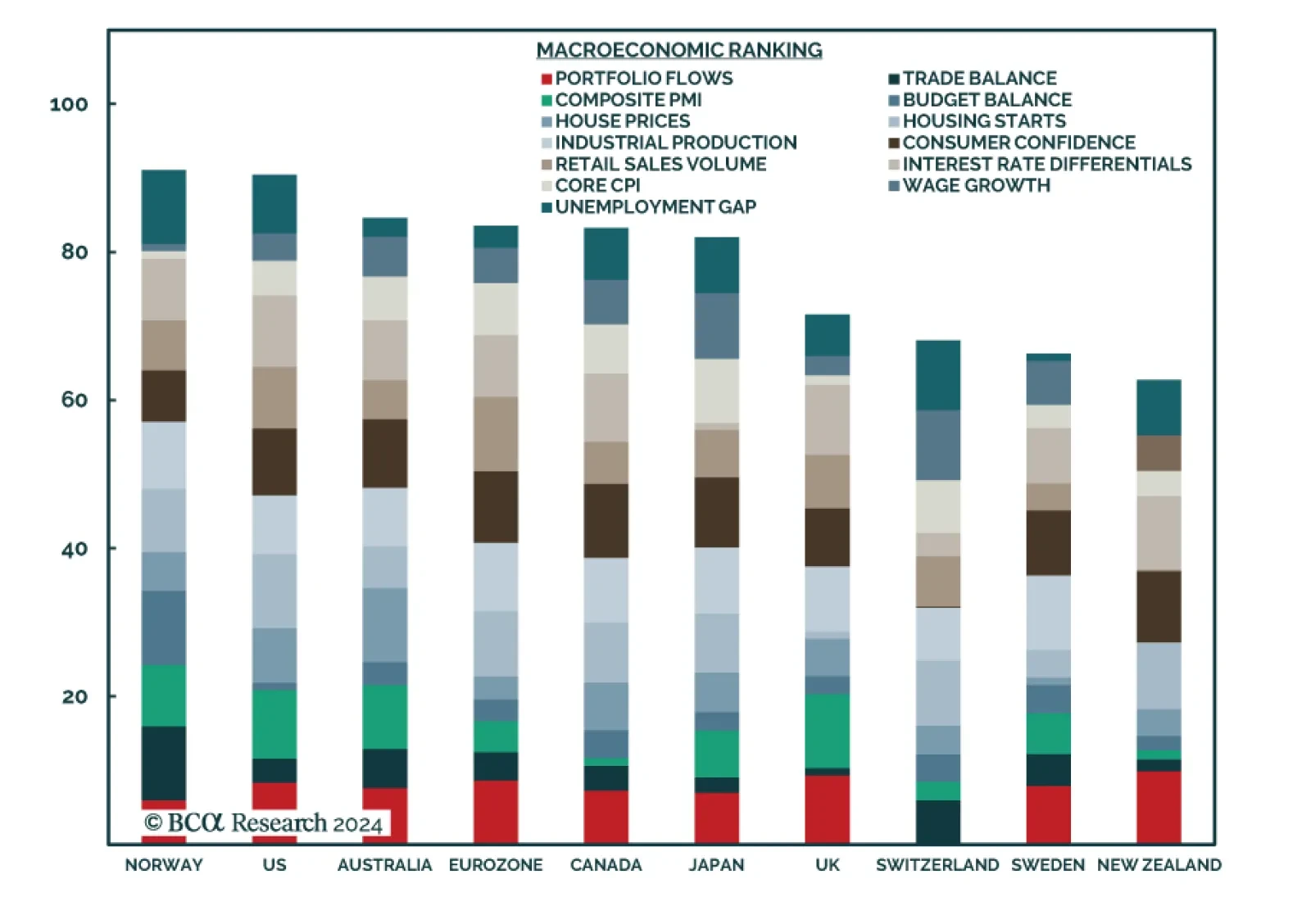

As we discussed in a recent Insight, the krone is the top pick for our Foreign Exchange Strategy team. The krone upgrade is one of the most significant changes in our colleagues’ attractiveness ranking model. Norway has the…

