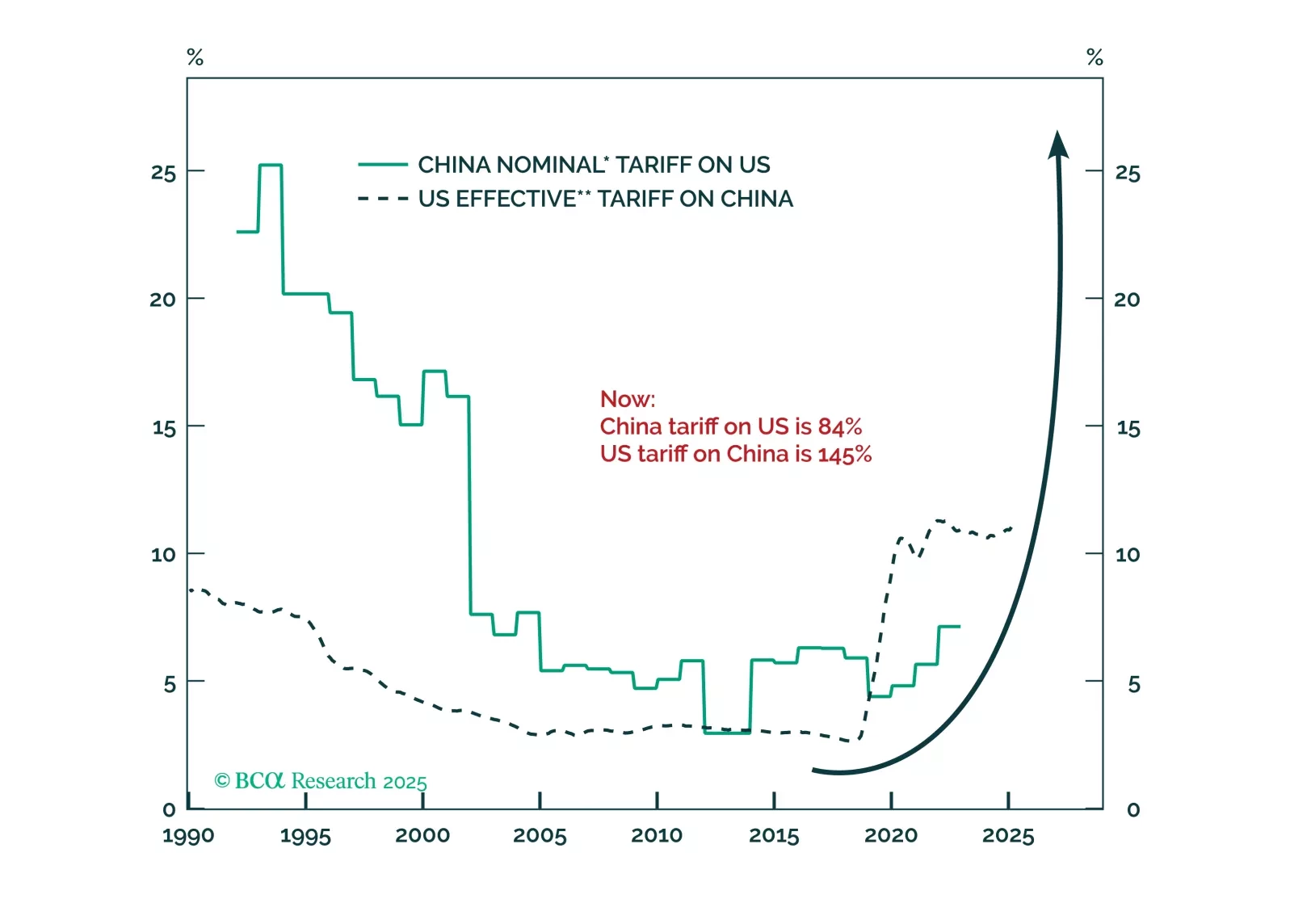

China prepares to devalue the yuan in response to US tariffs. Our Emerging Markets strategists recommend shorting CNH, downgrading offshore Chinese equities, and staying bearish on global risk assets. Beijing sees the tariffs as a…

China’s aggressive retaliation against U.S. tariffs will enable President Trump to shift from punishing allies and redirect the trade war toward China. If Beijing does not react to the latest tariffs by doubling its fiscal stimulus,…

