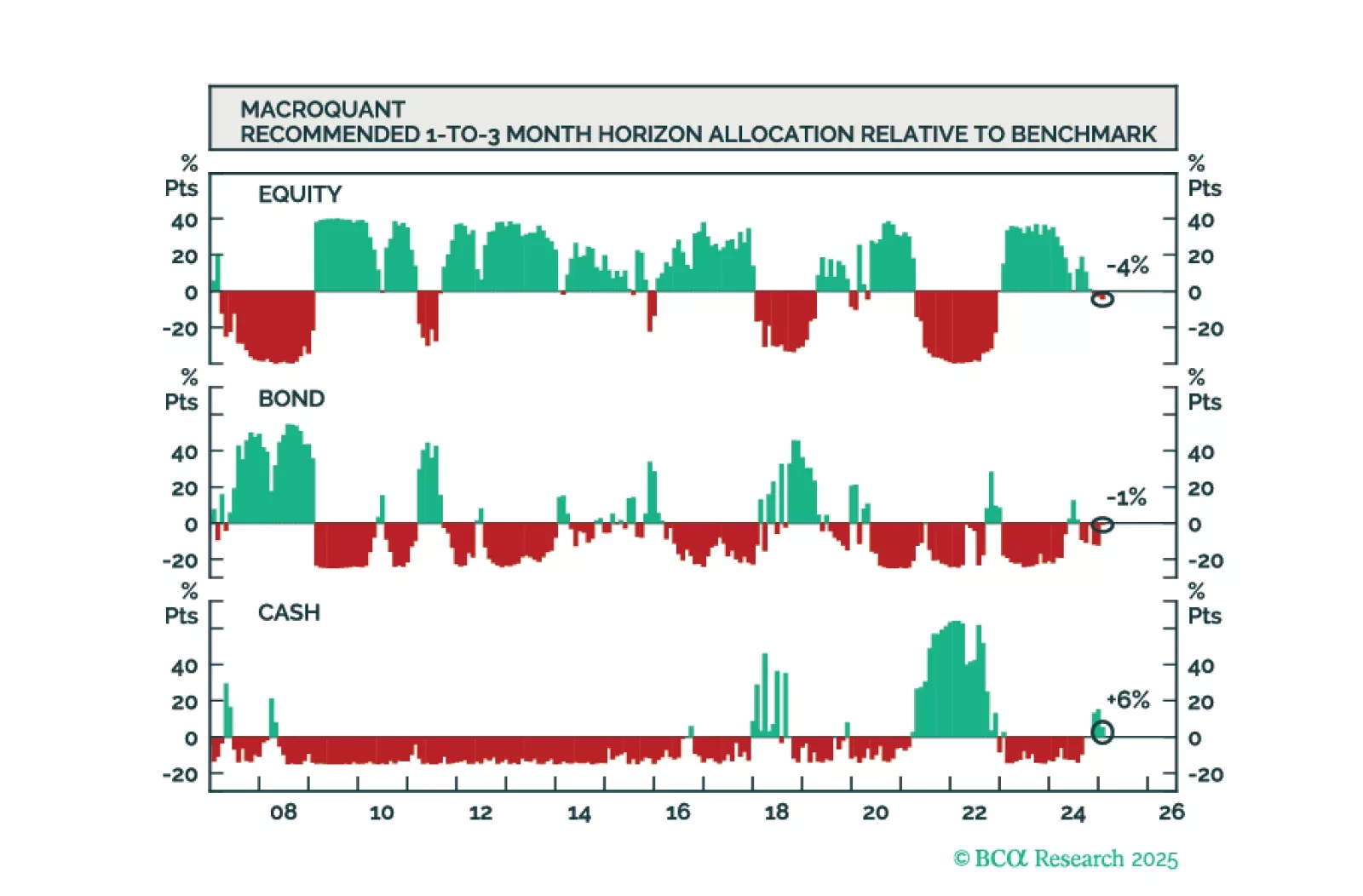

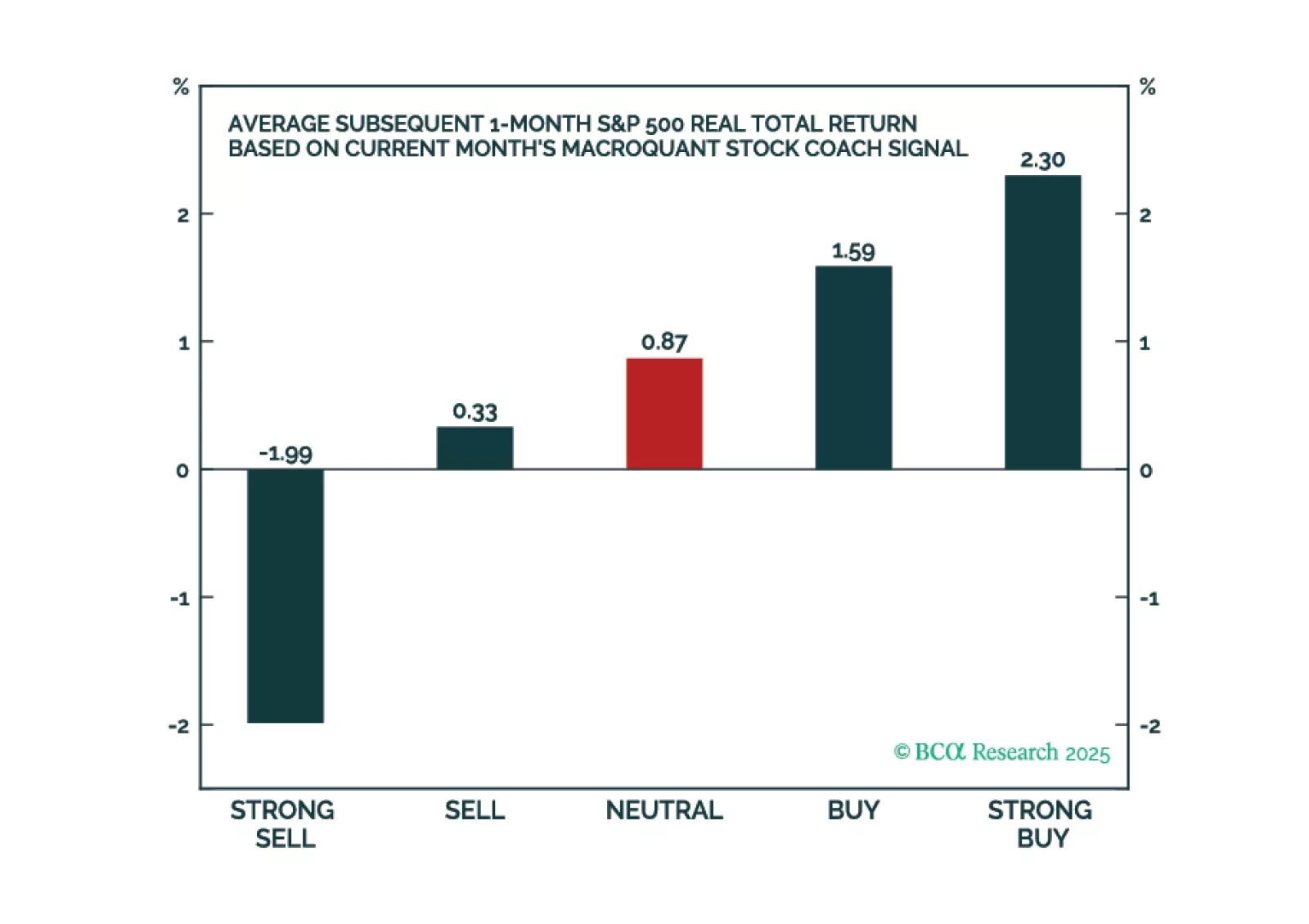

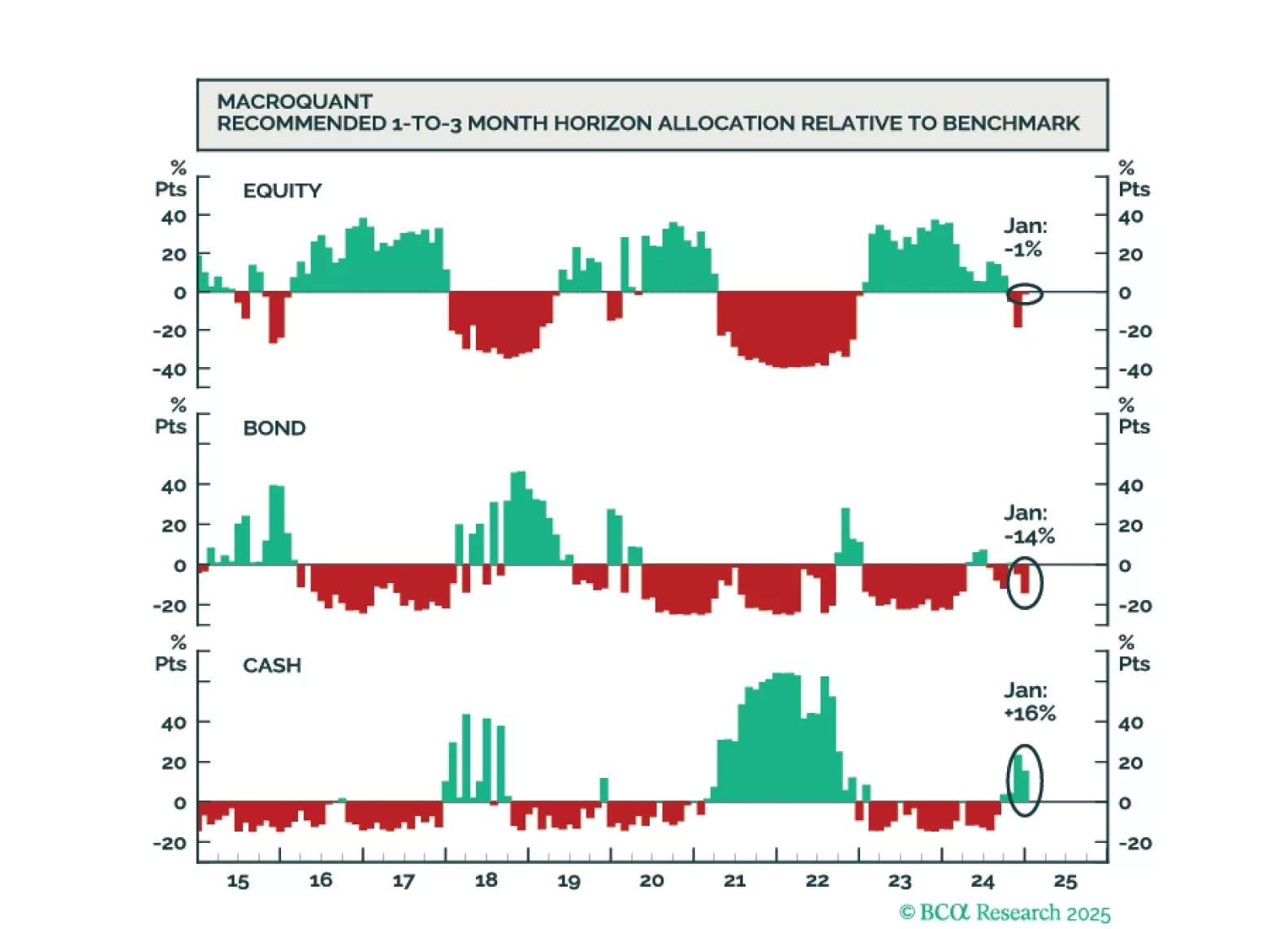

The MacroQuant model is no longer bullish on stocks but is not yet prepared to turn underweight. Subjectively, the Global Investment Strategy team is more bearish on equities than the model.

The MacroQuant model is no longer bullish on stocks but is not yet prepared to turn underweight. Subjectively, the Global Investment Strategy team is more bearish on equities than the model.

