Investors should be tactically tilting allocations towards Direct Lending, Distressed Debt, and Directional Hedge Fund strategies at the expense of Real Estate, Private Equity, and Diversifier Hedge Funds. Structural opportunities…

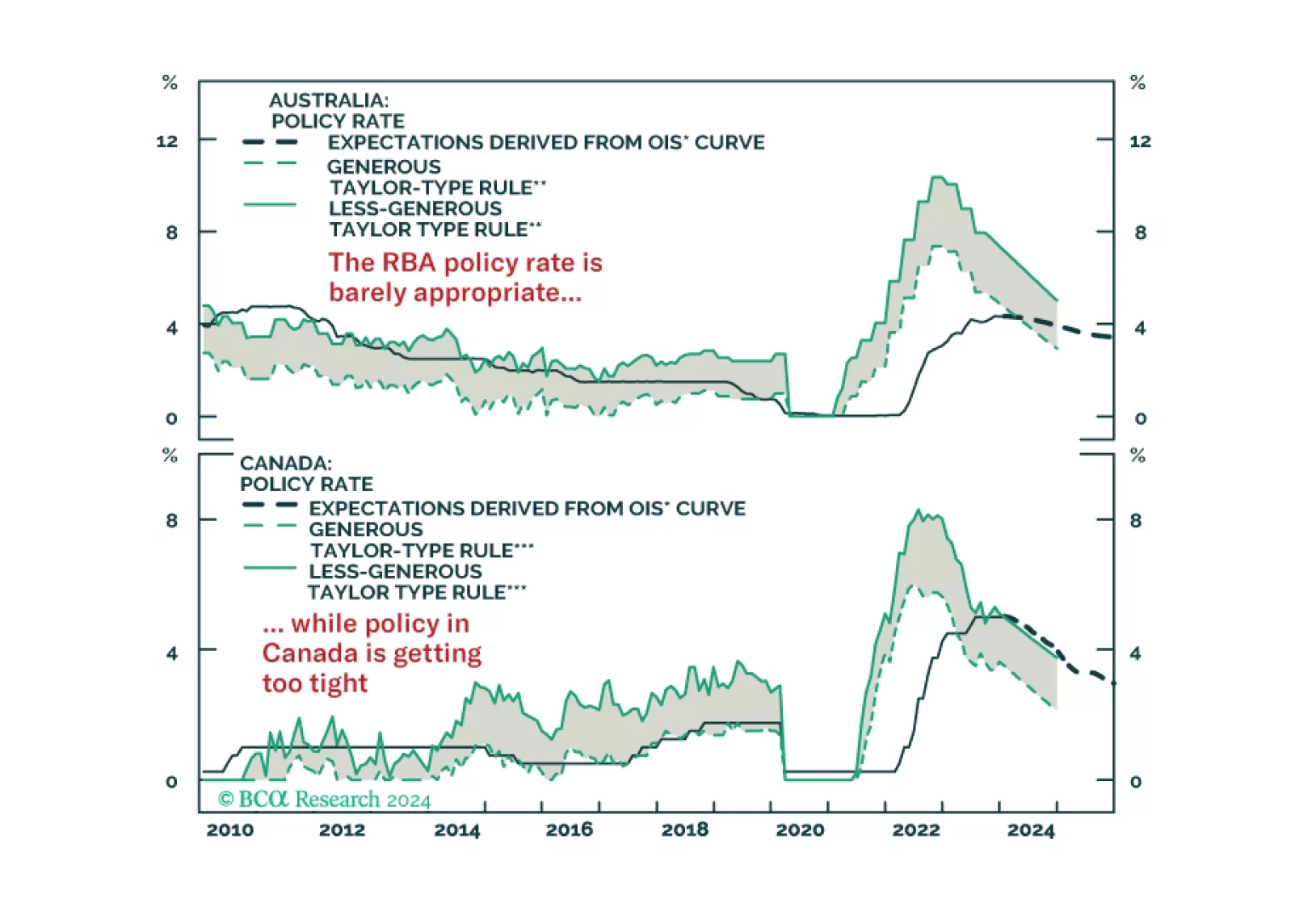

In this Strategy Insight, we assess the monetary policy path for Australia and Canada in 2024 and we discuss how to profit from a growing divergence between the two economies.

