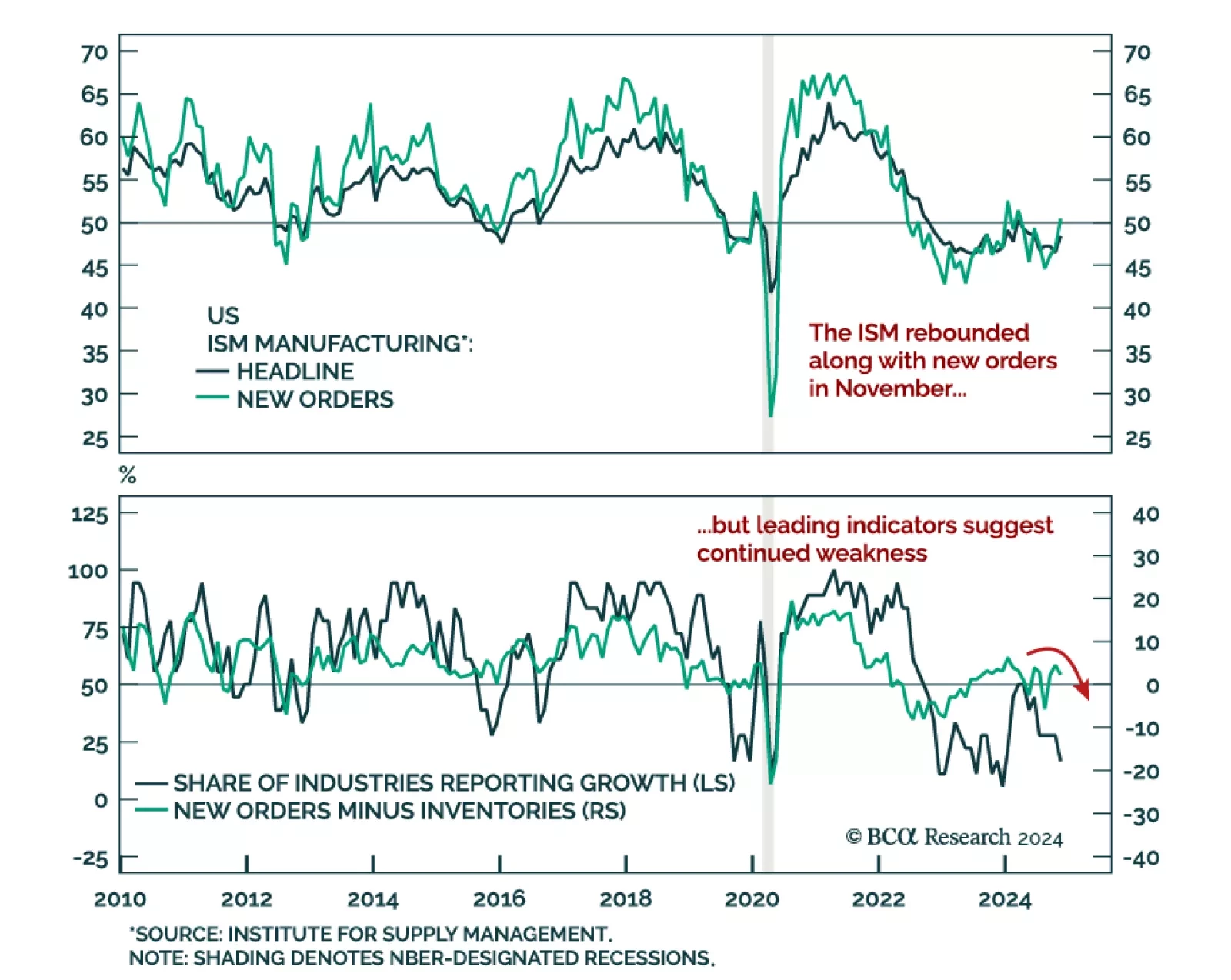

The November ISM Manufacturing index beat expectations, increasing to 48.4 from 46.5 in October. The improvement was partly driven by the new orders component, which increased to 50.4 from 47.1. Price pressures moderated.…

This week we conduct a thorough audit of our open positions by revisiting the original basis and subsequent performance of all 13 cyclical recommendations. Following the review, we recommend closing 6 of the 13 positions.

