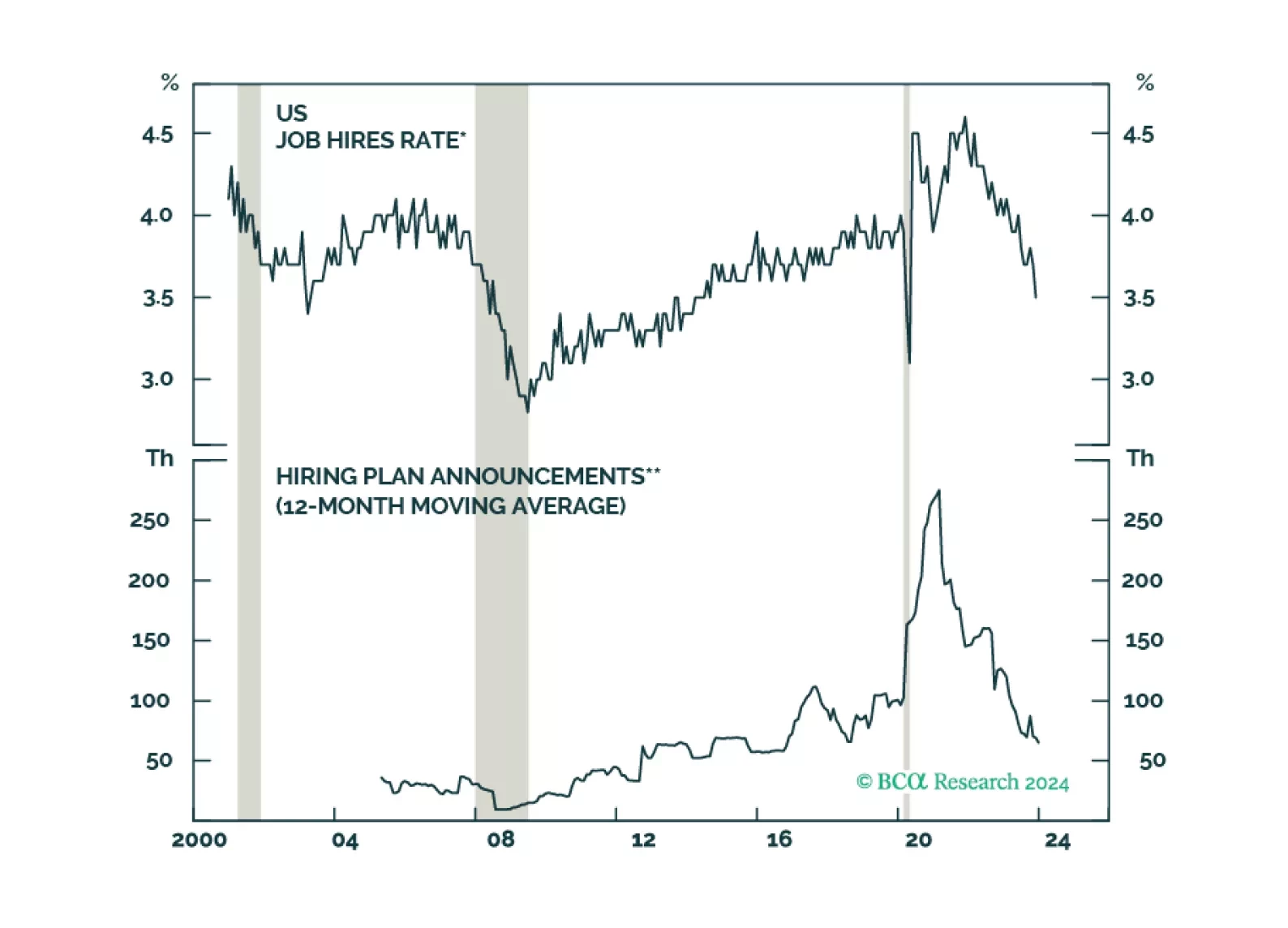

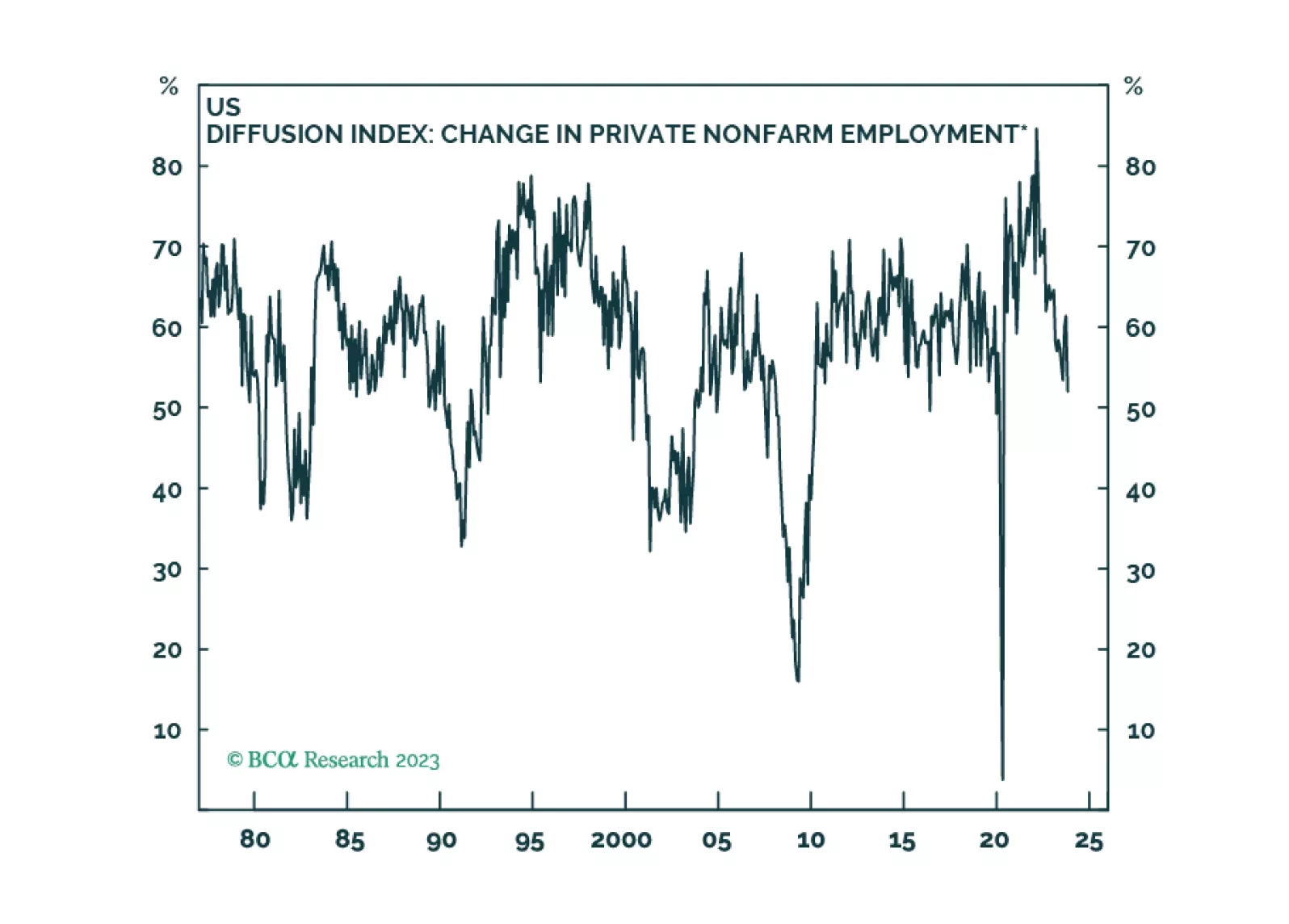

Investors have taken comfort in the fact that unemployment has remained low in the major economies. But underneath the surface, there are clear signs that labor demand is weakening. The clock keeps ticking towards our H2 2024…

