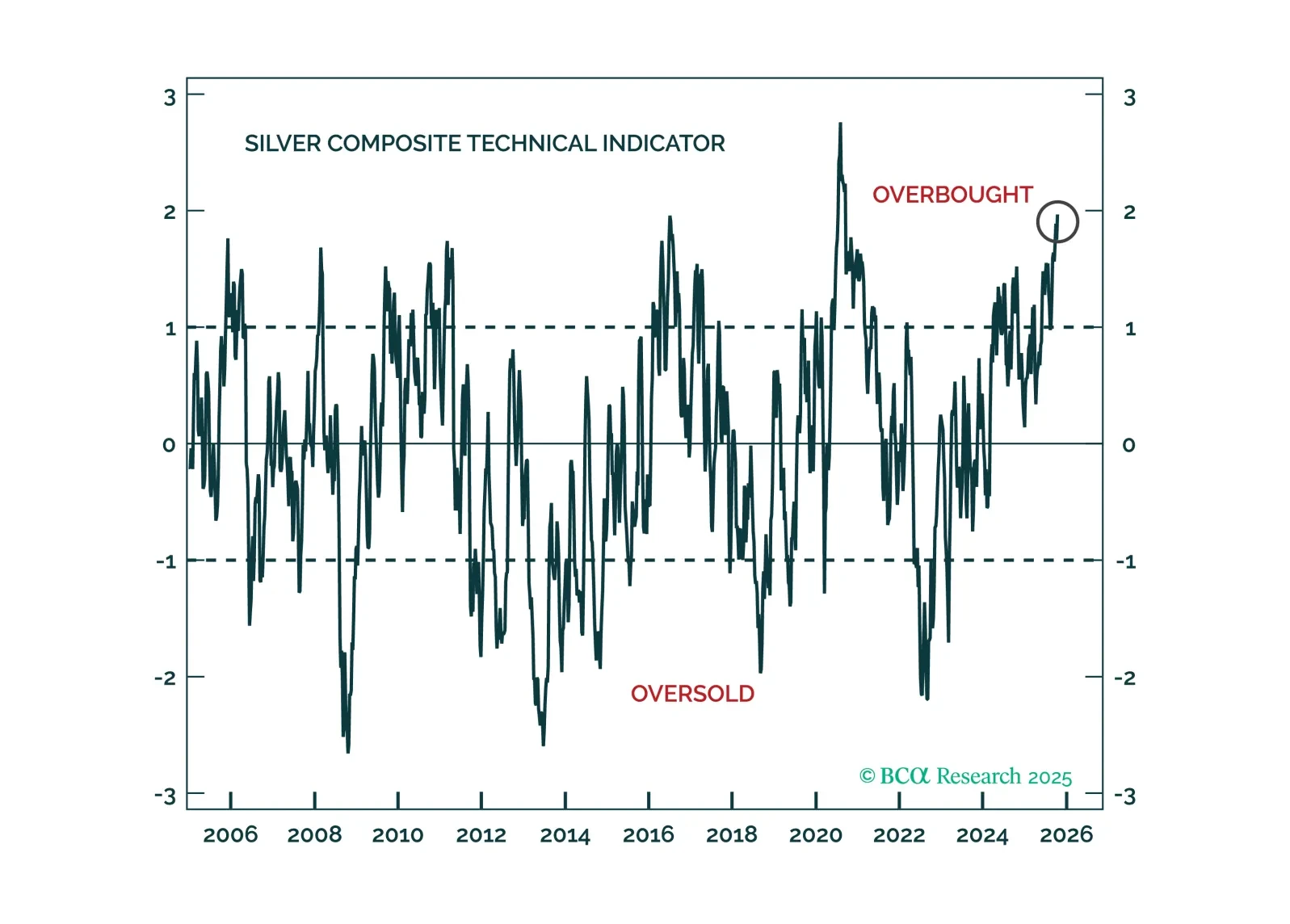

Speculative froth has built up across all precious metals, yet gold’s structural tailwinds will allow it to weather corrections better than its peers.

