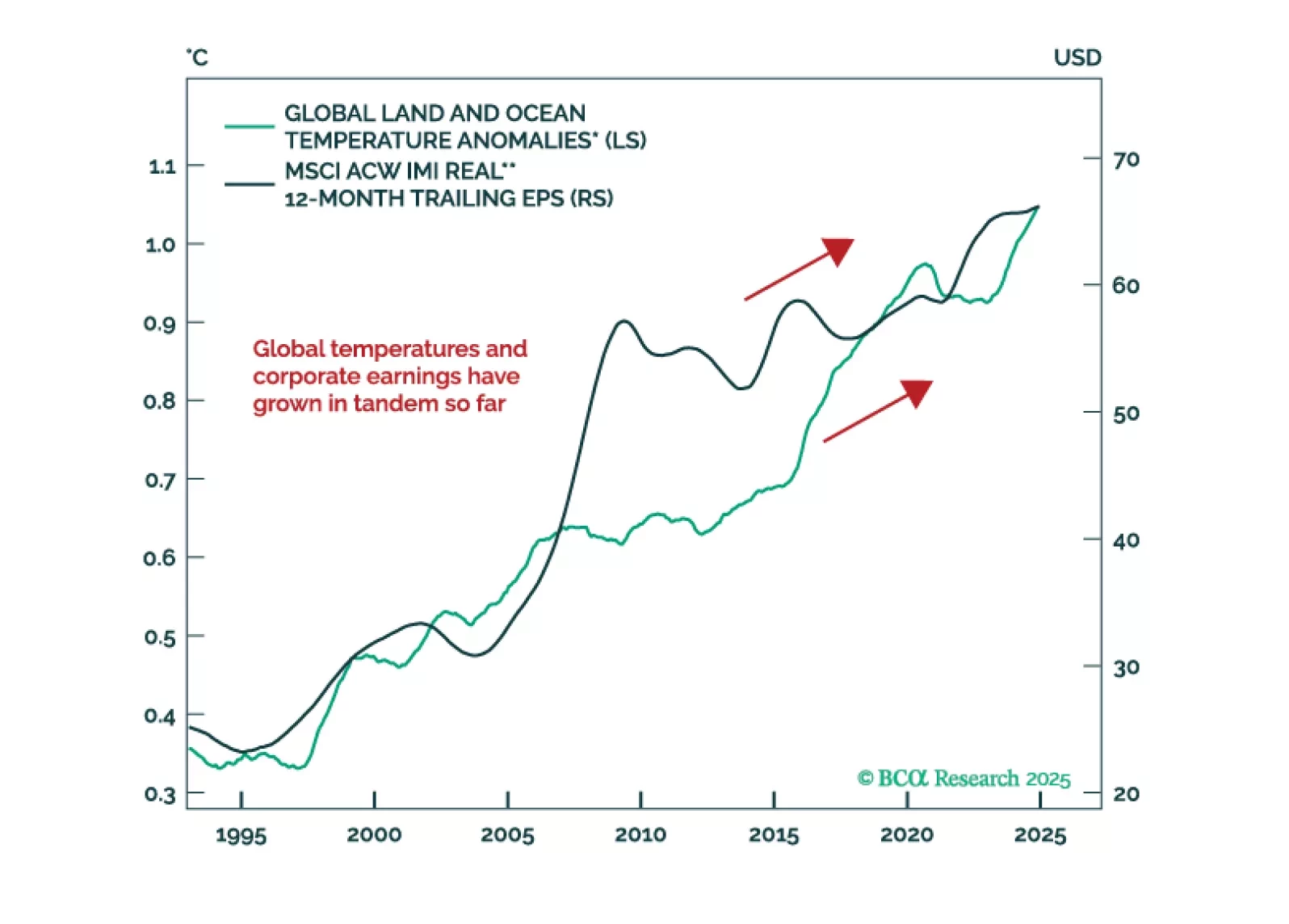

In our Beta report, we take a break from US politics and focus on the investment implications of climate change. Our colleague Ritika Mankar, of BCA’s Global Investment Strategy, makes a case for long-term investors to actually…

