Our Emerging Markets, China, and Commodities strategy teams published their 2025 joint outlook. Our colleagues remain bullish on the US dollar for now but see rising odds of the Trump administration actively pursuing greenback…

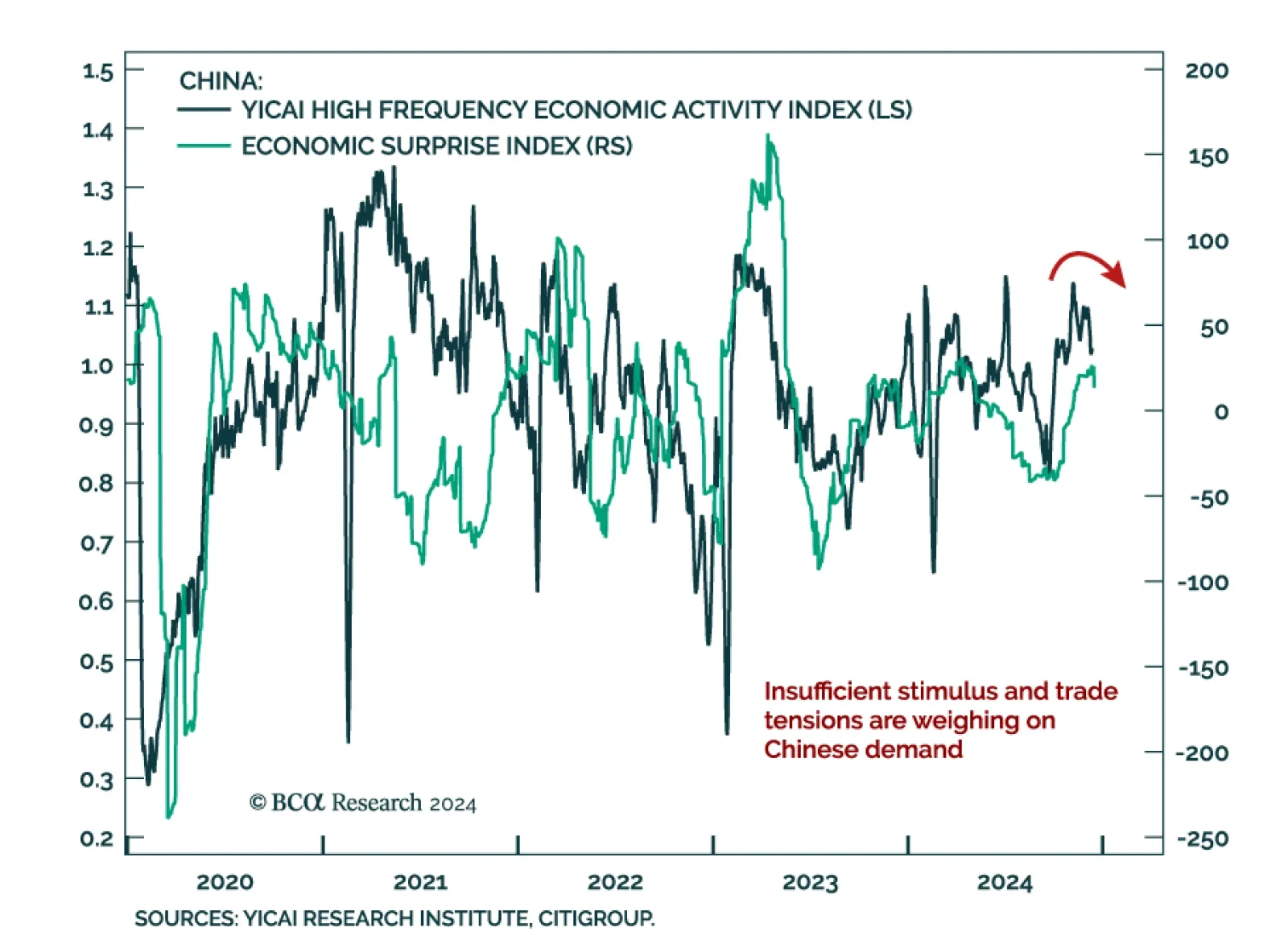

