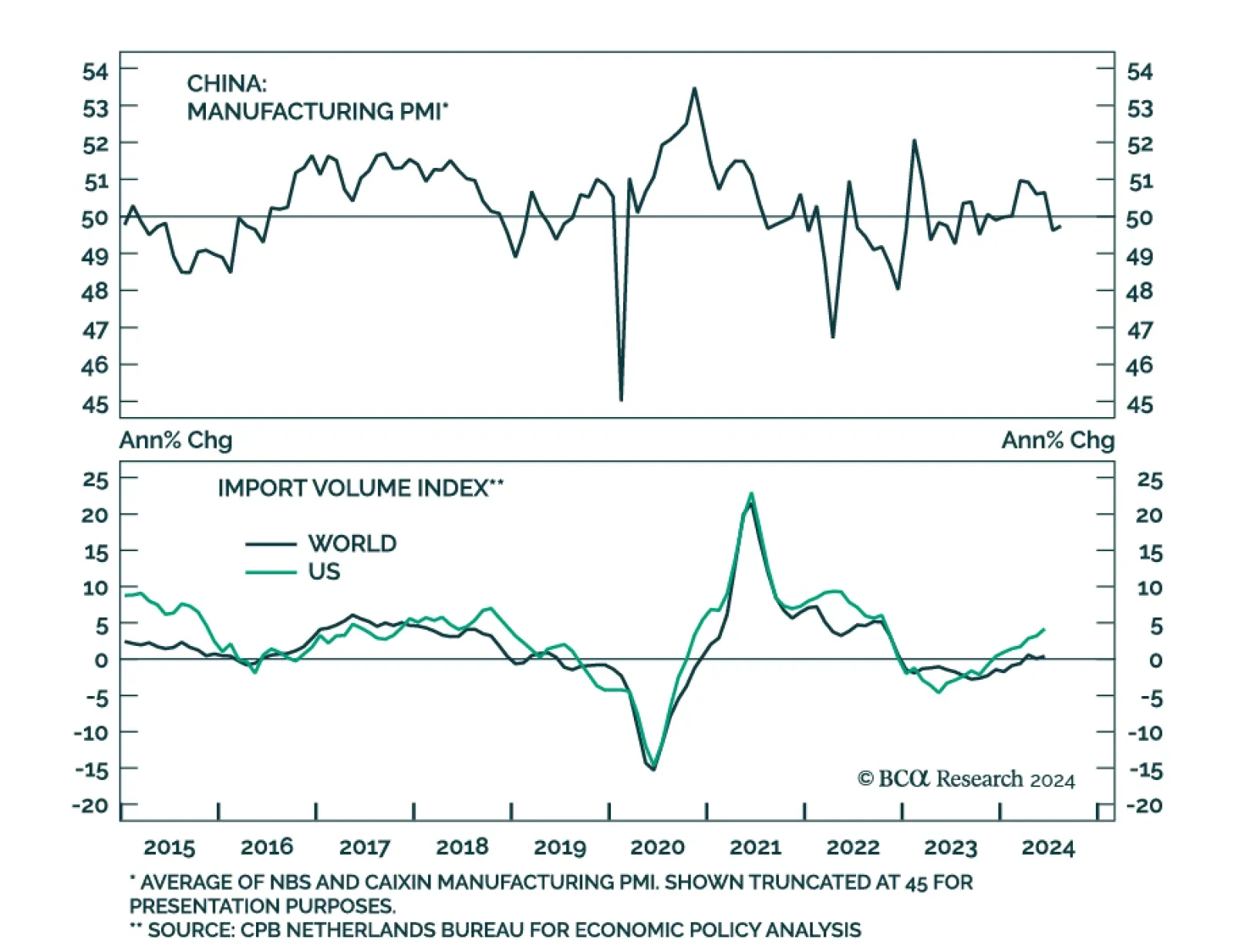

Both leading PMI measures painted a sluggish picture of China’s economic conditions in August. The NBS composite PMI suggested that overall activity barely expanded (50.1) and that the manufacturing sector’s…