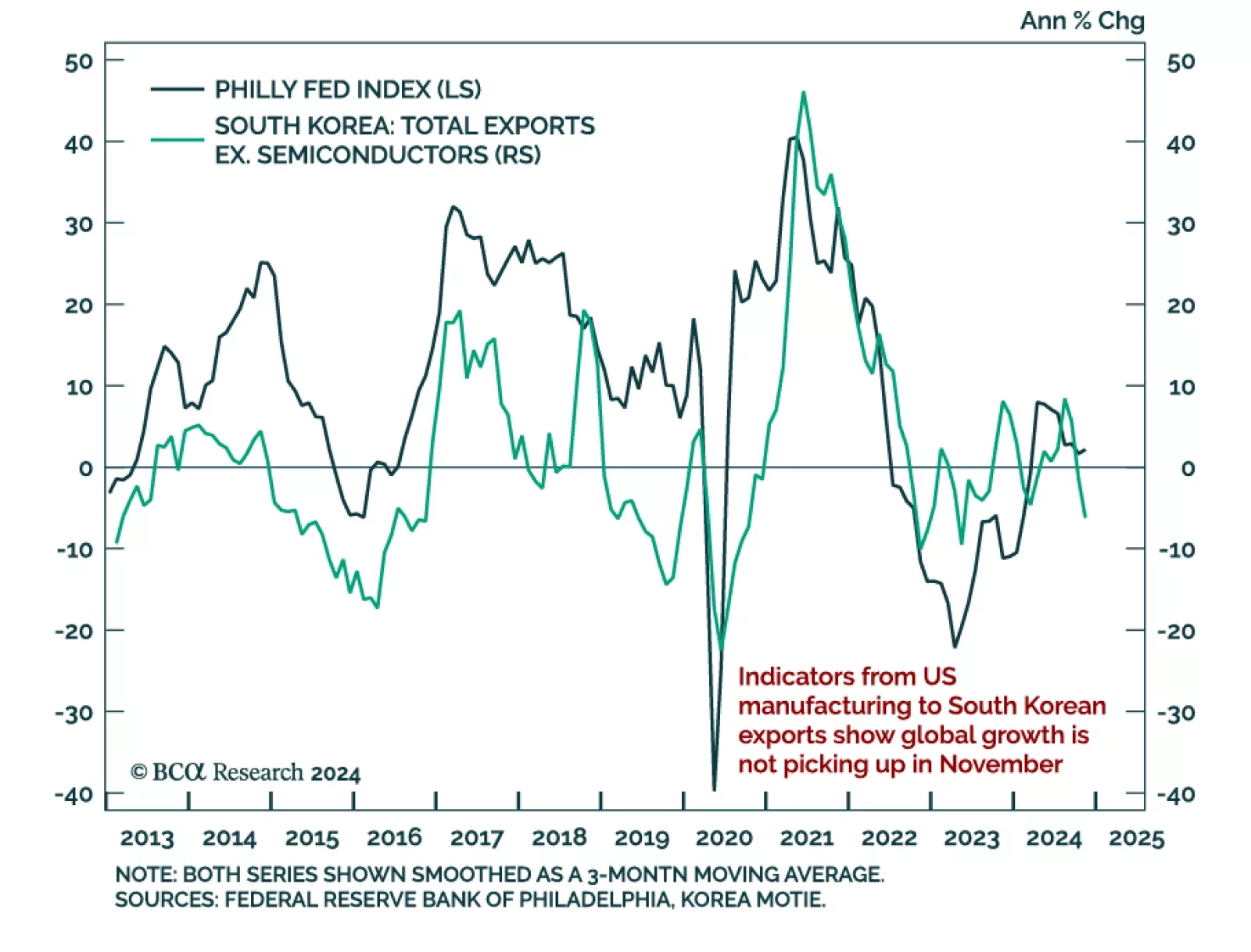

The November Philly Fed manufacturing survey missed expectations and fell to -5.5 vs. 10.3 in October. New orders and shipments softened although they still indicate growth. Most indicators of current activity decreased, while…