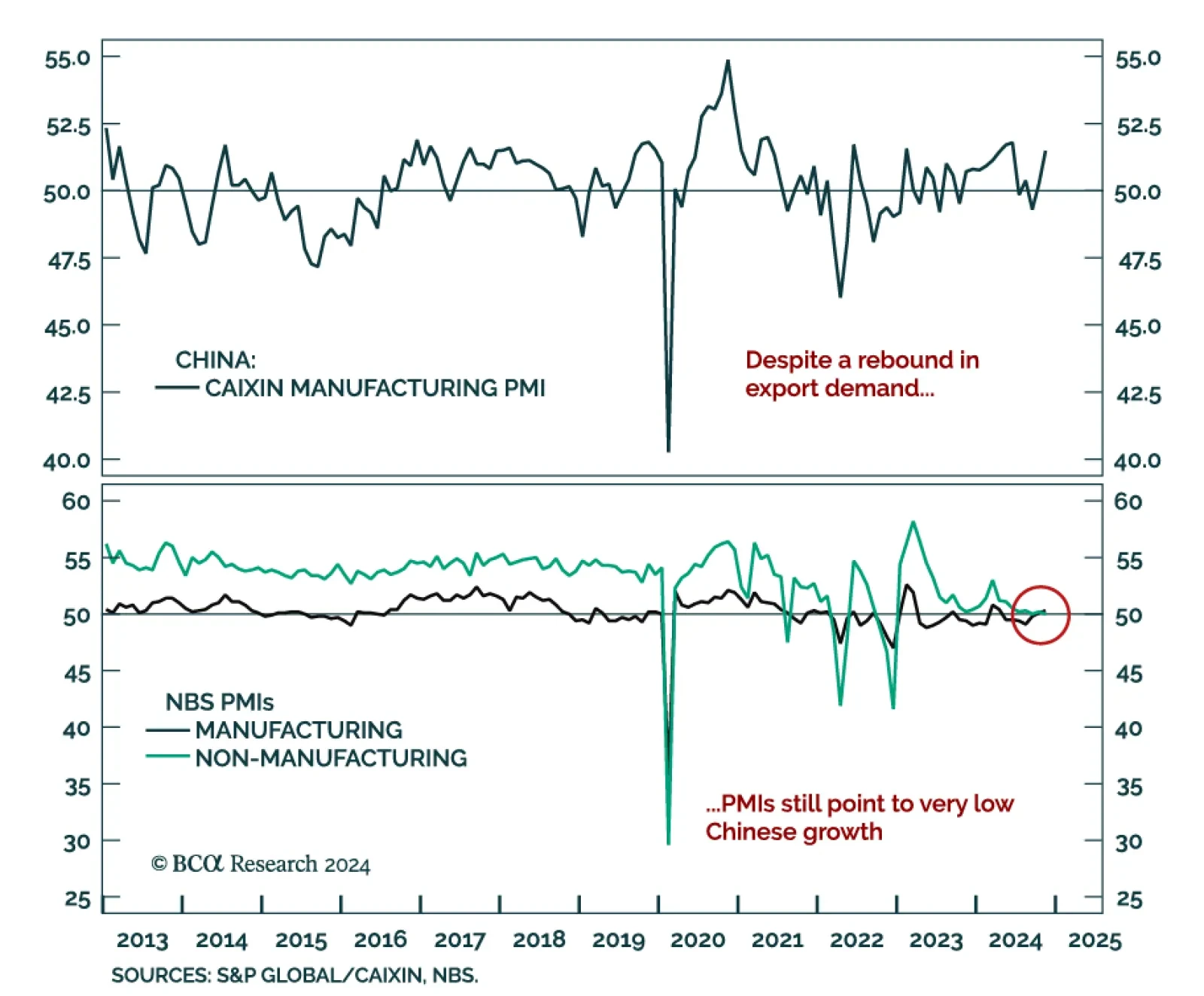

Chinese activity indicators were mixed in November, reflecting the dynamic of a resilient supply side coupled with weak demand. Industrial production growth was roughly flat at 5.4% y/y vs. 5.3% in October, while retail sales…

