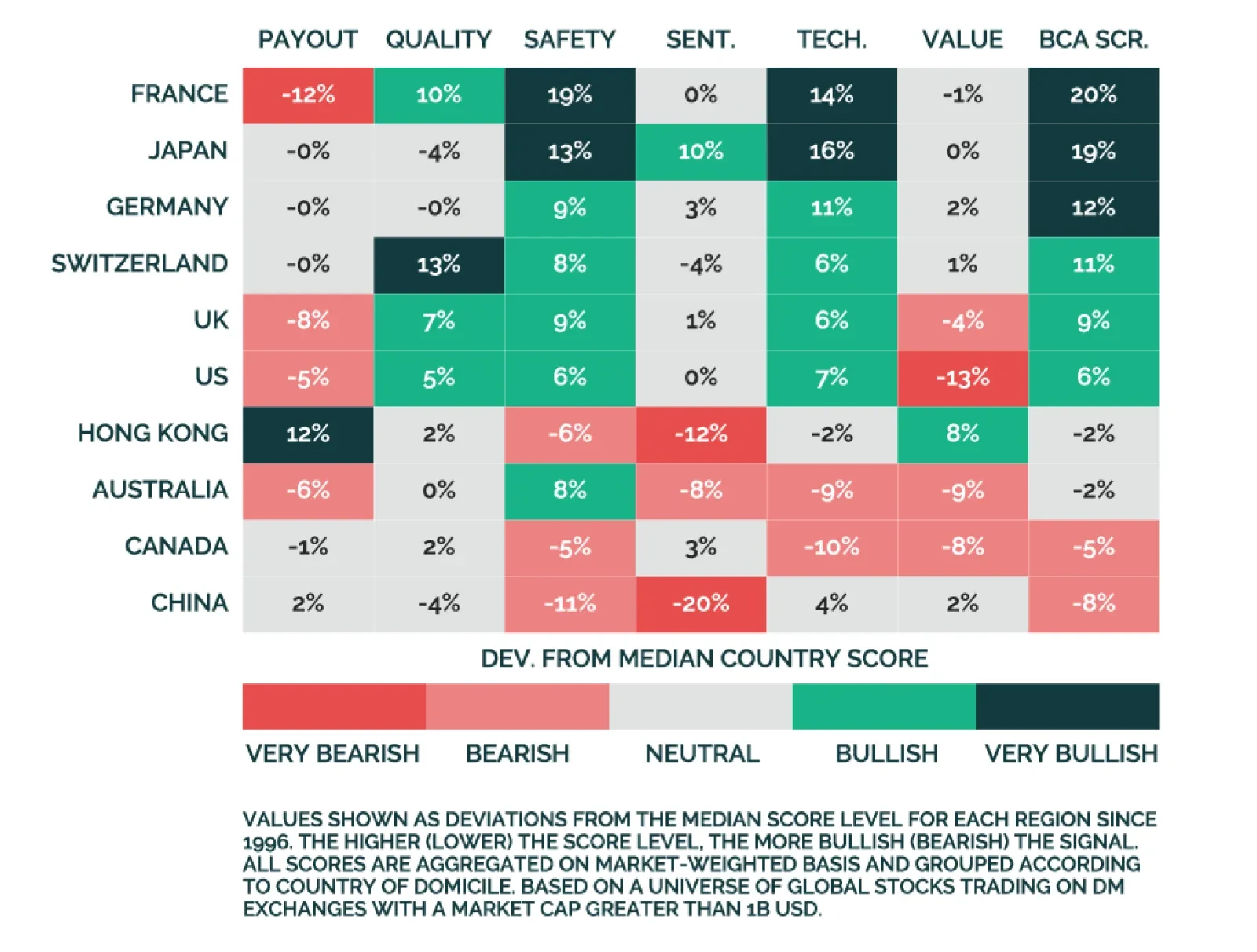

In a recent report, BCA Research’s Equity Analyzer service proposes two strategies to help investors navigate the conflict in the Middle East. The first strategy uses the “Macro Sensitivities” filter on…