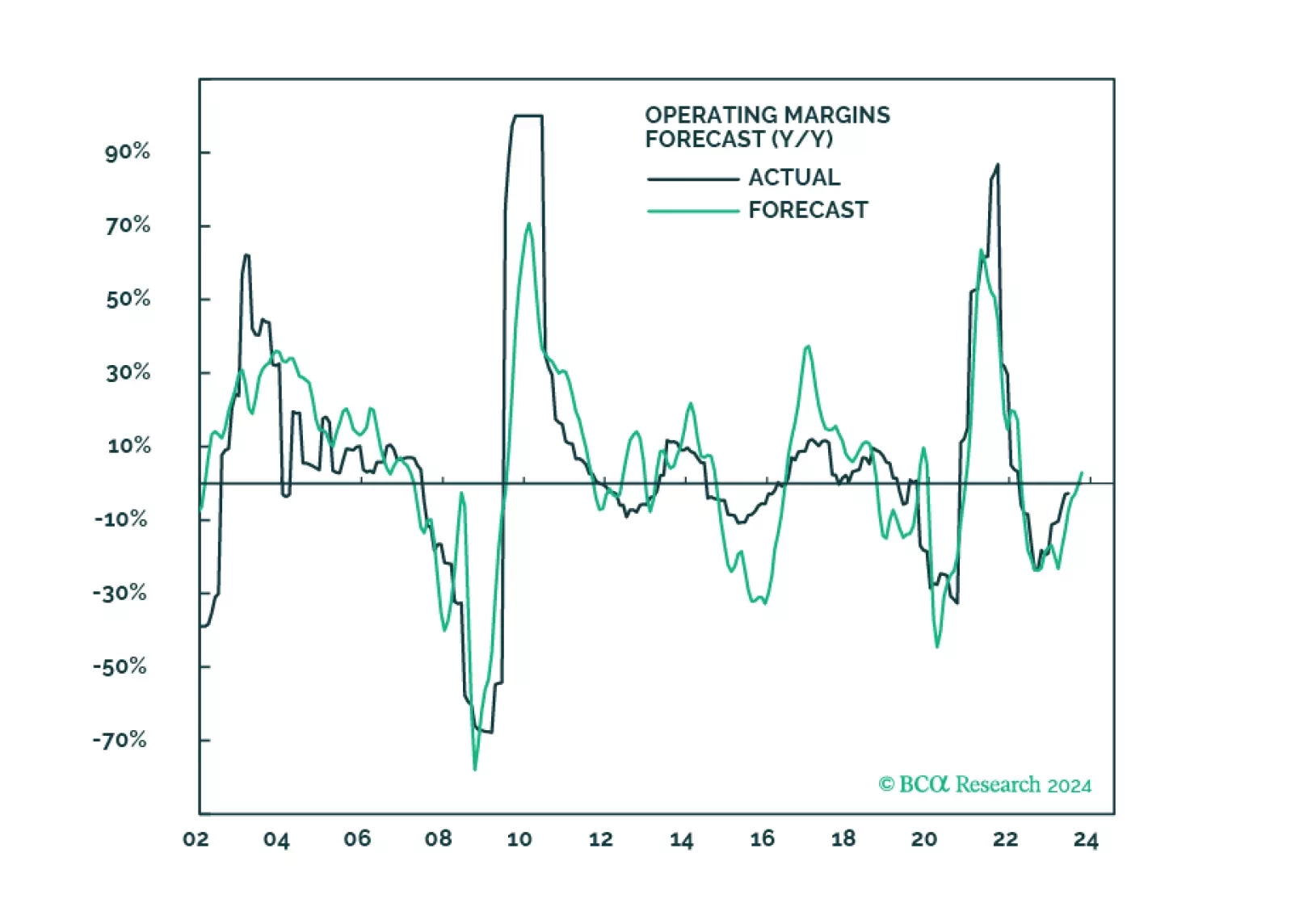

Disinflation coupled with sticky wage growth is likely to result in either a second wave of inflation or layoffs and a recession. In the meantime, market expectations for sales, growth, and margins are overly optimistic and are…