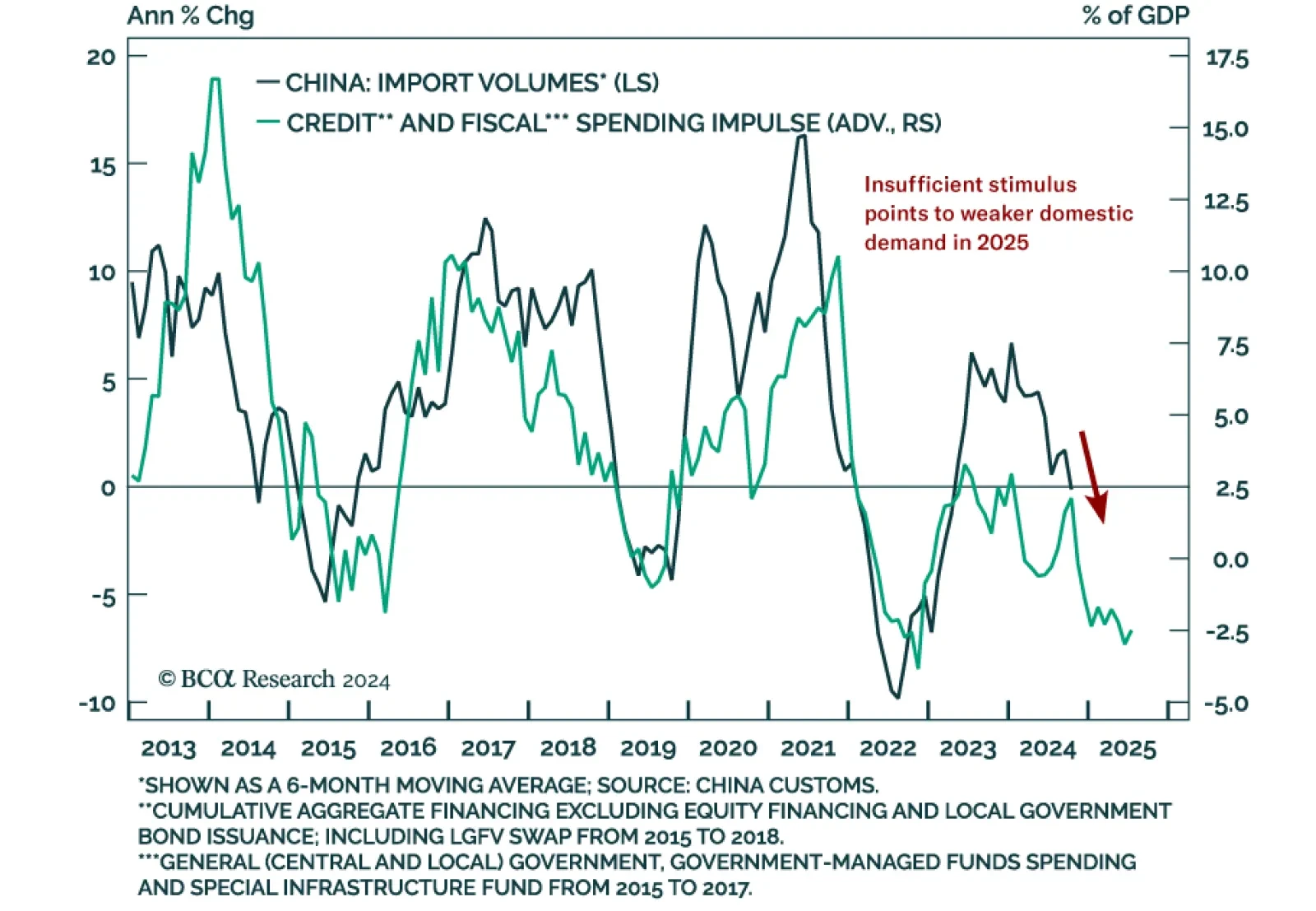

China’s November monetary and credit data were disappointing. New yuan loans increased by 580 bln, nearly half the expected amount. Total social financing rose by 2.3 tln instead of the expected 2.7 tln. Finally, M2 growth…

Congress will pass tax cuts by end of 2025 producing a fiscal thrust of about 0.9% of GDP in 2026. Trump will count on that stimulus as a basis for slapping tariffs on leading trade partners.China will retaliate against Trump…

