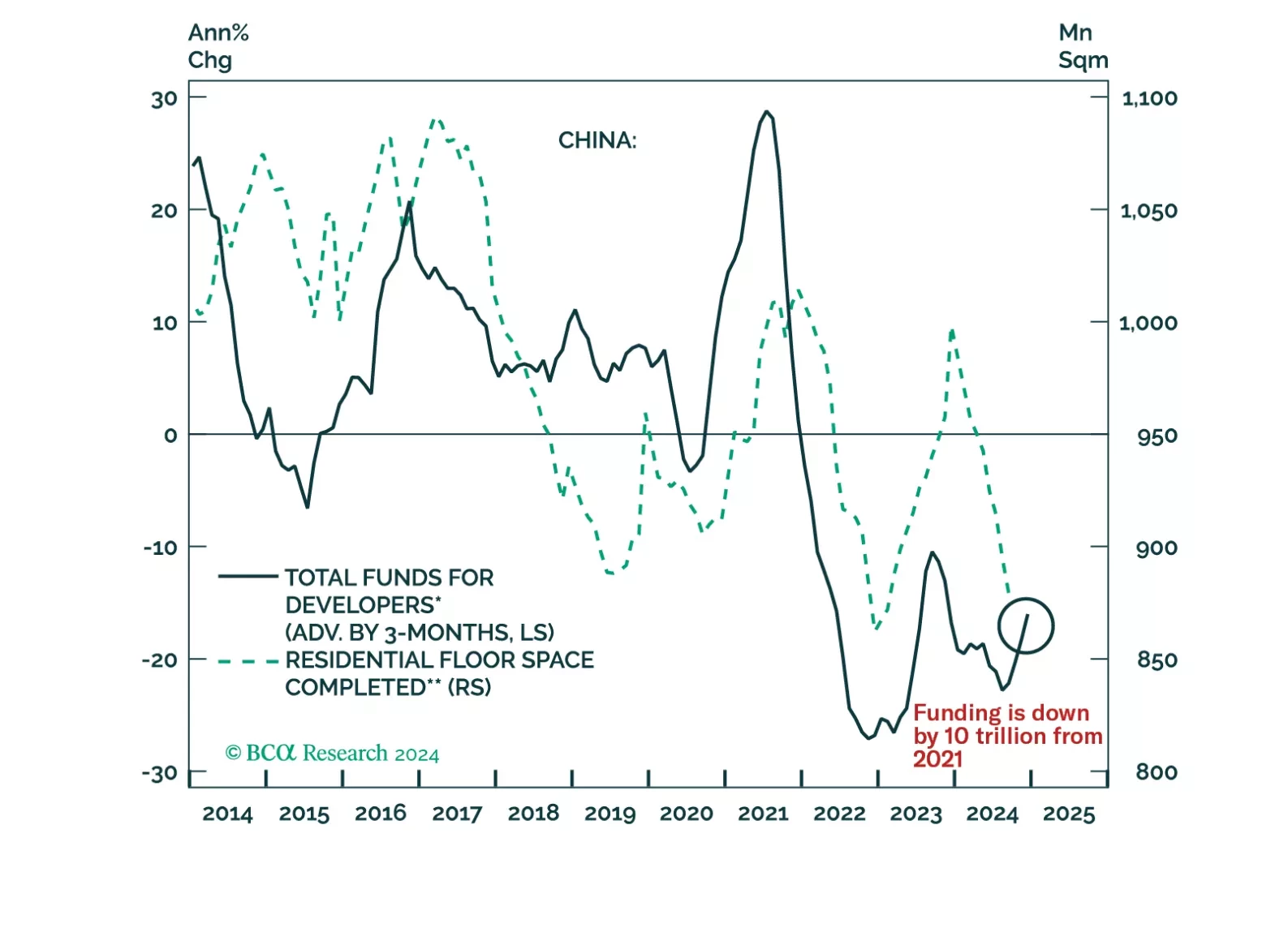

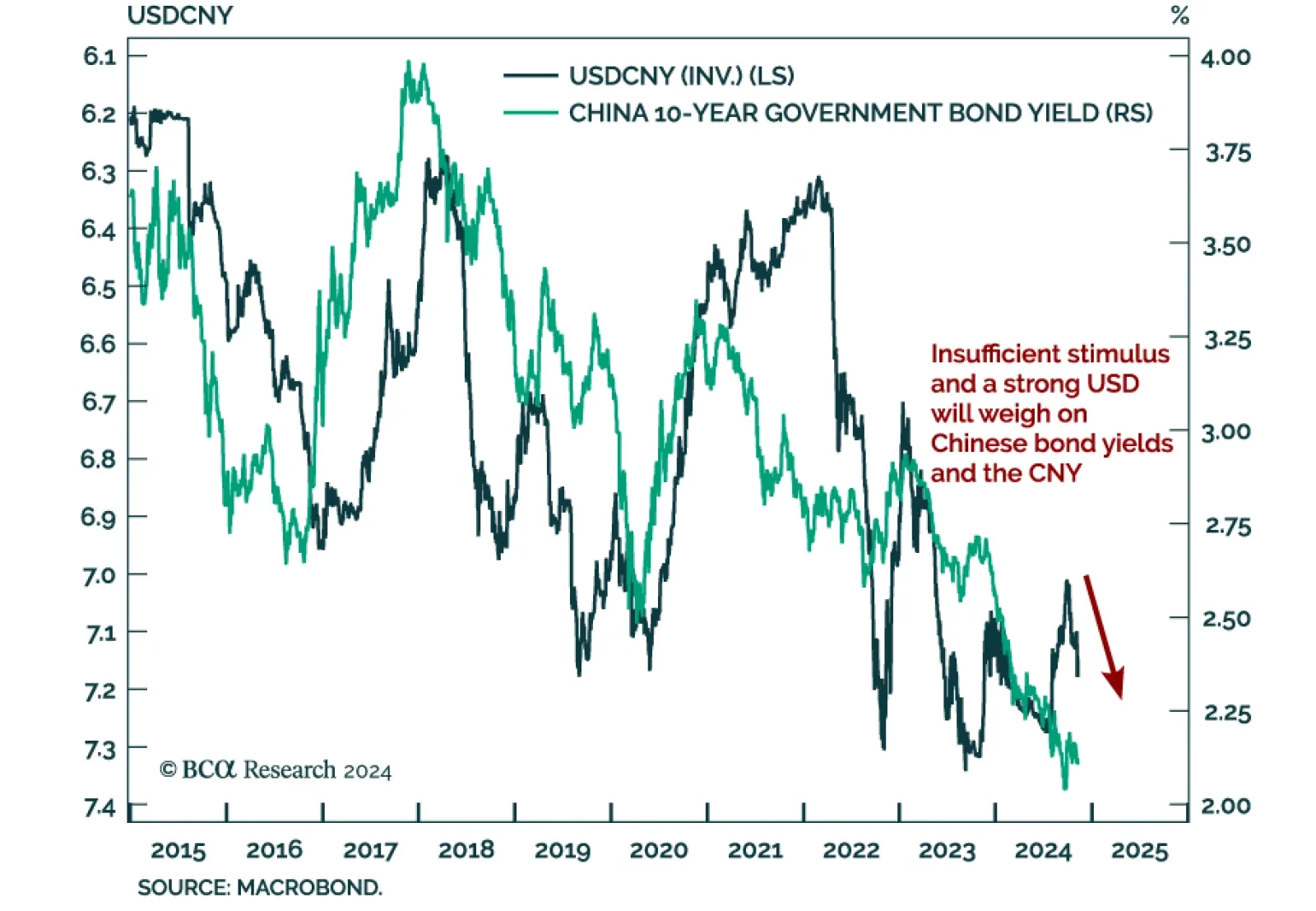

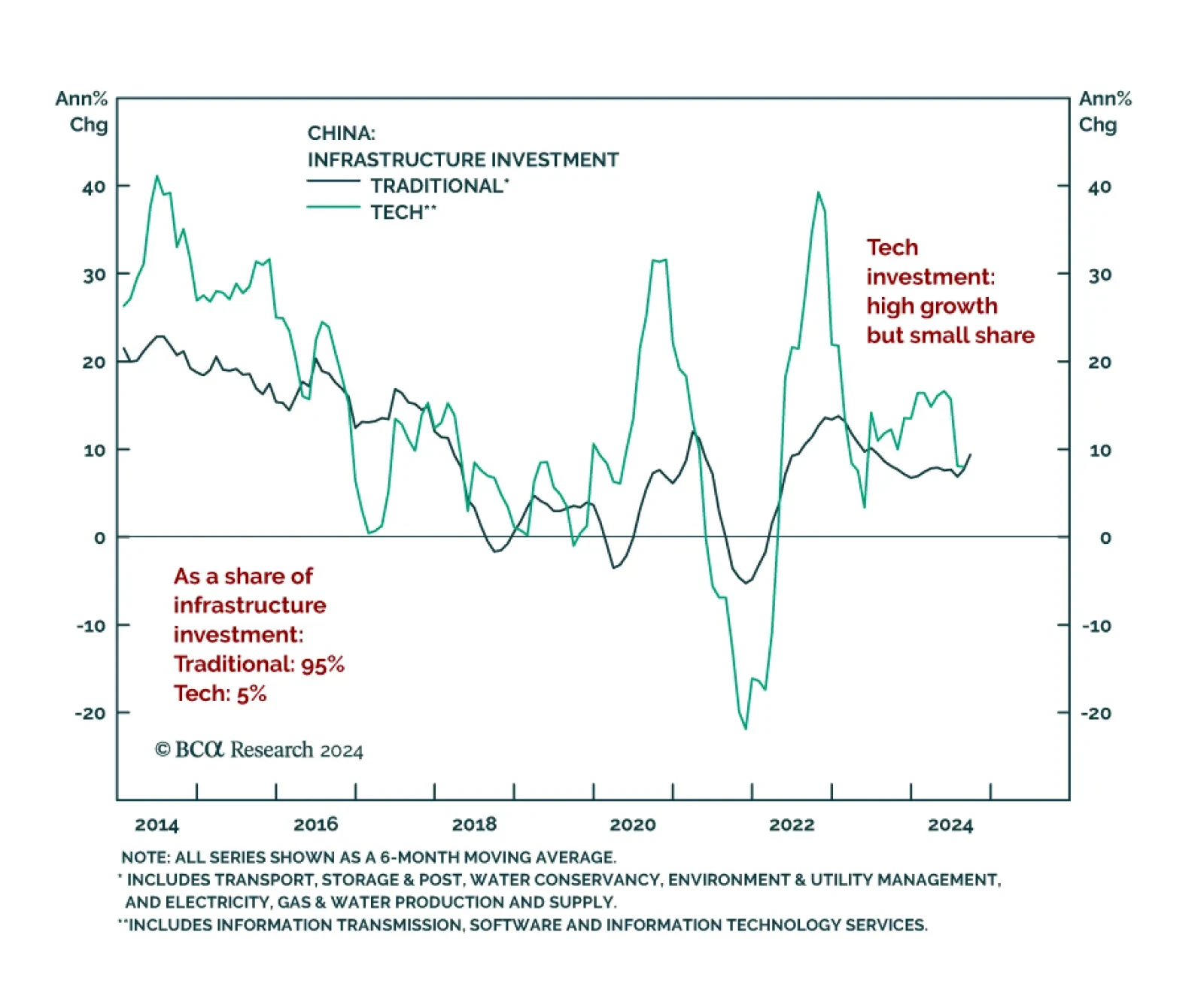

As highlighted recently, we do not think China’s announced stimulus