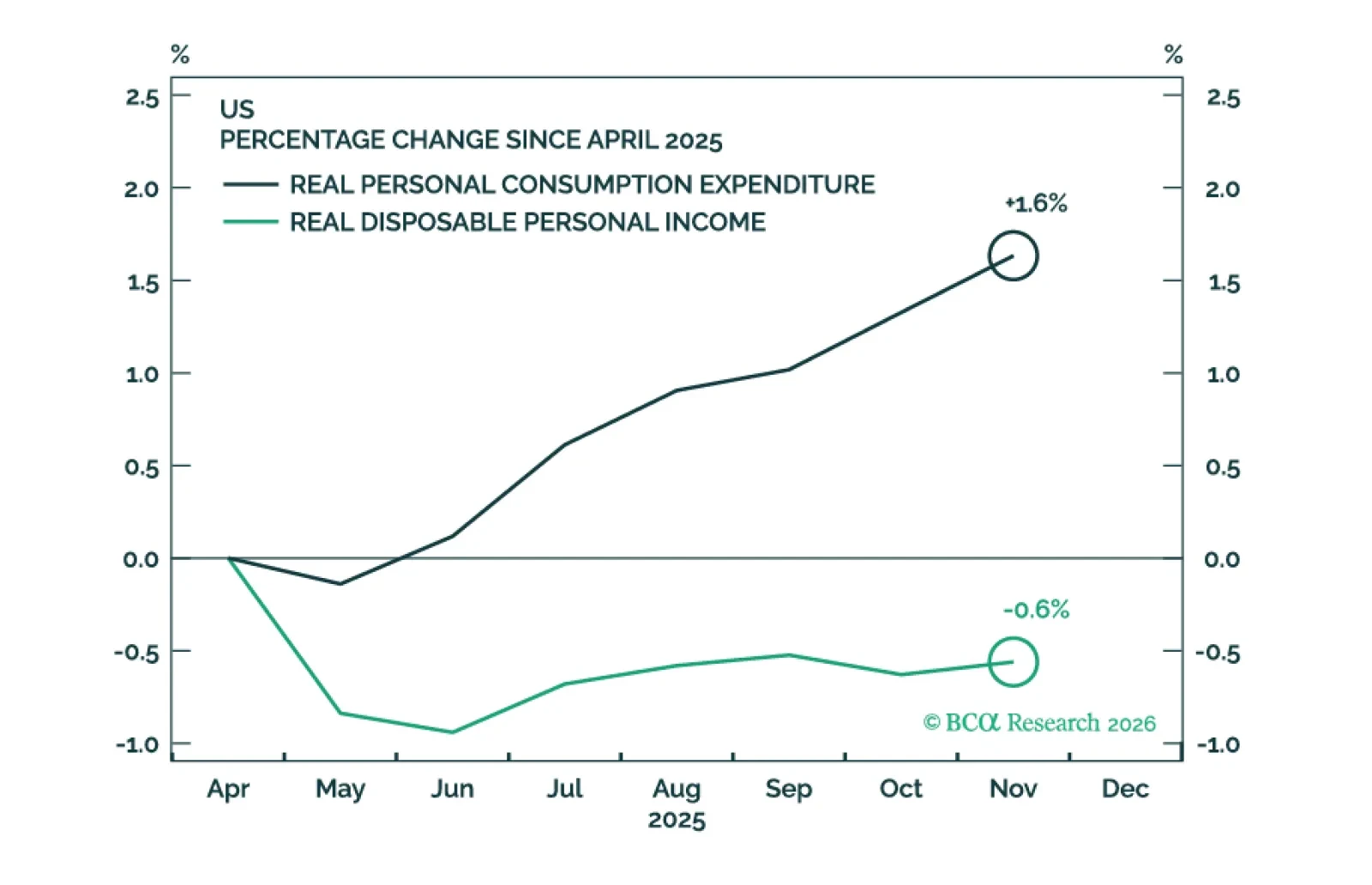

Recent economic data have been reasonably firm. We will cut our 12-month US recession probability to 40% from 50% if the Supreme Court strikes down President Trump’s tariffs. This would take our scenario-weighted year-end 2026…

