Highlights Butterflies & Yield Curve Models: With bond market volatility now back to the subdued levels seen prior to the COVID-19 market turbulence earlier in 2020, it is a good time to update our global yield curve valuation…

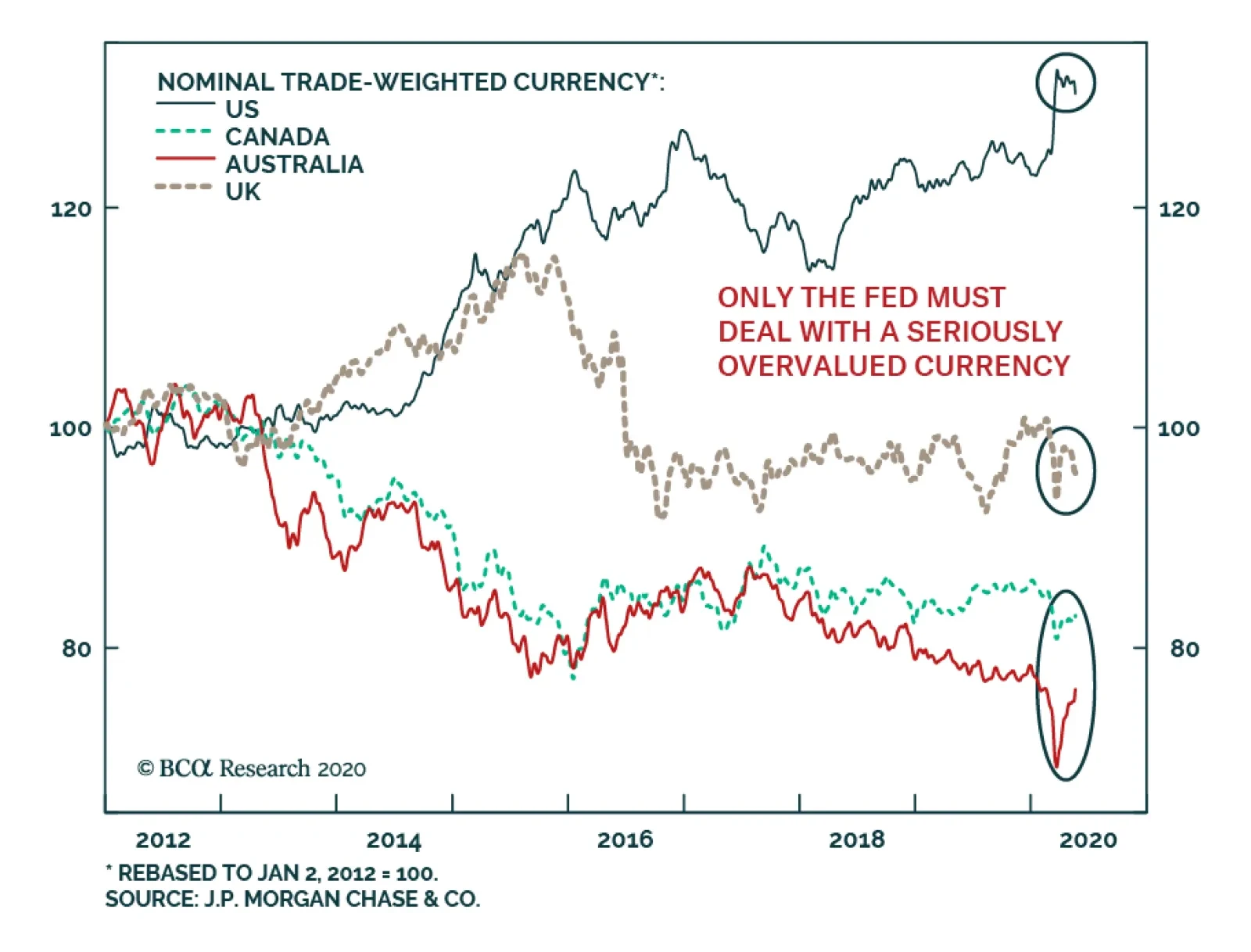

Highlights Our intermediate-term timing models suggest the US dollar is broadly overvalued. We are maintaining a modest procyclical currency stance (long NOK, GBP and SEK), but also have a portfolio hedge (short USD/JPY). Go…

Highlights Recommended Allocation The coronavirus pandemic is not over. Enormous fiscal and monetary stimulus will soften the blow to the global economy, but there remain significant risks to growth over the next 12 months…

