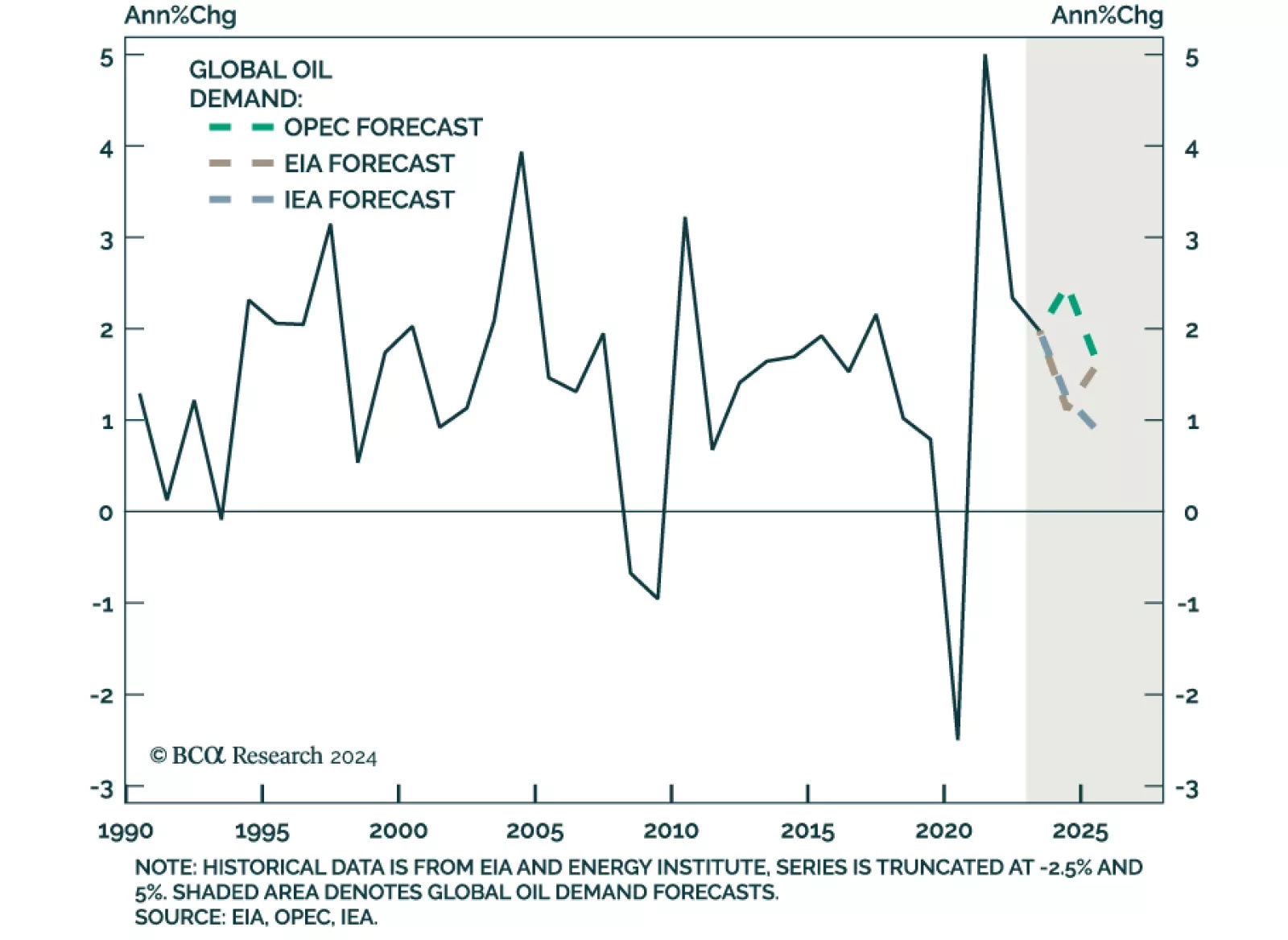

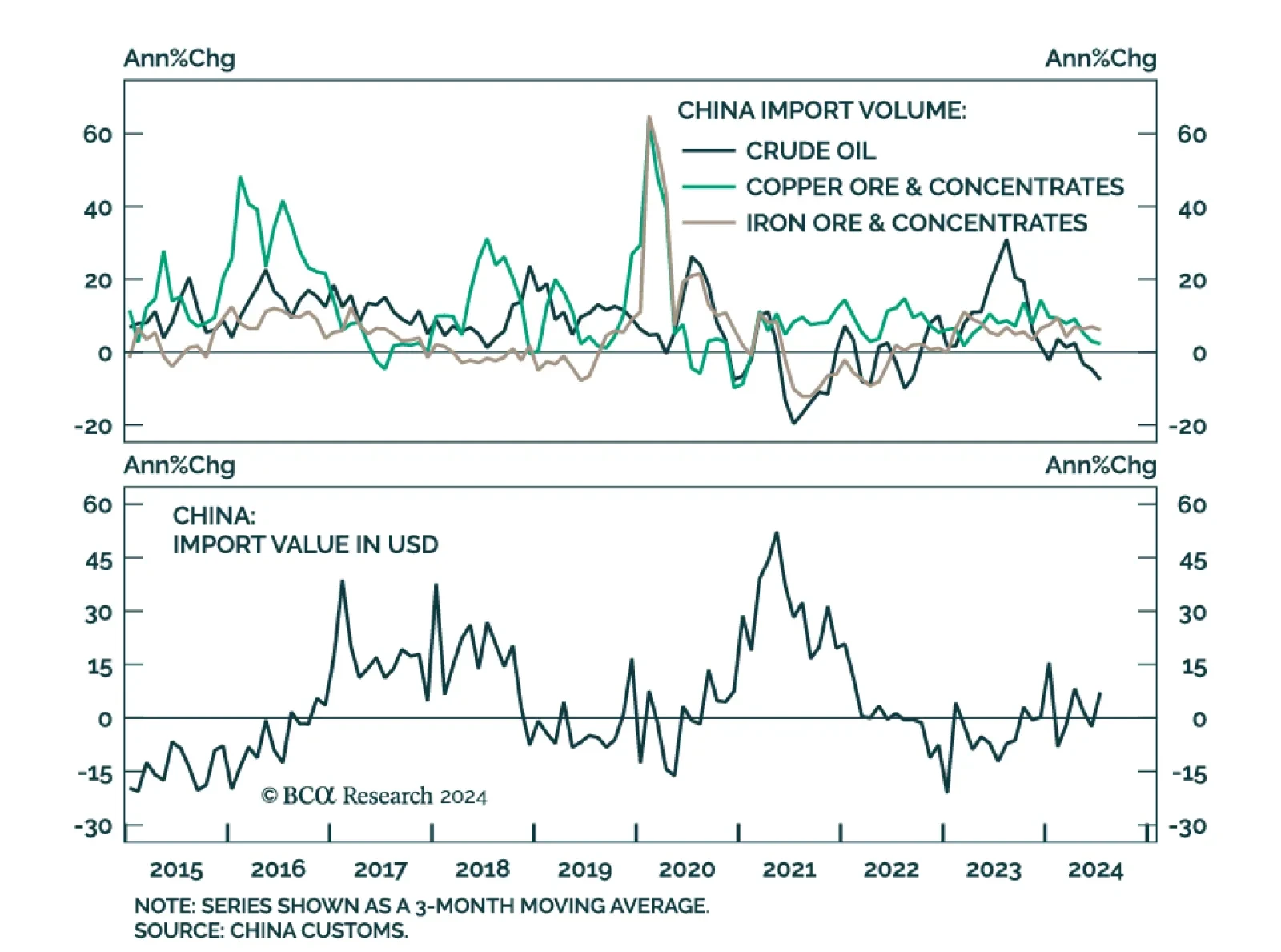

Back in May, our Commodity and Energy strategists argued that OPEC, EIA, and IEA oil demand forecasts were likely too optimistic. Indeed, while all three major oil price forecasters projected a moderation in demand this year,…