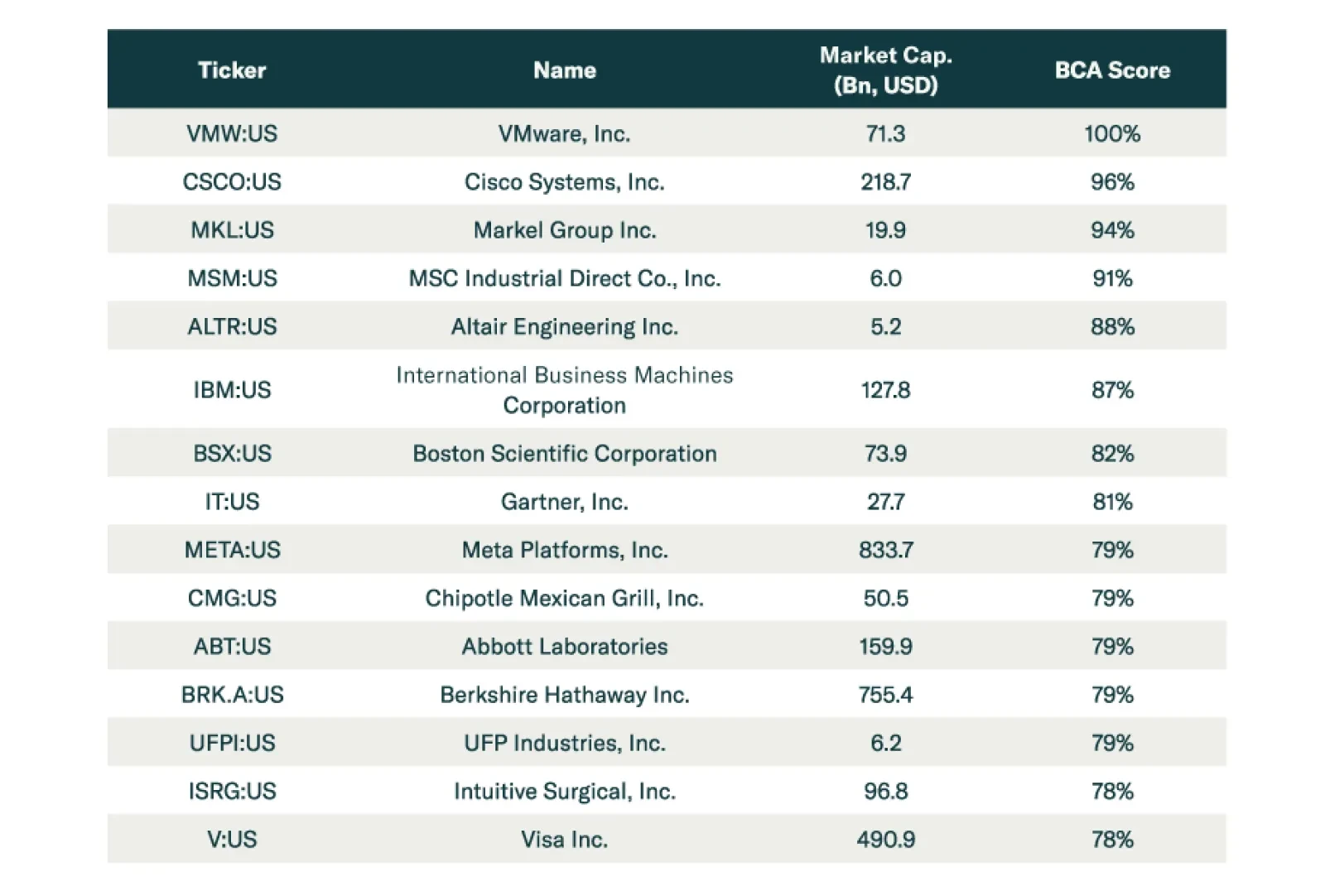

A powerful feature of the Equity Analyzer platform is its breadth of coverage: roughly 13 thousand stocks trading on MSCI Developed Market exchanges. Since we have a cross-section of the same stock level data across multiple…