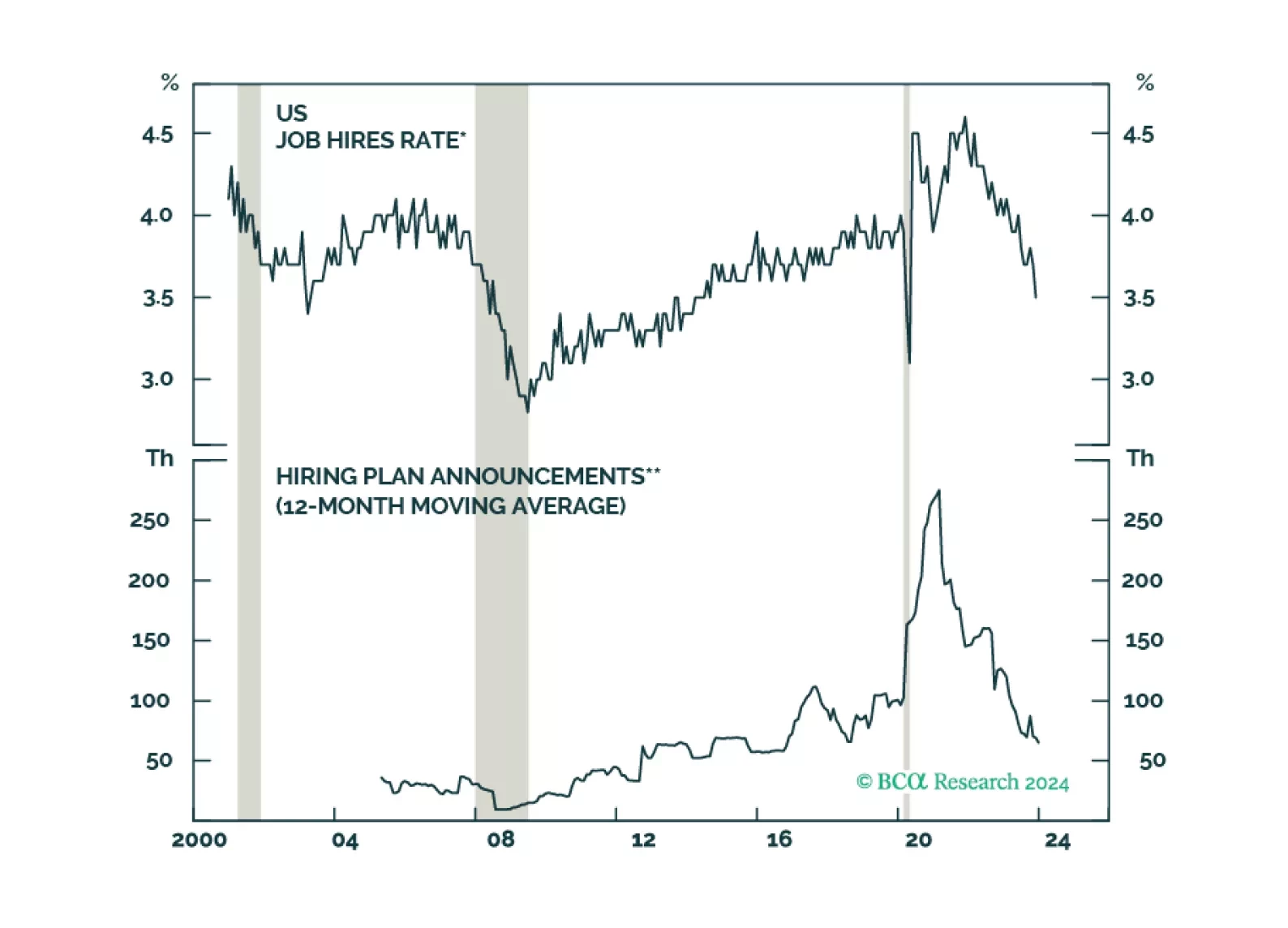

Investors have taken comfort in the fact that unemployment has remained low in the major economies. But underneath the surface, there are clear signs that labor demand is weakening. The clock keeps ticking towards our H2 2024…

