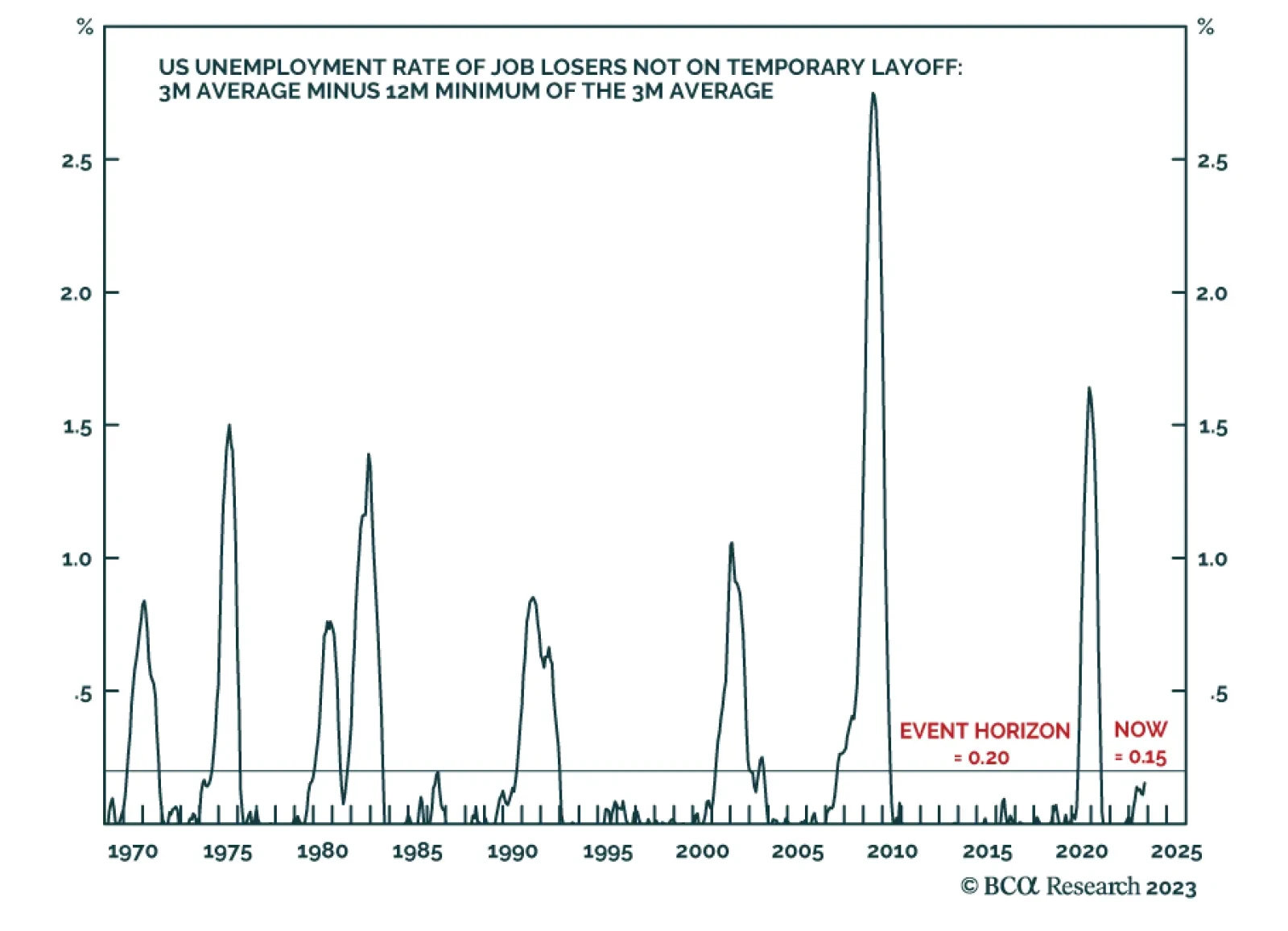

The ‘Joshi rule’ real-time recession indicator signals the start of a US recession when the three-month moving average of the unemployment rate of ‘job losers not on temporary layoff’ rises by 0.20 percent…