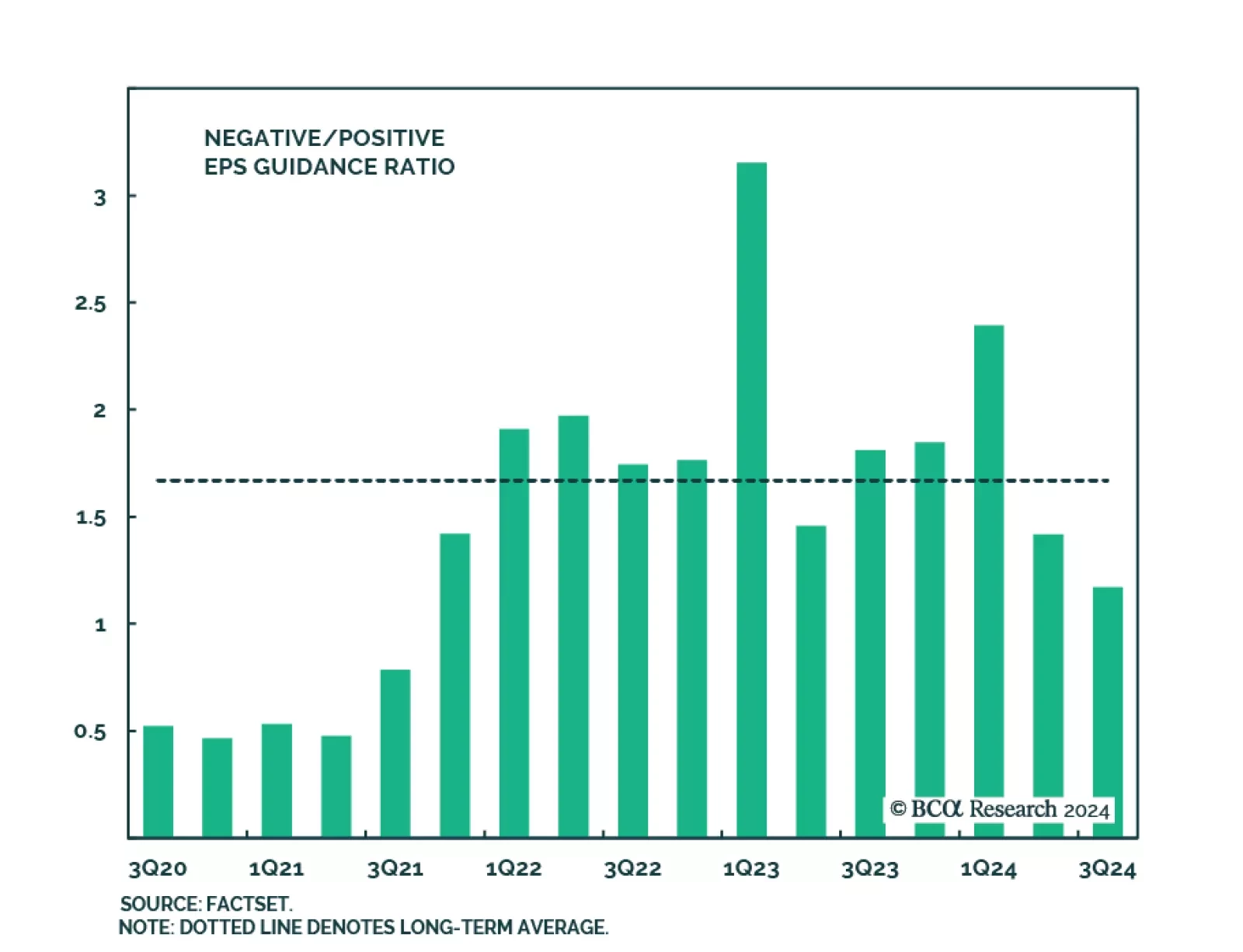

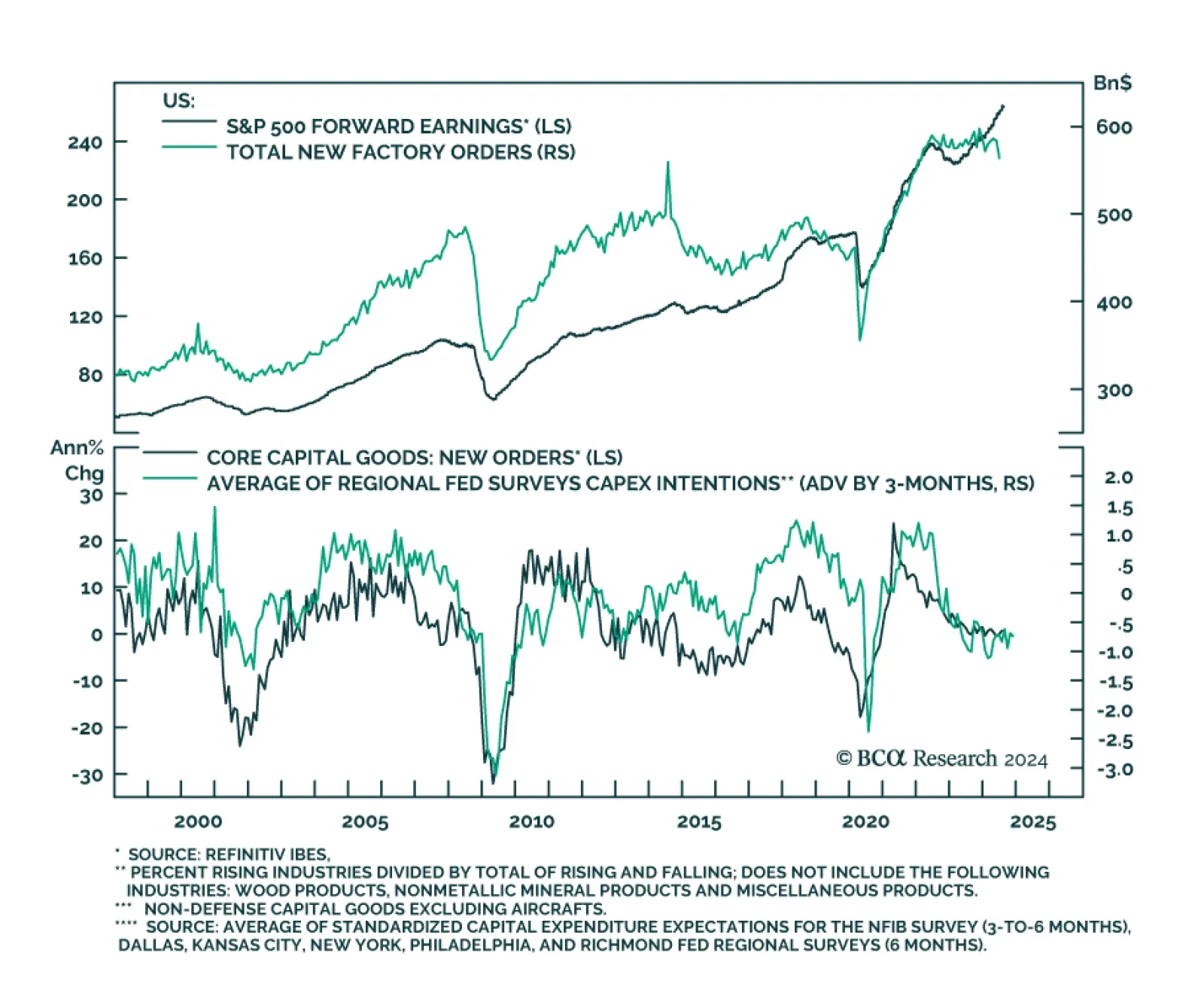

The Q2 2024 earnings season is drawing to a close with 93% of S&P 500 companies having reported results as we go to press. Nearly 80% (60%) of companies have topped earnings (sales) expectations in Q2, according to Factset…

