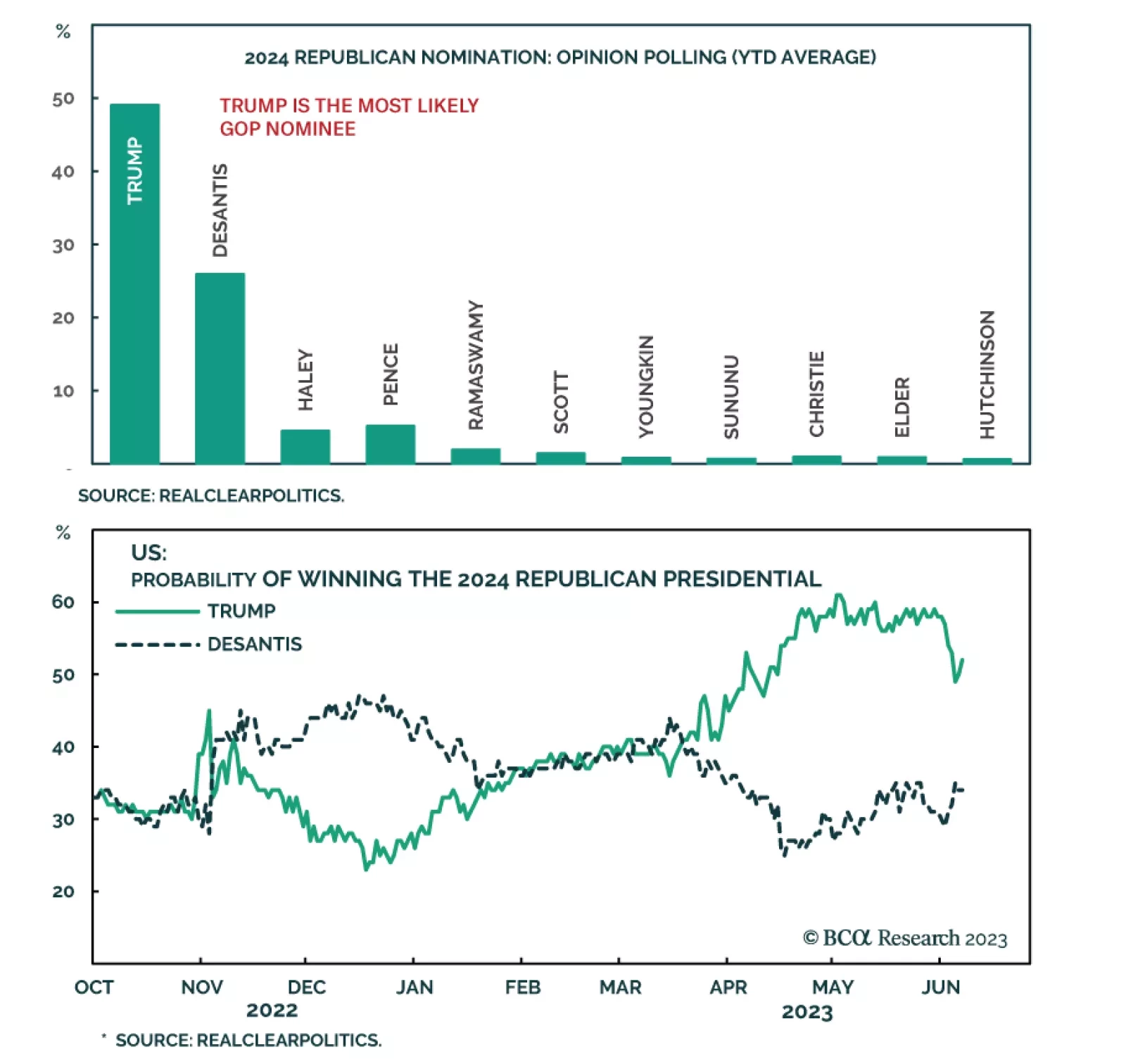

The Republican Party’s odds of winning the 2024 election will benefit, if anything, from state courts’ attempts to exclude President Trump from primary or general election ballots. Higher odds of a change of ruling party will…

Today, we are sending you the BCA annual outlook for 2024. The report is an edited transcript of our recent conversation with Mr. X and his daughter, Ms. X, who are long-time BCA clients with whom we discuss the economic and…

More equity volatility is coming in the short run. Trump’s nomination looks to be smooth, which marginally reduces the incumbent party advantage and increases policy uncertainty.

