In this note, we preview the Q1-2024 earnings season, give our take on expectations and share what we will be watching.

In this report, we present our quarterly review of our Model Bond Portfolio. The anti-growth bias of the portfolio allocations hurt the portfolio performance in Q1/2024 as global growth surprised to the upside. However, we anticipate…

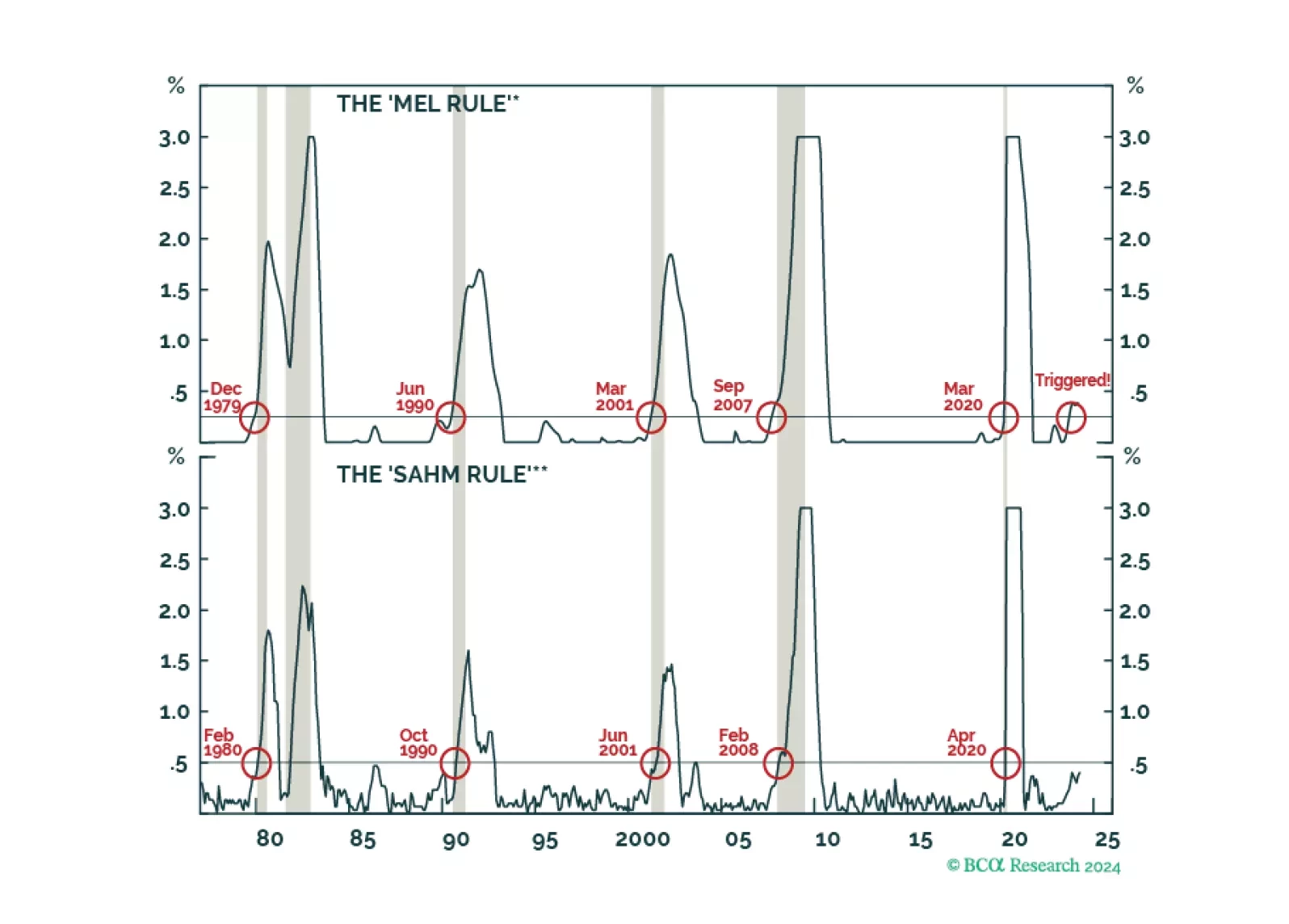

Contrary to conventional wisdom, most leading indicators suggest that the US labor market is weakening, including our very own “Mel rule.” After being overweight stocks last year, we moved to neutral at the start of 2024, and are now…

