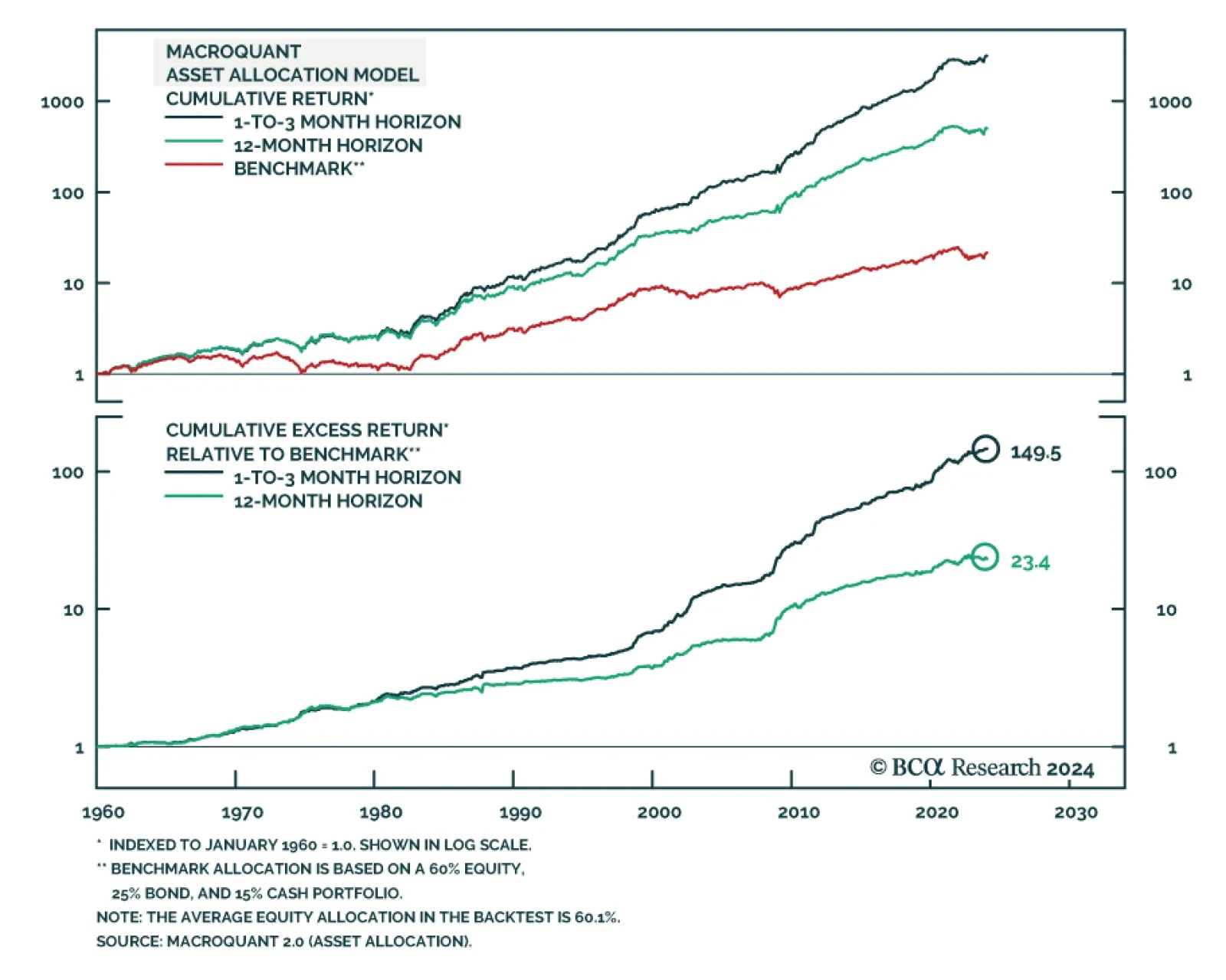

BCA Research’s Global Investment Strategy service has officially launched its MacroQuant 2.0 Model. The platform consists of a variety of modules, all of which communicate with each other to produce economically sensible…

