This report looks at the latest developments in G10 economies and implications for bond and FX market strategy.

In this monthly review, we give our take on where bond yields and the dollar are headed. This is within the lens of revisiting our fundamental indicators.

In this week's report, we review the impact of political developments, as well as incoming fundamental data, on our positioning.

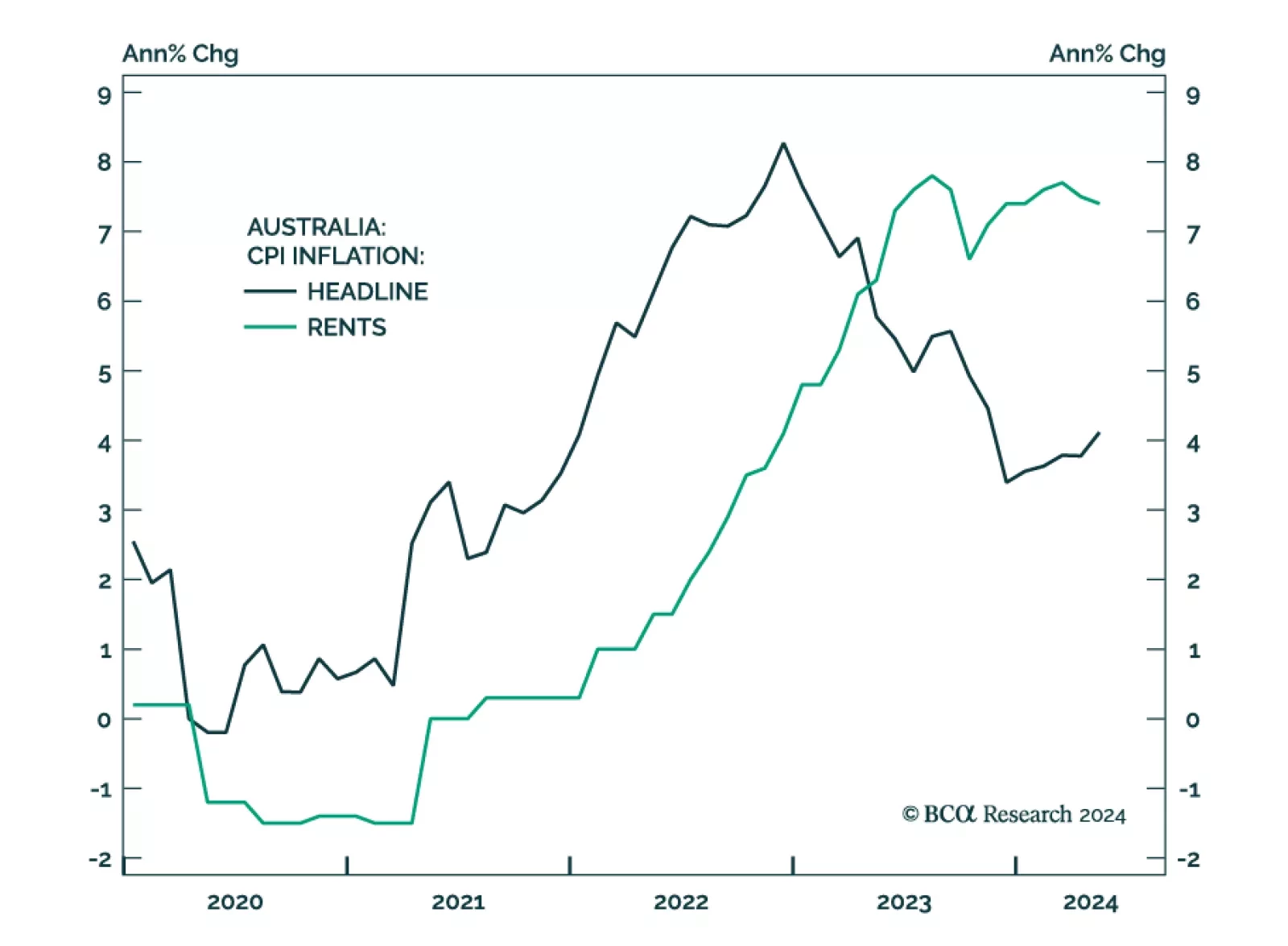

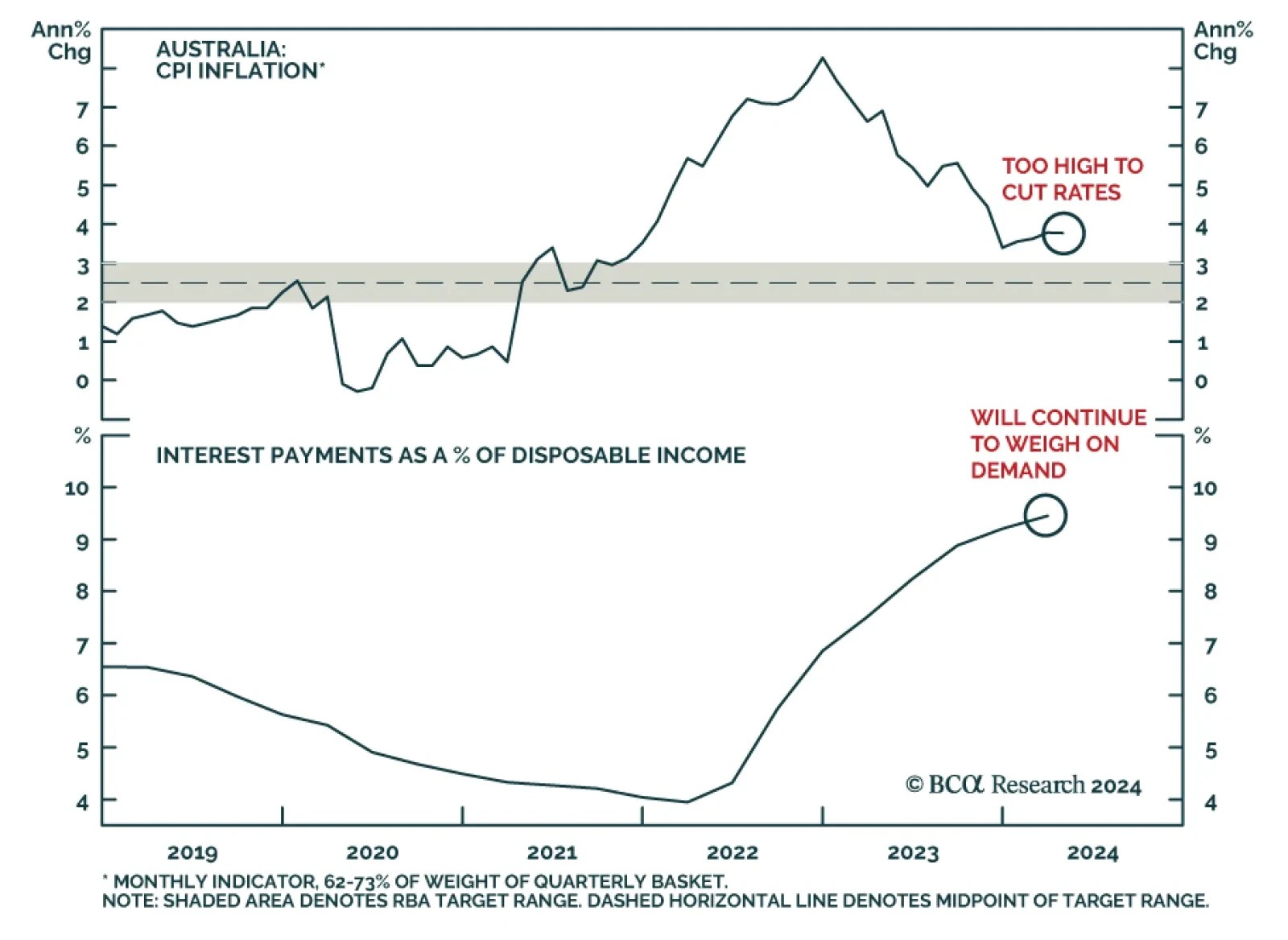

Australia’s inflation for May was released on Tuesday. Annual headline CPI increased from 3.6% in April to 4%, outpacing expectations of 3.8%. Trimmed-mean inflation also increased from 4.1% to 4.4%. Individual…

