Highlights The elevated uncertainty about global growth stemming from the COVID-19 virus in China has not only made investors more anxious, but central bankers as well. This means that, only six weeks into the year, policymakers may…

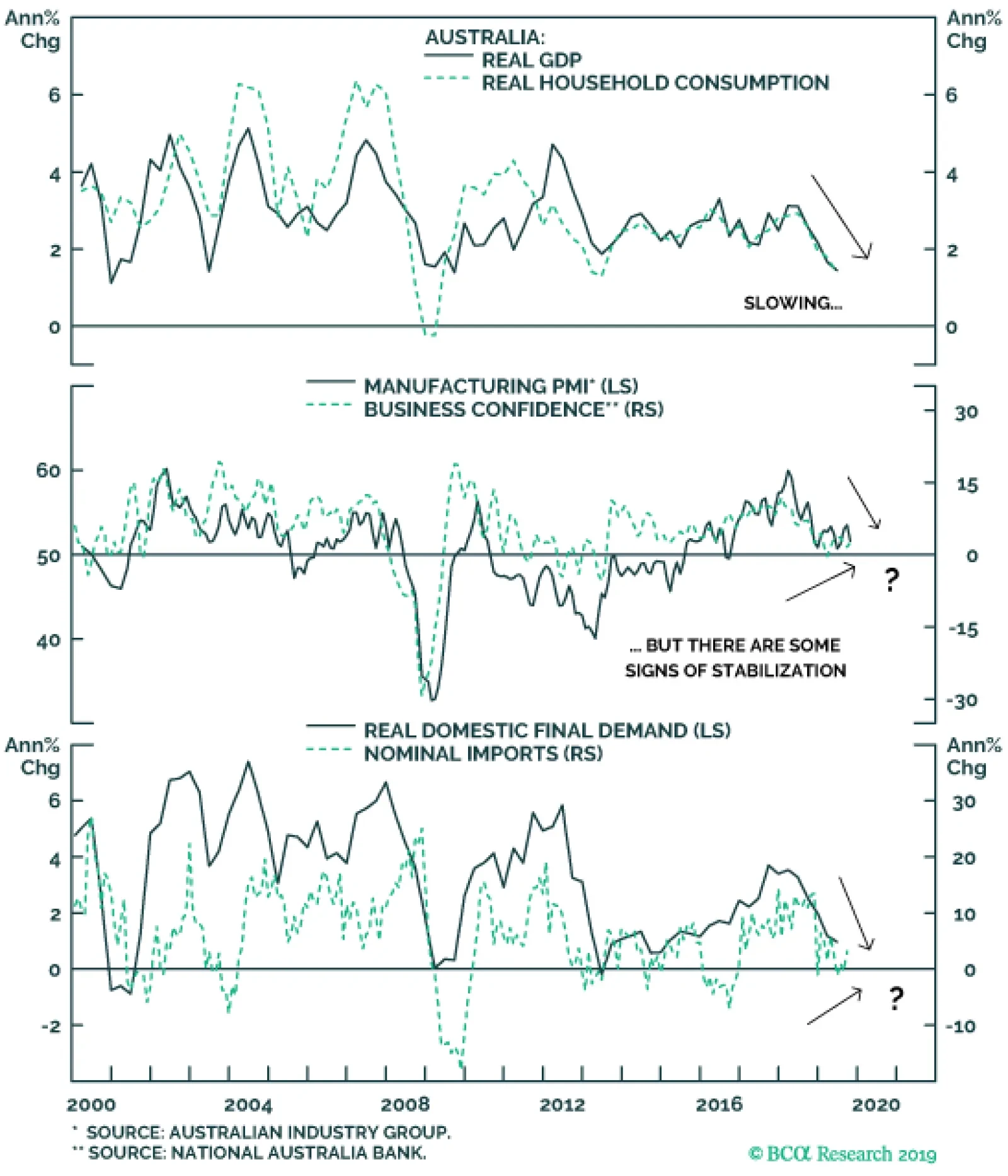

The latest RBA minutes revealed a dovish tilt at the February 5 meeting. Domestically, household consumption was a major source of concern. Combined with the bush fires and China slowdown, the outlook for near-term growth was…

