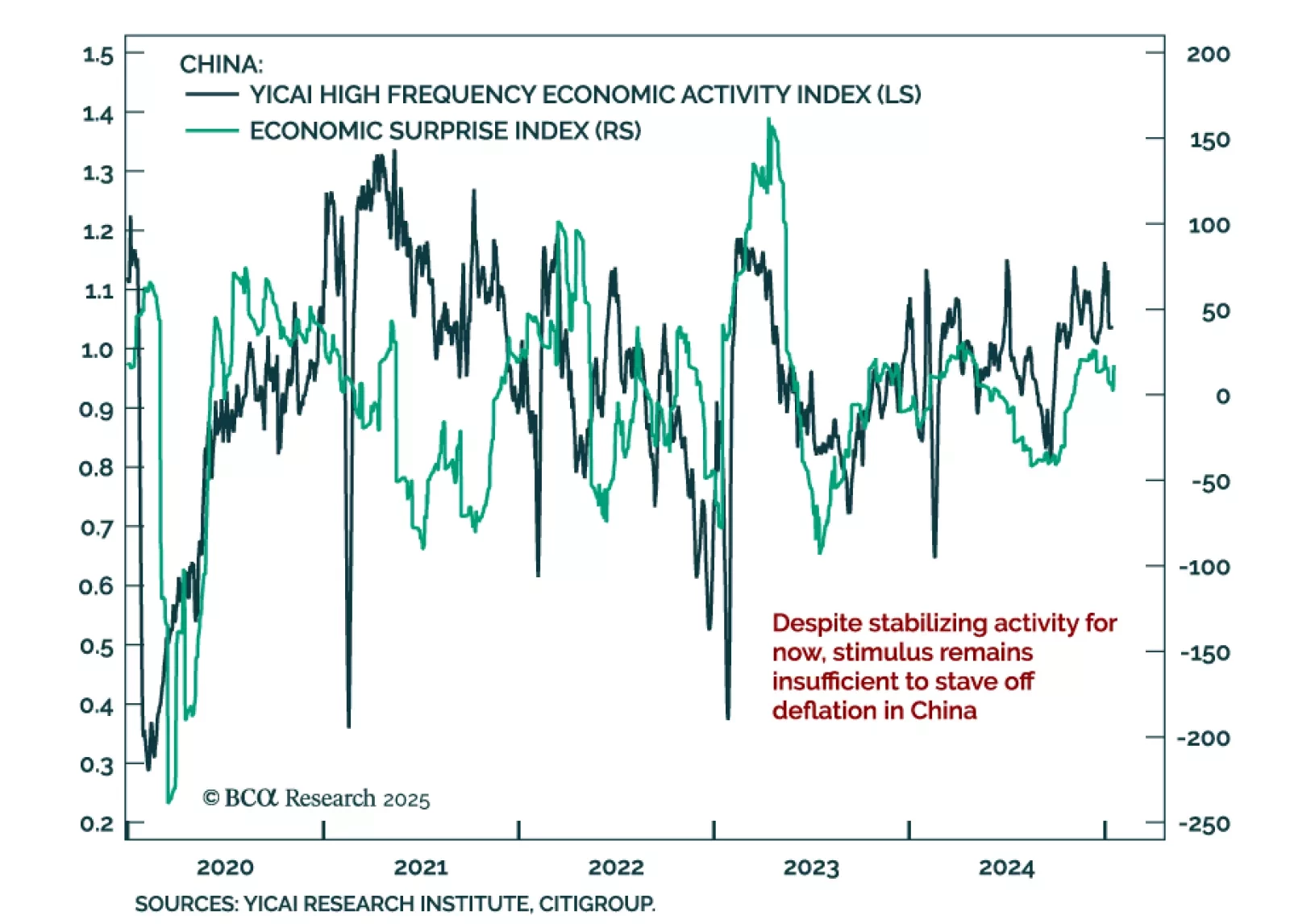

Chinese activity was decent in December, with GDP growth topping the 5% target for 2024. Industrial production growth ticked up to 6.2% y/y from 5.4% in November. Retail sales also picked up, increasing to 3.7% from 3.0% a month…

