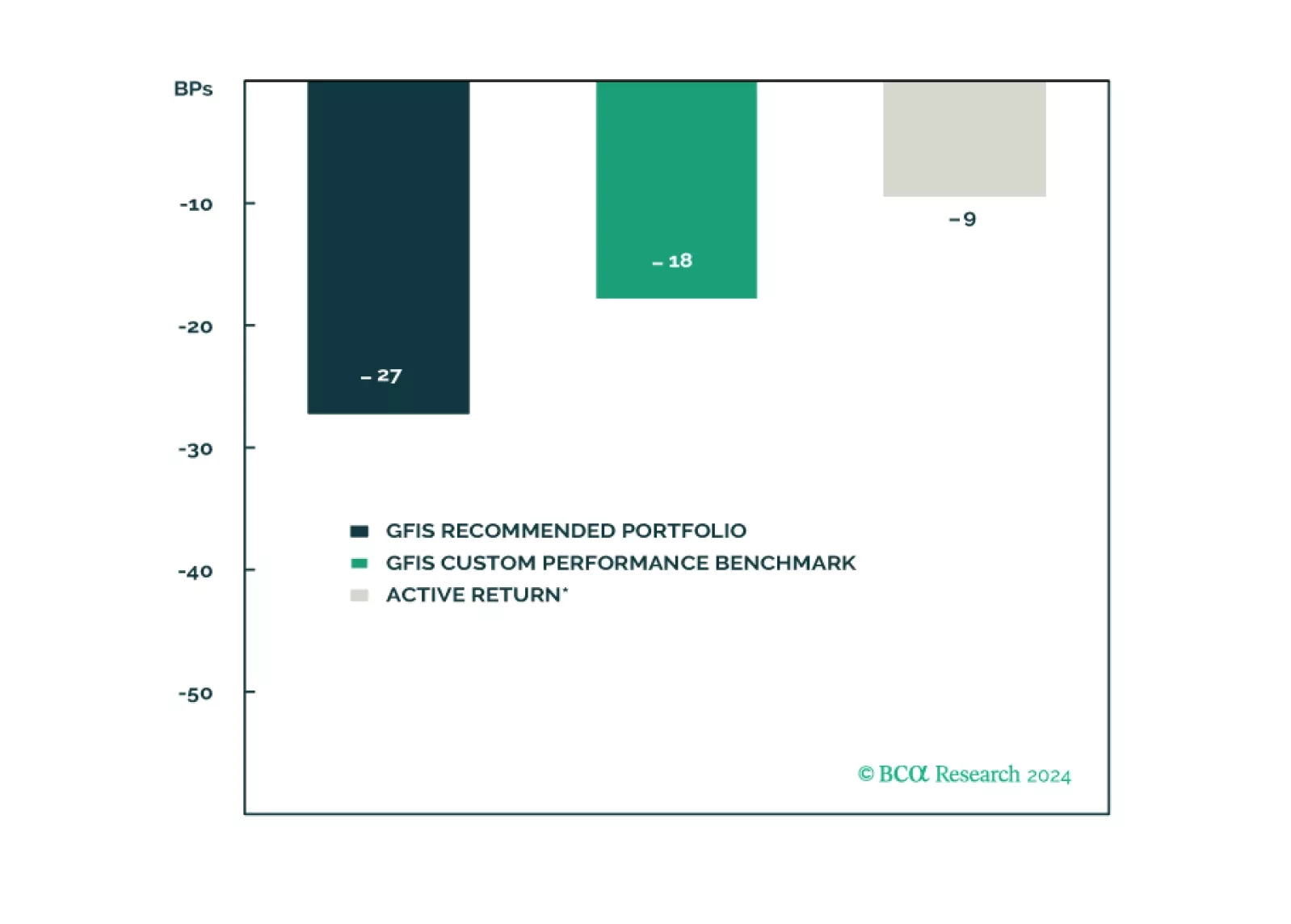

In this report, we present the quarterly review of our Model Bond Portfolio. Rebounding growth and political instability led to slightly negative portfolio performance in Q2/2024. As global growth starts to moderate, we continue to…

