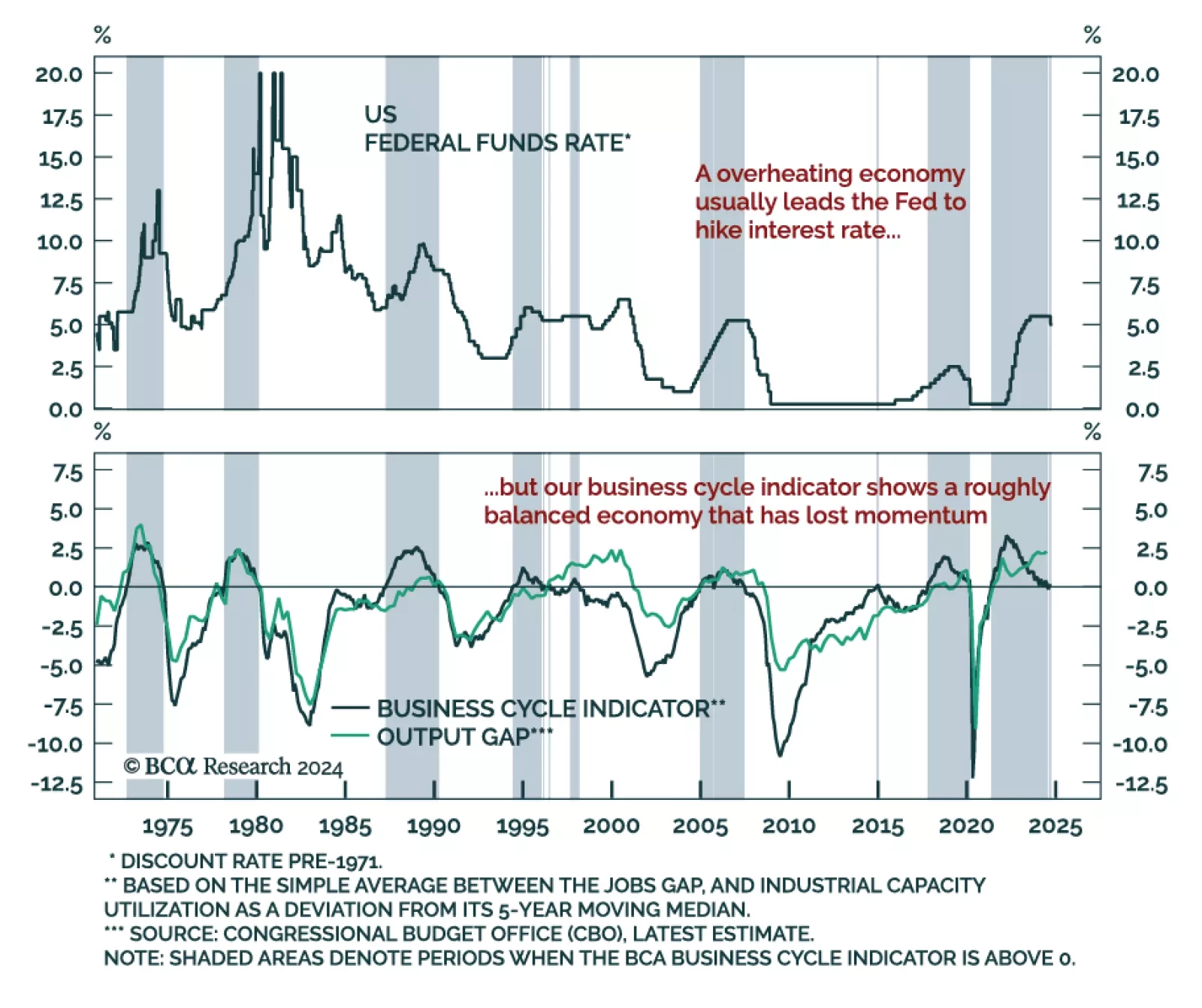

According to the latest estimate of the output gap, the US economy still operates above potential. Continued overheating – a no-landing scenario – would cause a drastic re-pricing across markets which expect a near-…