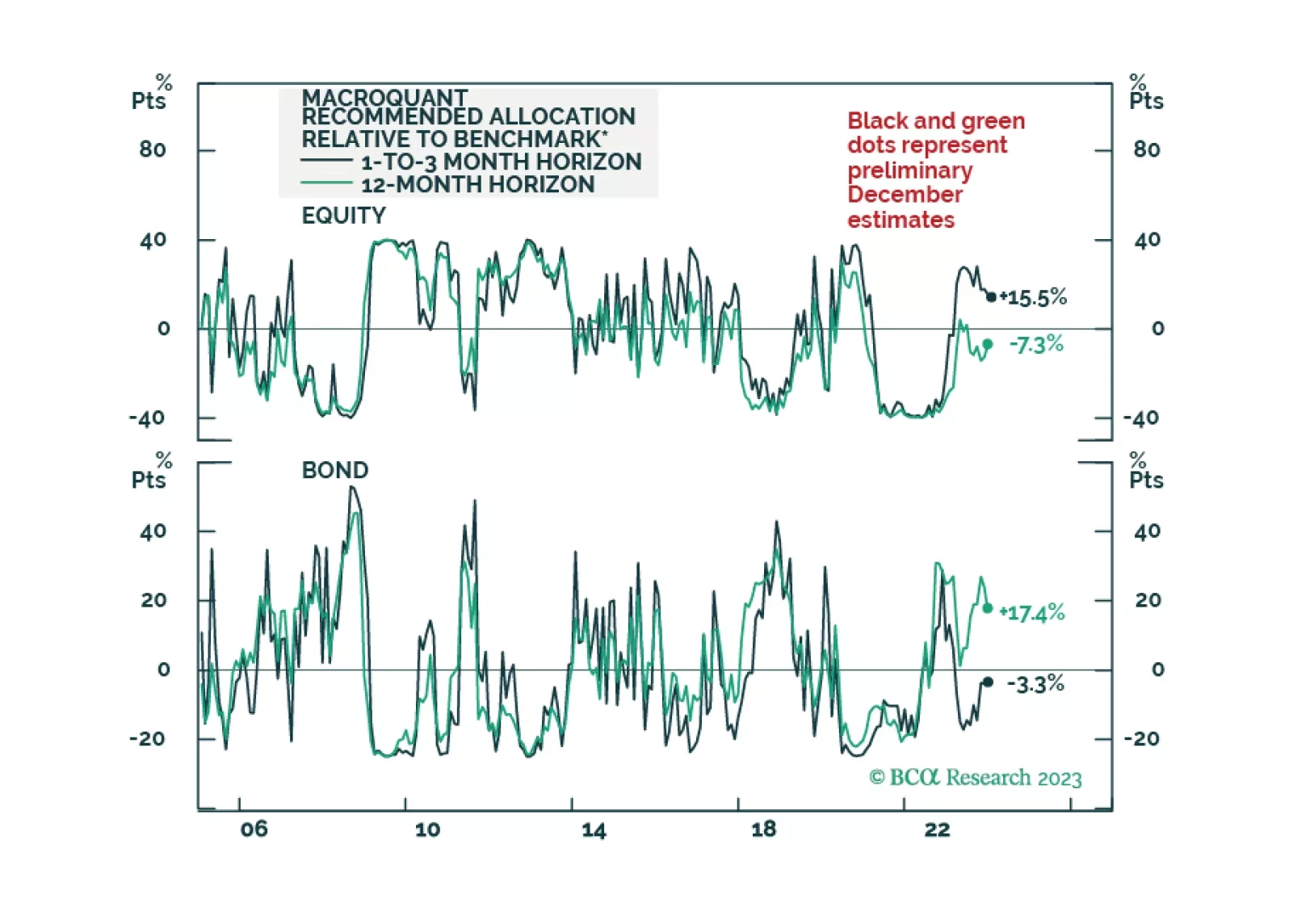

A soft landing can be achieved but not maintained. We are cutting our tactical recommendation on stocks from overweight to neutral and scaling back our long-duration stance.