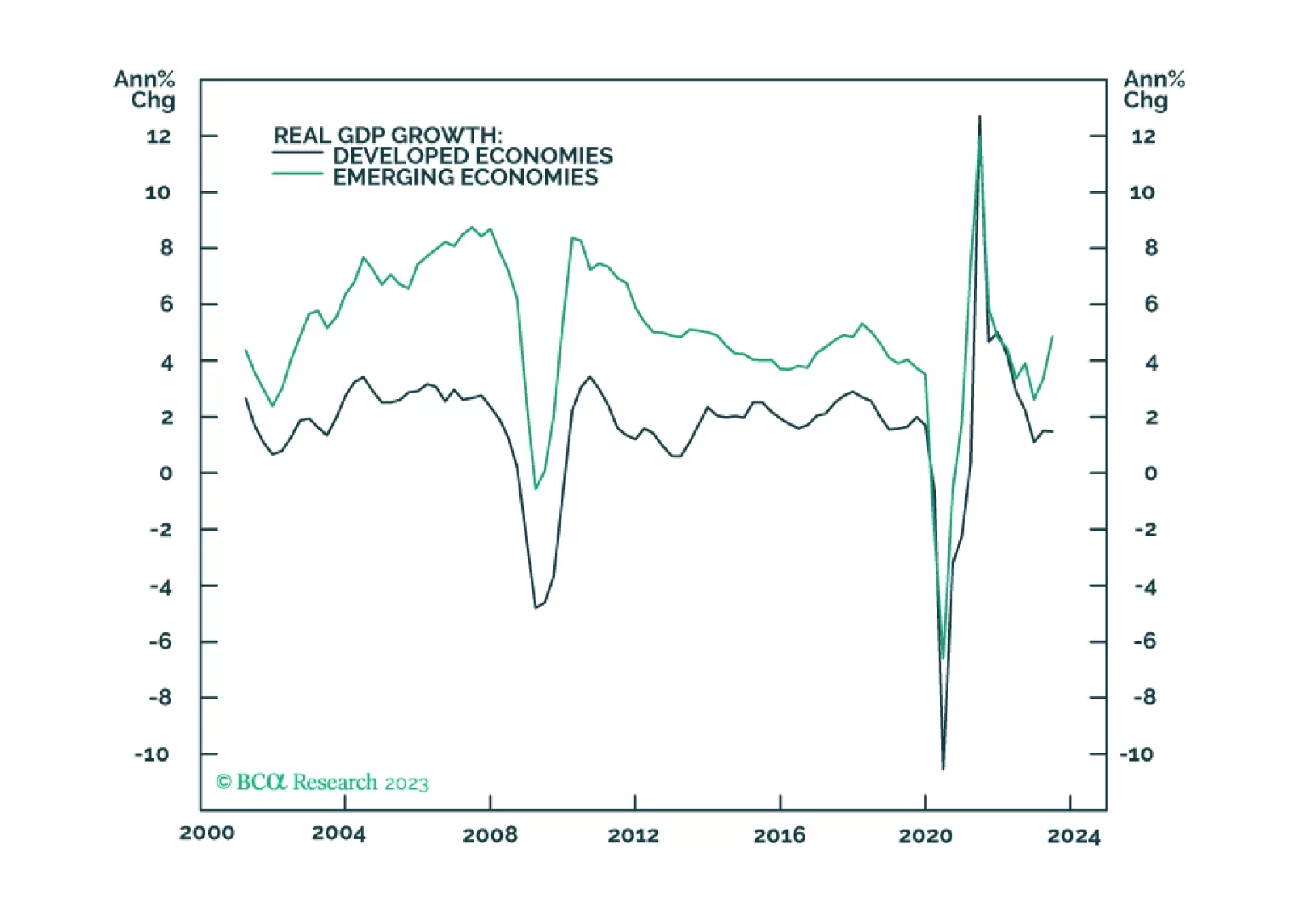

Global instability will continue in 2024 – whatever happens afterward. Slowing economies will exacerbate already high geopolitical risk and policy uncertainty stemming from the US election and foreign challenges to US leadership.…