The Reserve Bank of Australia kept its cash rate at 4.35% at its policy meeting on Tuesday, in line with market expectations. Australia’s monthly measure of headline inflation came in at 3.6% in April, still considerably…

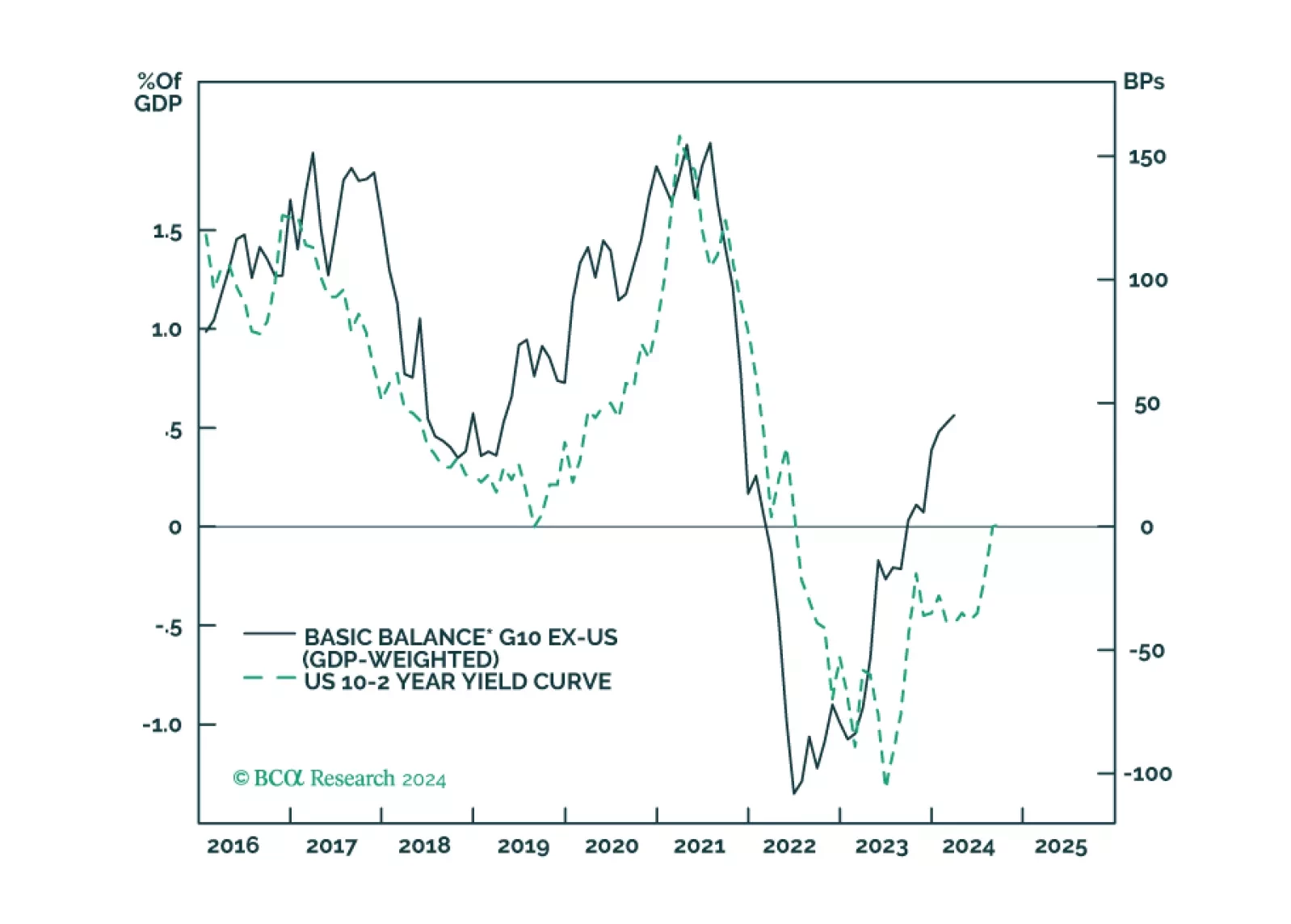

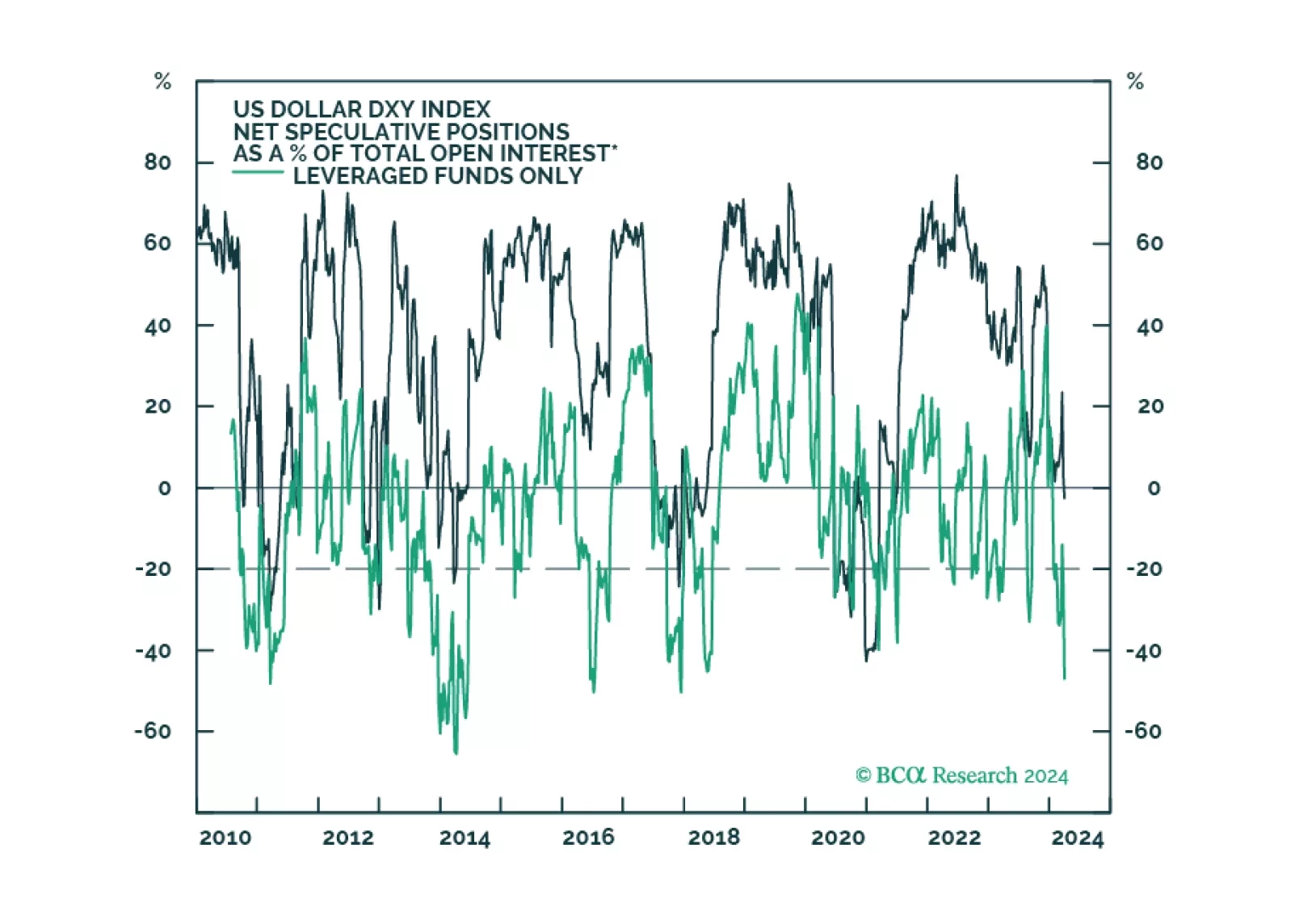

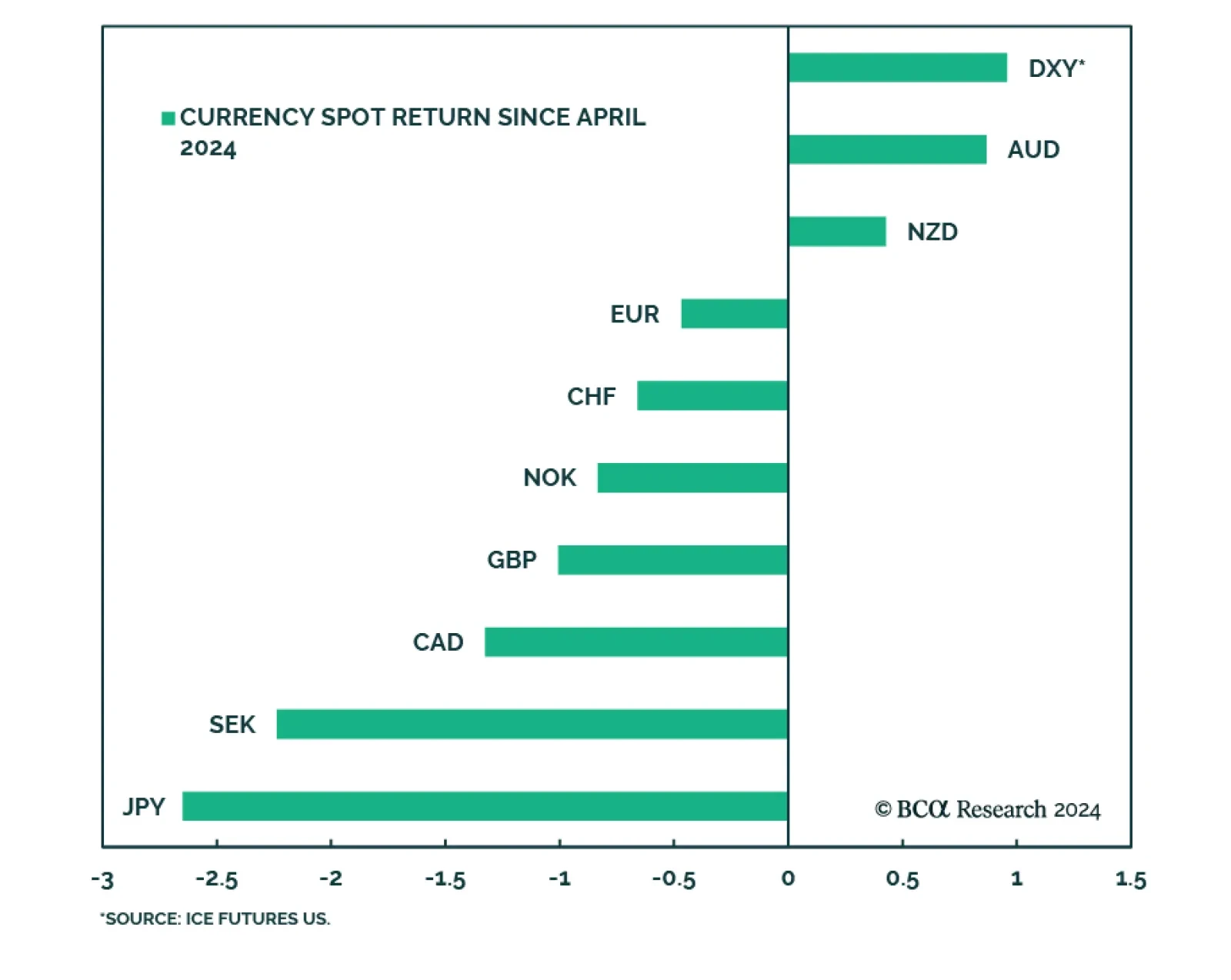

According to BCA Research’s Foreign Exchange Strategy service, the improvement in global economic data will put some upward pressure on yields while pressuring the dollar lower (as a counter-cyclical currency). When it…

In this report, we review our trade recommendations based on incoming data in the last month.

