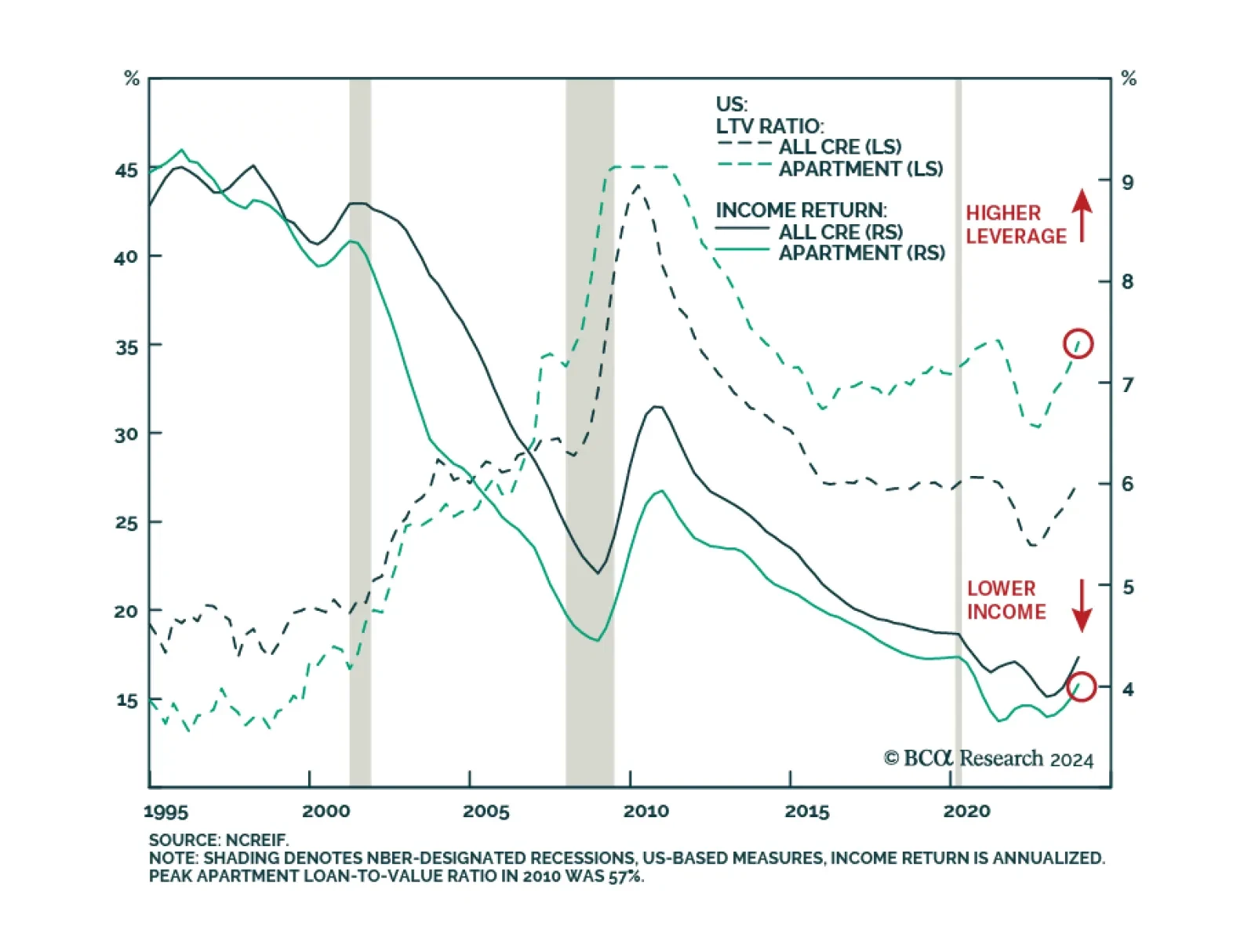

According to BCA Research’s Private Markets & Alternatives service, fundamentals show US Multifamily assets to be akin to picking up pennies in front of a steamroller. Multifamily, and Office, have long served as…