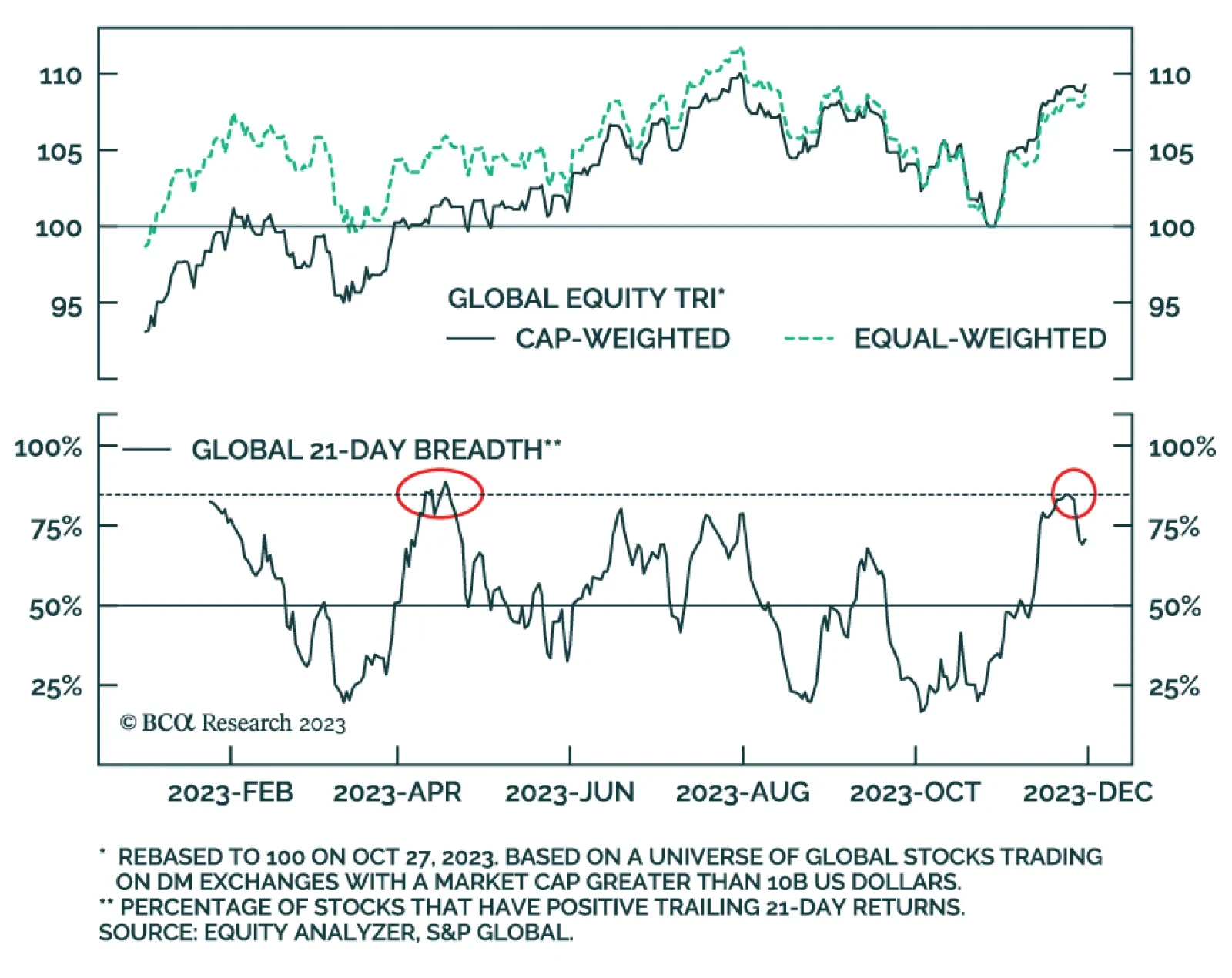

It’s no secret that a handful of mega caps have been driving markets in 2023, masking a somewhat lackluster year for equities. In fact, on an equal-weighted basis, markets gave up nearly all their YTD gains by the end of…

In our simulations of fairly deep global recessions averaging -1.5% in 2024 global GDP growth, we expect OPEC 2.0 to reduce output enough to offset lost demand. Even so, we find oil prices drop ~ $22/bbl – from ~ $100/bbl in 1H24 to…