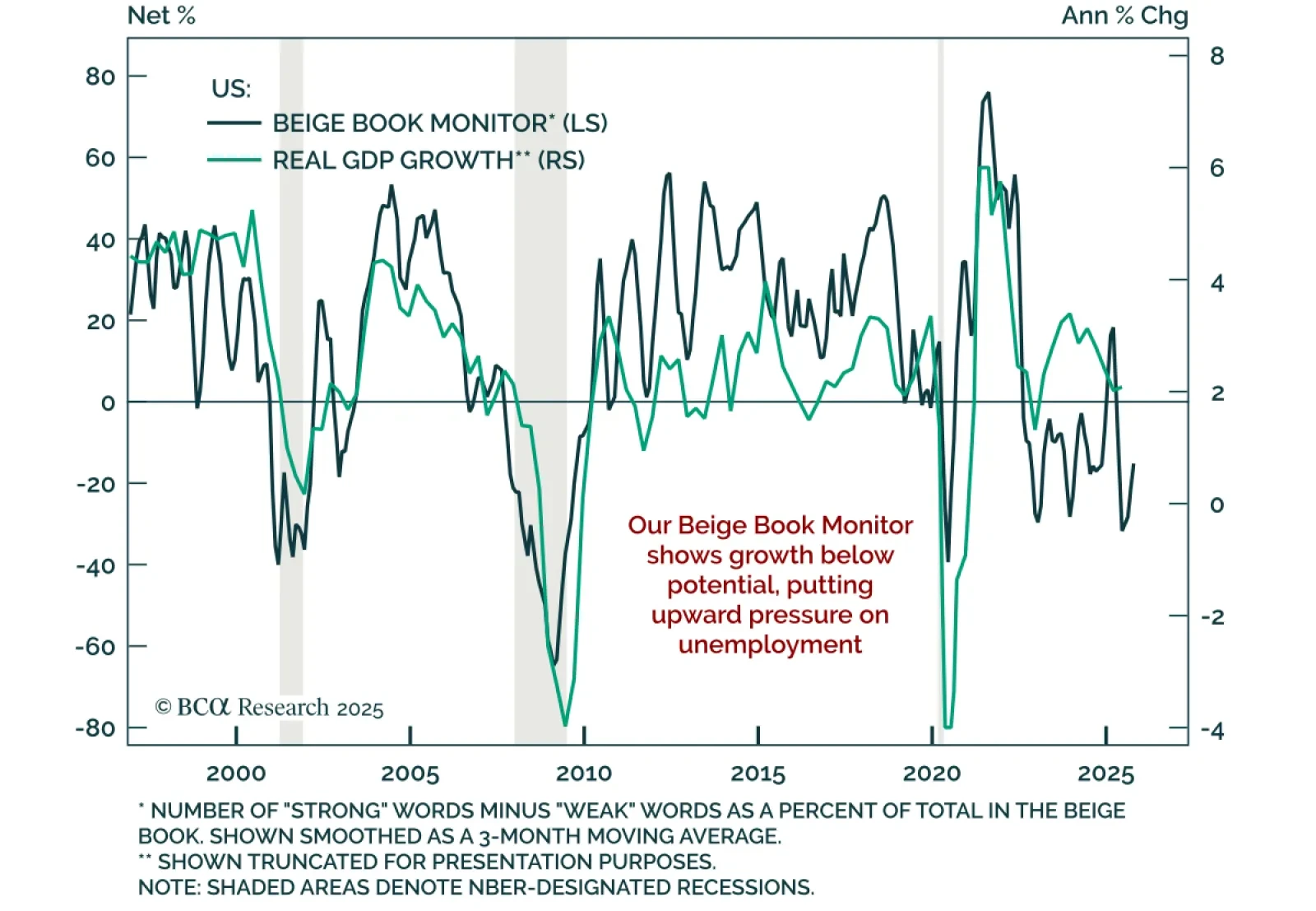

The October Fed Beige Book points to slowing growth as uncertainty continues to weigh on activity. Fed contacts reported consumer spending recently decreased, though auto sales were supported by EV purchases ahead of the expiration…

Despite concerns about fiscal sustainability, a rise in term premia, and attacks on central bank independence, monetary policy remains the primary driver of bond markets. In our Q3 Review & Outlook, we update our views and…

Our Portfolio Allocation Summary for October 2025.

A short guide on how best to use and interpret our real-time fractal heatmap for asset allocation.