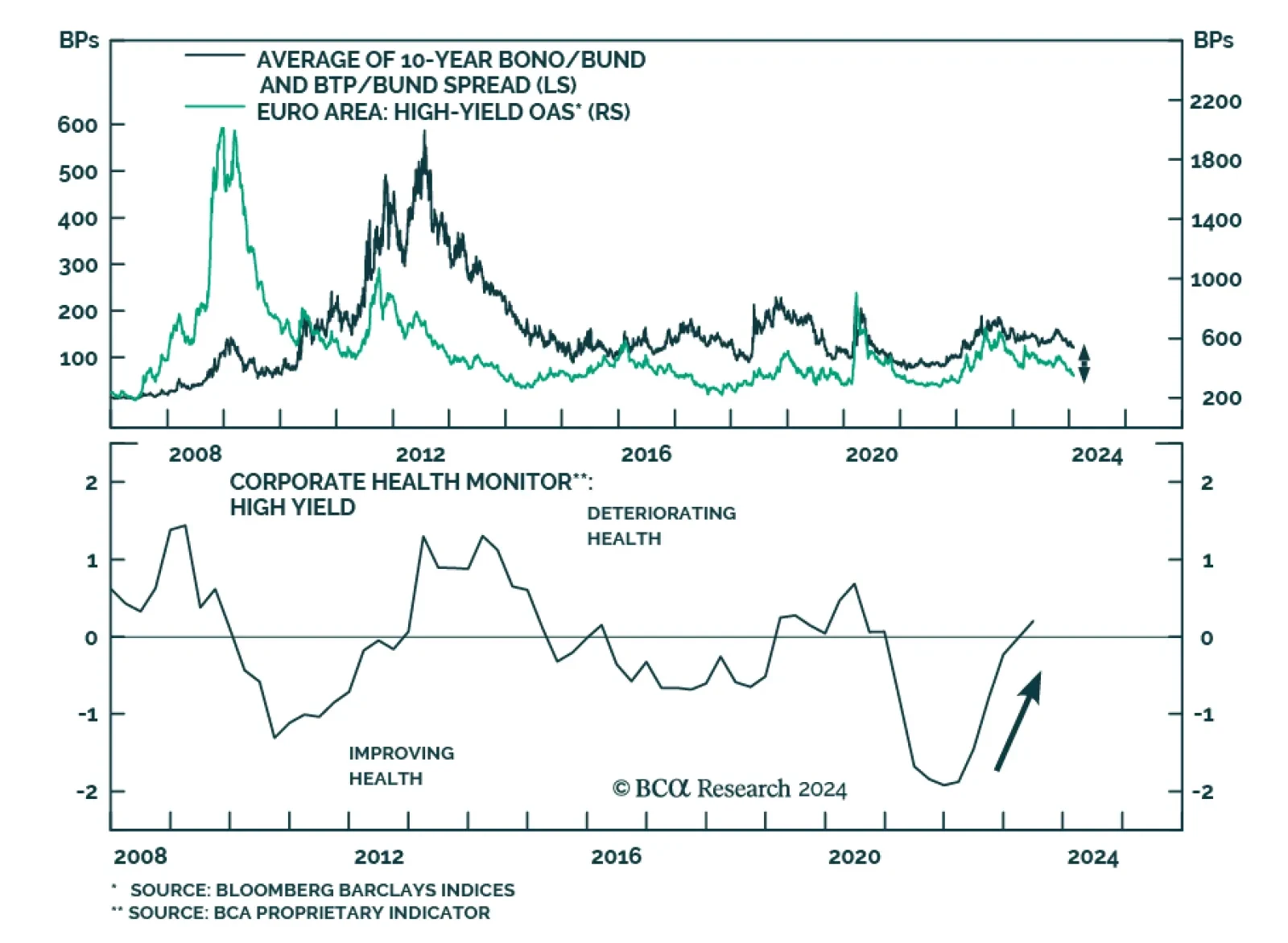

According to BCA Research’s European Investment Strategy service, European sovereign bonds in the periphery offer more upside than high-yield (HY) corporate bonds. Many question the outlook for peripheral bonds in Europe…