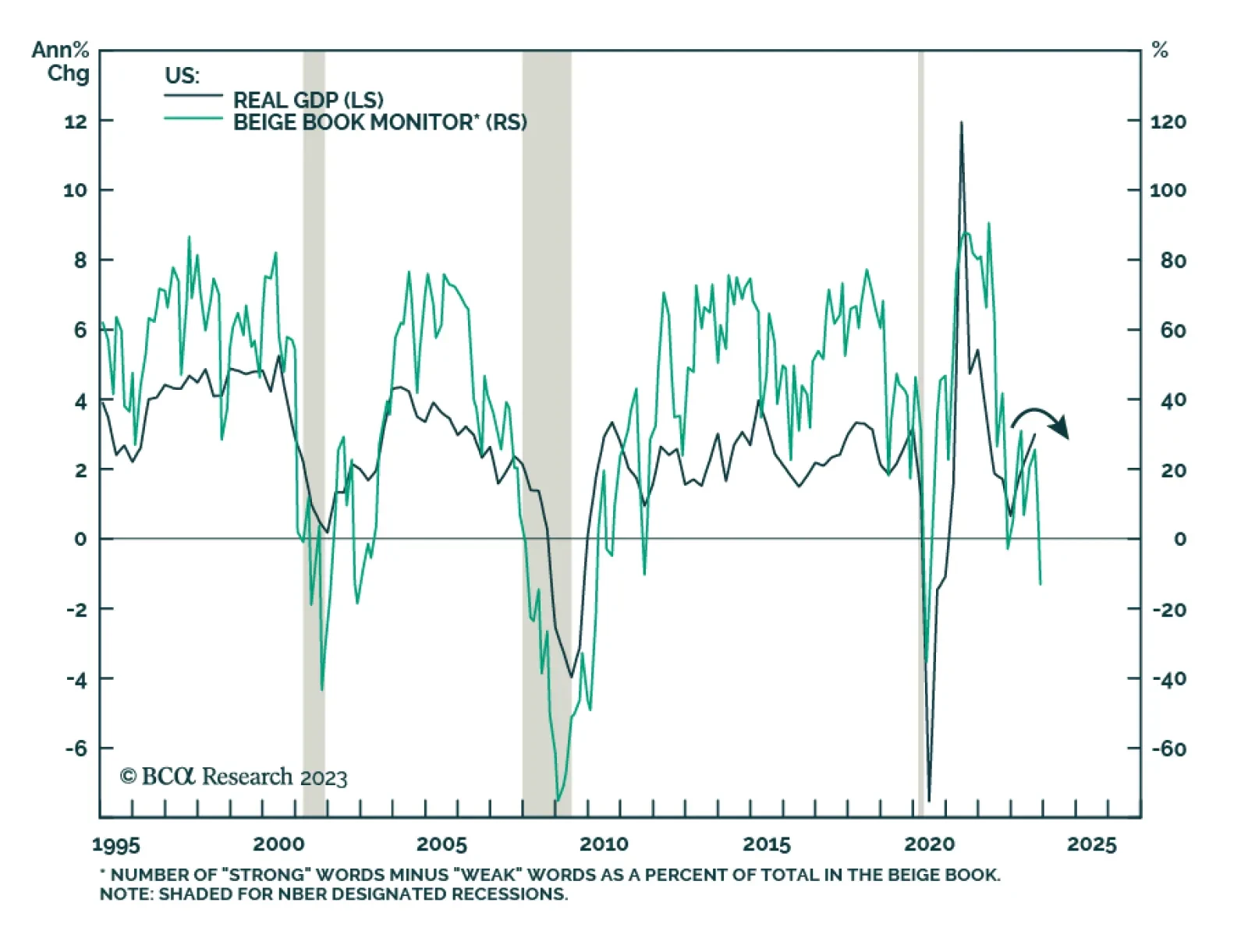

The Fed’s latest Beige Book delivered a pessimistic message for the US economy. Half of the 12 districts reported slight declines in activity, two indicated that “conditions were flat to slightly down,” and the…