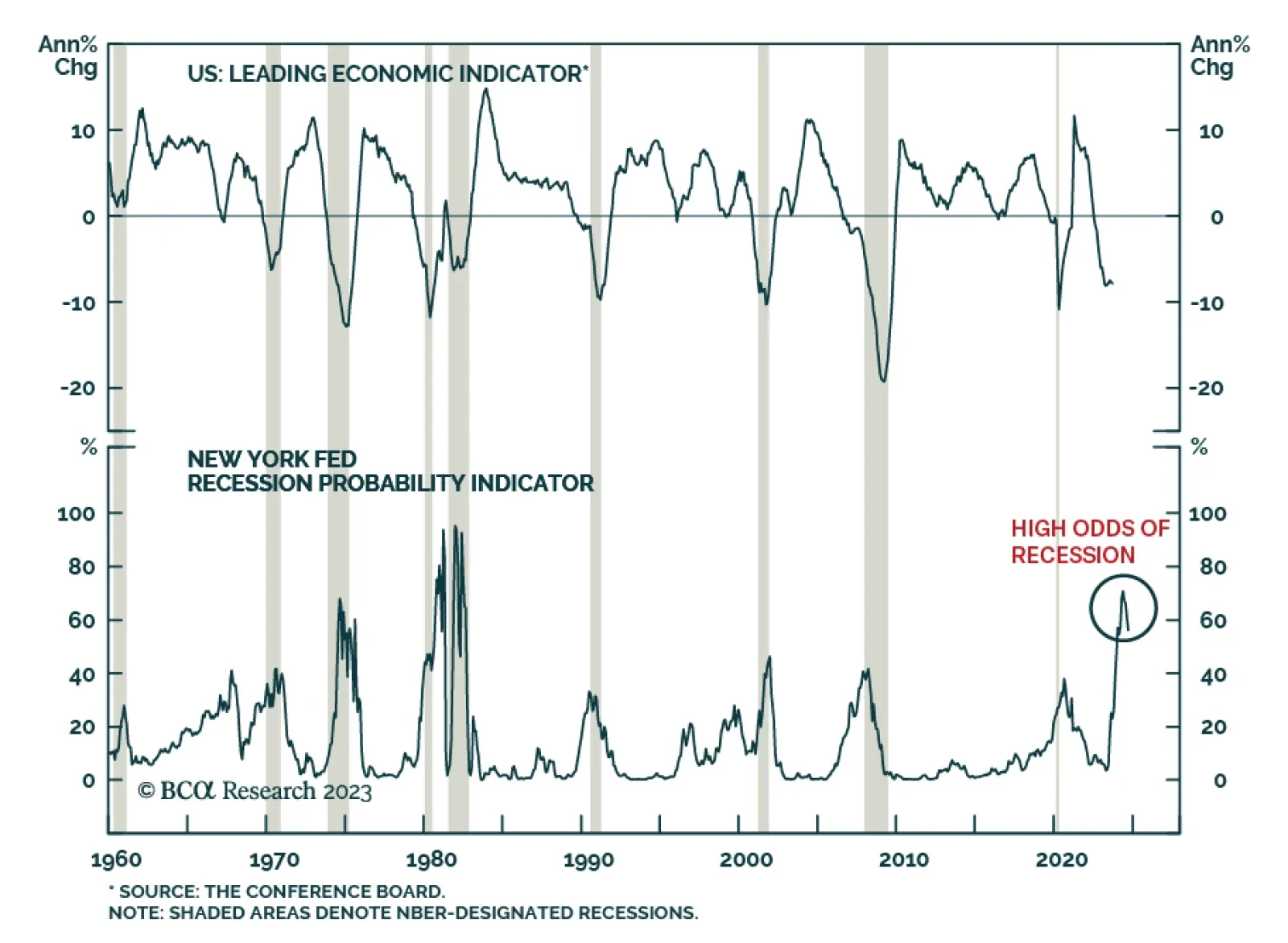

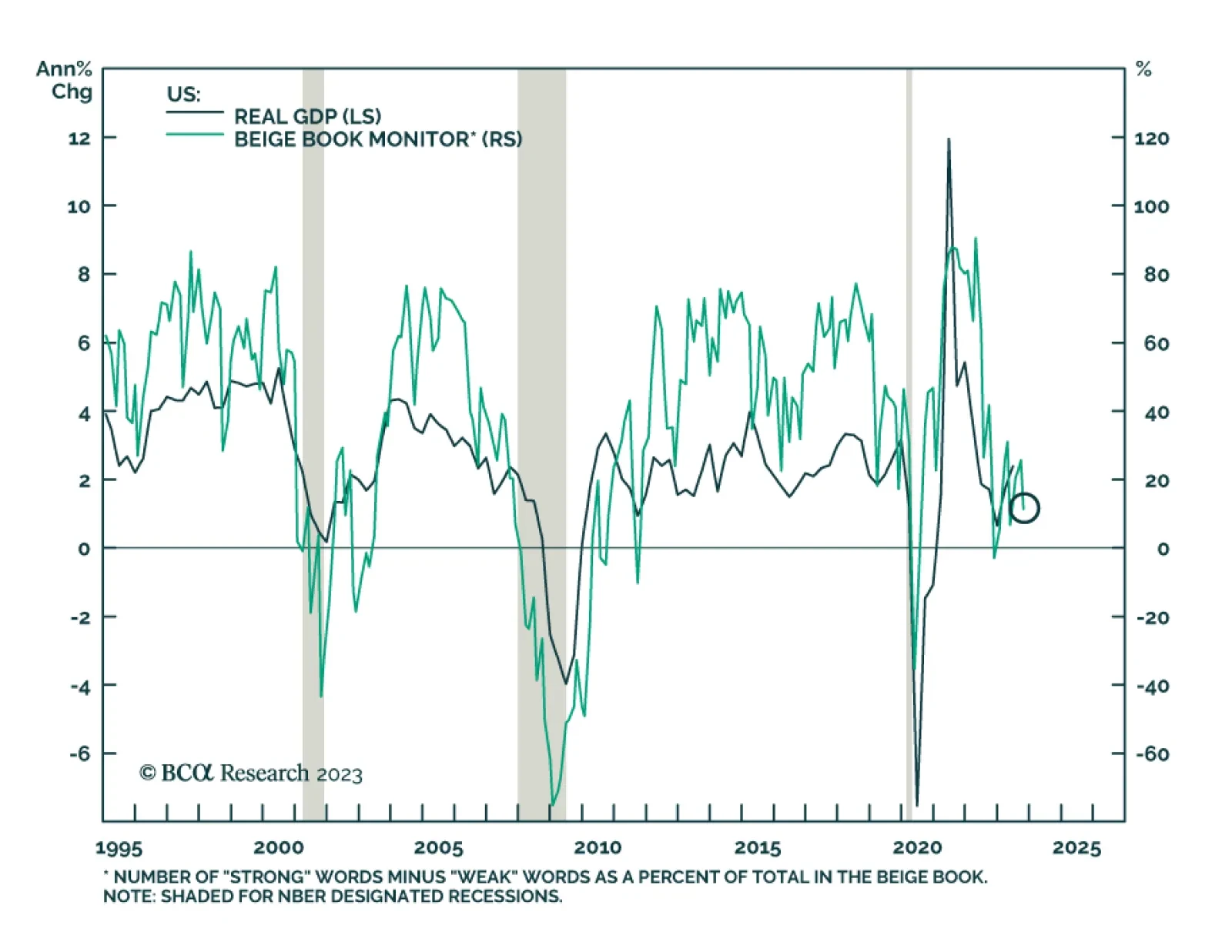

The Conference Board's Leading Economic Index's 0.7% m/m decline in September sent a weaker-than-anticipated signal about the outlook for the US economy. It fell below anticipations that the pace of decline would remain…

Stronger-than-anticipated retail sales and nonfarm payroll employment in September indicate that conditions are still favorable for US consumers. Similarly, the latest reading from the Atlanta Fed's GDPNow model stands at 5.4…

