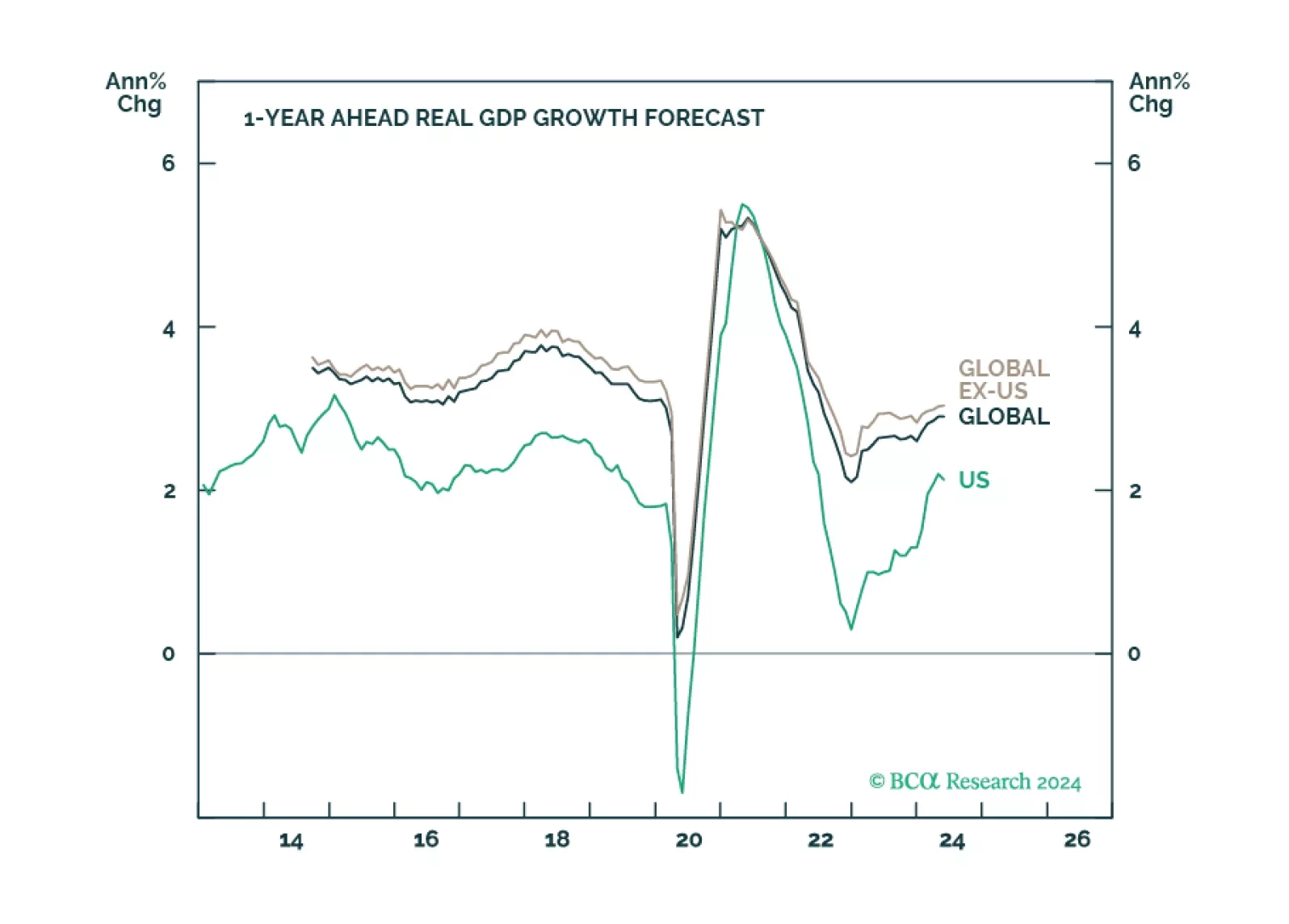

There is a path to a soft landing, but it is a narrow one. We estimate that there is only a 20% chance that the US will avoid a recession before the end of 2025. We are currently neutral on global equities, but expect to downgrade…

