Highlights The dollar will continue to rally despite the trade truce agreed upon last weekend between U.S. President Donald Trump and China President Xi Jinping. Not only is this truce far from a permanent deal, but global growth…

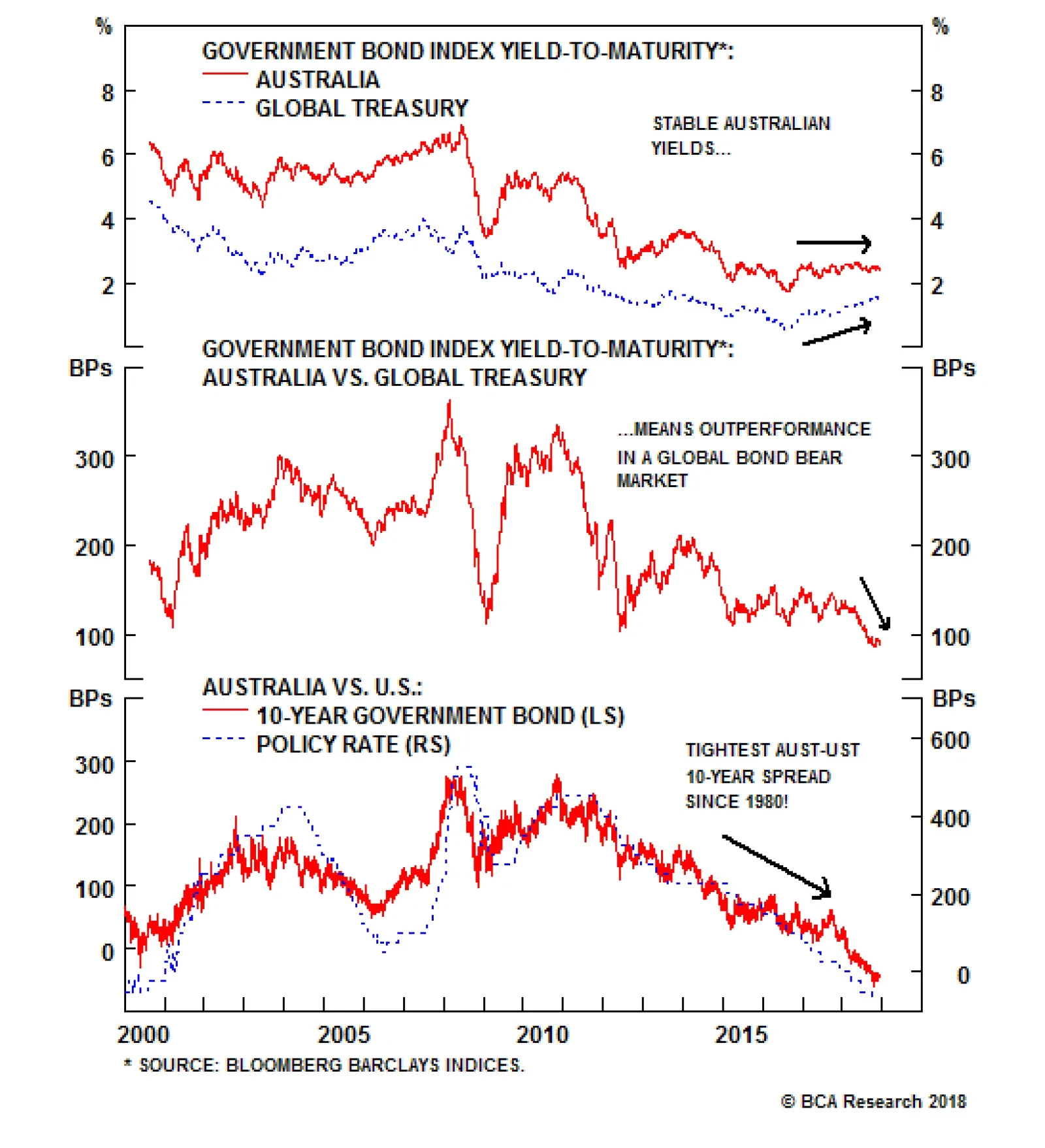

Our fixed income strategists have maintained an overweight stance on Australian government bonds since the end of 2017. That high-conviction view stemmed from their expectation that the Reserve Bank of Australia (RBA) would keep…