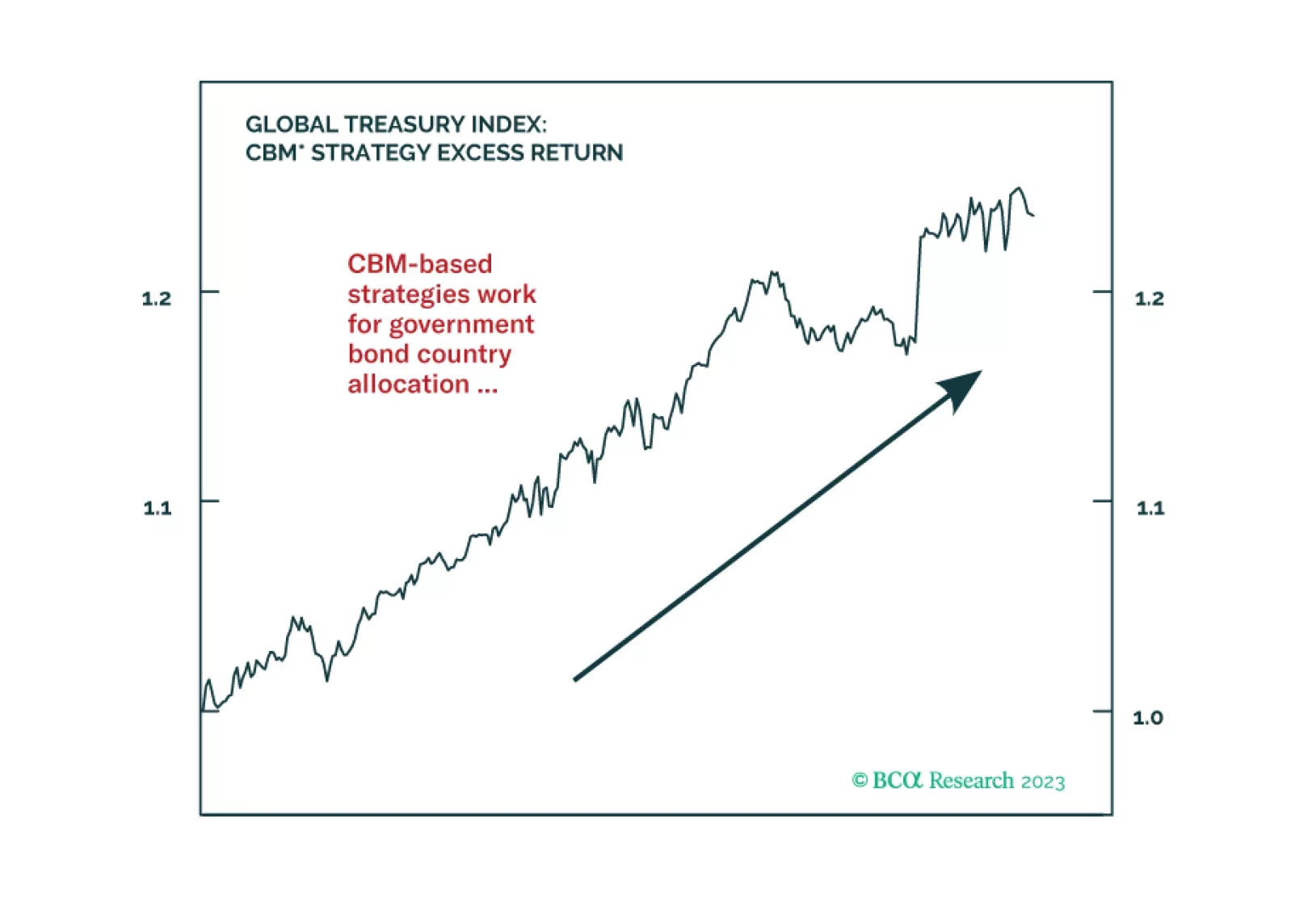

In this report, we present the quarterly review of the Global Fixed Income Strategy Model Bond Portfolio. The portfolio remains positioned for slower global growth momentum over the next 6-12 months, favoring government bonds over…