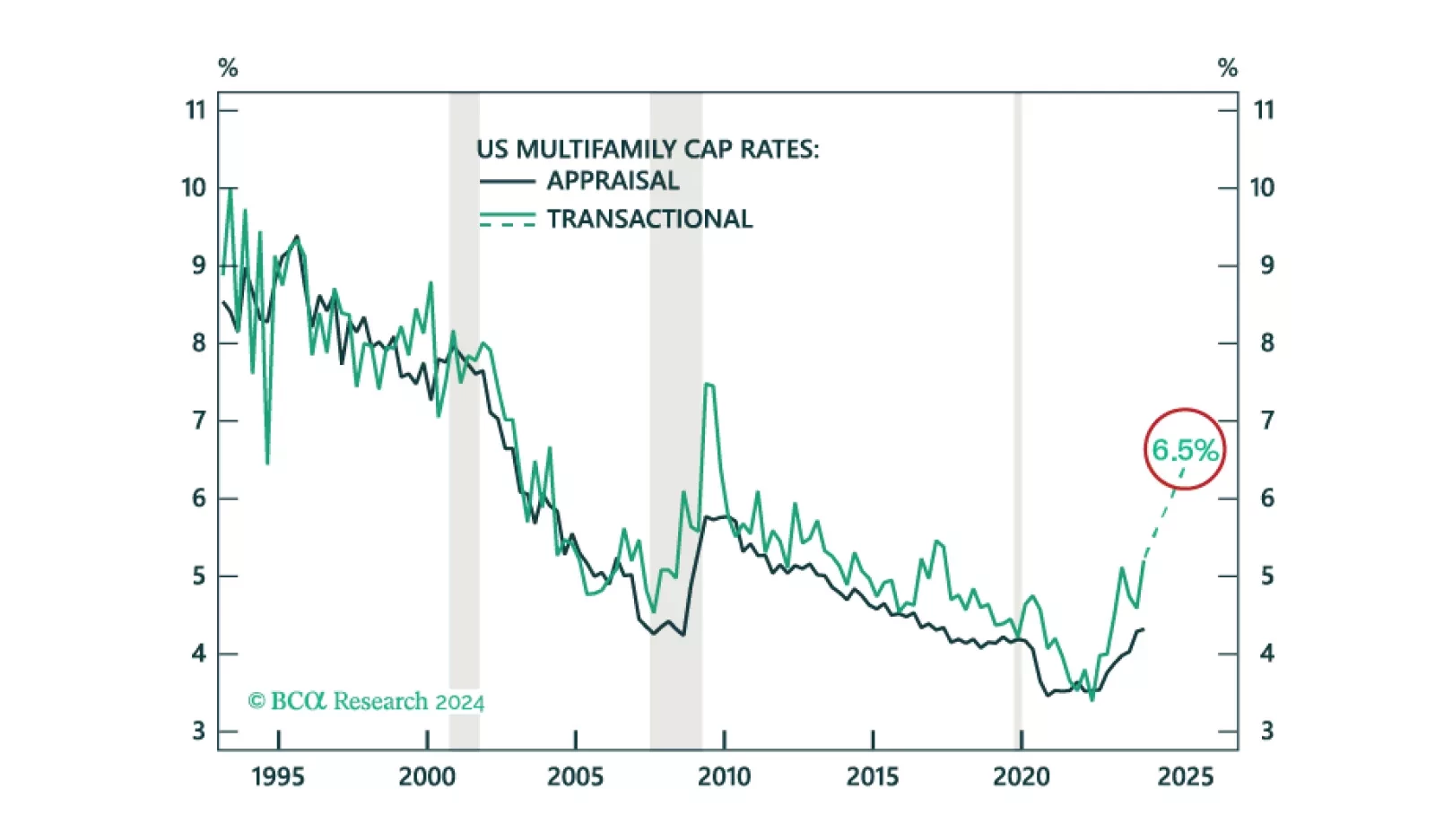

We project US Multifamily cap rates to increase from 5.2% to 6.5%. While we find an unfavorable risk-adjusted return on the asset, especially relative to other opportunities in CRE, cap rates are moving closer to peak.