Our Emerging Markets strategists just published a report on Singapore stocks after a significant rally over the past year. Singapore’s manufacturing sector faces headwinds from contracting global new orders, which signals that a…

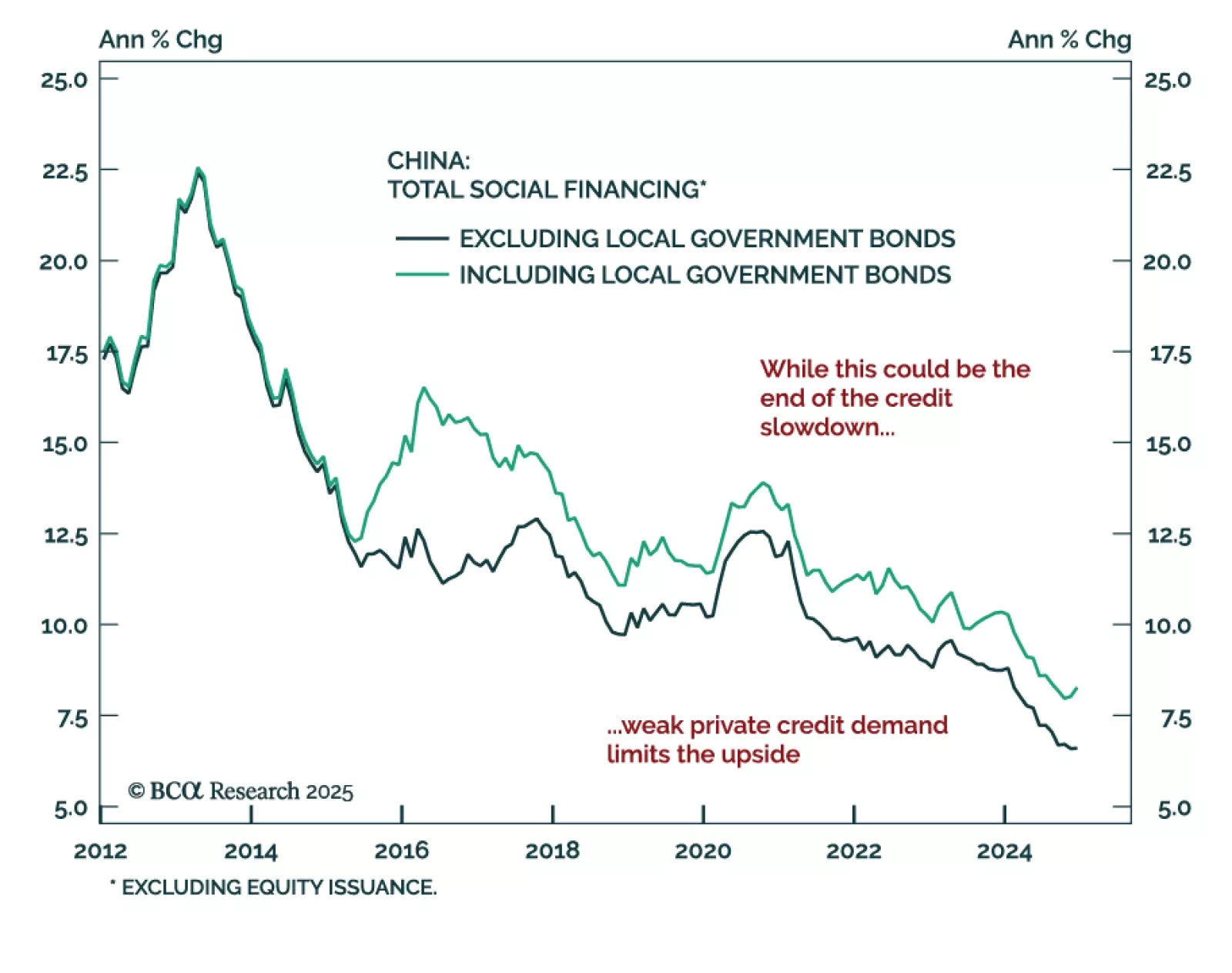

China’s monetary and credit data was relatively strong. New yuan loans increased more than expected, as did aggregate financing. M2 met estimates at 7.3% y/y. As was the case for trade in December, seasonality plays a big role…