measures will be enough to stave off deflation (see Today’s Pick). To lift China’s economy, Beijing must unveil large fiscal transfers to…

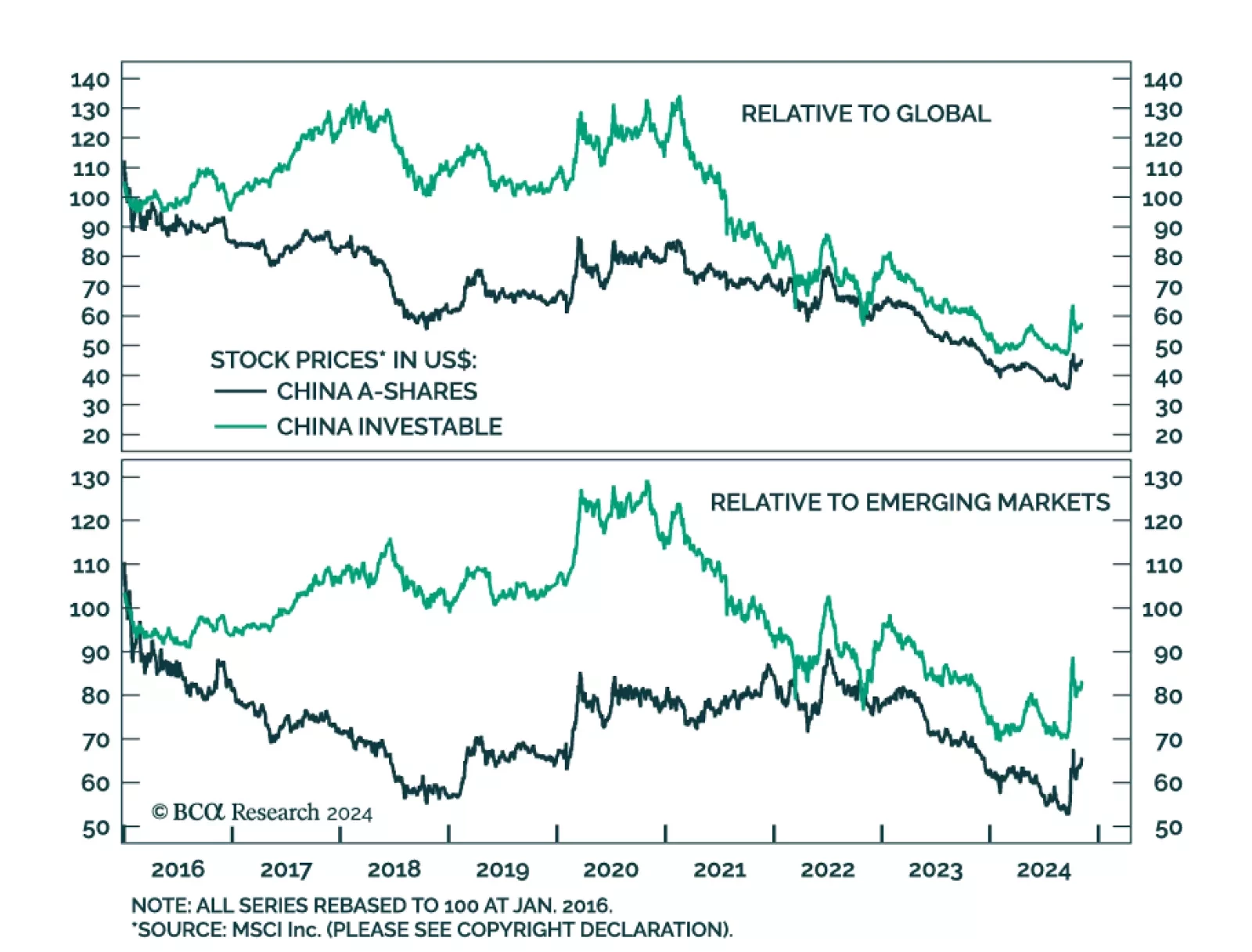

Our China Investment Strategy team recently met with clients in China to assess investor sentiment and discuss the outlook as Beijing unveils new stimulus measures. China’s economic recovery faces headwinds and is…