In Section I, we examine some concerning signs of US economic weakness that emerged in June. We also discuss portfolio positioning in the face of falling interest rates and cross-check our recommended US equity overweight in the face…

The consensus soft-landing narrative is wrong. The US will fall into a recession in late 2024 or early 2025. We were tactically bullish on stocks most of last year, turned neutral earlier this year, and are going underweight today.…

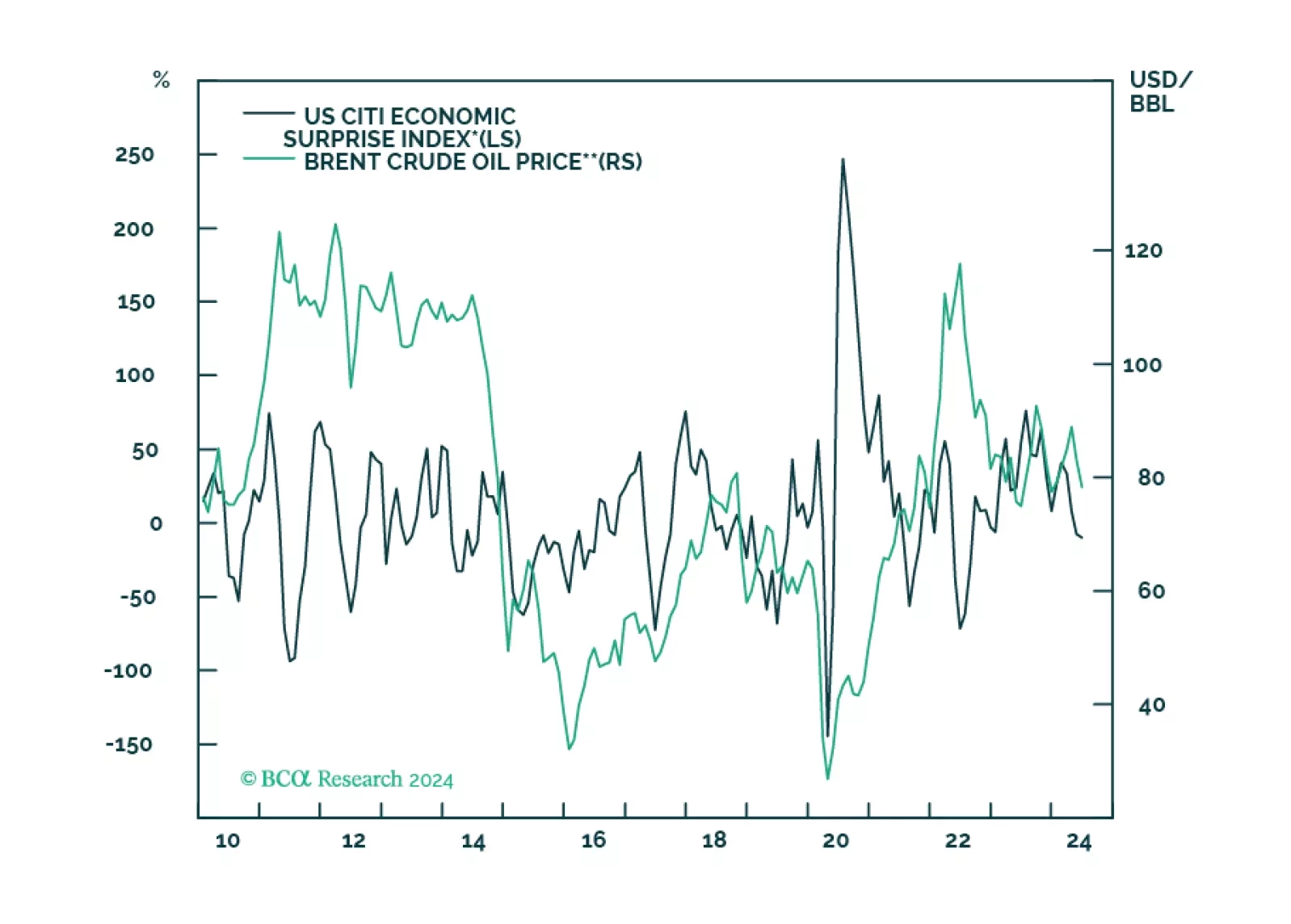

We close our overweights to Energy and Aerospace & Defense. The macroeconomic backdrop is deteriorating for Energy. As for A&D, the good news is already priced in.