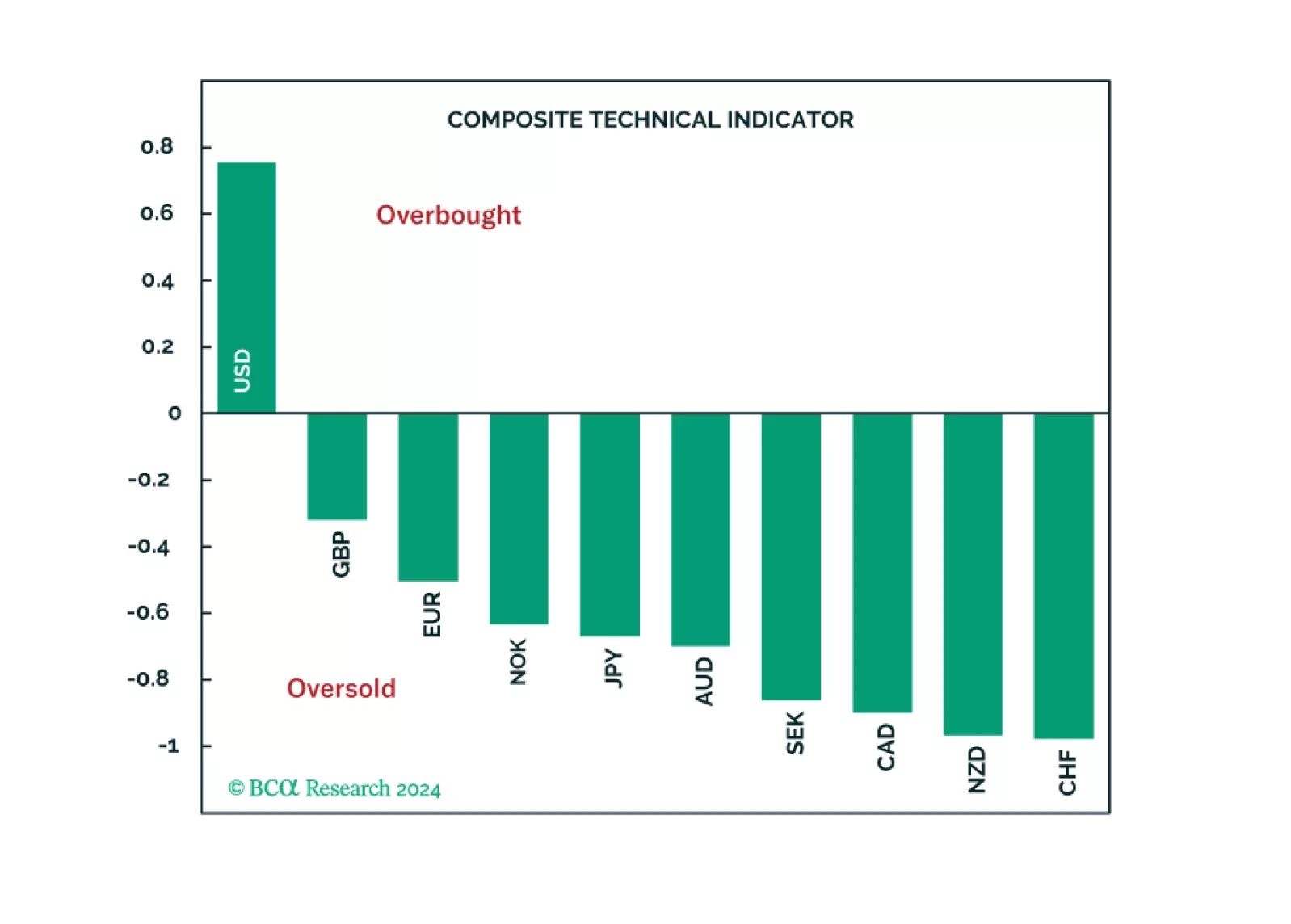

In this report, we review what our technical indicators are telling us about the G10 currencies.