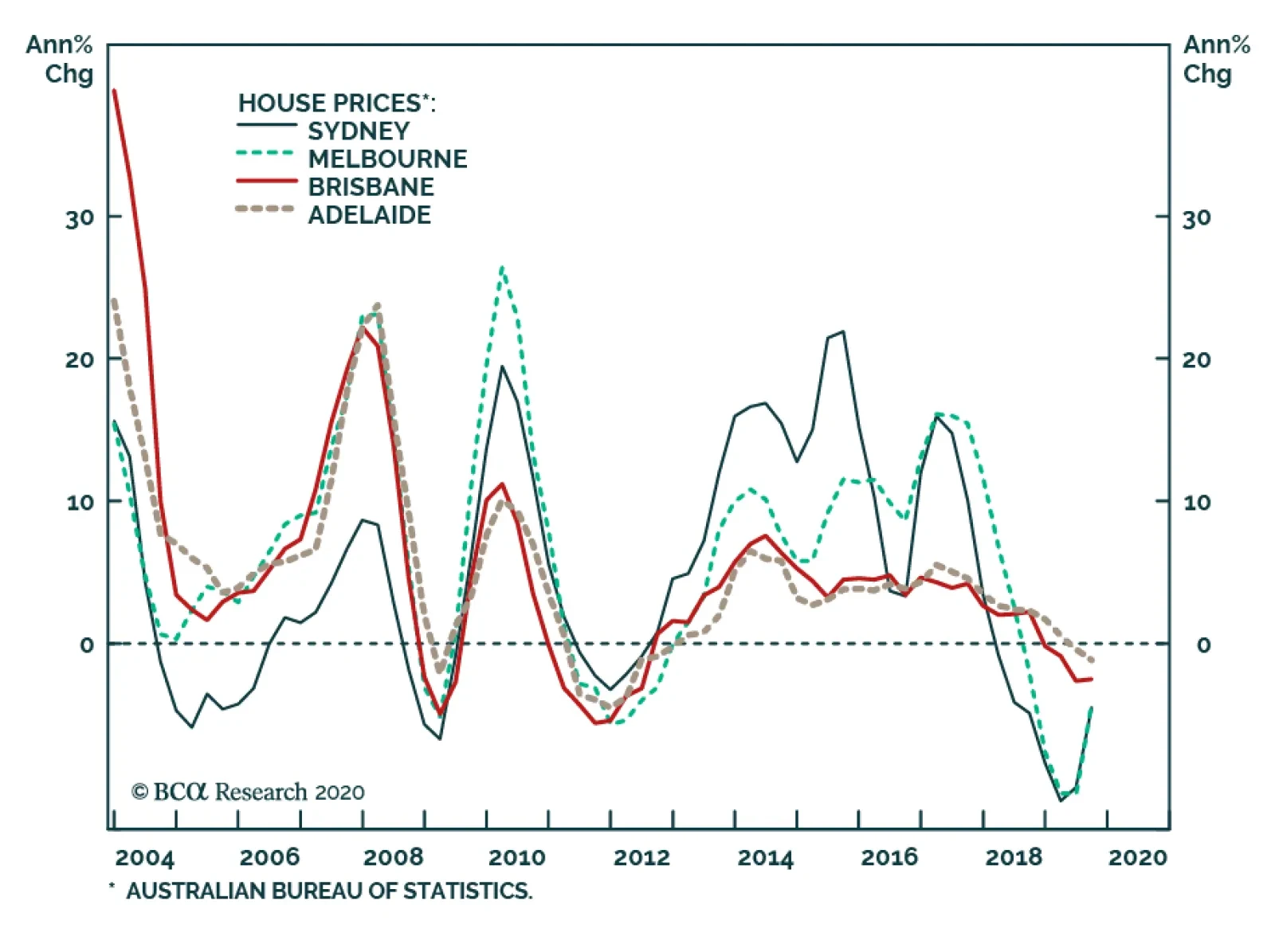

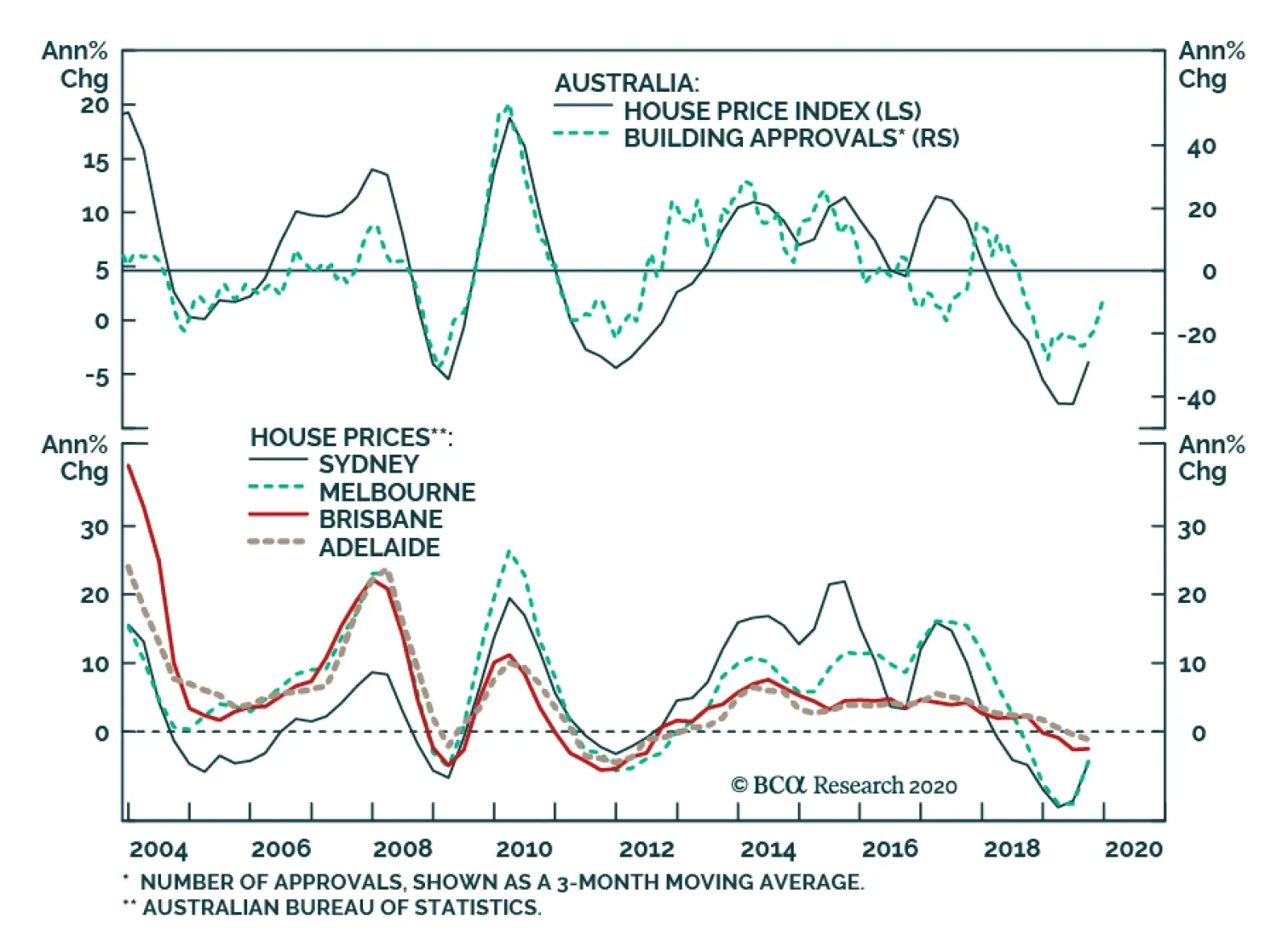

Australia’s economy has suffered a rocky period, hit by wildfires, slowing global growth and a quickly receding domestic activity. While it could take a bit more time before the global economy becomes a tailwind for…