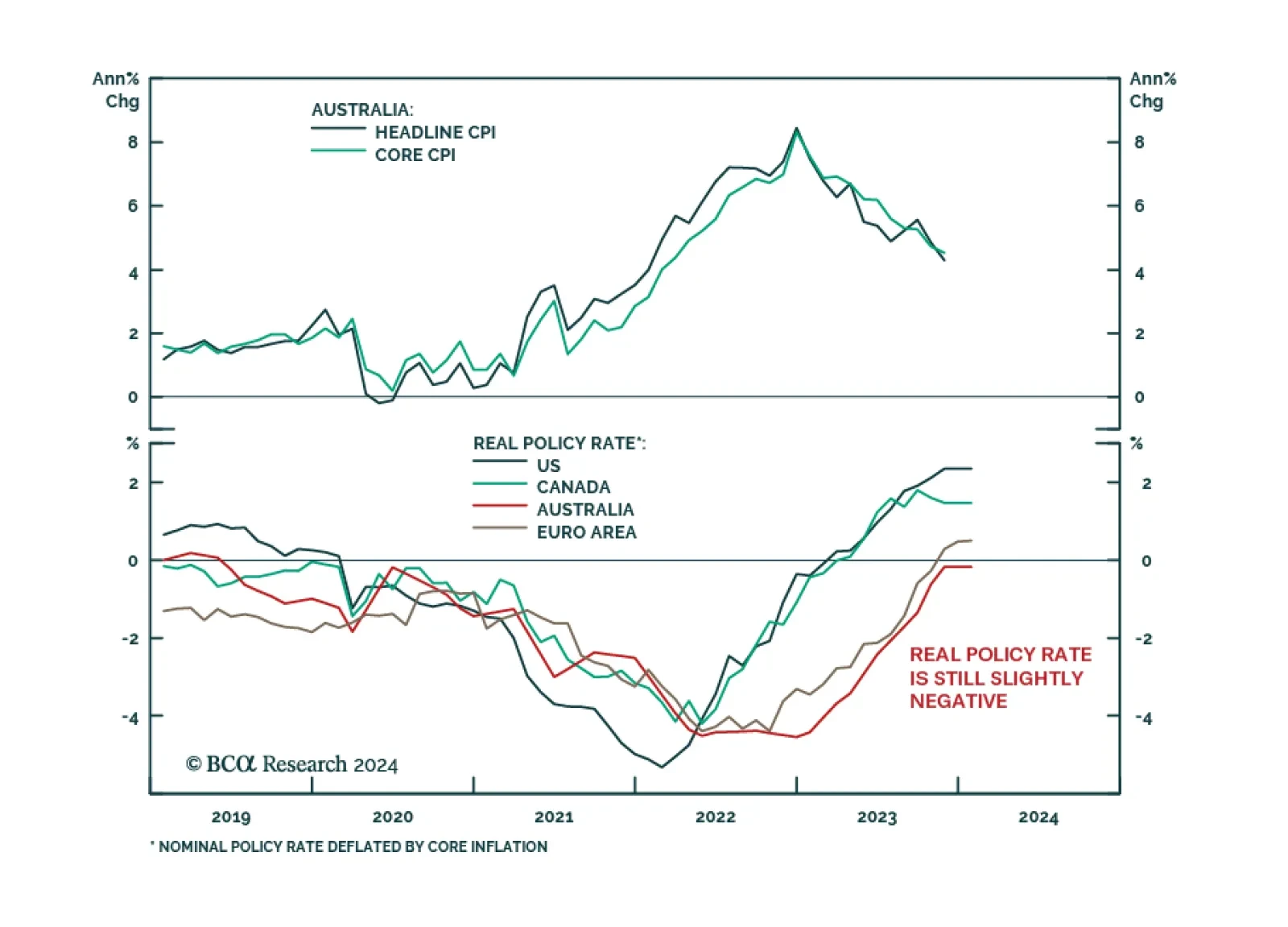

Australian CPI inflation fell from 4.9% y/y to a 22-month low of 4.3% y/y in November – slightly below expectations of 4.4%. Underlying measures of core inflation also indicate that price pressures eased in November. The…