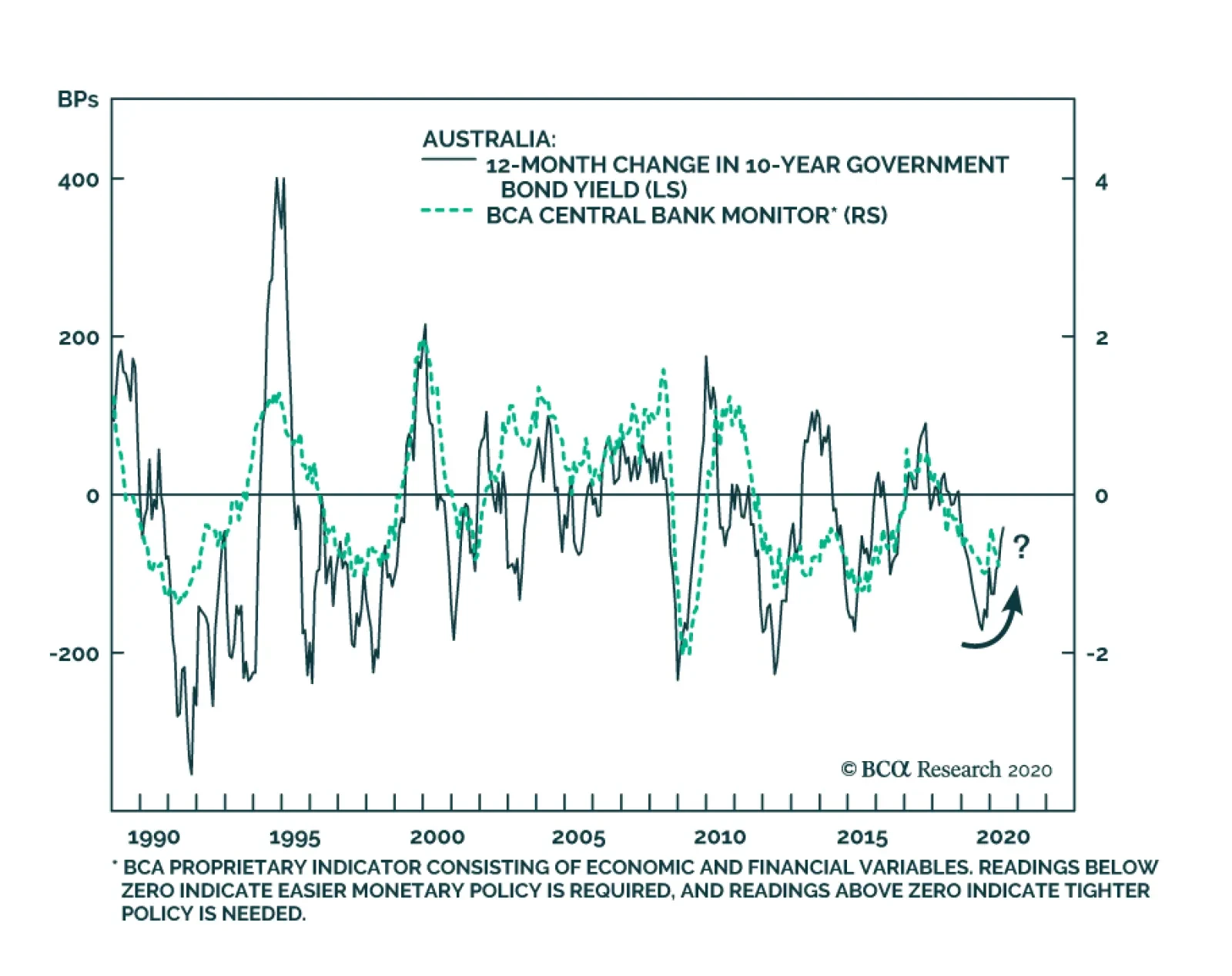

BCA Research's Global Fixed Income Strategy service's Reserve Bank of Australia (RBA) monitor may be turning the corner after Australia delivered 125bps of stimulus since June 2019. The Australian unemployment gap has…

Highlights In this Weekly Report, we present our semi-annual chartbook of the BCA Central Bank Monitors. All of the Monitors are now below the zero line, indicating the need for continued easy global monetary policy to help mitigate the…