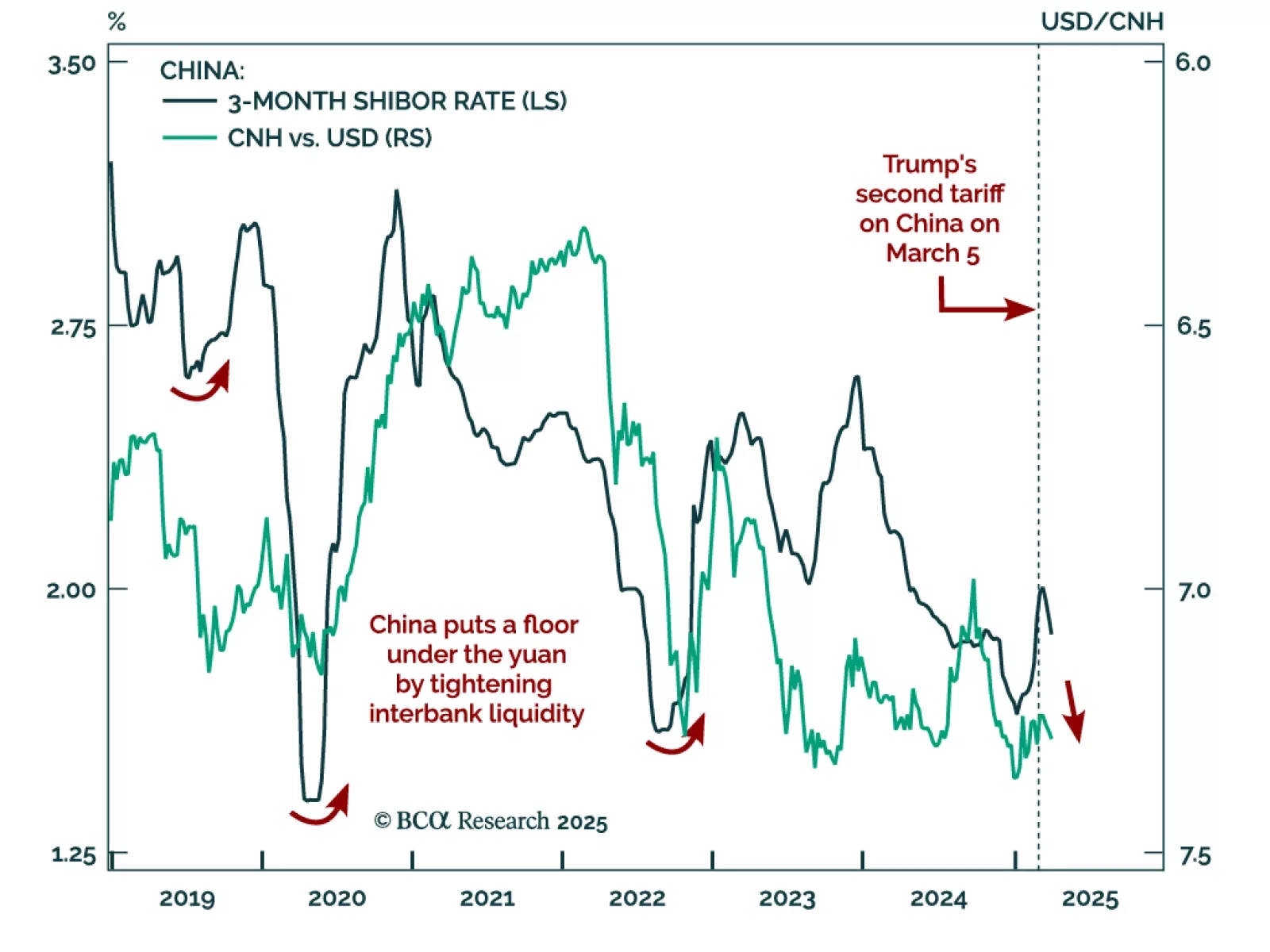

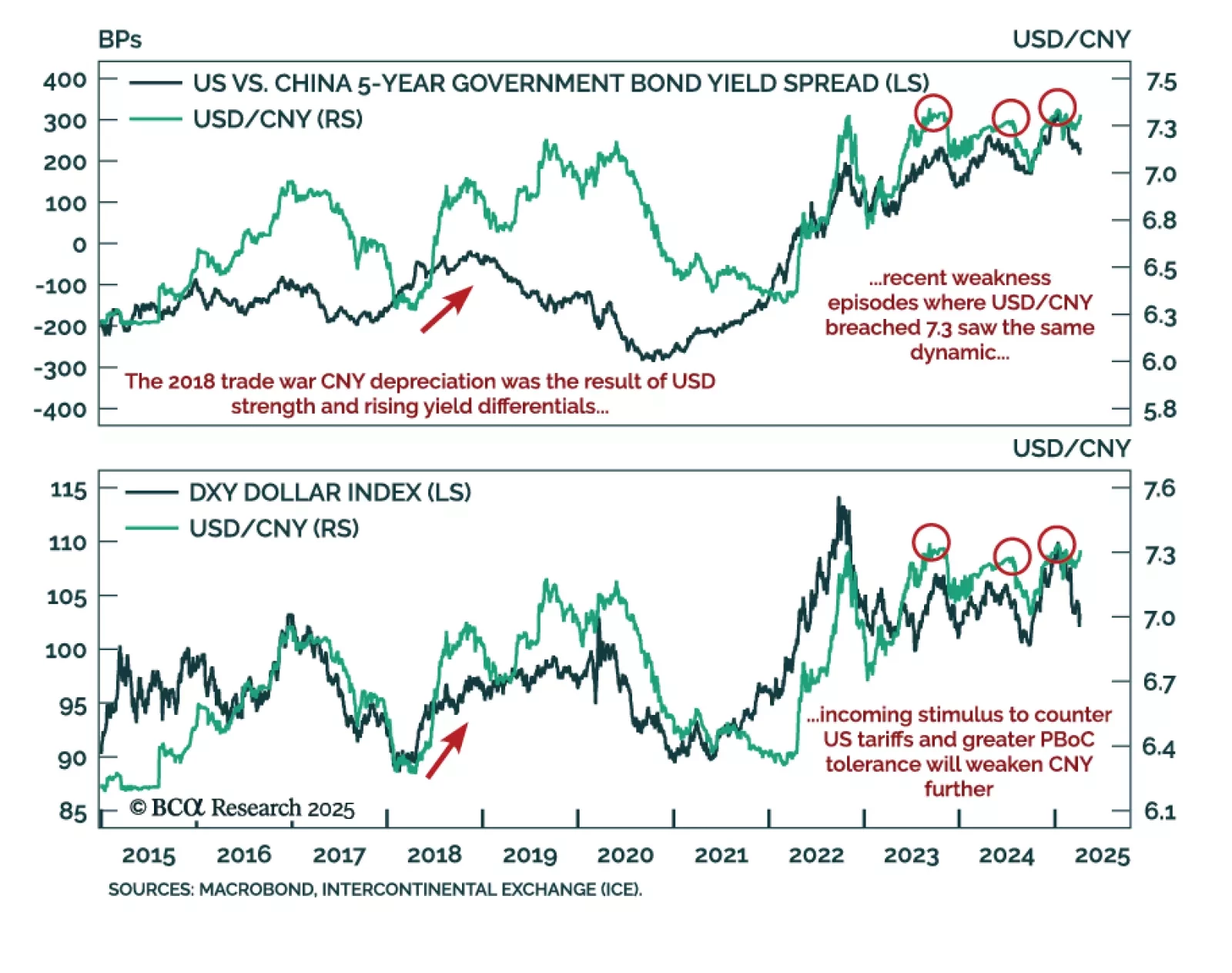

USD/CNY’s break above 7.3 signals more downside is in store for the yuan, supporting short high-beta FX and long CHF and JPY positions. The CNY has weakened in 2025 even as the US dollar has depreciated against most major currencies…