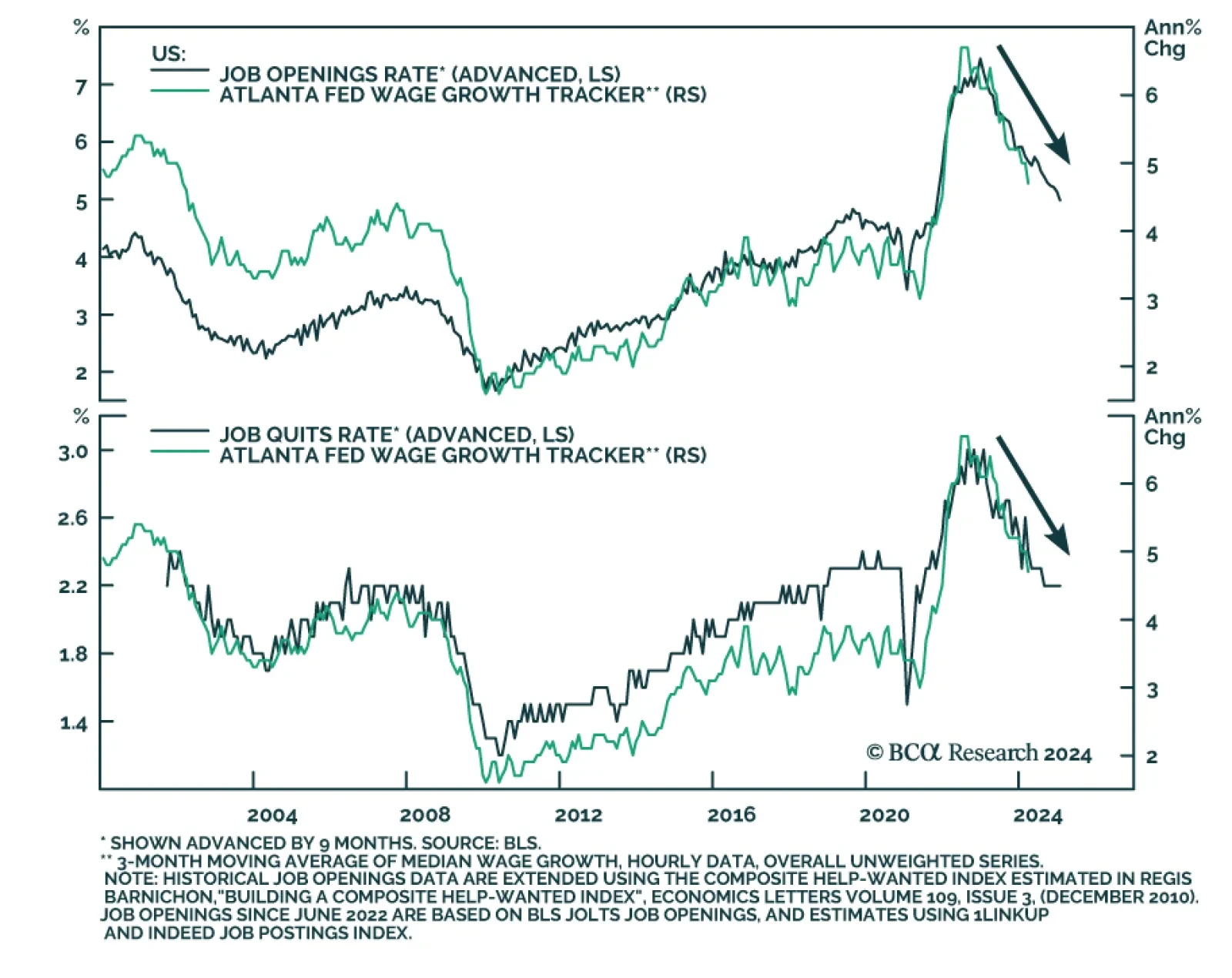

US job openings softened from 8.5 million in March to 8.1 million in April, below expectations of 8.4 million, and the lowest level in three years. Healthcare and social assistance, as well as leisure and hospitality, drove the…