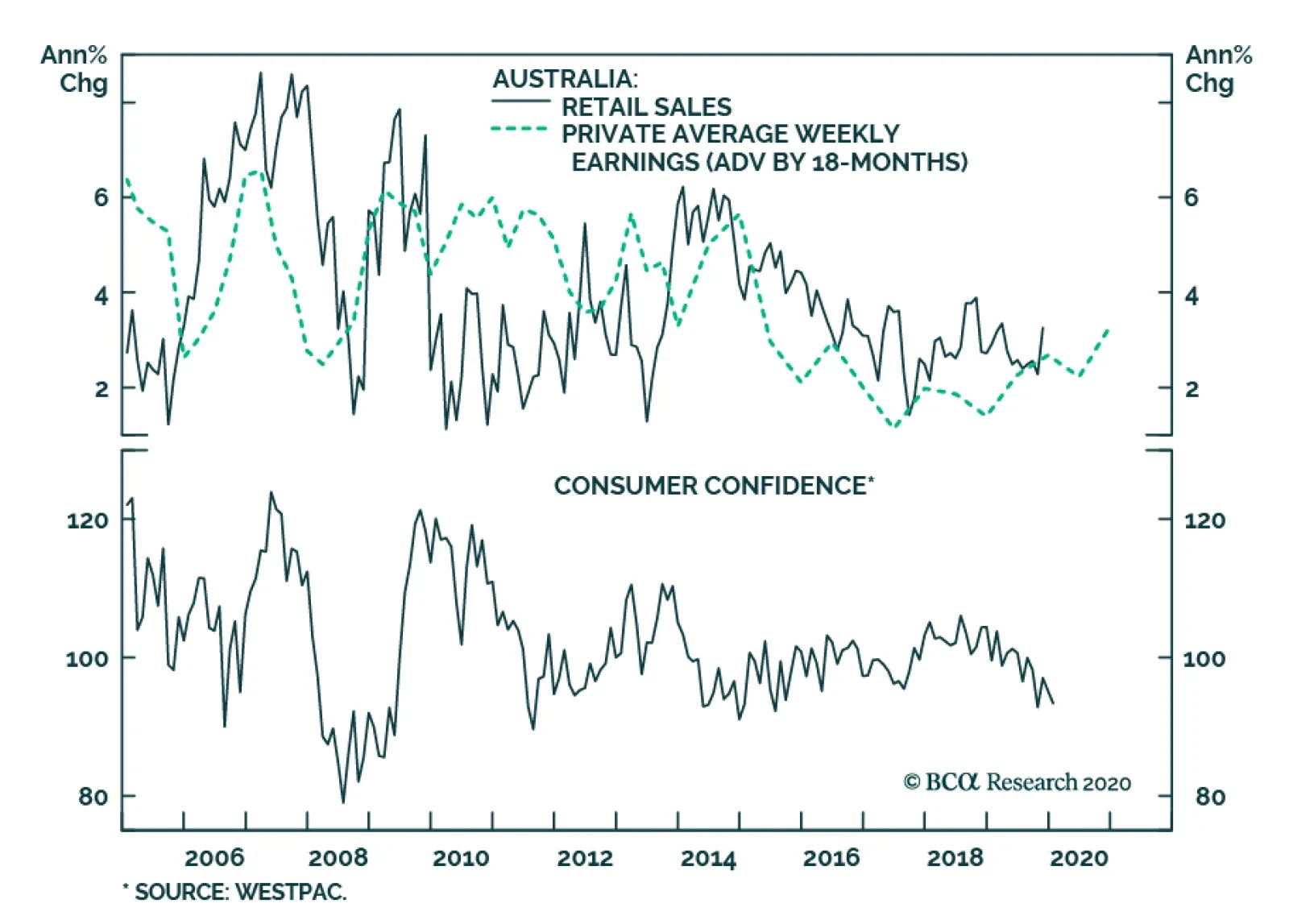

The implications of a stronger Australian housing market extend beyond construction activity. Australian retail sales have been very weak in 2019. However, wage growth has picked up, buoyed by healthy job creation and an…