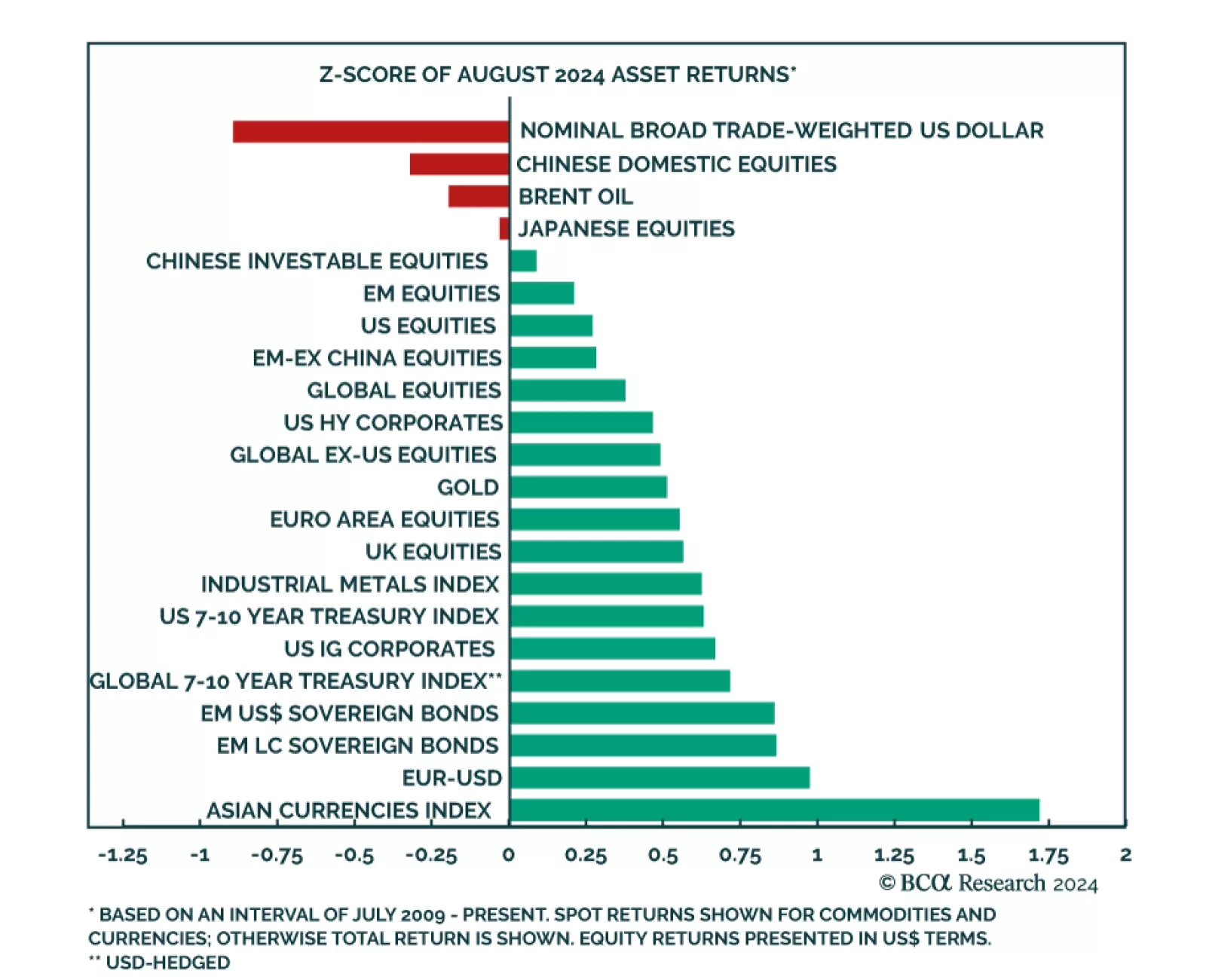

The risk-on soft-landing narrative dominated investors’ psyche last month and pro-cyclical assets topped the August return ranking. Asian currencies led the pack by a wide margin, while the dollar was the largest laggard…