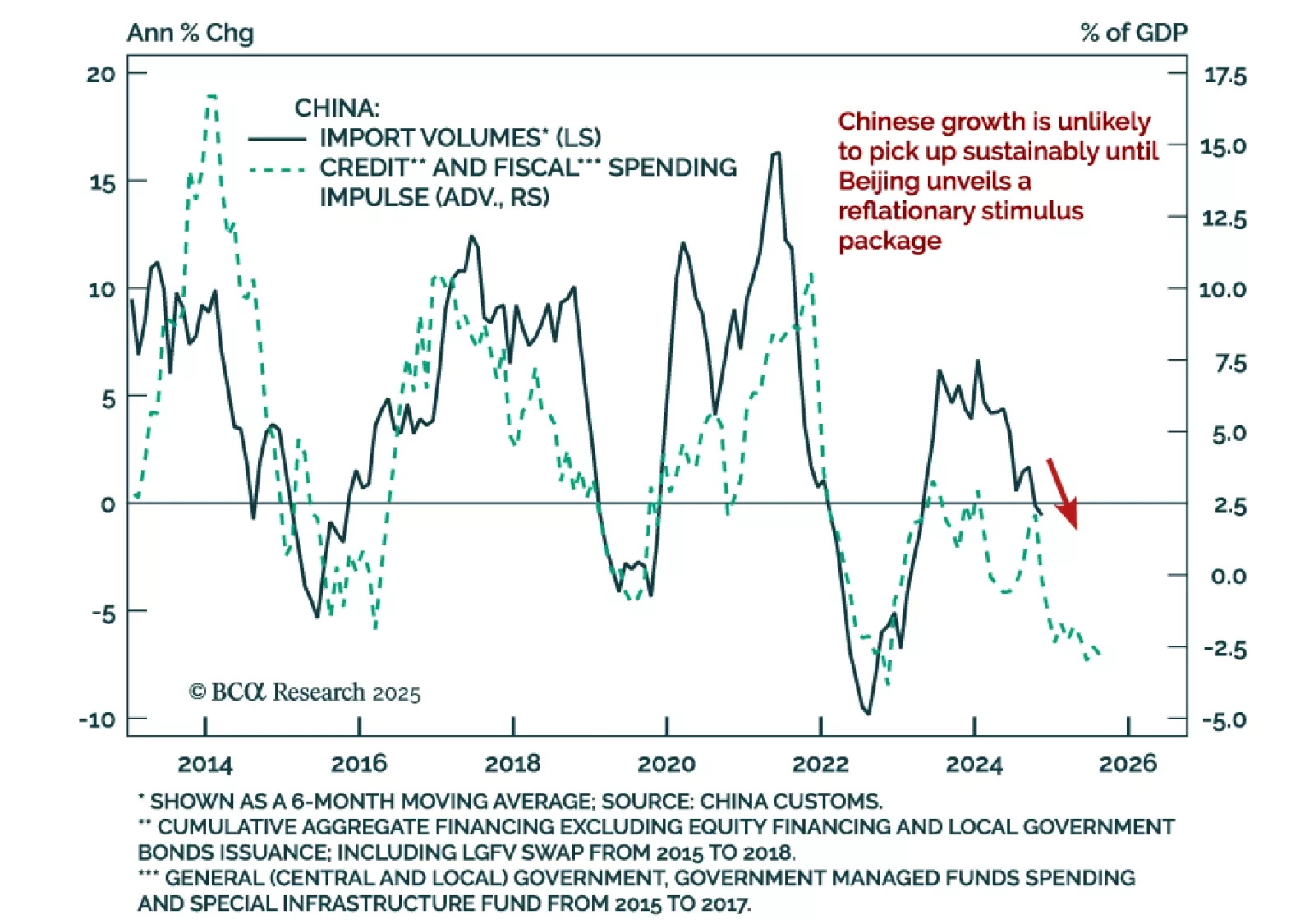

China’s December trade data was positive, with exports in USD terms rebounding to 10.7% y/y from 6.7% in November, and imports rebounding to 1.0% from -3.9%. Taken at face value, the numbers are positive for both the Chinese and…