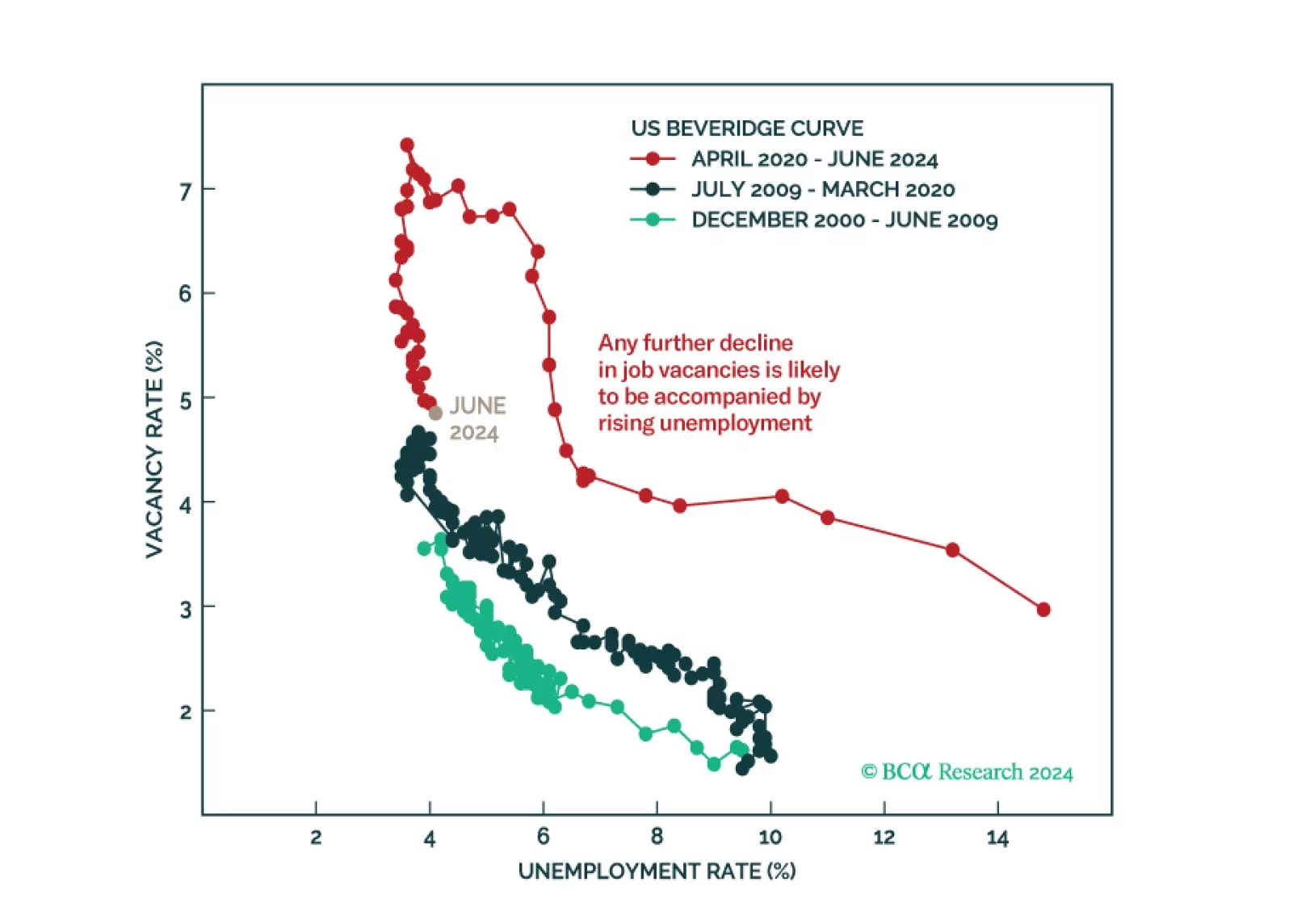

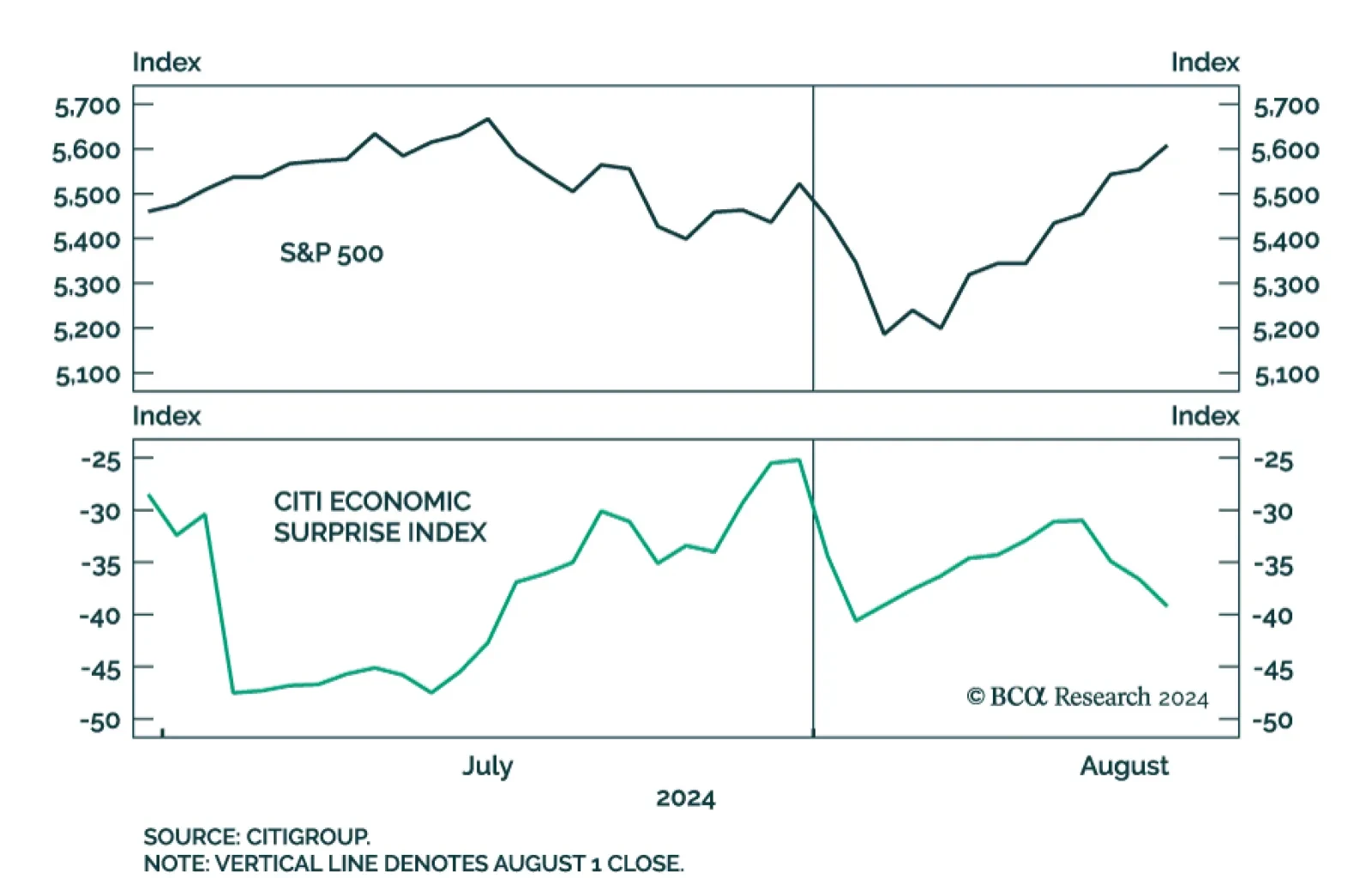

It didn't take long for markets to utterly shrug off the surprise rise in July's unemployment rate. On Tuesday, the S&P 500 closed higher than it was the day before the July Employment Situation report was released…