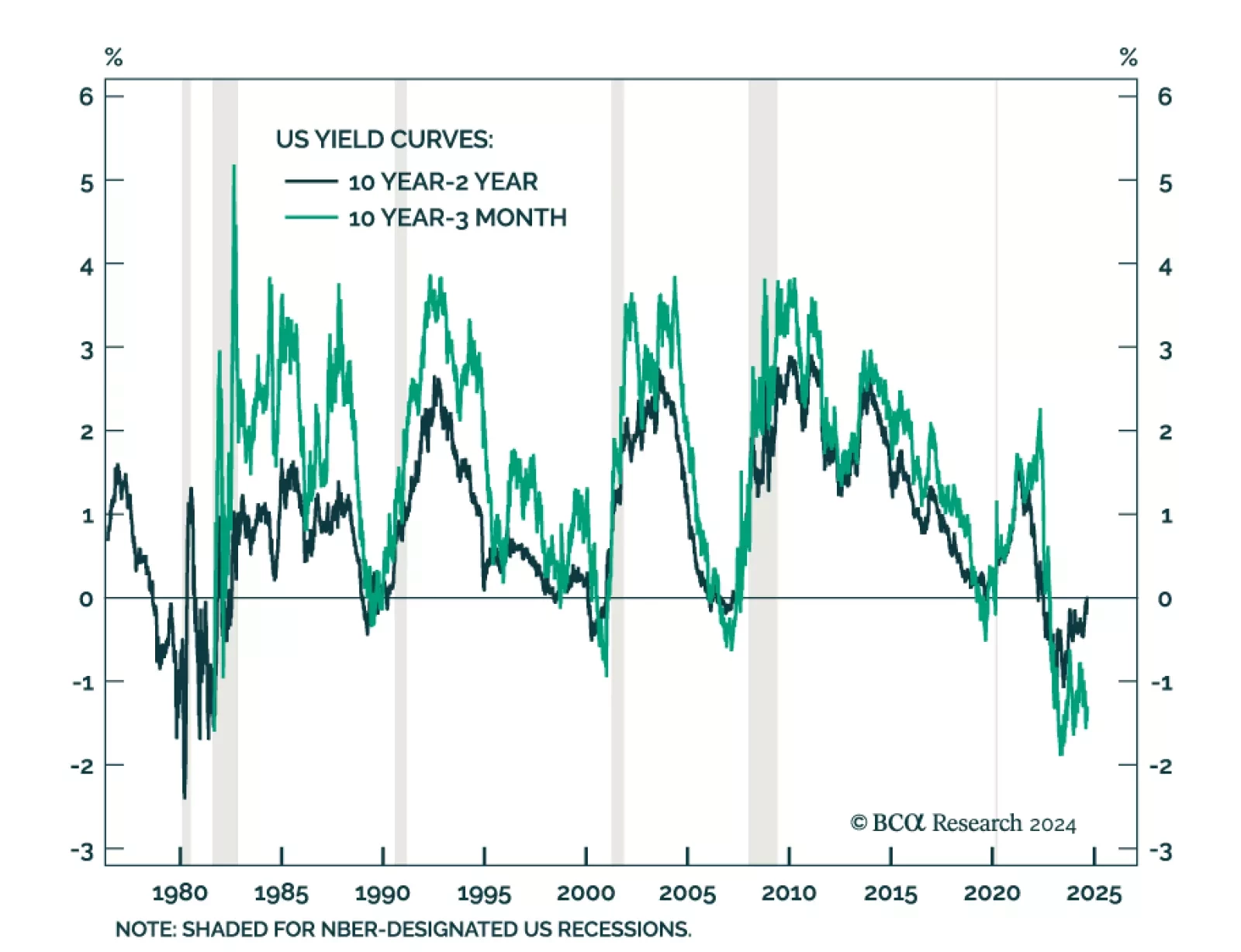

The 2Y/10Y segment of the yield curve is flirting with un-inversion. Aggressive rate cut expectations have largely driven its steepening, with the 2-year Treasury yields falling nearly 100 bps over the past couple of months.…