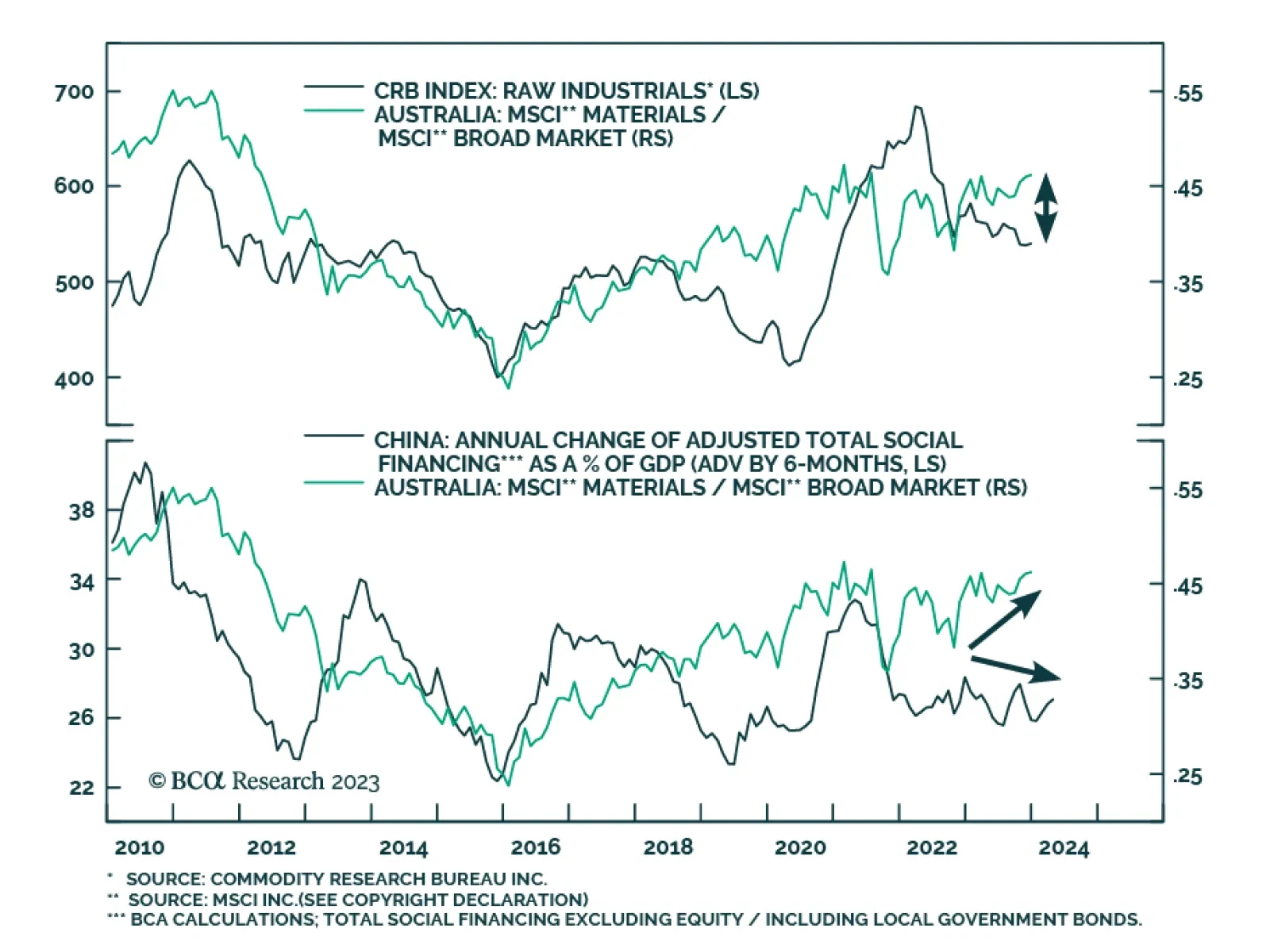

Australian materials stocks have been outperforming the country’s broad index since mid-August, undoing the sector’s relative losses of the prior months, and bringing the year-to-date gain to 7.7% in absolute terms…