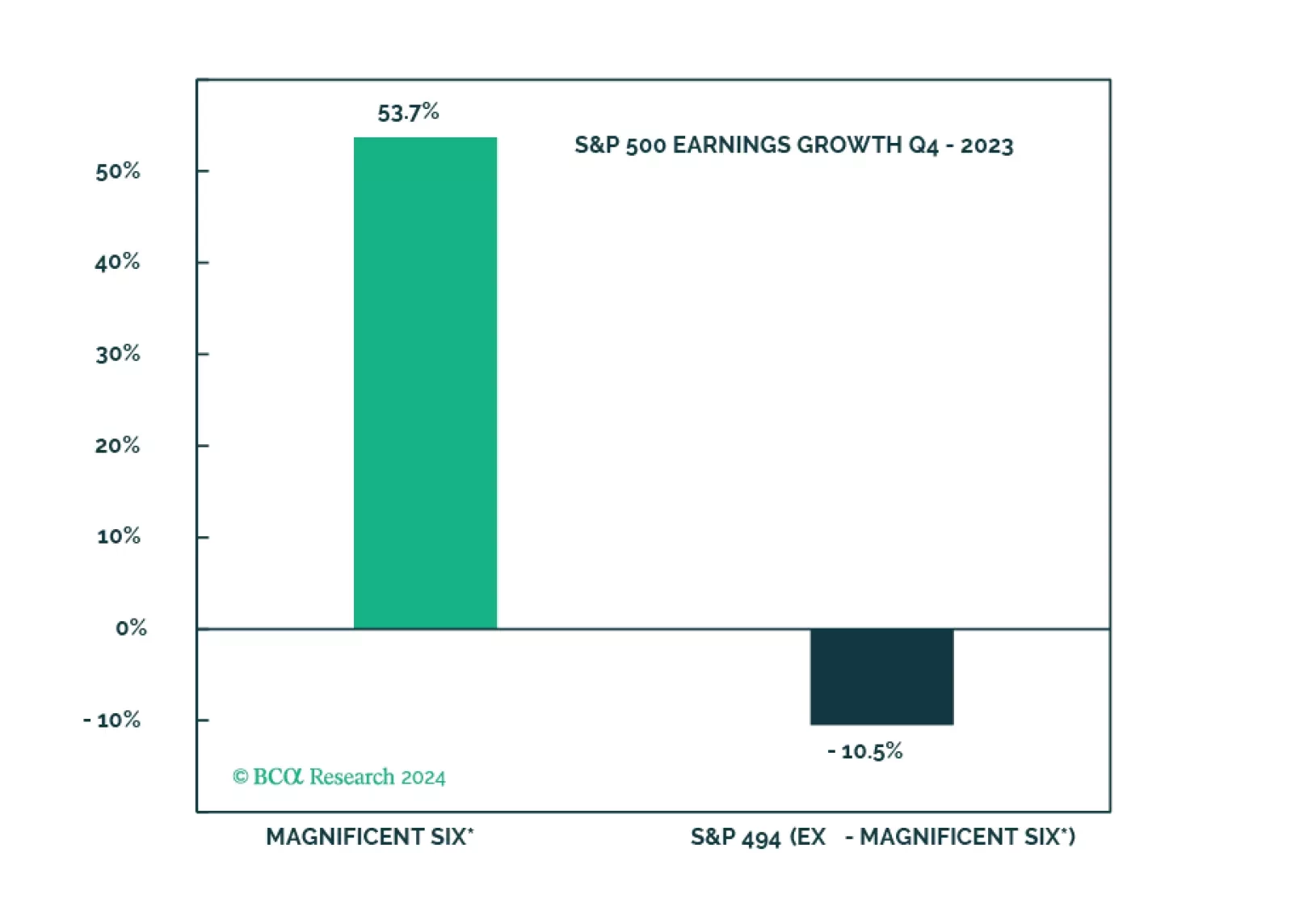

Reported earnings for Q4-2023 were rather underwhelming and prone to issues that we have identified over the past few months: Growth is concentrated in just a few sectors and companies, while the profitability of a broad swath of the…

Recessions often begin seemingly out of the blue when the economy’s temperature falls enough to set in motion adverse feedback loops that cause unemployment to rise. We expect the US economy to suddenly freeze over towards the end of…