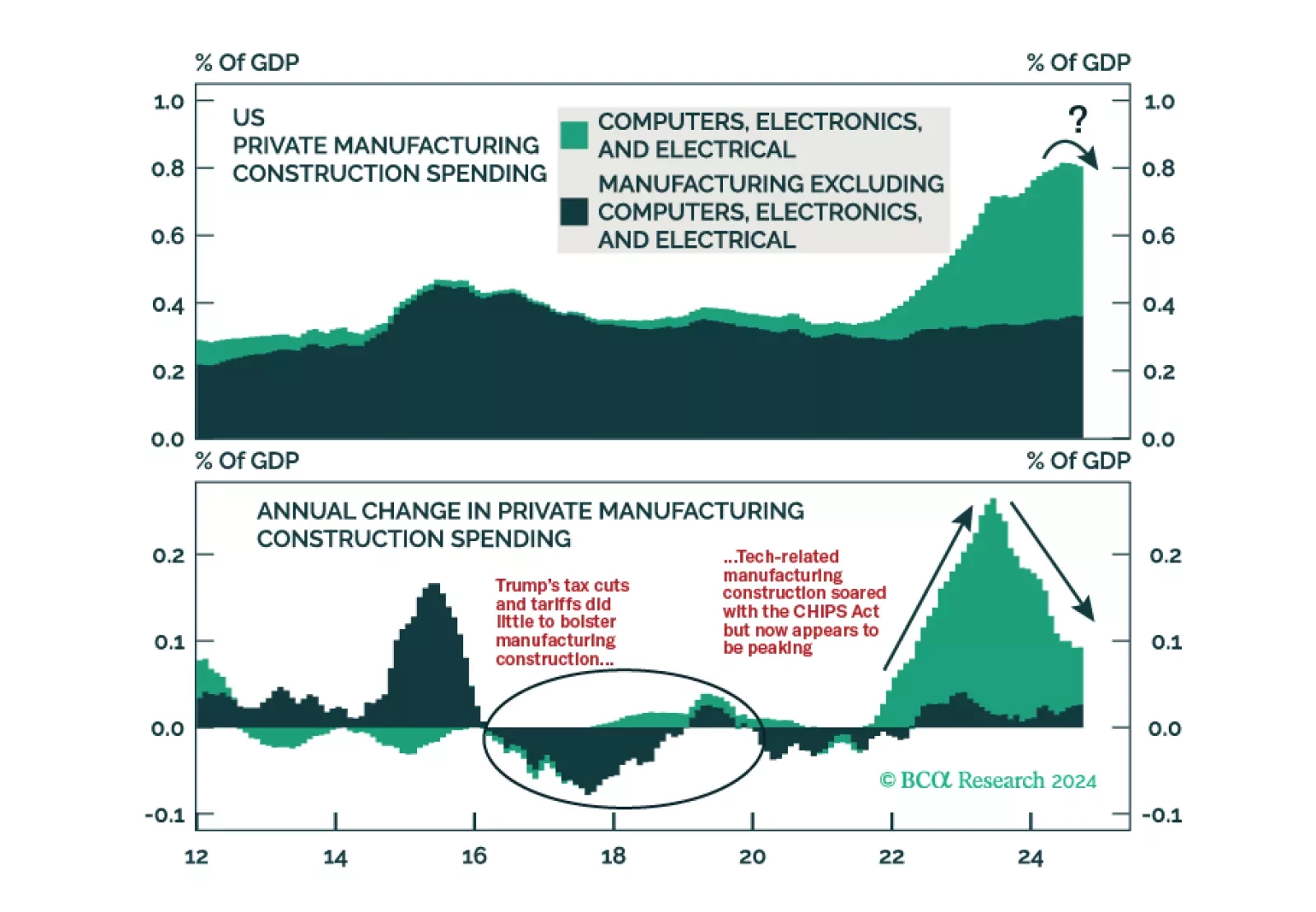

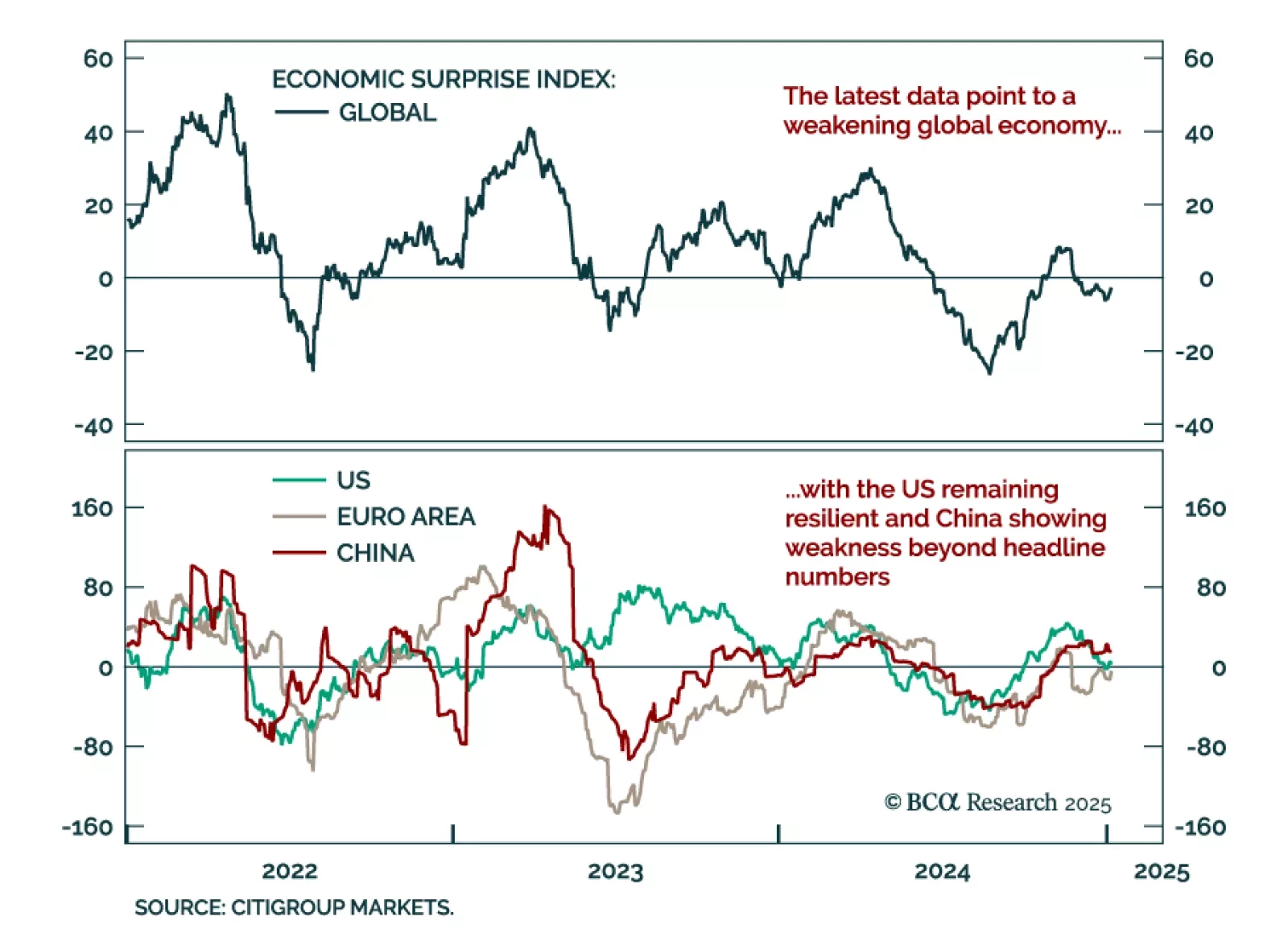

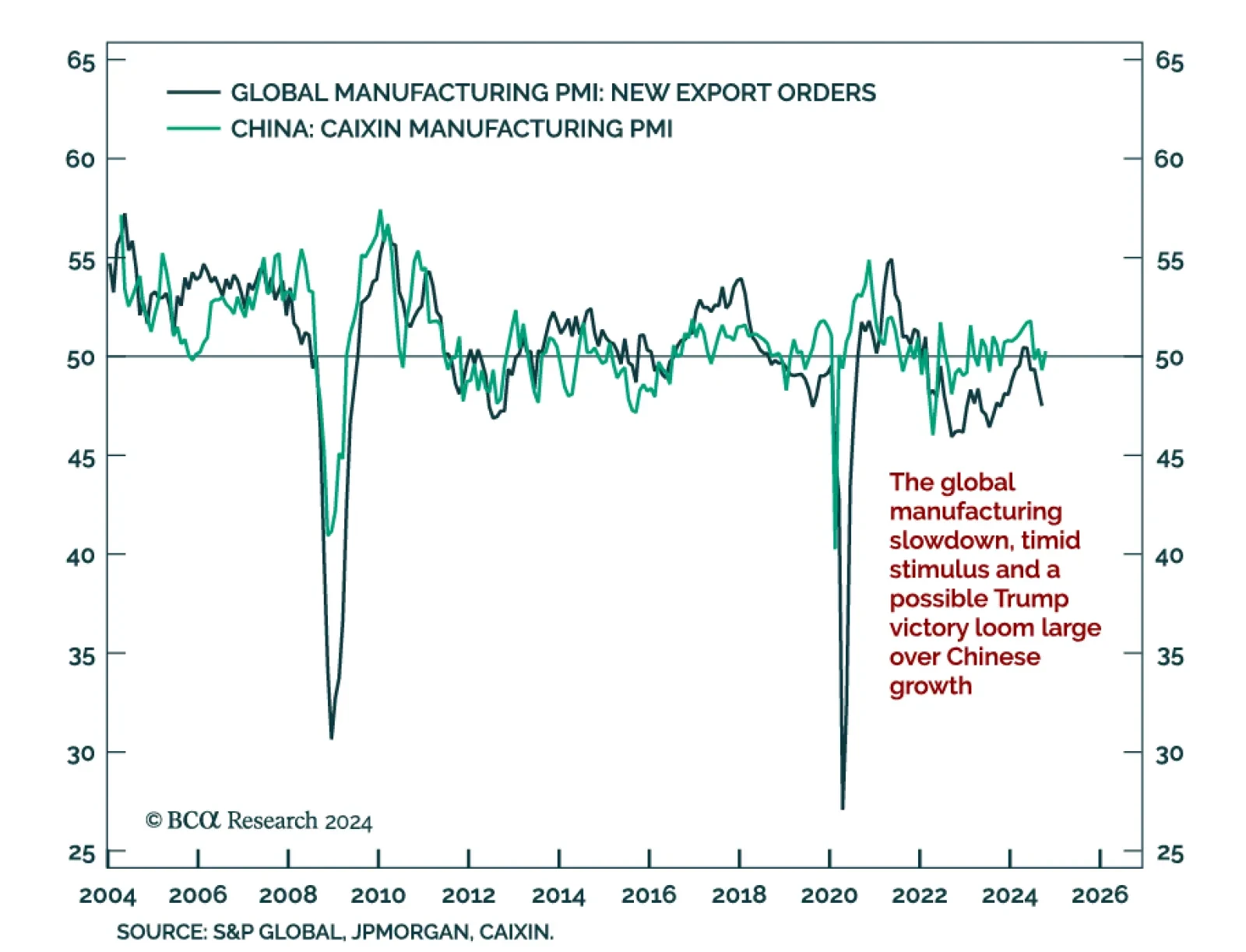

Economic data released over the holiday period extended recent trends, reflecting a softening global economy with resilient US growth, and an ailing manufacturing sector. The December global manufacturing PMI declined to 49.6…