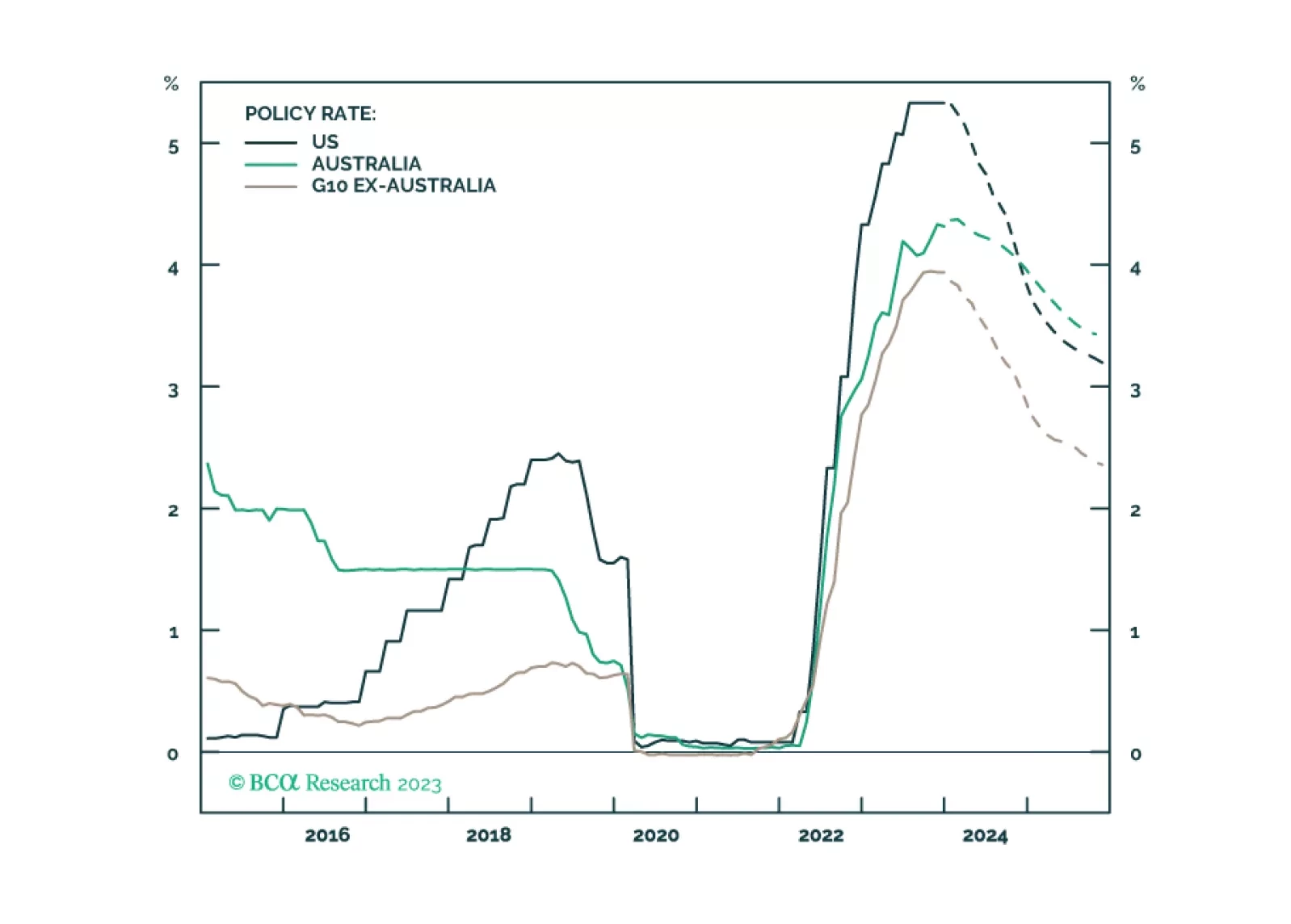

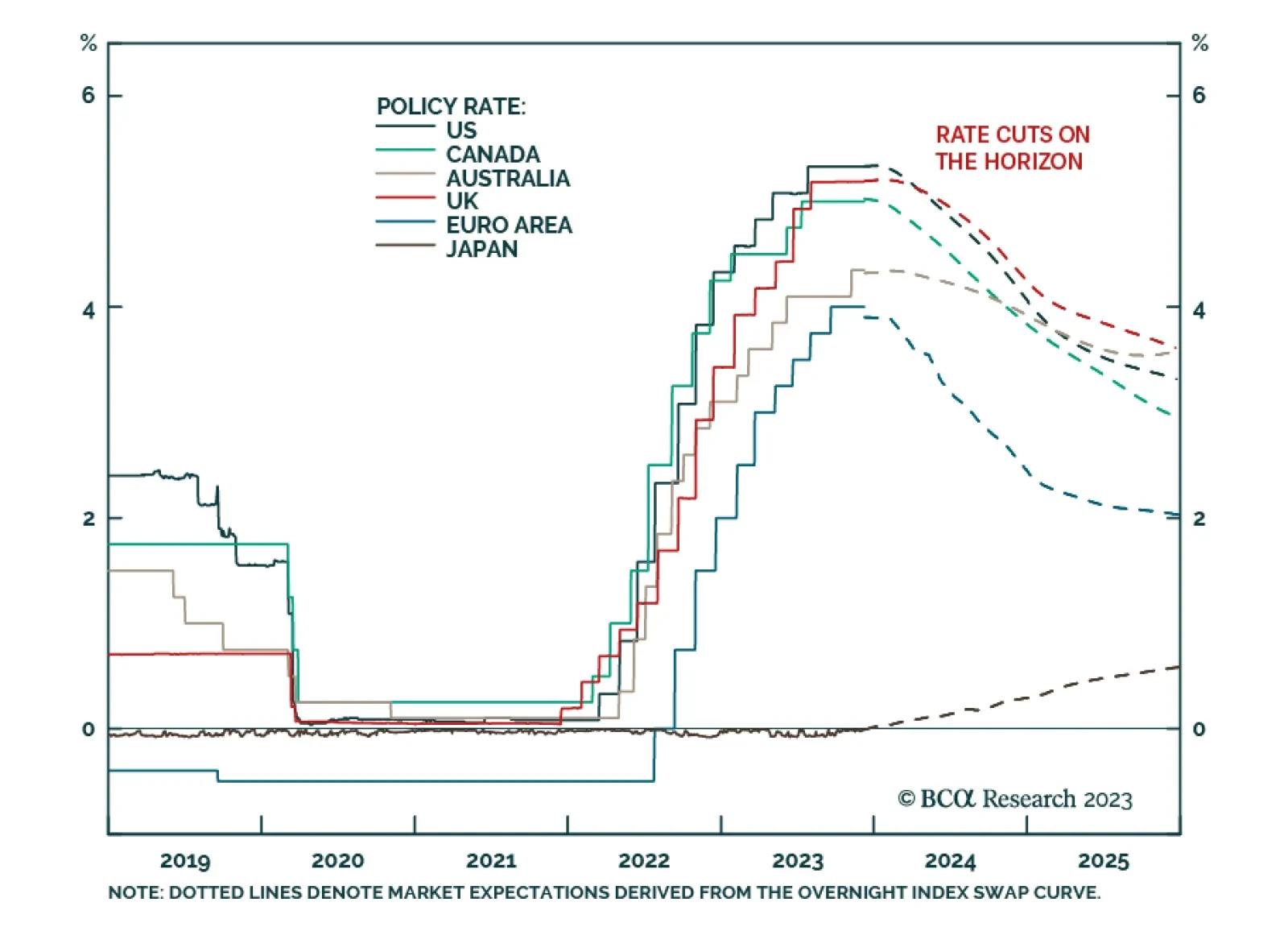

Multiple major DM central banks are scheduled to decide on monetary policy this week. The US Fed will meet on Wednesday, followed by the ECB, BoE, and Norges Bank on Thursday. It comes after the BoC and RBA both opted to keep…