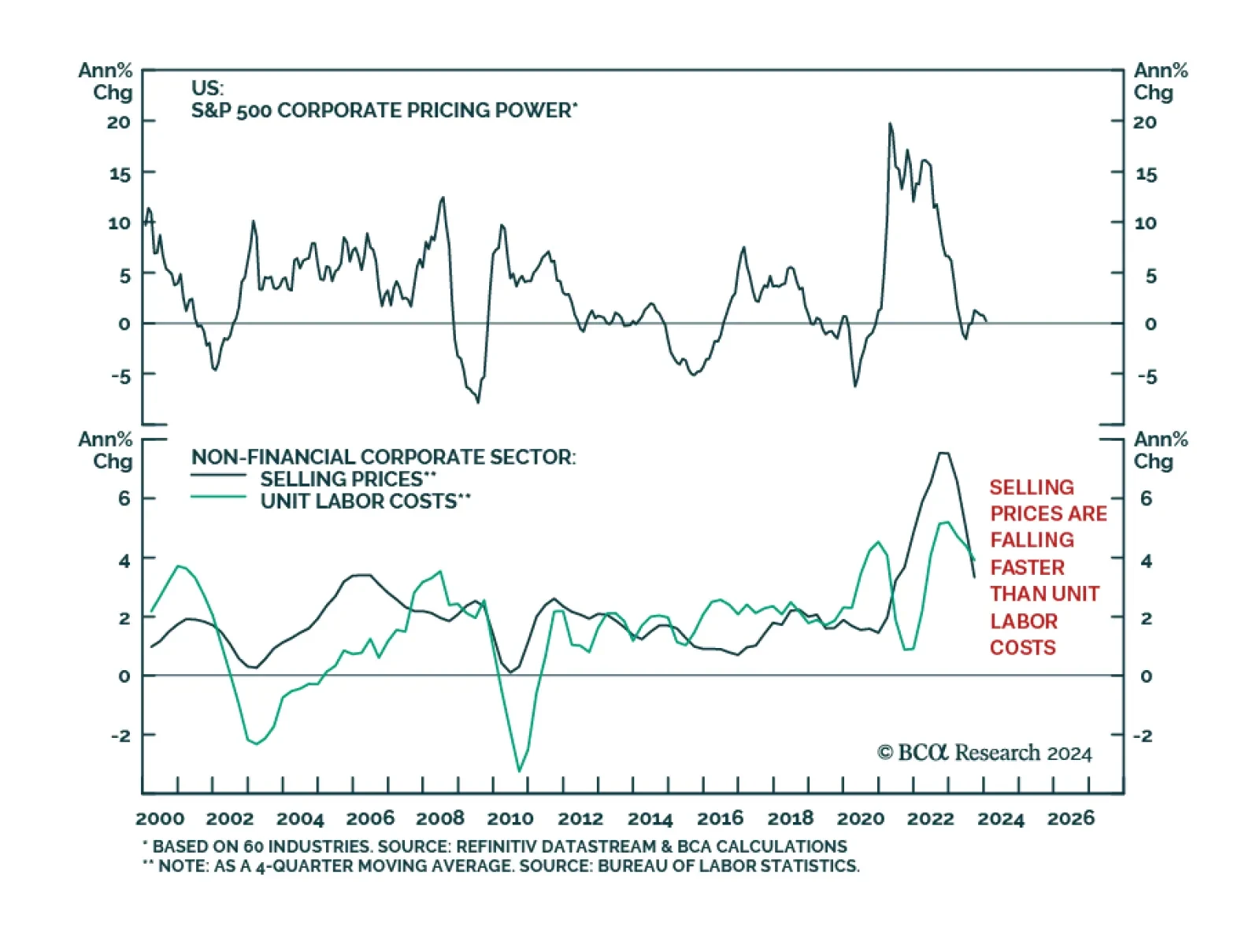

According to Factset, analysts are forecasting S&P 500 earnings and revenues to grow by 11.0% y/y and 5.0% y/y respectively in 2024 (an acceleration from 0.9% and 2.8% in 2023). Information technology and communications…