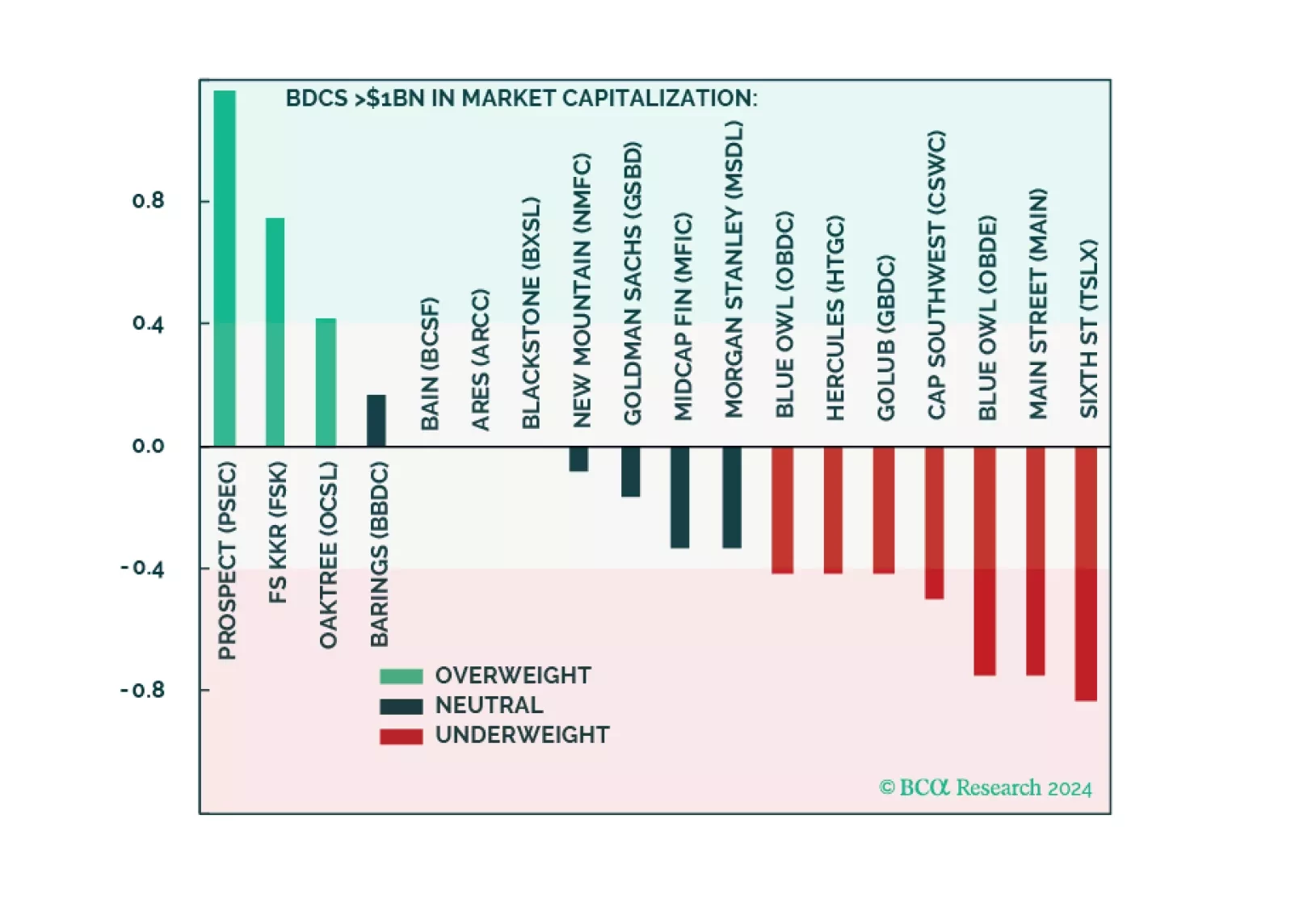

We are positive Private Credit but currently underweight Public BDCs. Today’s market pricing and sentiment in BDCs are excessively optimistic. Long-term investors should await a better entry point. Traders may find an attractive…

