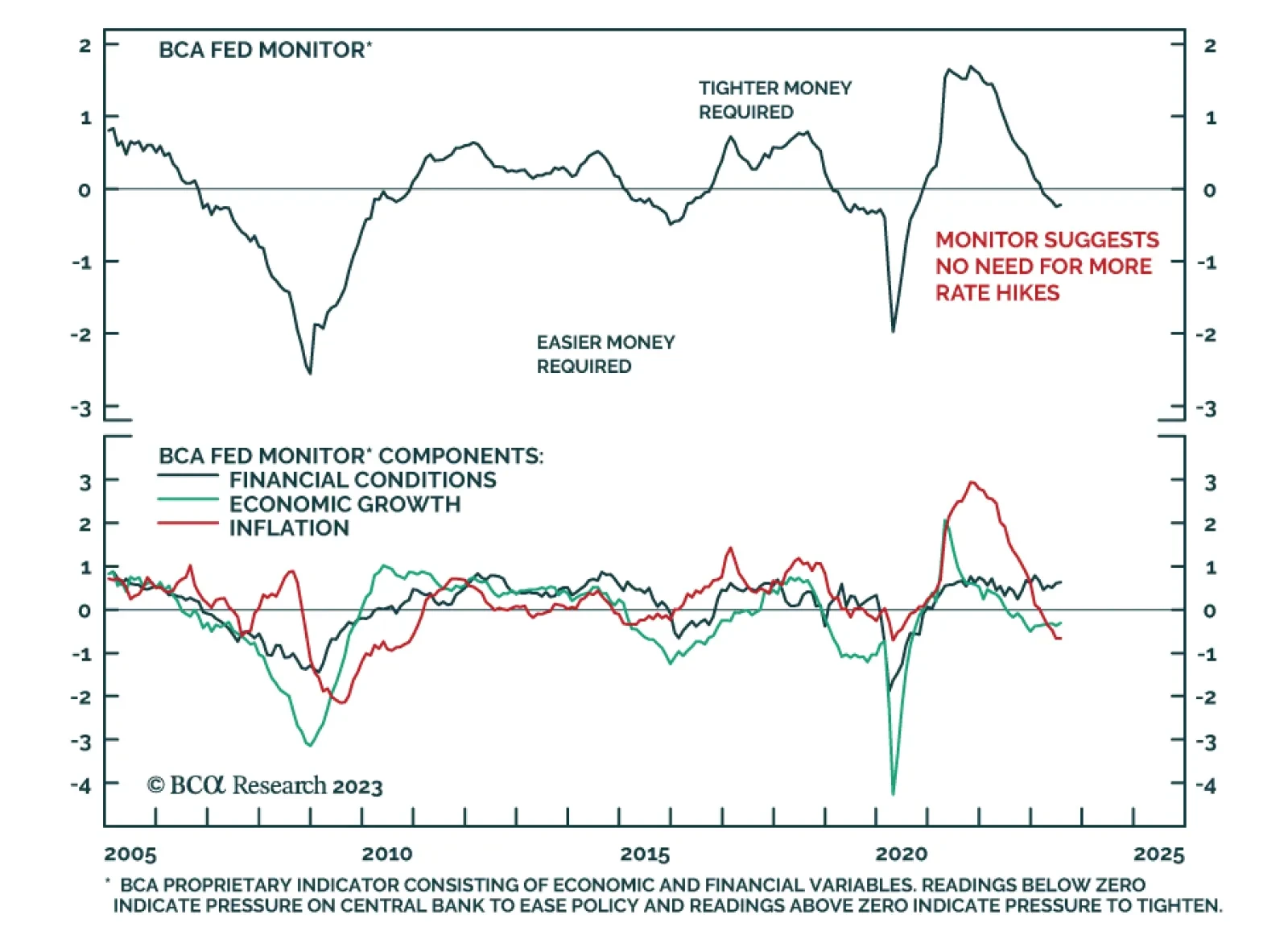

While we are sympathetic to the view that the Fed could temporarily achieve a soft landing, we are skeptical that it could stick that landing for very long. Stocks could strengthen into year-end, with small caps potentially leading…