We spent last week visiting our clients in China. In this report, we share some of the key questions from the client meetings as well as our responses.

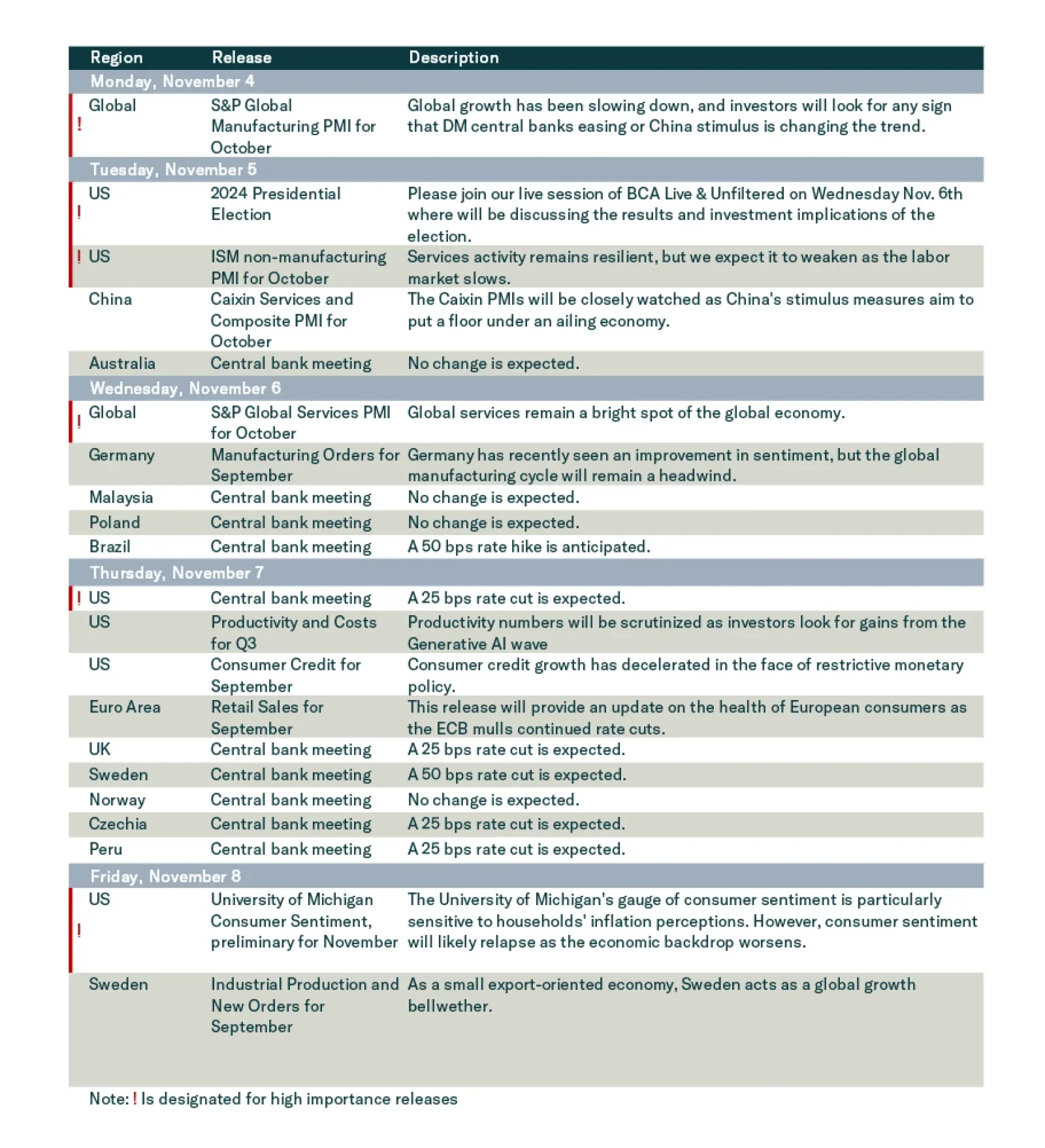

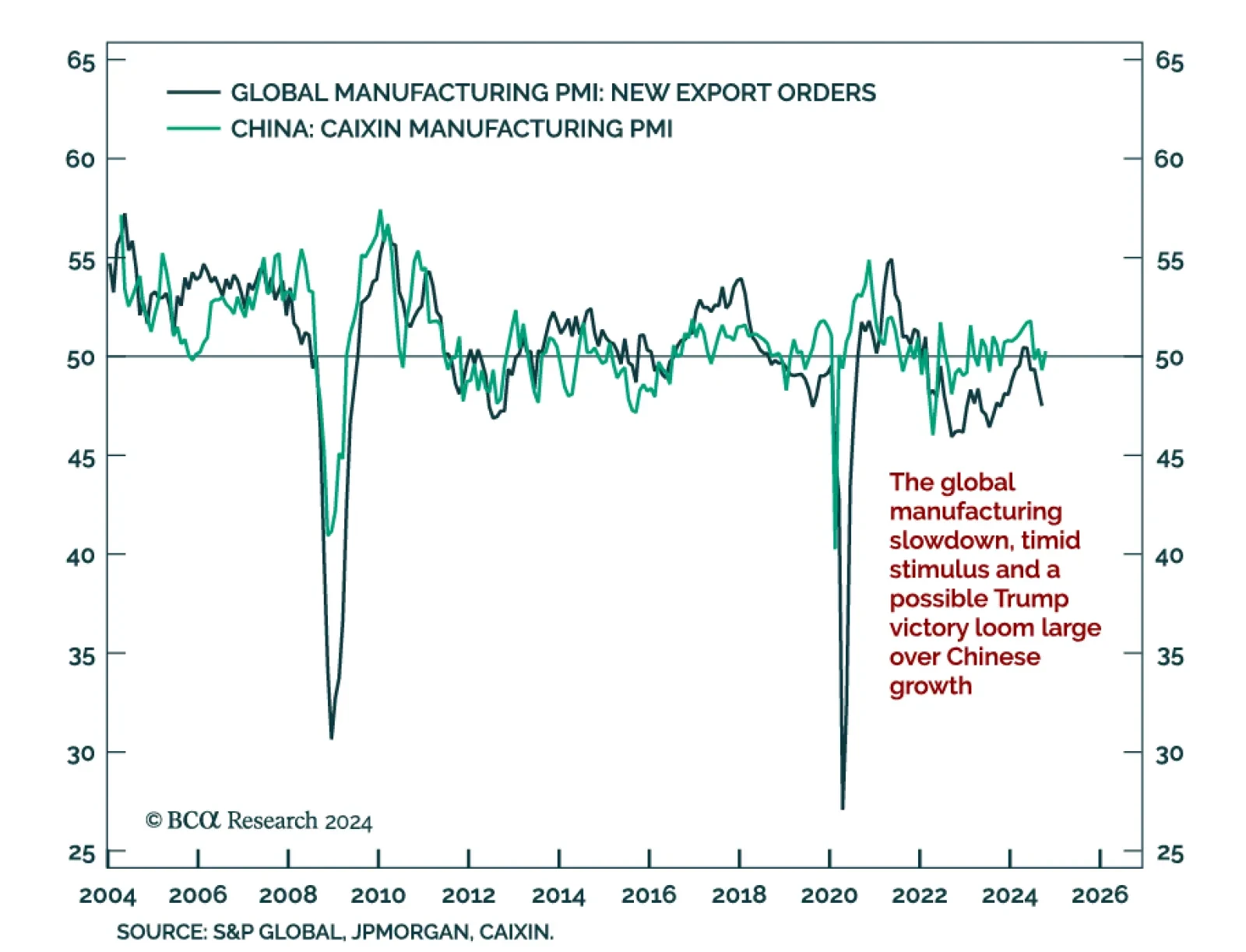

Will the prospect of expanding trade tensions lead to more Chinese stimulus, and create an opportunity for Chinese equities? Not necessarily, as the election results were already factored in our EM and China strategists’…