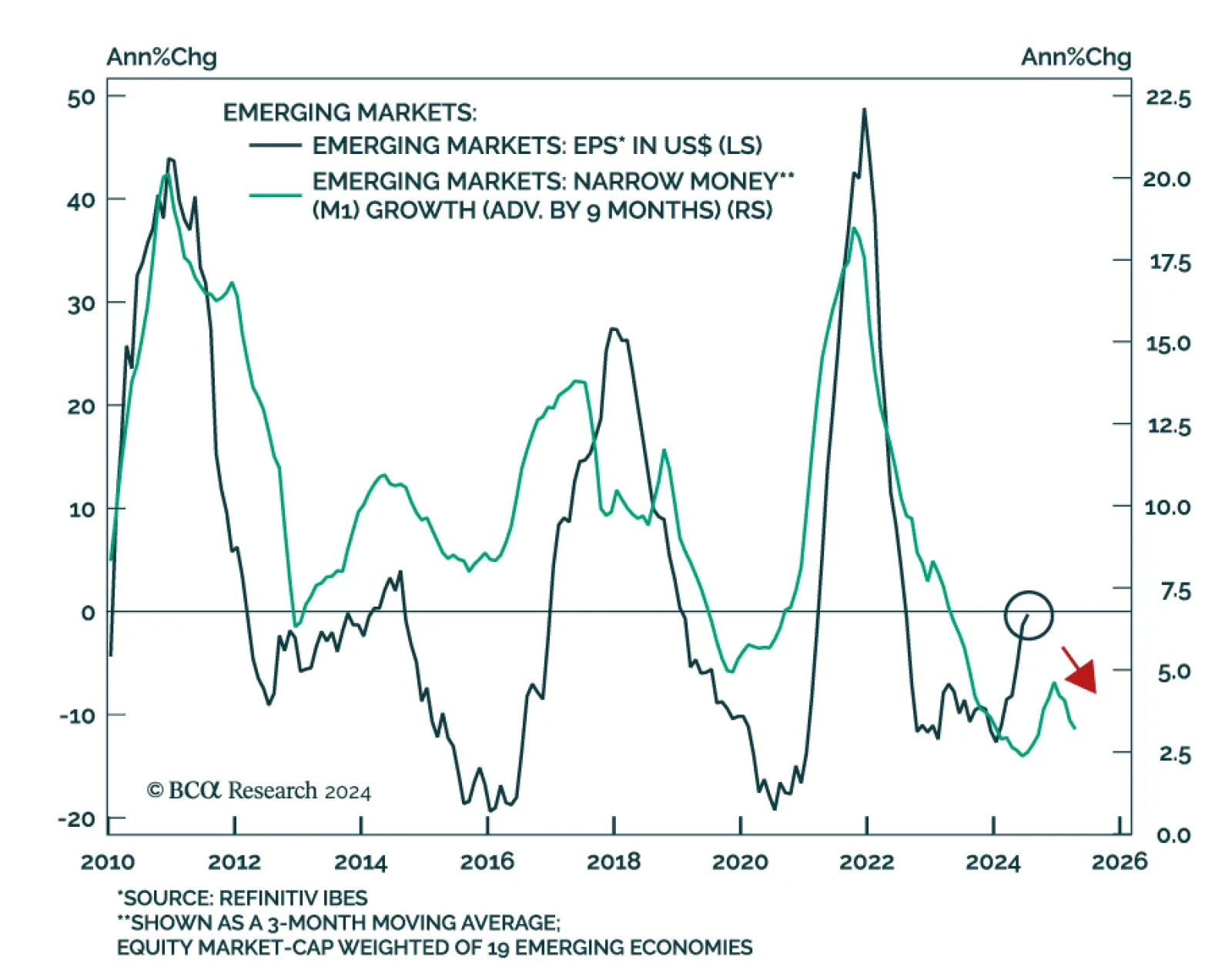

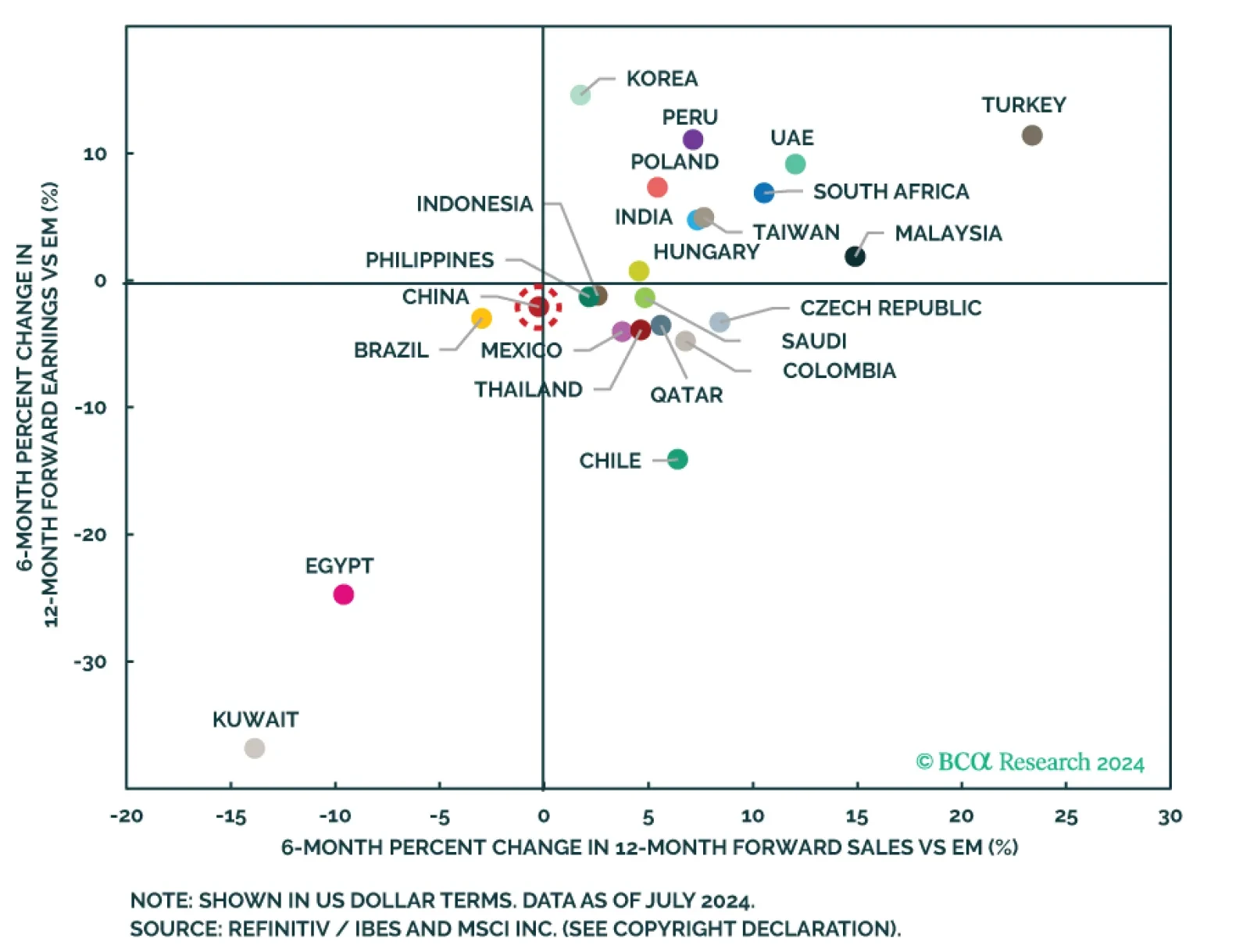

EM equities have dramatically underperformed their US and Eurozone peers in USD terms over the past 15 years. The inability of EM and EM Asia companies to grow their EPS largely explains EM equities “lost decade” (and…