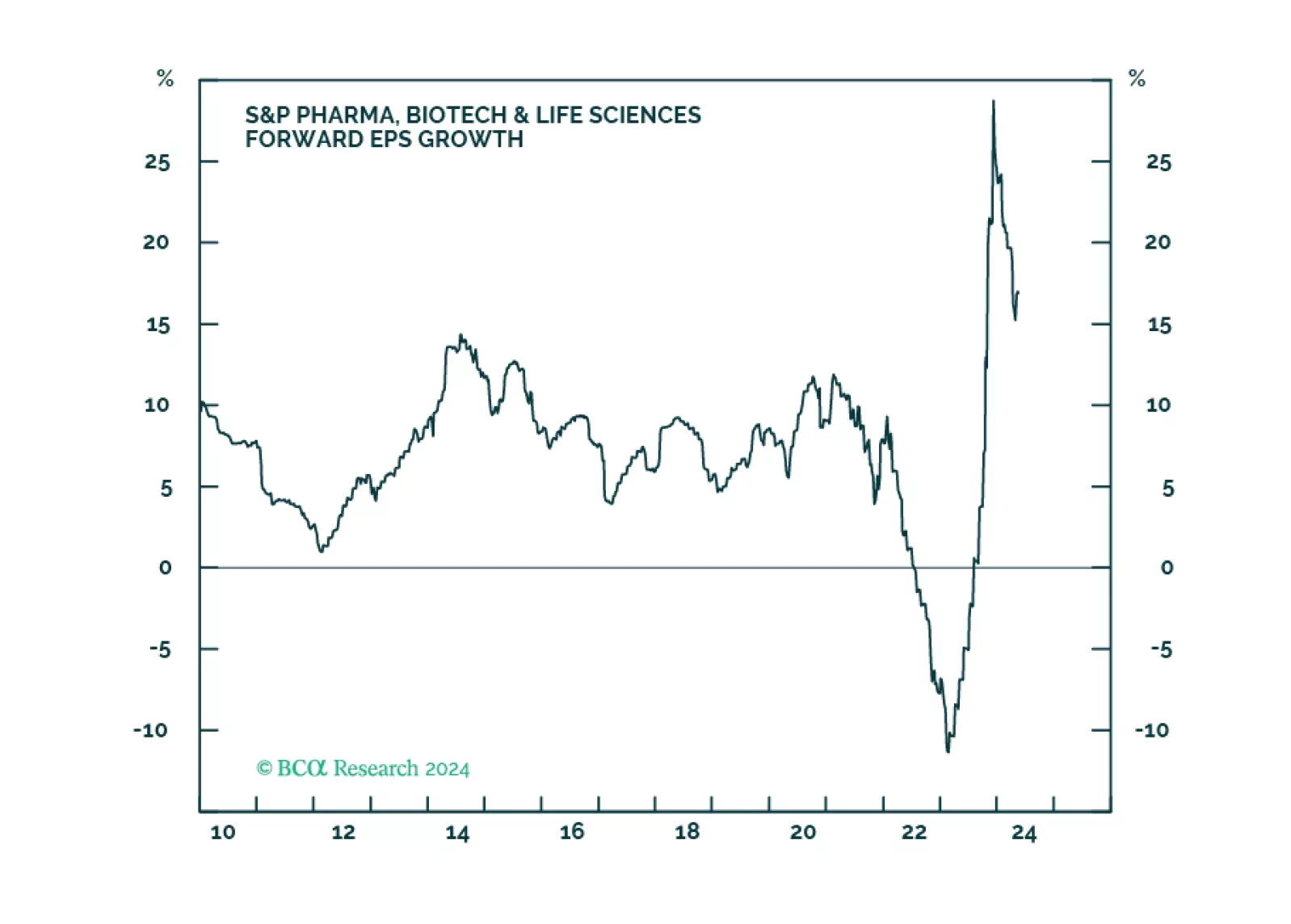

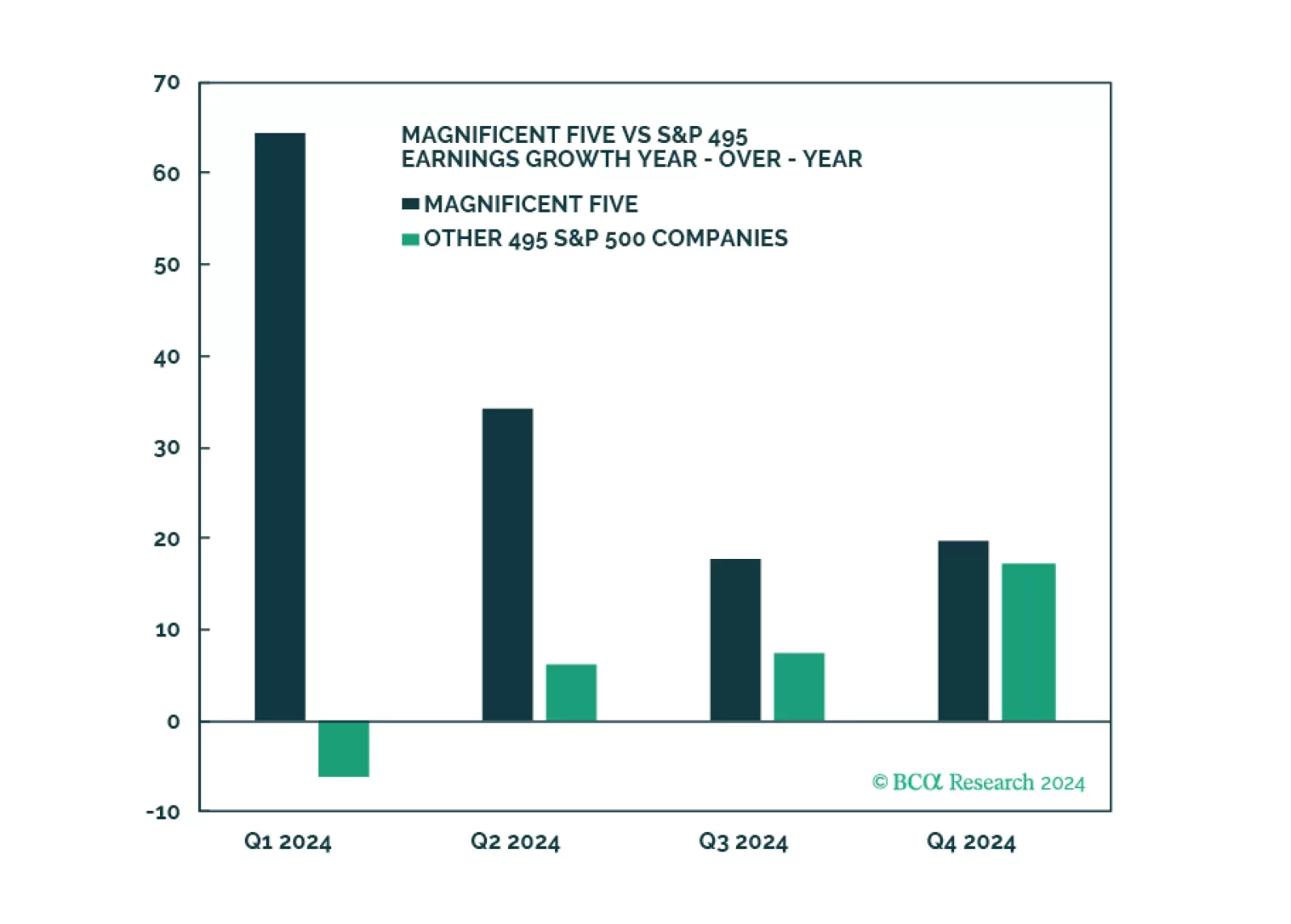

Q1 Earnings and sales growth were strong, but the devil is in the details: Without the Magnificent Five, earnings growth for the index would have been negative. On a positive note, margins have stabilized, and earnings growth is…