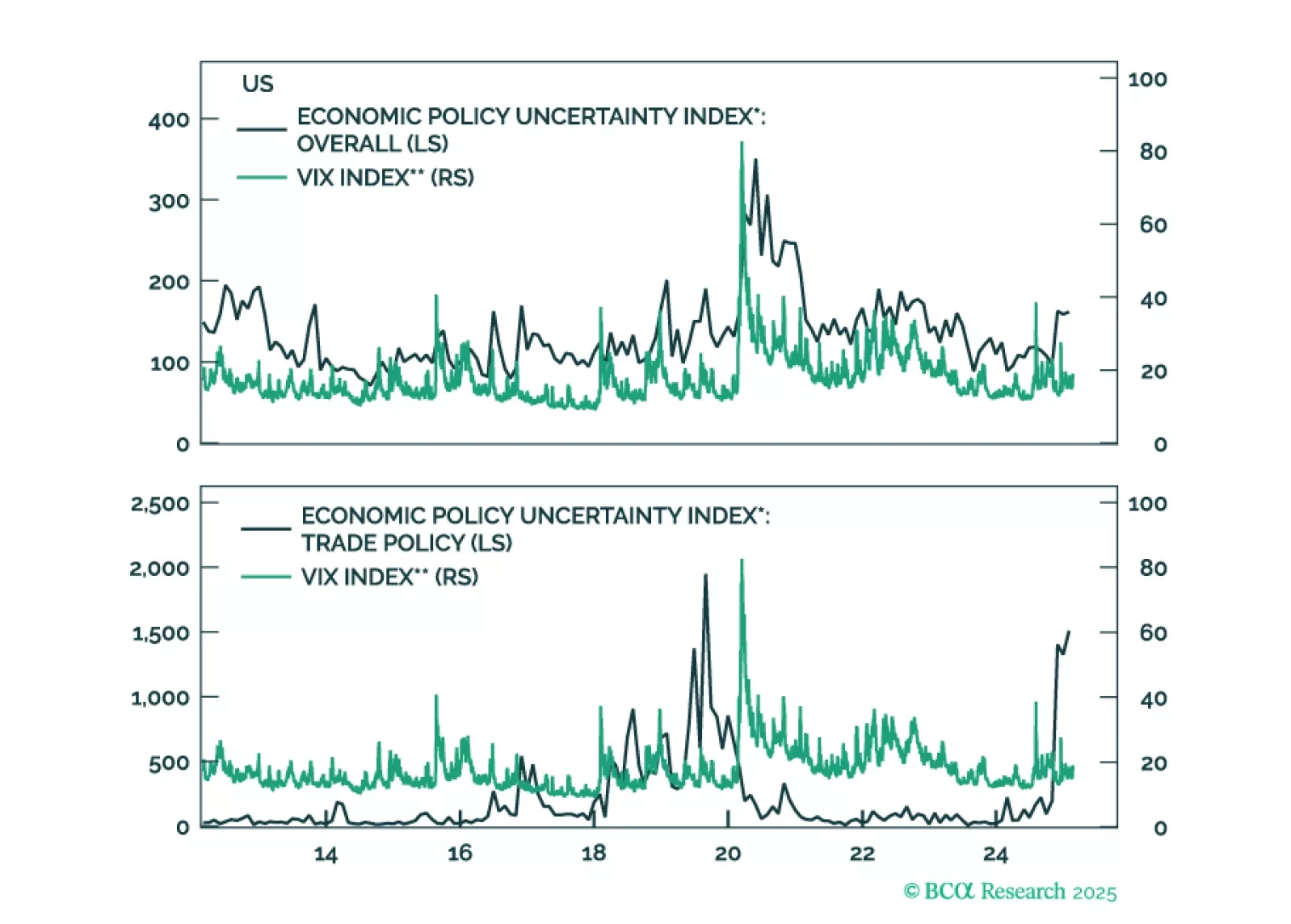

US growth has slowed in recent weeks. This can be seen in the weaker data on retail sales, consumer confidence, services PMIs, and a swath of housing releases (notably starts, existing home sales, homebuilder confidence, and stock…

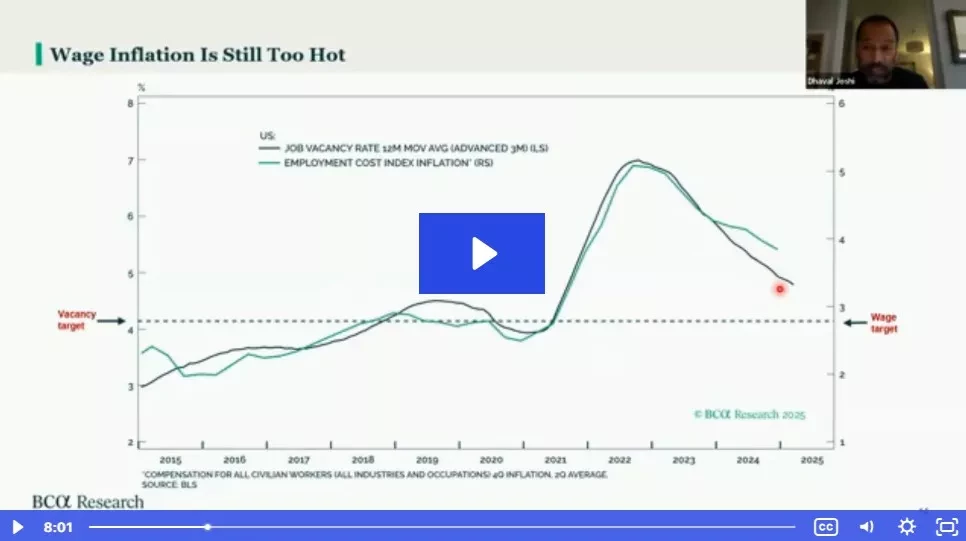

In this webcast, Dhaval will give an update on his key views for 2025. The discussion will include:

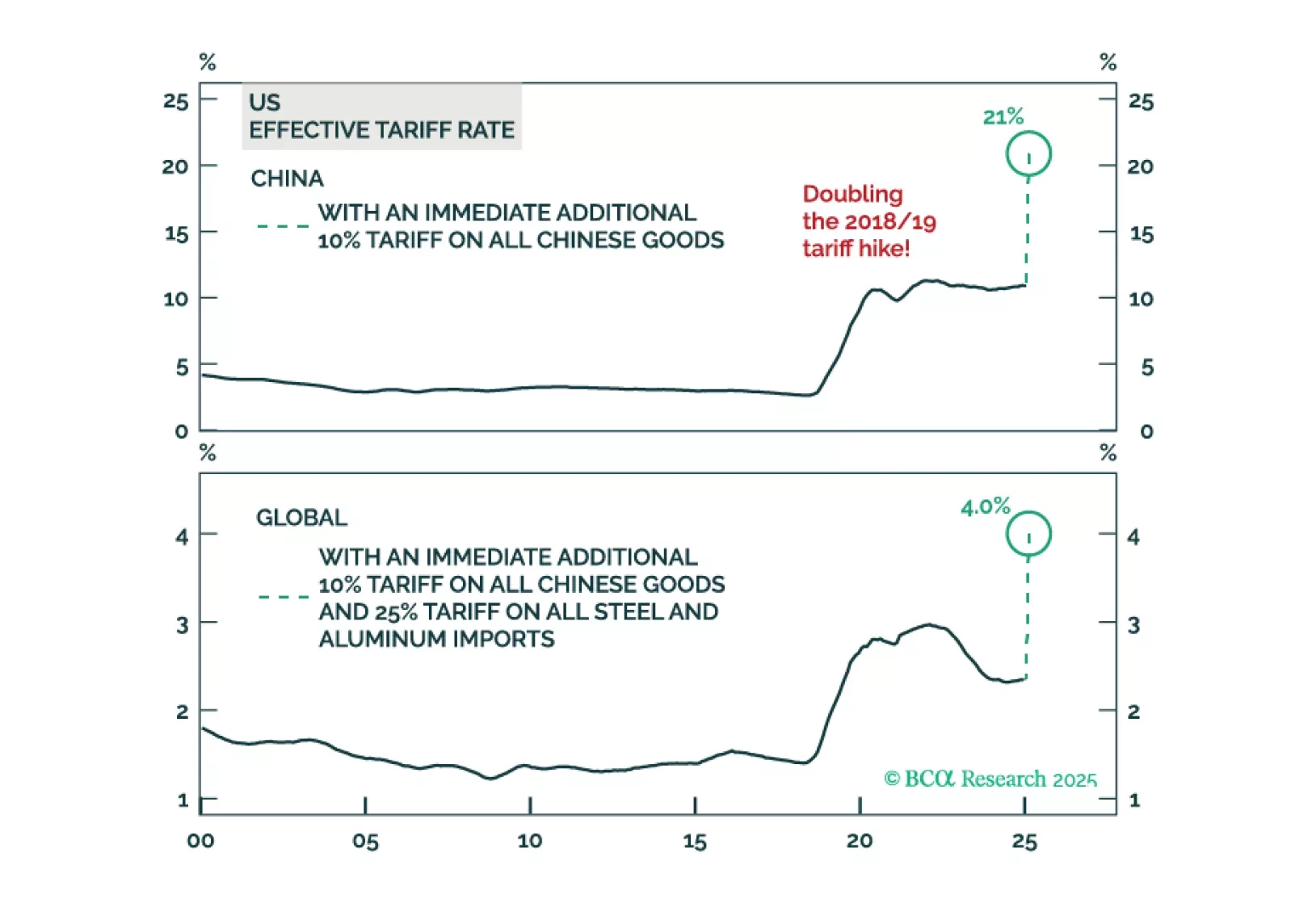

Why the US is heading into ‘mini stagflation’.