China’s November trade balance increased to CNY 692.8 bln on the back of slowing-but-still-growing exports (down to 5.8% y/y from 11.2% in October), and a worsening imports contraction (-4.7% y/y vs. -3.7% in October). In…

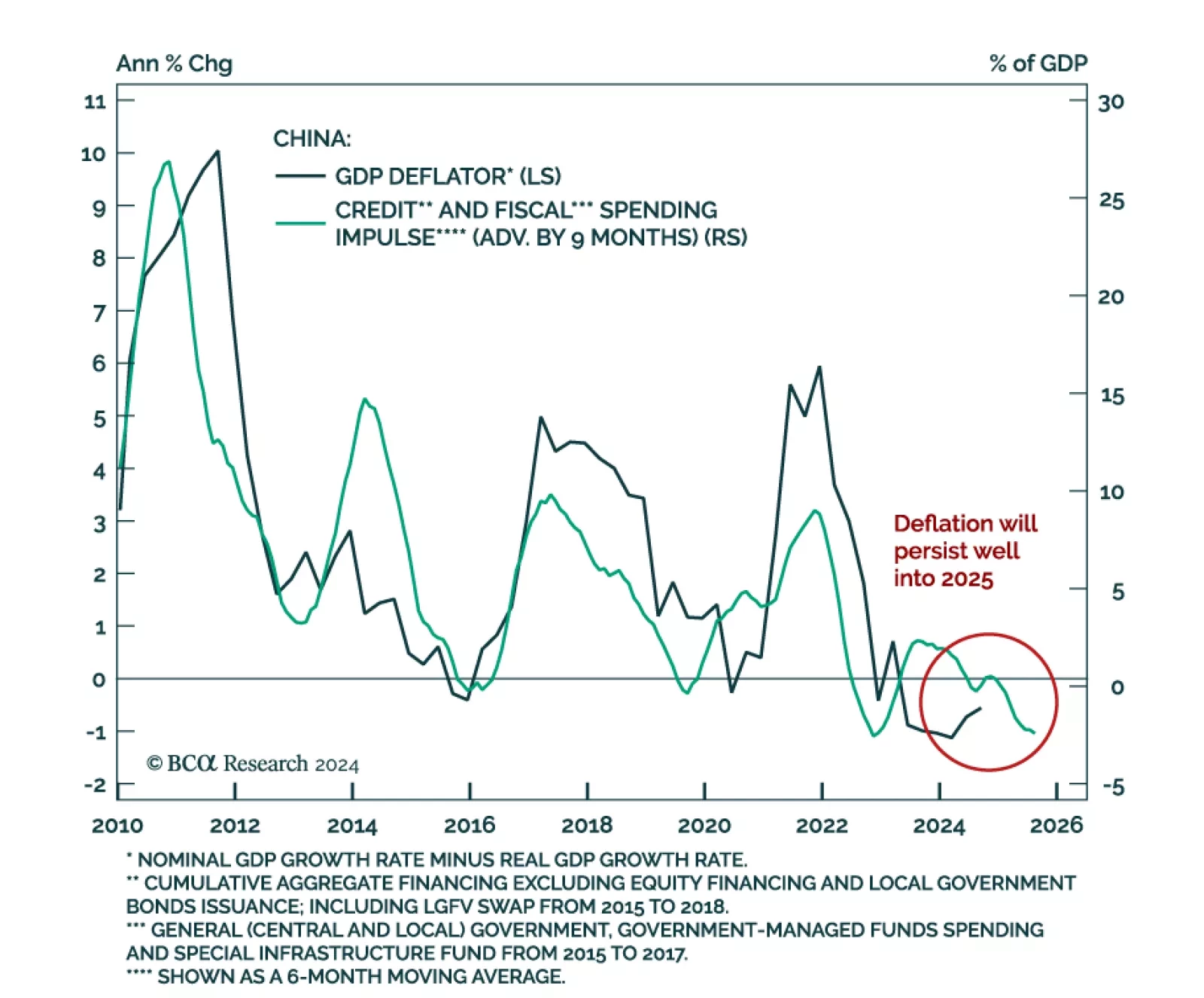