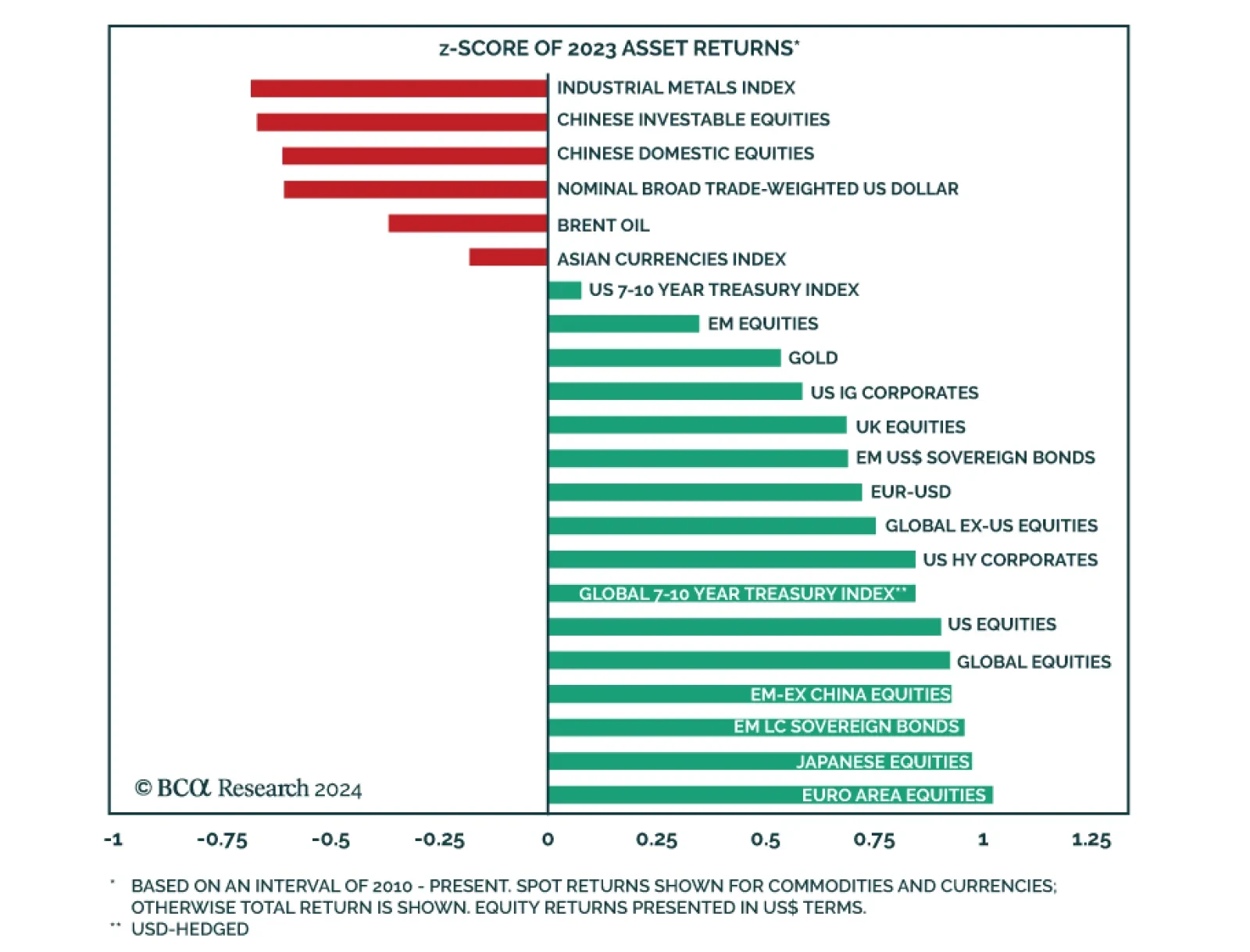

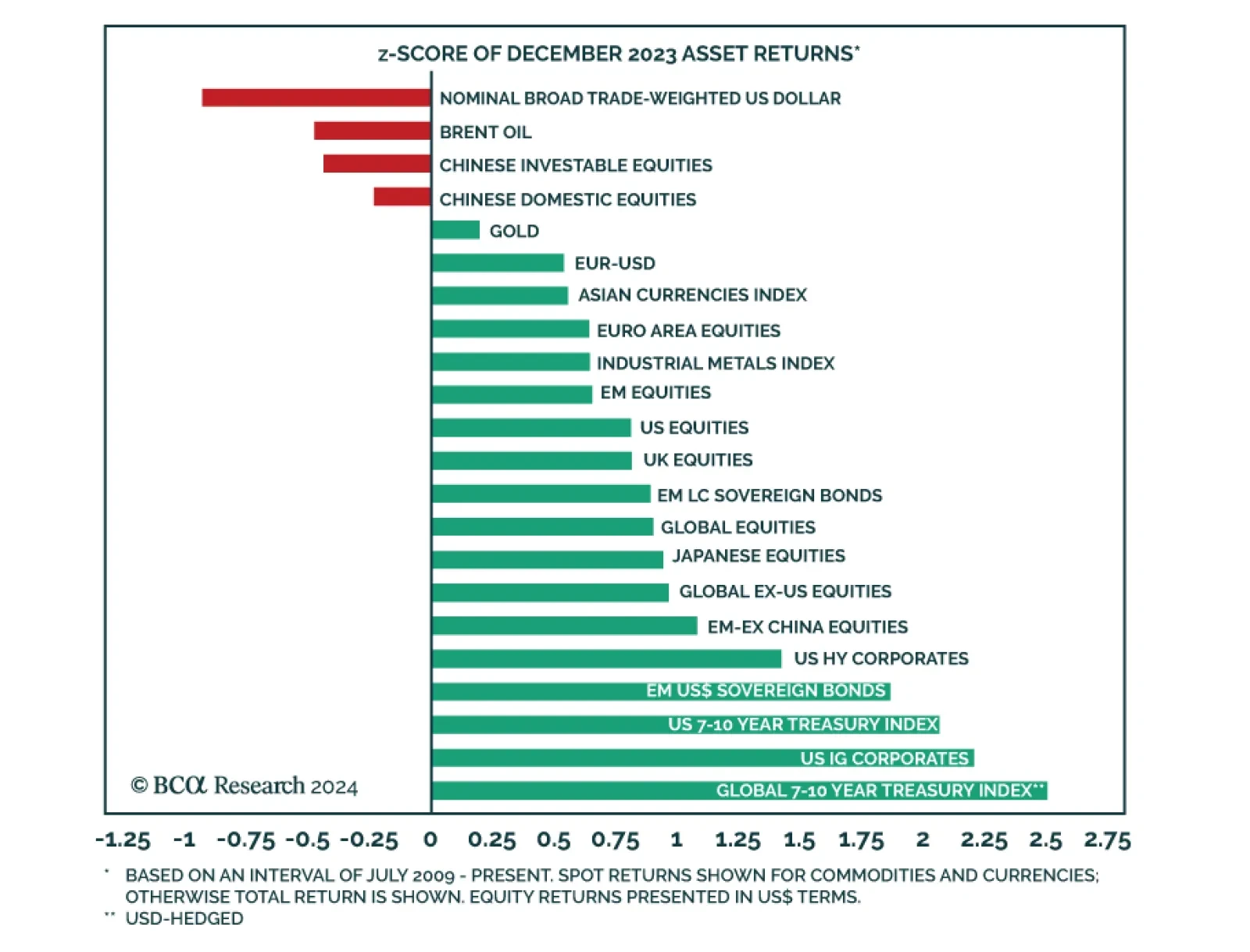

2023 was an unexpectedly good year for global financial markets. Most of the major financial assets we track generated positive abnormal gains. Although US stocks outperformed their global counterparts, Eurozone, Japanese, and…