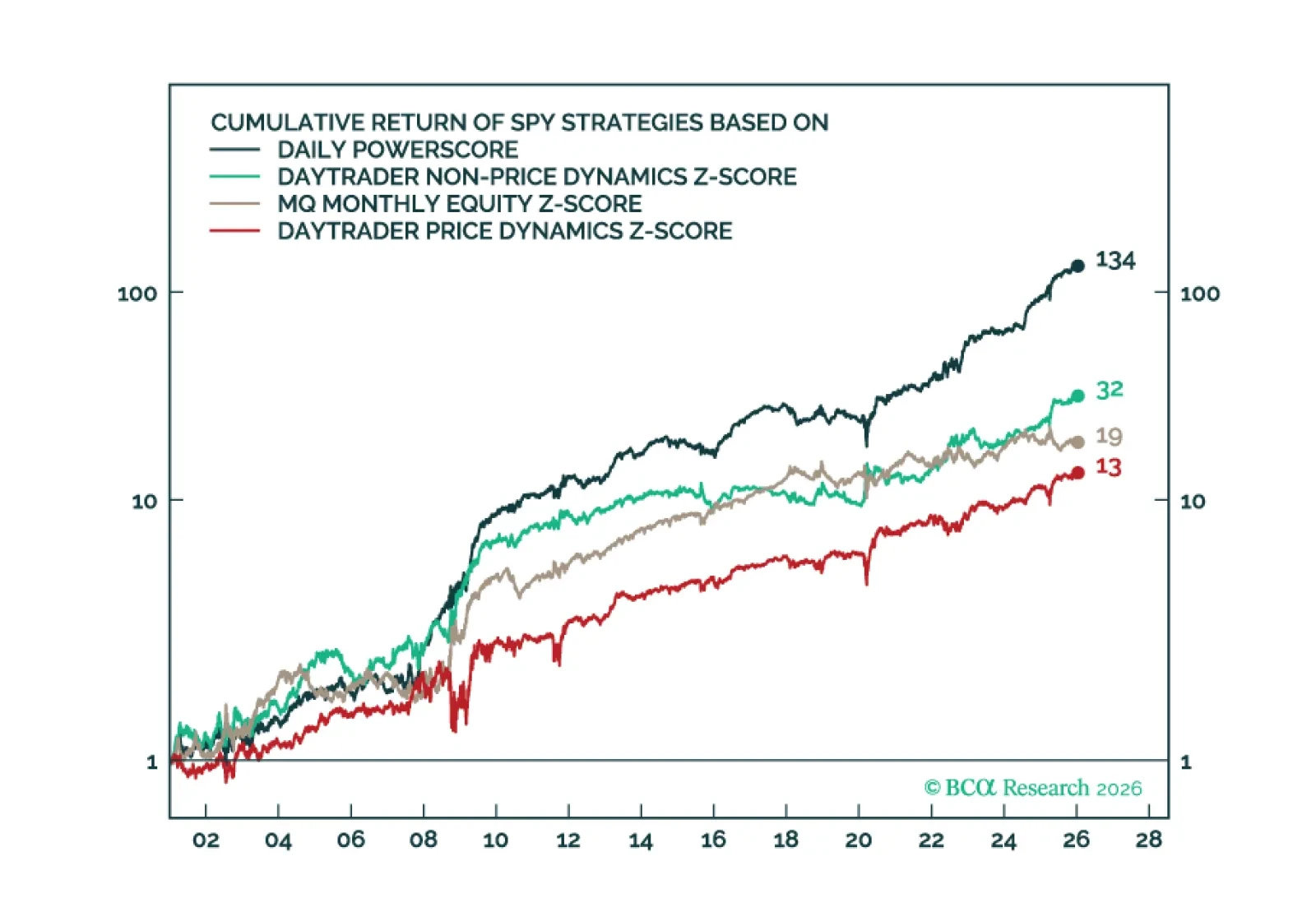

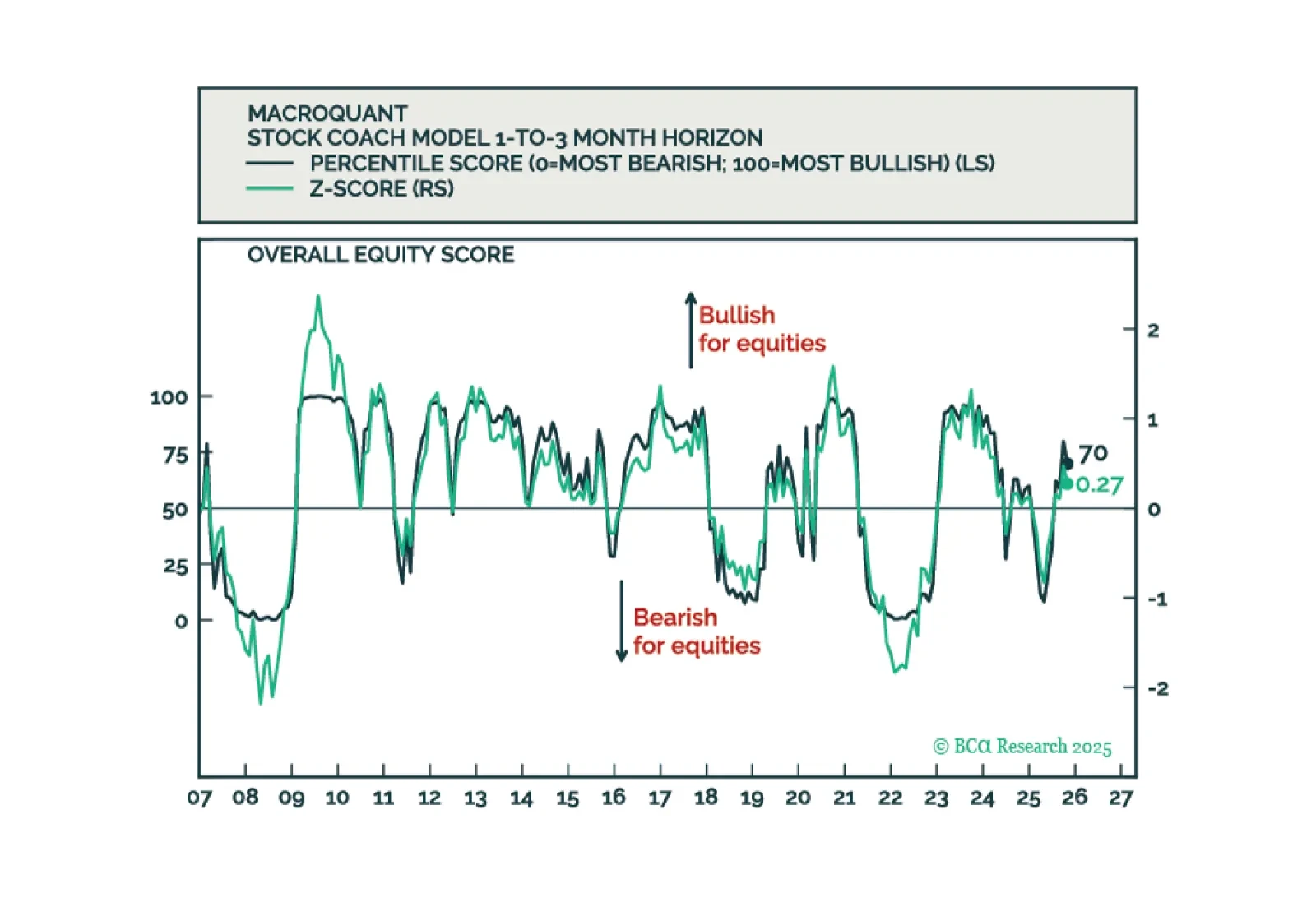

Over the past few months, we have been deploying new market-timing tools aimed at improving the accuracy of our calls. Today’s report highlights our ultra high-frequency Daily Oscillators, which provide daily signals on the near-term…