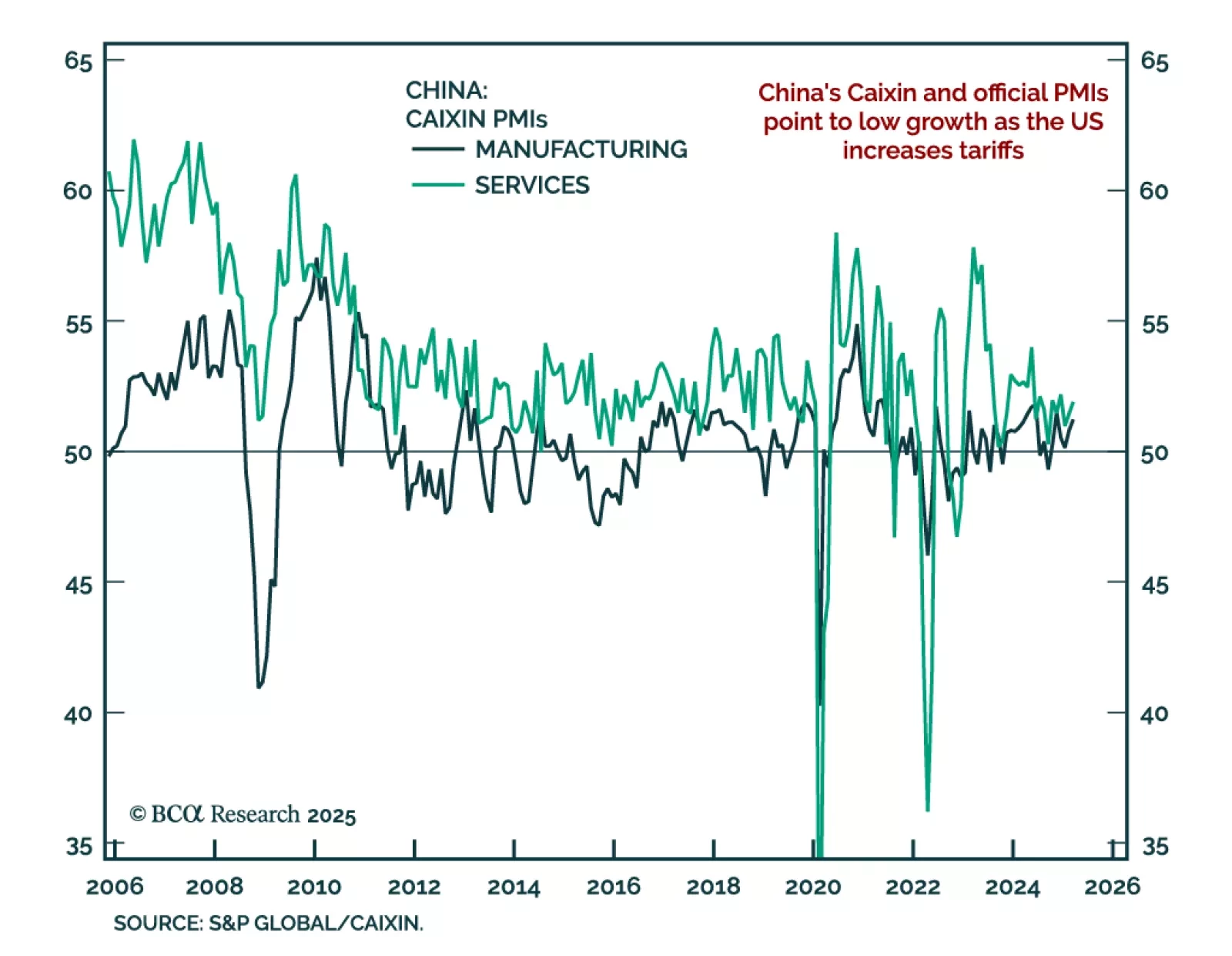

China’s economy remains subdued, supporting our overweight in onshore local-currency bonds and a selective approach to local equities. March Caixin PMIs showed only marginal improvement, with the composite index rising to 51.8 from…

Stocks will continue to struggle in the second quarter as President Trump tries to implement tariffs. Tax cuts will only temporarily dispel growth fears, if at all. Middle Eastern instability will add oil price surprises to an…