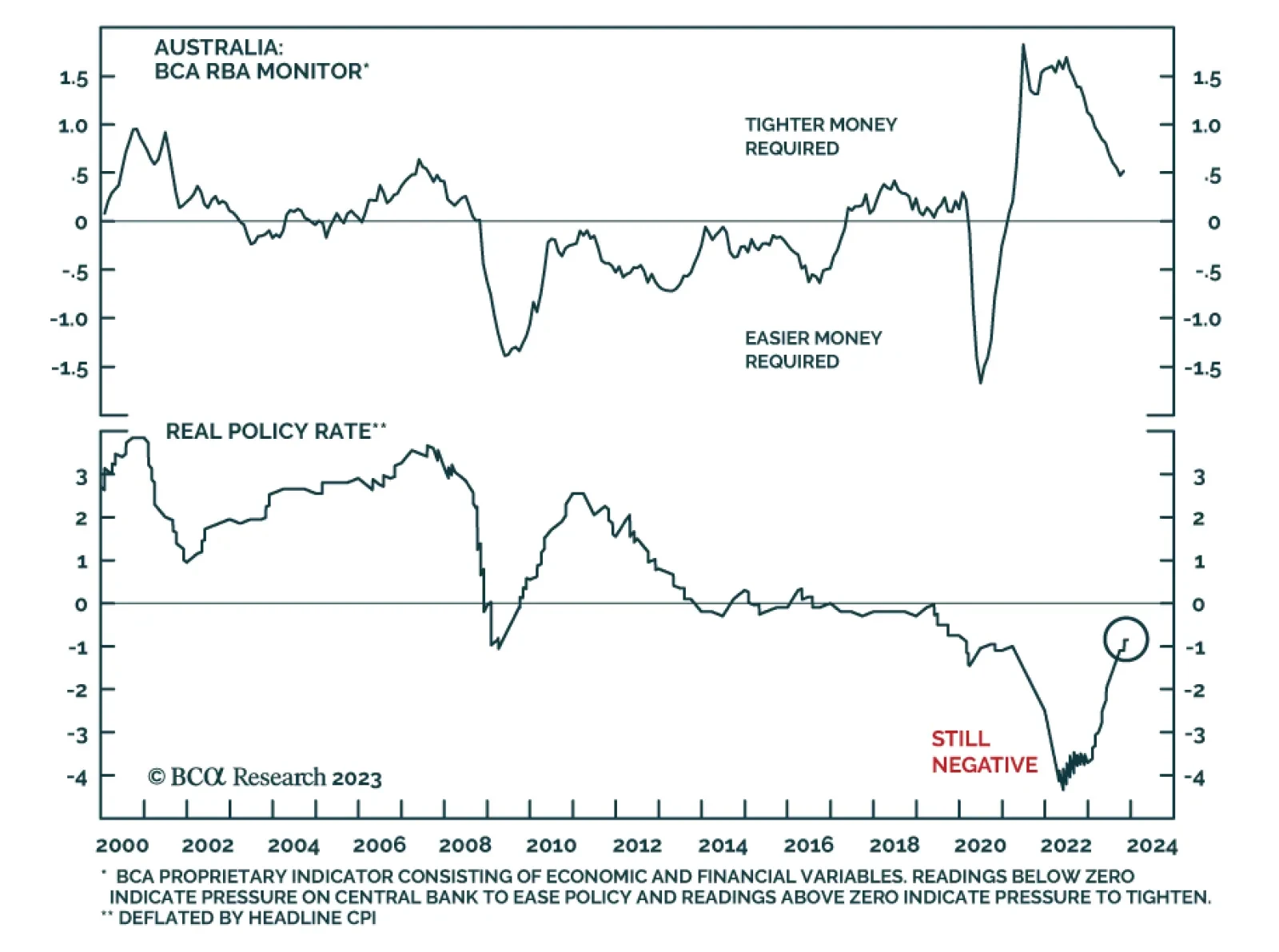

The Reserve Bank of Australia (RBA) kept the cash rate unchanged at 4.35% on Tuesday, in line with expectations. In her post-meeting statement, Governor Michele Bullock revealed that economic developments since the RBA’s…