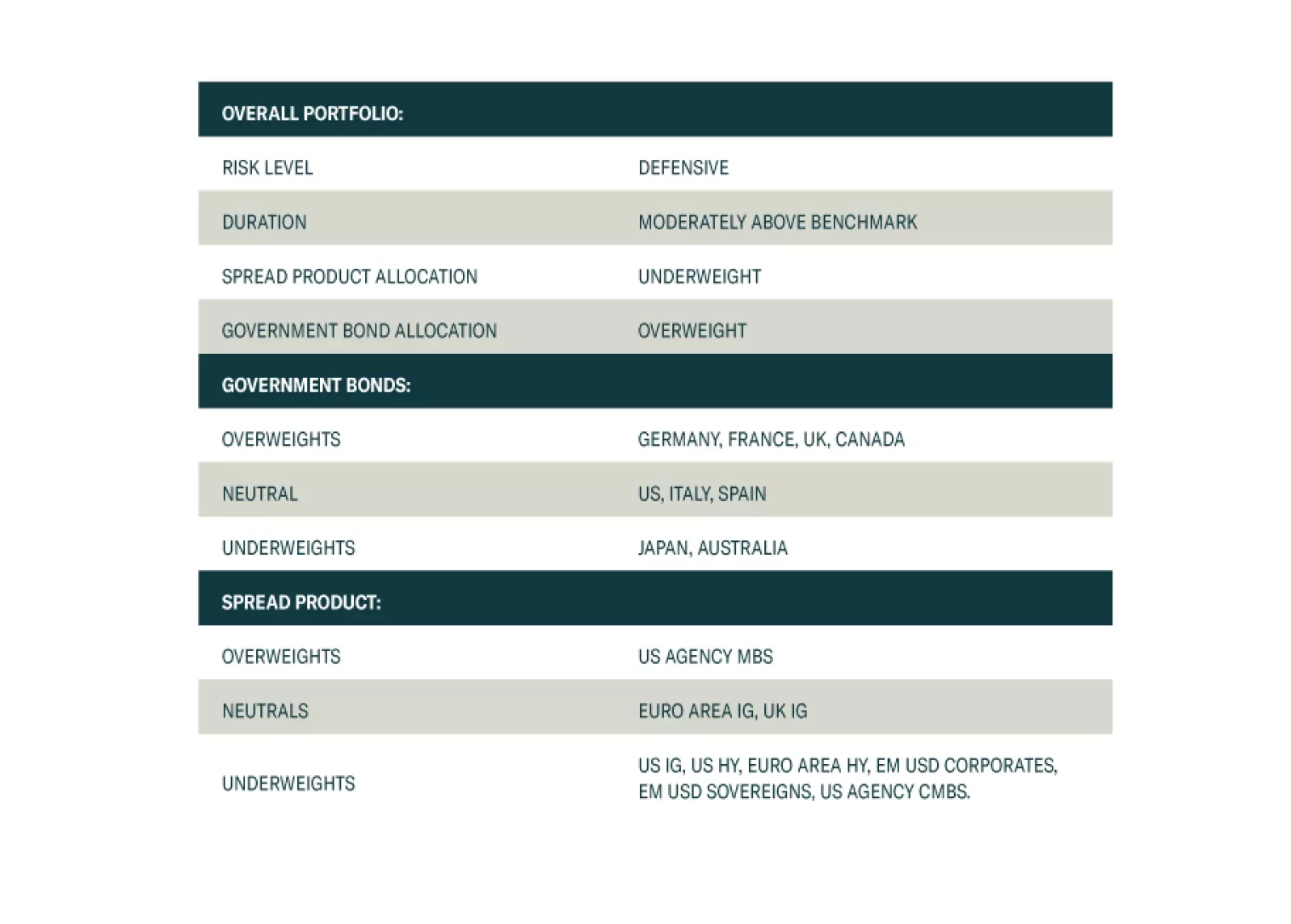

We present the performance review of the Global Fixed Income Strategy Model Bond Portfolio for 2023. We also discuss the outlook for 2024 performance based on our Key Views for the year. The portfolio is positioned to benefit from a…