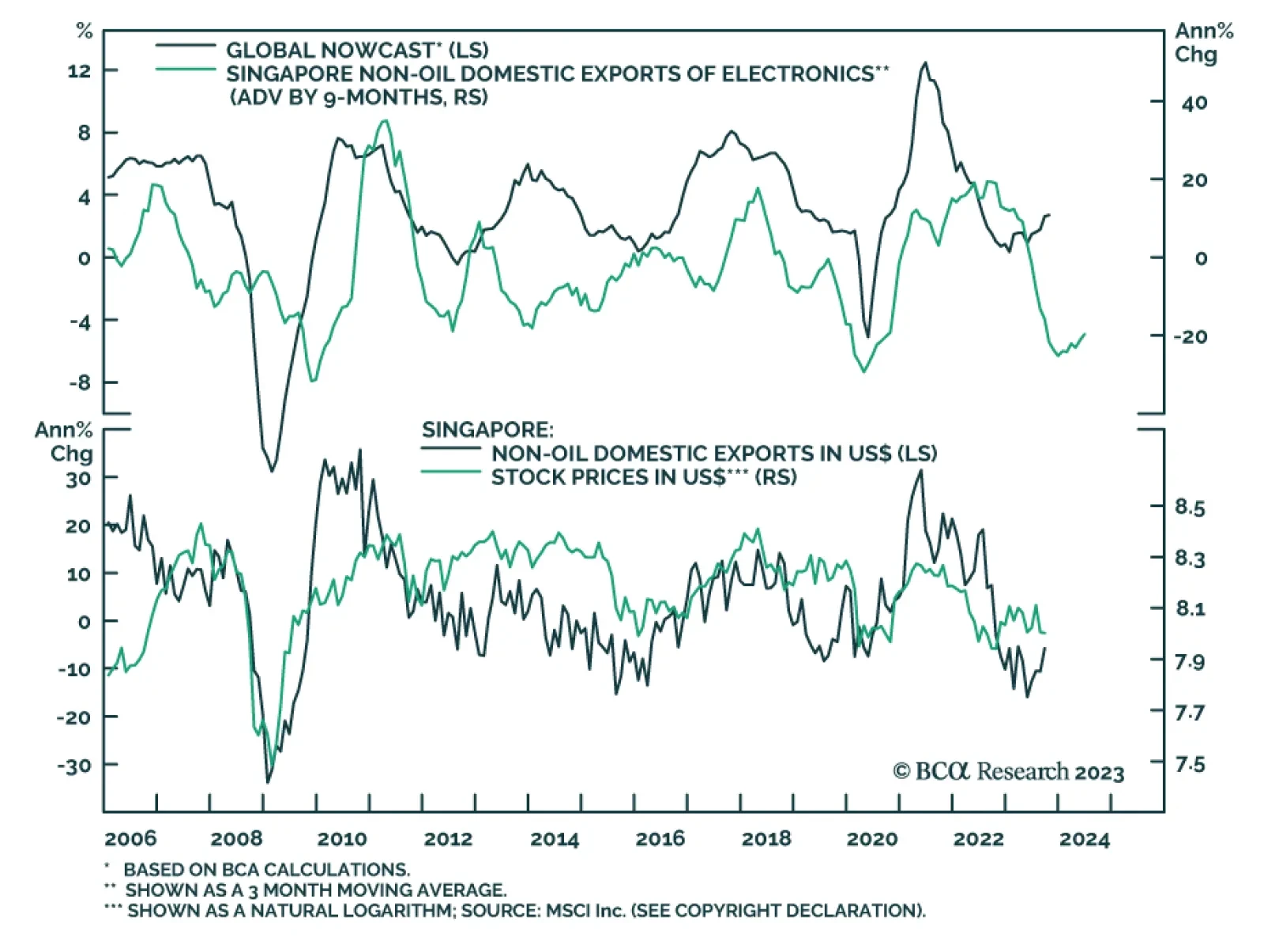

Singapore is a small open economy that is highly sensitive to fluctuations in global and Asian economic activity. This characteristic makes its exports a good bellwether for global growth. On this front, the upside surprise in…