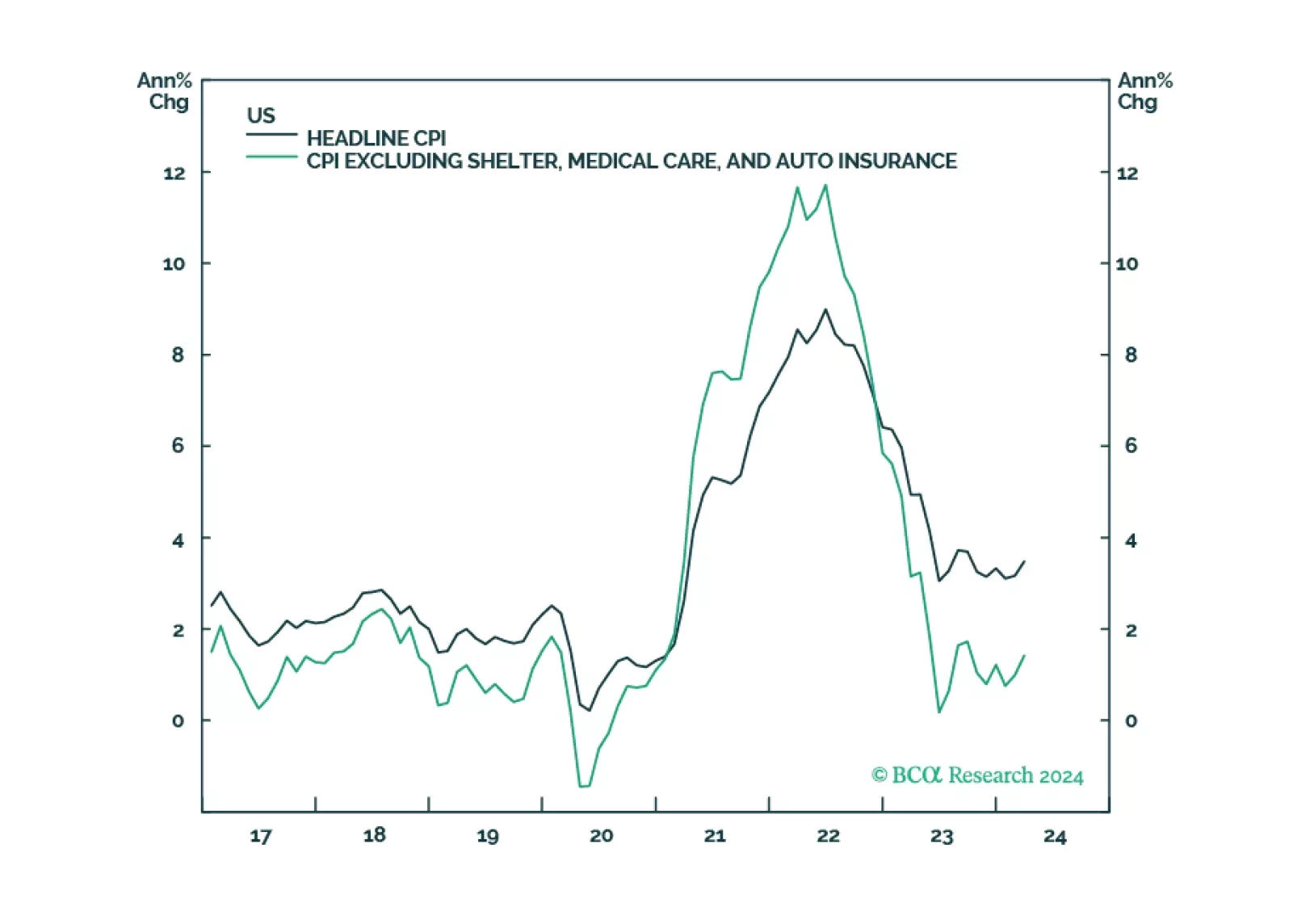

In this week’s report, we defend four out-of-consensus claims. Claim #1: Underlying inflation in the US is not reaccelerating. Claim #2: The US labor market is set to weaken abruptly. Claim #3: The S&P 500 will drop to 3700 in…