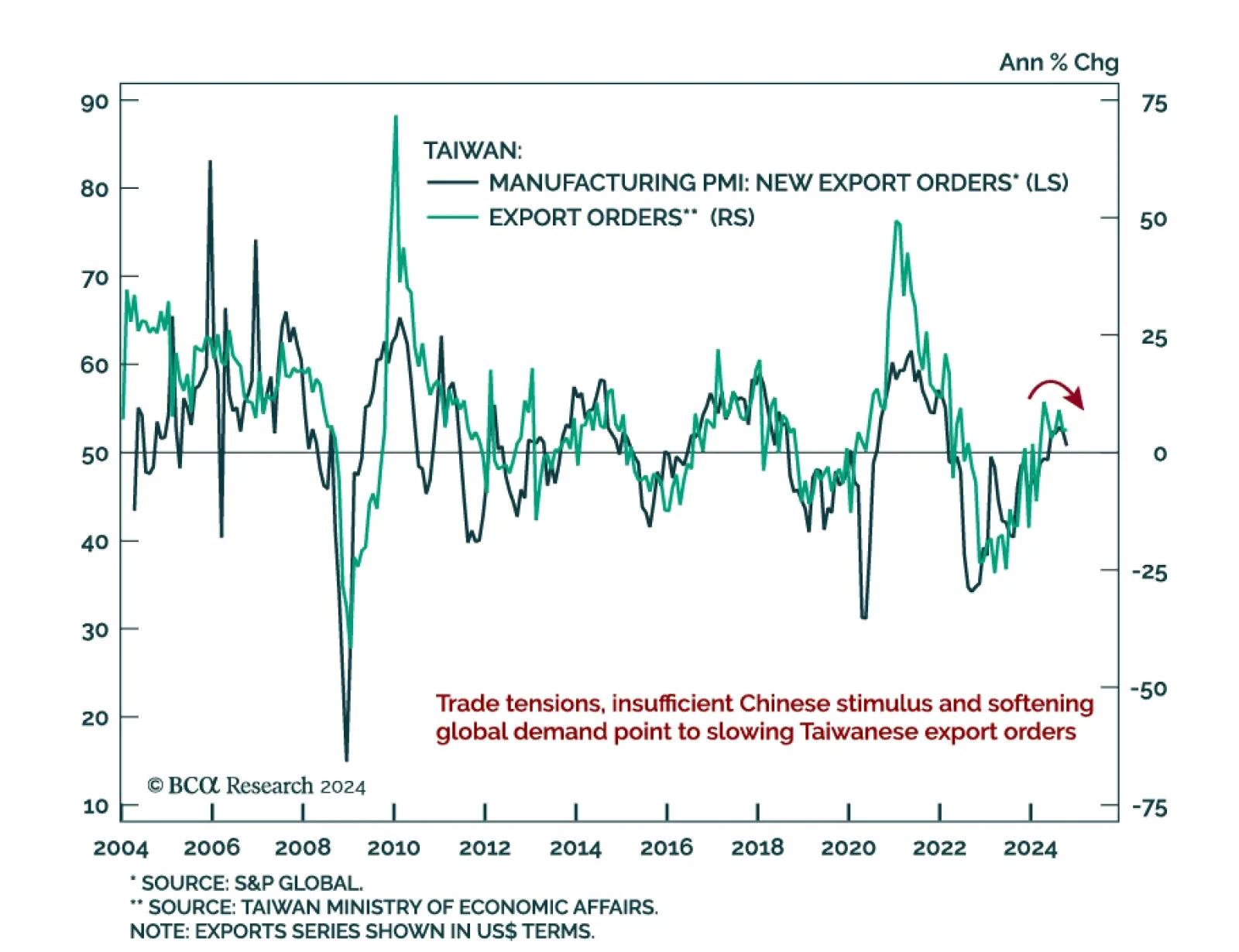

Taiwanese export orders surprised positively when a deceleration was expected, printing at 4.9% y/y, up from 4.6% in September. The increase was spread across most categories, with exports of electronic products accelerating to…