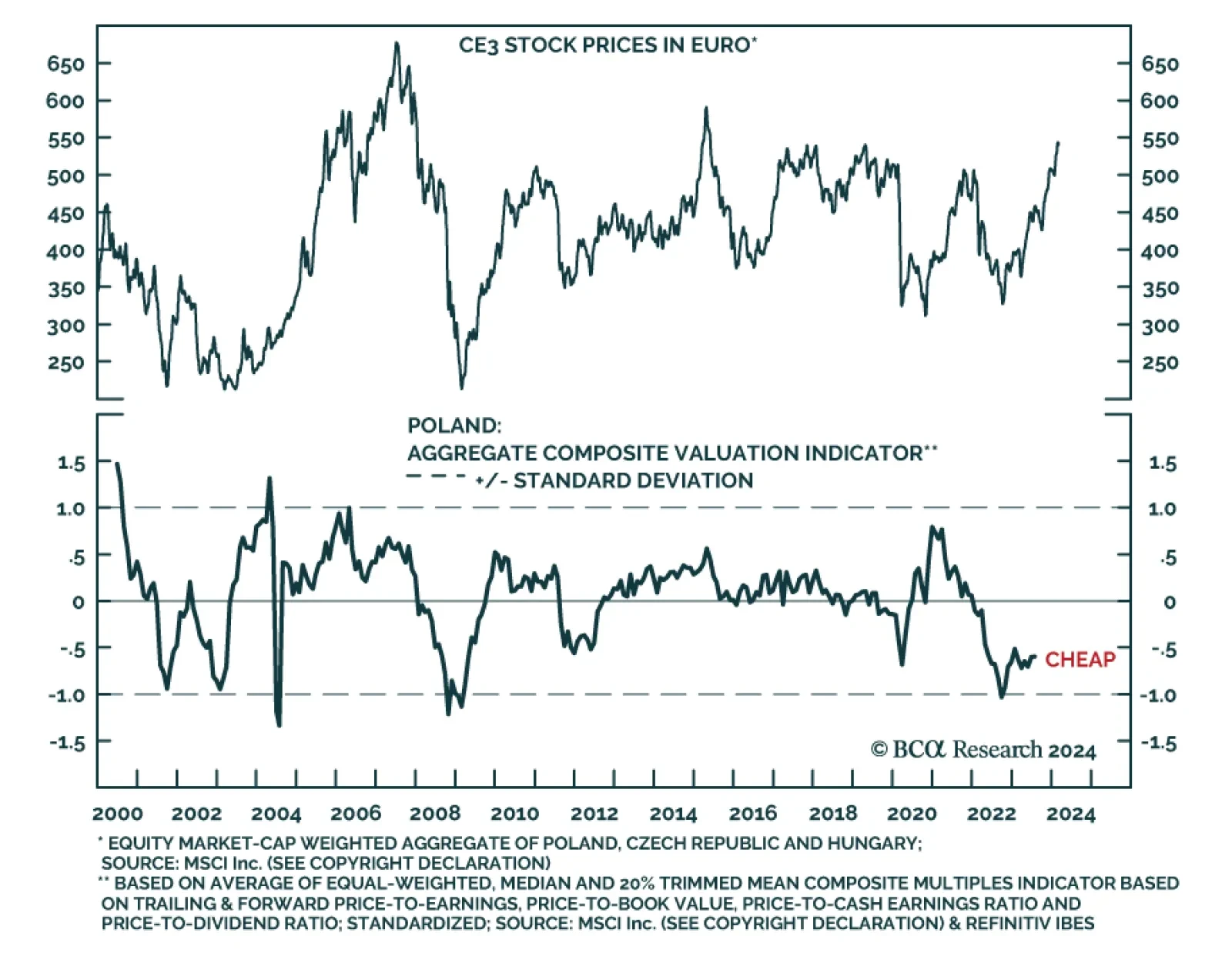

A market-cap weighted index of CE3 economies (Poland, Hungary and Czechia) returned a whopping 64% in common currency terms since its 2022 low. Polish and Hungarian equities led the rally, advancing by a respective 86% and 78% in…