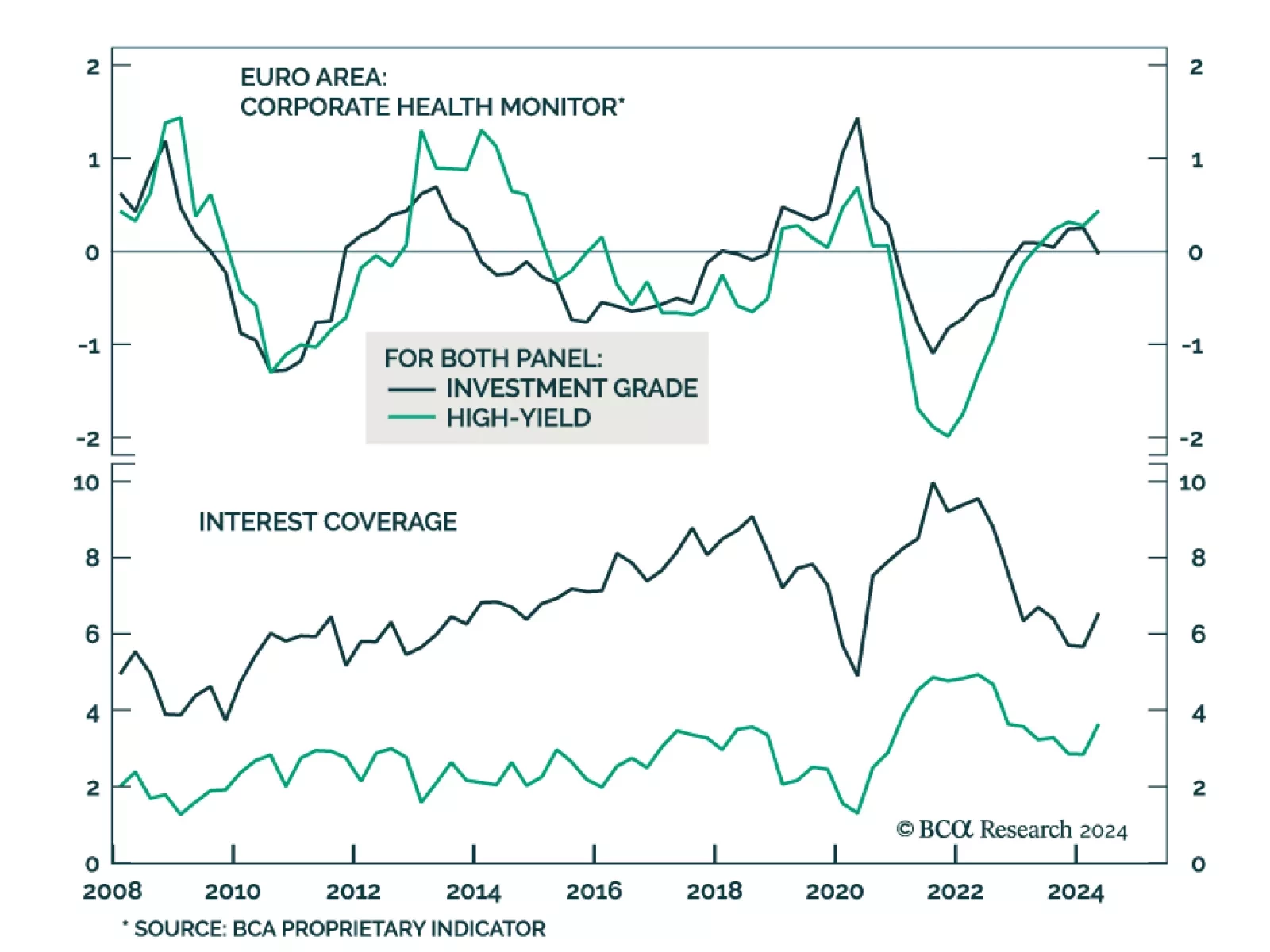

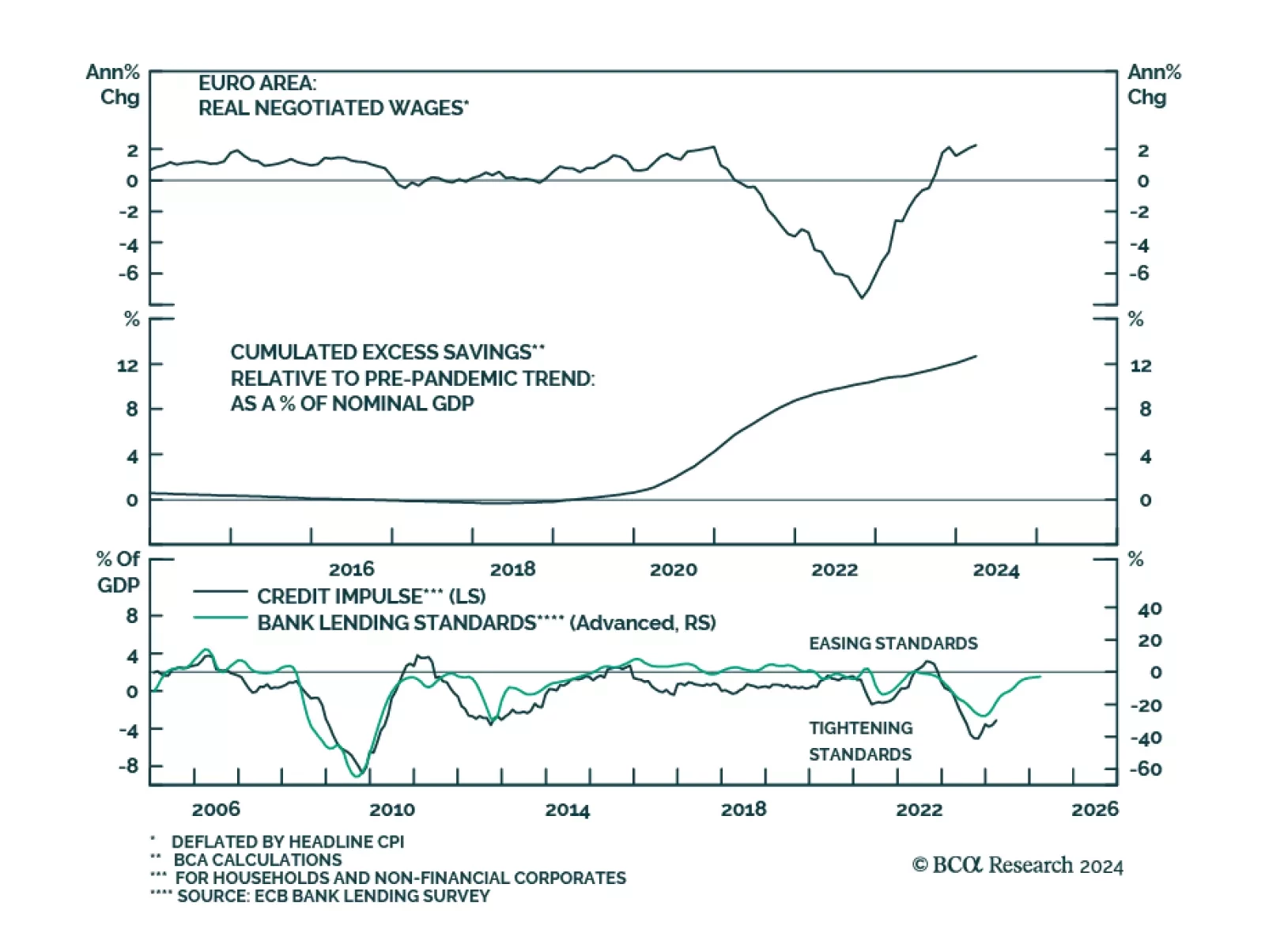

According to BCA Research’s European Investment Strategy service, an increase in borrowing costs will further weaken vulnerable corporate balance sheets. As suggested by their Corporate Health Monitors (CHMs), the health of…