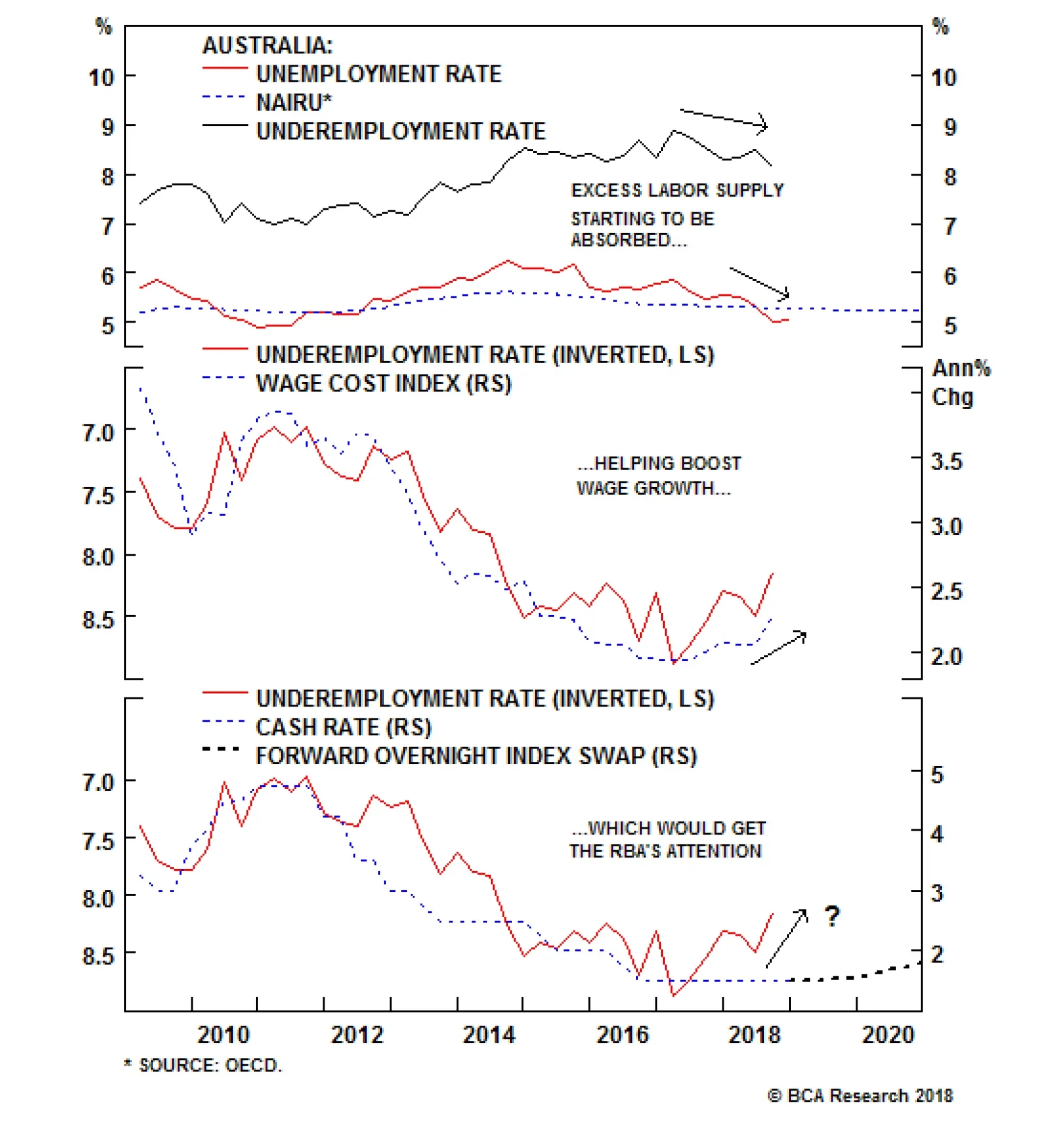

BCA’s bullish stance on Aussie government bonds remains appropriate until there is more decisive evidence pointing to convergence of Australian growth and inflation to the other major economies. Labor market dynamics will…

Dear Client, Early next week, we will be sending you our BCA Outlook 2019 - our annual dialogue with the bearishly inclined Mr. X and his family. In this report, BCA editors will highlight the most impactful themes for the global…