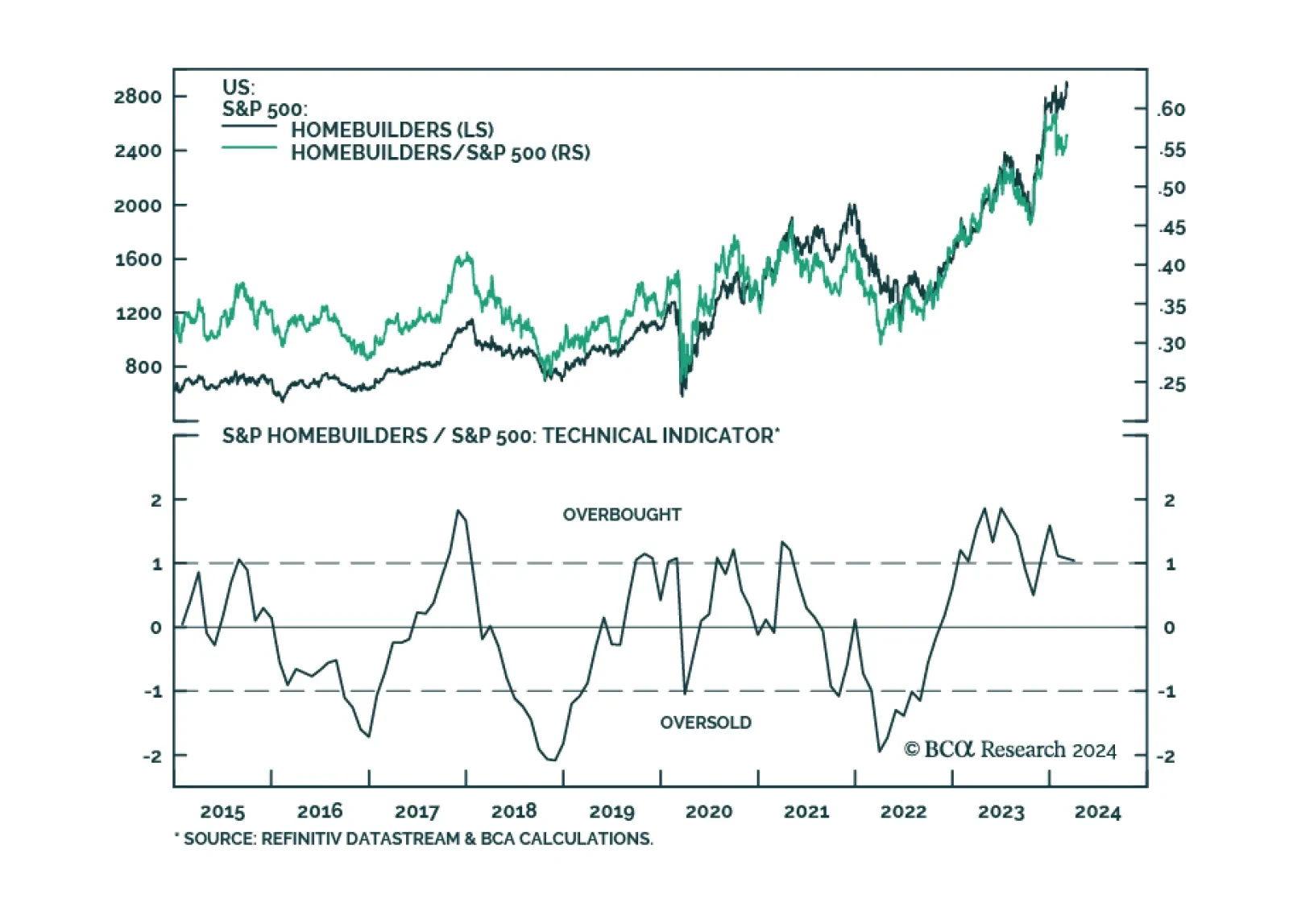

The S&P 500 Homebuilders index has returned a whopping 50% since October and outperformed the overall market by 24% over this period. Tight US housing supply is placing a floor under construction activity and constitutes a…

According to BCA Research’s Geopolitical Strategy and The Bank Credit Analyst services, trade policy under a second Trump presidency represents the greatest cyclical risk to investors. In 2018, the Trump administration…