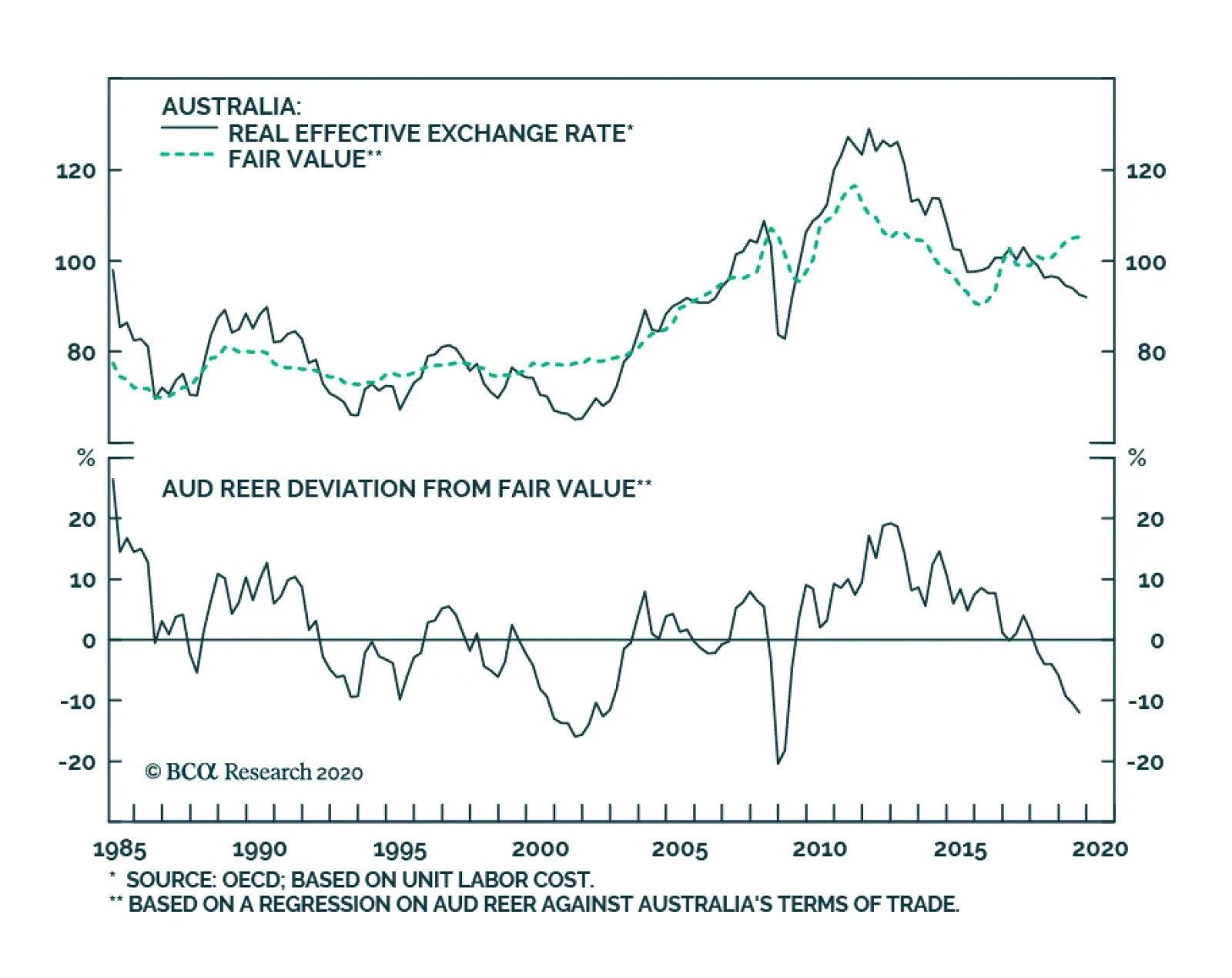

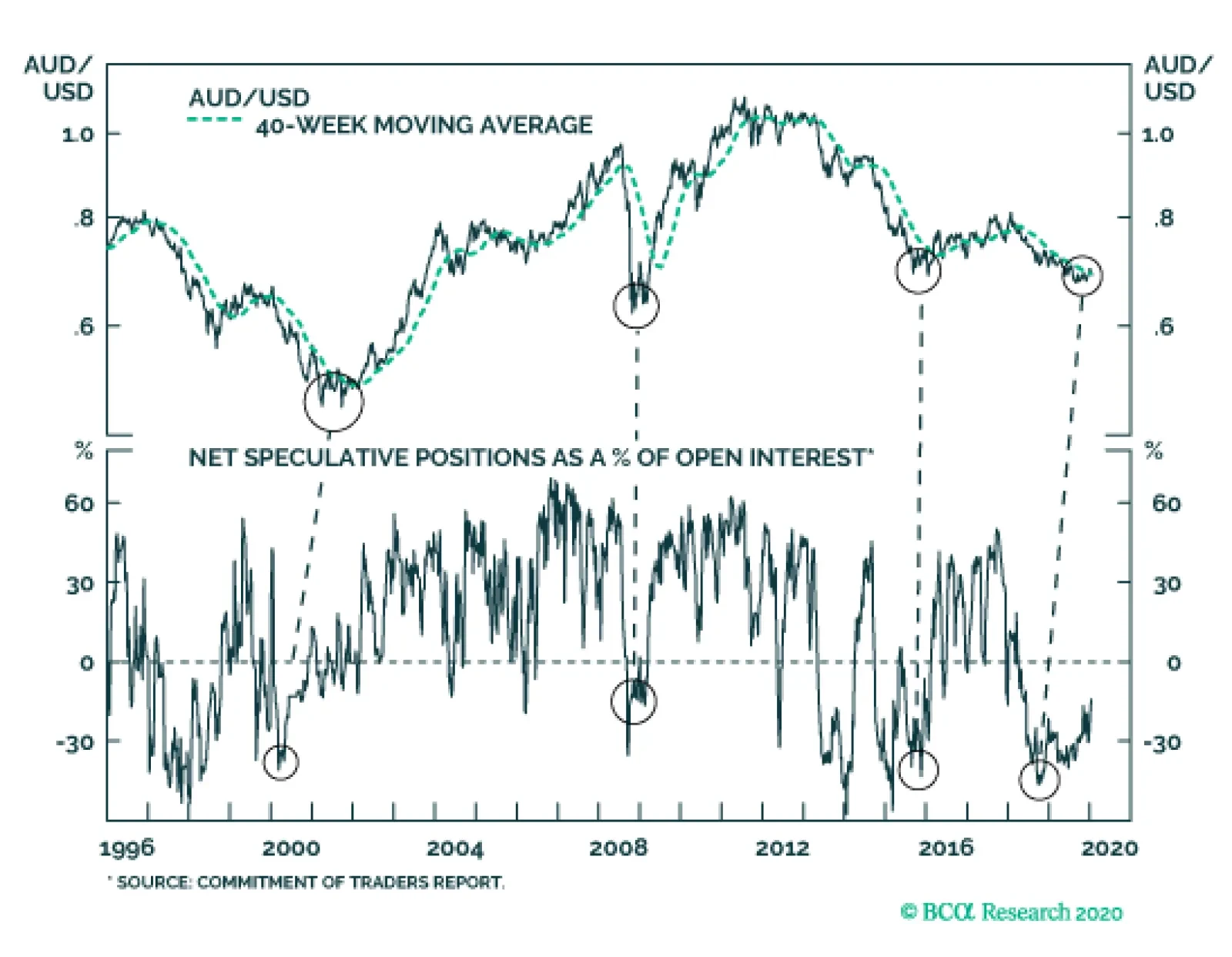

The improving economic outlook for the Australian economy points to a positive outcome for the AUD/USD. This is especially true as the AUD is historically the best performing currency in the G10 when global growth rebounds but…

Over the longer term, the Australian dollar will outperform its commodity-currency counterparts. This bullish view is predicated on three key developments: Commodity Prices: As the market becomes more liberalized and long-term…

Highlights We expect both the Australian dollar and Chinese RMB to move higher in the coming months. A key catalyst is broad-based weakness in the US dollar. The composition of goods benefiting from the US-China Phase I deal are a…

GAA DM Equity Country Allocation Model Update The GAA DM Equity Country Allocation model is updated as of December 31, 2019. The model made two significant changes to its allocations this month. First, the allocation to the US is…

The Reserve Bank of Australia has already cut interest rates by 75bps this year, taking the Cash Rate down to a record low of 0.75%. At the November 5th monetary policy meeting, the RBA did not ease policy but still delivered a…