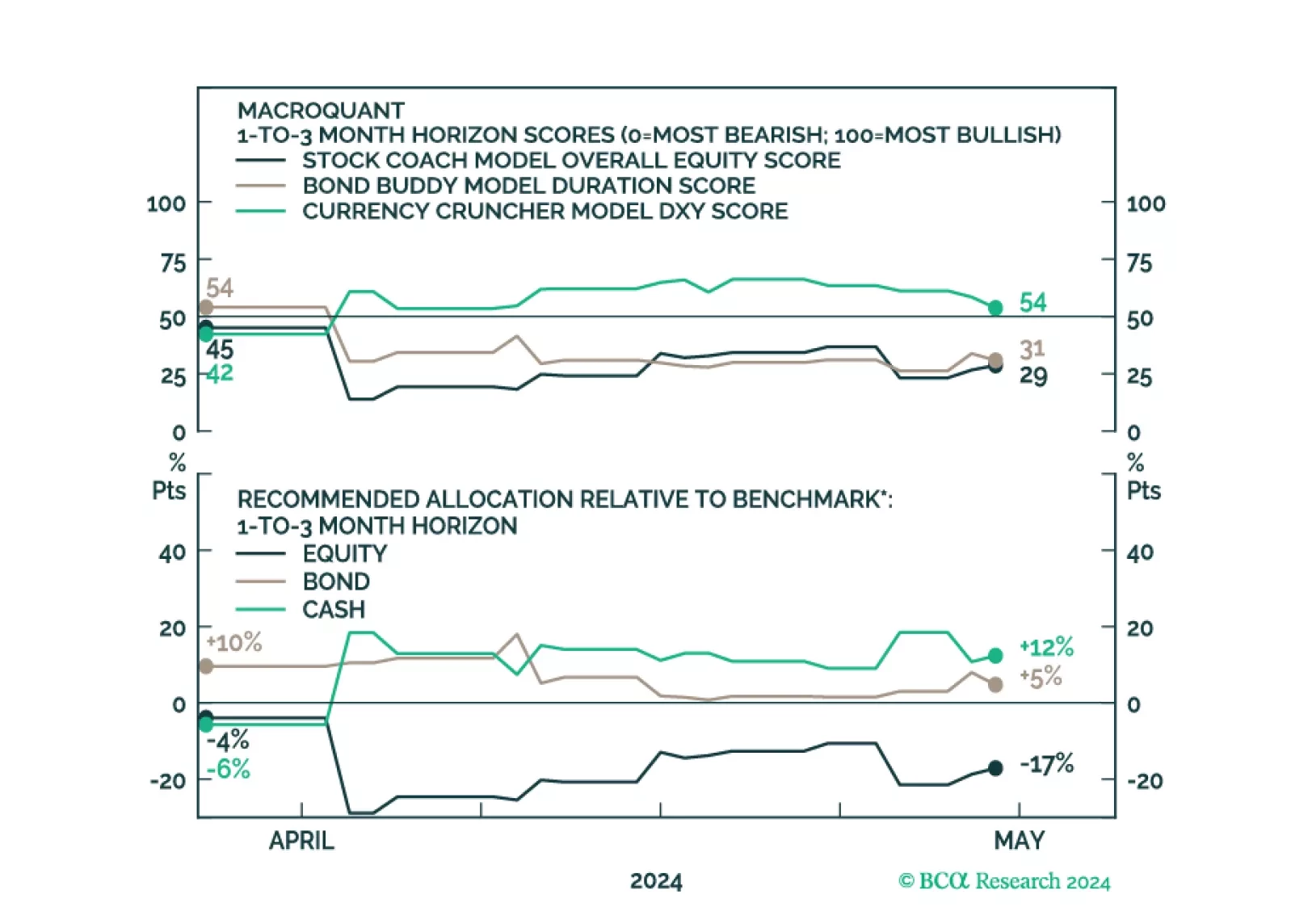

MacroQuant downgraded equities from neutral to underweight on a 1-to-3 month horizon. The model suggests increasing exposure to cash.