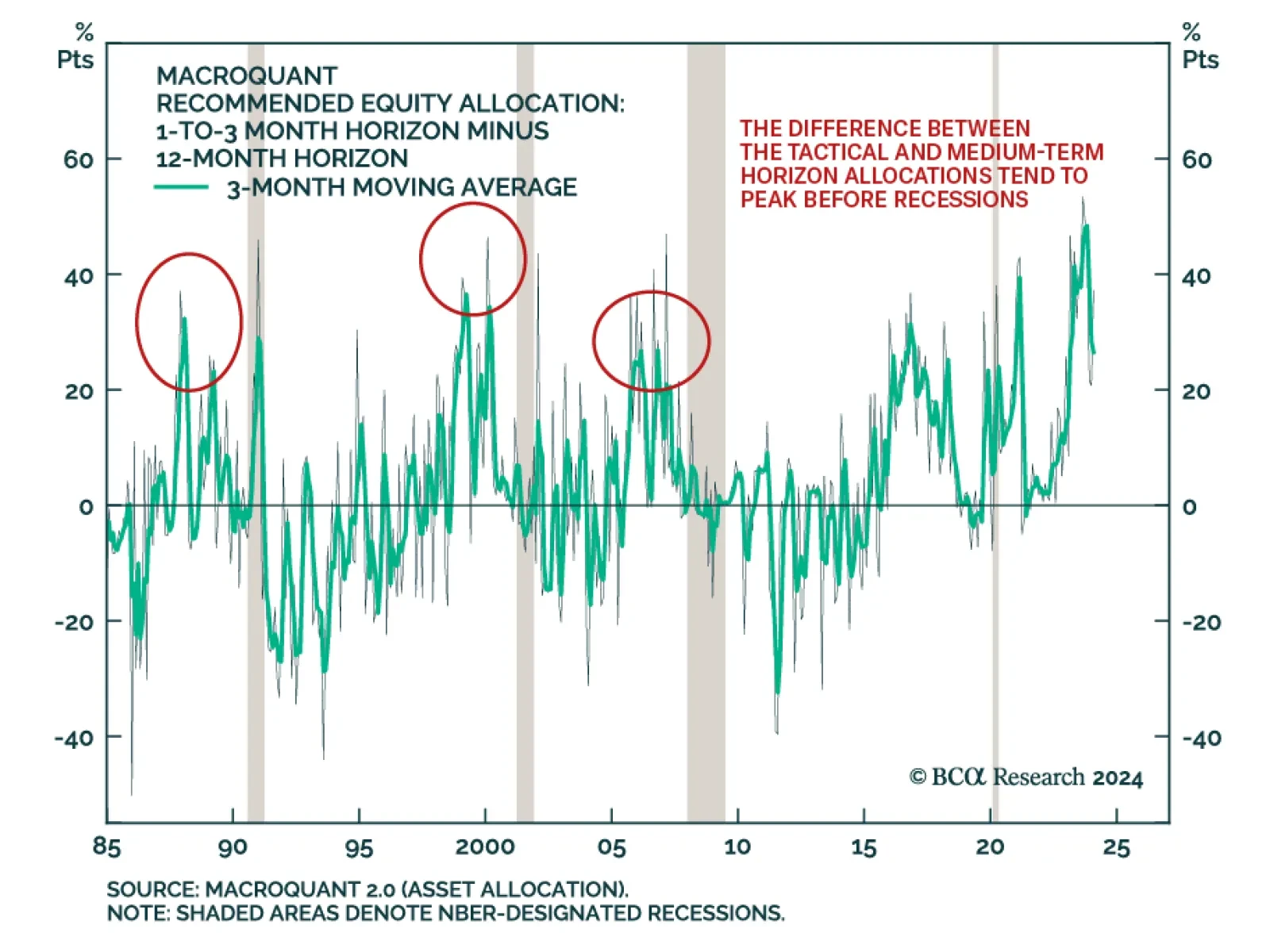

BCA Research’s Global Investment Strategy service’s US equity model, Stock Coach, has become more bullish on the near-term prospects for the S&P 500. The model’s short-term (1-to-3 month) equity score…