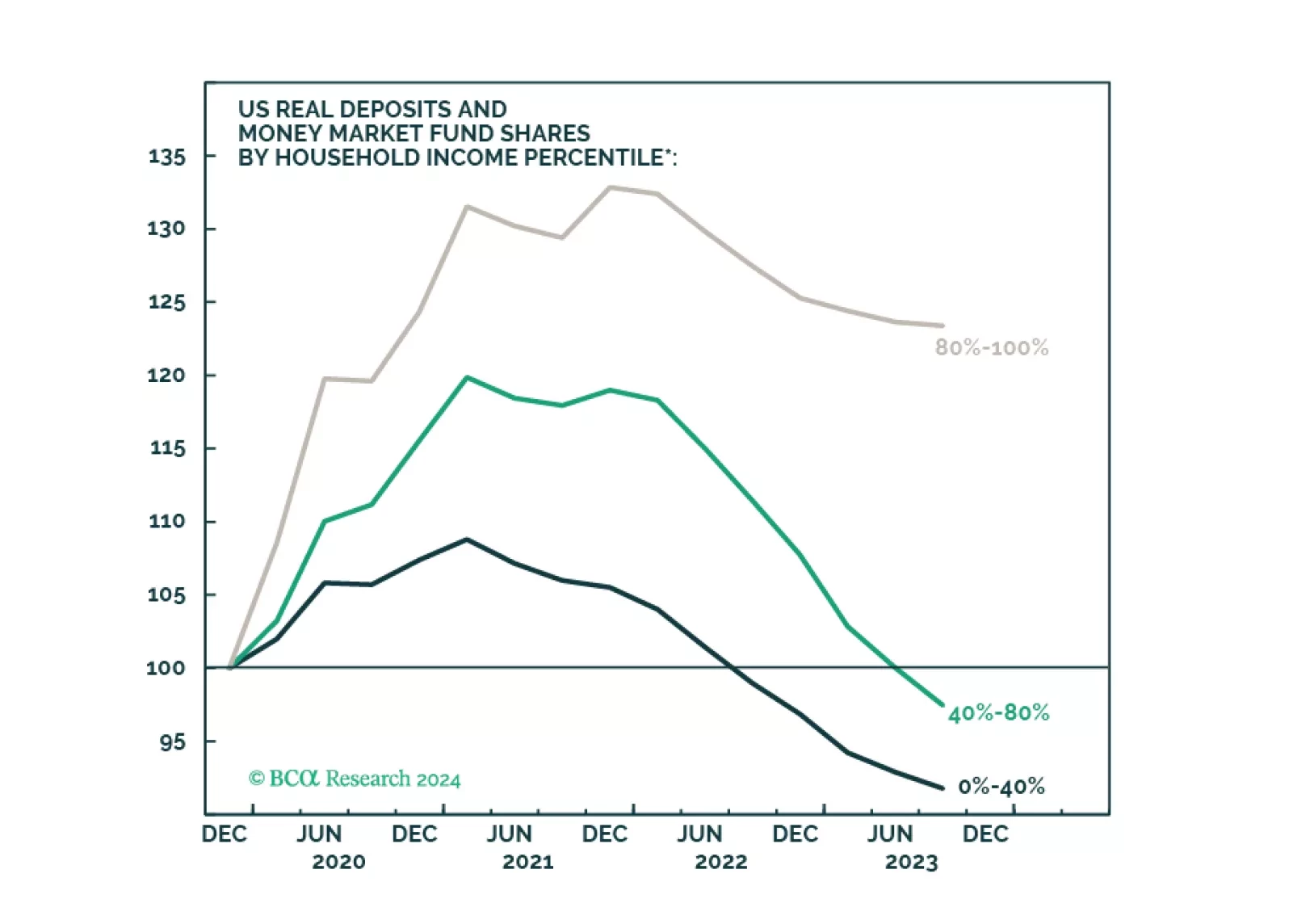

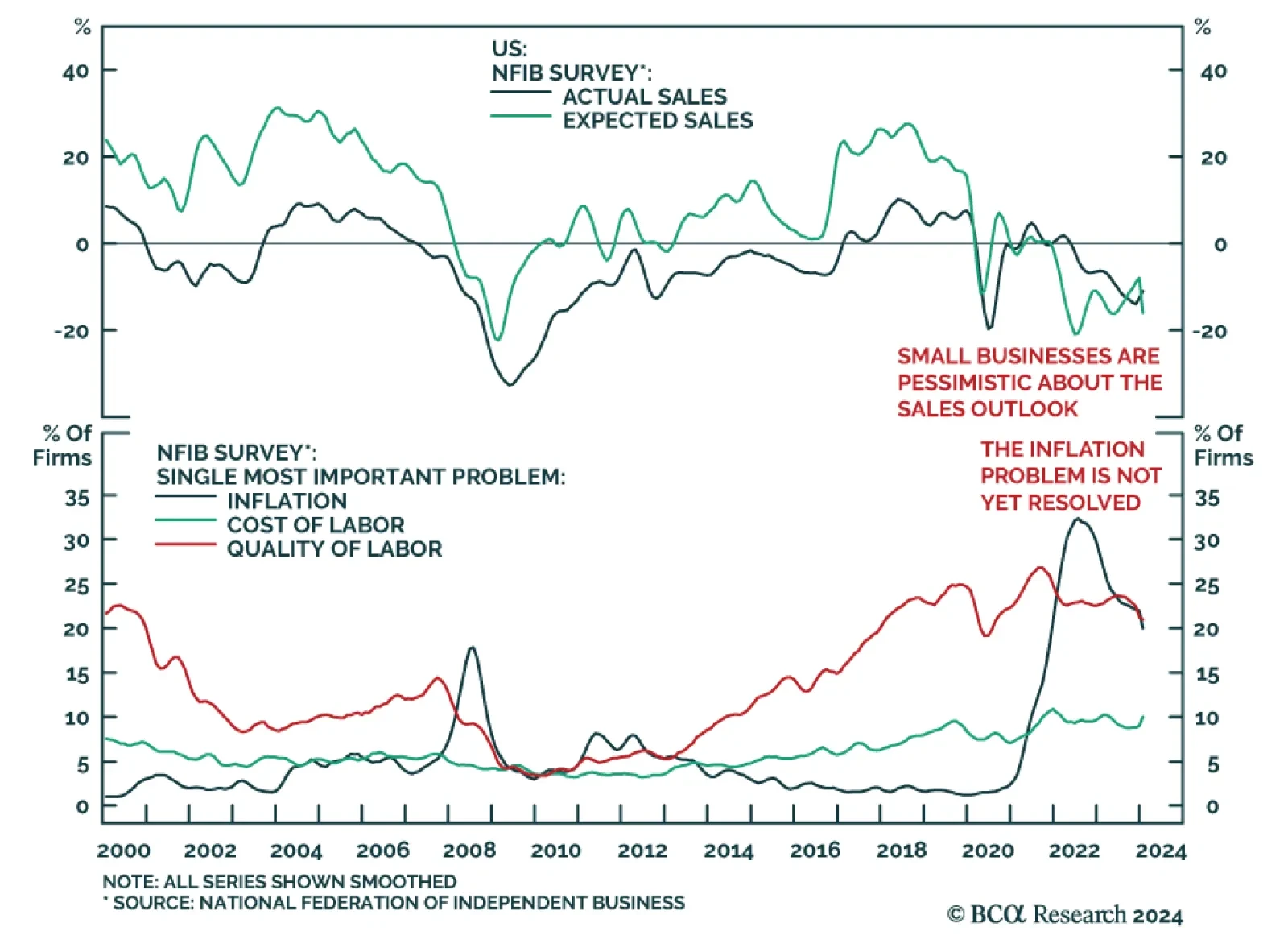

We highlighted in a recent Insight that positive economic surprises are prompting economists to revise up their US economic growth expectations. The Goldilocks narrative is supporting the rally in risk assets. However, results of…