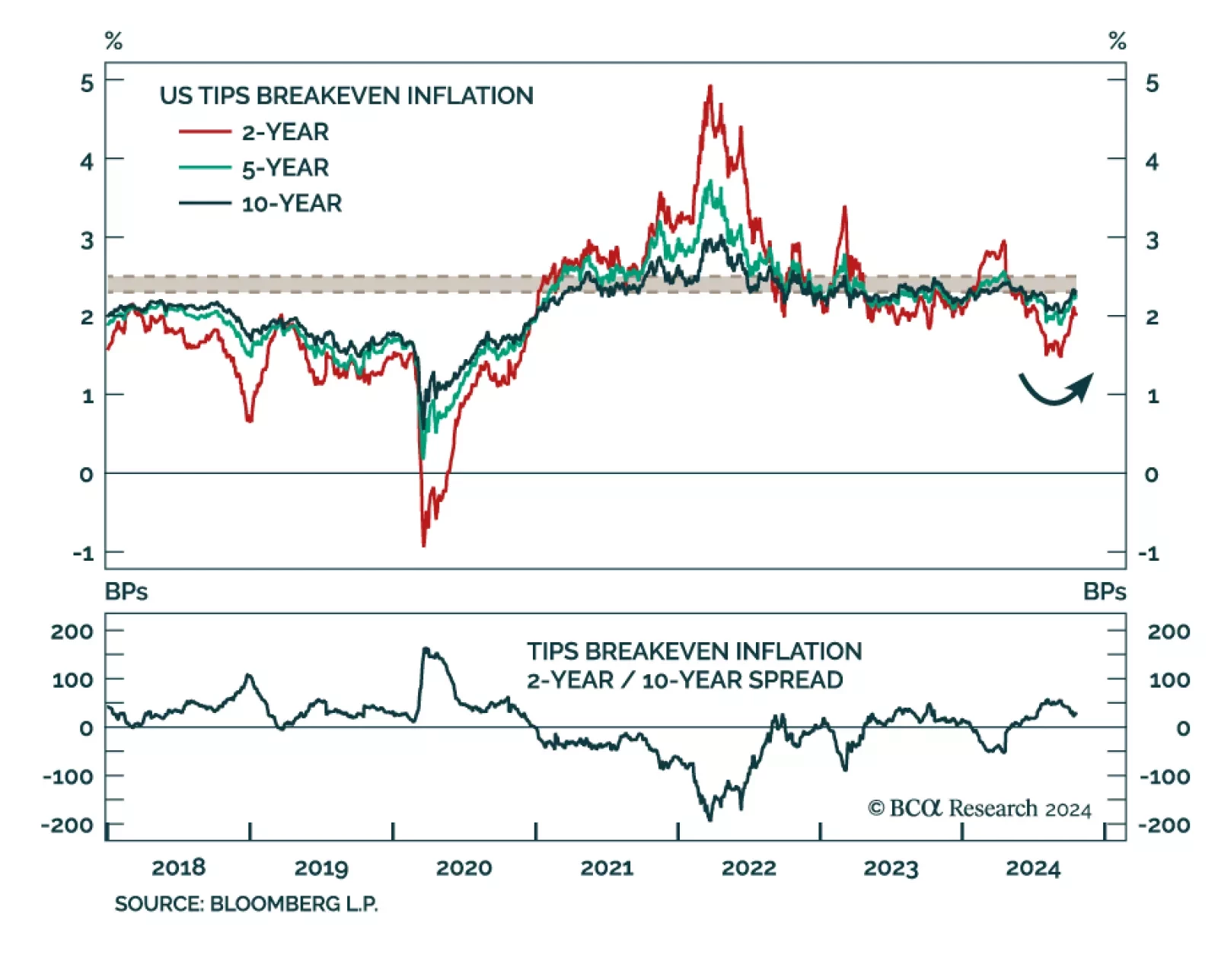

Since the August selloff in risk assets, the main cross-asset driver was the shift from inflation worries to growth worries. Some of that price action has reversed, as TIPS breakeven inflation rates swiftly rebounded since early…