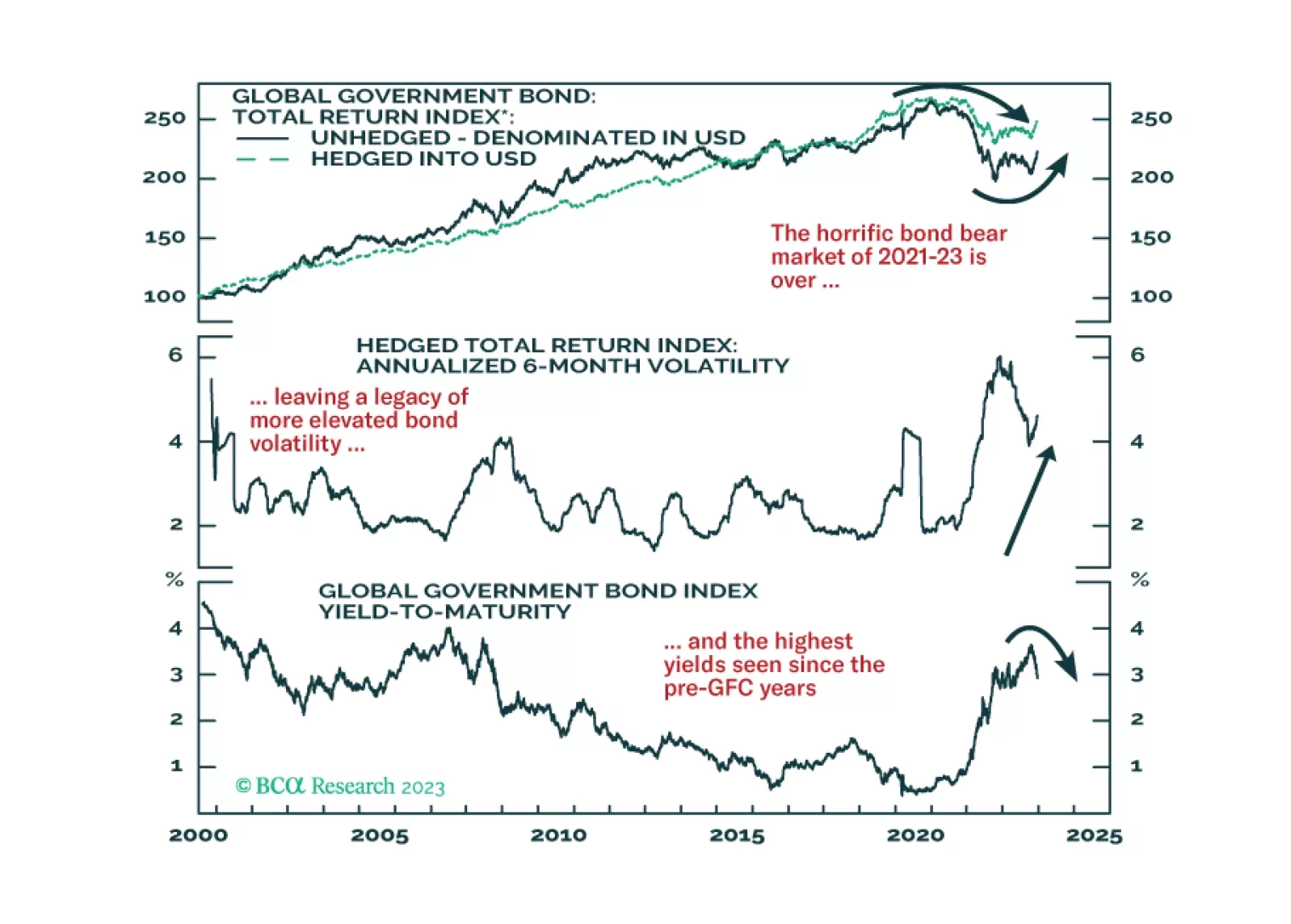

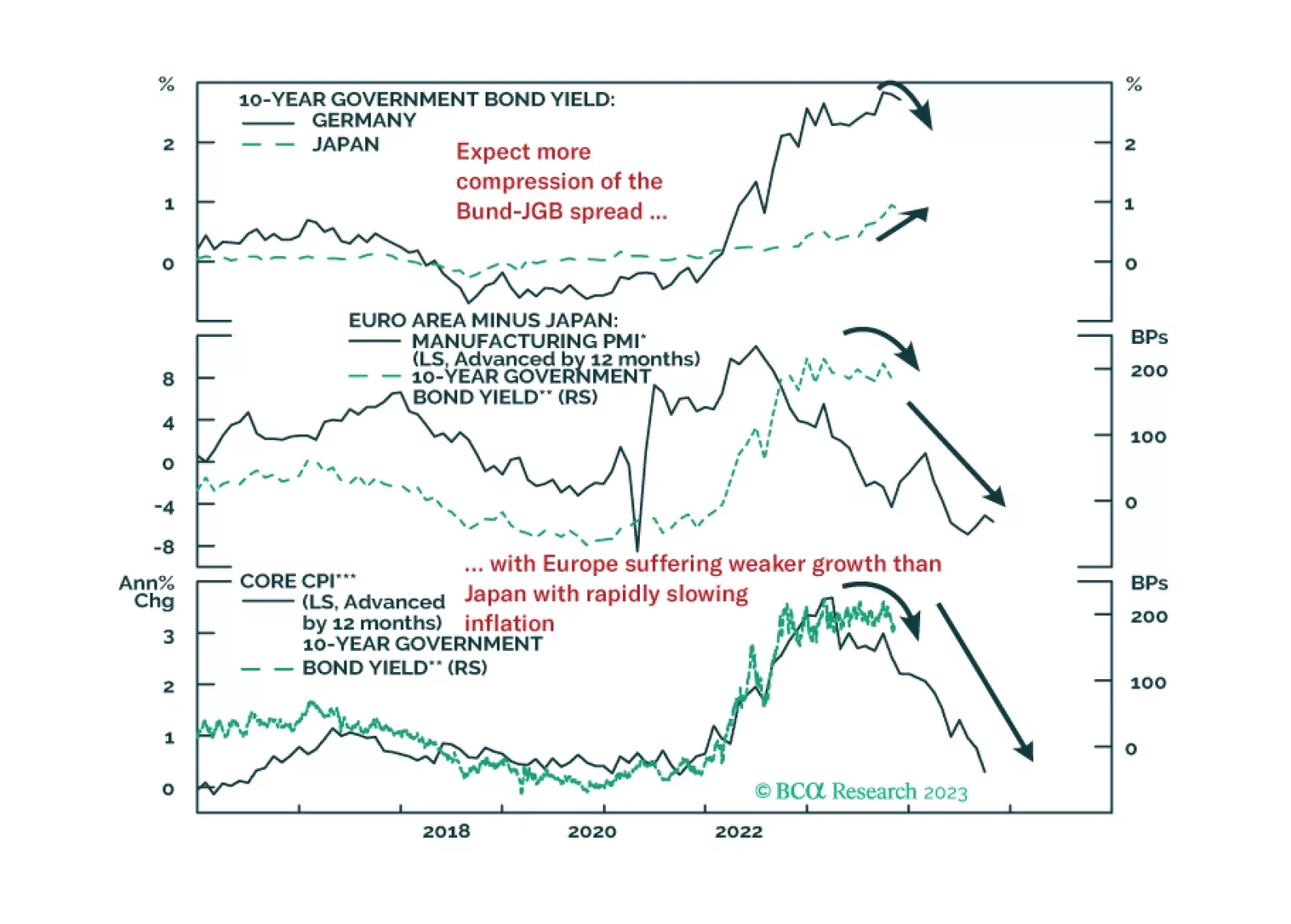

In this Insight, we review the performance and rationale for our current set of tactical fixed income trade recommendations. Our highest conviction positions also happen to be our most successful trades: positioning for a narrowing…

Labor markets are softening in most developed economies, as is usually the case in the