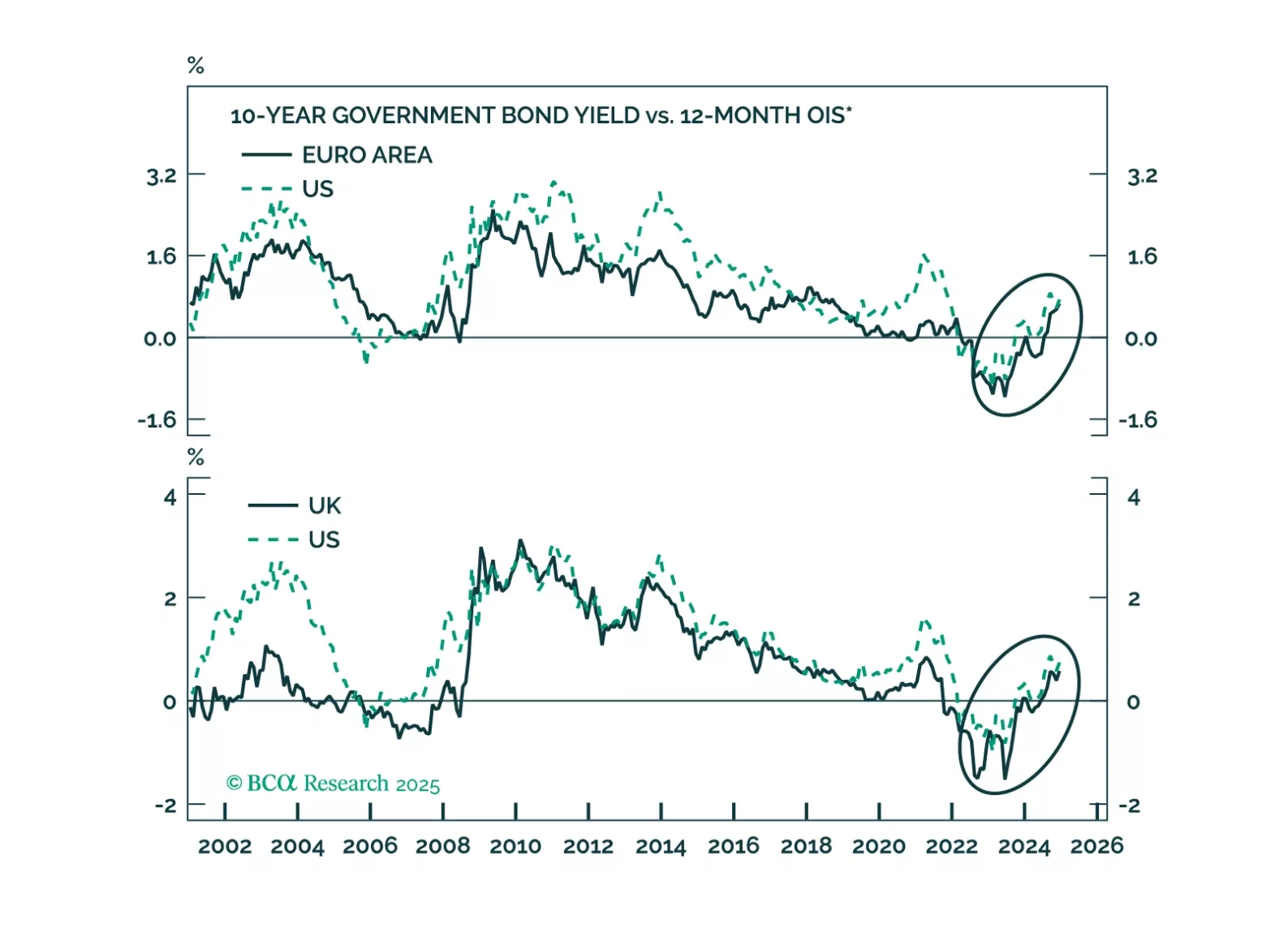

UK and German bonds are victims of the global bond market riots. Will European yields continue to move higher and will the euro and the pound find a floor anytime soon?