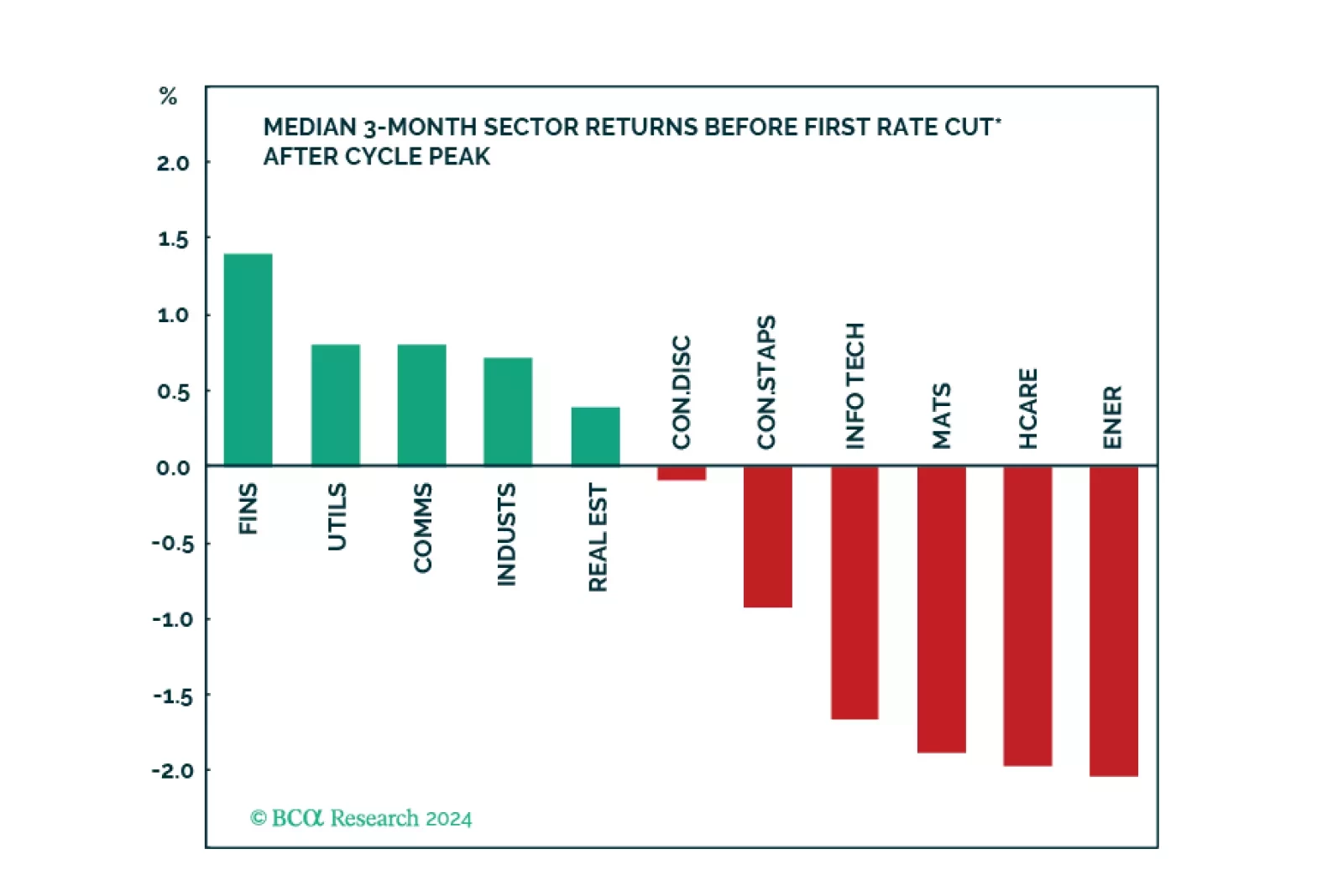

We created a sector selection scorecard based on performance of sectors under various macroeconomic regimes while taking into consideration revisions to expected earnings growth and valuations in a historical context. Our total…

Easier financial conditions, rising home prices, rebounding consumer sentiment, and a stabilization in manufacturing activity all augur well for near-term US growth prospects. An unsustainably low savings rate is a key risk to the US…