Investors typically associate high-flying tech stocks with high sensitivity to interest rates. The rationale is simple: Given that most of their cashflows are further into the future, their value will be more sensitive to changes…

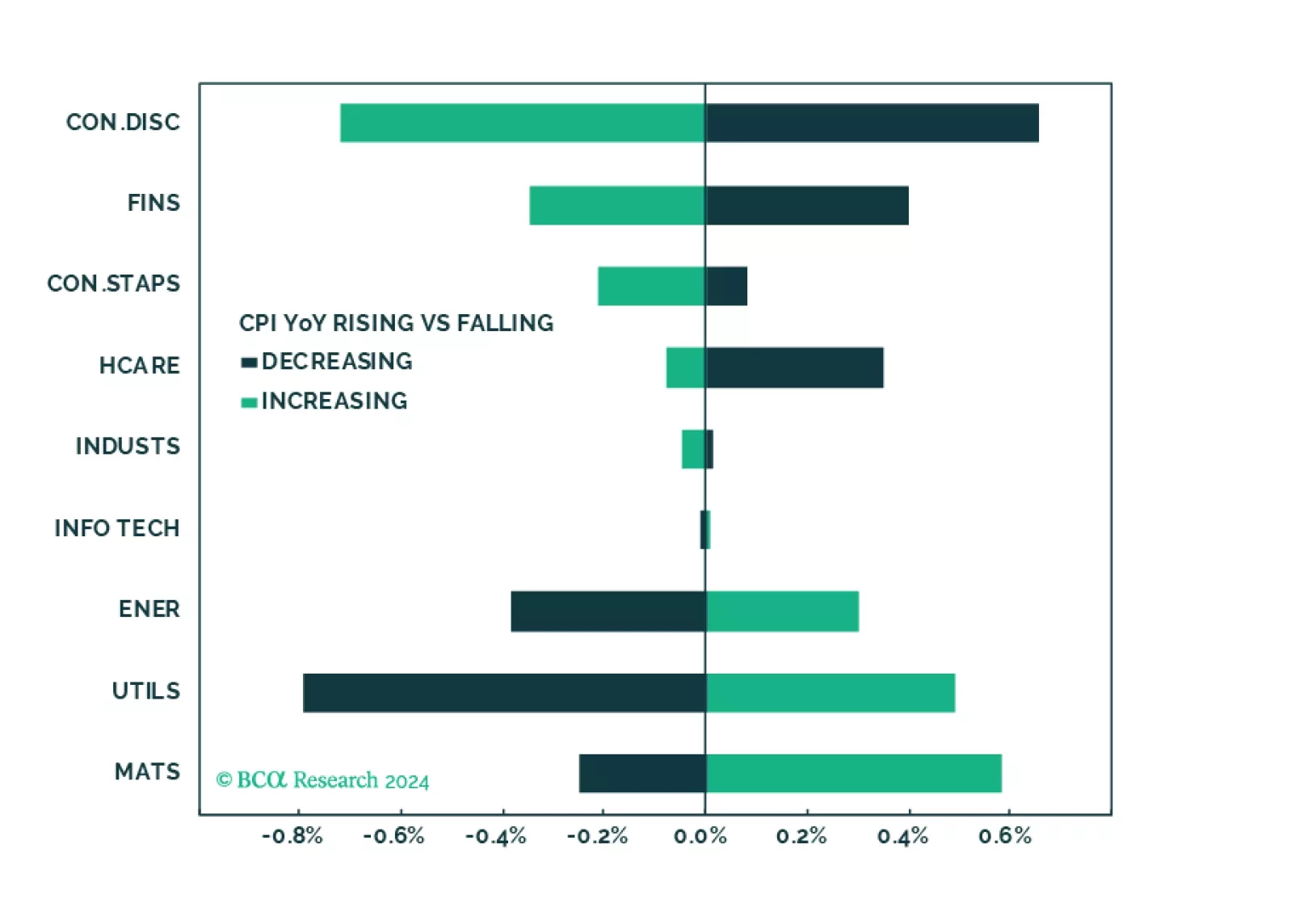

Fears of a hard landing are abating as growth has been surprising to the upside. New worries are emerging, such as the trajectory of disinflation, and the pace and timing of rate cuts. In this environment, it is important to build a…