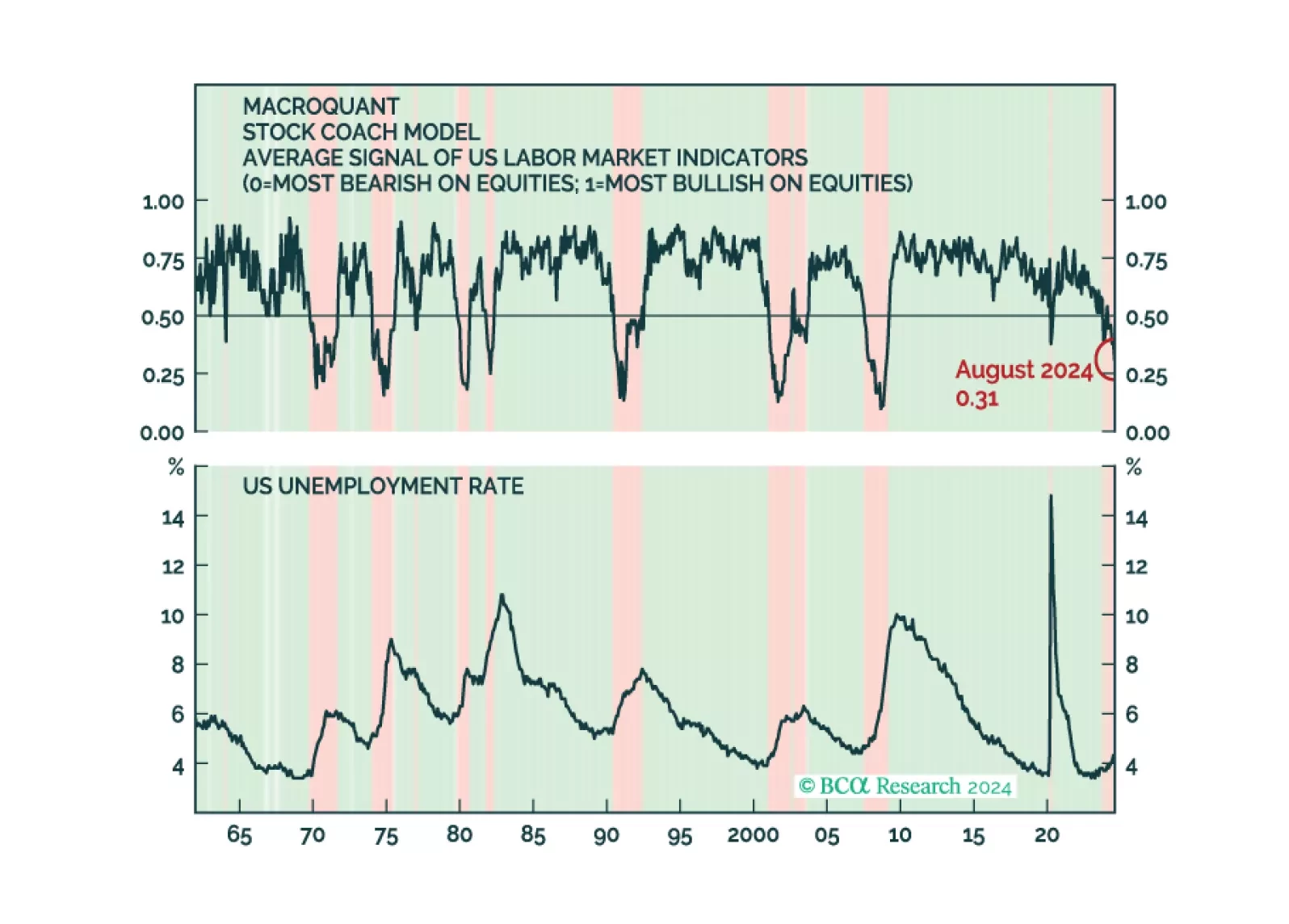

MacroQuant continues to recommend underweighting equities and overweighting bonds. This is consistent with the Global Investment Strategy Team's decision to downgrade global equities to underweight in late June.