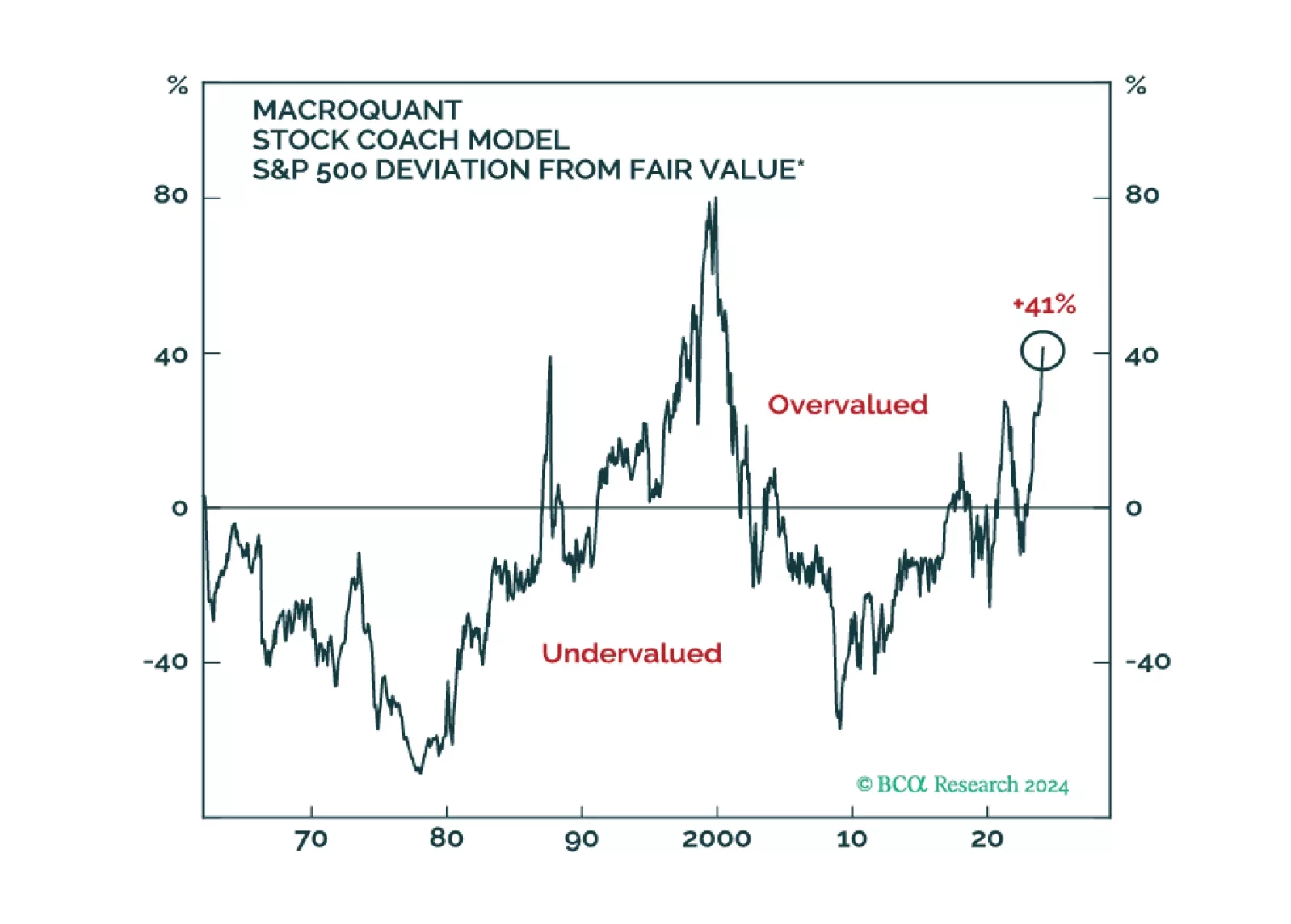

The soft landing and rate cuts narrative is being priced out, and the S&P 500 is overvalued and getting overbought. The Magnificent Seven are about to get a new moniker on the back of performance dispersion. However, without the…