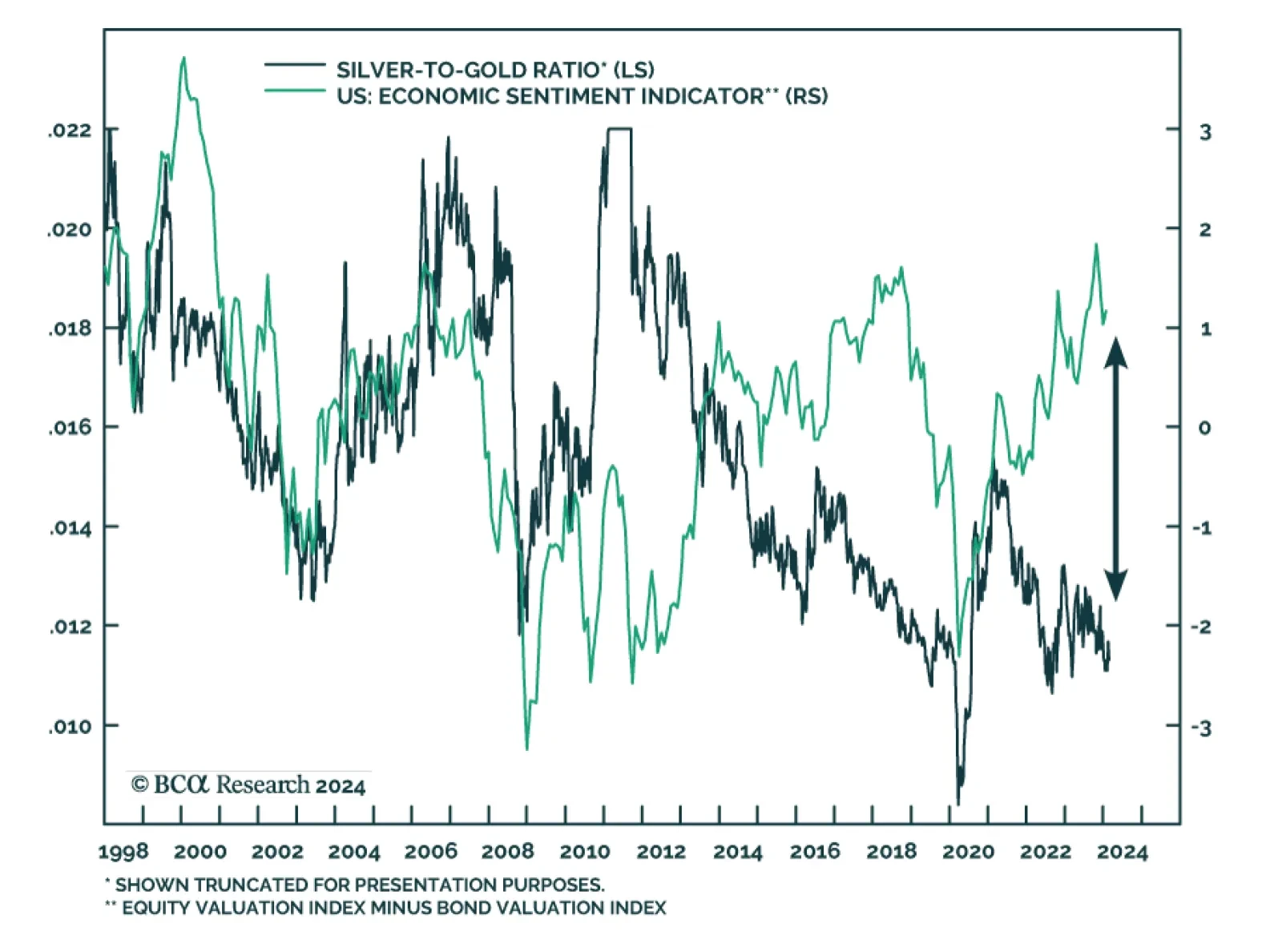

Our US economic sentiment indicator – which is based on the difference between our equity valuation index and our bond valuation index – remains on an uptrend since its pandemic trough. Investors are pushing US stocks…