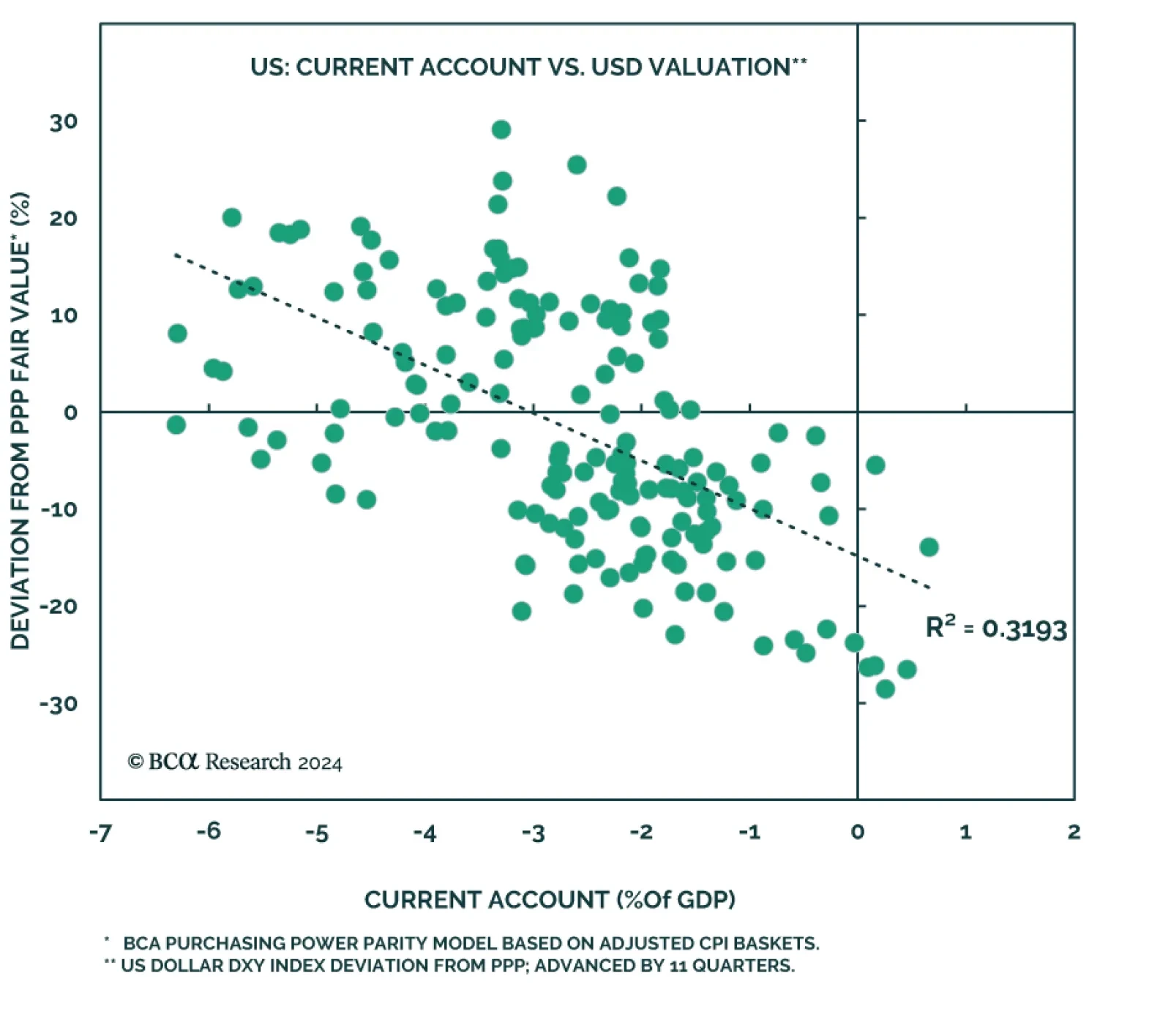

While balance of payments (BoP) do not really matter for day-to-day FX considerations, they do matter over the long term. According to BCA’s Foreign Exchange Strategists, at high levels of US dollar valuation like today,…