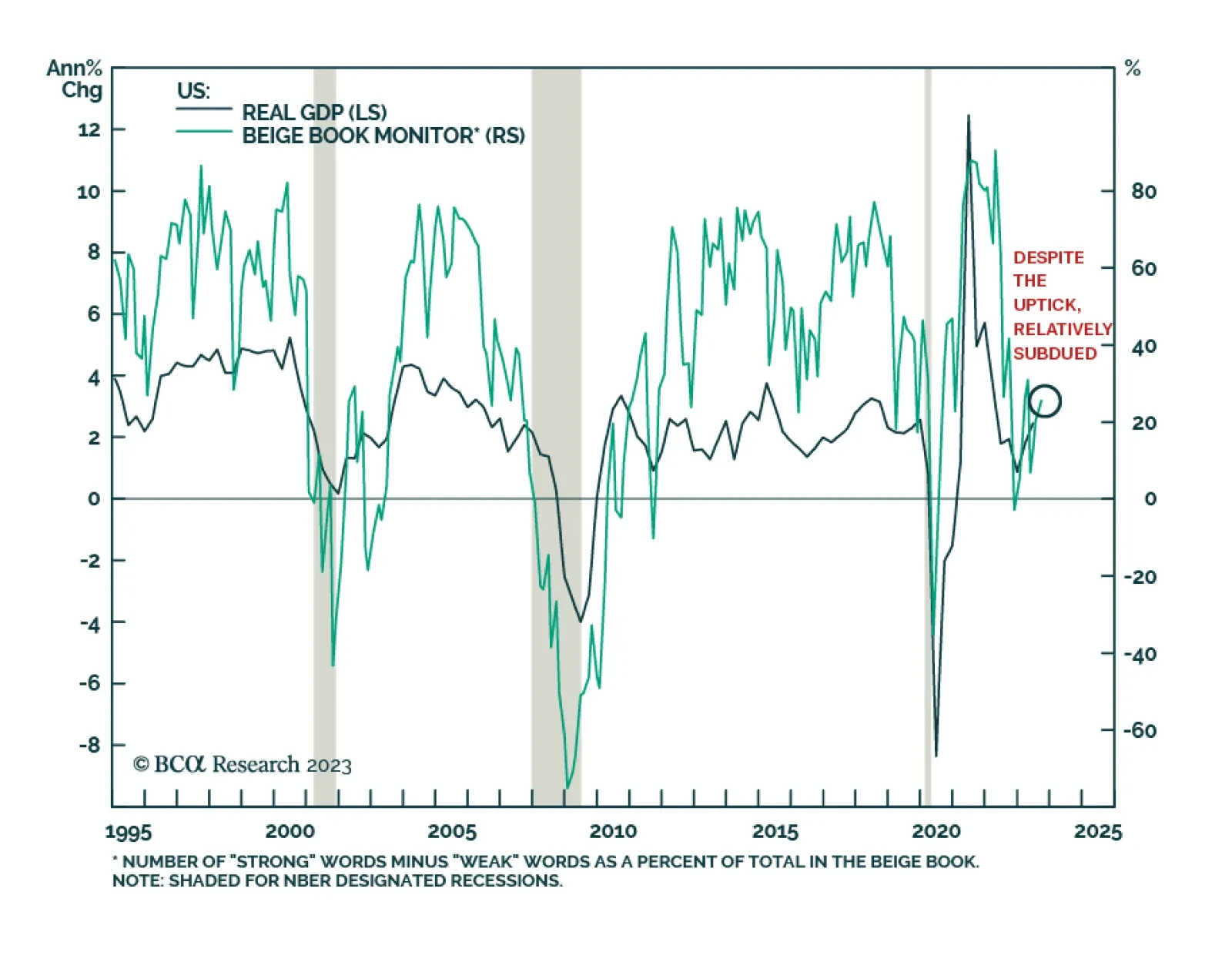

Overall, the Fed’s latest Beige Book provided a pessimistic assessment of the US economy. Although the report characterized tourism spending as “stronger than expected,” it also noted that pent-up demand for…