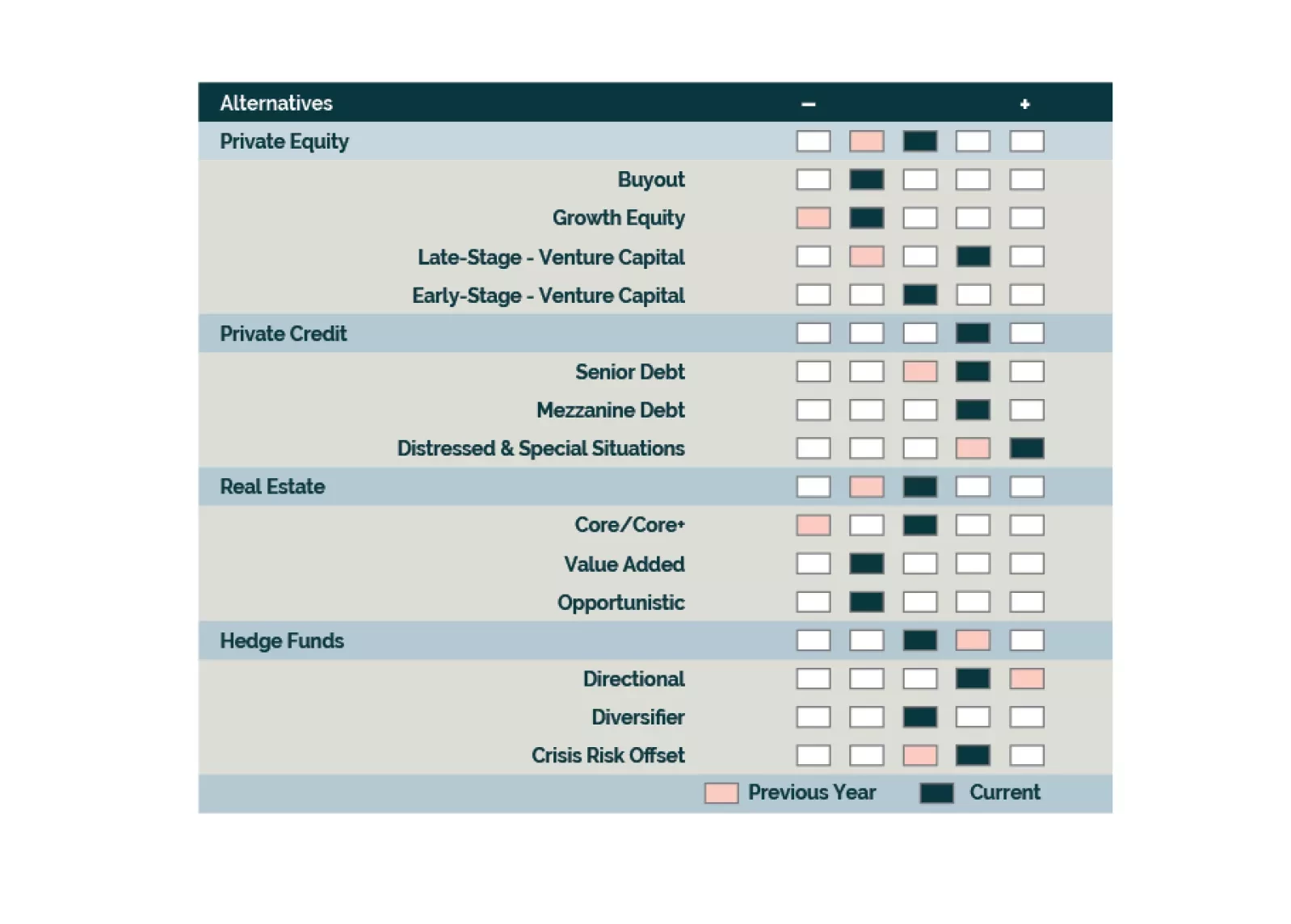

We go overweight Late-Stage Venture Capital and APAC Private Equity but remain underweight North America Buyouts. We maintain our neutral outlook towards Hedge Funds and are positive on Long-Short Equity, Event Driven, and CRO…