Highlights Investment Grade Sector Valuation: Our investment grade corporate bond sector valuation models for the US, euro area, UK, Canada and Australia show some common messages, as markets have adjusted to a virus-stricken world.…

Yesterday, BCA Research's Global Fixed Income Strategy service concluded that among the major countries without negative interest rates (the US, UK, Canada, and Australia), longer-term borrowing rates do not need to fall…

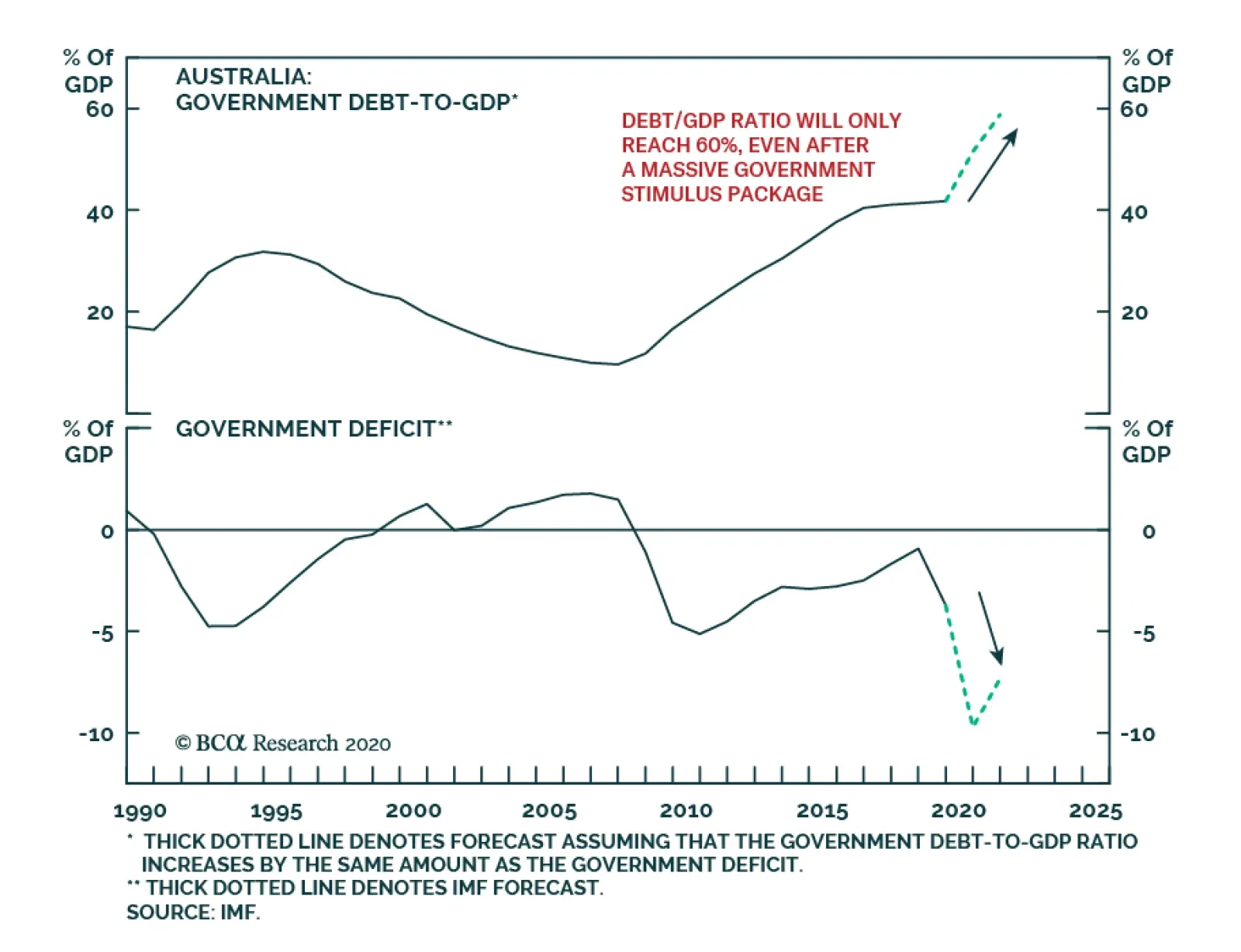

Yesterday, BCA Research's Global Fixed Income Strategy service argued that Australia’s particularly aggressive monetary and fiscal support give the economy a better chance of seeing a “v”-shaped recovery as…