The geopolitical backdrop remains negative despite some marginally less negative news. China’s stimulus is not yet large or fast enough to prevent a market riot. Two of our preferred equity regions, ASEAN and Europe, are struggling…

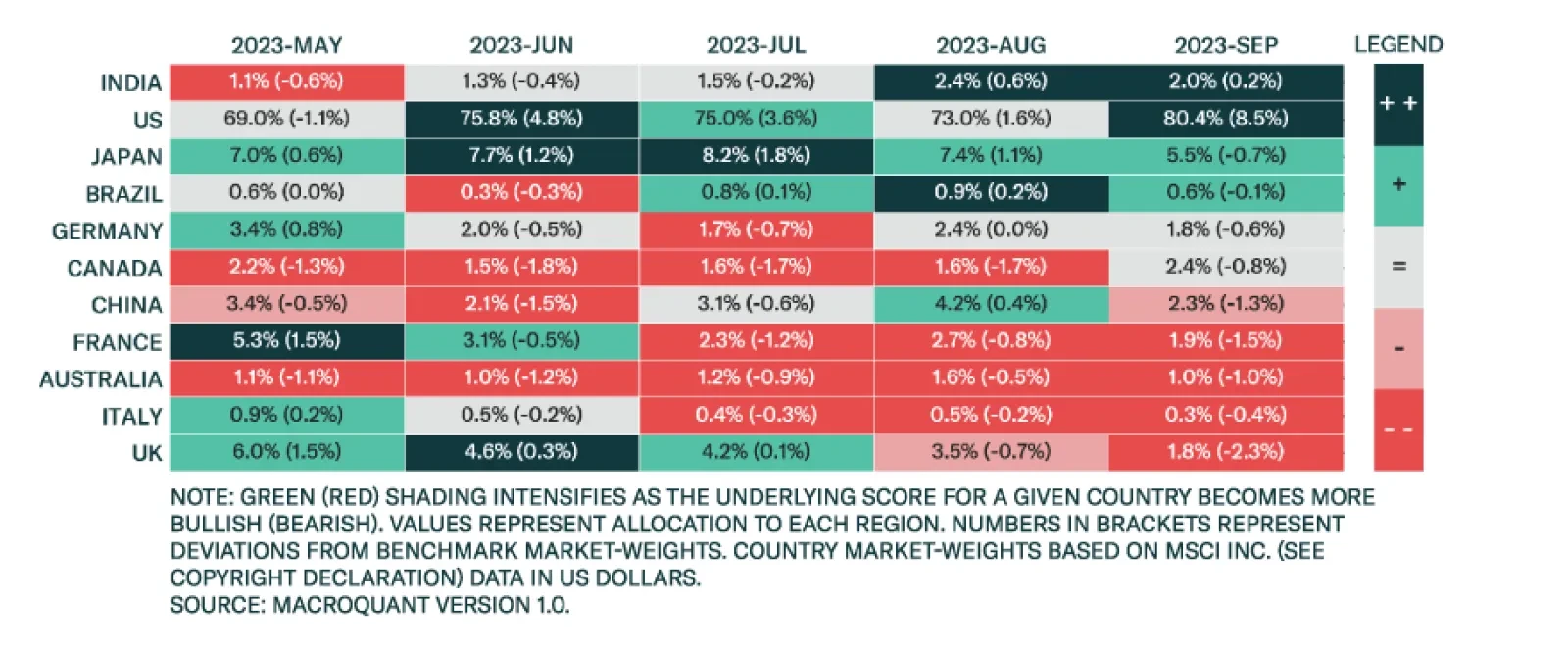

Our Global Investment Strategy Service’s MacroQuant 1.0 model favors the US and India within the equity universe. The 1.0 version of the MacroQuant model is calibrated to produce recommendations over a 30-day investment…