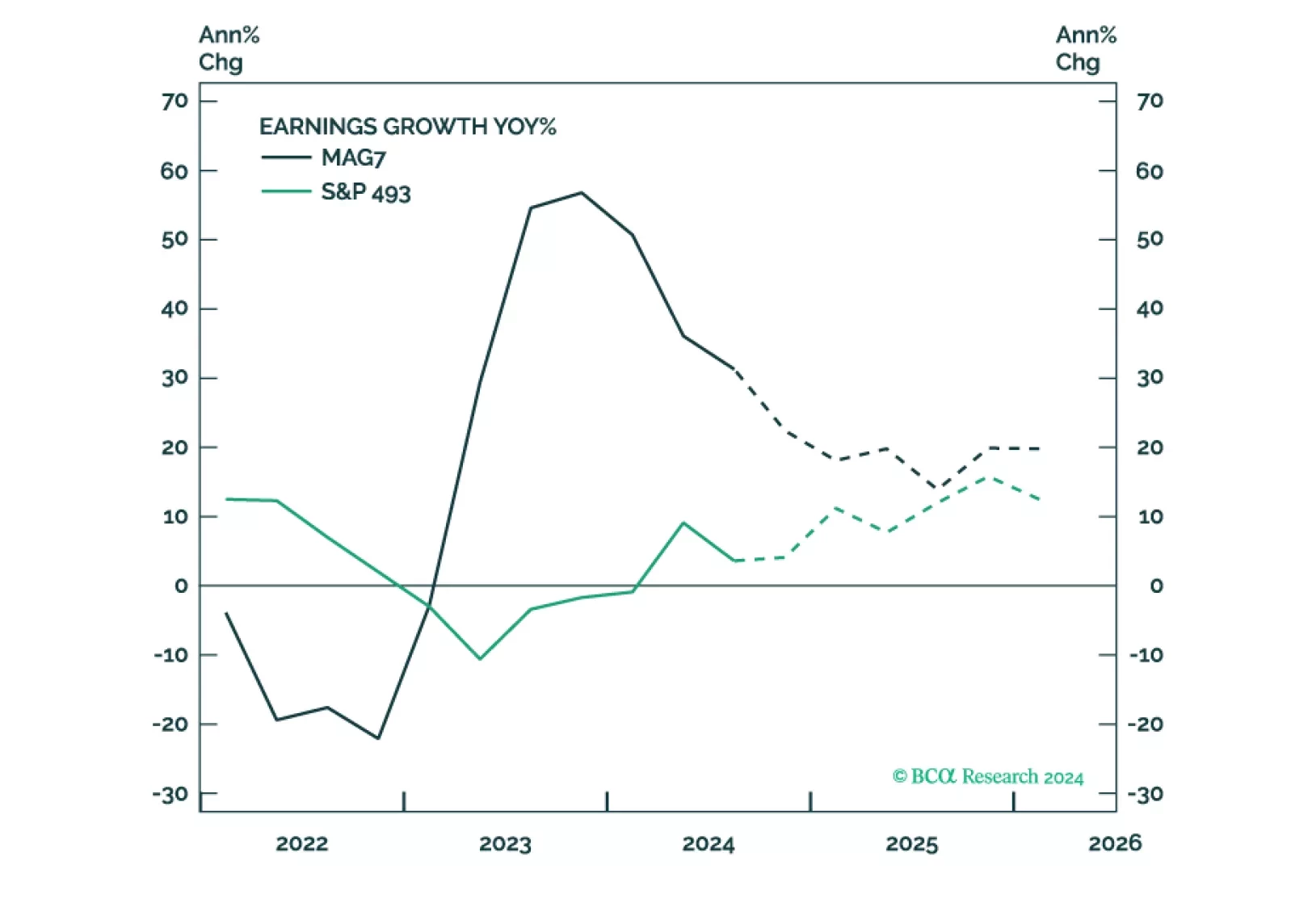

Trump's policies aim to support domestic producers and will be pro-growth and inflationary, at least initially. This environment is supportive of equities. Earnings will likely be strong, but elevated valuations make equities prone…