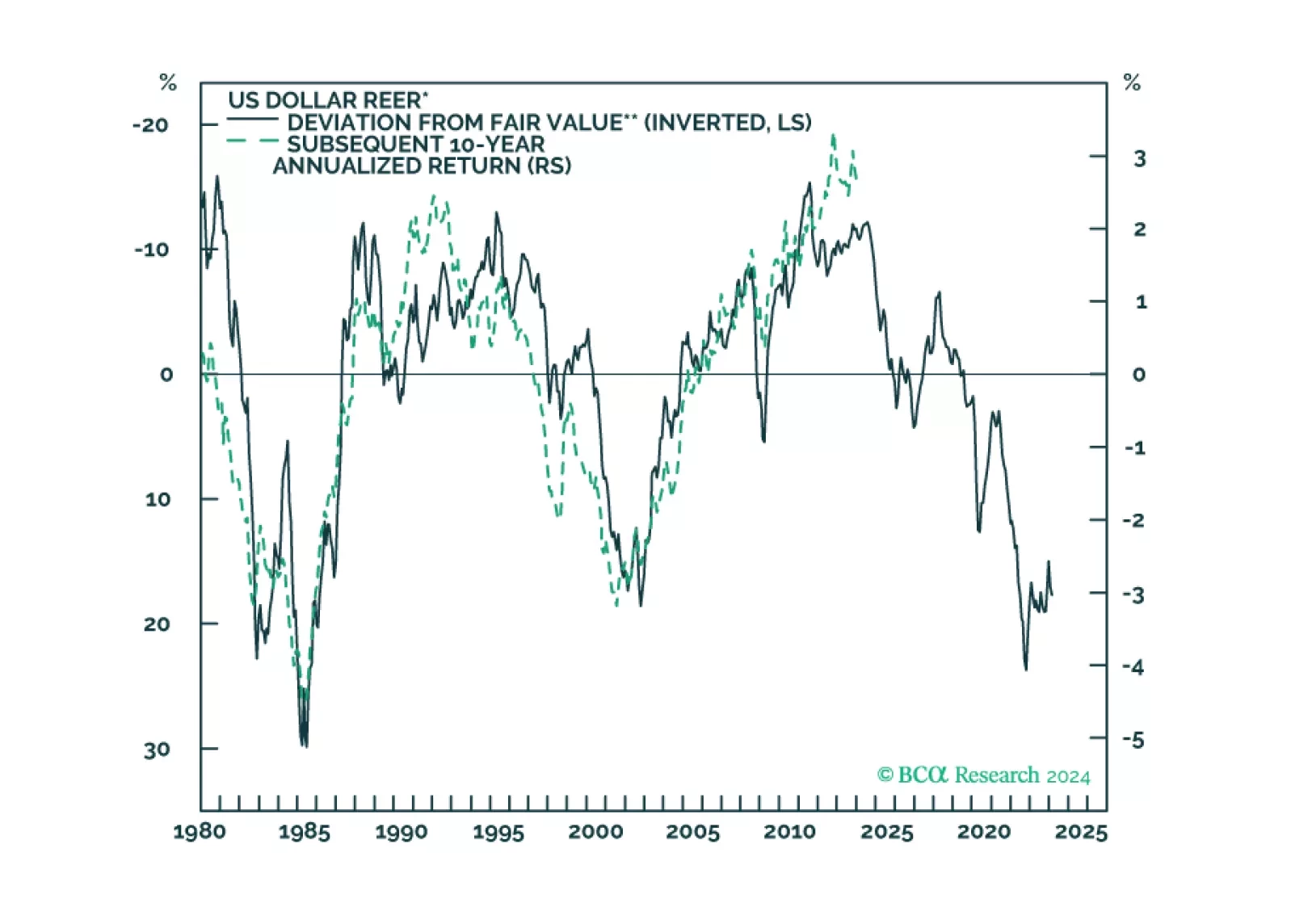

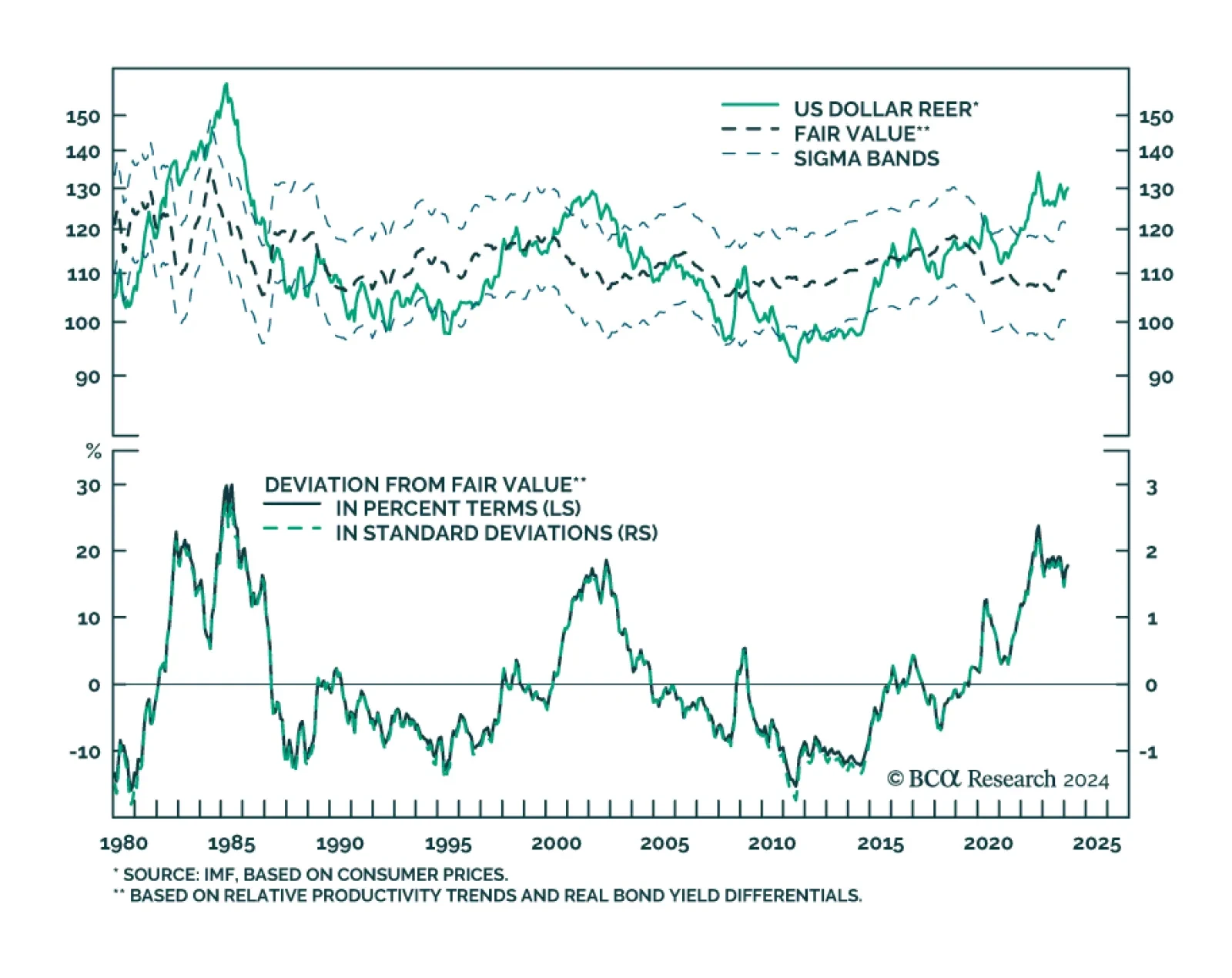

In a recent Special Report, BCA’s Foreign Exchange Strategists update their long-term fair-value models for the real effective exchange rate. The model aims to capture deviations from the long-term drivers of a currency,…