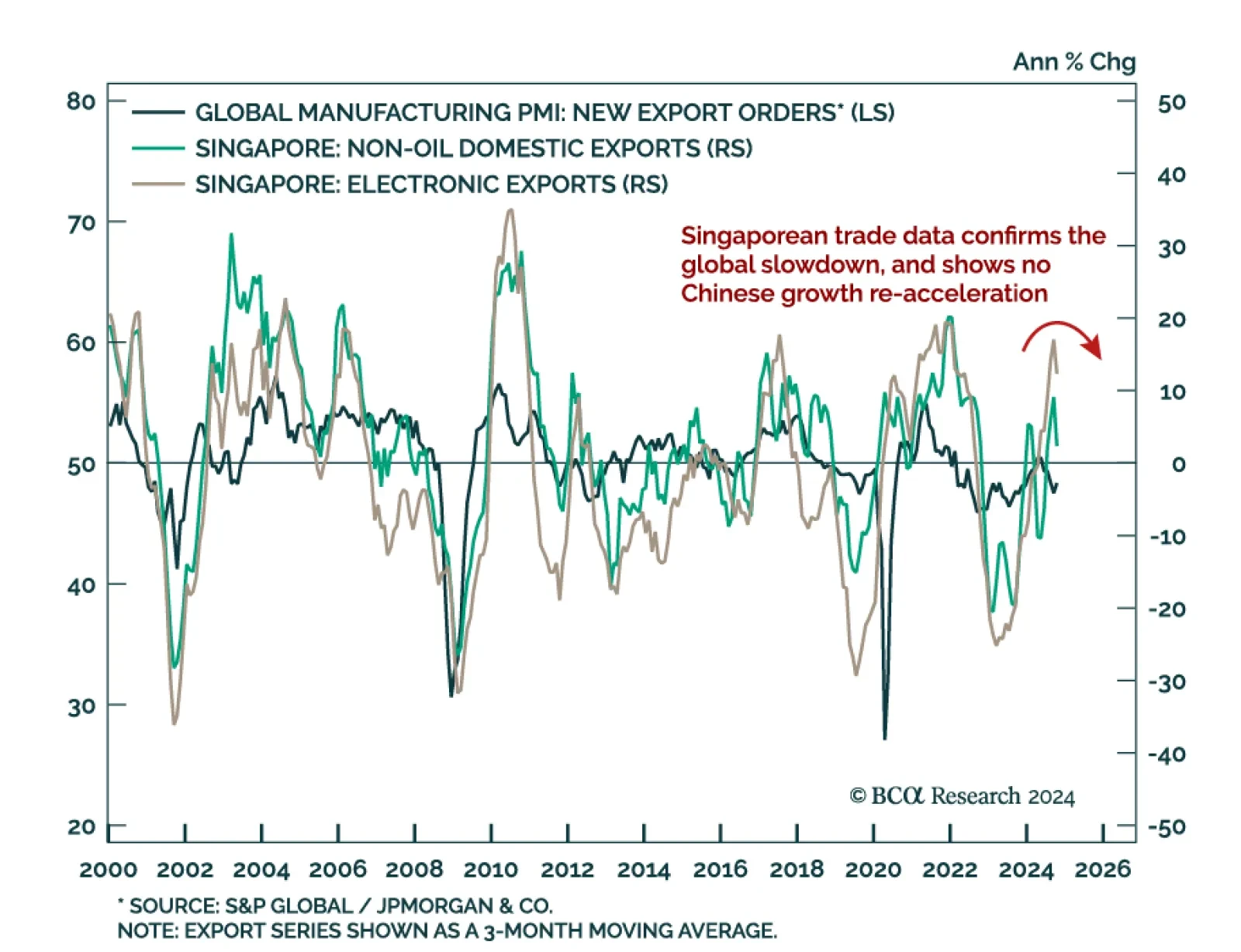

East Asian exports reveal the global economy keeps decelerating. Singaporean non-oil domestic exports (NODX) missed expectations and decelerated in October, falling 7.4% m/m (-4.6% y/y). Electronics exports grew 2.6% y/y, slowing…

