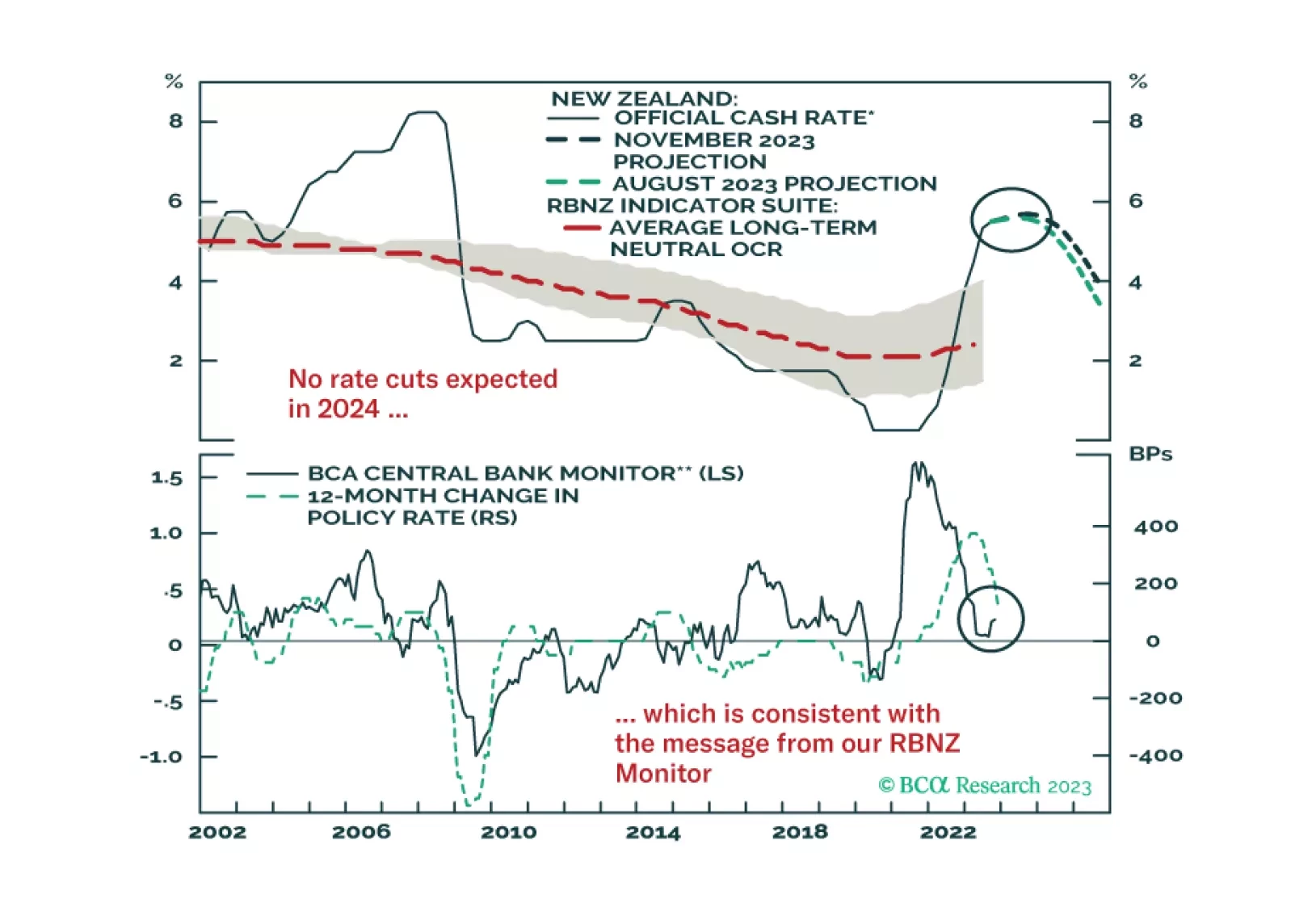

In this Insight, we discuss the outlook for monetary policy in New Zealand after this week’s RBNZ policy meeting, and introduce related fixed income and currency trade ideas.