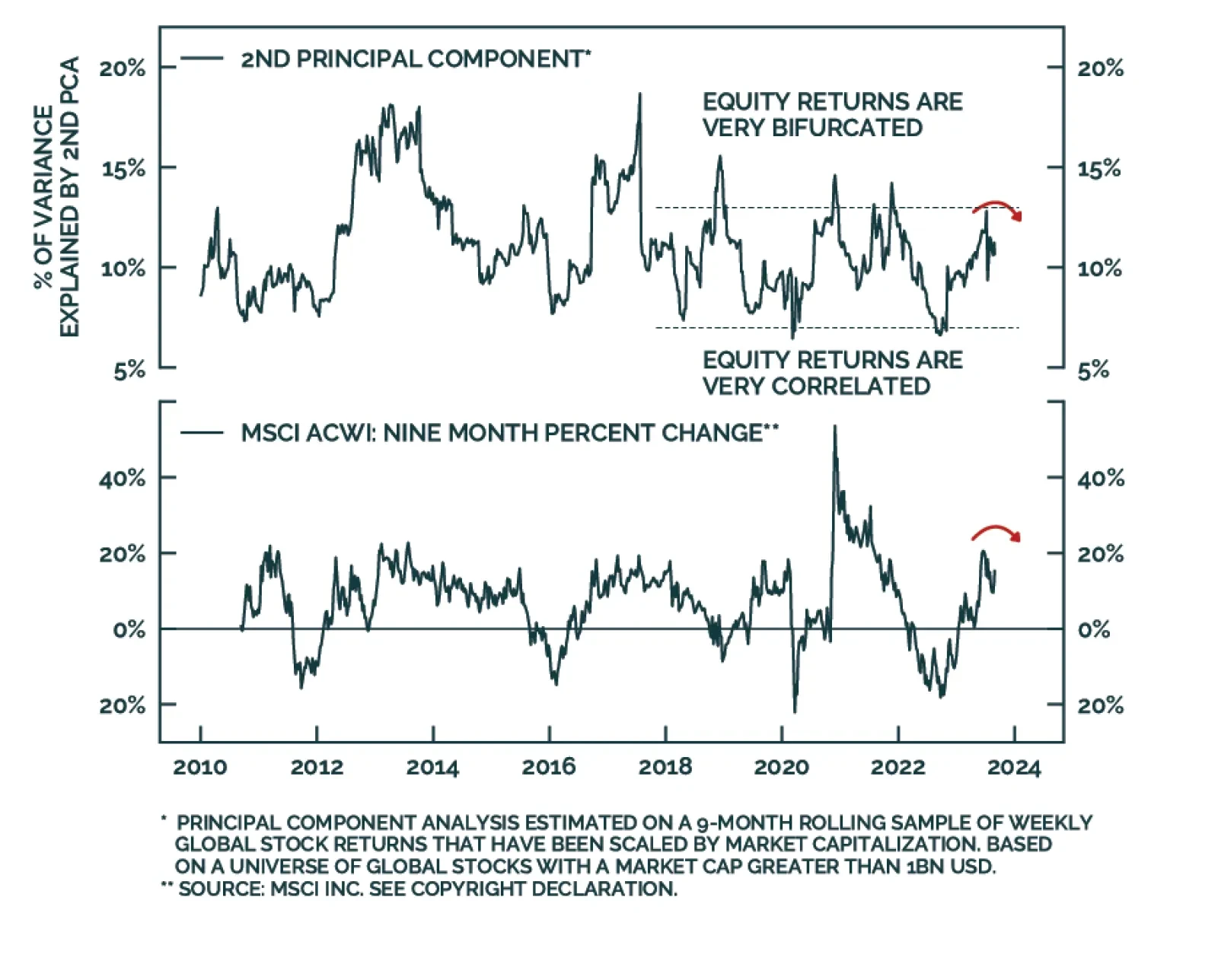

Unsupervised methods, like Principal Component Analysis (PCA), can create powerful indicators that are based purely on the structure of the data and void of researcher bias. Therefore, they can provide agnostic evidence to…