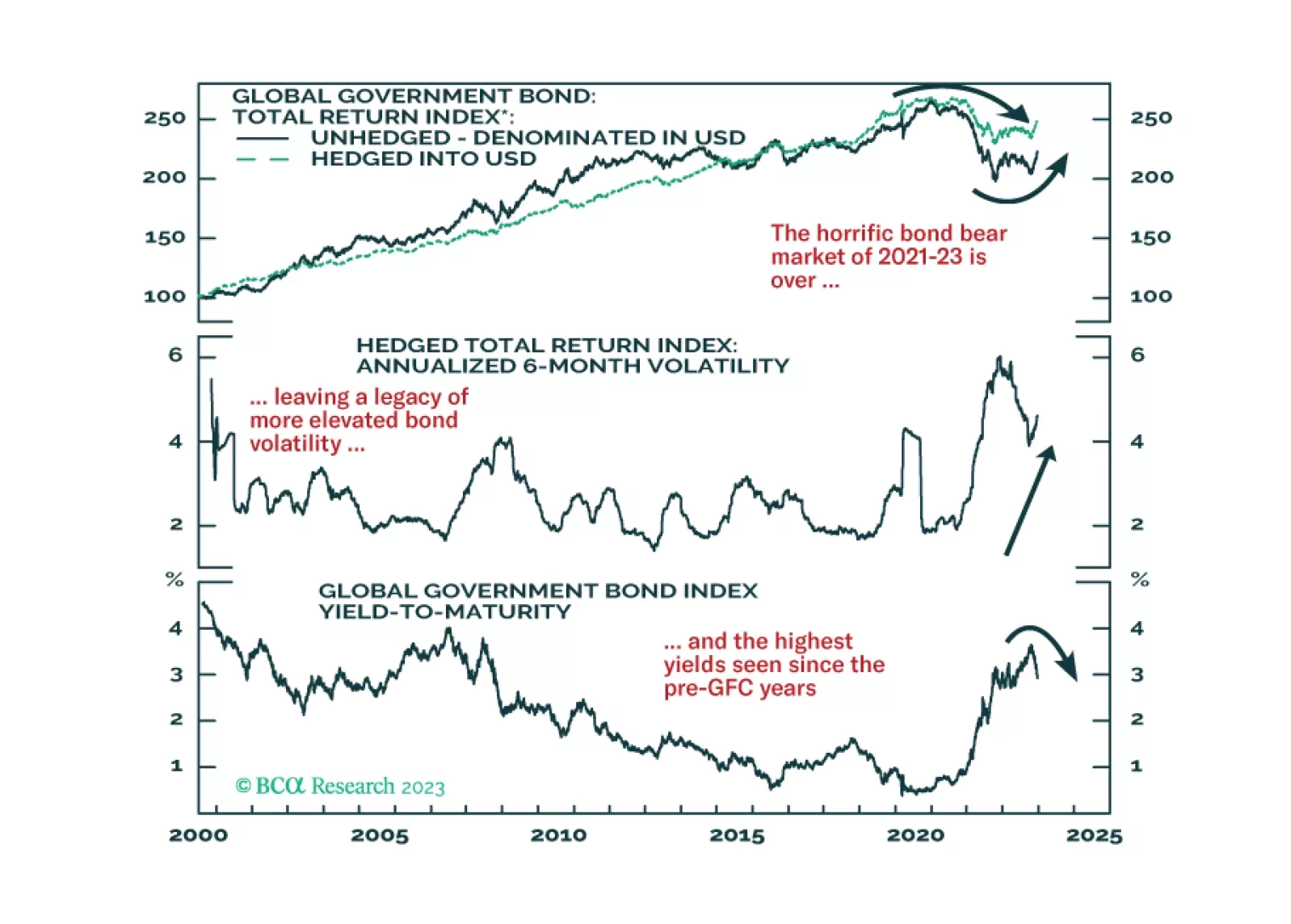

Global financial markets ended 2023 on a positive note, delivering a second consecutive month of exceptional gains in December. Fixed income once again led in terms of abnormally large returns on the back of increased…