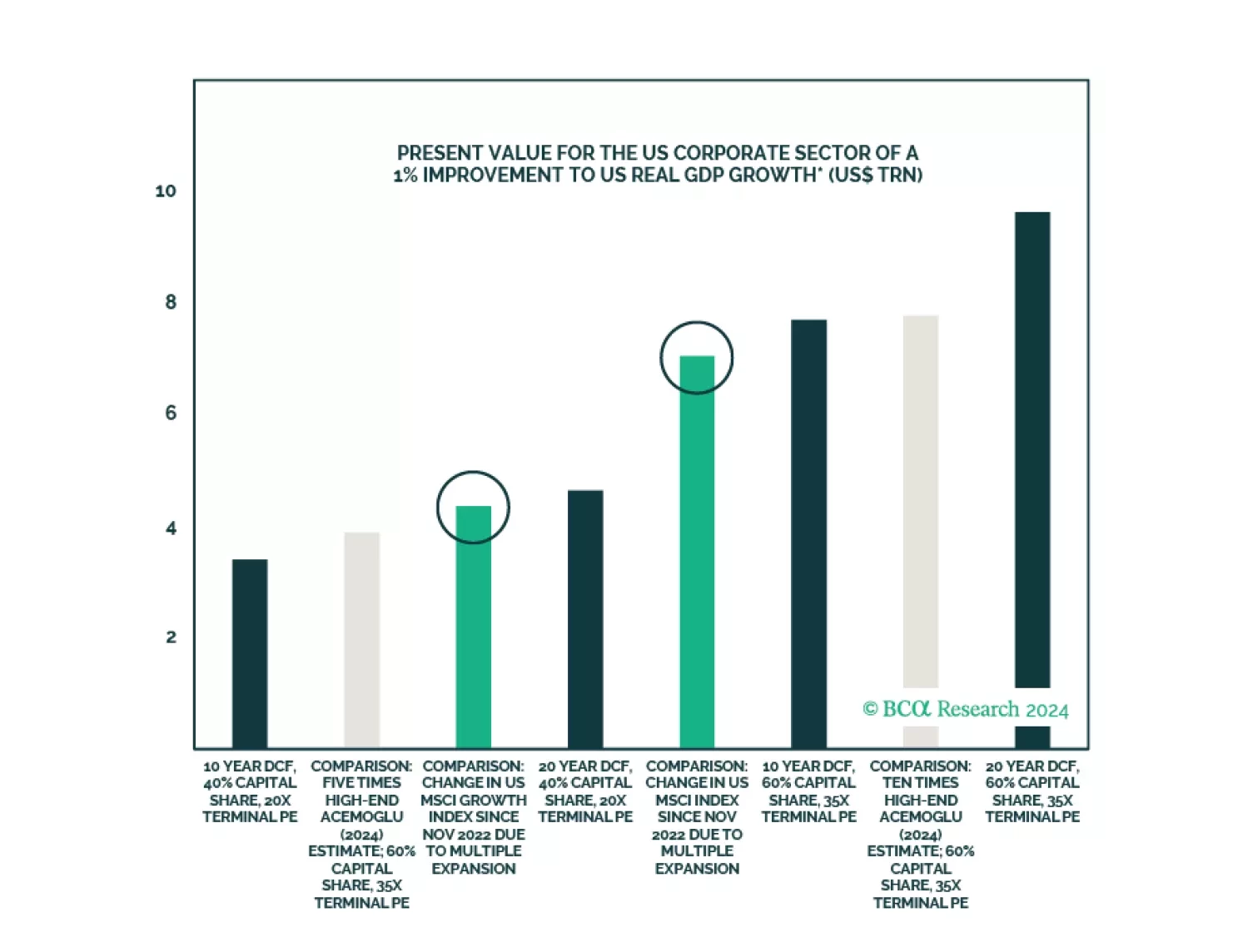

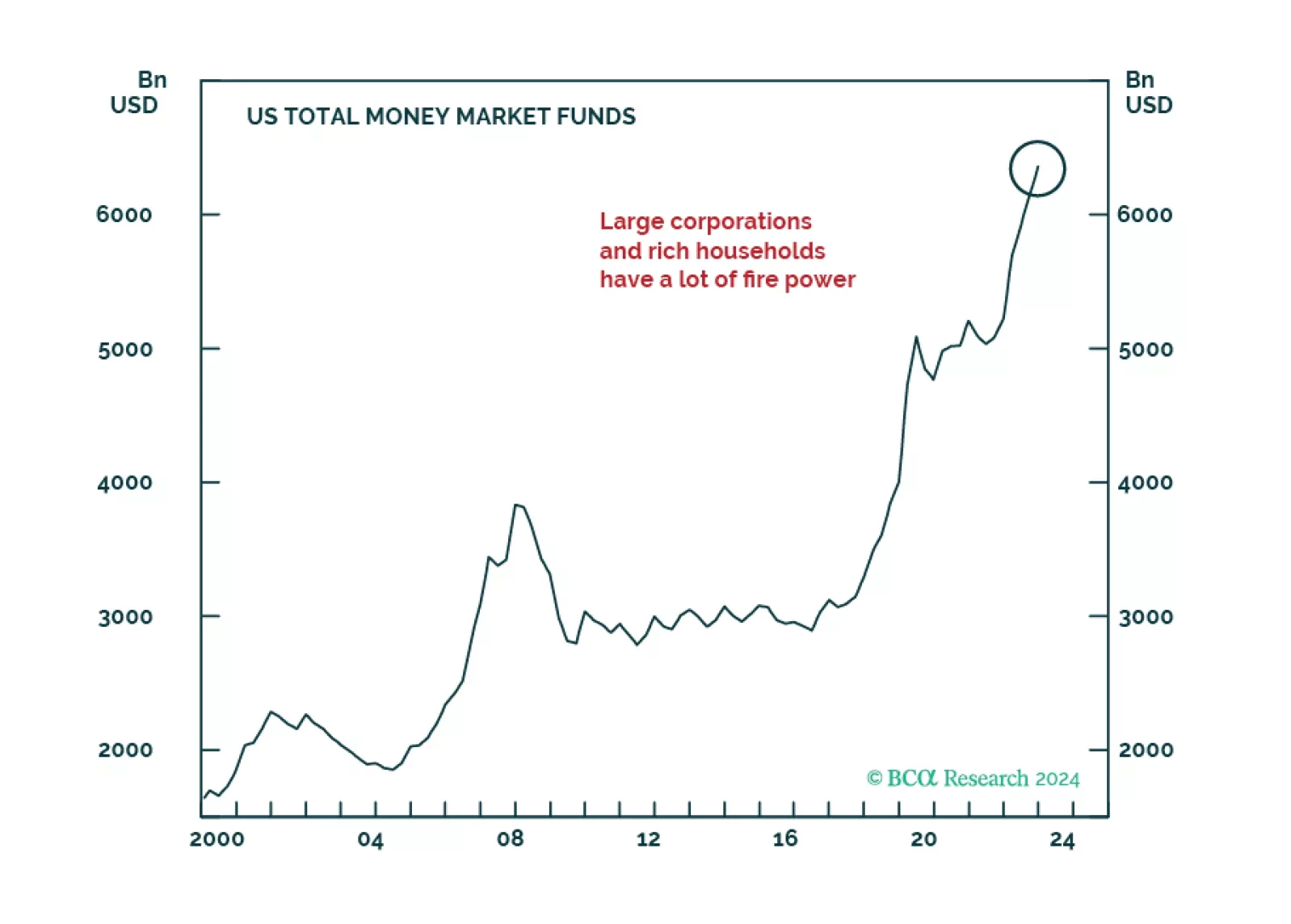

Generative AI-related rally resumed in May. Much of the recent market gains are down to excess liquidity that was begotten by the massive pandemic stimulus, creating a dichotomy between multiple economic challenges and exuberant…