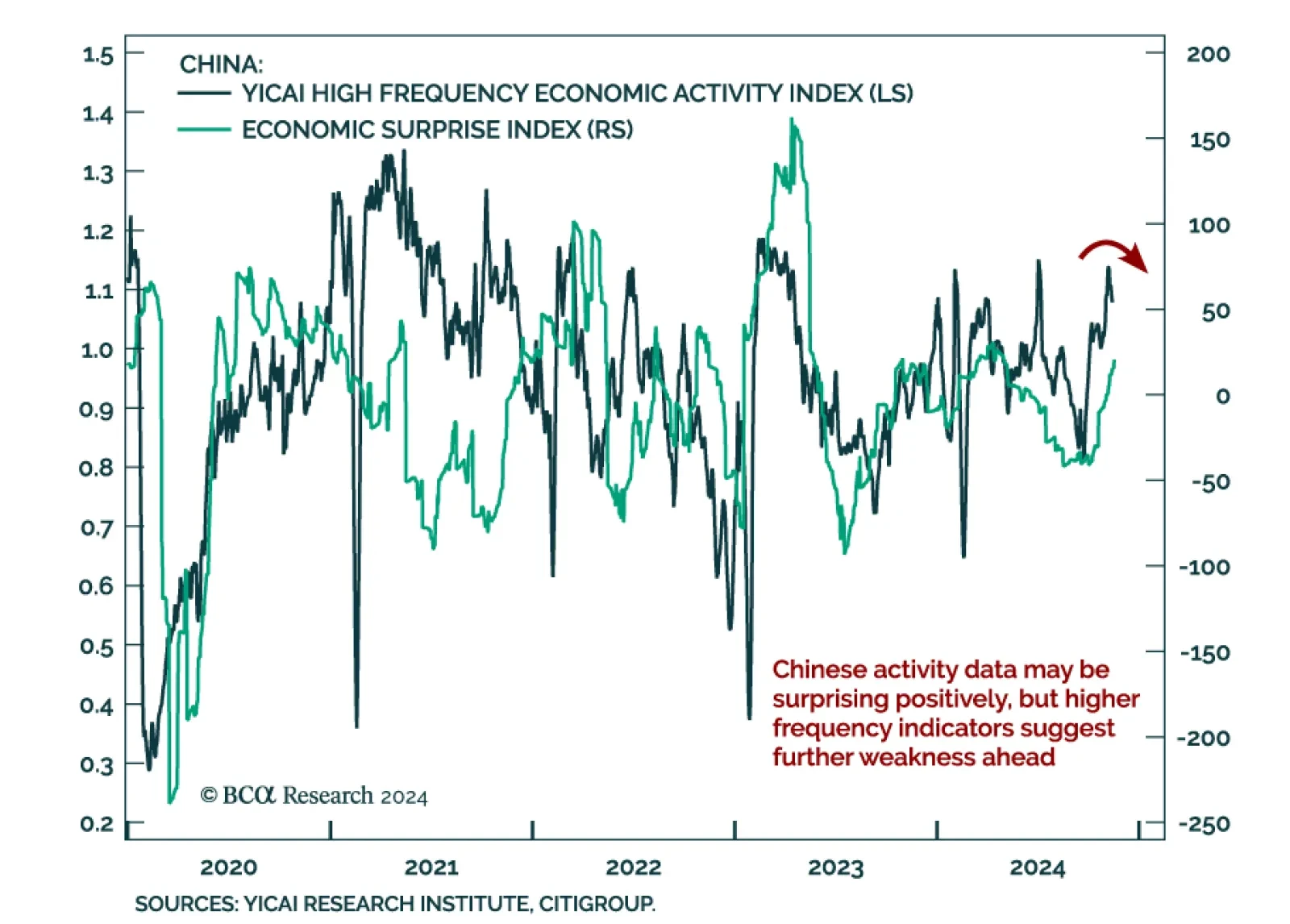

Chinese activity indicators showed resilience in October, with retail sales jumping from 3.2% to 4.8% y/y. Industrial production growth was roughly unchanged at 5.3% y/y. New and used home prices keep falling, albeit at a slower…