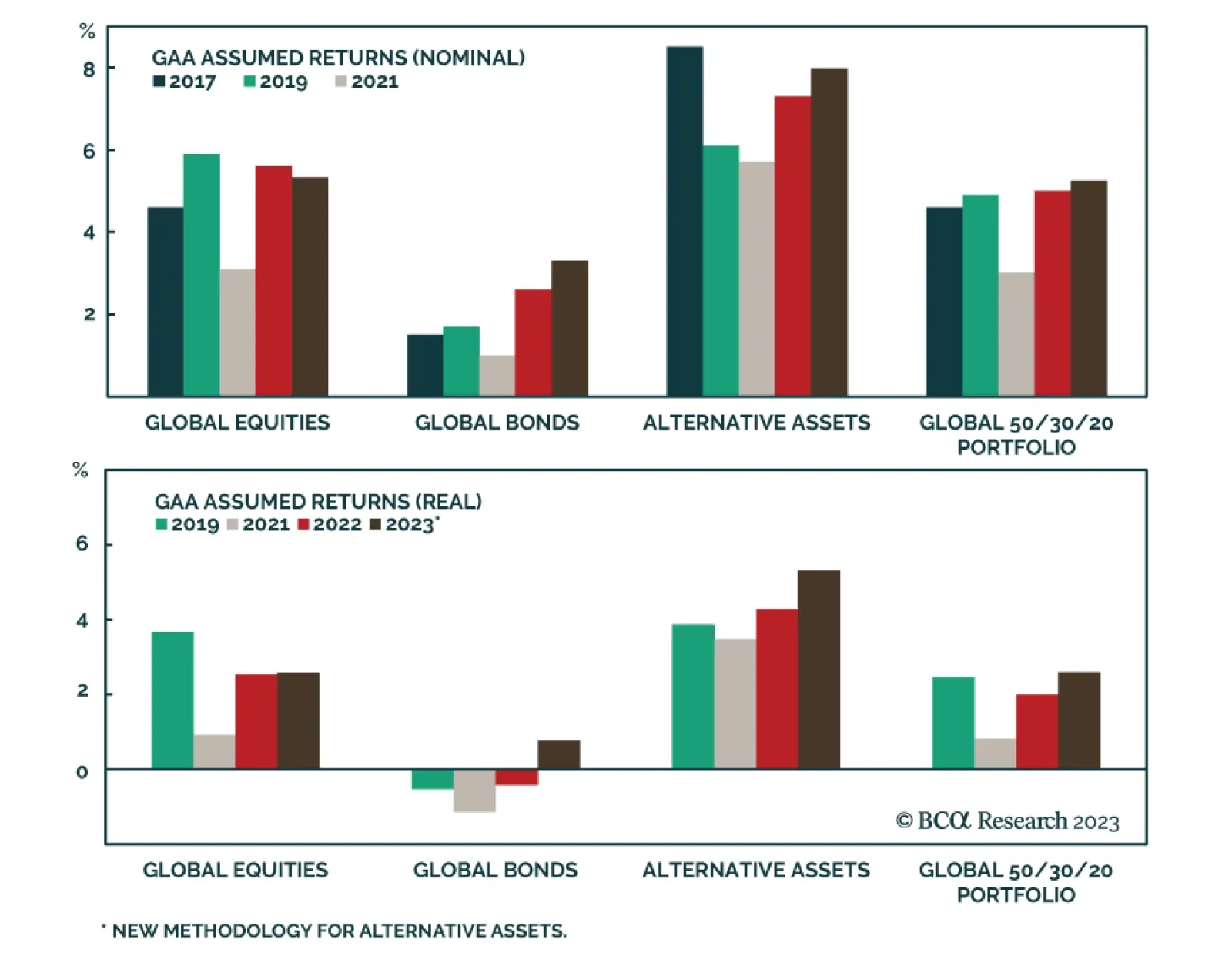

In a recent report, BCA Research’s Global Asset Allocation service updated its long-term return assumptions for a wide range of public and private assets. While still lower than the historical returns, the team’s…