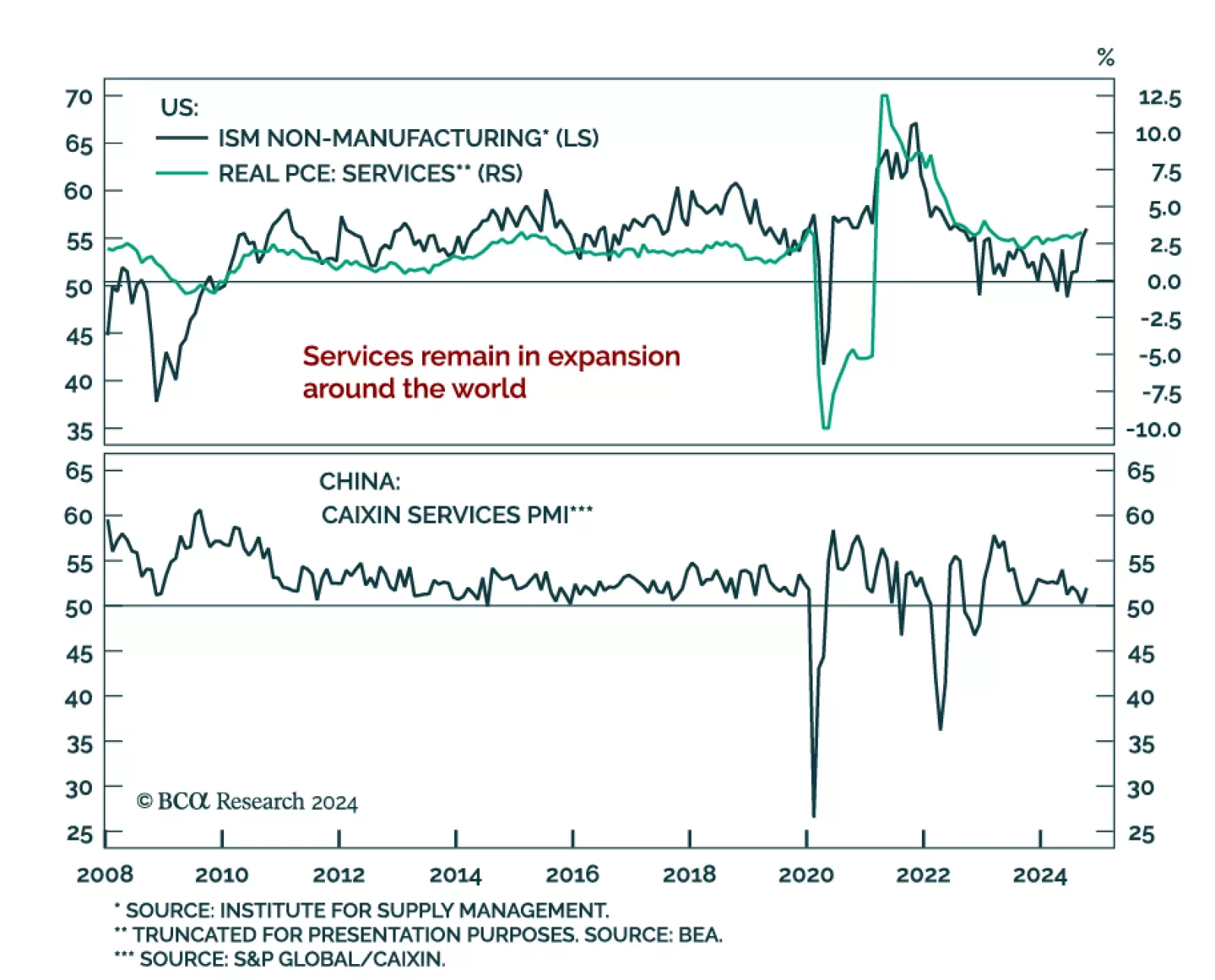

The October ISM non-manufacturing PMI beat expectations, rising to 56 from 54.9 in September, up from a sub-50 low in June. Most components indicate an expansion, but the only significant increase came from employment. New orders…

China’s Caixin Manufacturing PMI rebounded one point in October to 50.3. This was in line with the NBS PMIs from earlier this week, which also showed a modest rebound. We are looking for a turning point in China as the…