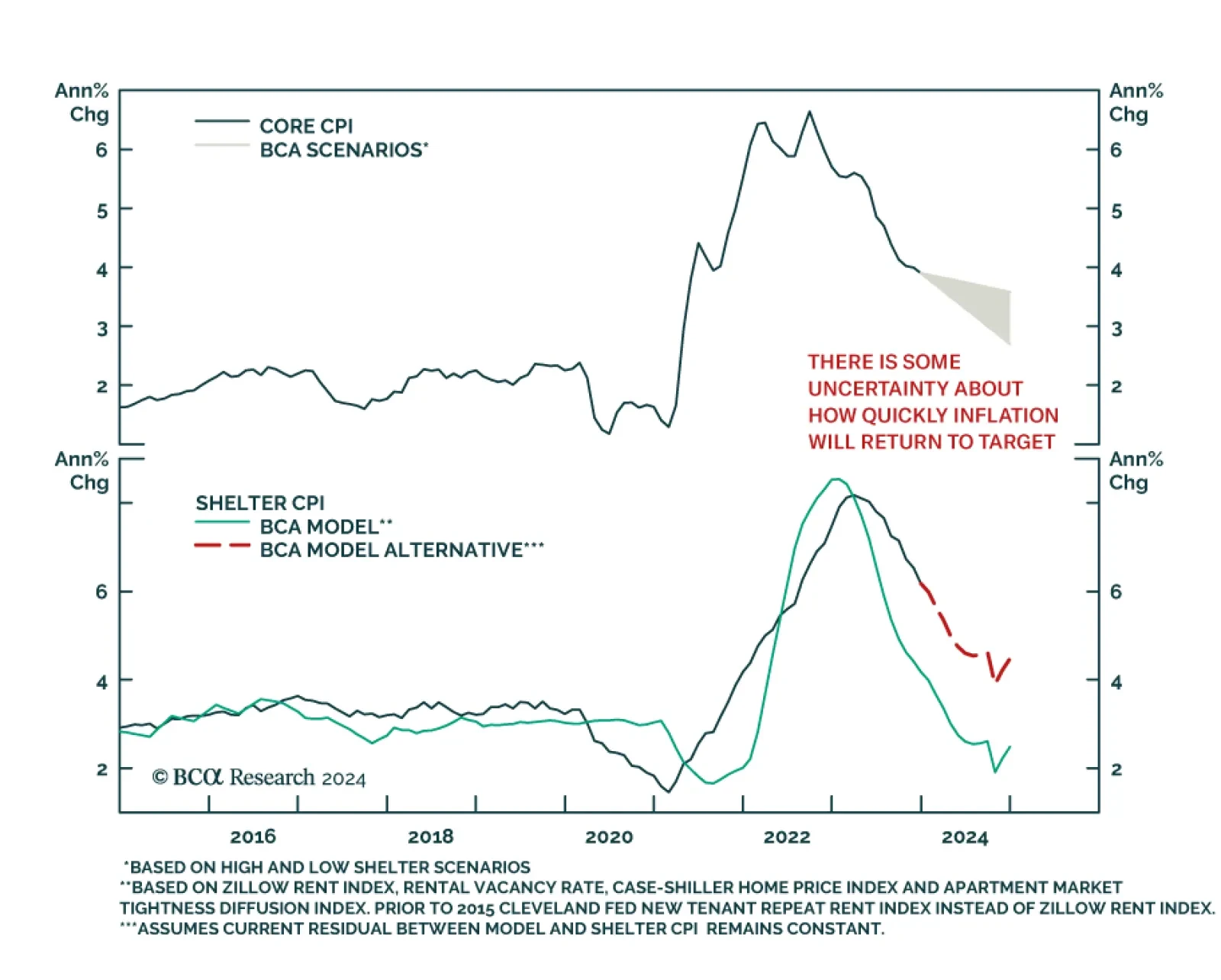

According to BCA Research’s The Bank Credit Analyst service, there are two important flaws in the market’s “Goldilocks” narrative. First, investors are assuming inflation will fully return to target…