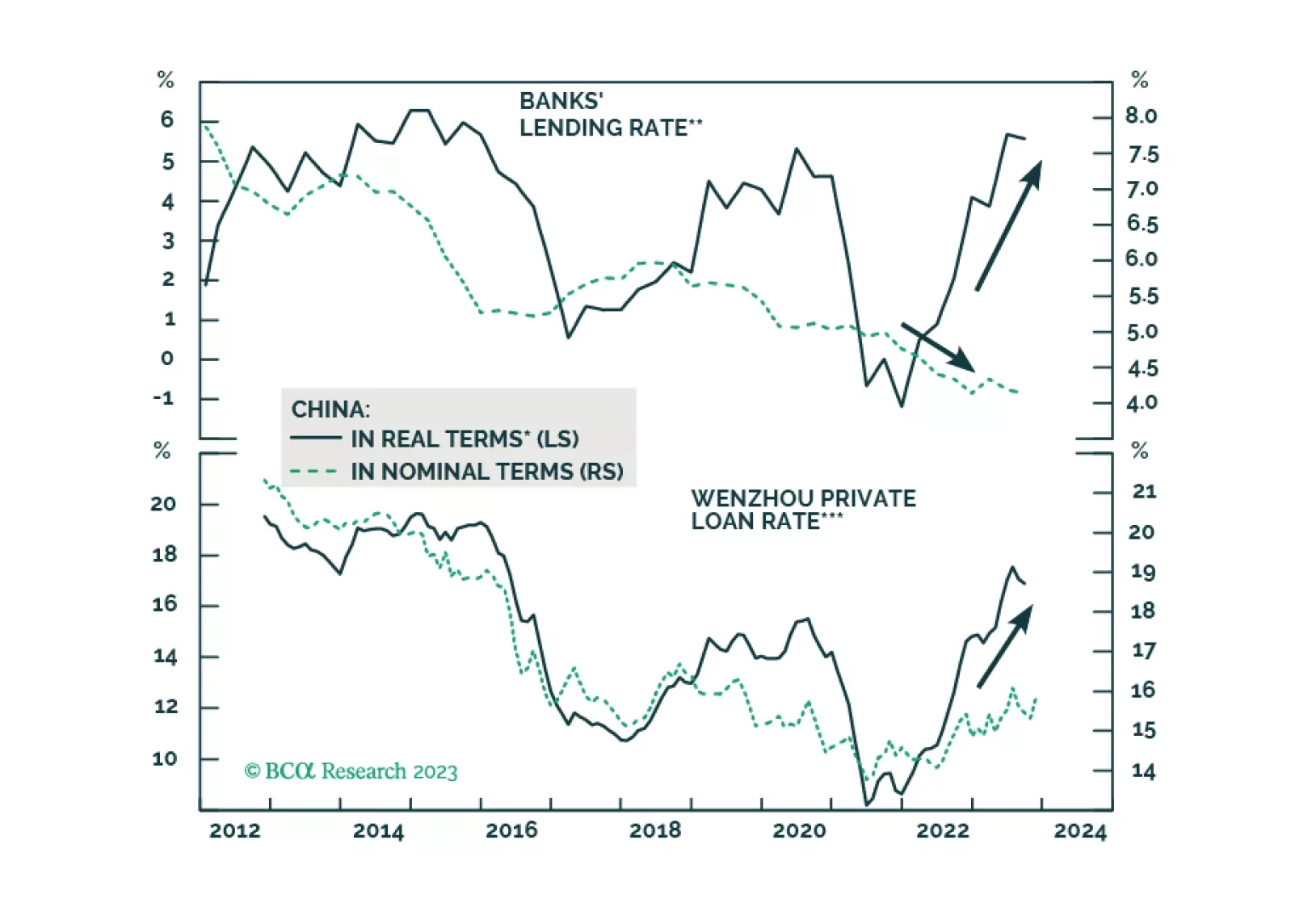

The statement from last week’s Central Economic Work Conference indicates that Chinese authorities are still not considering large-scale stimulus in 2024. Odds are that a full-fledged business cycle recovery in 2024 is unlikely.…