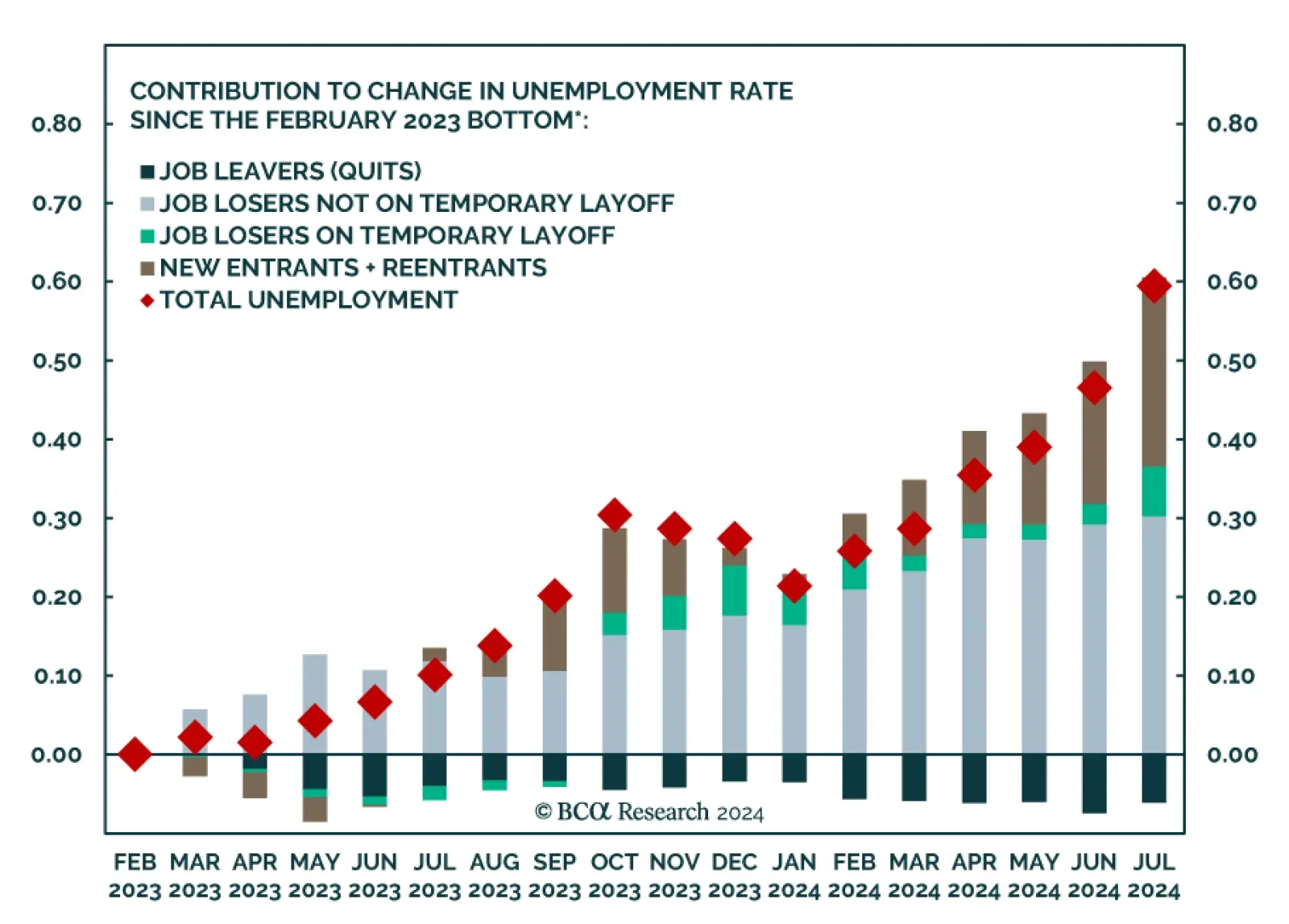

Markets have recouped some of the losses incurred in the aftermath of the July US Employment Situation report. Was the surprise rise in the unemployment rate a false alarm? Supply-side dynamics alone cannot explain the…