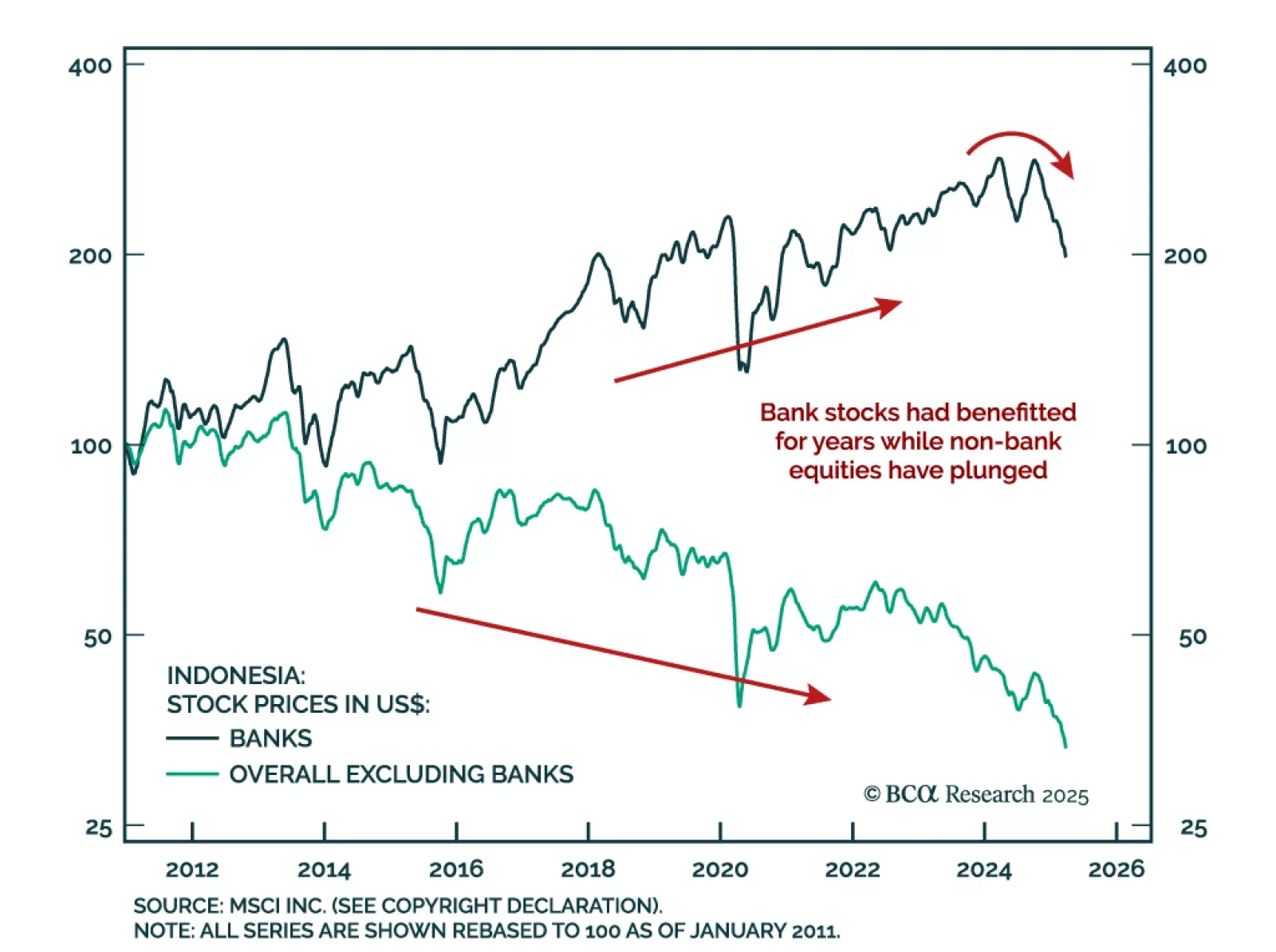

Our Emerging Markets strategists maintain a neutral view on Indonesia within EM equity and bond portfolios but continues to recommend shorting the rupiah versus the US dollar. They are closing their long Indonesian banks/short EM…