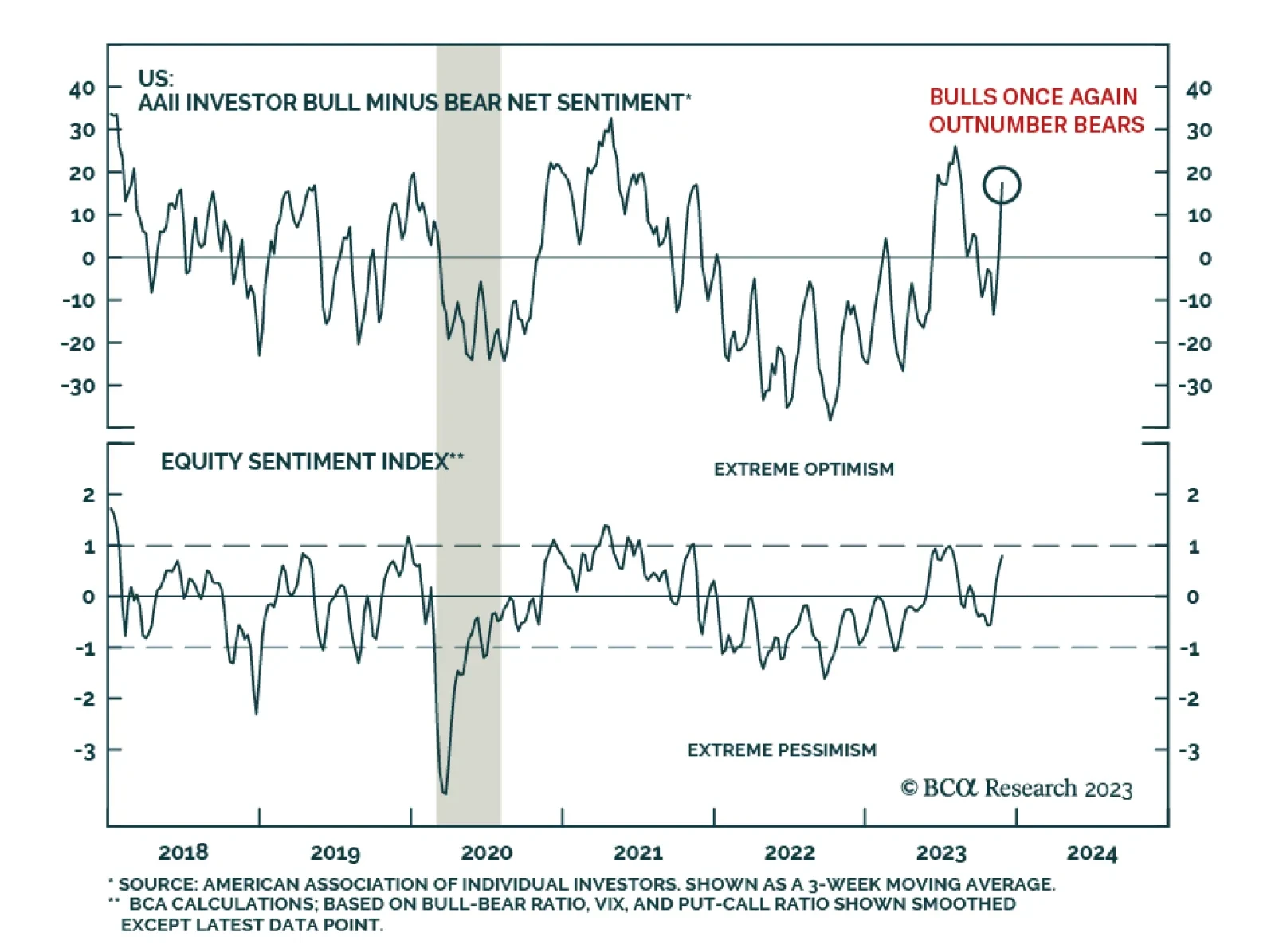

After a sharp rally since late-October, the S&P 500 is now on the verge of breaking above its late July year-to-date high and completely erasing the losses incurred over the prior three months. Investor sentiment has also…