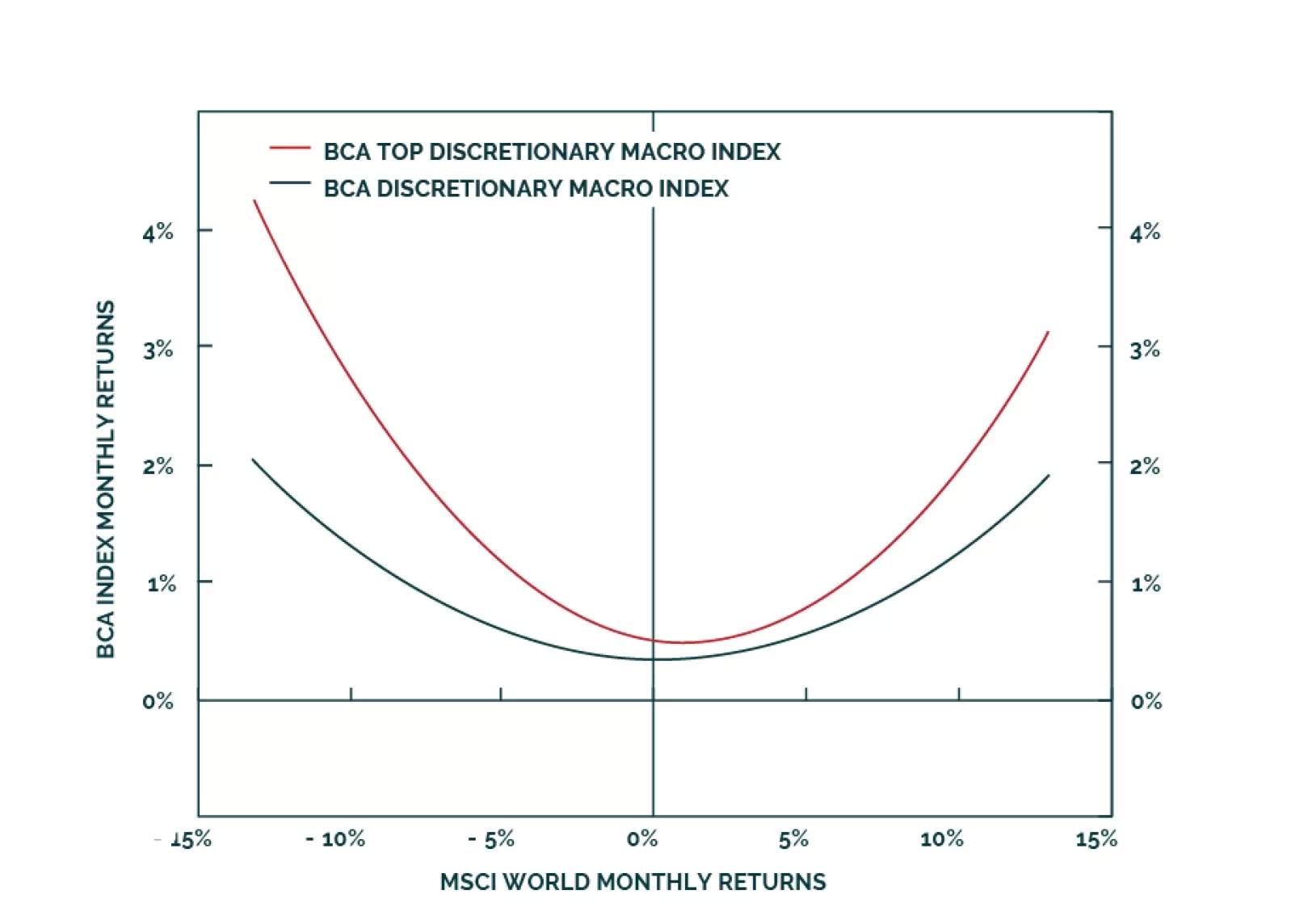

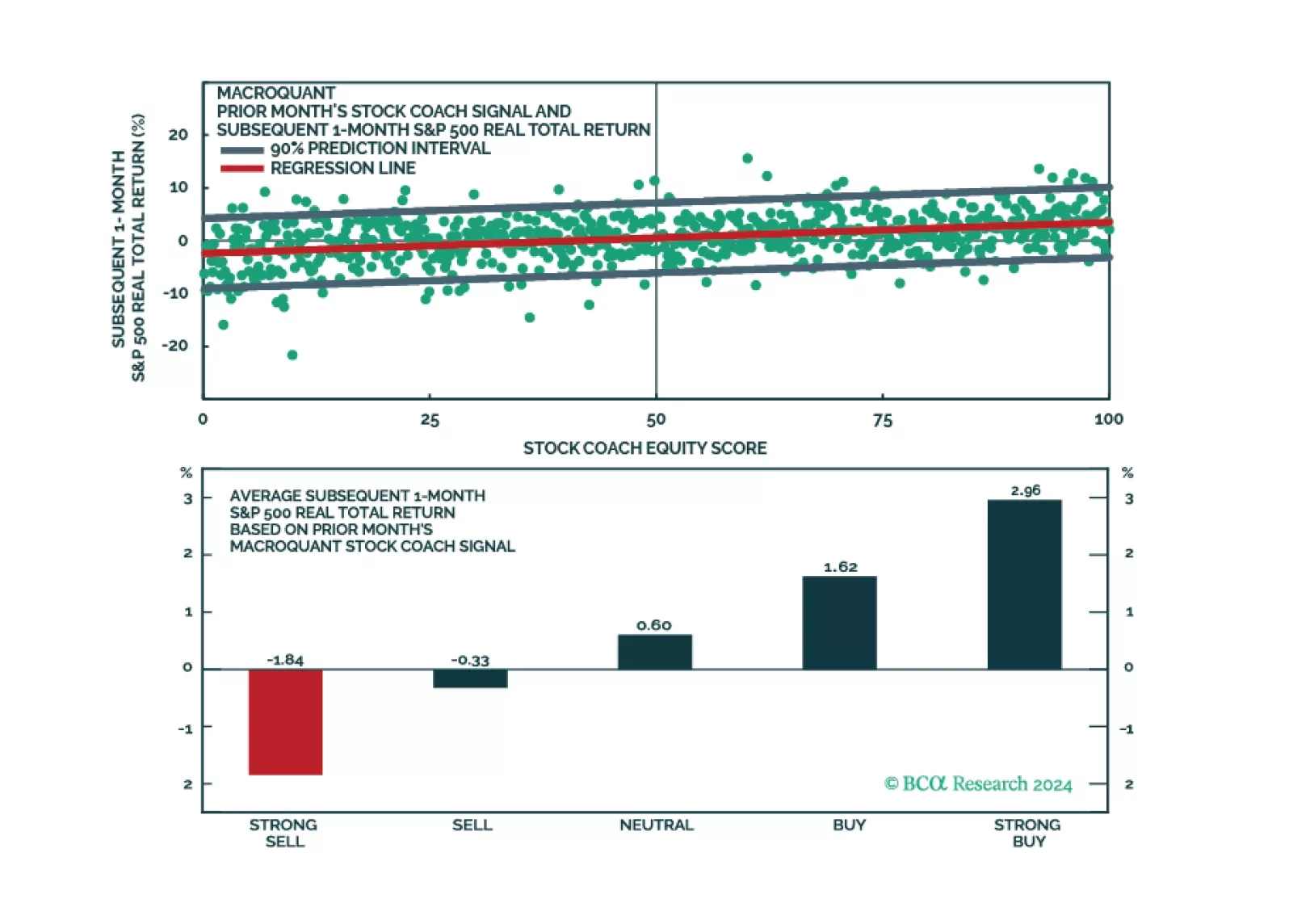

MacroQuant sees significant downside risks to stocks over a 1-to-3 month horizon and suggests increasing allocation to long-term bonds. The model favours defensive equity sectors but is also hedging its bets by overweighting…