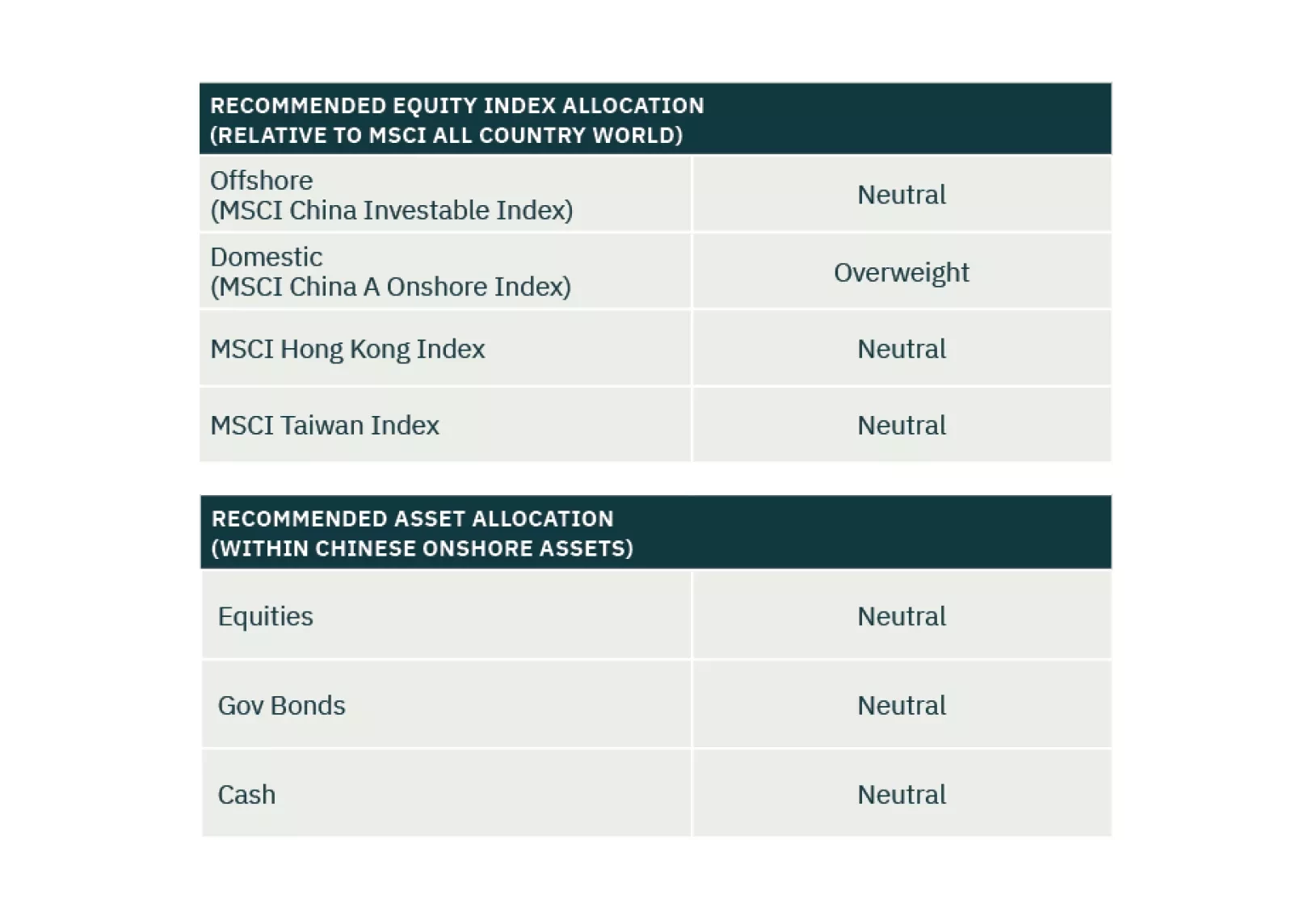

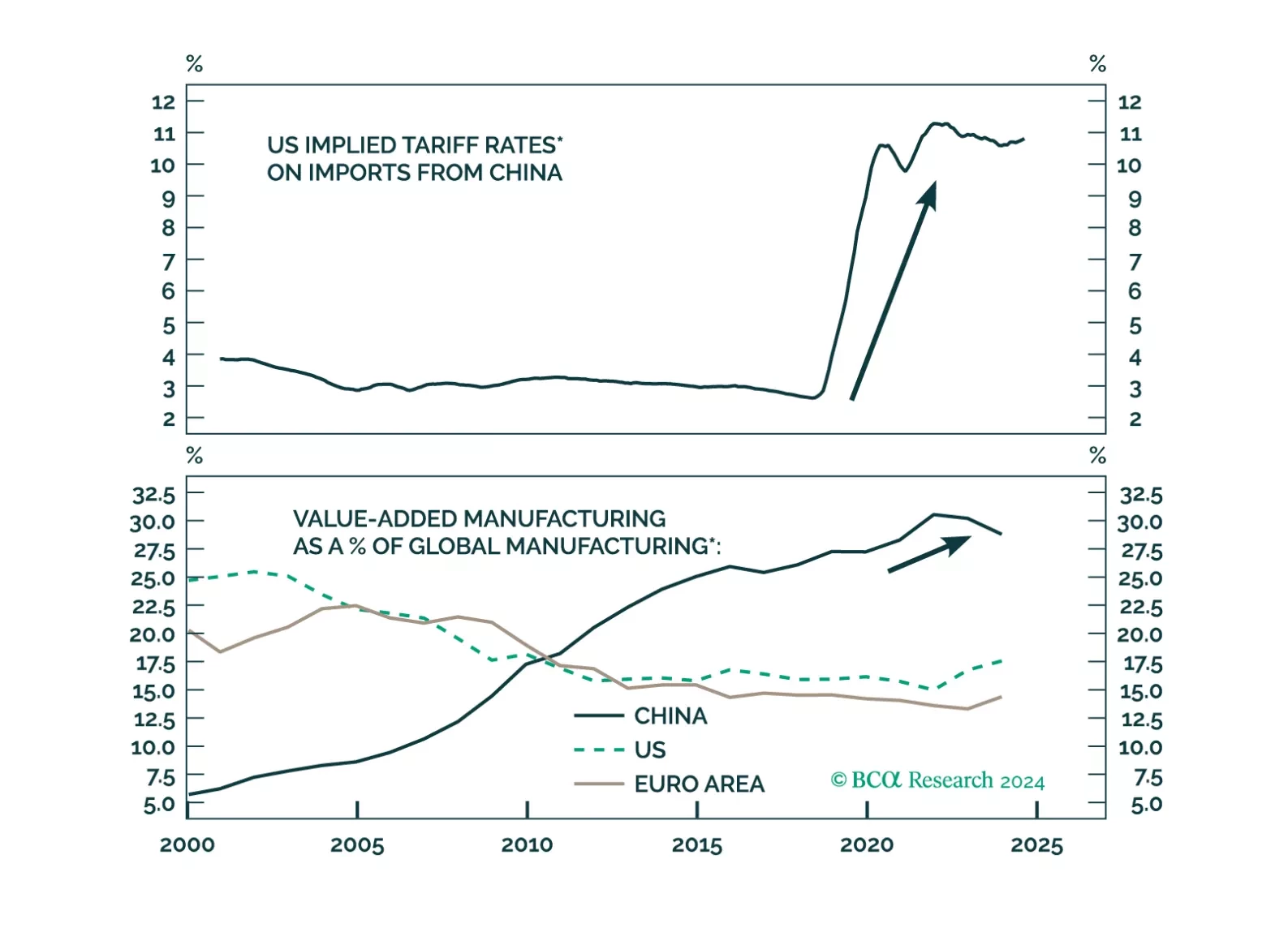

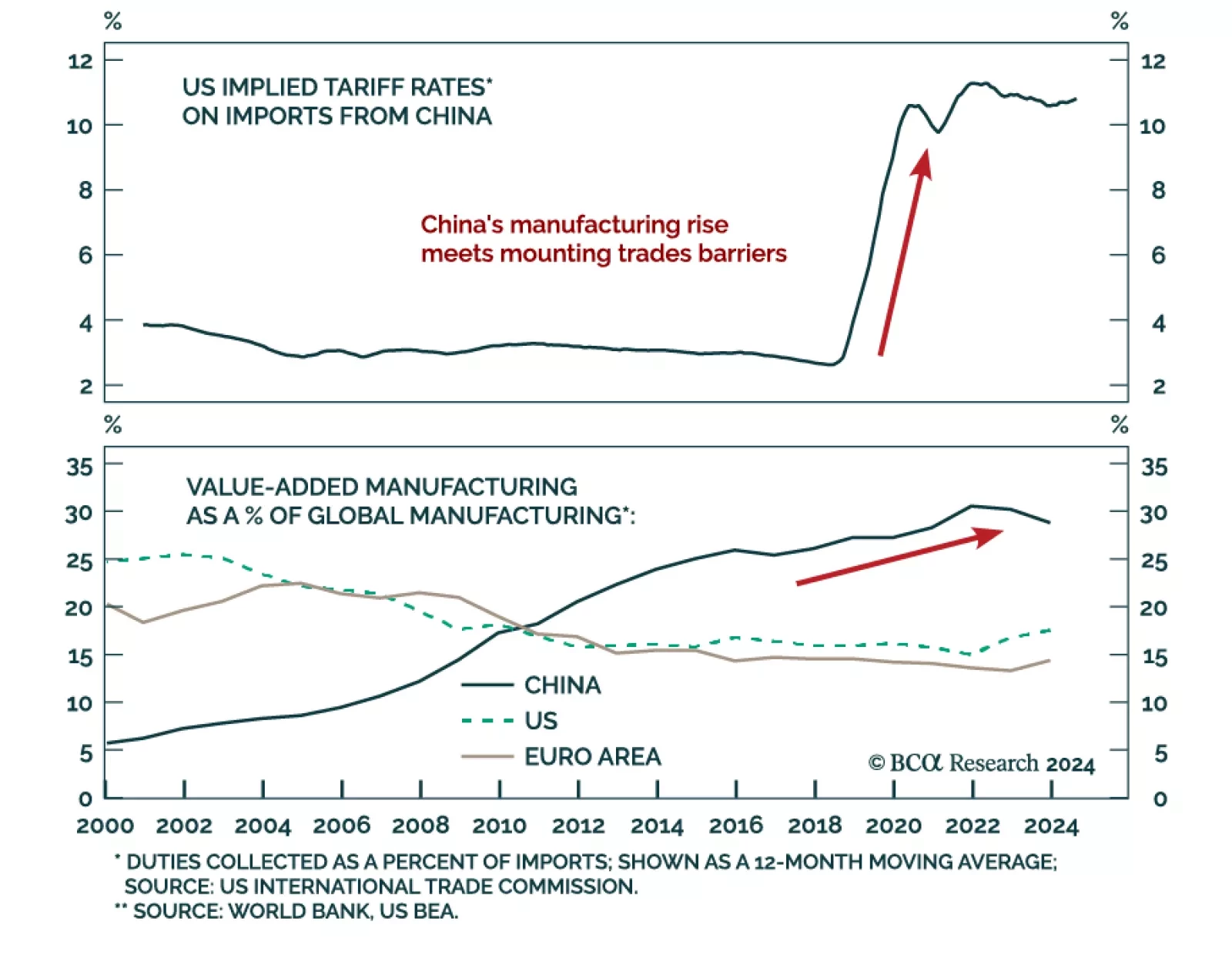

Our China Investment Strategy team assessed the country’s outlook in a context of underwhelming stimulus and rising trade tensions. Trump’s re-election raises the likelihood of tariff hikes on Chinese exports…

Trump's presidential re-election makes US tariff rate hikes on Chinese exports an imminent threat. Beijing has made extensive efforts to derisk the domestic economy and diversify trade away from the US. However, China is no better…