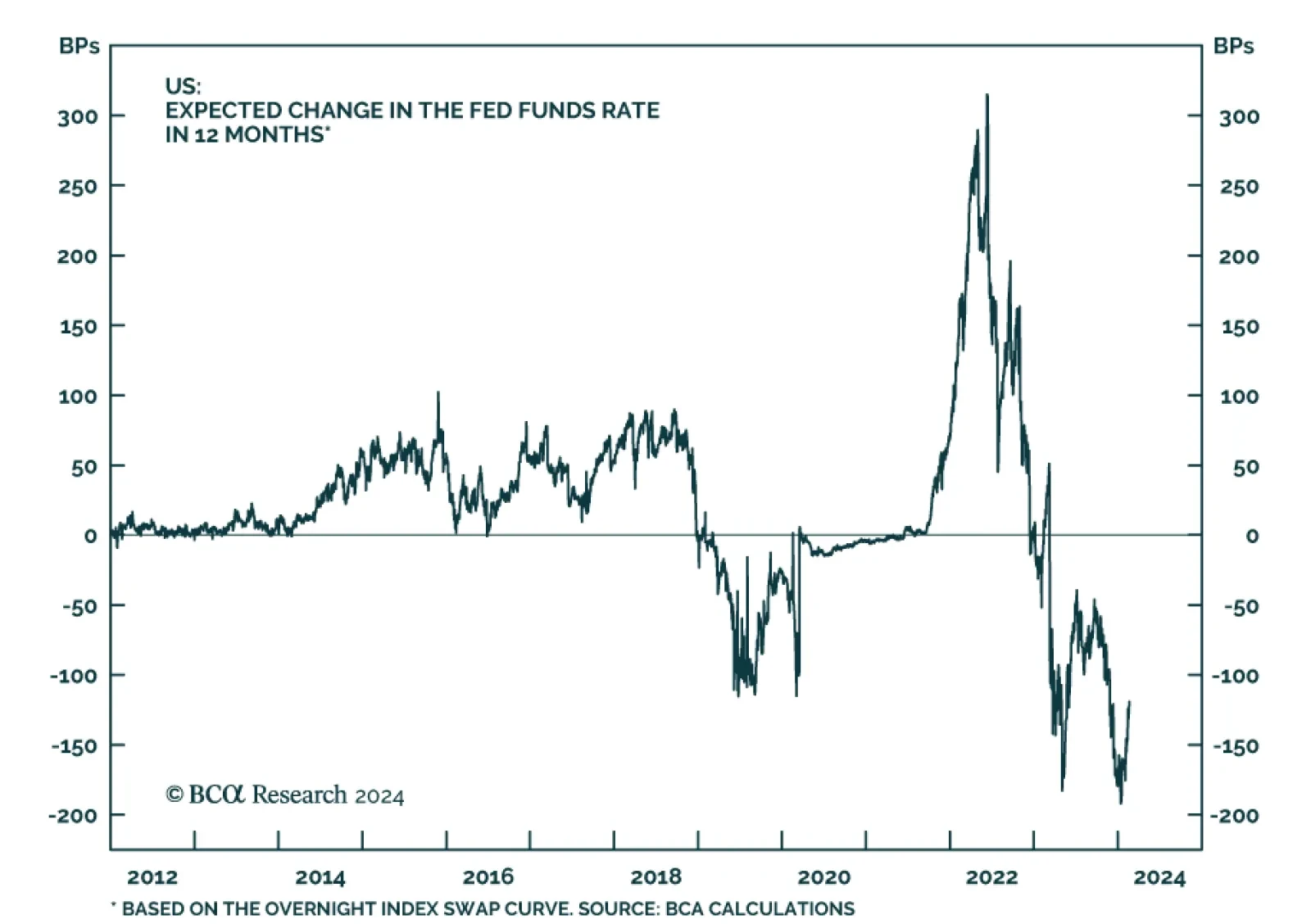

US Treasuries have been selling off over the past two months as investors downgrade the odds of an imminent start to the Fed’s easing cycle. Naturally, a question facing investors is whether current levels constitute a good…