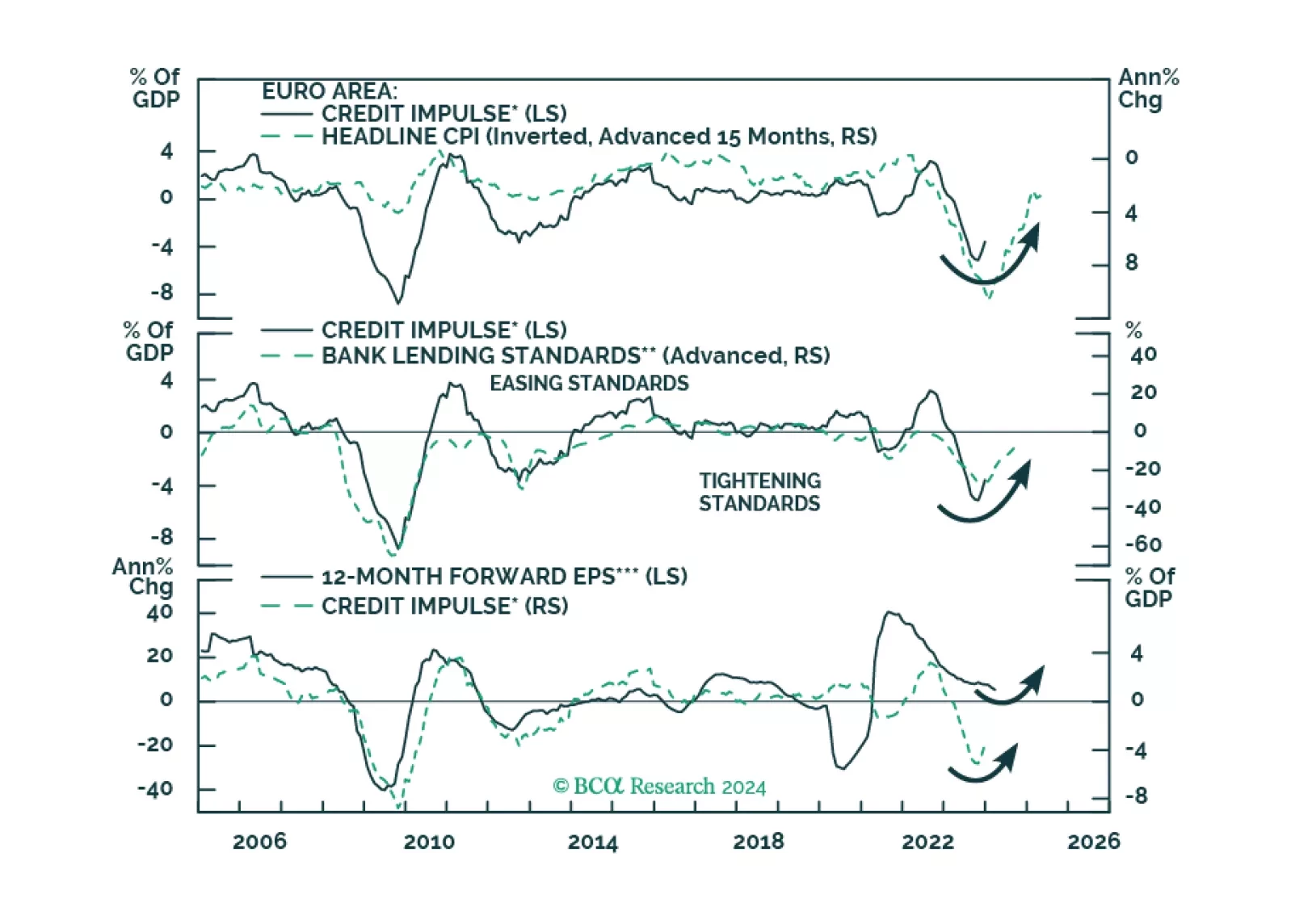

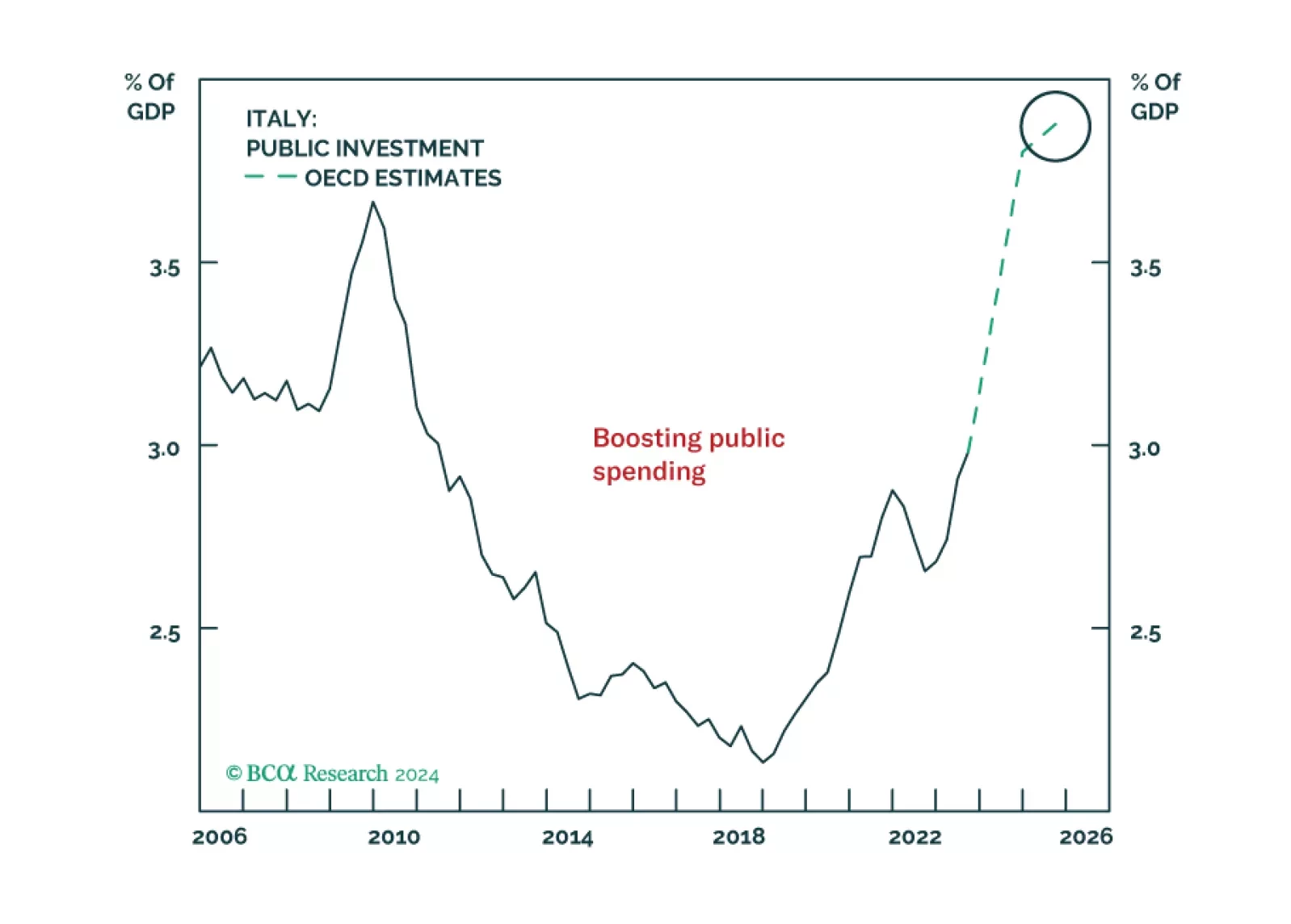