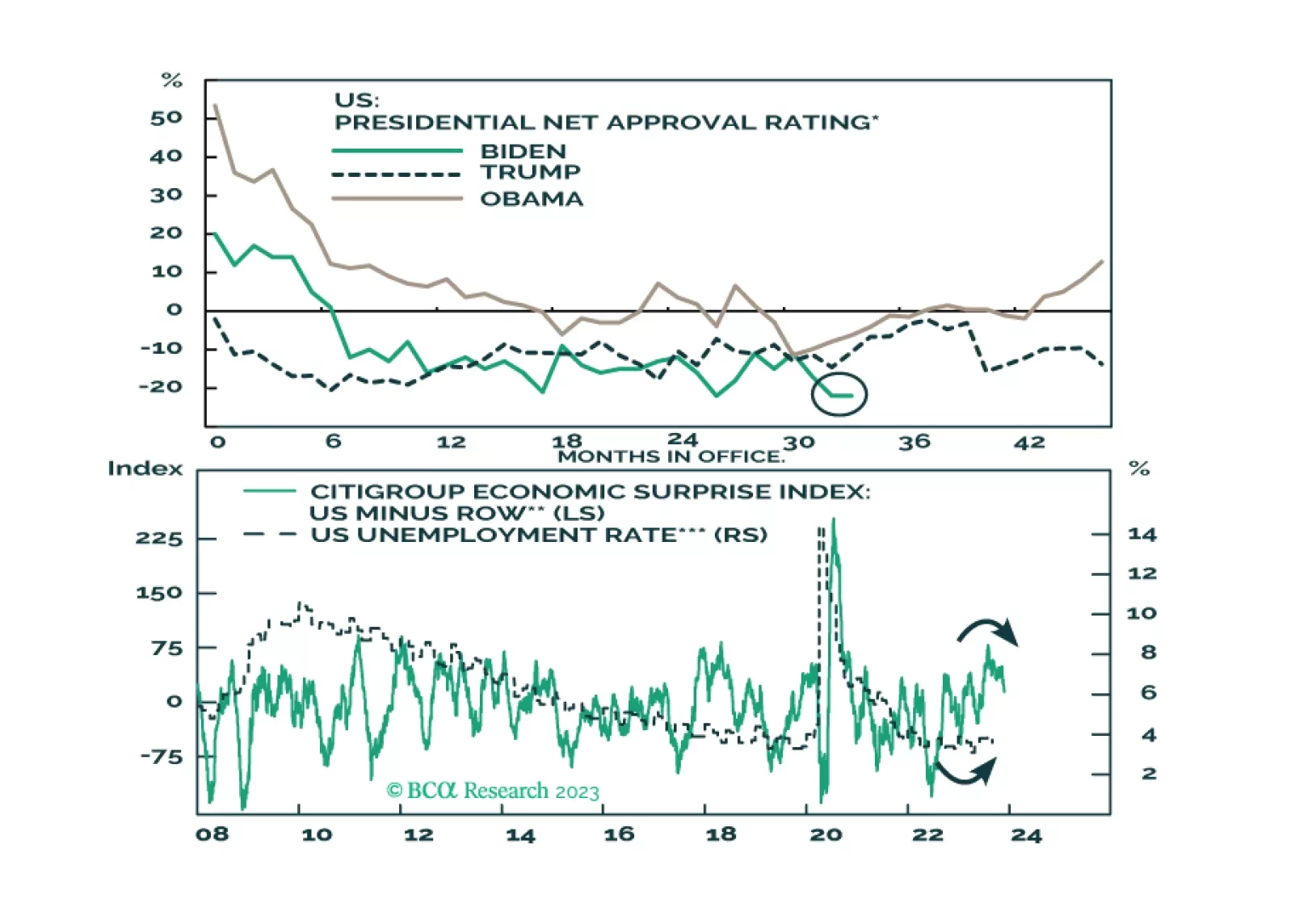

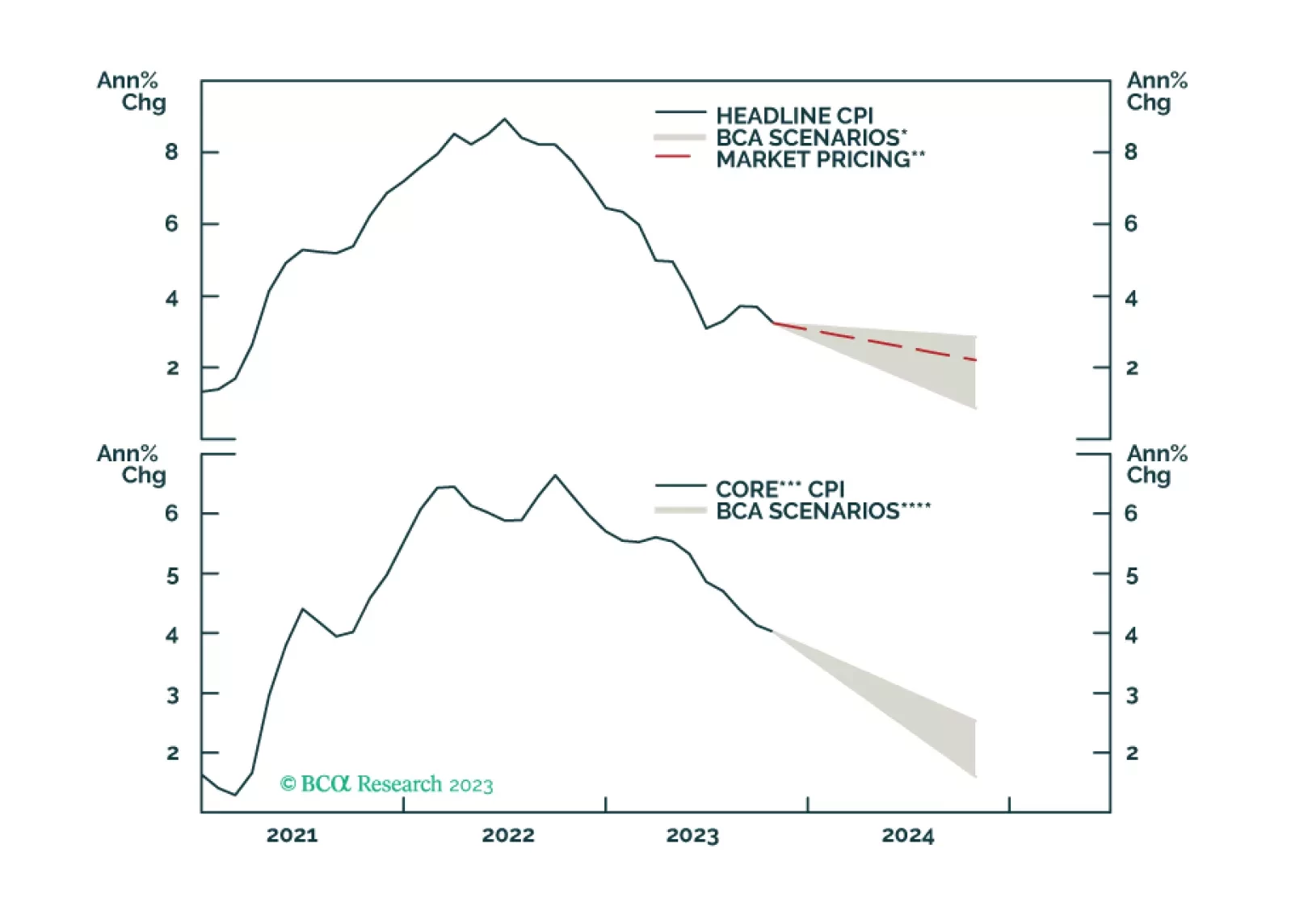

According to our Global Investment Strategy (GIS) service, so far this year, inflation in the US has declined sharply even though employment growth has remained strong. There are many factors that have contributed to this…