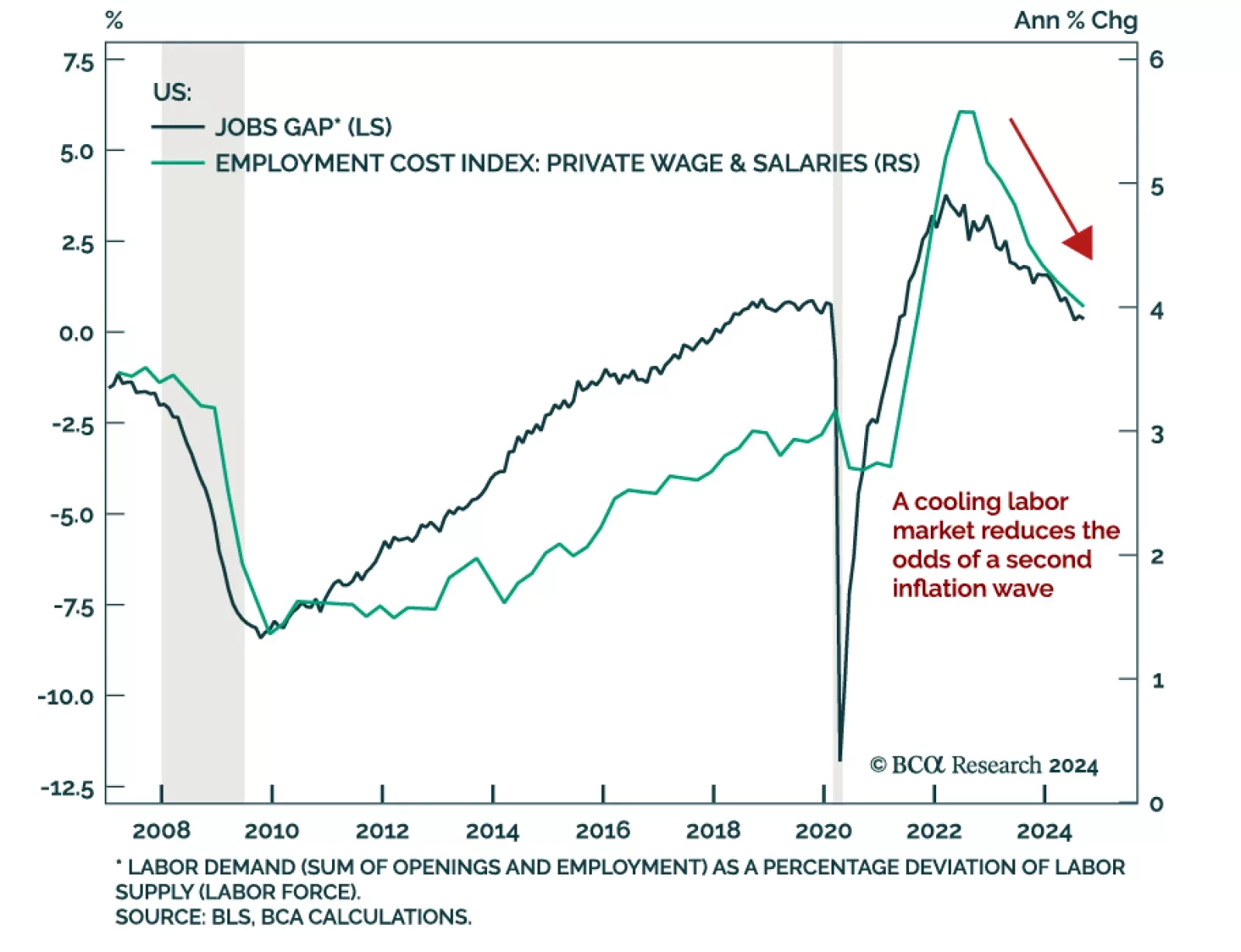

The prospect of a new trade war more than offsets the other pro-business parts of Trump’s agenda. With the labor market already weakening going into the election, we are raising our 12-month US recession probability from 65% to 75…

China’s Caixin Manufacturing PMI rebounded one point in October to 50.3. This was in line with the NBS PMIs from earlier this week, which also showed a modest rebound. We are looking for a turning point in China as the…

The Fed’s preferred measure of inflation, core PCE, met expectations of a reacceleration to 0.3% month-on-month, and reached 2.7% year-over-year. The rest of the Personal Income and Outlays report showed solid…