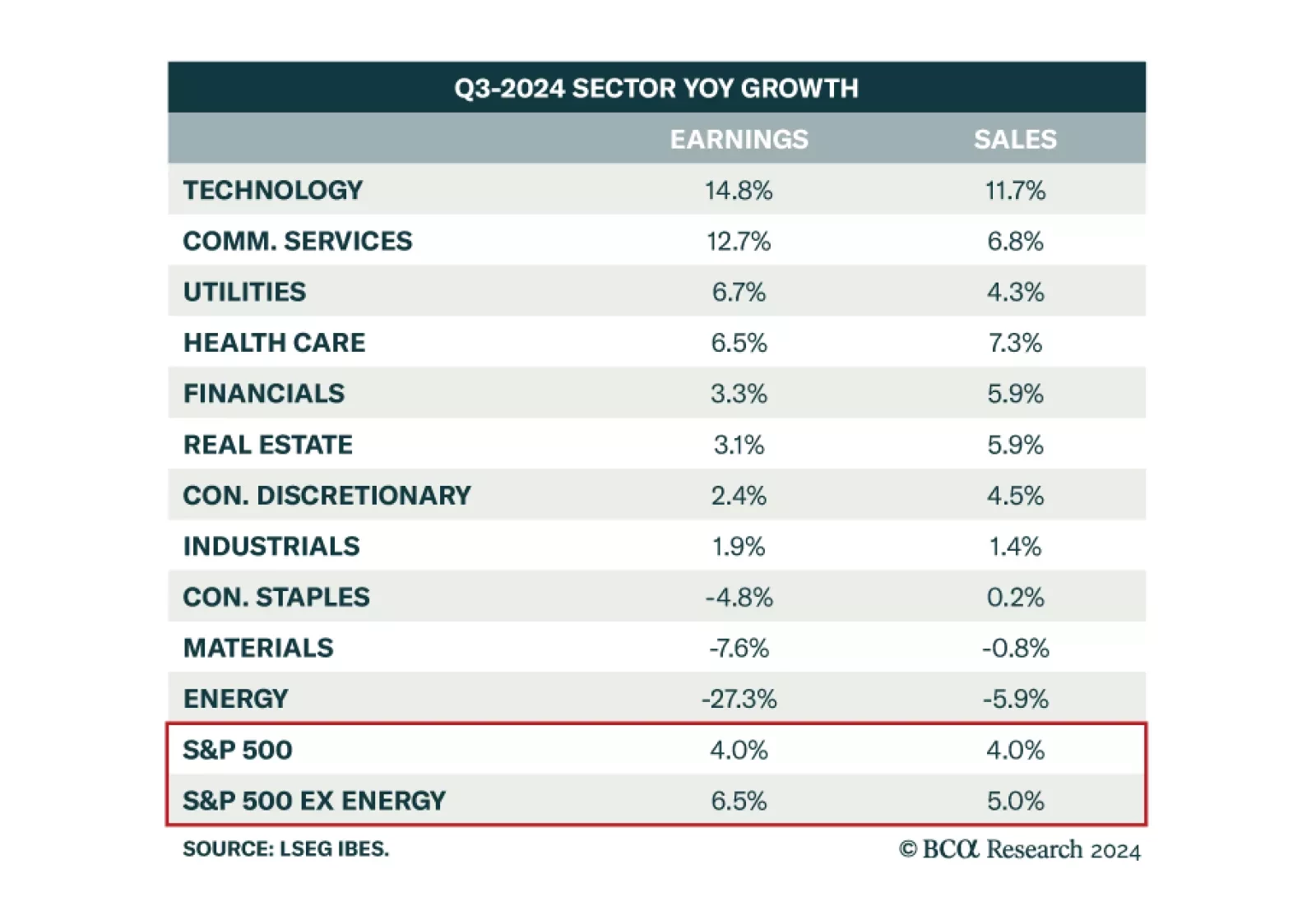

Our US Equity Strategy colleagues expect Q3 earnings to be strong enough to fuel the soft-landing narrative. Analysts expect S&P 500 earnings growth to be 4.0% year-over-year, with sales growth of 4.0% too. Yet, with…