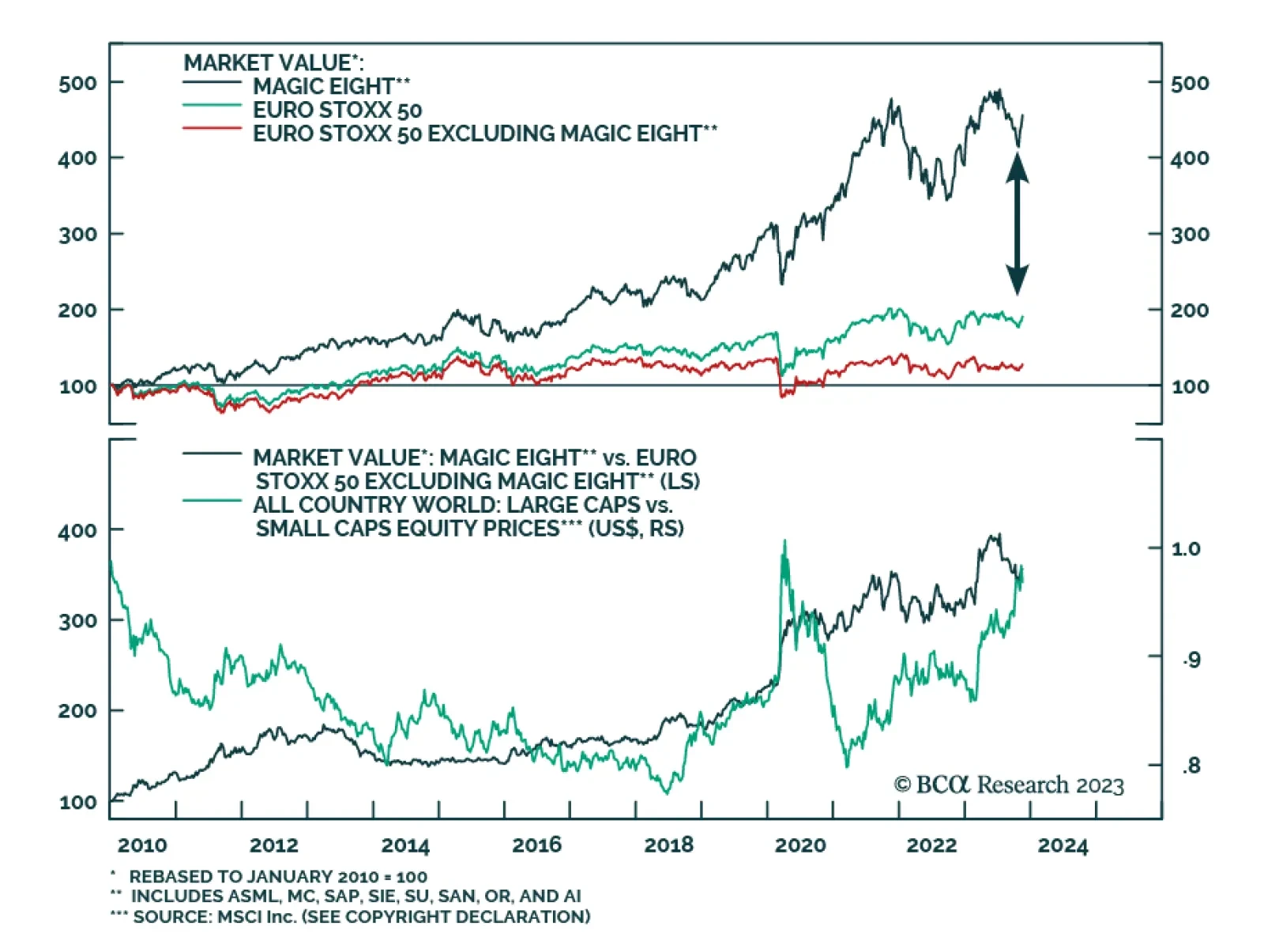

According to BCA Research’s European Investment Strategy service, the Magic Eight are the European counterpart to the US’ Magnificent Seven. The dominance of the so-called Magnificent Seven in the US S&P 500 is…