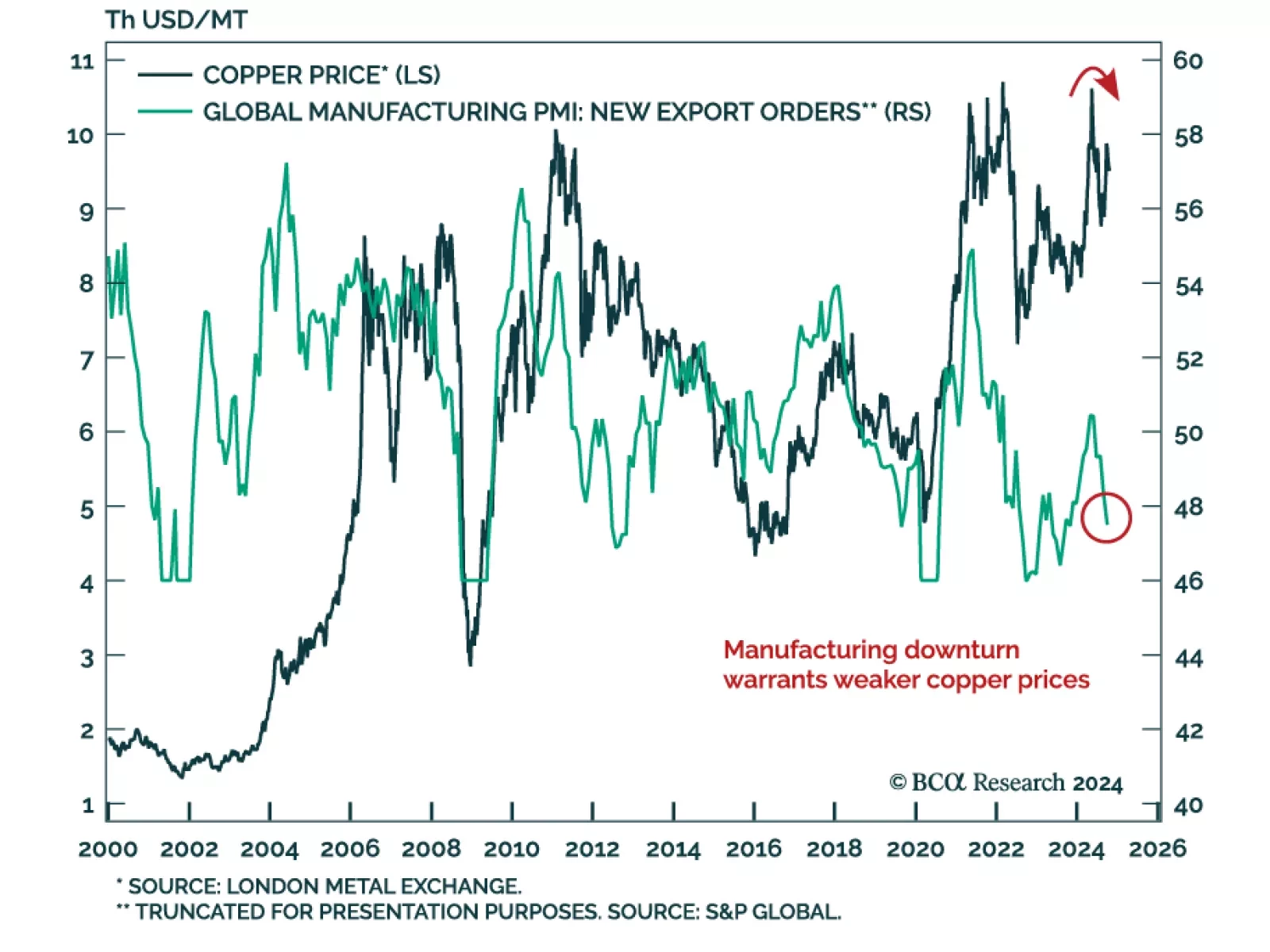

Speculators have supported copper prices as demand growth slowed below the pace of supply growth. Our Commodity and Energy Strategy colleagues believe this does not bode well for the metal. The copper market faces a situation…