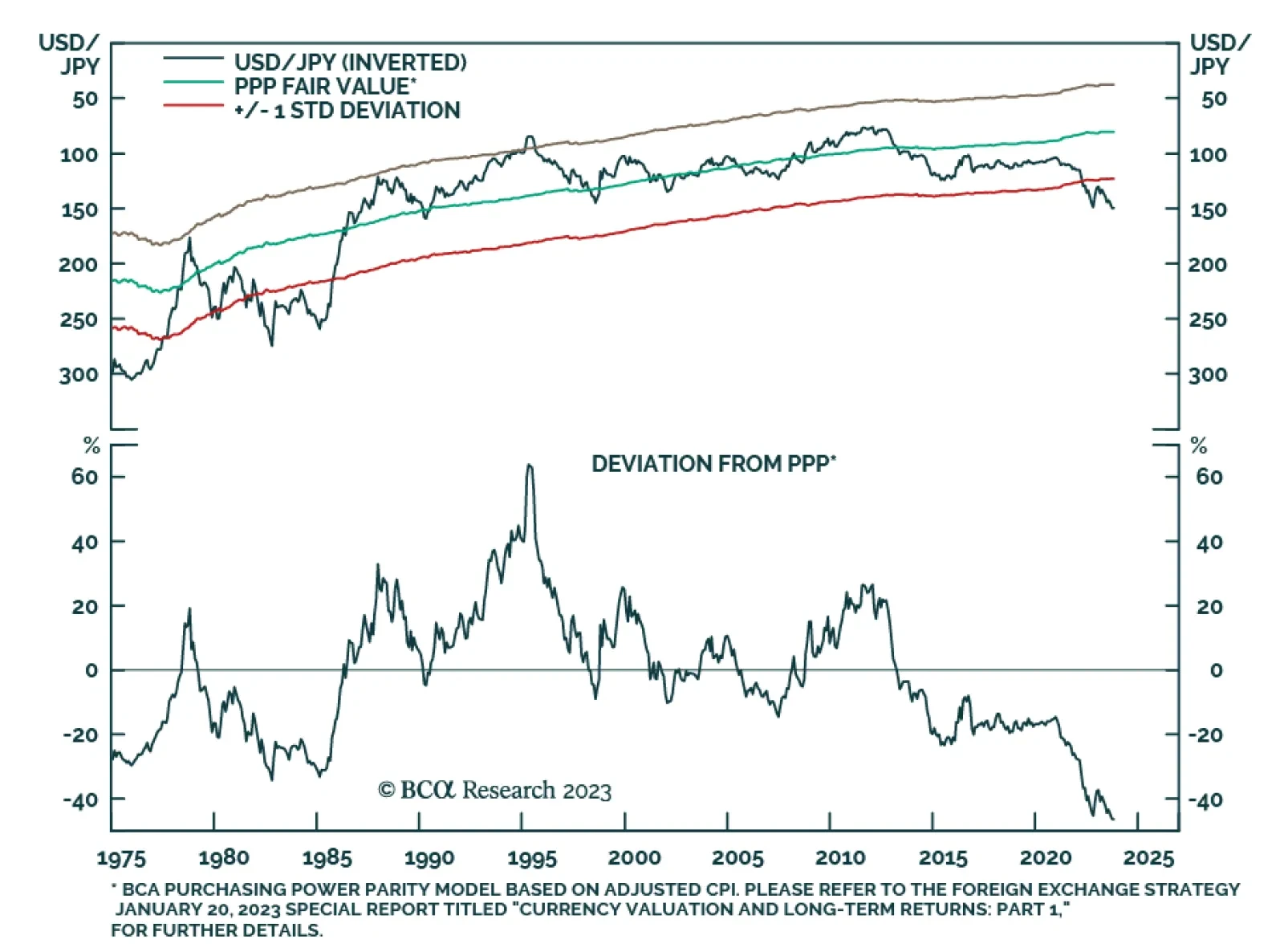

The Japanese yen has depreciated by 12.6% against the USD year-to-date. This exceeds the 1.6% depreciation and 0.8% appreciation by the euro and British pound against the US dollar respectively. With the higher-for-longer…

More equity volatility is coming in the short run. Trump’s nomination looks to be smooth, which marginally reduces the incumbent party advantage and increases policy uncertainty.