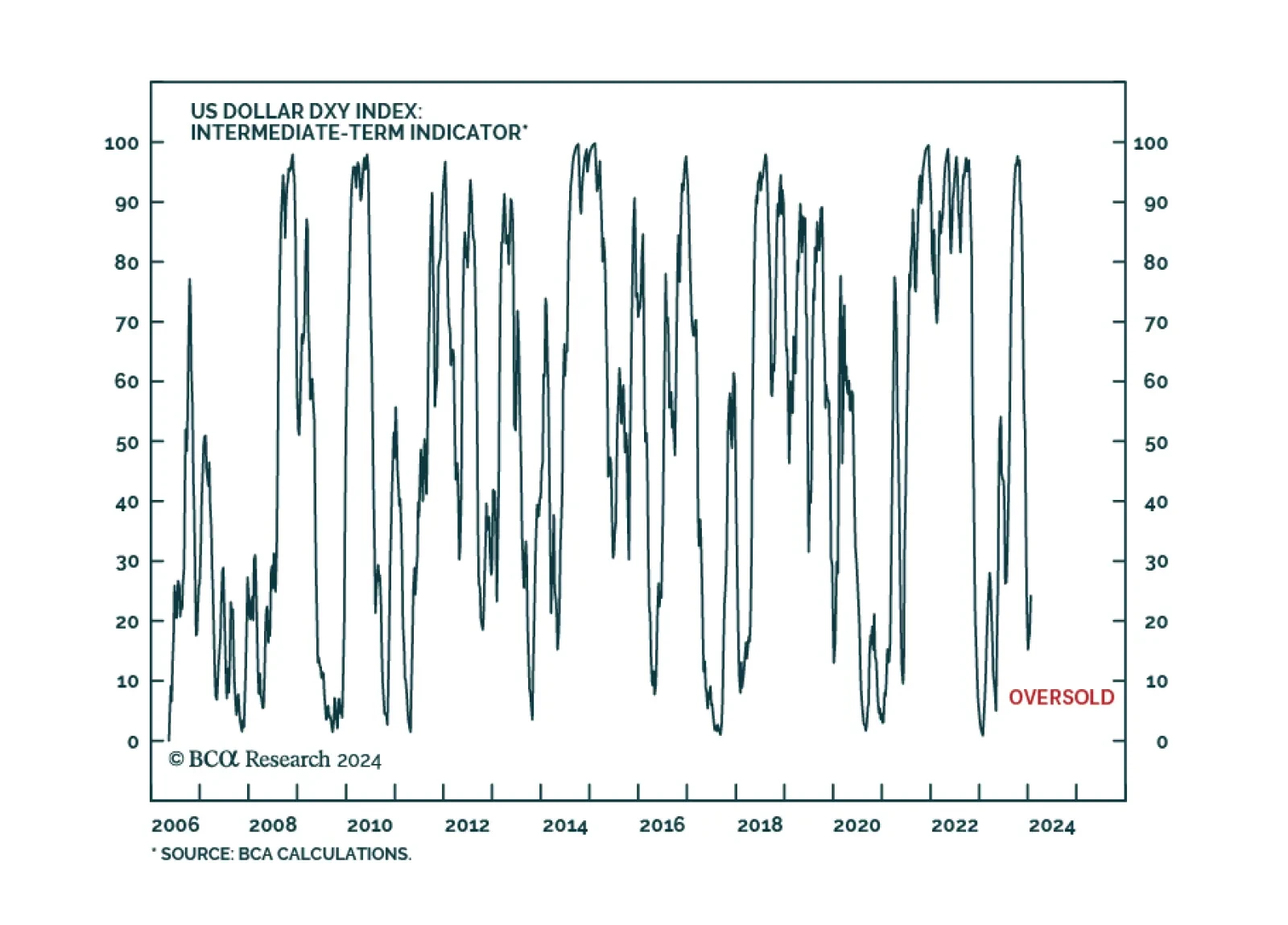

The US dollar has started the year on a strong note with the DXY gaining 2.6% since it bottomed on December 27. Multiple forces are behind this appreciation. Investors have been scaling back their expectations of Fed rate hikes…