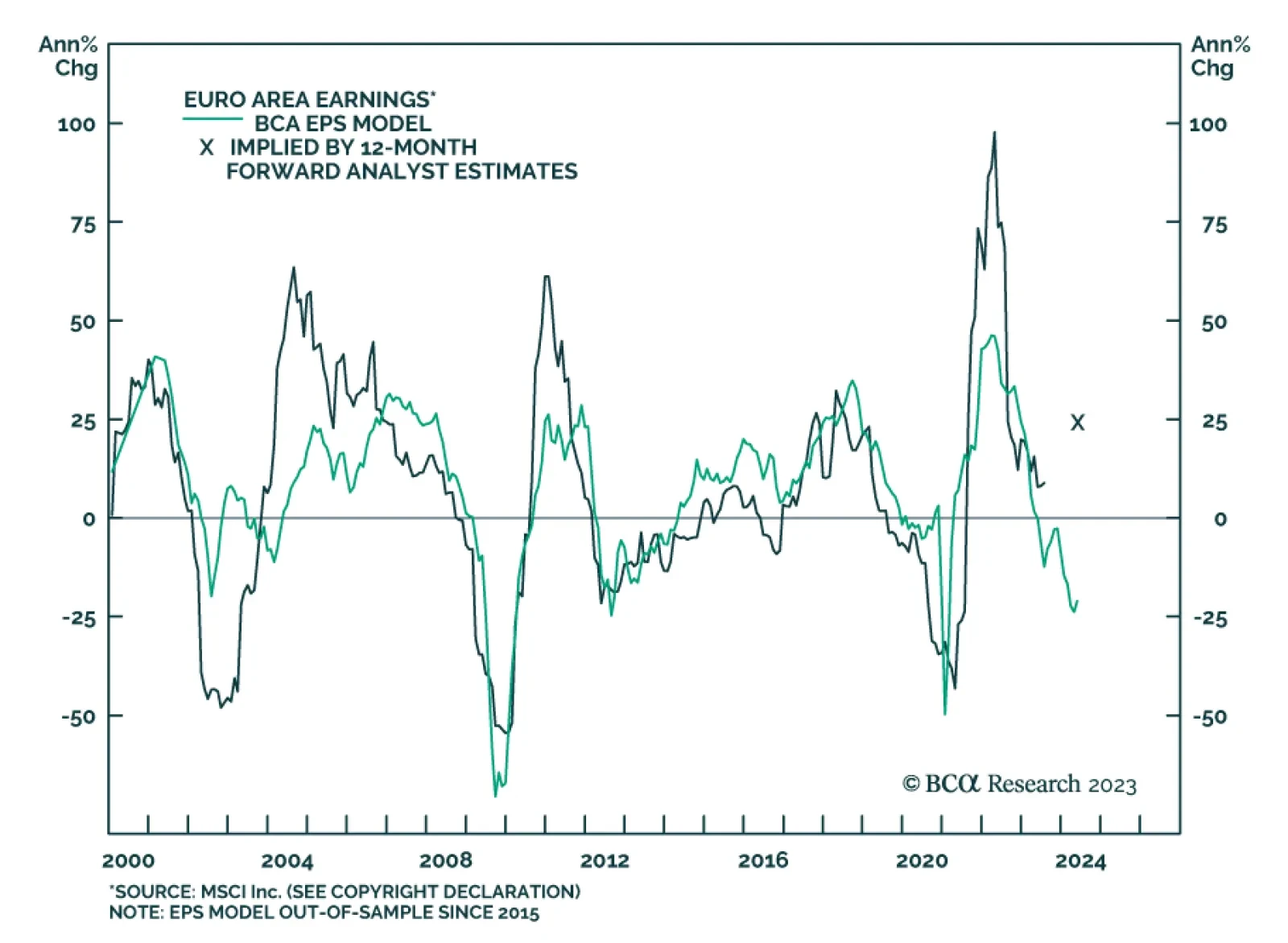

According to BCA Research’s European Investment Strategy service, the profit outlook for Eurozone earnings continues to deteriorate. The team’s earnings model for Eurozone equities continues to point to a deepening…

The Treasury market’s reaction to Fed Chair Jermone Powell’s Jackson Hole speech was relatively tame on Friday. Although there was some volatility during the speech, the 10-year yield ended the day broadly unchanged.…