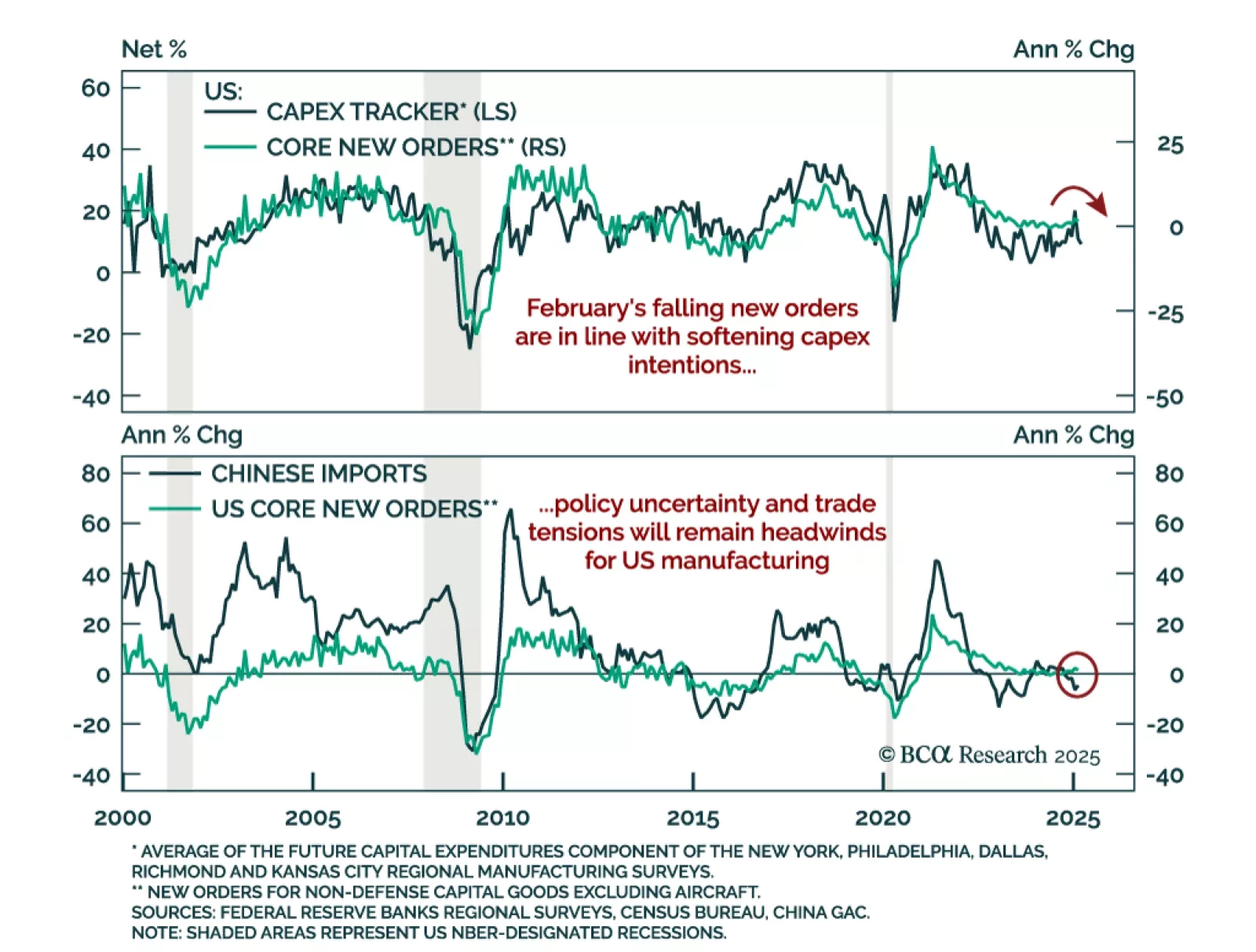

A drop in core capex orders points to slowing business spending and softening global growth. Businesses appear to have front-loaded shipments ahead of potential tariffs while deferring new orders amid policy uncertainty. With hiring…