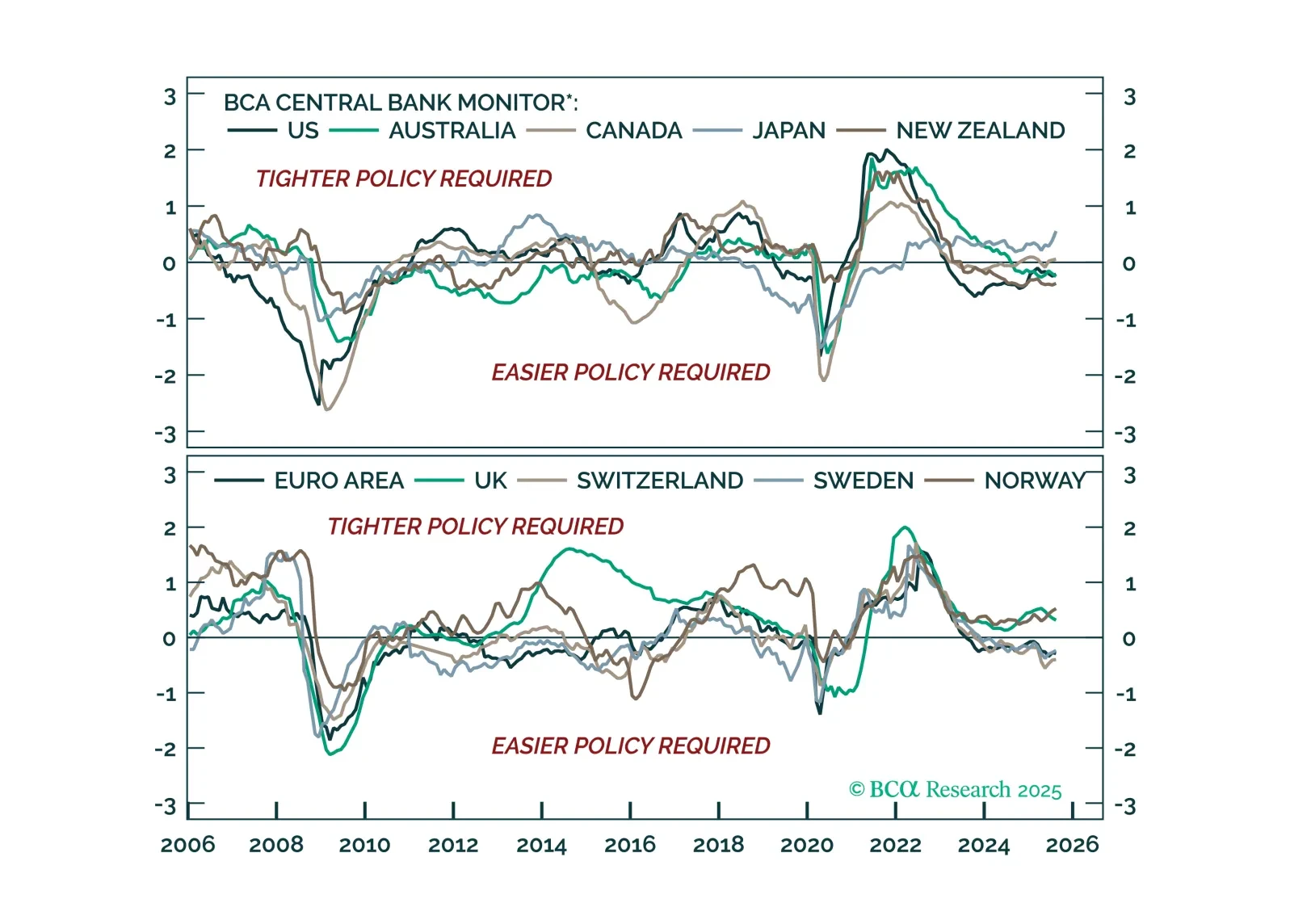

Monetary policy divergences are re-emerging. We rely on BCA’s Central Bank Monitor to assess the current policy stance of major central banks, and highlight the tactical opportunities across bond markets and currencies.