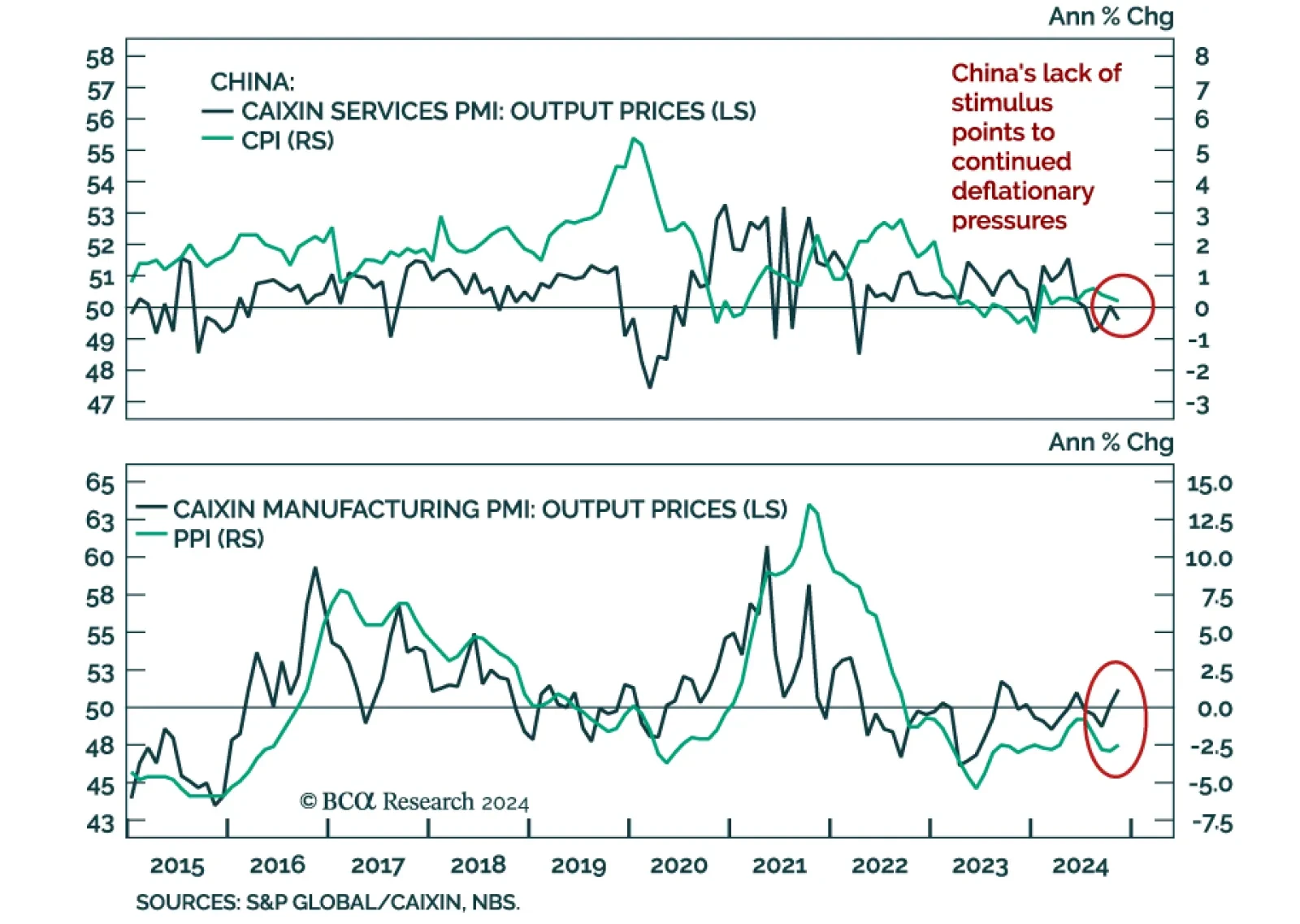

Chinese deflationary pressures intensified in November, with CPI ticking down to 0.2% y/y from 0.3% in October. Producer prices deflation eased, with prices falling 2.5% y/y, less than -2.9% y/y a month prior. The weak data…