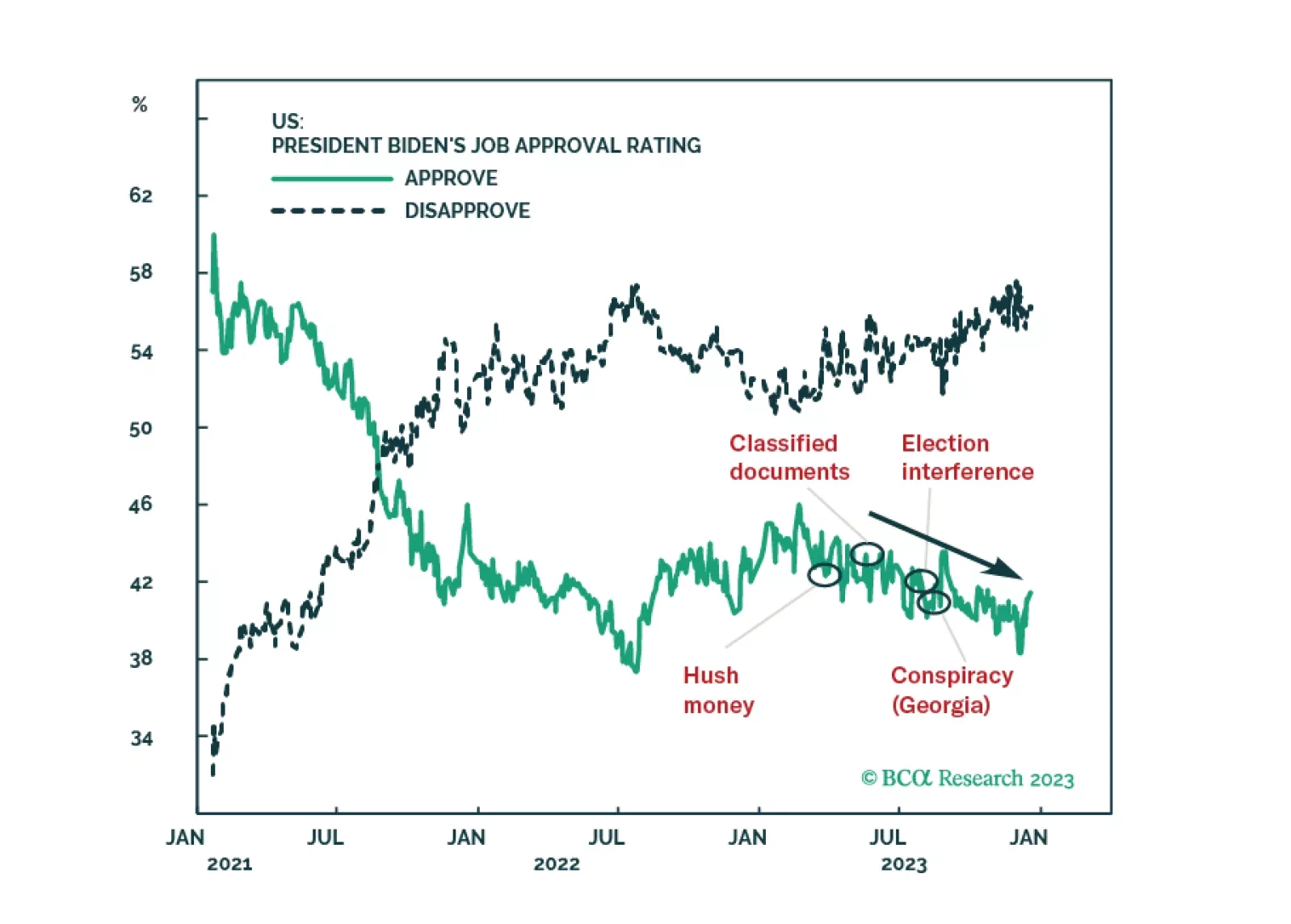

According to BCA Research’s US Political Strategy service, if Trump is imprisoned, the odds of Republican policy enactment will rise, not fall, on the margin. If he is not imprisoned, then the opposite will occur. Prior…