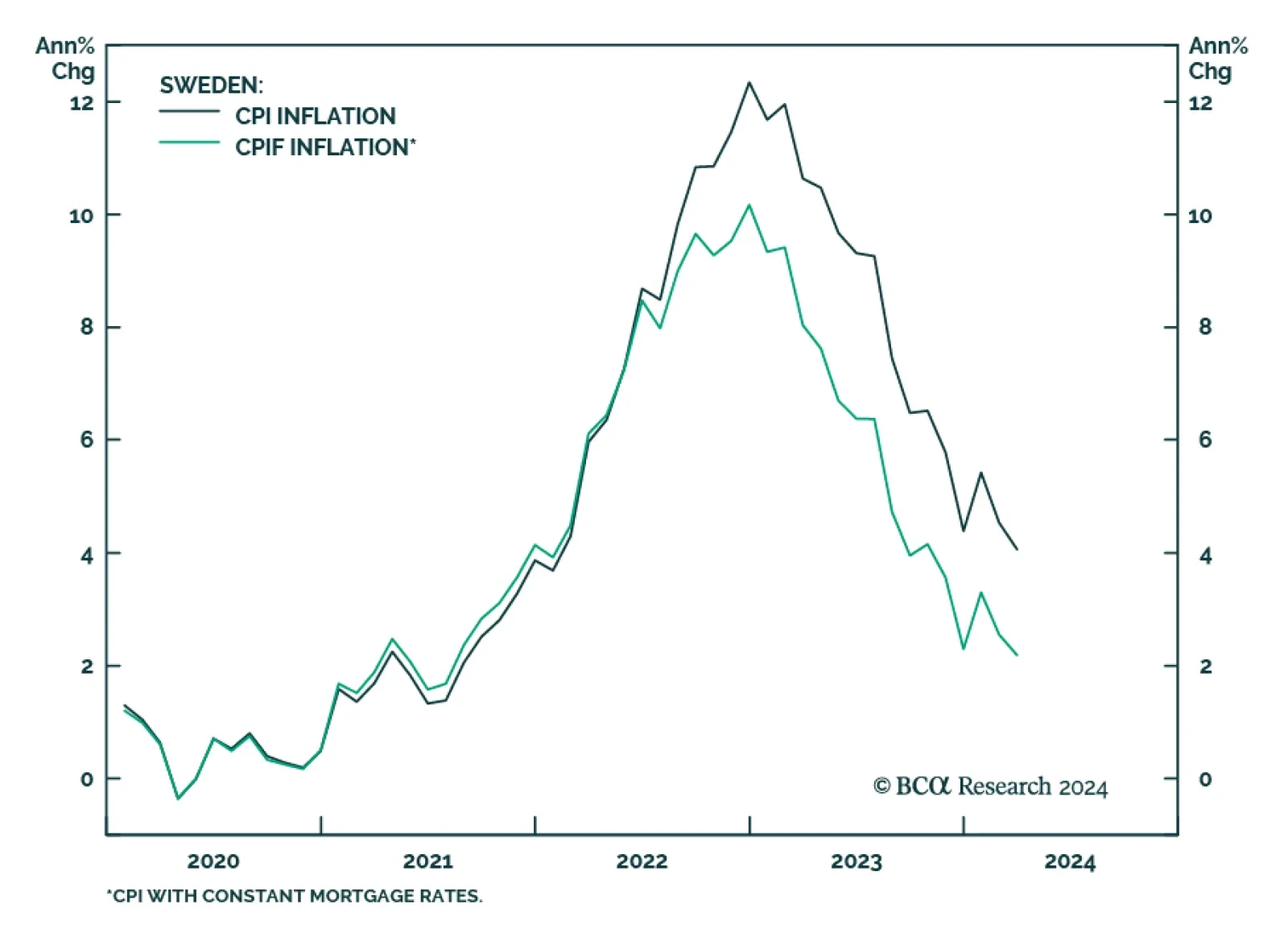

Headline inflation in Sweden came in at 4.1% in March. Lower food prices as well as lower inflation for recreation and culture were the main contributors to the drop. The biggest positive contributor was housing due to higher…

In this report, we review our trade recommendations based on incoming data in the last month.