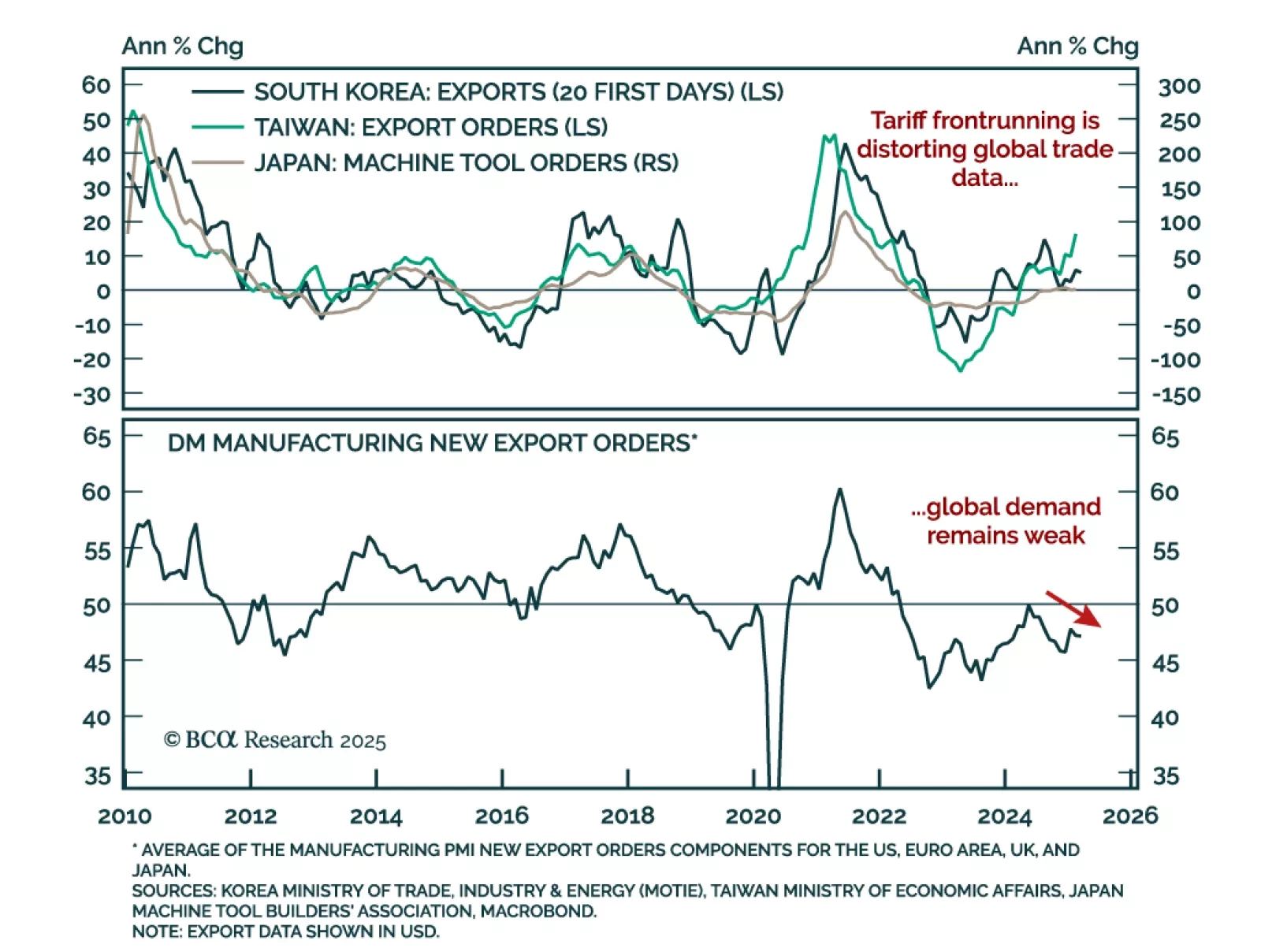

East Asian trade data has been disappointing. Preliminary February data for Japanese machine tool orders showed a slowdown to 3.5% y/y from 4.7% in January. Broader machinery orders were down 3.5% m/m in January. Taiwanese exports…