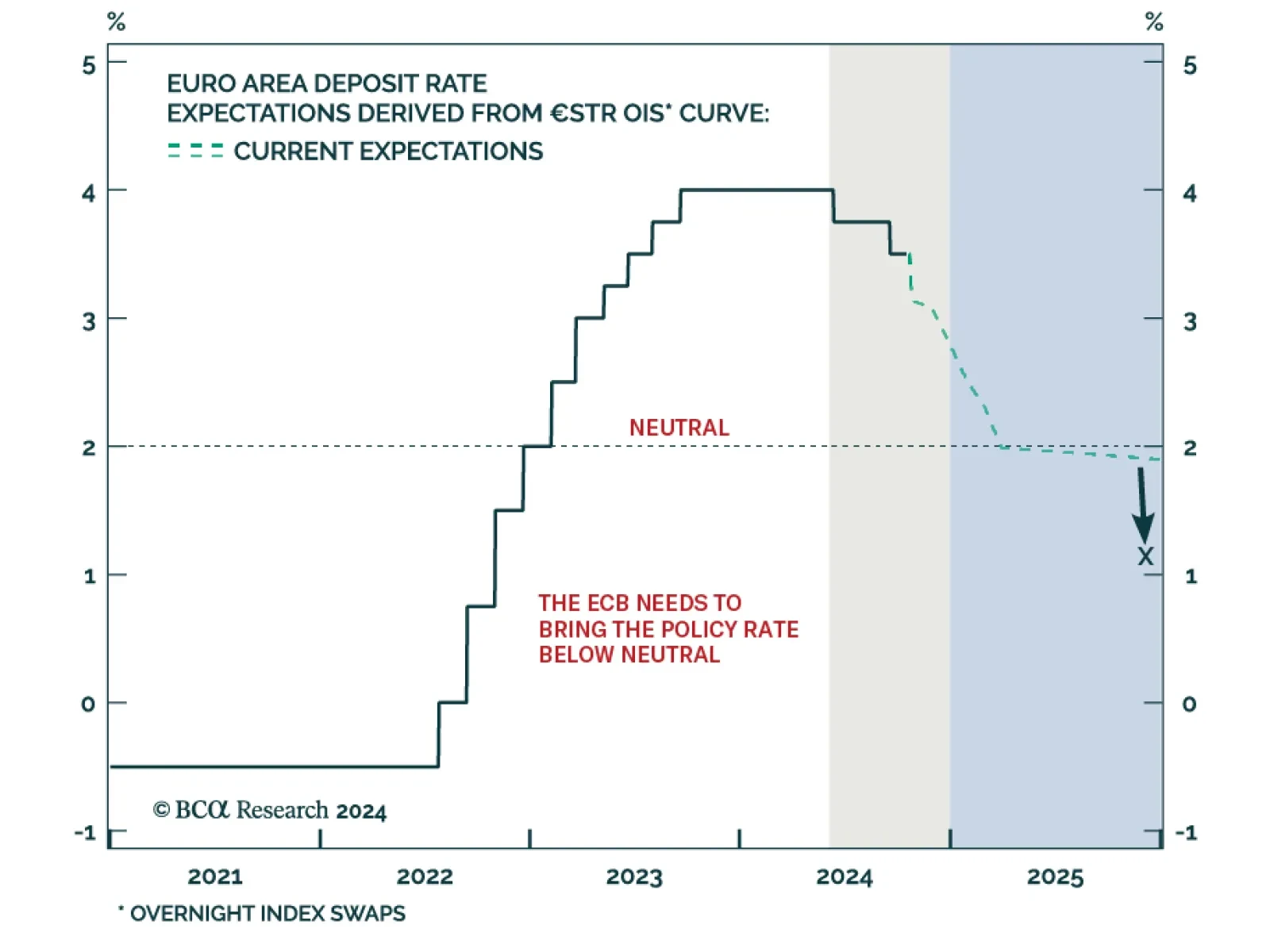

The ECB cut interest rates by 25 bps for the third time this year, lowering the deposit facility rate from 3.5% to 3.25%. While the ECB is avoiding explicitly committing to a path for policy, President Lagarde’s repeated…