lead-up to recessions. Our base case is that the global recession will begin in the second half of 2024, but we will be monitoring our MacroQuant…

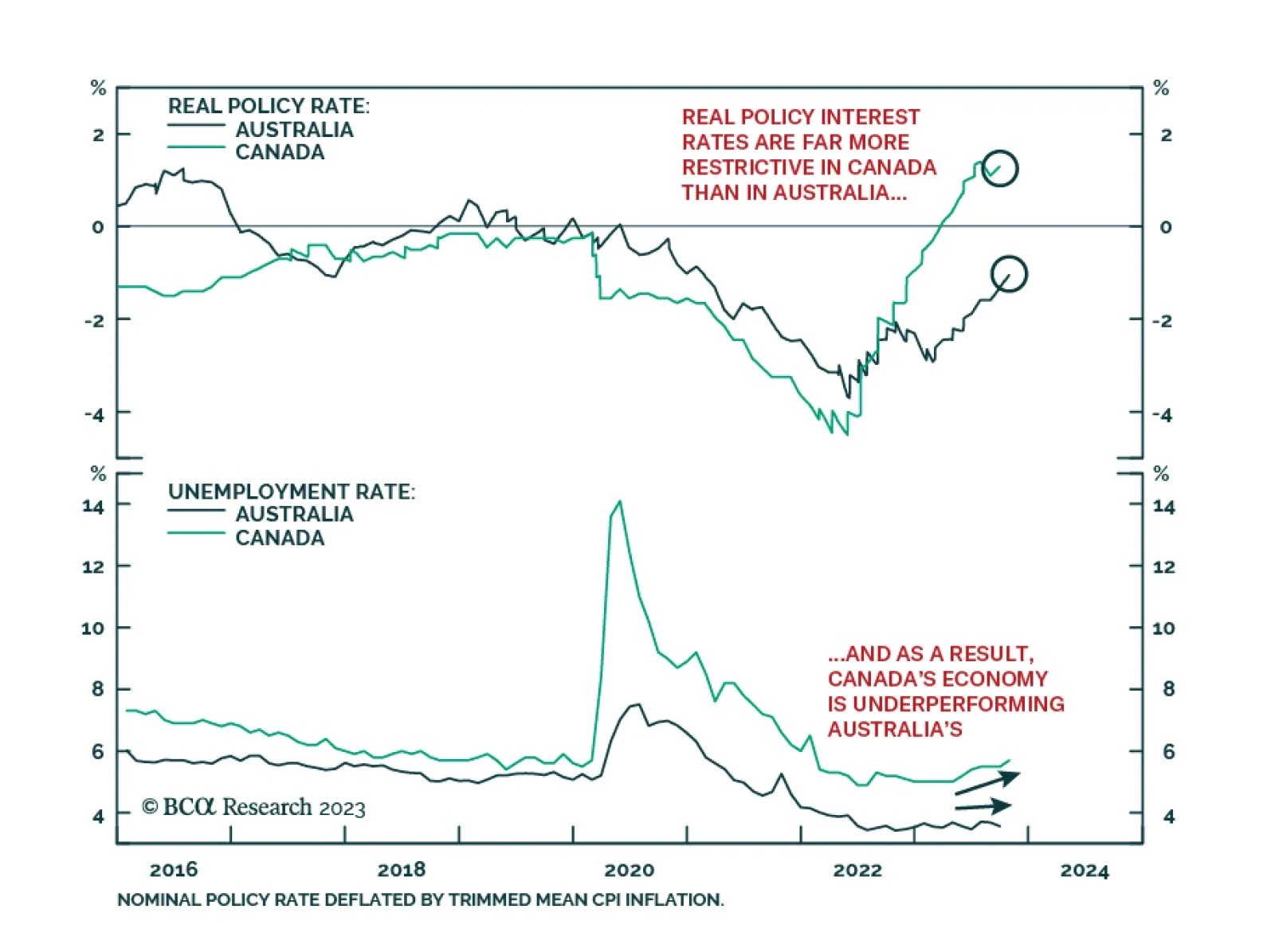

The economies of Canada and Australia share many similarities. Both nations are major commodity exporters, but with overvalued housing markets and highly indebted consumers. Lately, however, a notable gap has appeared…