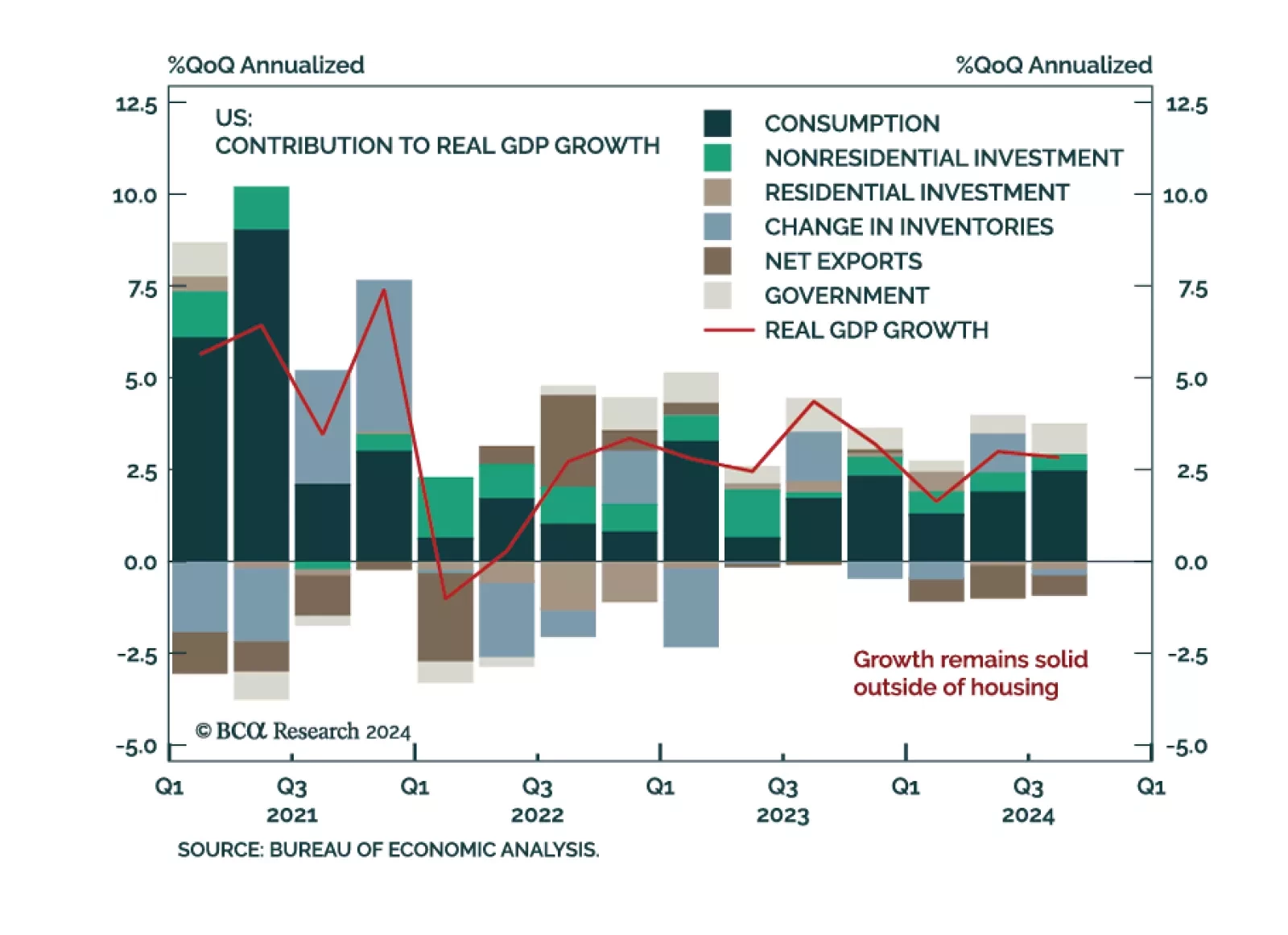

Advanced Q3 GDP for the US met expectations, showing 2.8% quarterly annualized growth and a small deceleration from 3.0% in Q2. Importantly, growth remains above trend. The report was strong across the board except for housing.…