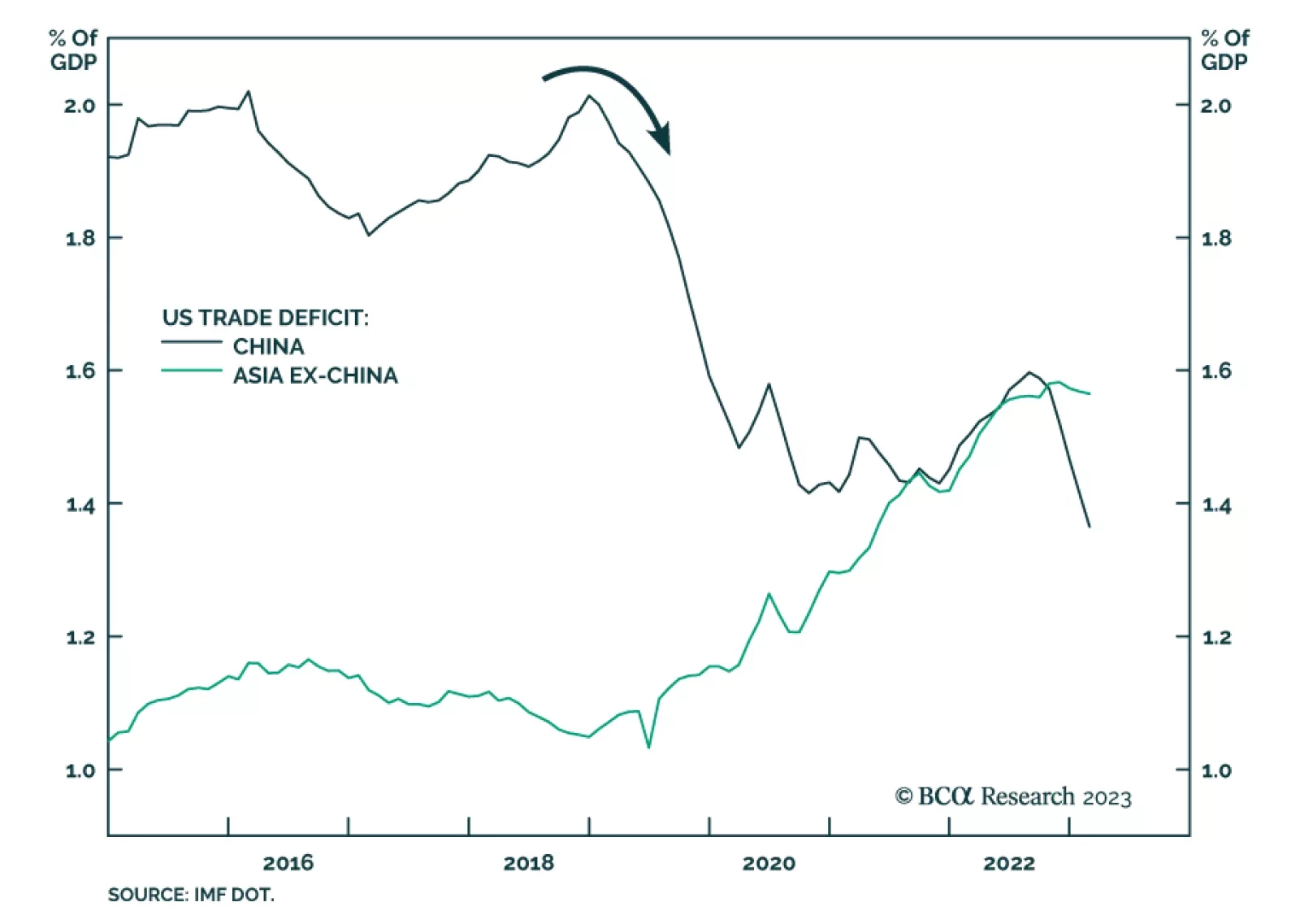

The Biden administration reached out to China to try to reduce tensions over the month of May, attracting interest from the investment community, though our Geopolitical Strategists believe the US and China cannot agree to a…

Remain cautious and defensive overall. Stay long DM Europe over EM Europe. Look for EM opportunities in Southeast Asia and Latin America over Greater China.