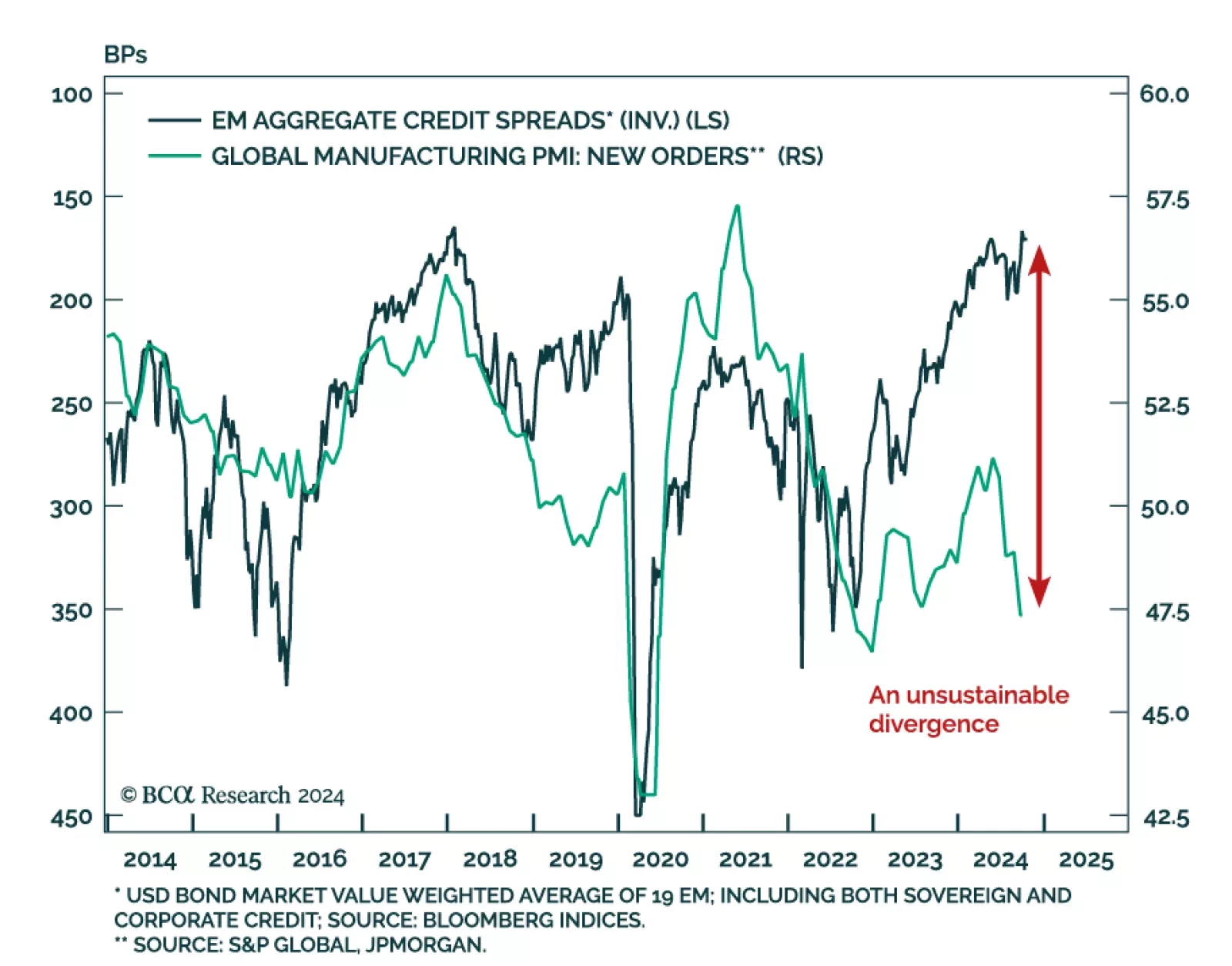

EM credit markets have recently defied the selloffs in EM equities, currencies, local currency bonds, and commodities. According to our Emerging Markets Strategy colleagues, such a decoupling is unusual. A potential Trump re-…