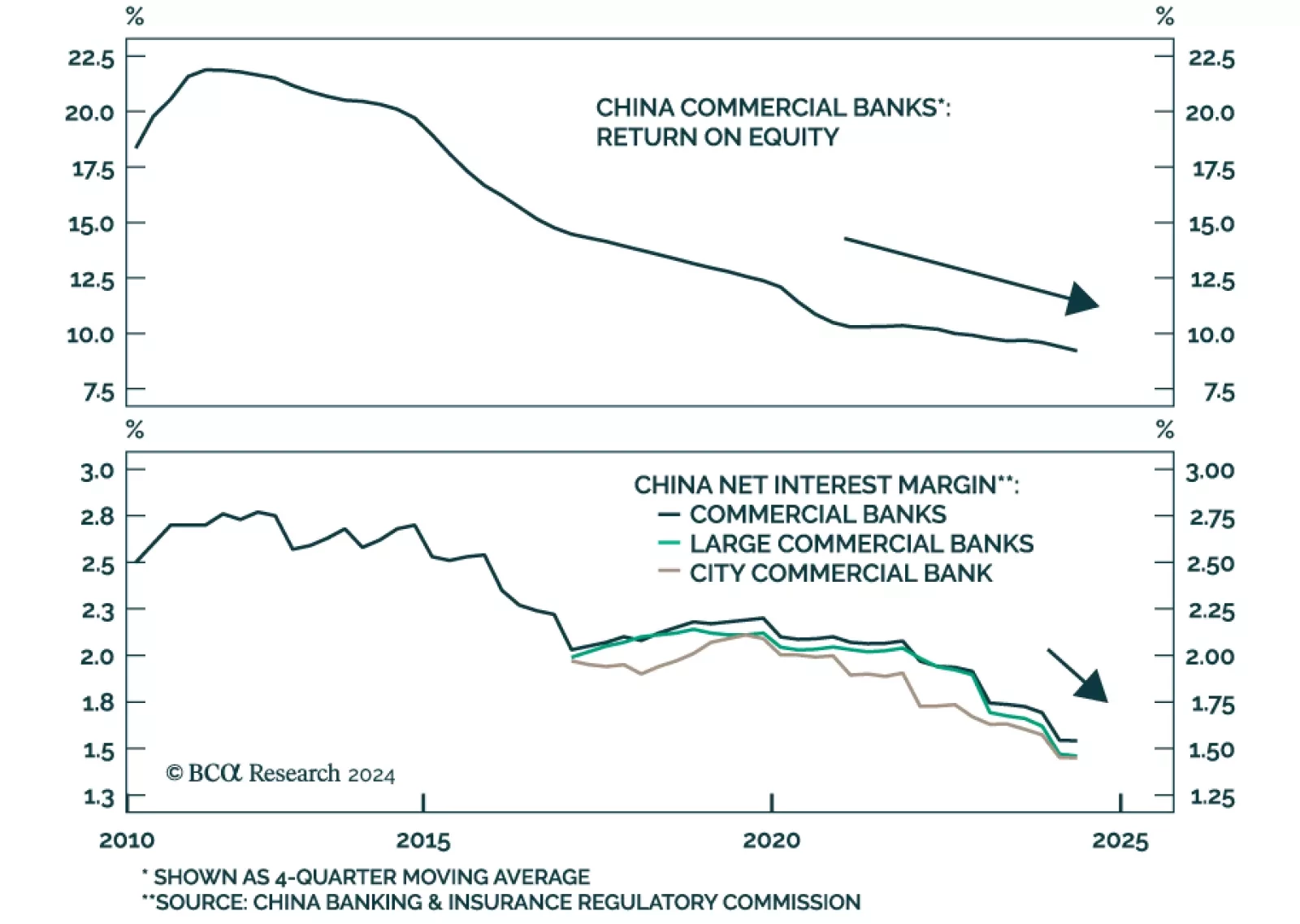

Chinese onshore and offshore bank stocks have outperformed their respective broad markets by 26% and 24% since October. Despite deteriorating return on assets, return on equity and net interest margins, investors have sought out…