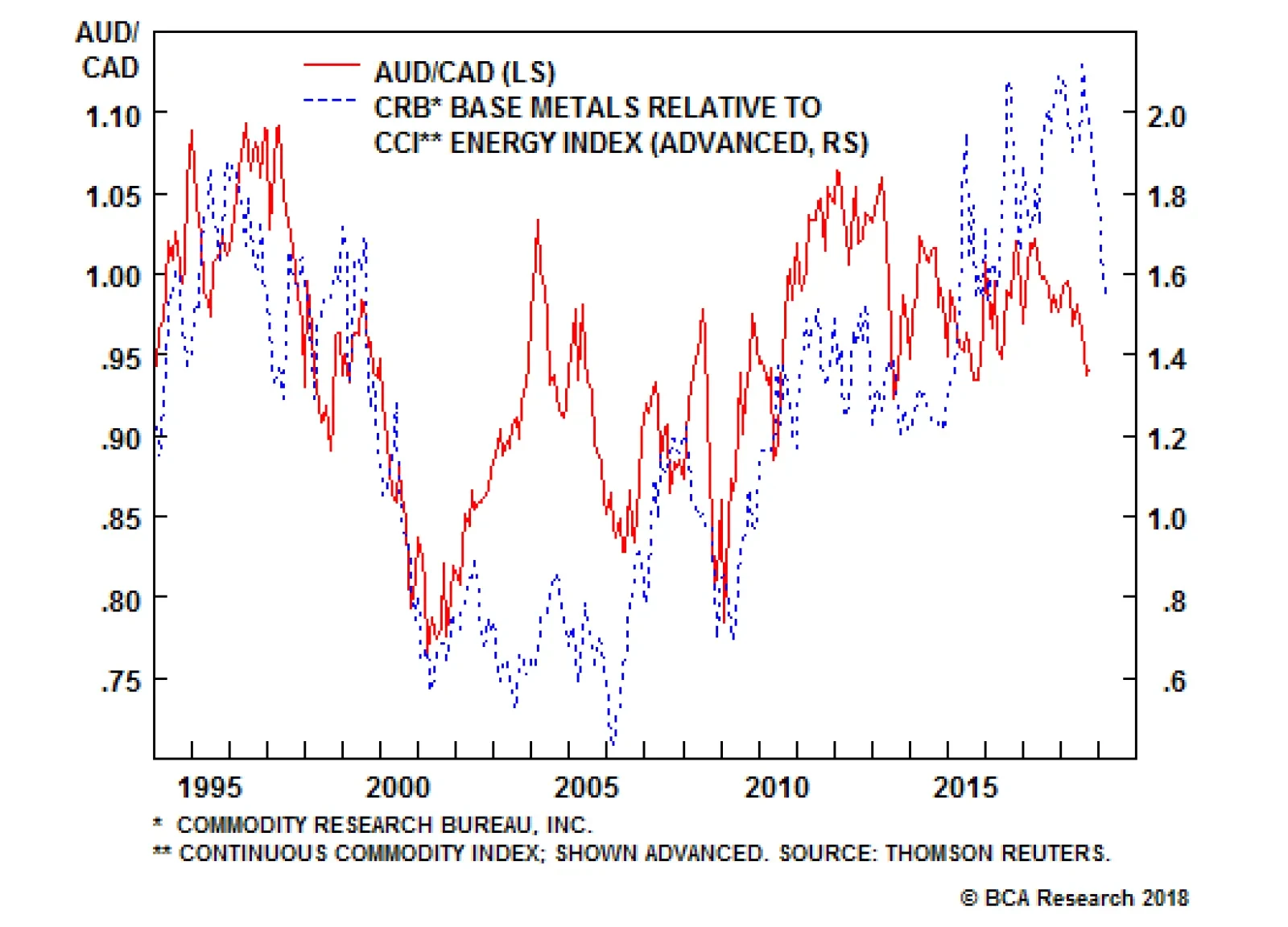

Our Global Investment Strategy team recommended this position past June as a means to benefit from potential China downside, and U.S. upside. A weaker yuan and Chinese economy will raise raw material costs to Chinese firms.…

Highlights We review last year's "Three Tantalizing Trades" and offer four additional ones: Trade #1: Long June 2019 Fed funds futures contract/short Dec 2020 Fed funds futures contract Trade #2: Long USD/CNY Trade #3…

Highlights In this Weekly Report, we present our semi-annual chartbook of the BCA Central Bank Monitors. The message now conveyed by the Monitors is that divergences between the cyclical pressures faced by the individual central banks…