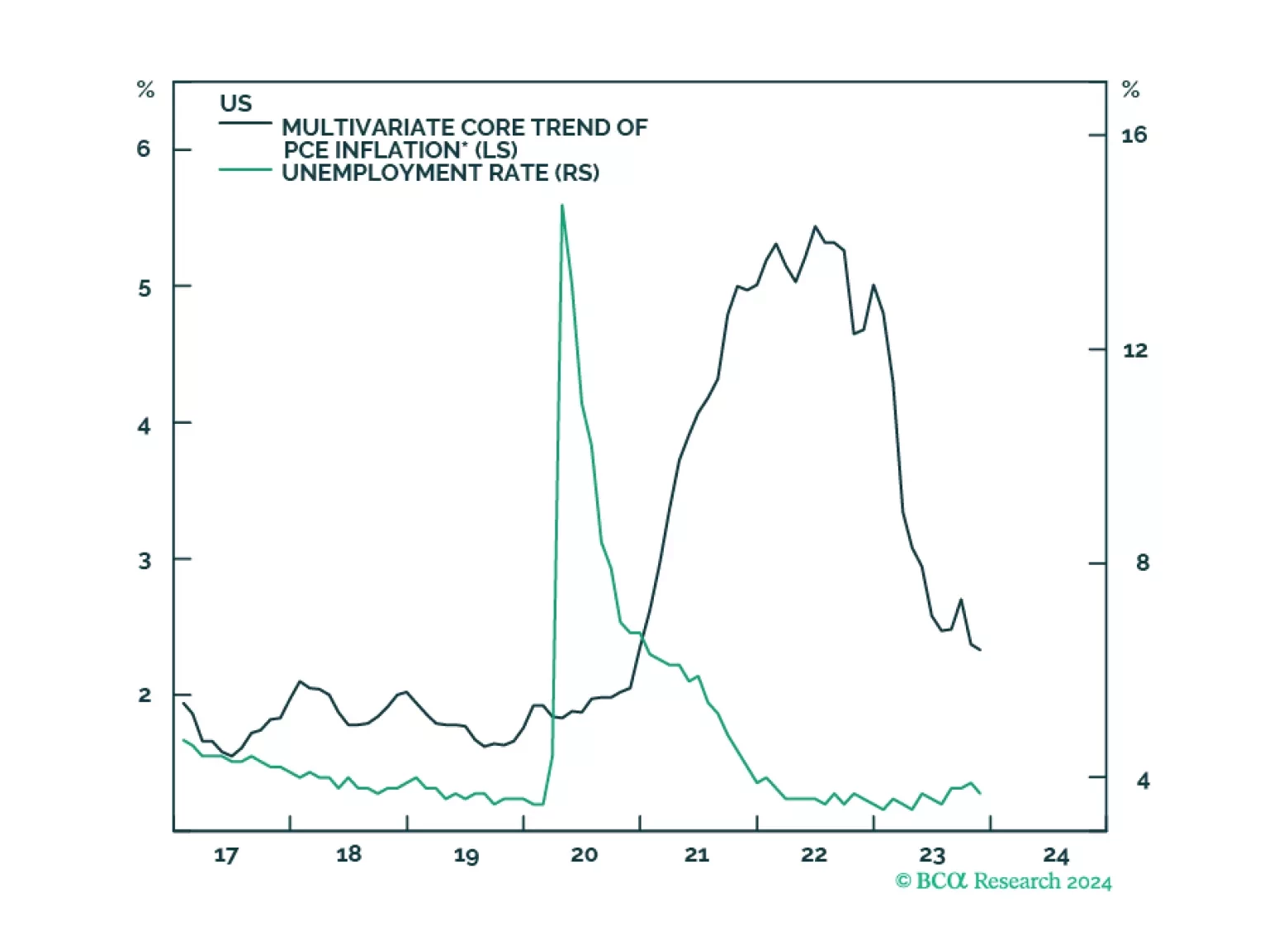

Global Investment Strategy predicted the surge of inflation in 2021/22 and the immaculate disinflation of 2023. Now their unique framework is predicting a recession in the second half of 2024.