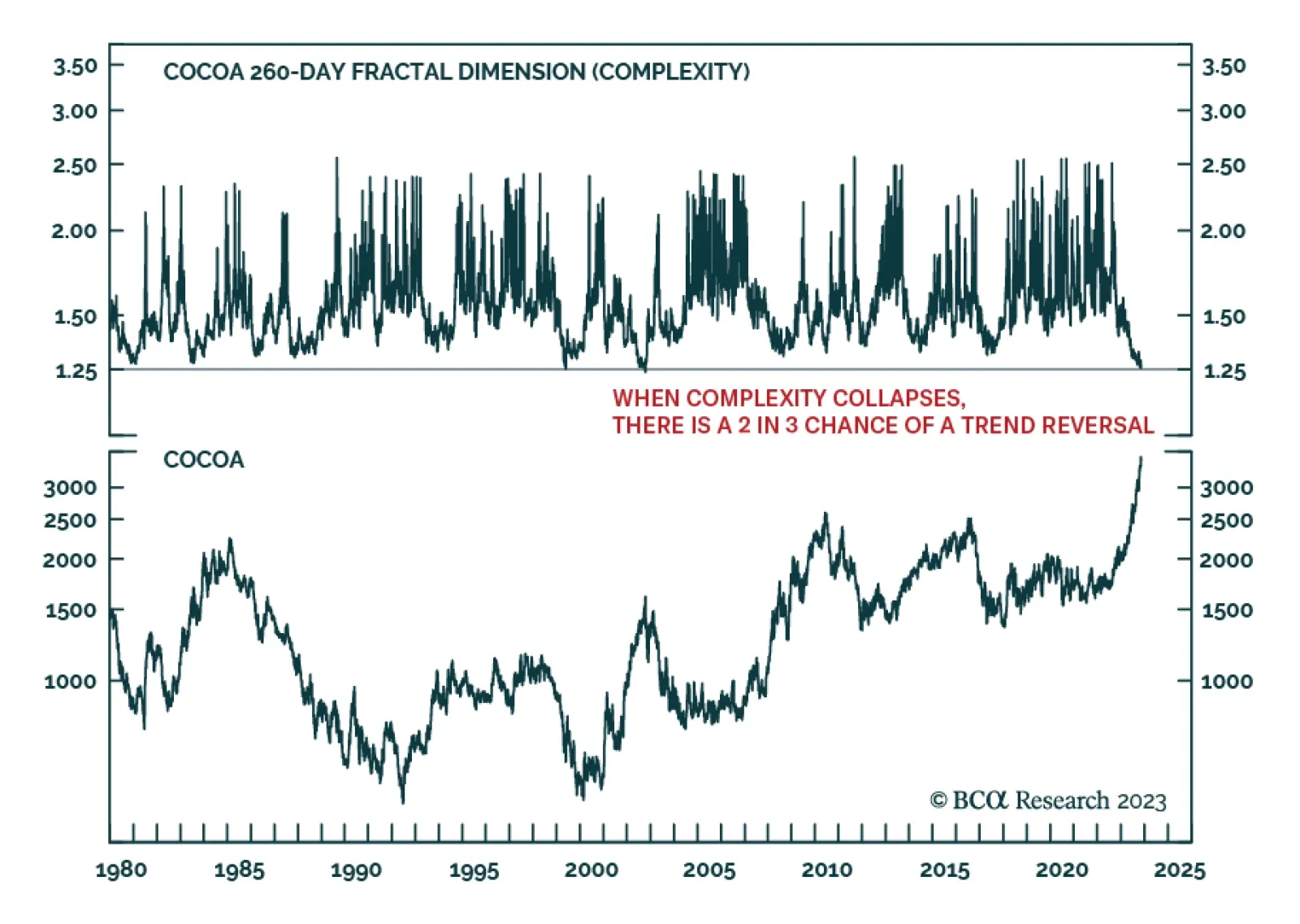

The spectacular rally in the cocoa price has taken it to its highest level in 44 years. The proximate cause is lower crop yields in Ghana and Cote d’Ivoire, the world’s two largest cocoa producers. Frequent extreme…