Chinese exports in USD terms missed expectations in July, growing by 7.0% y/y, down from 8.6% in June. Conversely, imports rebounded smartly from a 2.3% contraction, rising by 7.2% in July and upending expectations of 3.2%.…

August’s selloff has featured a rotation out of Big Tech. The Nasdaq shed 8% across Thursday, Friday, and Monday, led by concentrated selling among several Mega caps. Nvidia, Tesla, Microsoft and Amazon shed 14%, 14%, 6%…

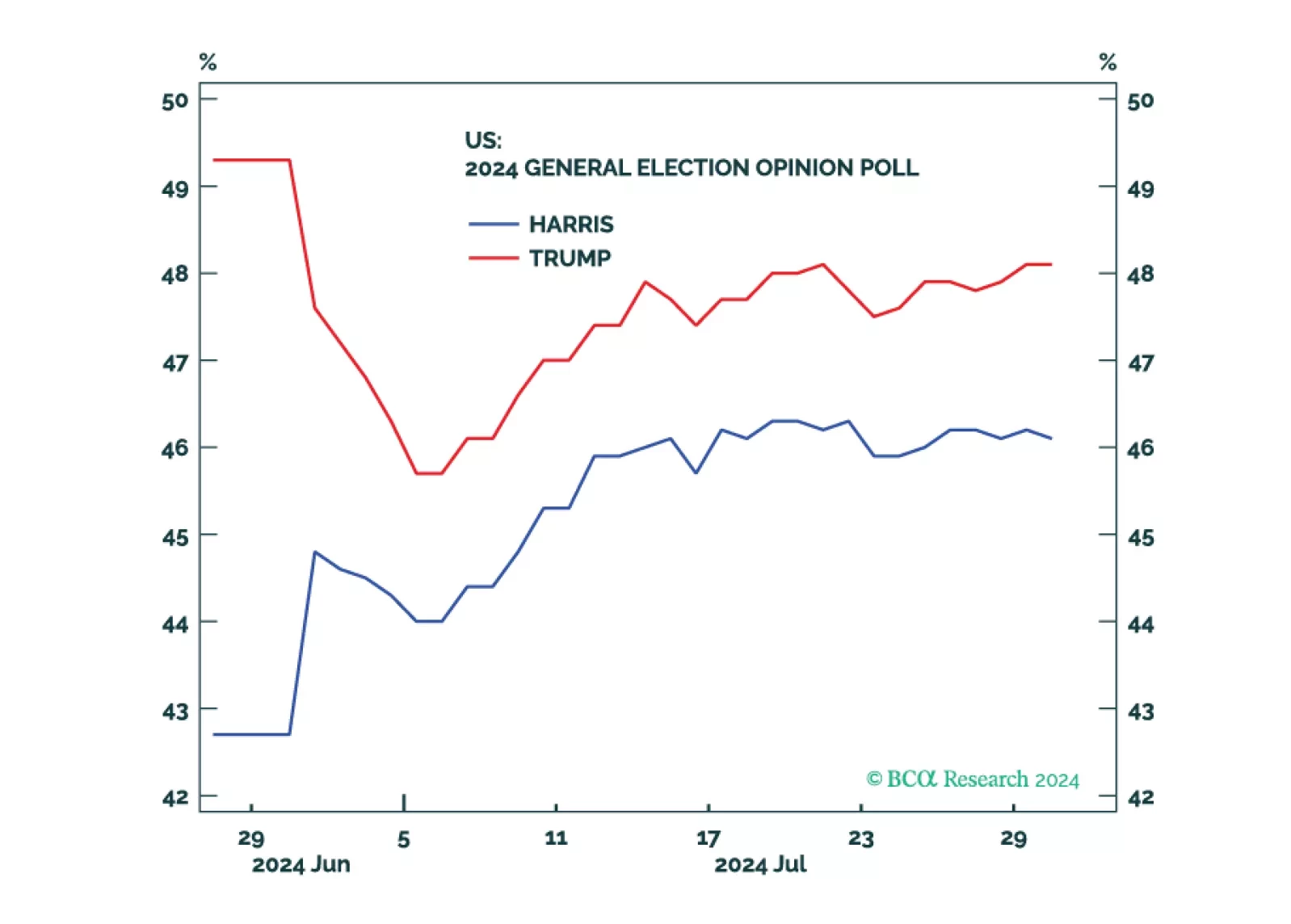

Republicans are favored but the election is still competitive. Equities, corporate credit, and cyclical sectors will fall until policy uncertainty is reduced.