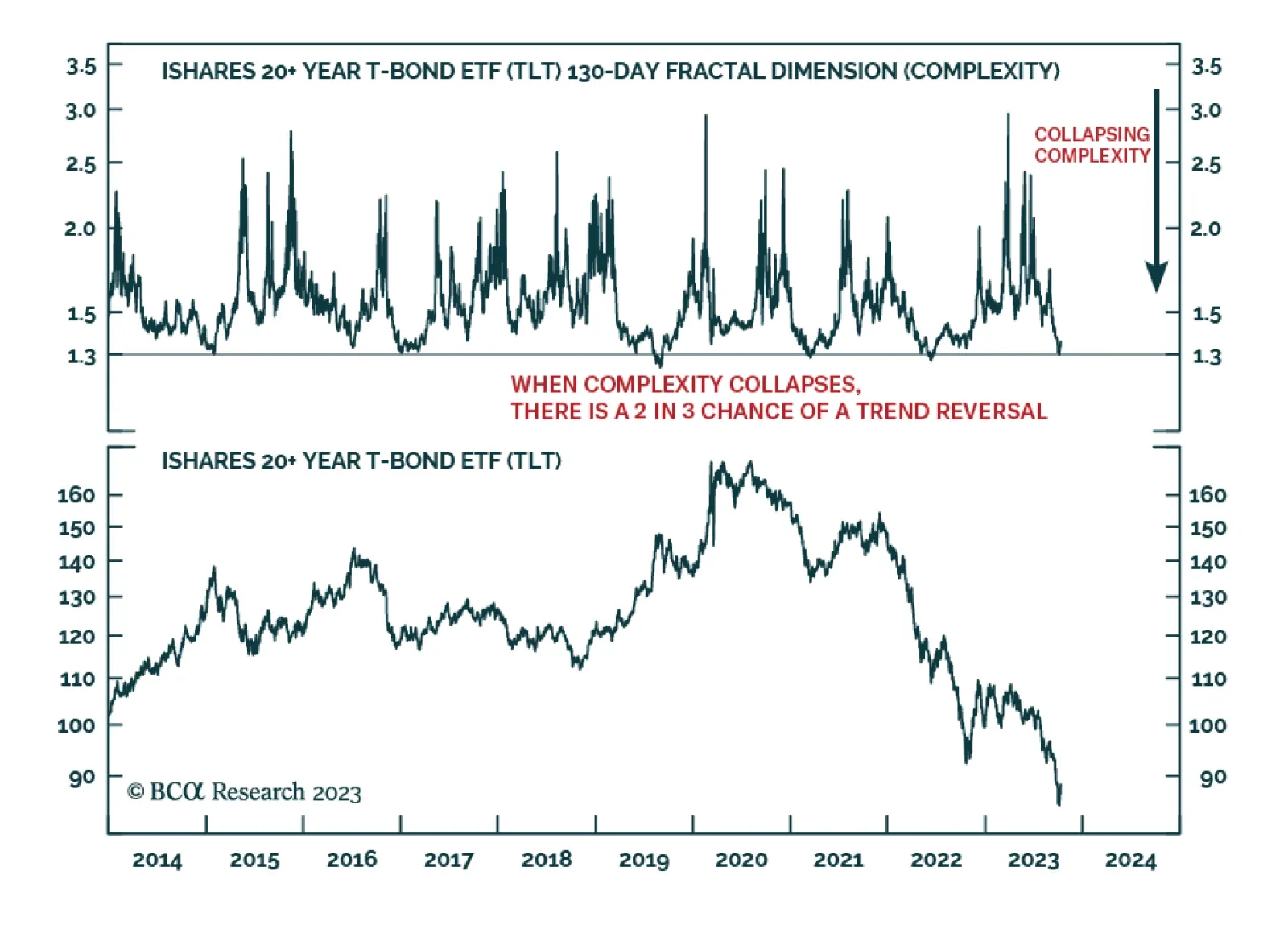

According to BCA Research’s Counterpoint service, the sharp sell-off in long duration bonds (ticker TLT) has reached the collapsed 130-day complexity that has preceded several turning-points in the last few years. This…