In this report, we go around the globe and survey the near-term outlook for G10 currencies. Our longer-term view on the dollar has been clear, we are sellers. In this report, we review if a tactical sell is also warranted given…

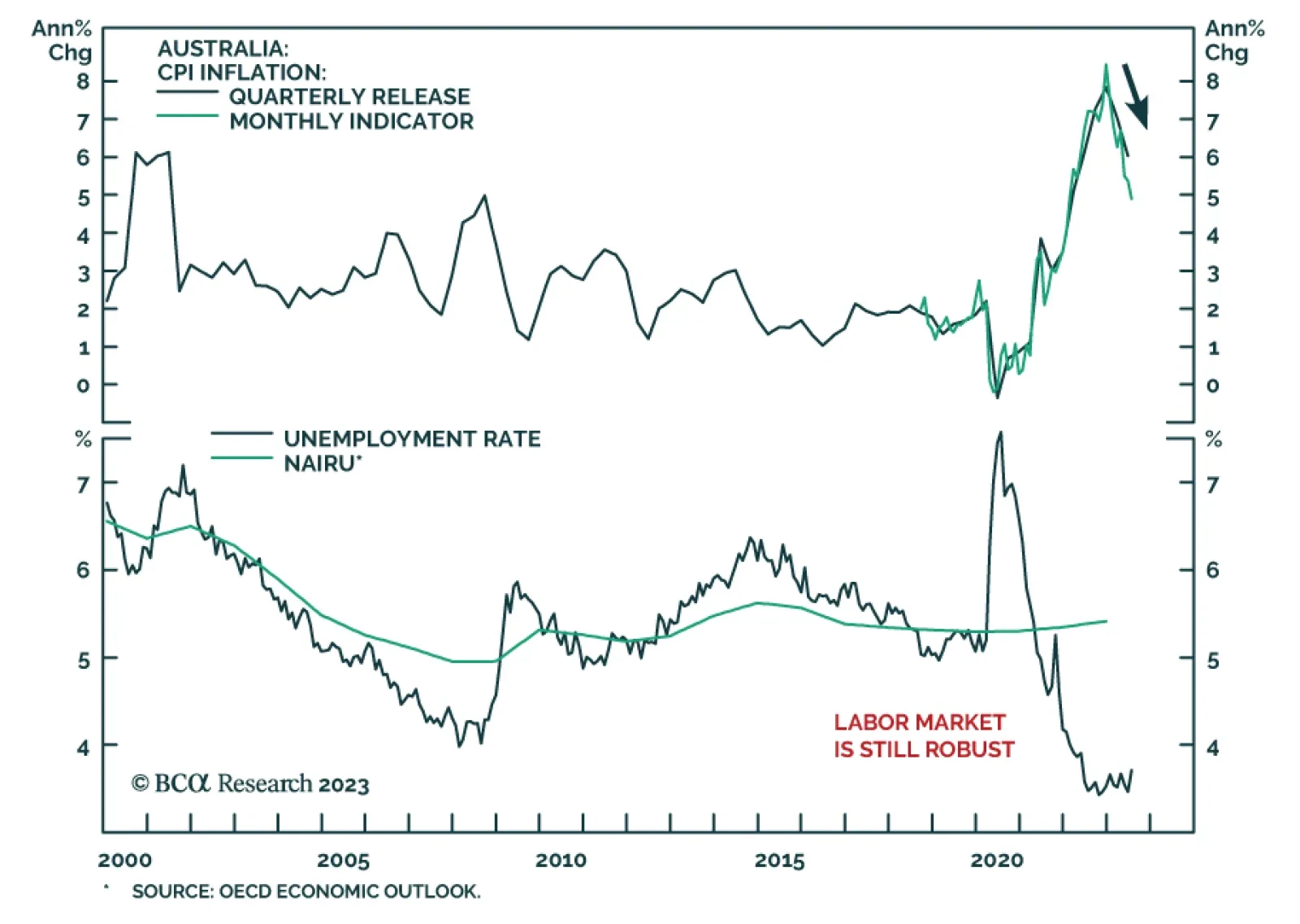

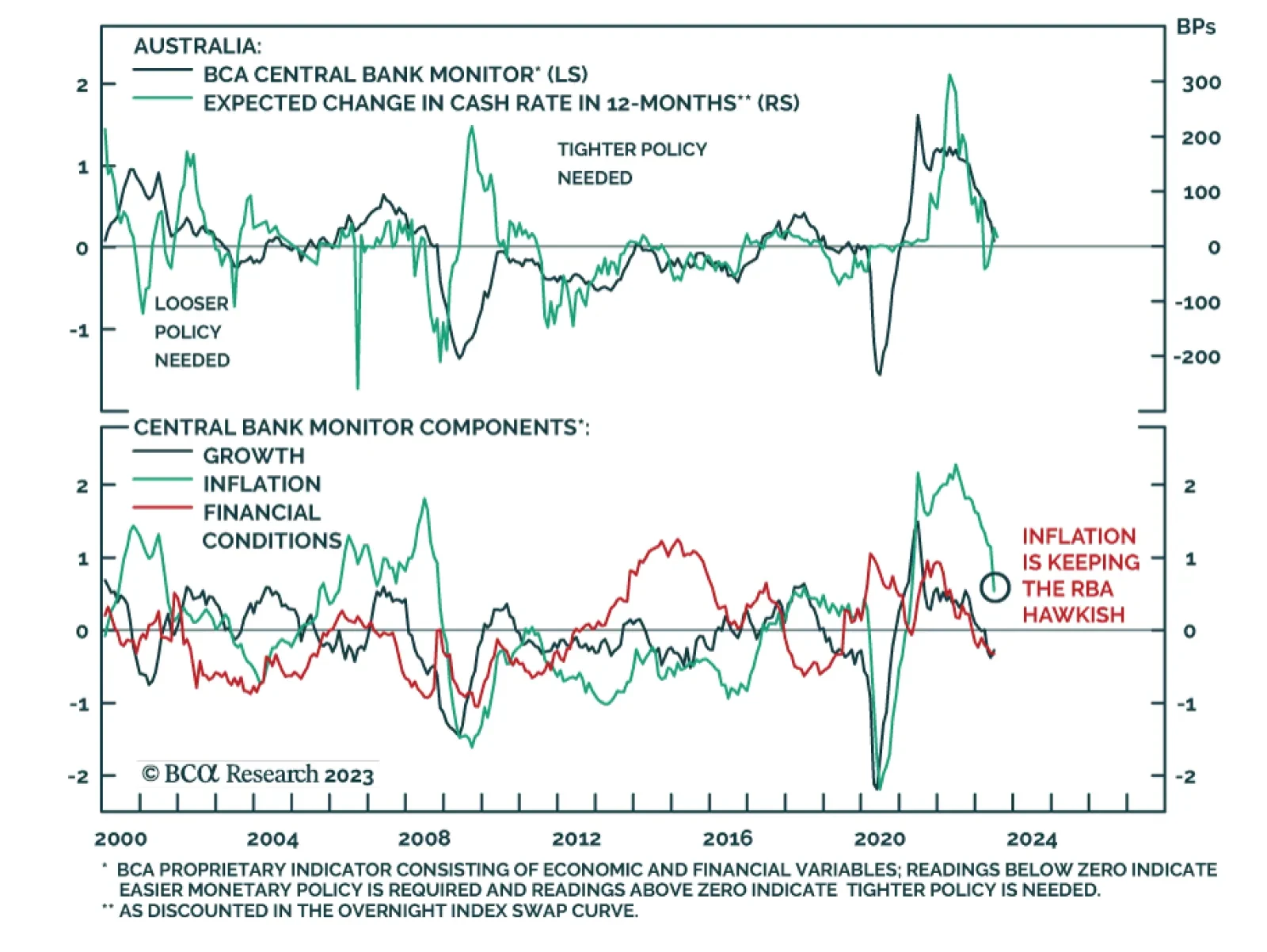

The AUD was the worst performing currency on Tuesday after the Reserve Bank of Australia kept its cash rate target unchanged at 4.1% for the third consecutive month. In particular, outgoing Governor Philip Lowe underscored that…

In this report, we review our FX trade recommendations with suggestions on how to position for the next few months.

The Reserve Bank of Australia kept interest rates on hold at 4.1% on Tuesday, surprising expectations of a 25bps increase. Governor Philip Lowe’s statement underscores that the decision “will provide further time…