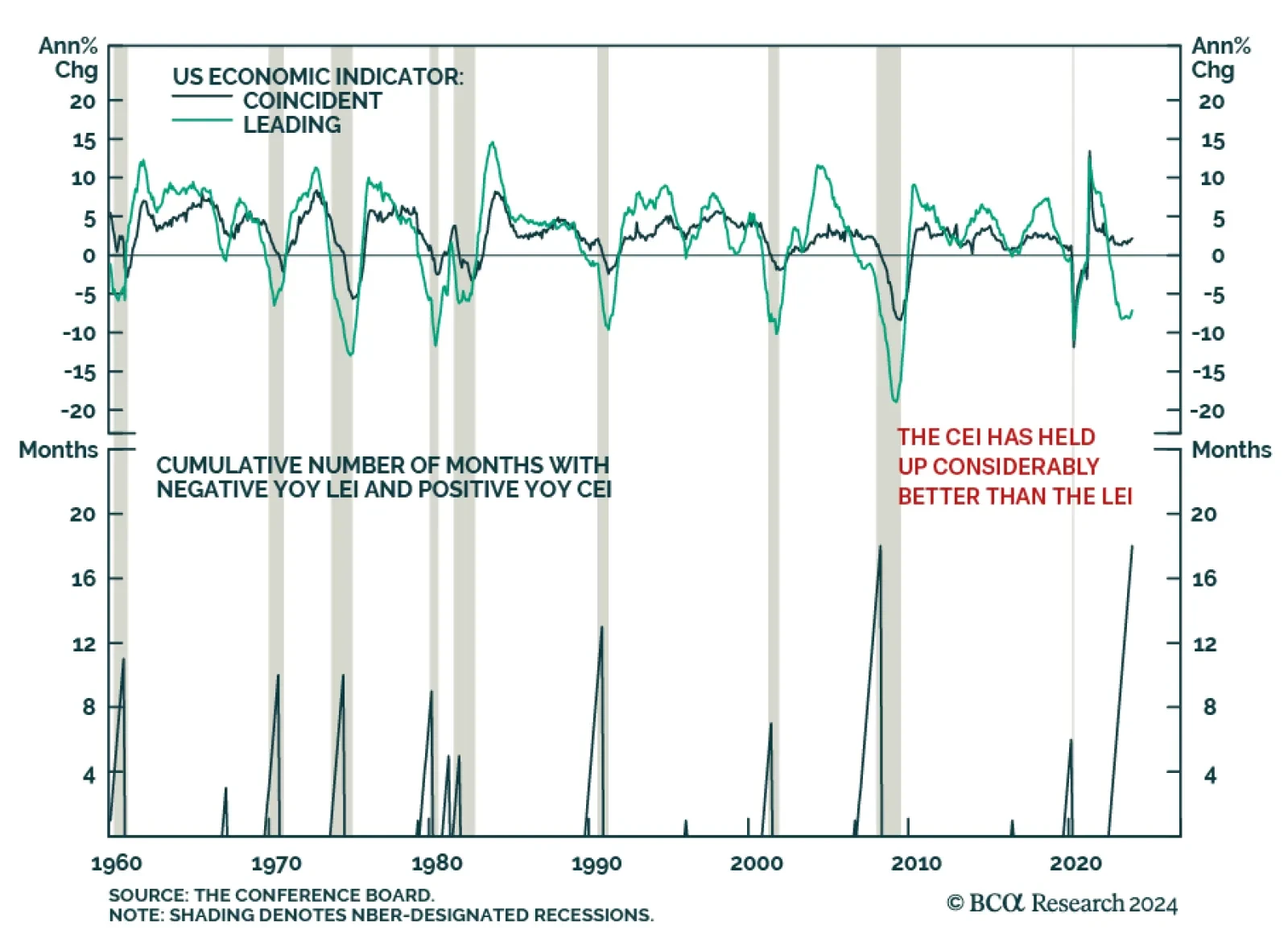

The US Conference Board’s Leading Economic Indicator (LEI) sent a mixed signal on Monday. On the one hand, the LEI posted its 22nd consecutive month-over-month decline in December – a negative sign for the…

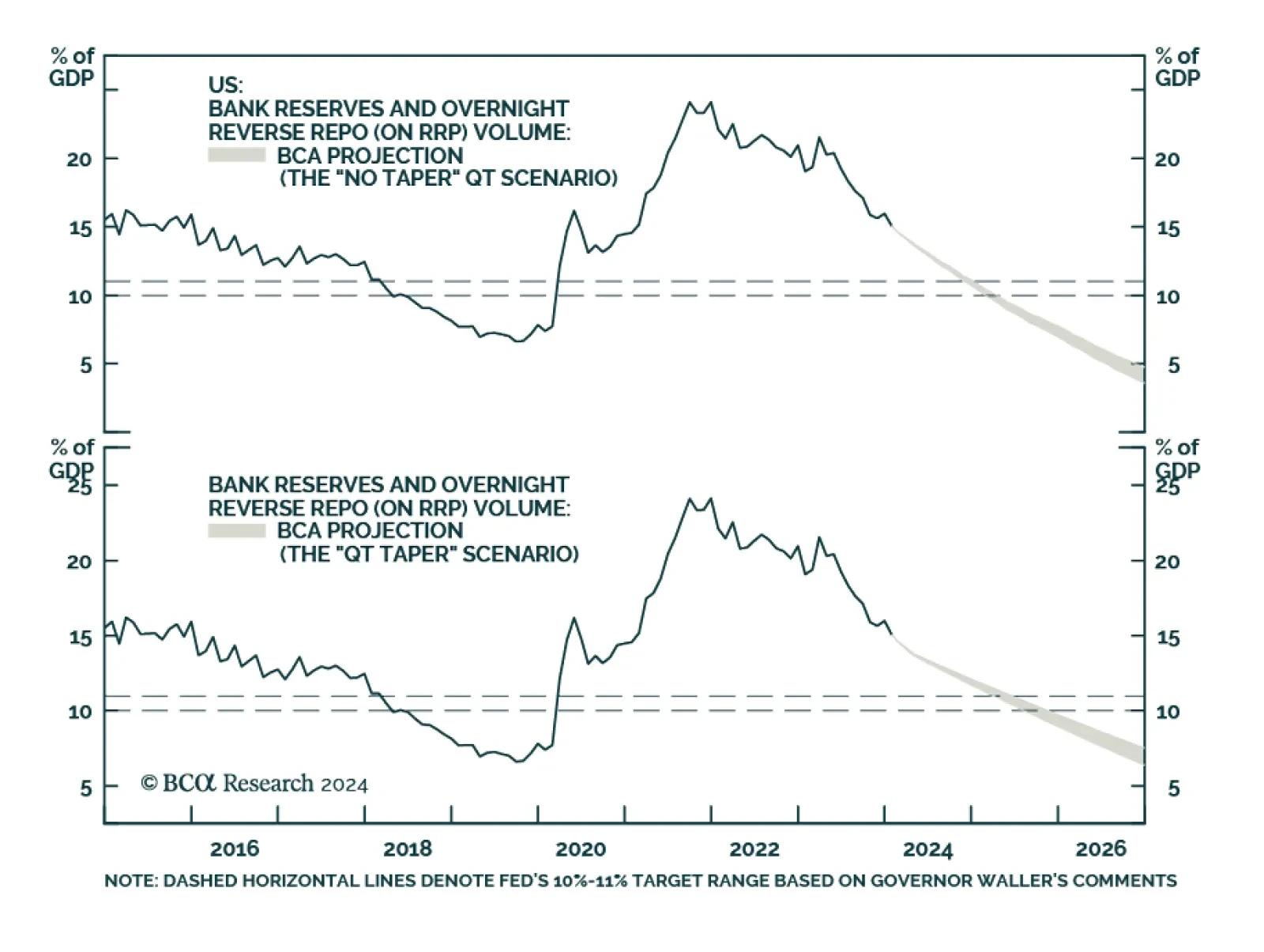

BCA Research’s US Bond Strategy service expects the Fed to slow the pace of QT starting at the May FOMC meeting, the same time that it starts cutting rates. QT will likely end altogether later in 2024 if the economy enters…

