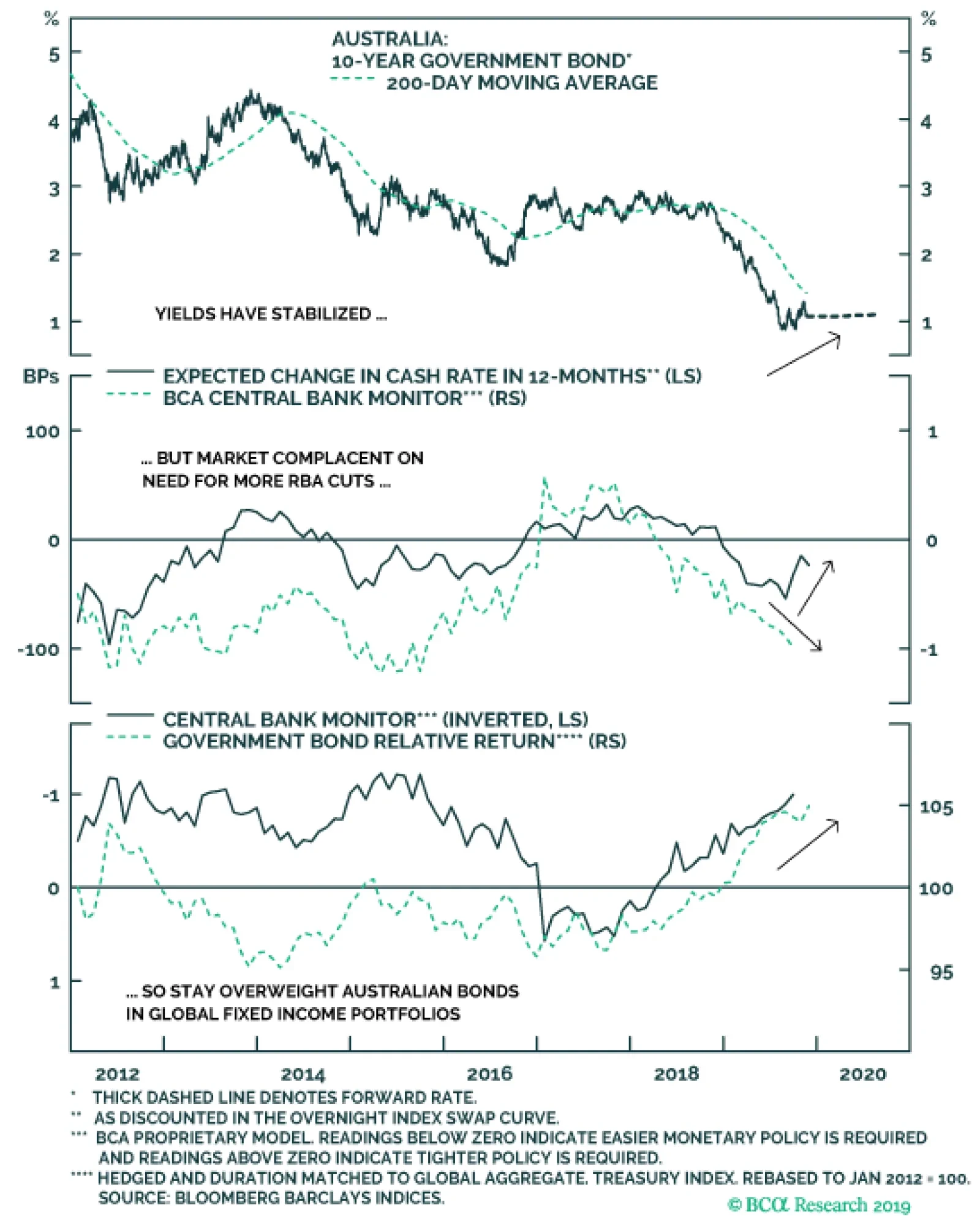

Australian sovereign debt is likely to outperform its global peers on a relative basis over the next 6-12 months. Despite signs that the global economy is starting to bottom out after the 2019 downturn, the momentum in…

Highlights Global High-Yield: The widening of US Caa-rated high-yield spreads is narrowly focused in Energy-related companies. The conditions for a spillover into the broader junk bond market (tight monetary policy, tightening lending…

Dear Client, In addition to this short weekly report, you will also receive our 2020 outlook, published by the Bank Credit Analyst. Next week, I will be on the road visiting clients in South Africa. I hope to report my discussions and…