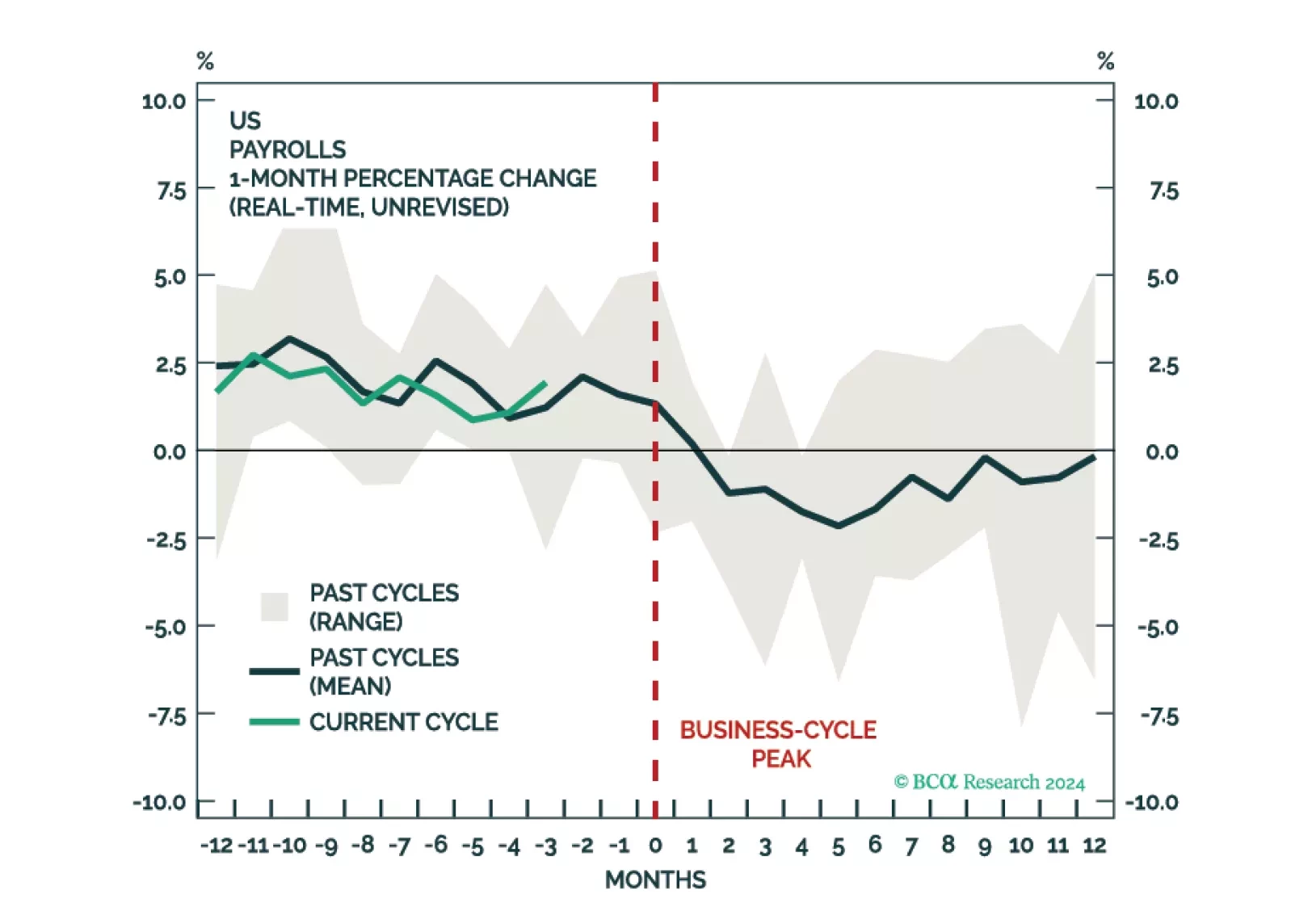

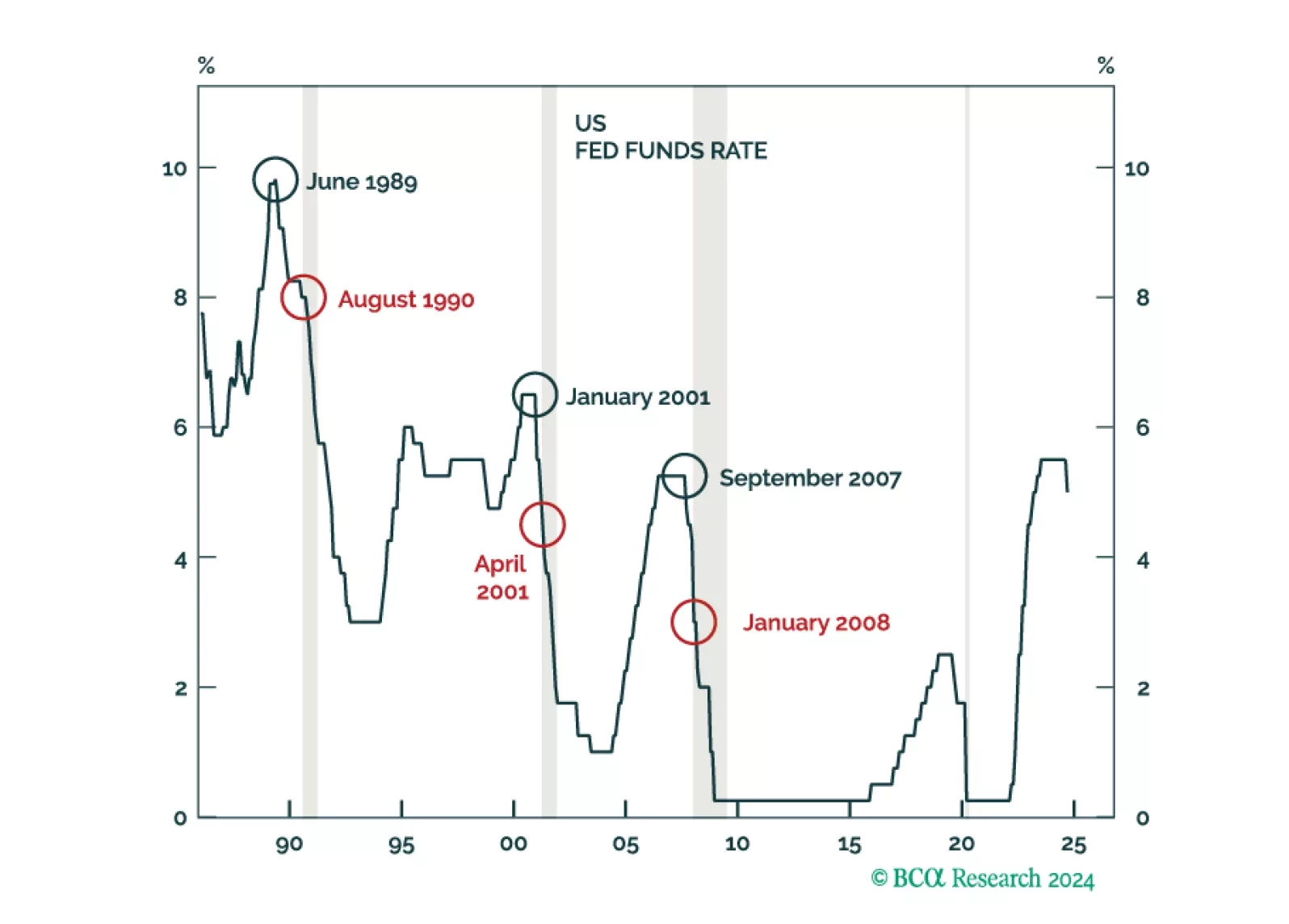

It is too early to say that the US labor market has turned the corner. We assign a 60% chance that the US will enter a recession over the next 12 months, with the downturn likely to begin in the first half of 2025. Accordingly,…

Our Q3 portfolio was defensive, which we believe will be the appropriate stance in the next six-to-twelve months. Data coming out of the US has remained robust which could cause US bond yields to temporarily overshoot. An overshoot…

After resisting the consensus narrative in 2022 that a US recession was imminent, and then predicting an immaculate disinflation for 2023, the Global Investment Strategy team has joined the dark side and is now expecting a recession…