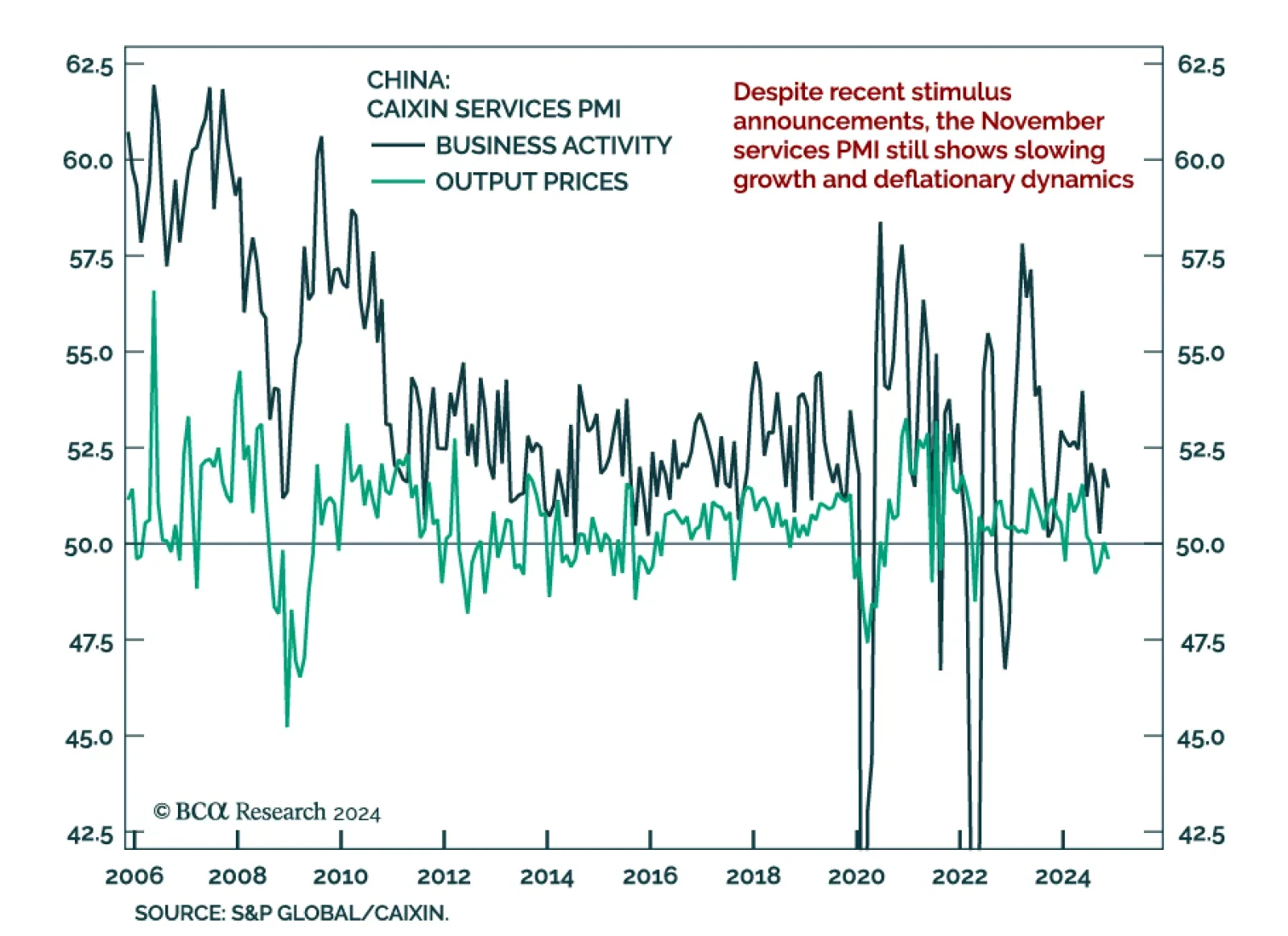

The November Caixin services PMI ticked down to 51.5, which along with a rising manufacturing PMI pushed the composite up to 52.3 from 51.9. Components such as new orders and employment also ticked down, and output prices fell to…