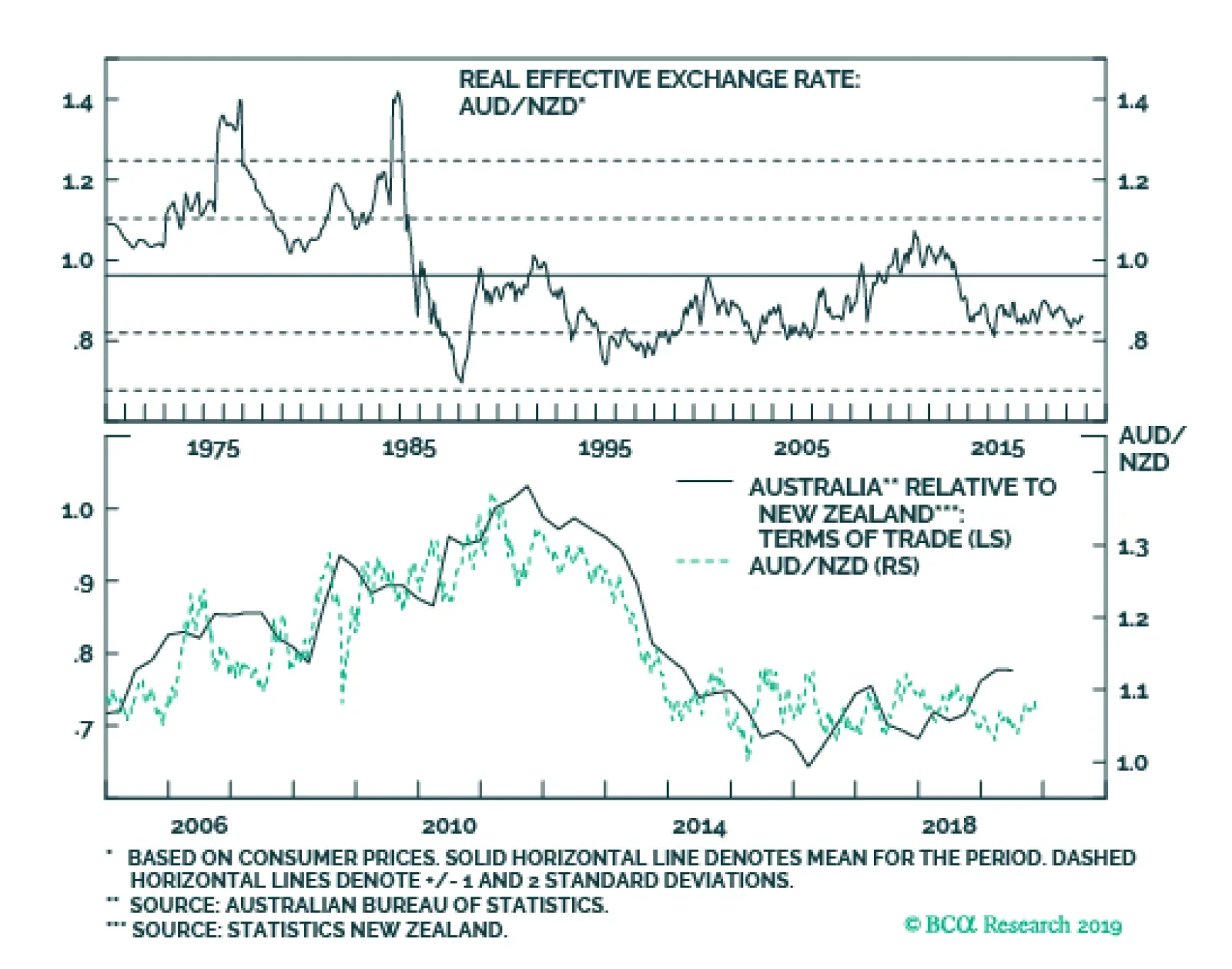

We are positive on the kiwi but believe it will underperform the AUD. First, the AUD/NZD is cheap on a real effective exchange rate basis. Meanwhile, a more pronounced downturn in Aussie house prices has allowed some cleansing of…

Highlights A few indicators suggest that global growth will soon bottom. The bottoming process could prove volatile, but the duration of the slowdown suggests a V-shaped rather than U-shaped recovery. The dollar should weaken as…

Highlights Equities & Bonds: The accelerating upward momentum of global equities – the ultimate “leading economic indicator” – suggests that the current rise in global bond yields can continue. Maintain…

Highlights In this Weekly Report, we present our semi-annual chartbook of the BCA Central Bank Monitors. All of the Monitors are now below the zero line, indicating a growing need to ease global monetary policy (Chart of the Week).…

Highlights Duration: Global manufacturing growth will rebound near the end of this year. Much like in 2016, this will result in higher global bond yields on a 12-month horizon. Investors should keep portfolio duration close to…