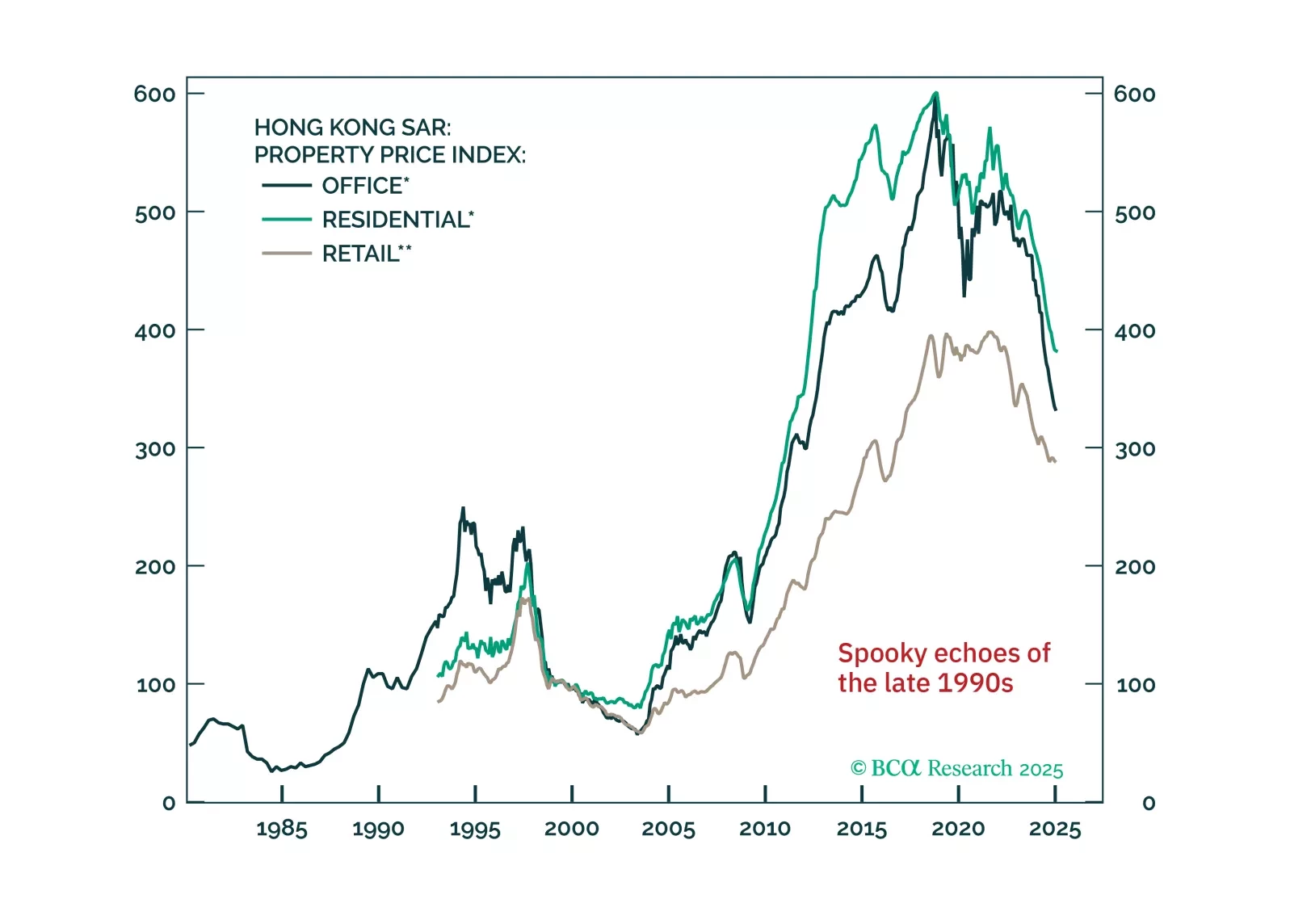

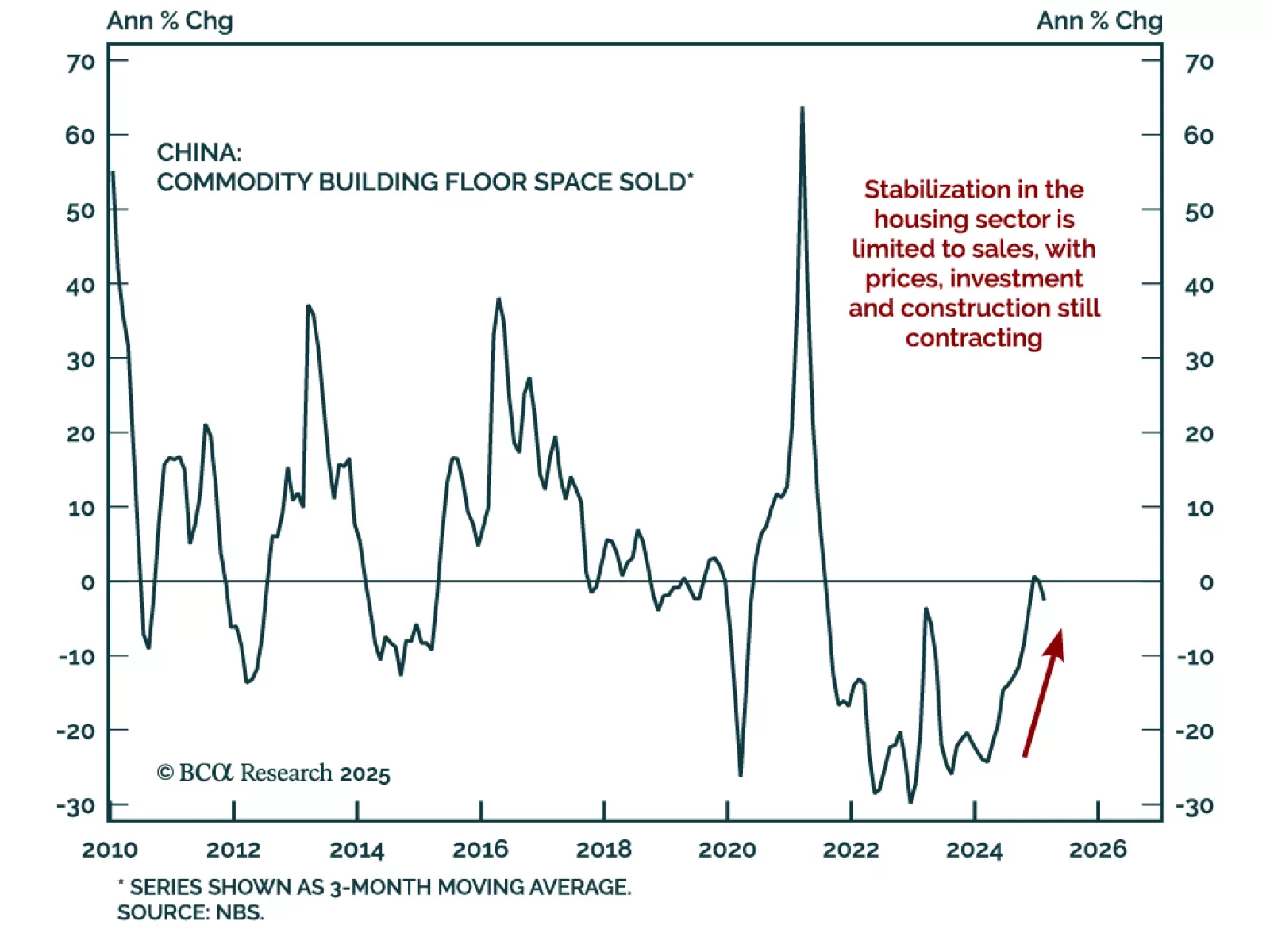

Our China strategists published a quick note on China’s property market following the release of housing data earlier this week. China’s housing market is showing early signs of stabilization after three years of crisis, though…