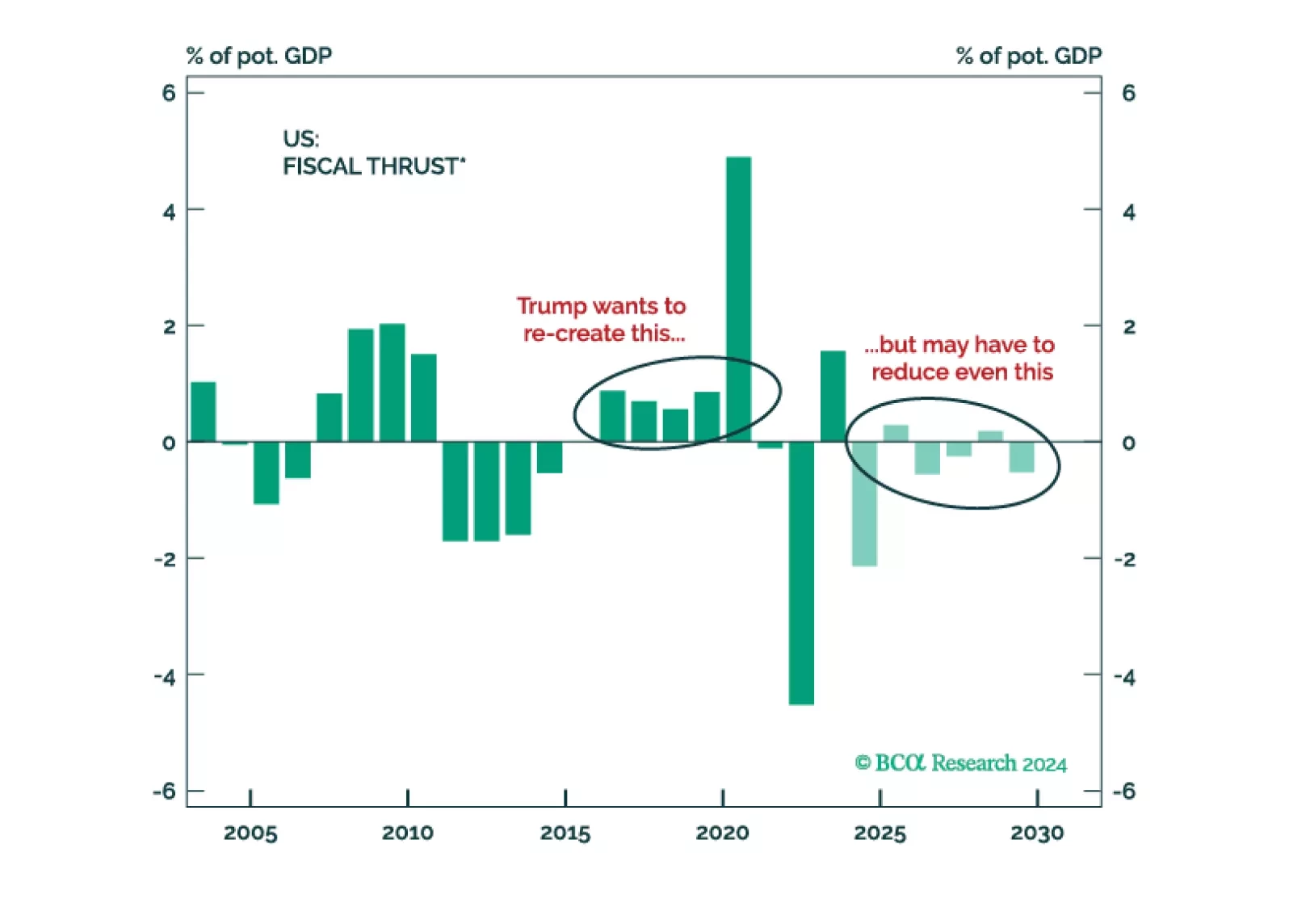

The month of November has brought us S&P 6,000! President Trump has won a “Red Sweep” (as we expected all year) and has ushered in a regime change in America. For now, we are open to chasing momentum. However, the biggest risk to…

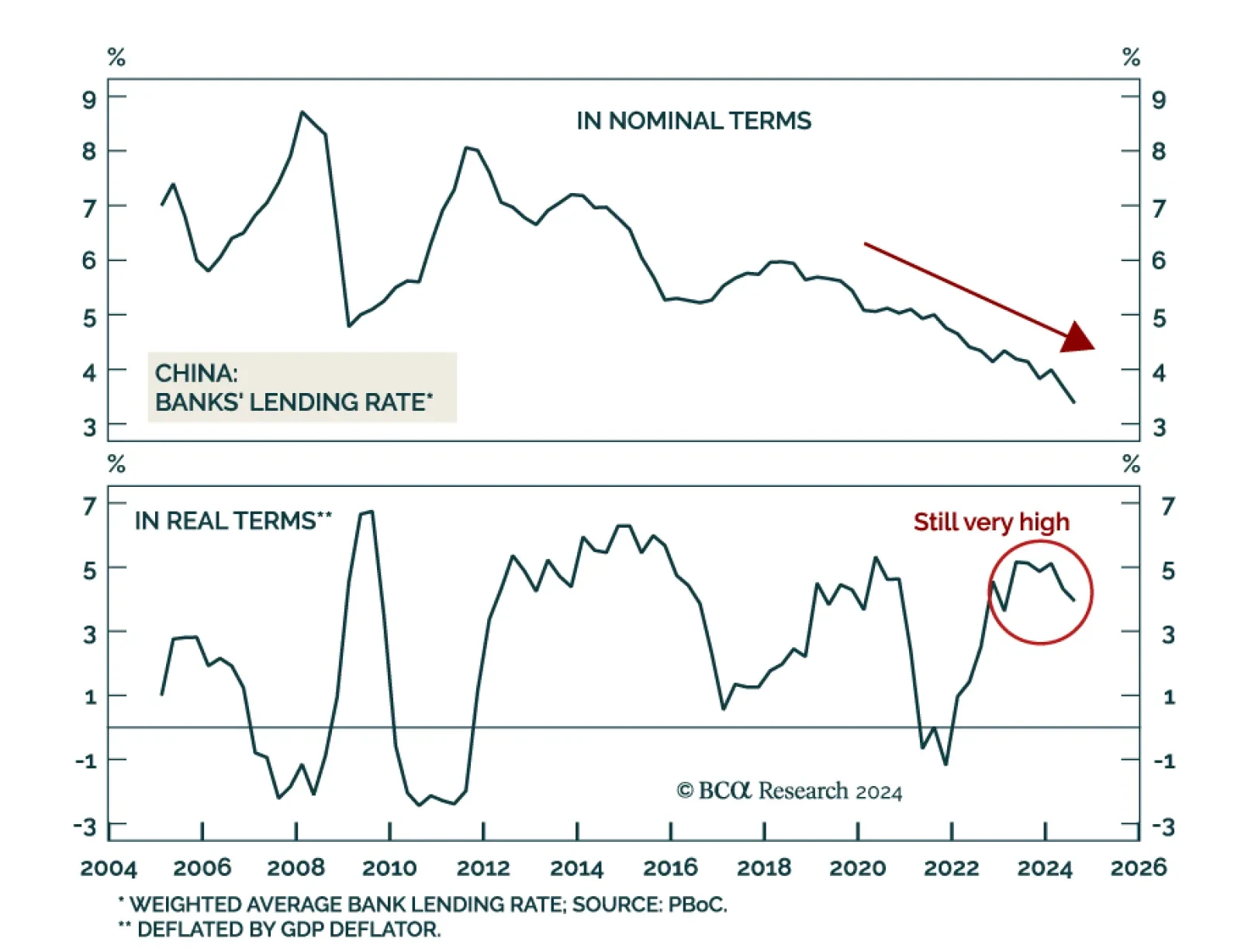

China’s October data for inflation and money disappointed. Headline CPI decelerated to 0.3% year-over-year from 0.4% in September, and PPI deflation worsened at -2.9% vs. -2.8% a month prior. While broad measures such as M2…