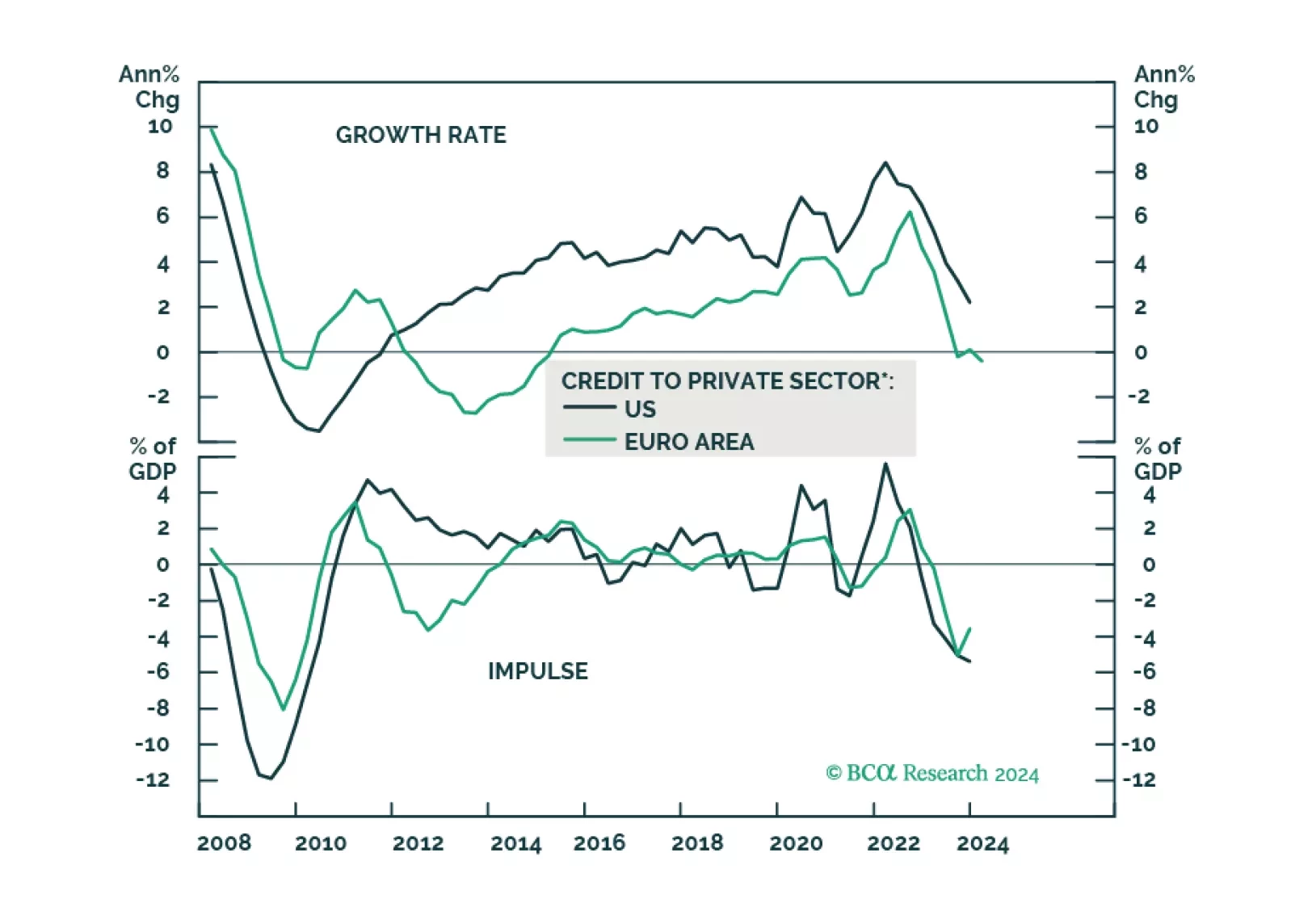

Europe credit flows are stabilizing, hence a major drag on the region’s growth will dissipate. What does this development imply for European equities?