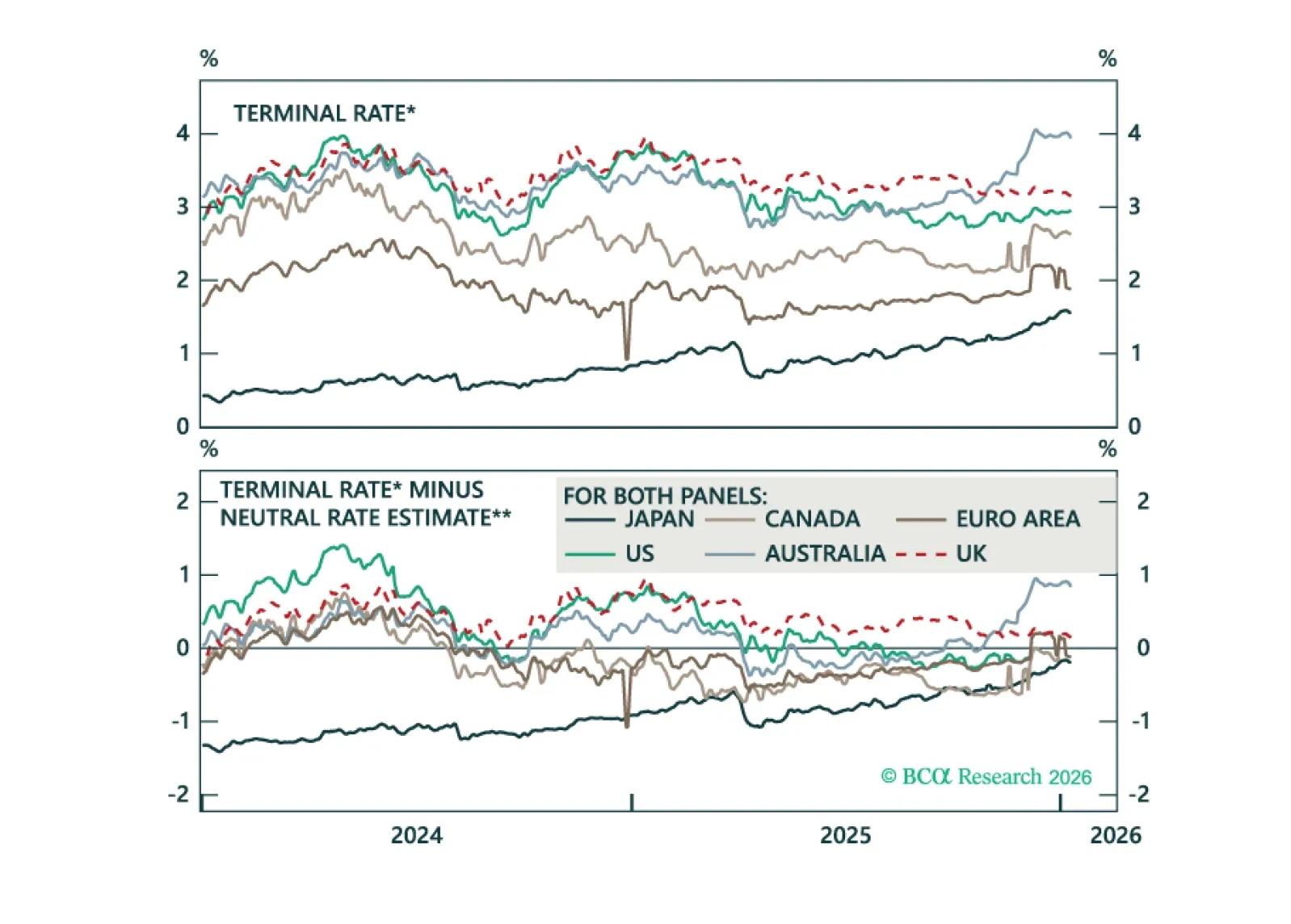

Our Q1 outlook maps global growth, curve dynamics, and policy surprises, which we then translate to our recommended global fixed income portfolio allocations and trades.