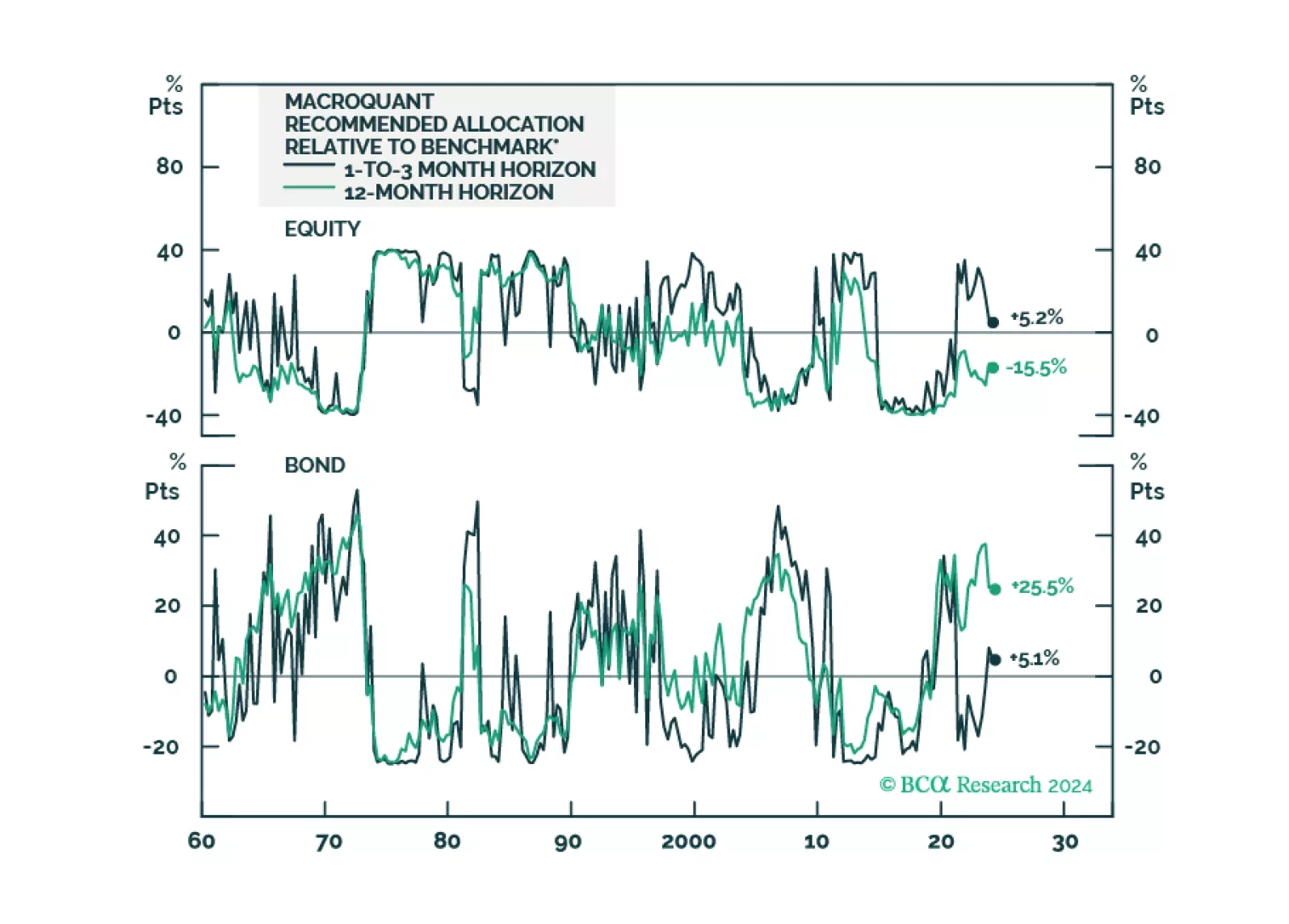

Following the release of the white paper yesterday, today we are sending you the inaugural issue of the MacroQuant Monthly, a report summarizing the output of our next-generation MacroQuant 2.0 model.