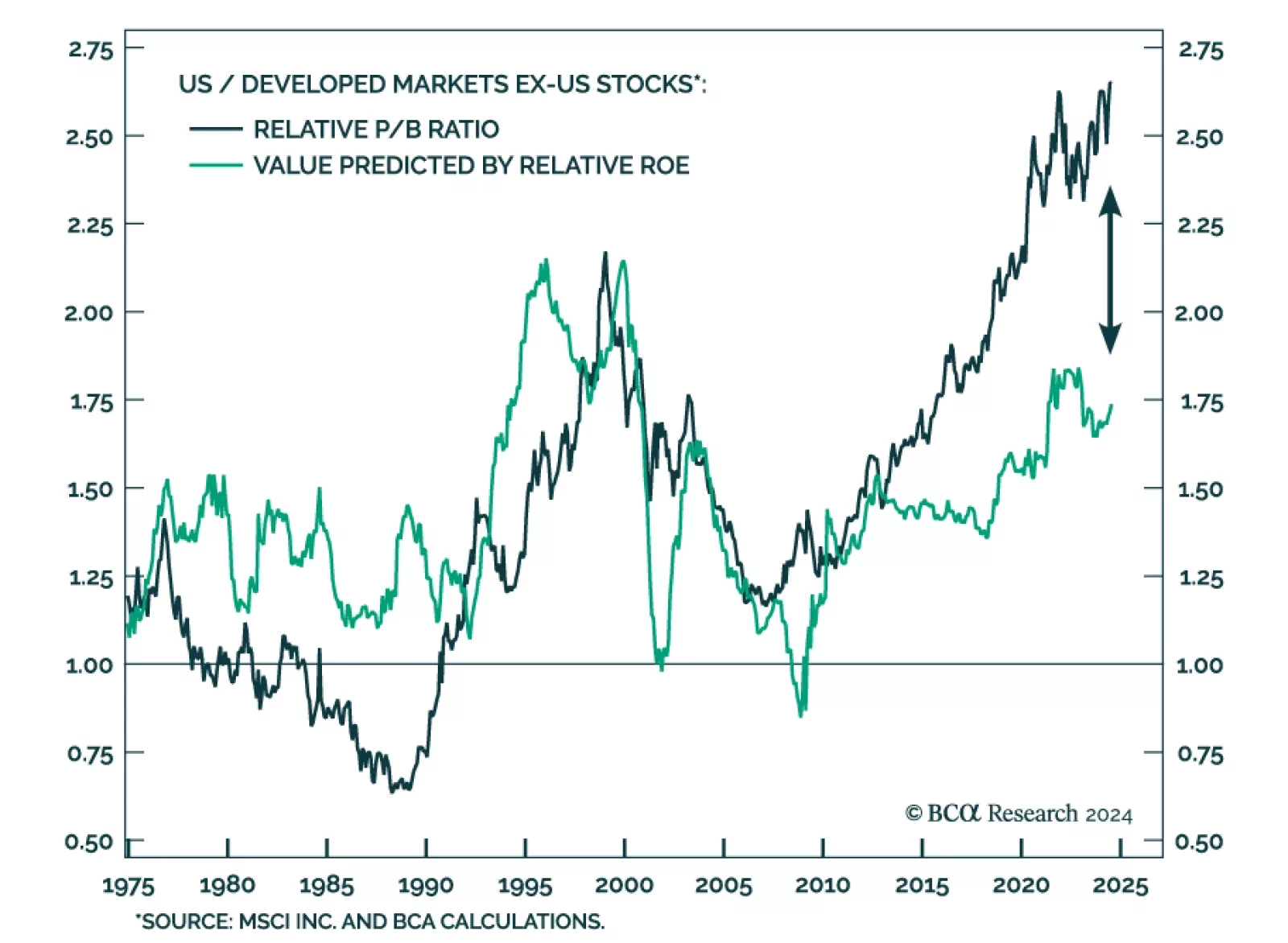

According to our Bank Credit Analyst service, an inflection point in the relative performance of US stocks is not likely to occur over the coming 6-12 months. A recession favors US equities in common currency terms barring…

Preliminary estimates suggest that US durable goods orders growth rebounded sharply from a 6.9% m/m contraction to 9.9% growth in July, upending expectations of a more muted 5.0% monthly increase. However, a 34.8% m/m rise in…

We’ve highlighted that continued deterioration in consumer fundamentals will tip the US economy into a recession. Slower compensation growth, tighter lending standards for consumer loans and dwindling excess savings will…