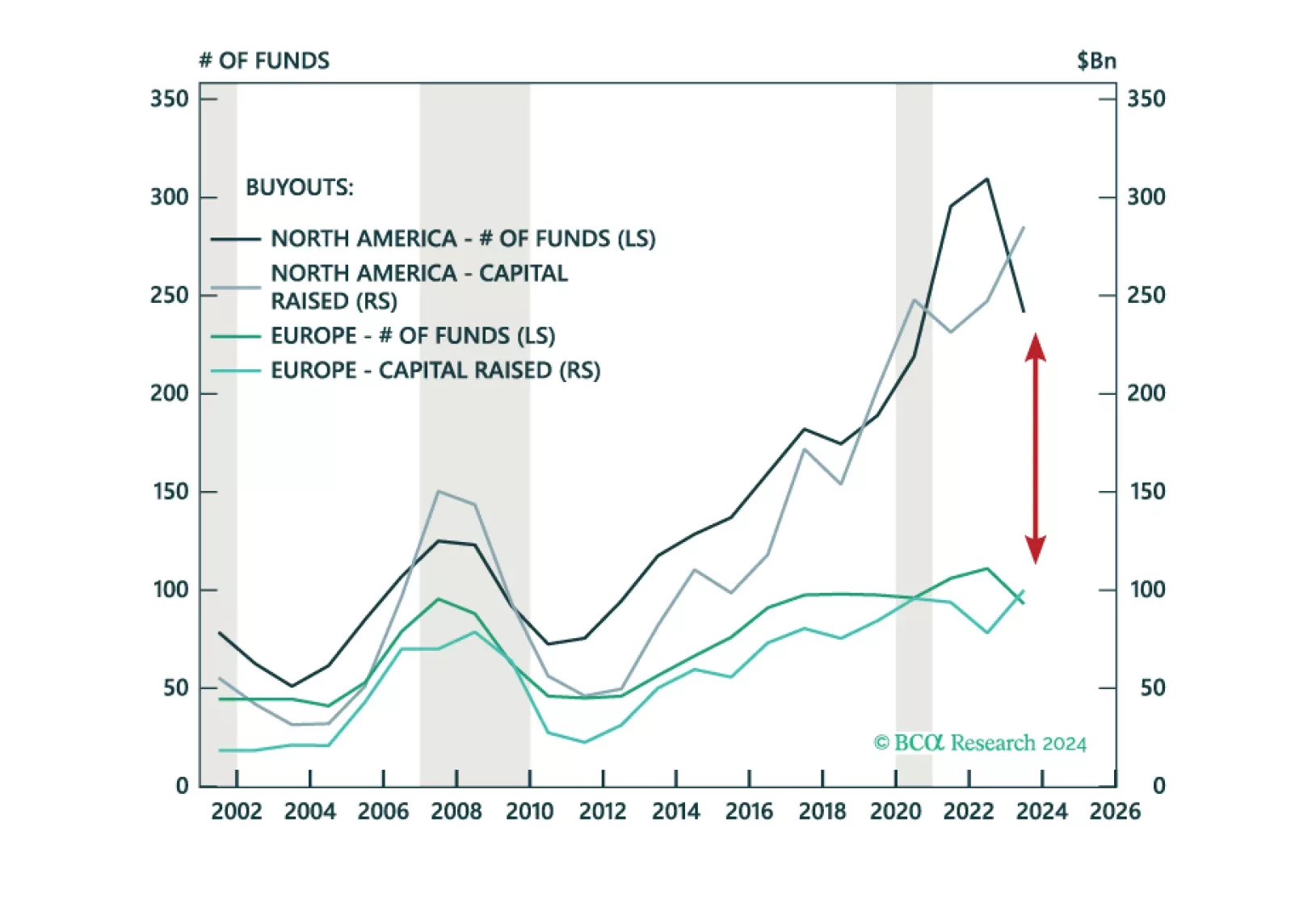

We are growing positive on Growth assets with recession expectations increasing our optimism on entry points. Equities are led by APAC Private Equity, North America Venture Capital, and Europe Buyouts. Our outlook continues to…

Don't buy the dip. The equity bull market is over. The US will enter a recession in late 2024 or in early 2025.

Outside of the US, forward earnings have grown at an underwhelming pace this year. Forward earnings for MSCI US have expanded by 7.3% in 2024YTD while MSCI EMU has remained flat and MSCI Japan has contracted by 4.9%. Against this…