A recent slew of macroeconomic data has reassured us that the runway to a recession is longer than many thought. However, that positive realization comes with two caveats. First, the Fed pivot is not imminent, and the magnitude of…

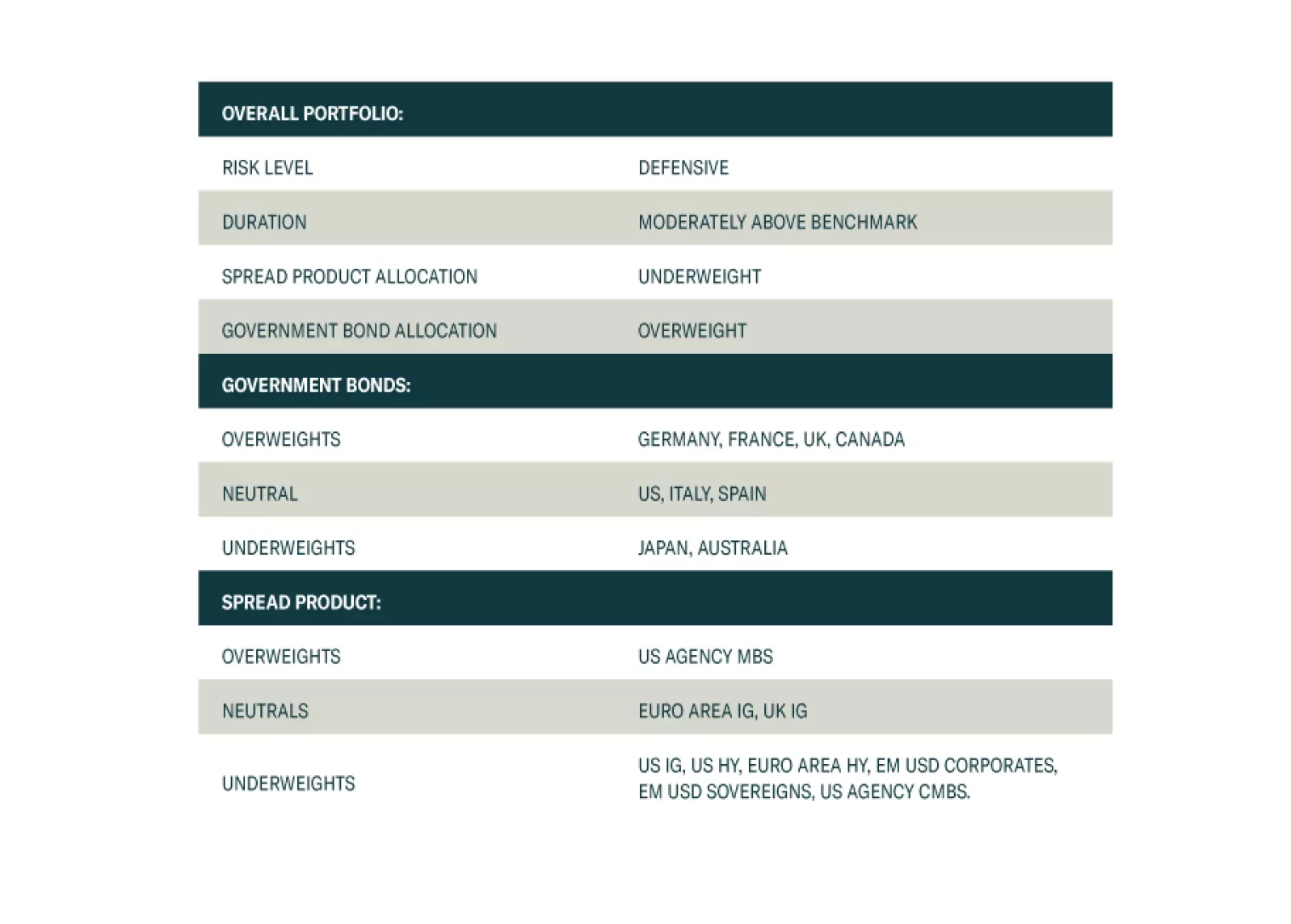

We present the performance review of the Global Fixed Income Strategy Model Bond Portfolio for 2023. We also discuss the outlook for 2024 performance based on our Key Views for the year. The portfolio is positioned to benefit from a…