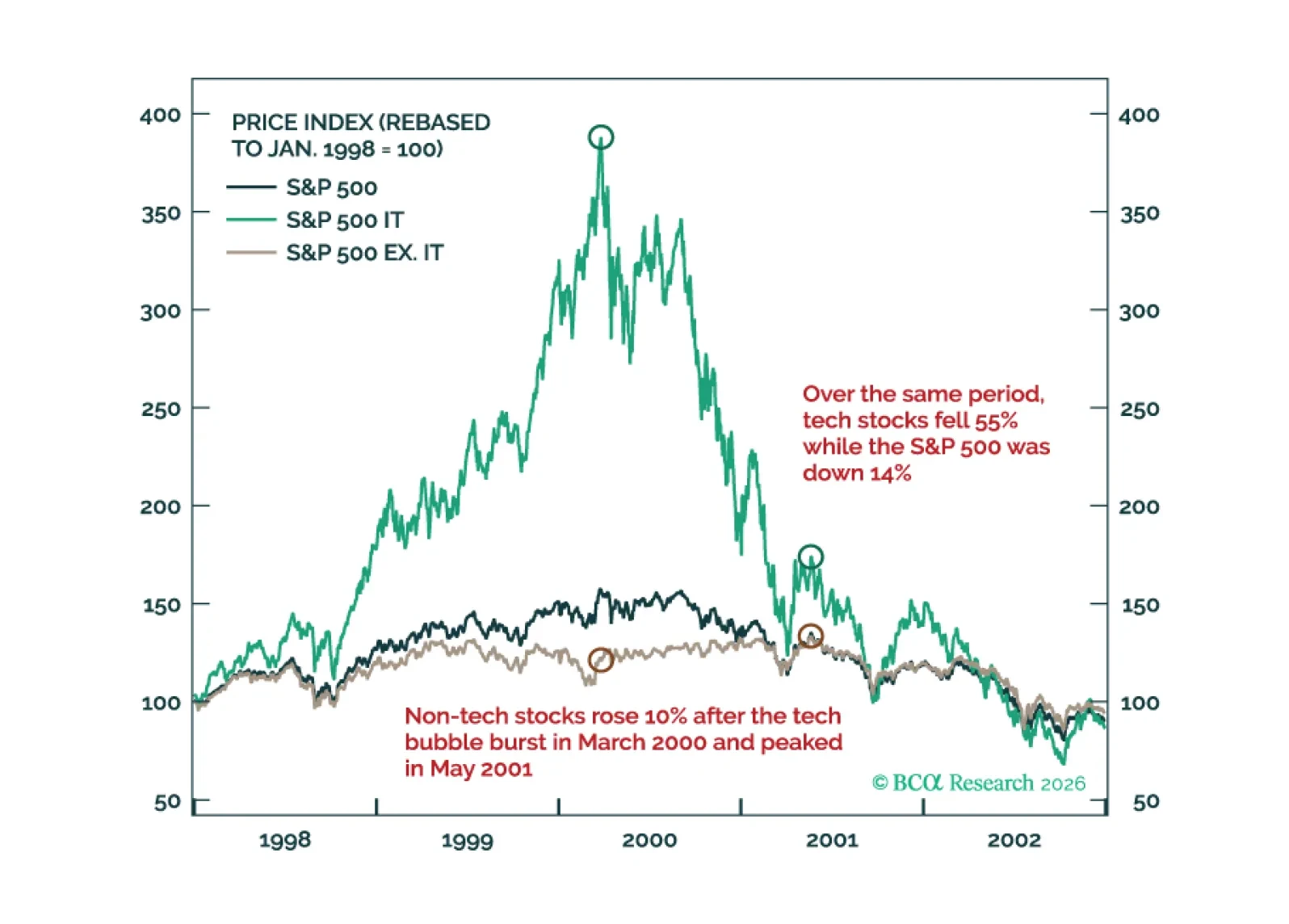

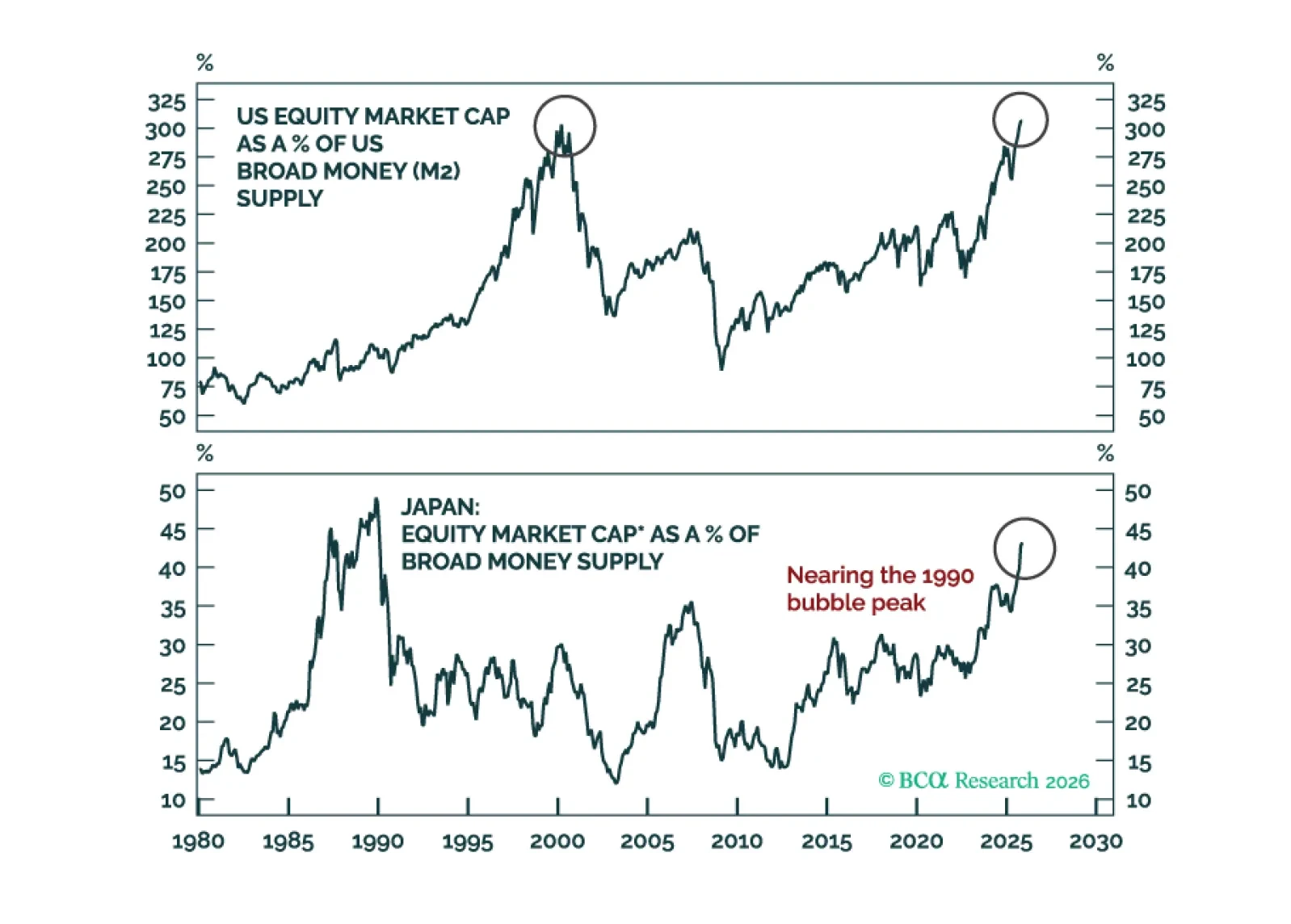

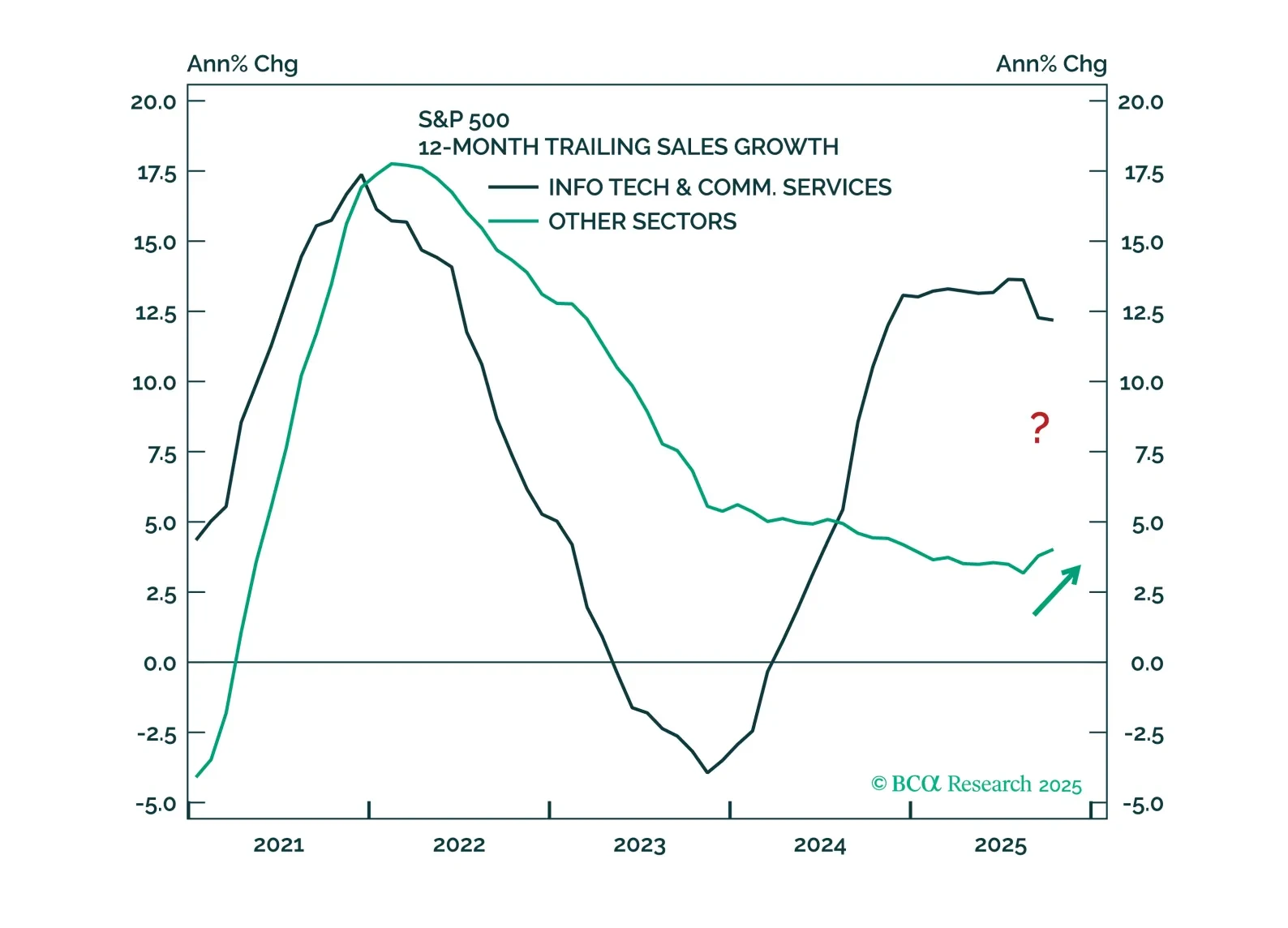

Much like the 2000 episode, we expect this year to unfold in two stages: A “Great Rotation” from tech stocks to non-tech names in the first half of 2026 followed by a broad-based selloff in stocks in the second half on the back of a…

At major technical crossroads, markets eitherpull back before staging a sustainable breakout, or attempt to break out only to drop considerably (i.e., a fakeout). We believe the latter dynamics are more likely to play out.

MacroQuant has downgraded equities to underweight, favors a below-benchmark duration stance in fixed-income portfolios, remains bearish on the US dollar, and is still bullish on gold.