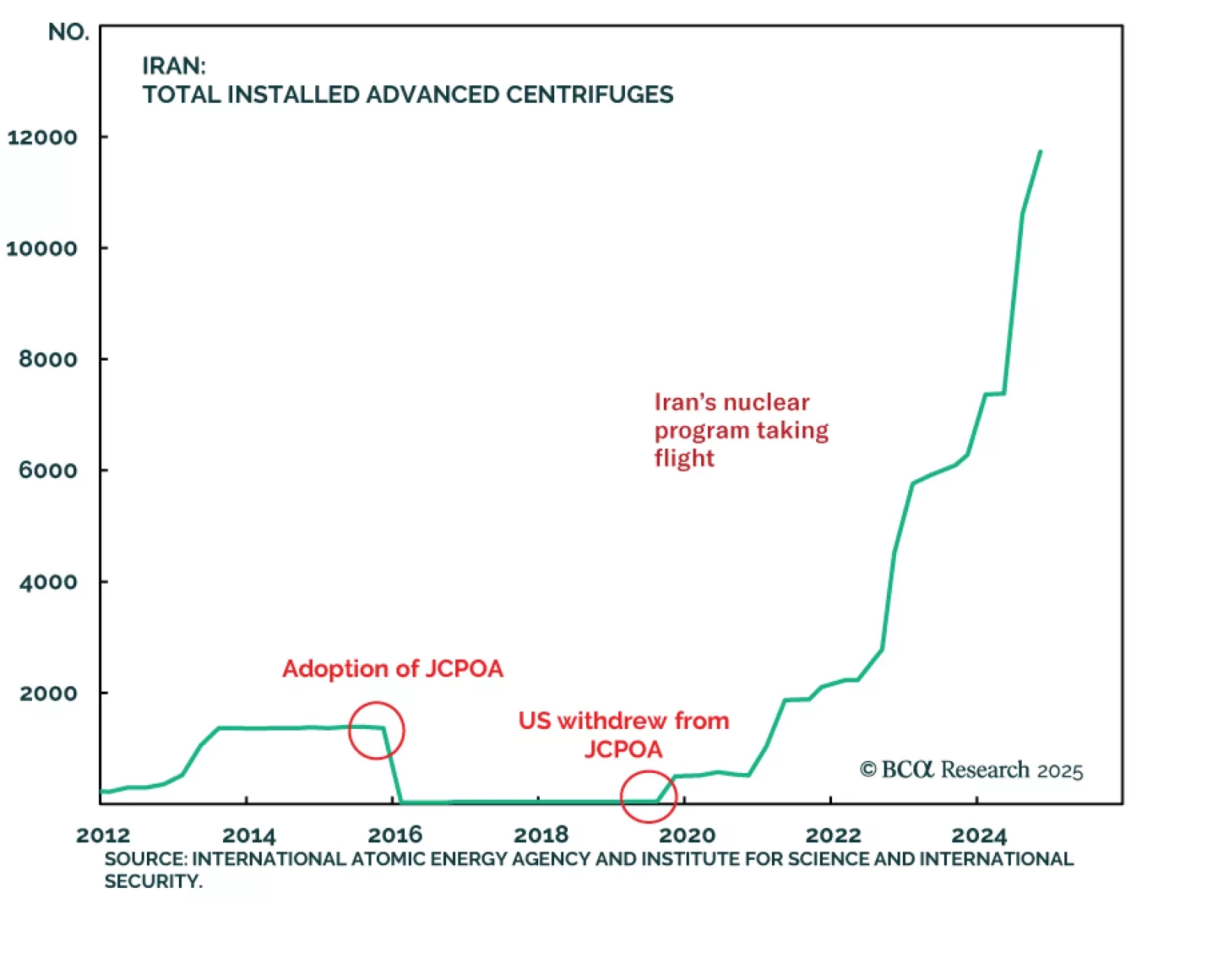

Our Geopolitical Strategy colleagues published their annual “Black Swan” report, where they outline low-odds scenarios that could have a major impact on financial markets. Here is the 2025 edition: China’s Policy Reversal: A…

Chinese December CPI and PPI releases show deflationary pressures are not abating. CPI slowed to a 0.1% y/y pace from 0.2% in November, while producer prices fell 2.3%. The Chinese economy has not meaningfully changed course…