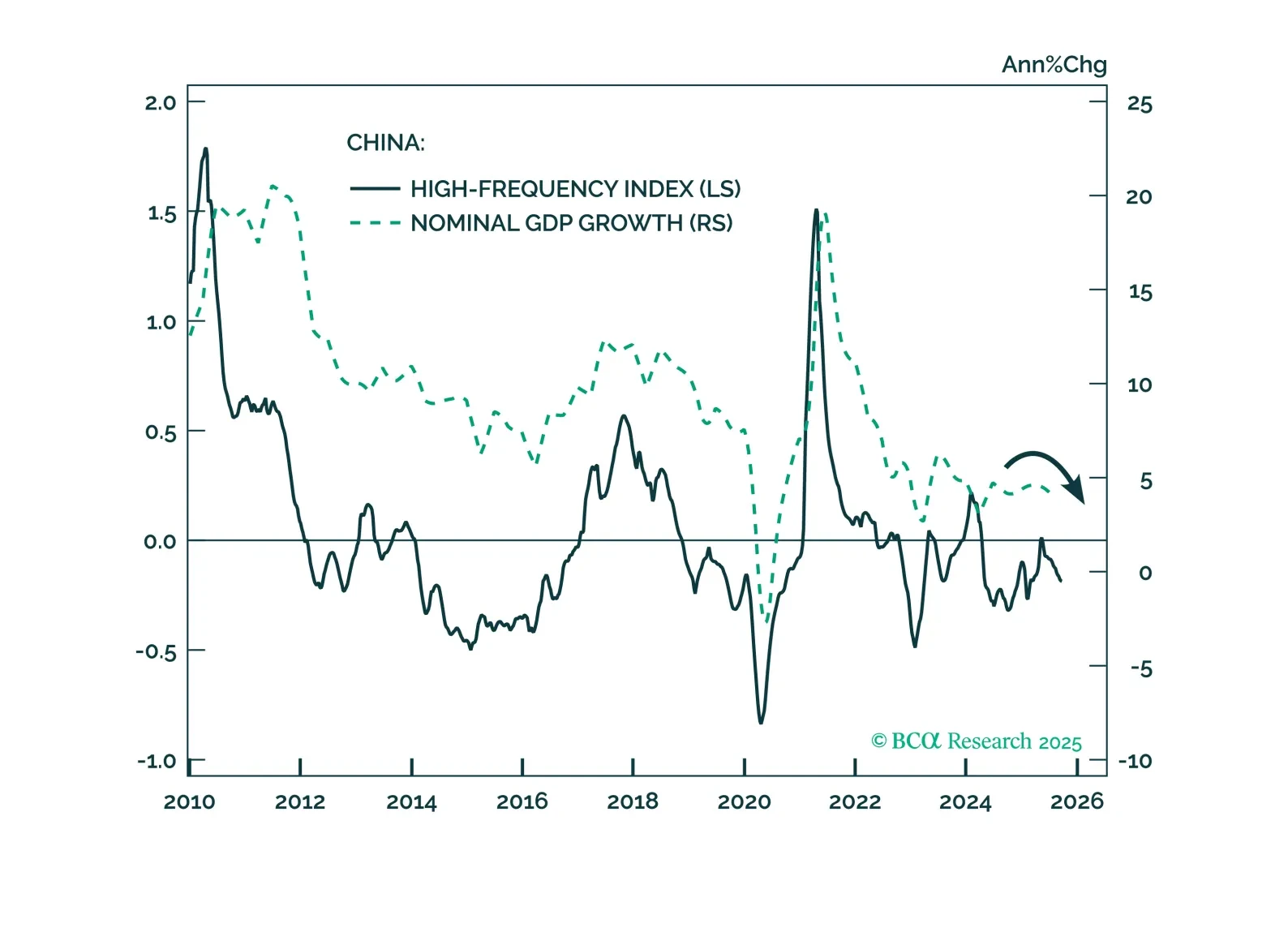

Our high-frequency indicators show China’s growth momentum weakening further in September, increasing the likelihood of new stimulus in the weeks ahead. We remain tactically cautious on Chinese equities, but strategically…