This year, we once again present our 2026 outlook as a retrospective from the future – a future in which the AI boom turned to bust.Next week, please join me for a Webcast on Wednesday, December 17 at 10:30 AM EST (3:30 PM GMT, 4:30…

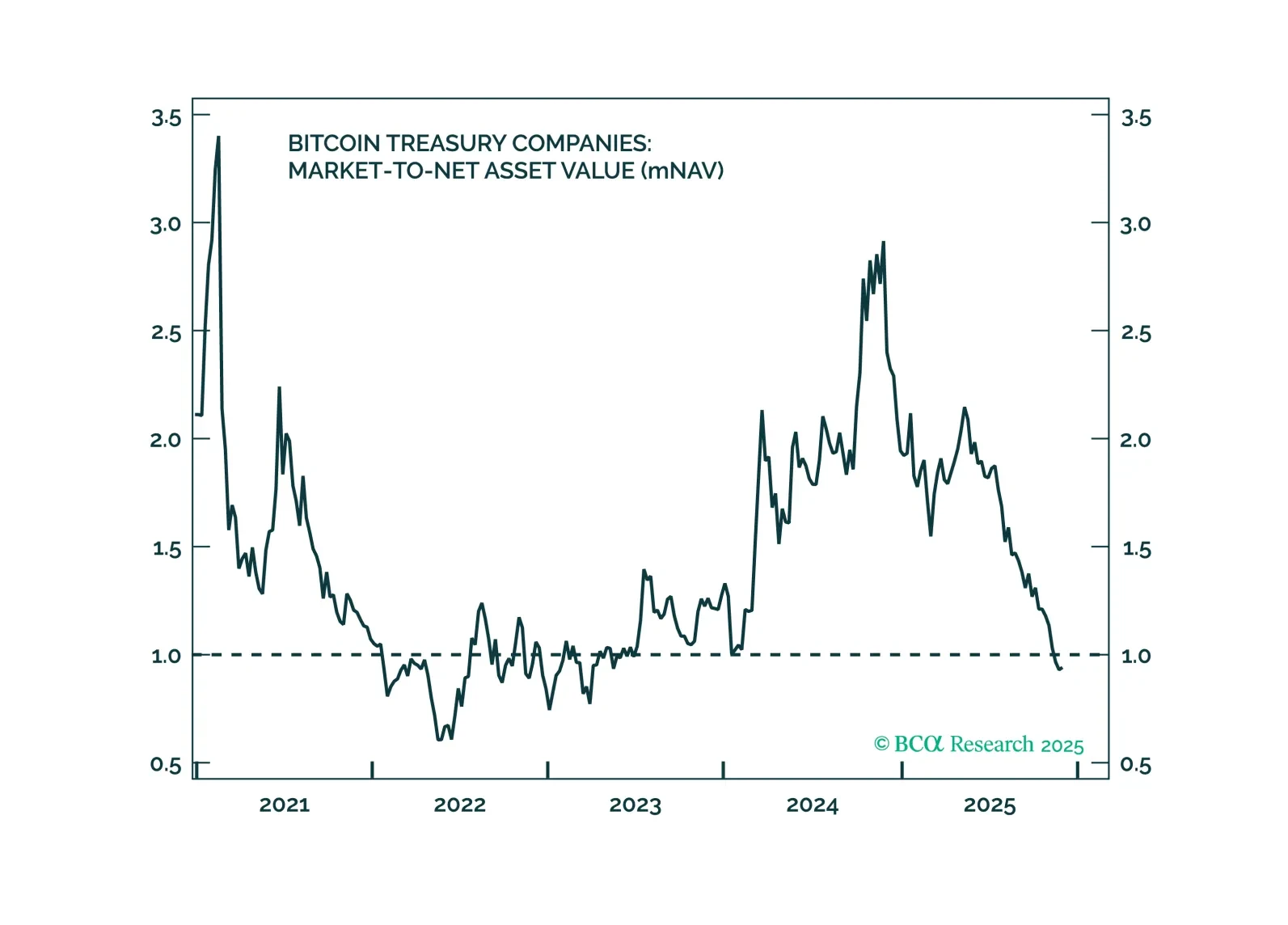

Bitcoin’s recent volatility masks a deeper story – the widest disconnect from traditional macro drivers since 2022. With sentiment now deeply negative and institutional demand still building, the conditions for a realignment with…

The K-shaped economy will likely reverse in 2026, with the cyclical parts of the economy doing better. Upgrade Financials and Materials from neutral to overweight. Downgrade Communication Services and Utilities from overweight to…

MacroQuant remains tactically overweight equities, favors an above-benchmark duration stance in fixed-income portfolios, remains bearish on the US dollar, and is bullish on gold.