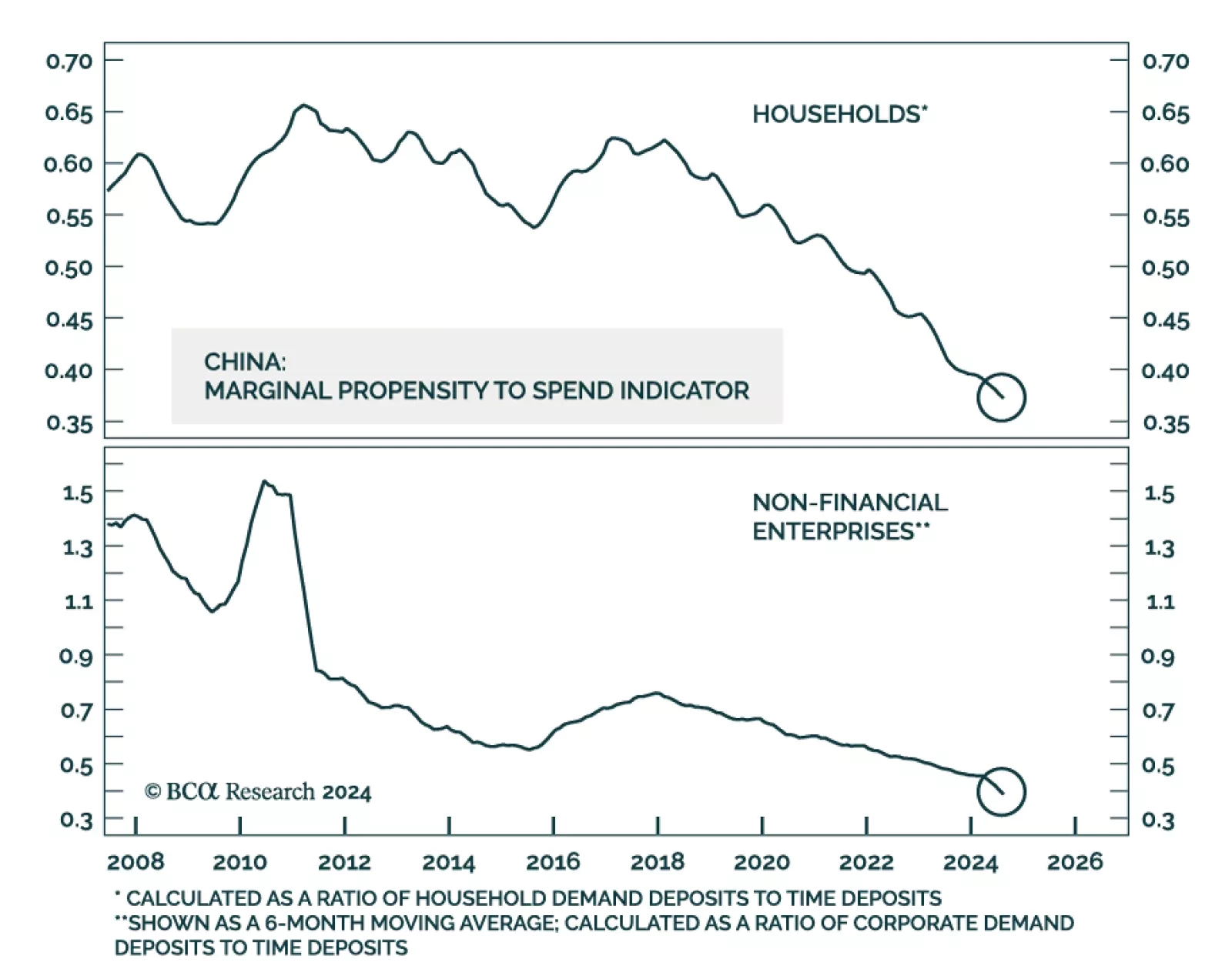

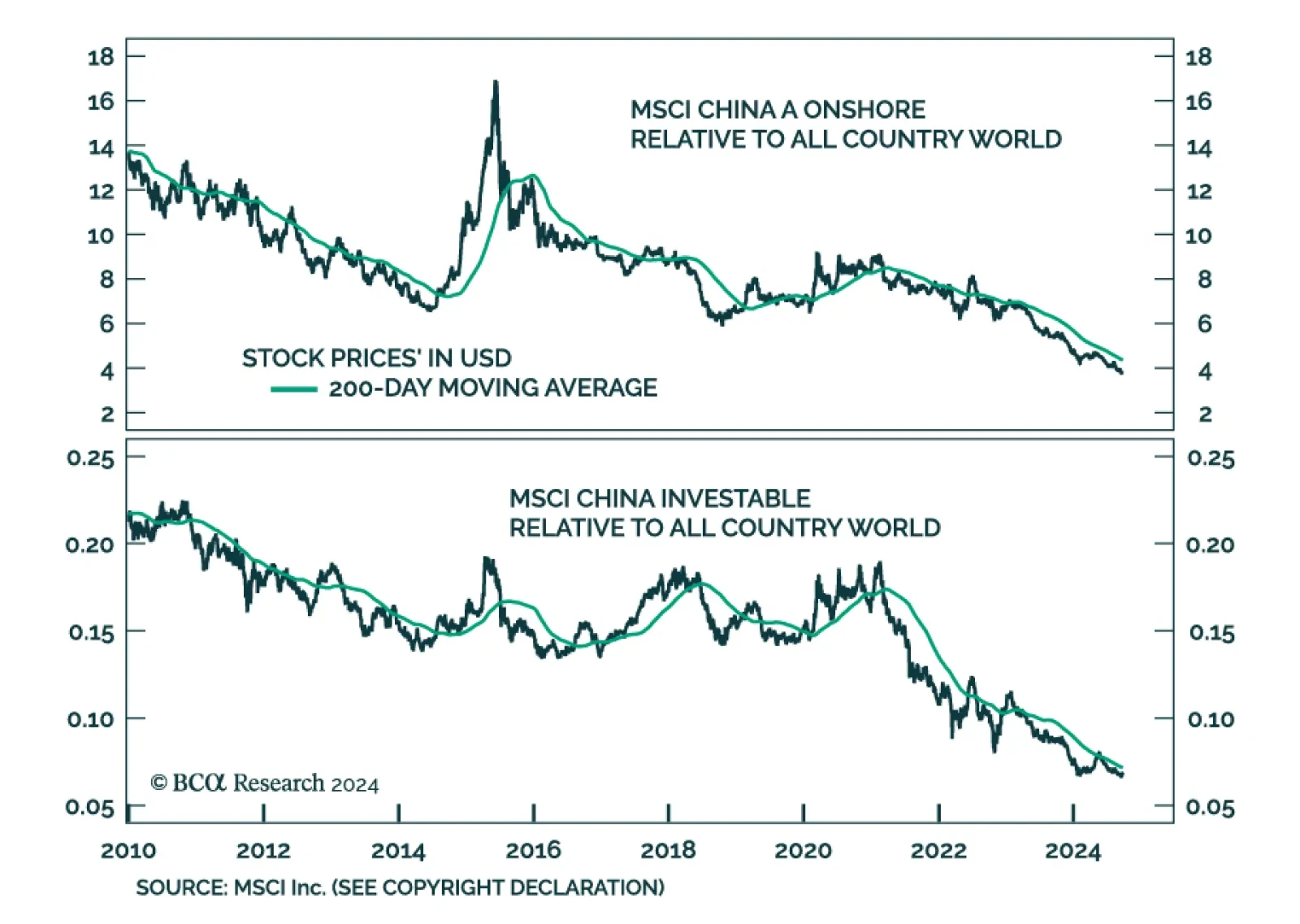

This week has not been short of developments on Chinese policy. After unleashing a monetary policy blitz, the authorities held an unscheduled Politburo meeting resulting in a pledge to take actions towards stabilizing the housing…