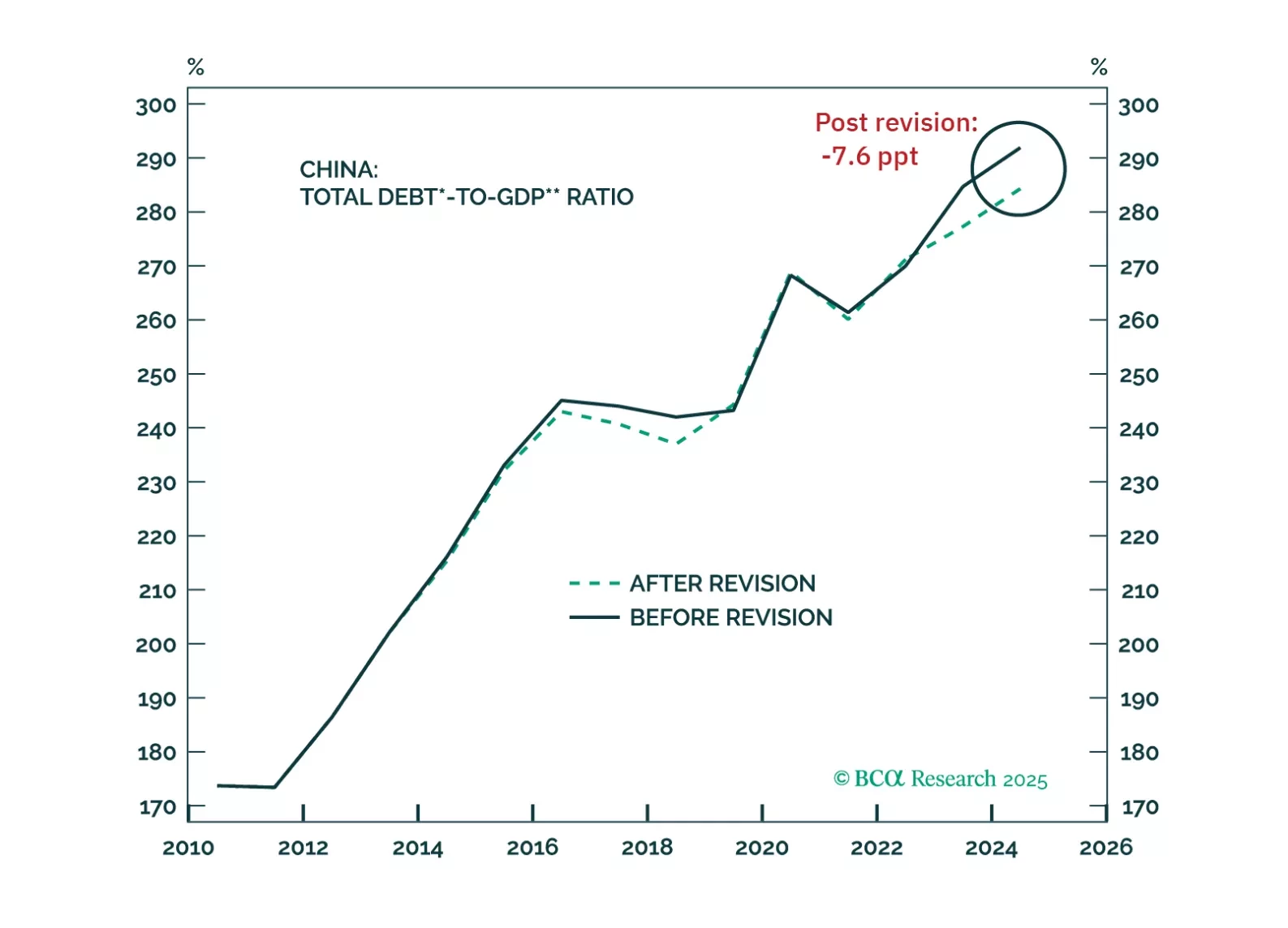

In this week’s report, we present our key takeaways from China's two notable adjustments recently implemented: an upward revision to its 2023 GDP and the reduction of the USD weighting in the RMB Exchange Rate Index.