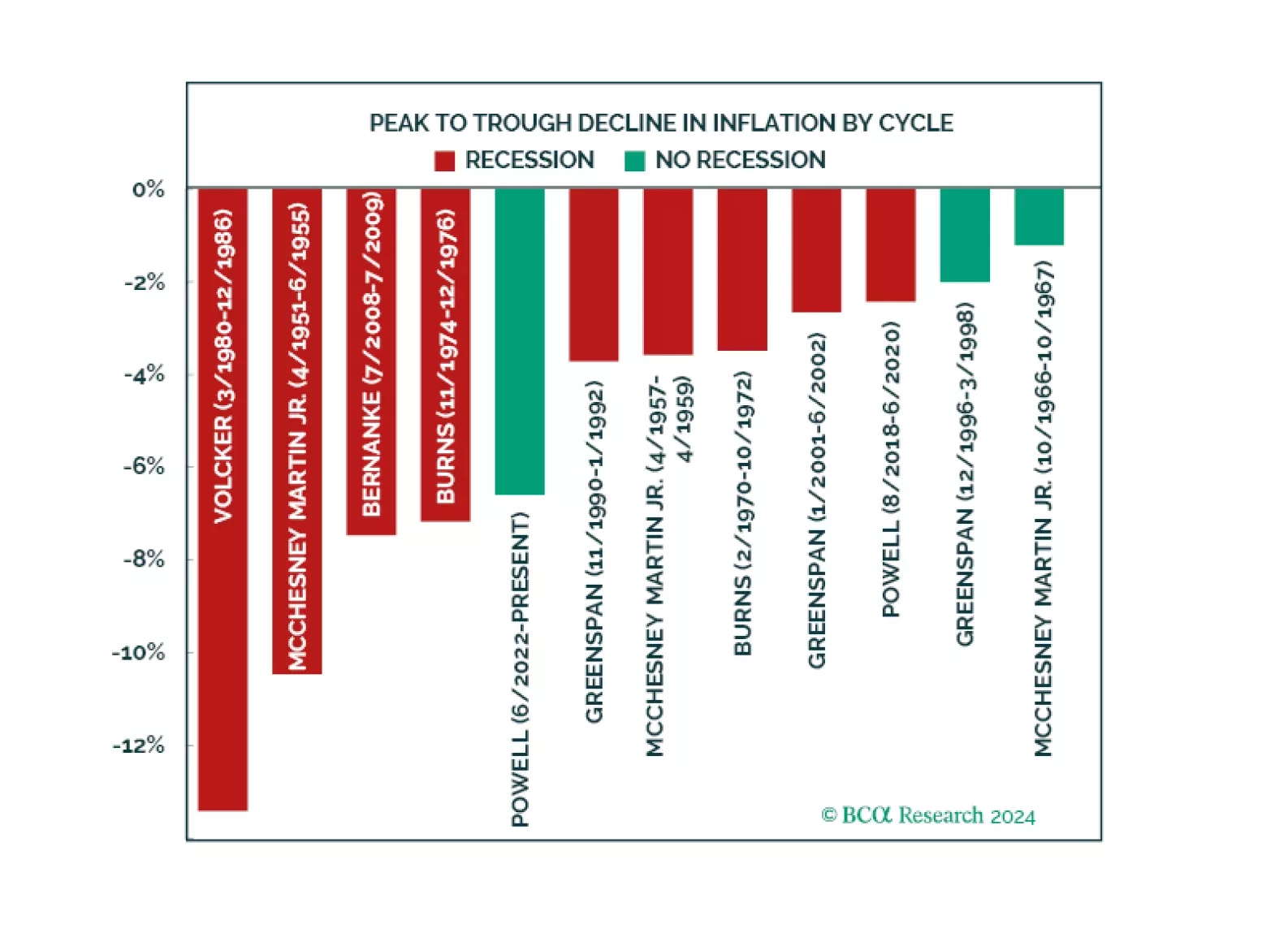

Can Powell achieve a soft landing? There are some indications he is doing it. We examine why our negative stance was wrong and analyze the four growth engines that kept recession at bay. Half of these forces remain while the other…