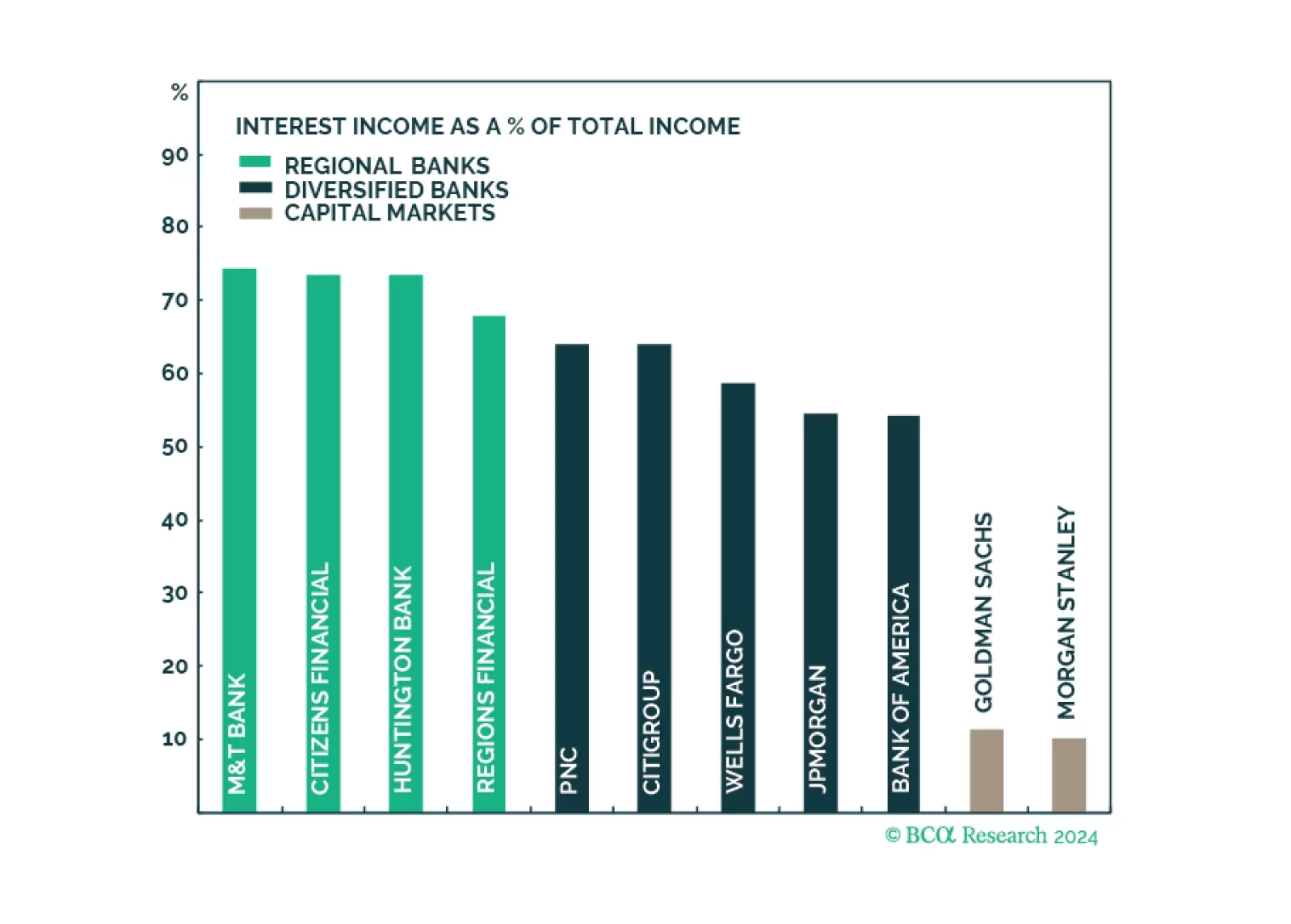

Q1 earnings results of the largest US banks have demonstrated that the engine of recent growth in profitability, NII, has faltered as funding costs are rising fast. However, the resurgence in non-NII thanks to a revival in corporate…