Why the BoJ must hike interest rates, and the global consequences.

The outlook…

In his latest Thoughts Of The Day, Peter Berezin discusses the different moving parts of the global economy today and the potential impact of Trump's policies.

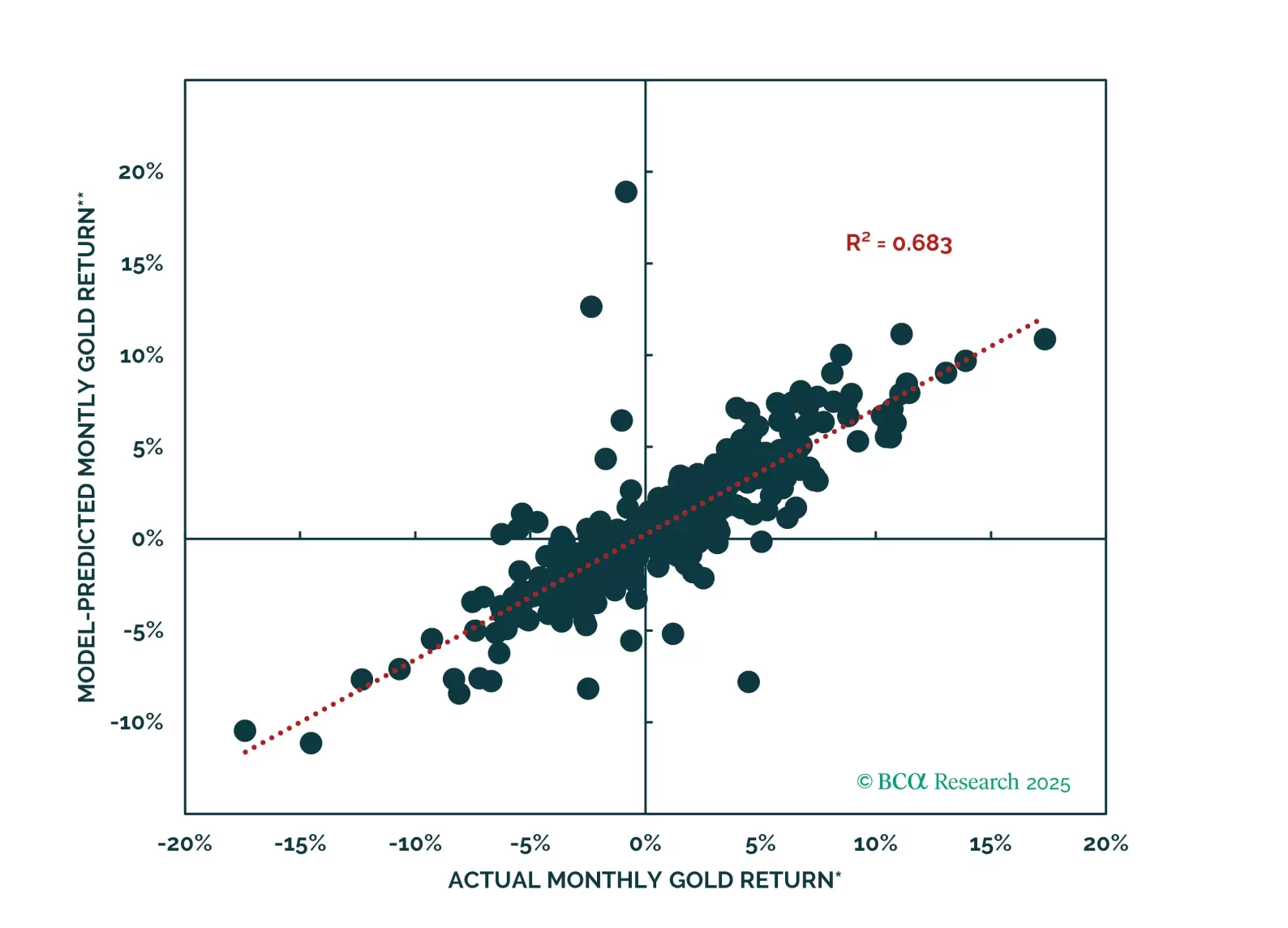

The latest version of the MacroQuant model suggests that the bull market in US stocks is winding down. The model expects Treasury yields to fall later this year but is not ready to go long duration just yet.