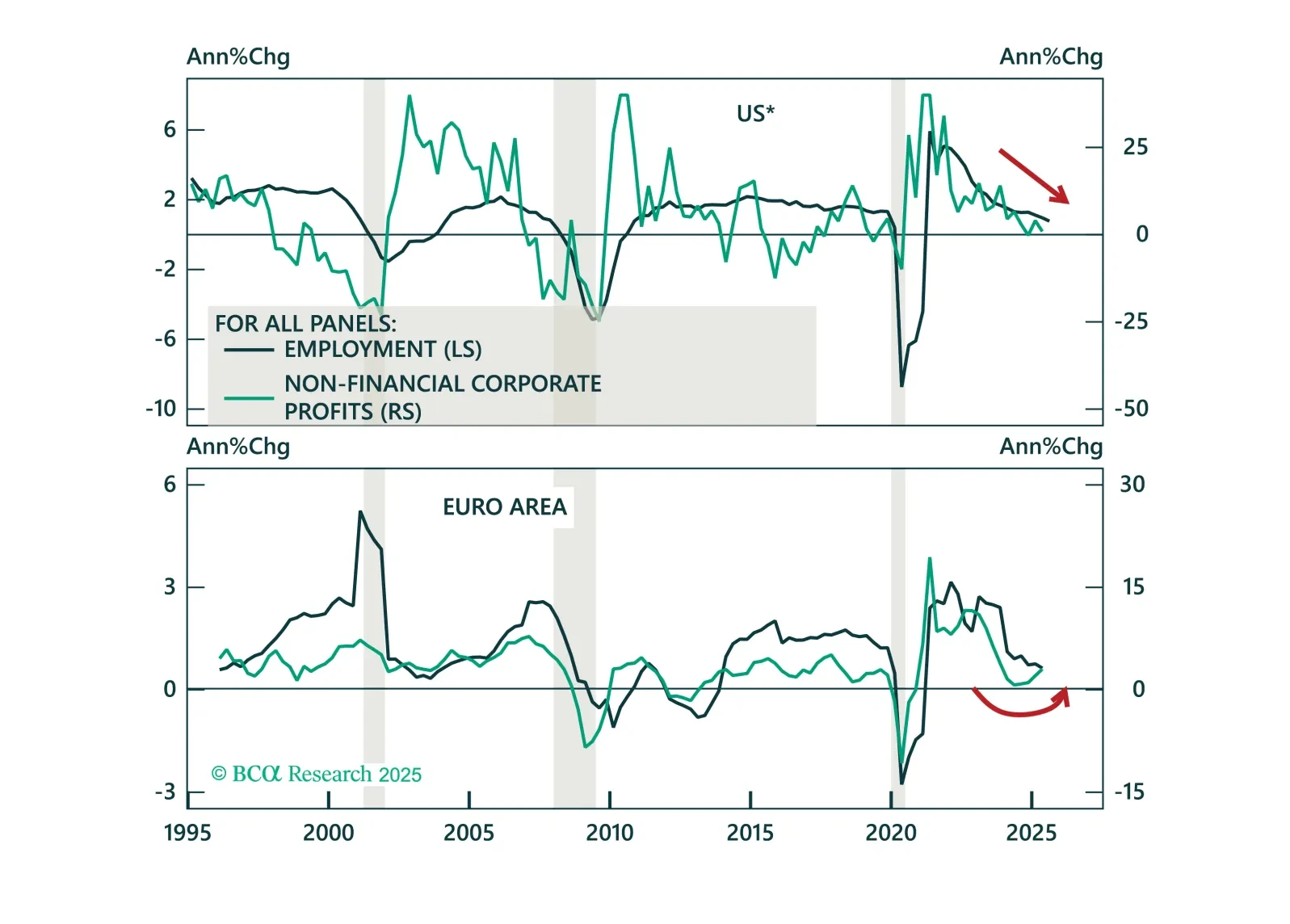

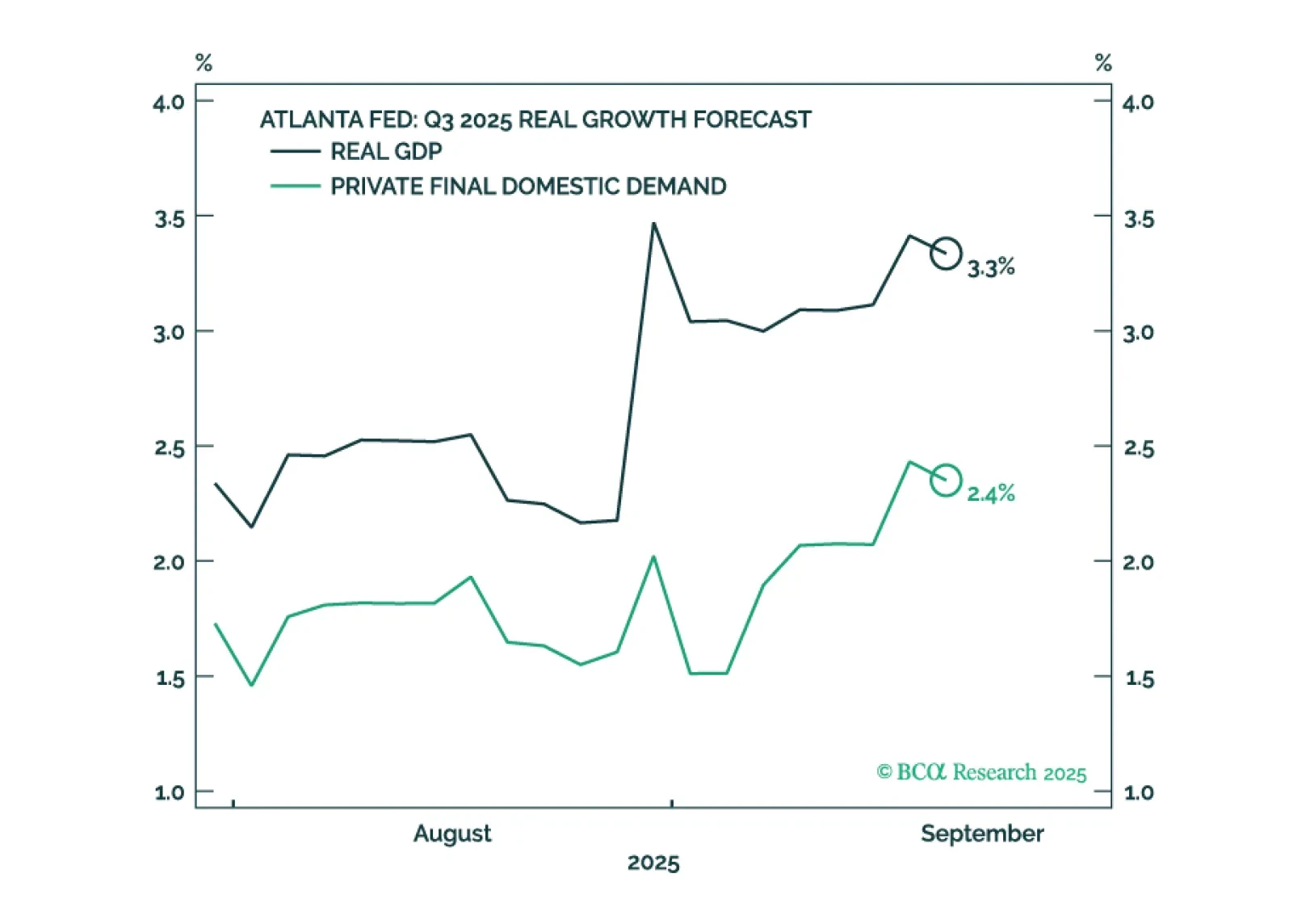

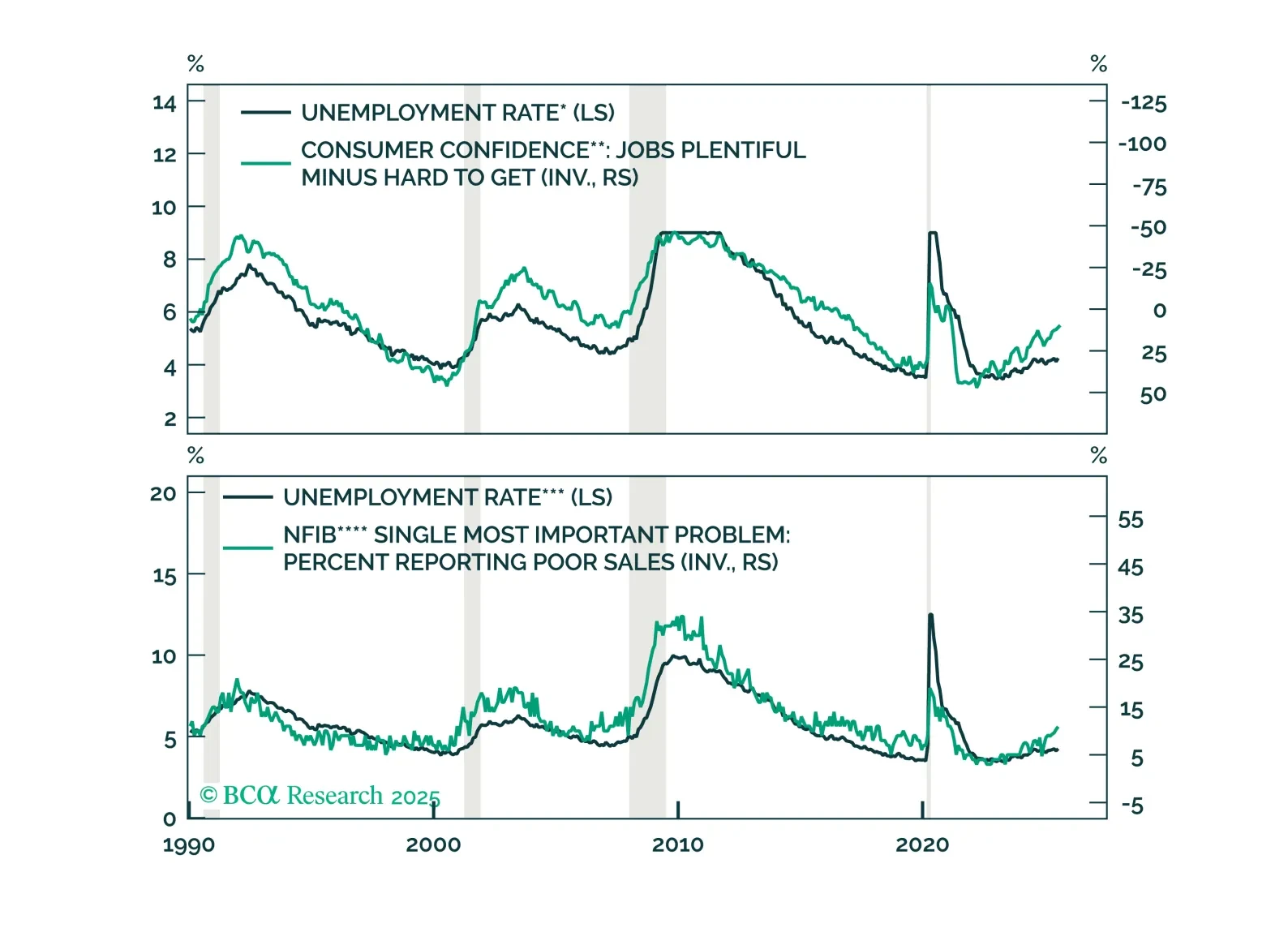

US GDP growth appears to have accelerated even as employment growth has faltered. We will make a final decision in early October when we publish our next Strategy Outlook, but most likely, we will cut our 12-month US recession…