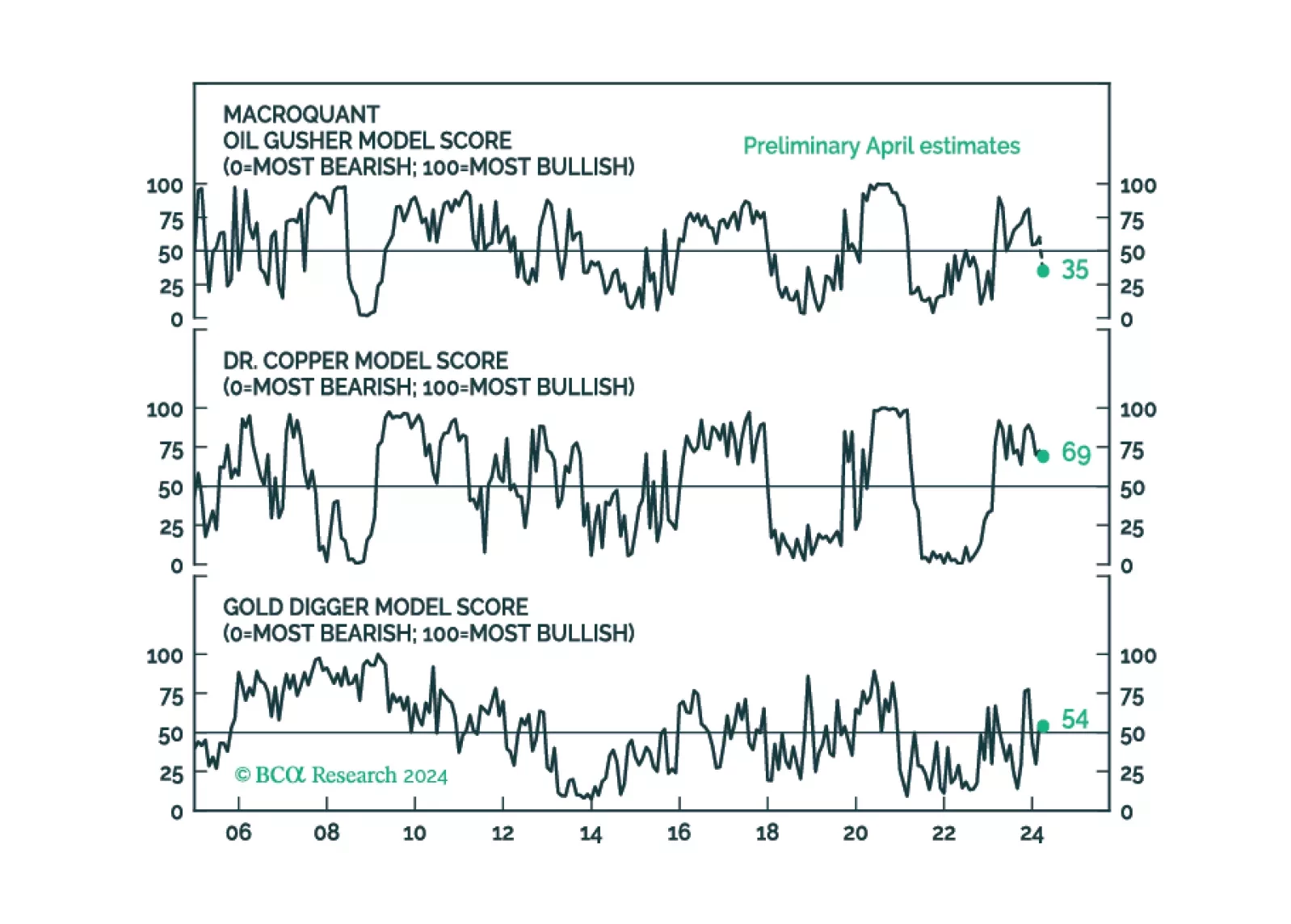

This year’s rise in commodity prices represents a blow-off rally rather than the start of a durable bull market. The global economy is heading for a recession. Stocks, commodities, and other risk assets are vulnerable.

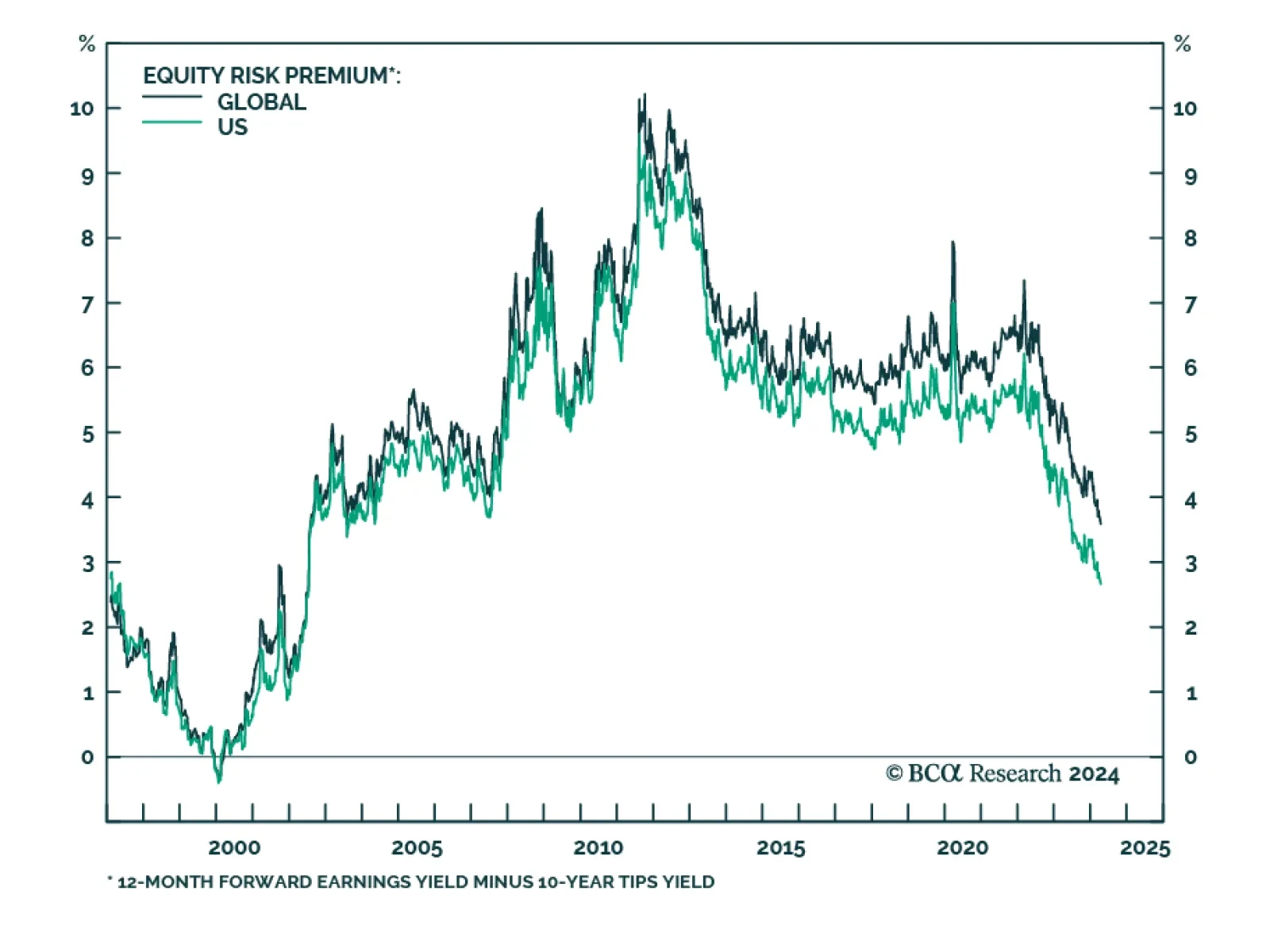

The equity risk premium – calculated as the 12-month forward earnings yield minus the 10-year real rate – continues to drop both for US and global stocks, standing at 2.7% and 3.7% respectively. The compression of the…