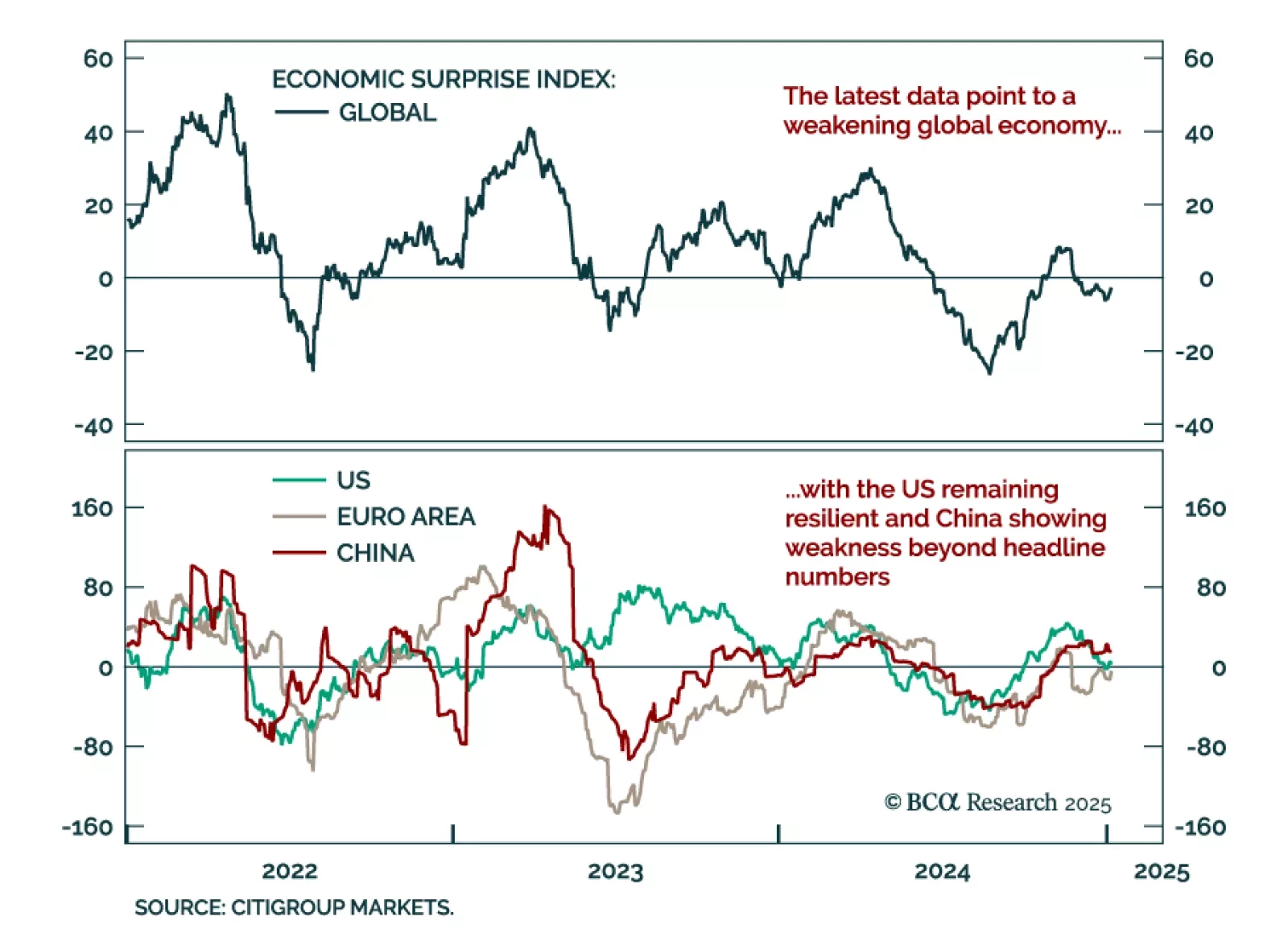

Economic data released over the holiday period extended recent trends, reflecting a softening global economy with resilient US growth, and an ailing manufacturing sector. The December global manufacturing PMI declined to 49.6…