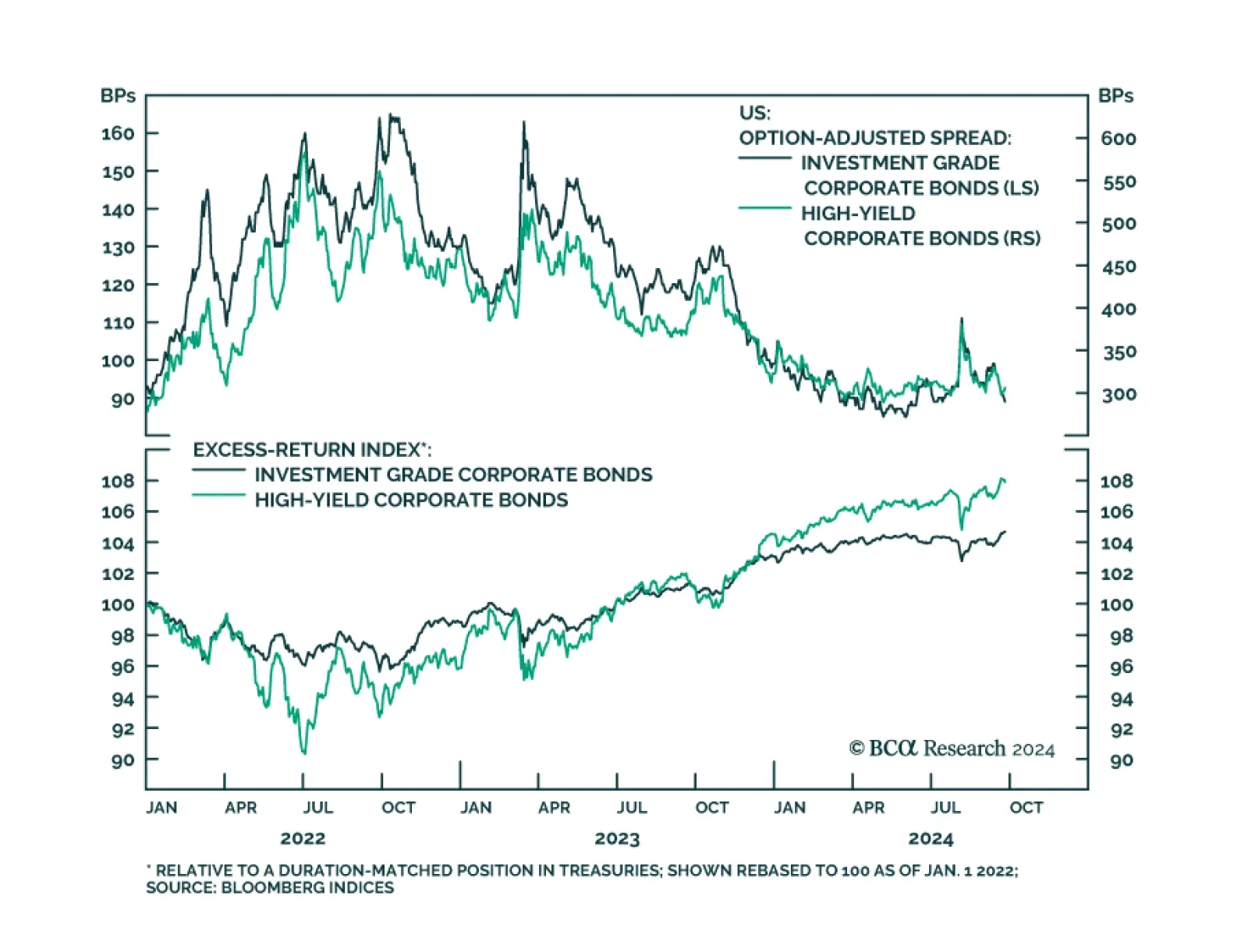

US investment grade and high yield spreads have tightened 22 and 75 bps since their August highs. Risk assets have cheered the outsized Fed rate cut as the narrative in markets aligns with the Fed’s conviction it can…

The PBoC announced further measures to stimulate the economy on Tuesday. It lowered the reserve requirement ratio from 10% to 9.5%, cut the 7-day reverse repo rate by 20 bps (following Monday’s 10 bps cut to the 14-day…