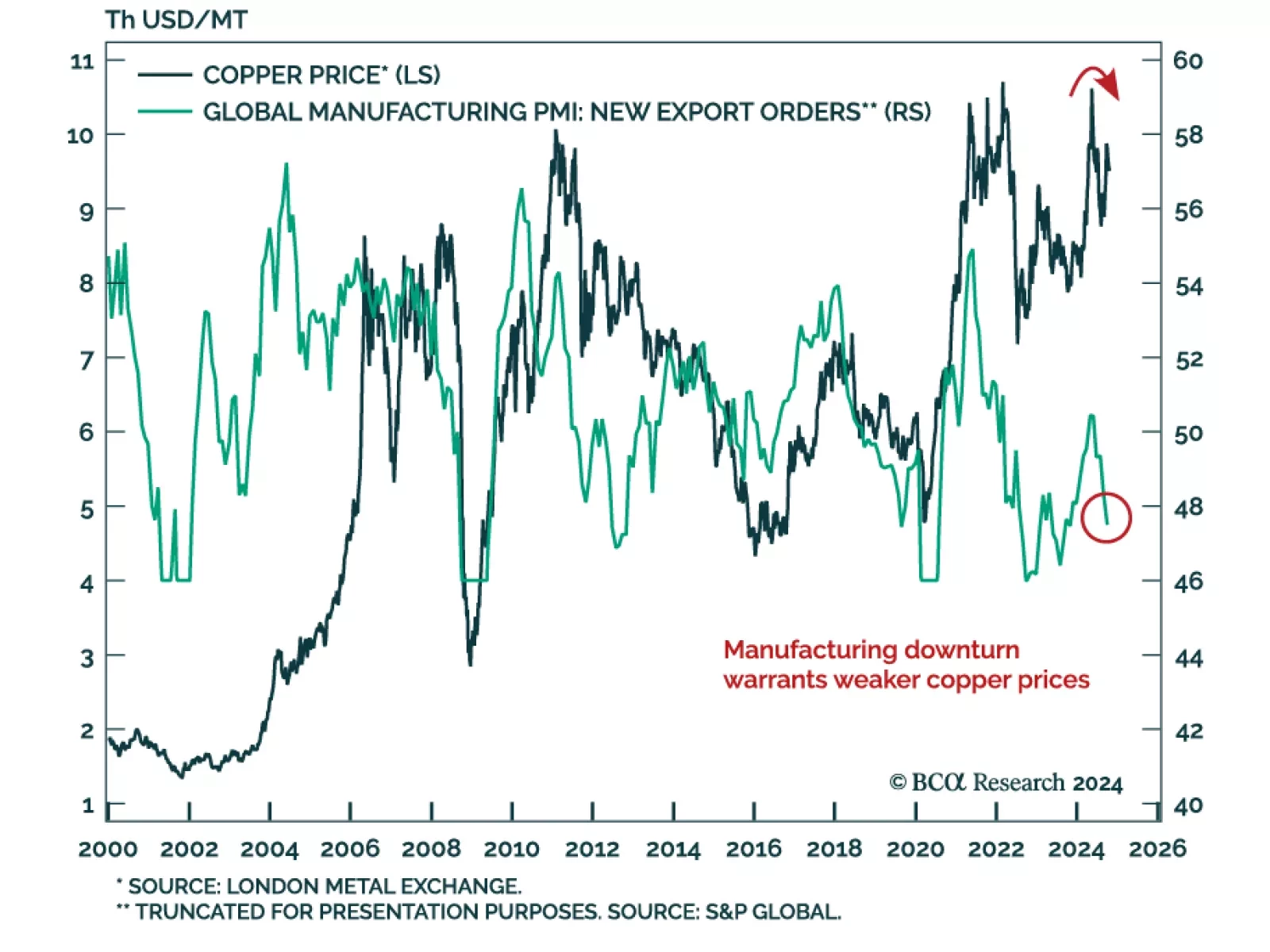

Speculators have supported copper prices as demand growth slowed below the pace of supply growth. Our Commodity and Energy Strategy colleagues believe this does not bode well for the metal. The copper market faces a situation…