The latest version of the MacroQuant model suggests that the bull market in US stocks is winding down. The model expects Treasury yields to fall later this year but is not ready to go long duration just yet.

While the US economy could remain upright on the tightrope for a while longer, it will inevitably fall, leading to a major bear market in stocks. We will be looking to our MacroQuant model for guidance on when to turn fully defensive…

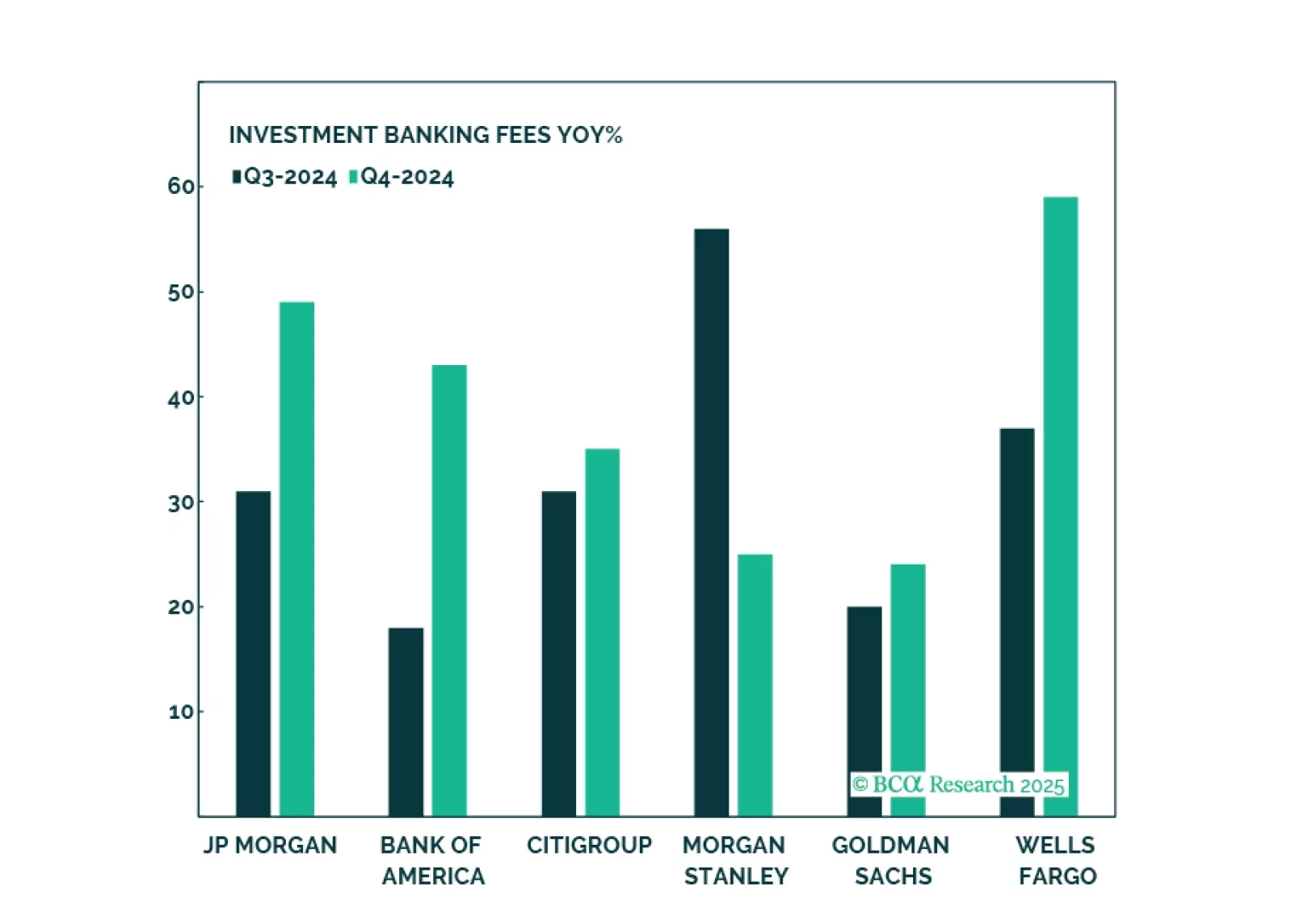

Banks have had an amazing run, and while such strong performance is unlikely to repeat, there is still oomph left in the trade thanks to a more favorable regulatory environment, stronger demand for loans, a steeper yield curve, and a…