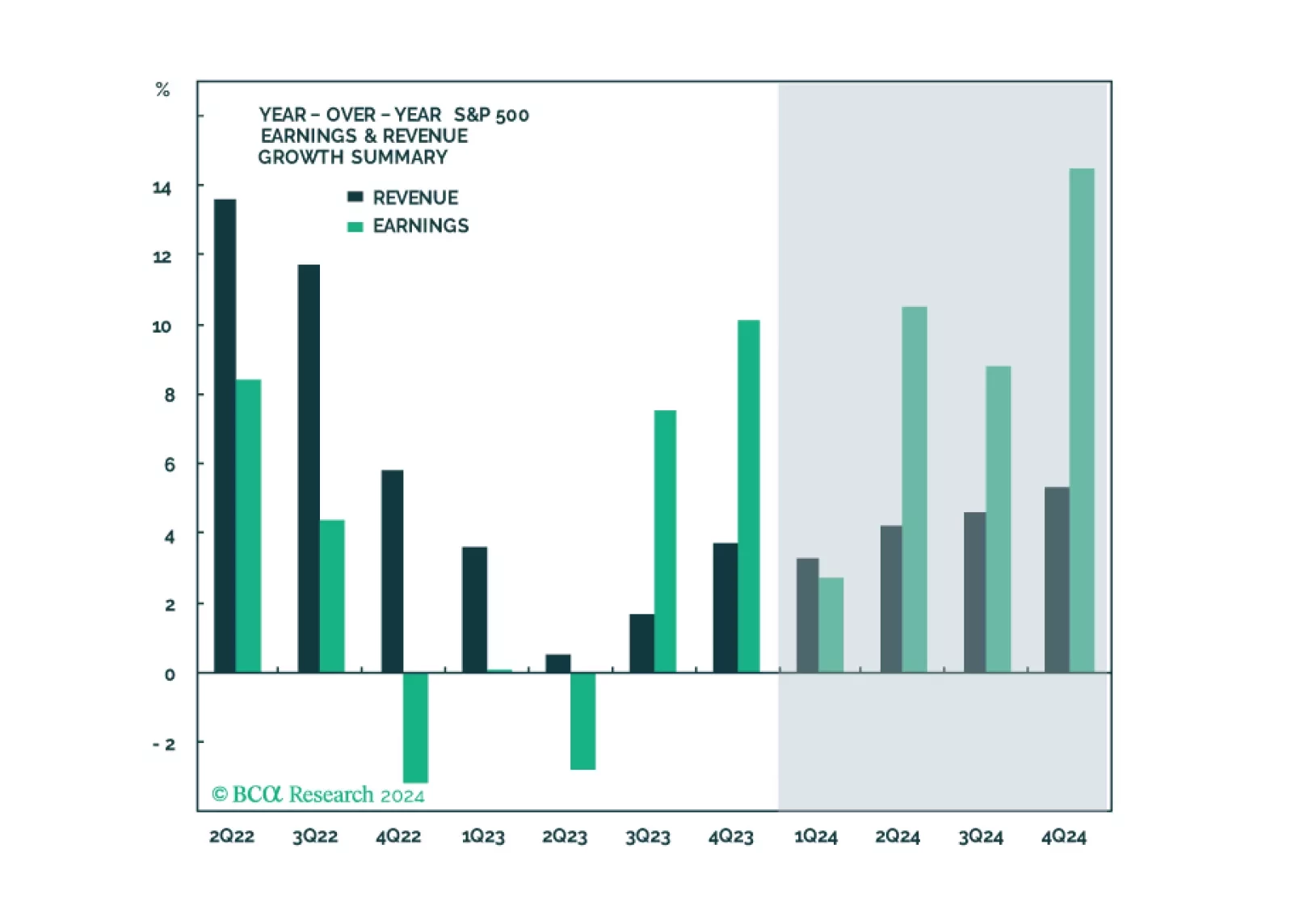

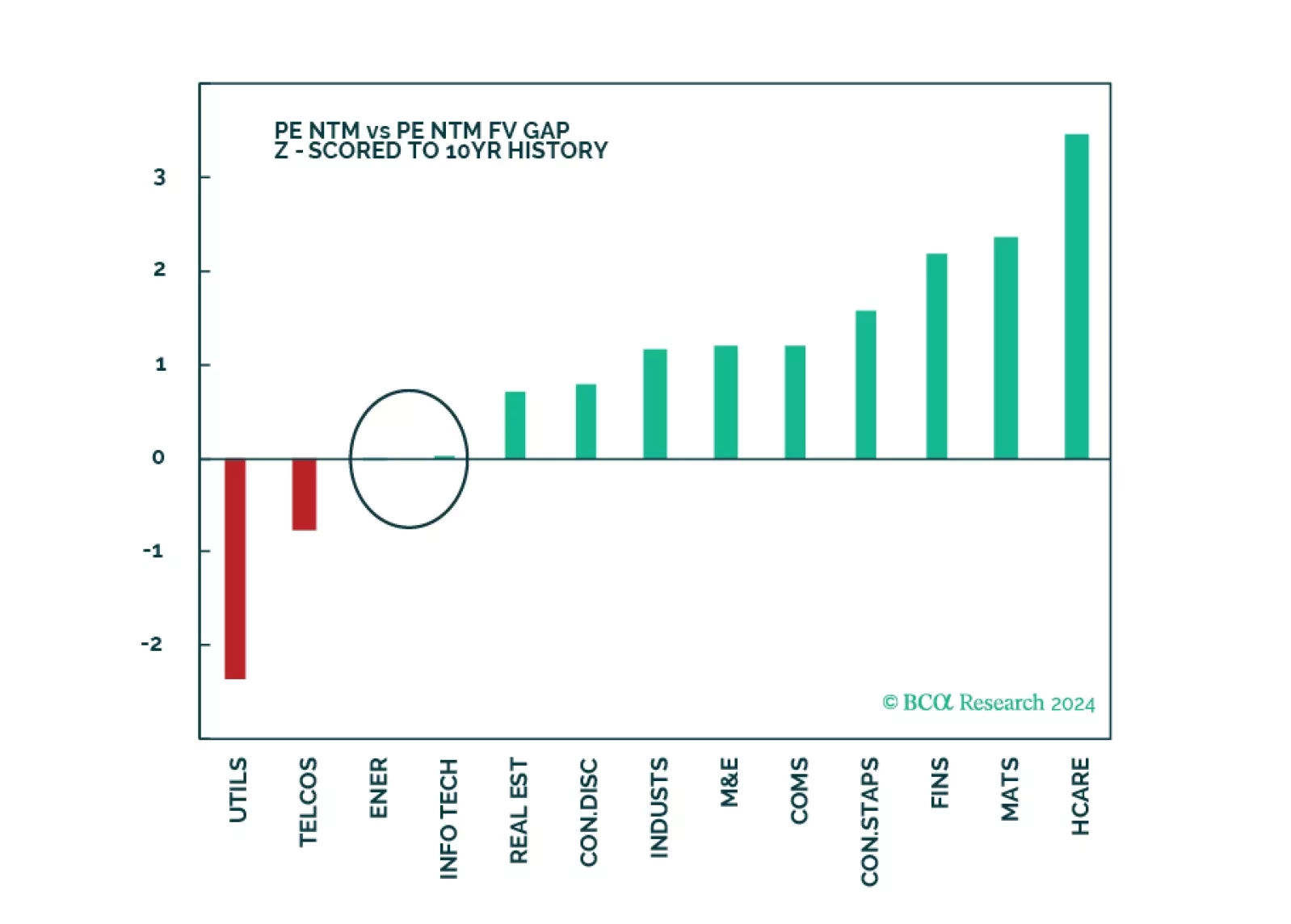

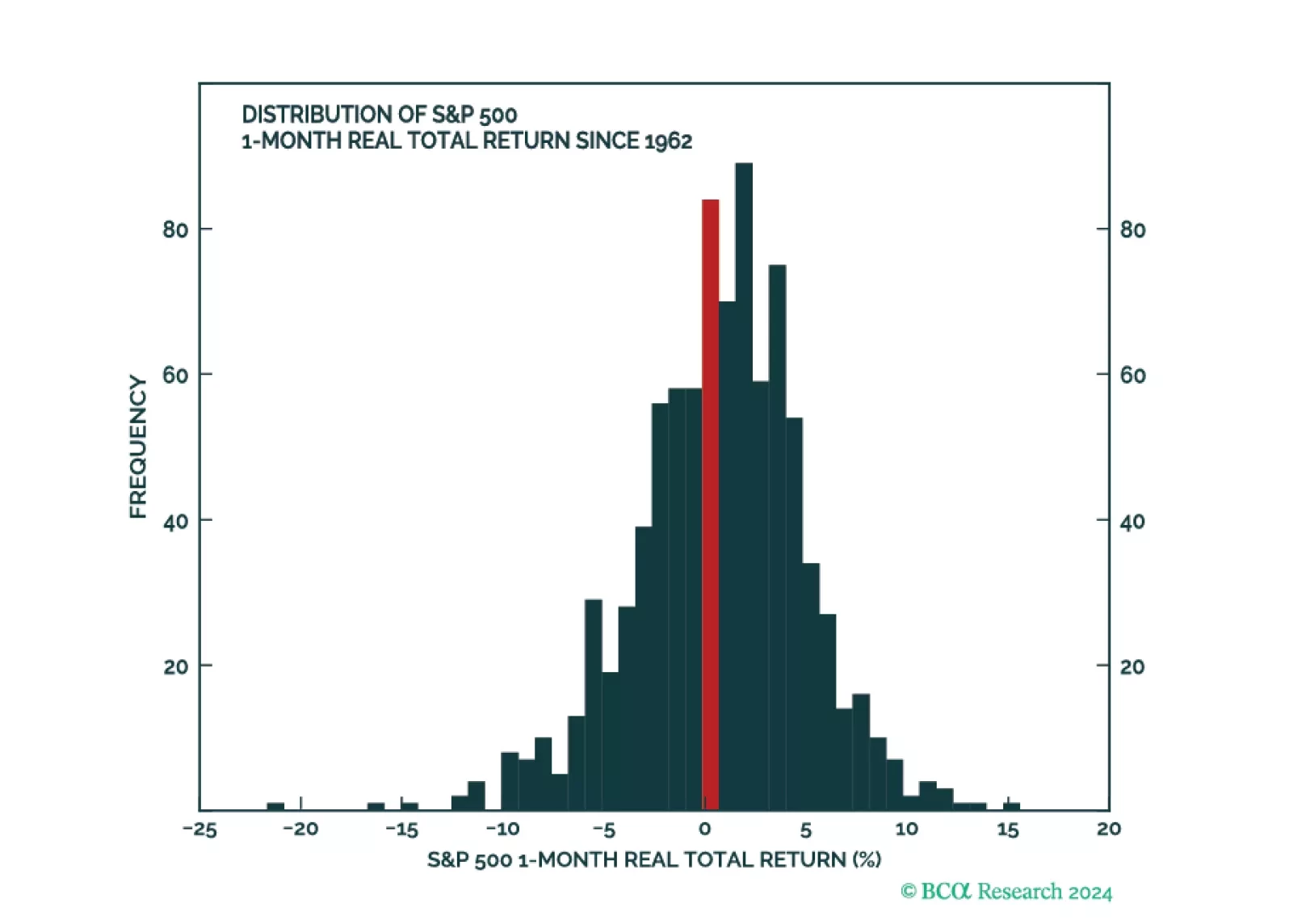

The equity rally extended into March as hard landing outcome was priced out. It has broadened, as money flowed into less over-loved pockets of the market. Our models signal that margins are about to stabilize, and earnings growth…

The global economy is wobbling precariously between slowing growth and reaccelerating inflation. This is unlikely to end well. Stay cautious, and hedge against both recession and inflation.

MacroQuant downgraded equities from overweight to neutral on a 1-to-3 month horizon. The model maintains a negative view on stocks over a 12-month horizon.