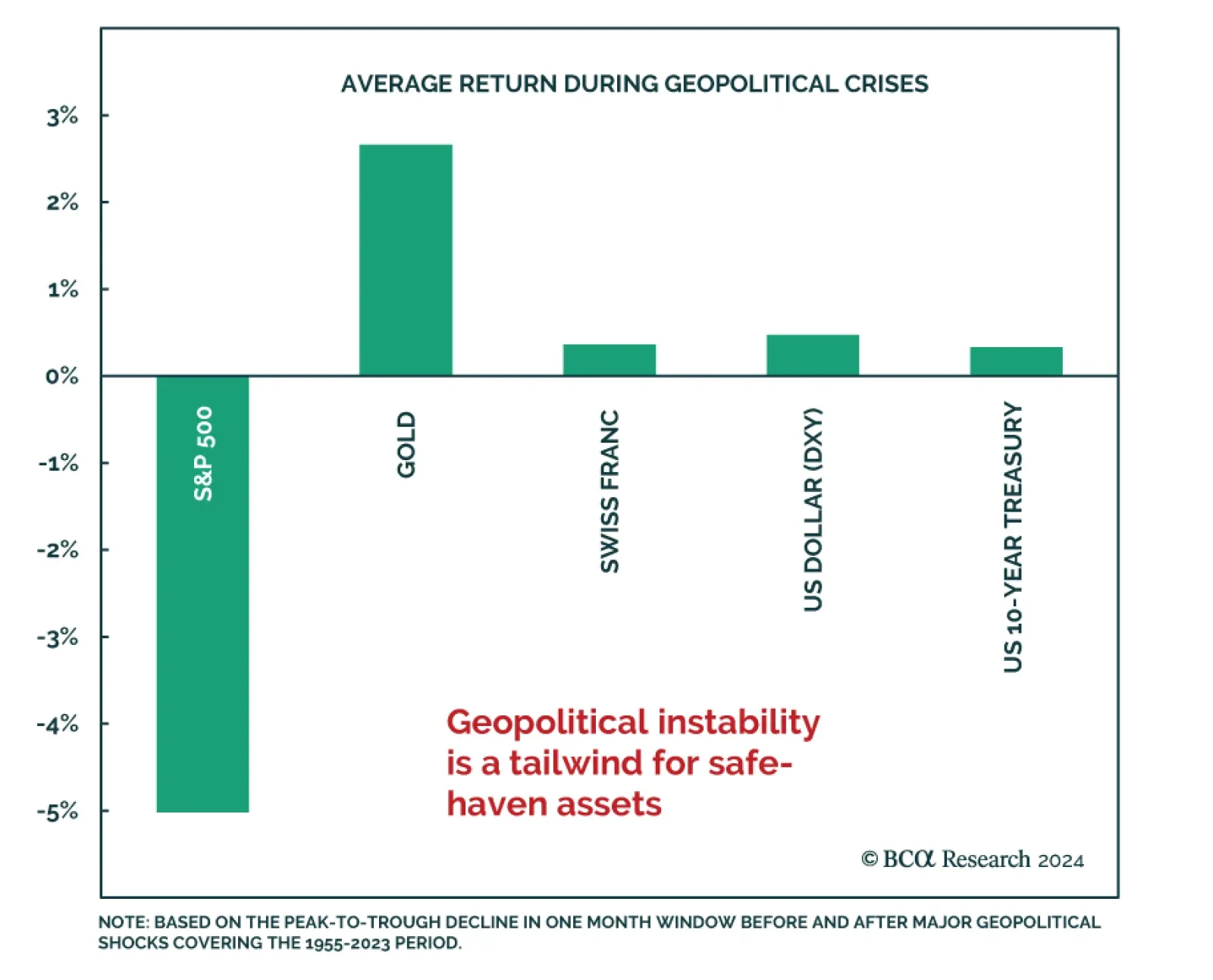

South Korea is undergoing political turmoil, with President Yoon attempting to declare martial law. The situation is fluid and can change quickly, but there are a few investment takeaways. As we pointed a few weeks back, BCA…

China’s November PMIs were mixed, and reflected very low growth. The official composite PMI was unchanged at 50.8, driven by a small uptick in manufacturing to 50.3 and a small downtick of services to 50. The Caixin…