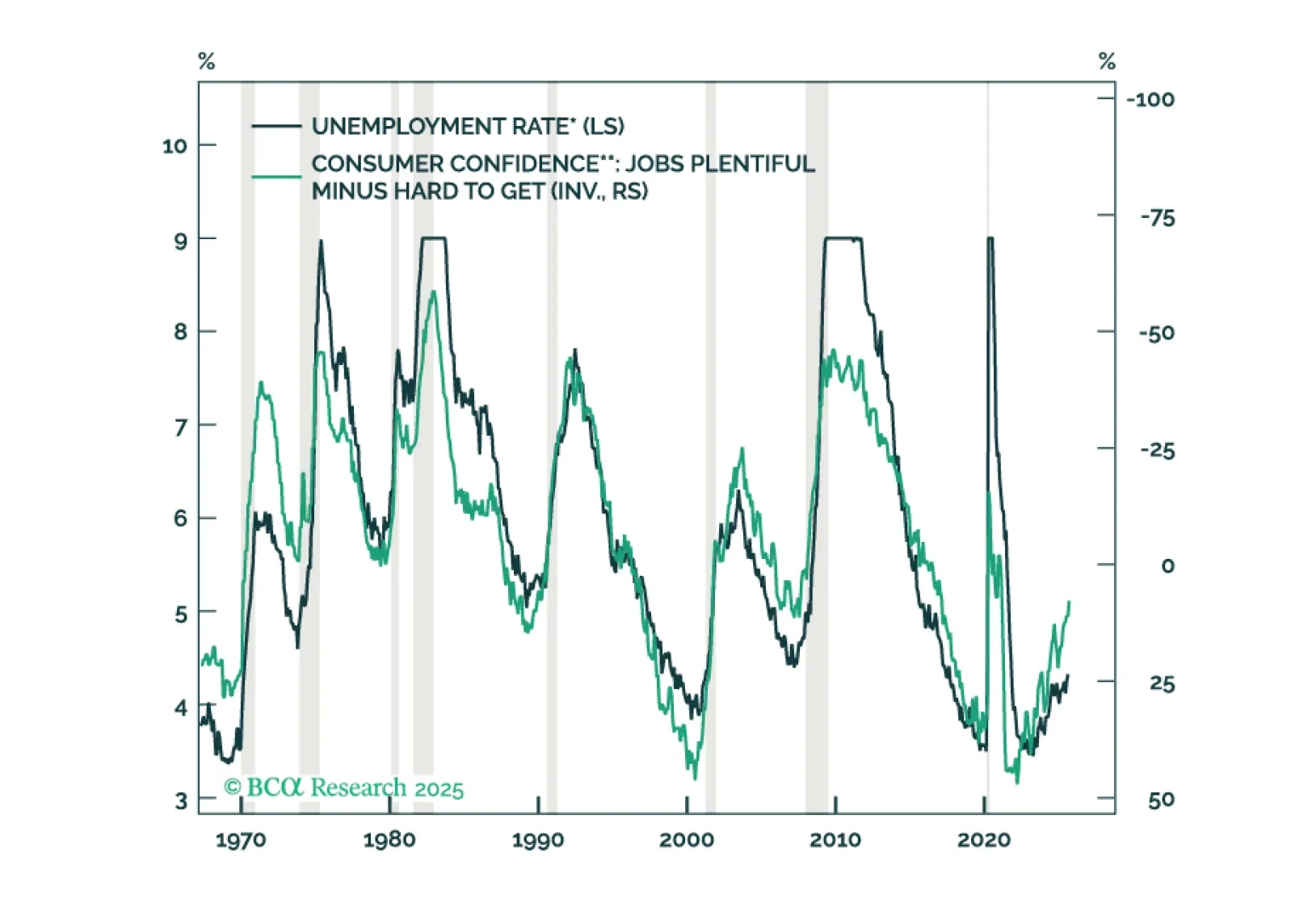

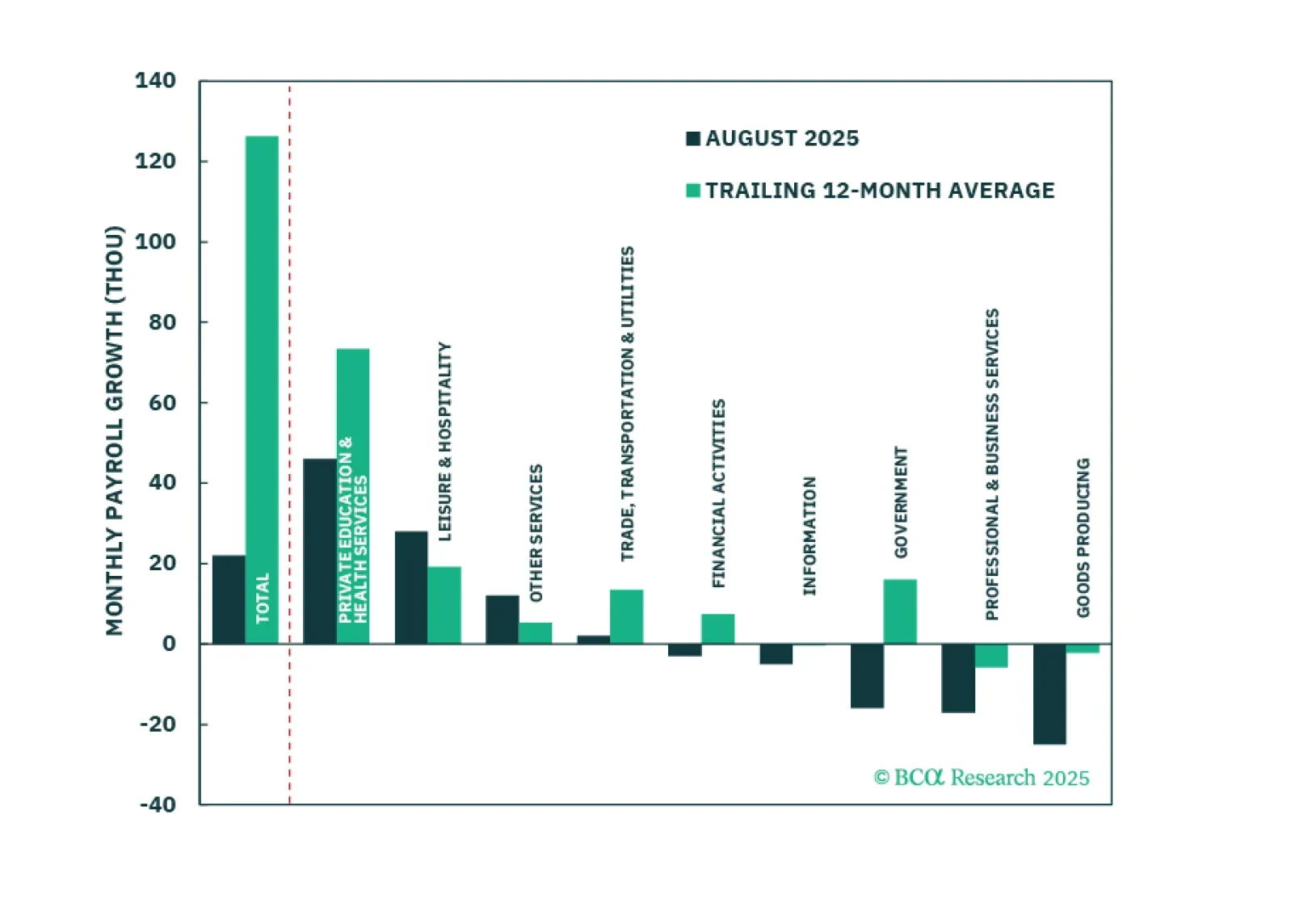

The August employment report showed a modest increase in labor market slack, enough to cement a 25-basis-point rate cut this month.

Our Portfolio Allocation Summary for September 2025.