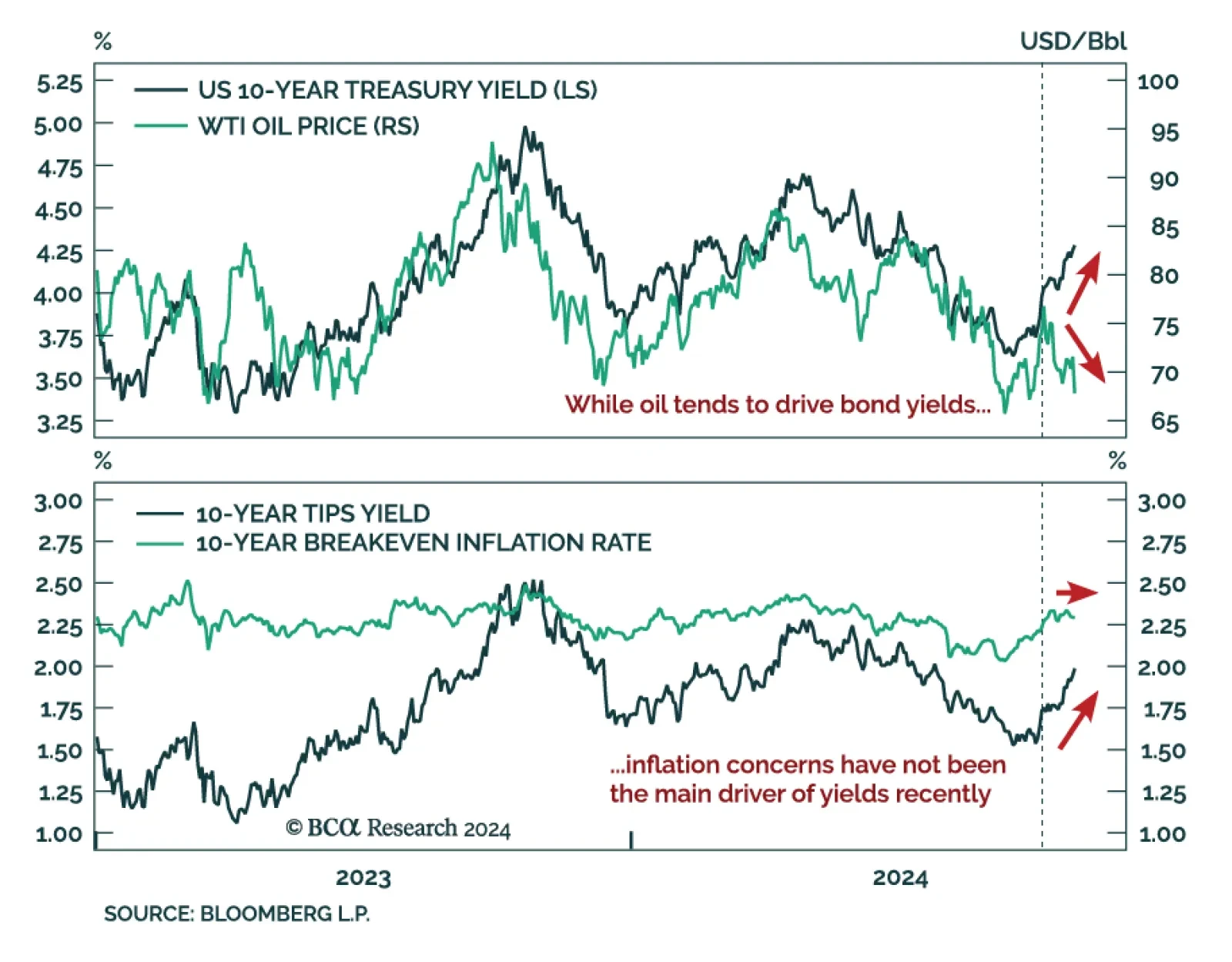

For the past two weeks, oil has sold off amid a global spike in yields. Oil prices and Treasury yields tend to be positively correlated, as oil prices are a fast-moving component of inflation, driving the inflation expectations…

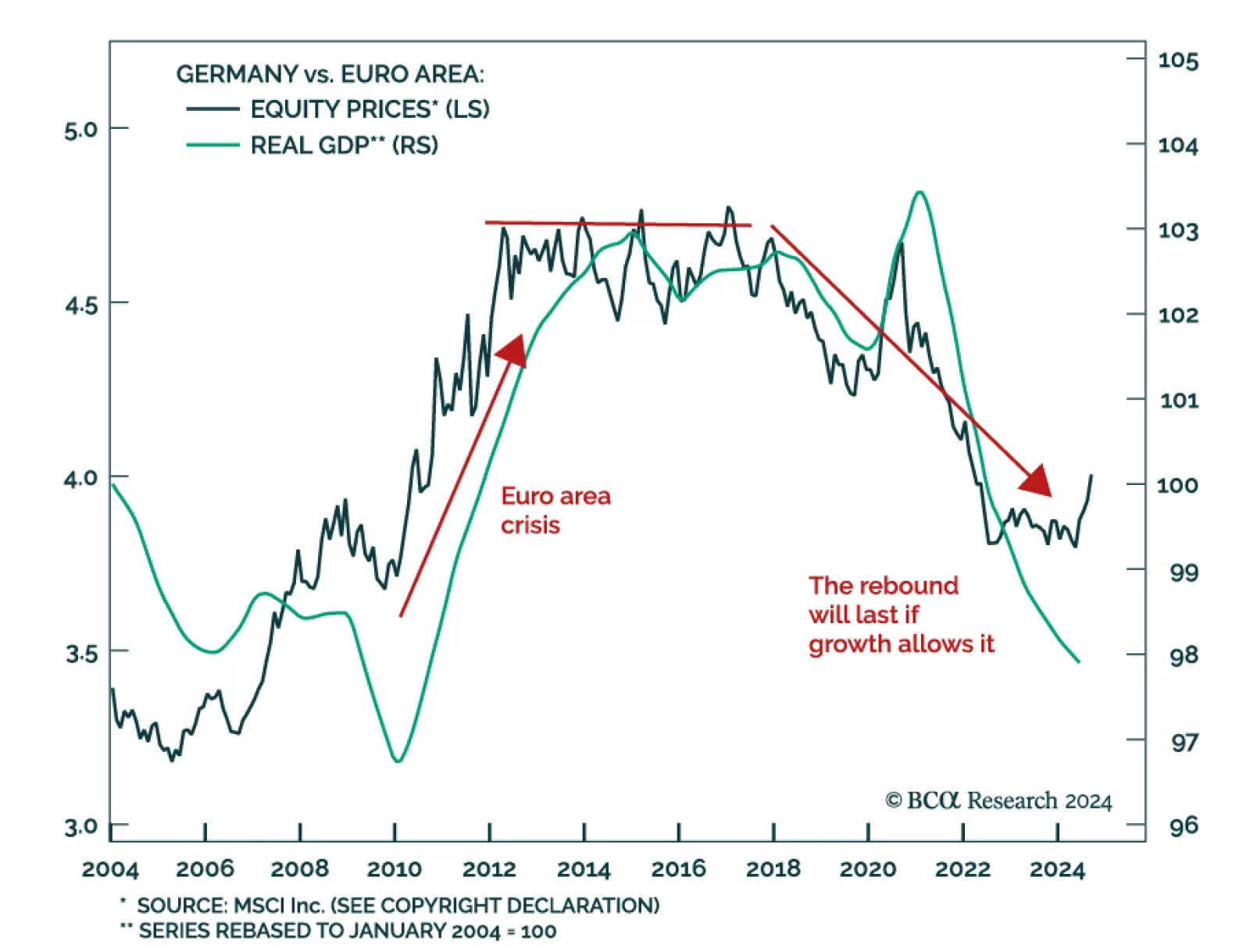

Germany’s problems are well known: Demographics, Chinese competition, underinvestment, energy dependence, and constrained fiscal policy. Our European Investment Strategy colleagues believe this bad news is priced in…