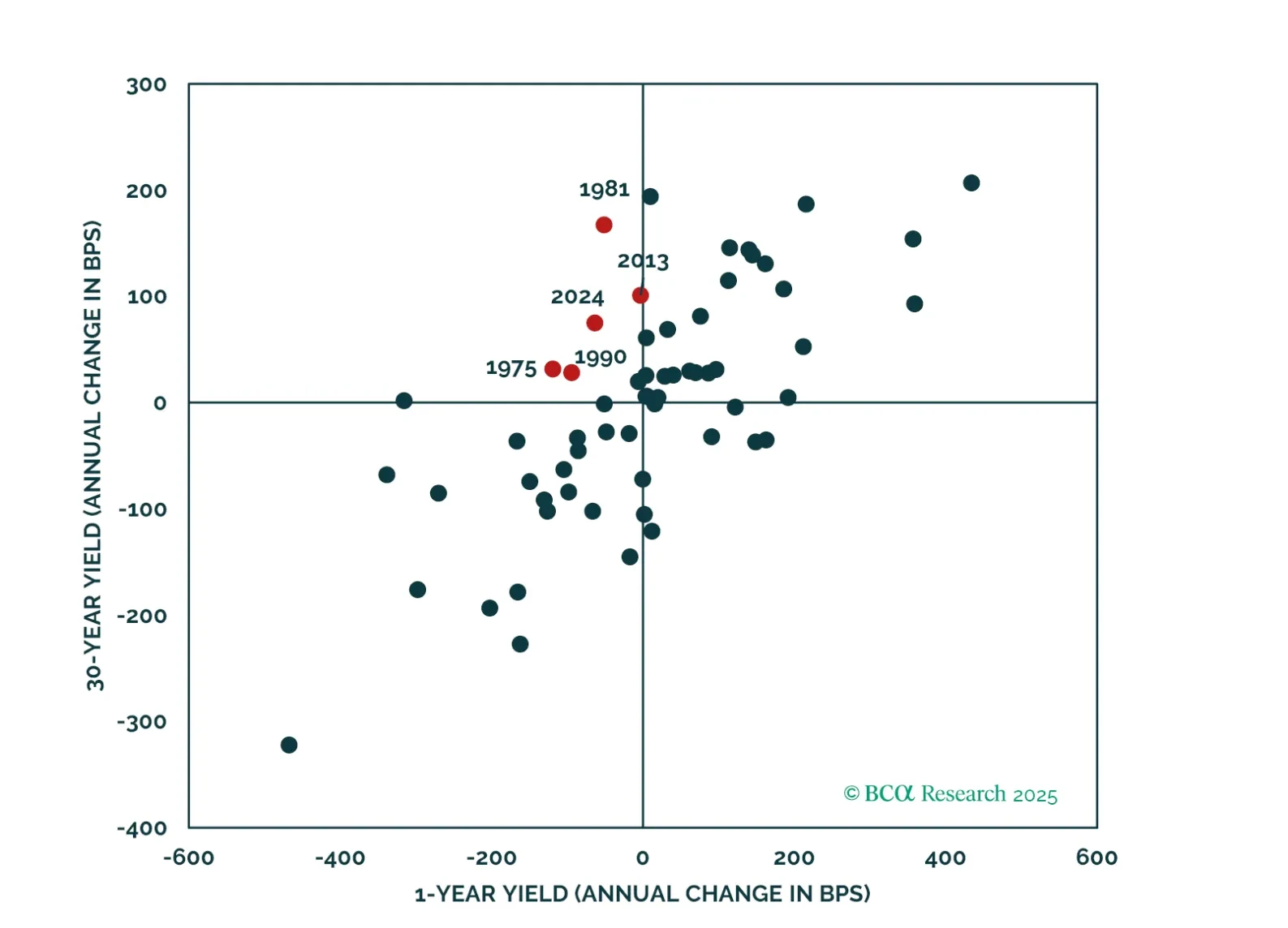

Paradoxically, raging optimism on the US economy is making a reacceleration in growth less likely in 2025. The reaction of the bond market has made the Fed rethink its cutting campaign. Markets are also constraining Trump’s agenda.…