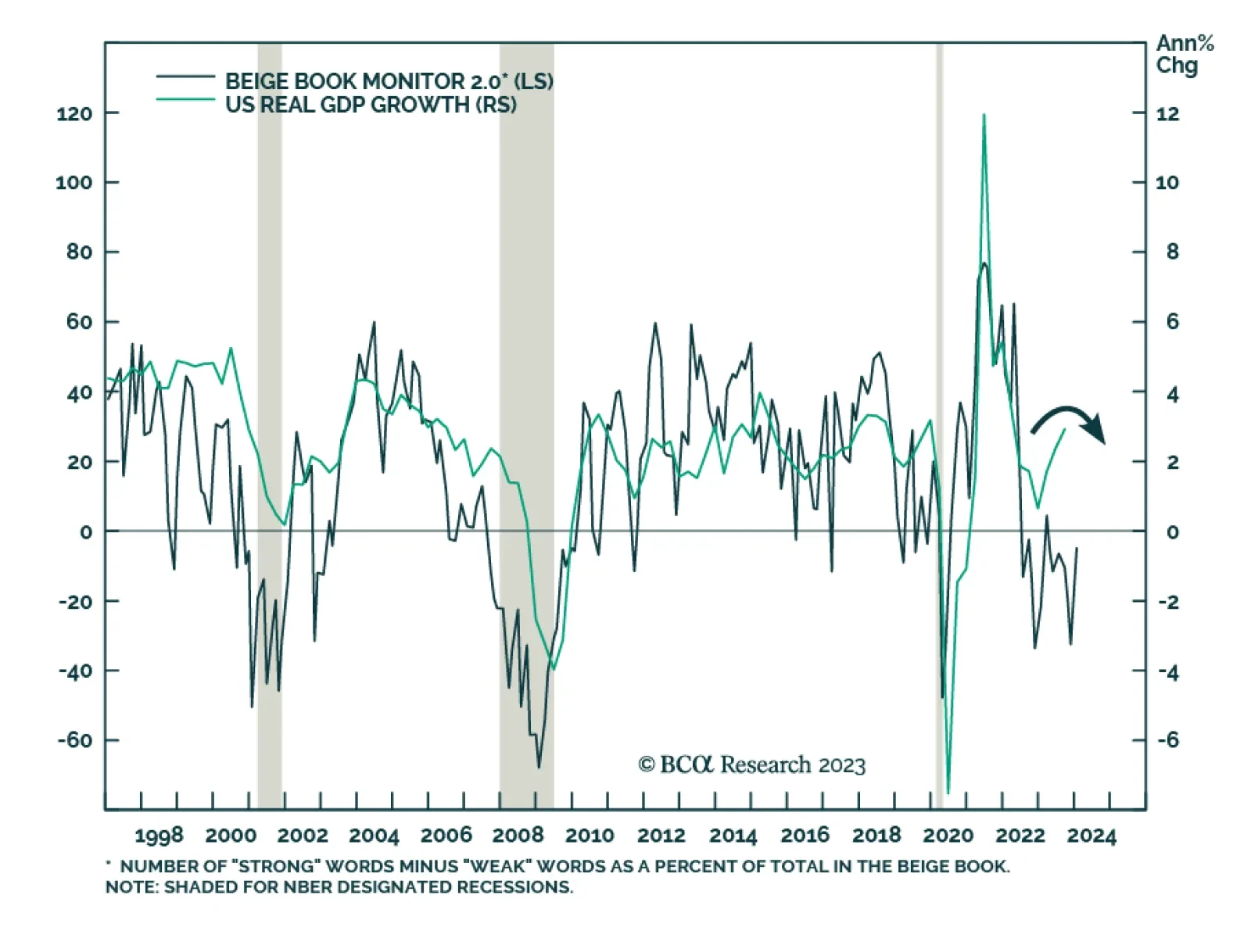

The Fed’s latest Beige Book delivered a lukewarm message on the US economy. Growth, employment, and prices were all relatively stable since the previous release in late-November. Eight districts reported little or no change…