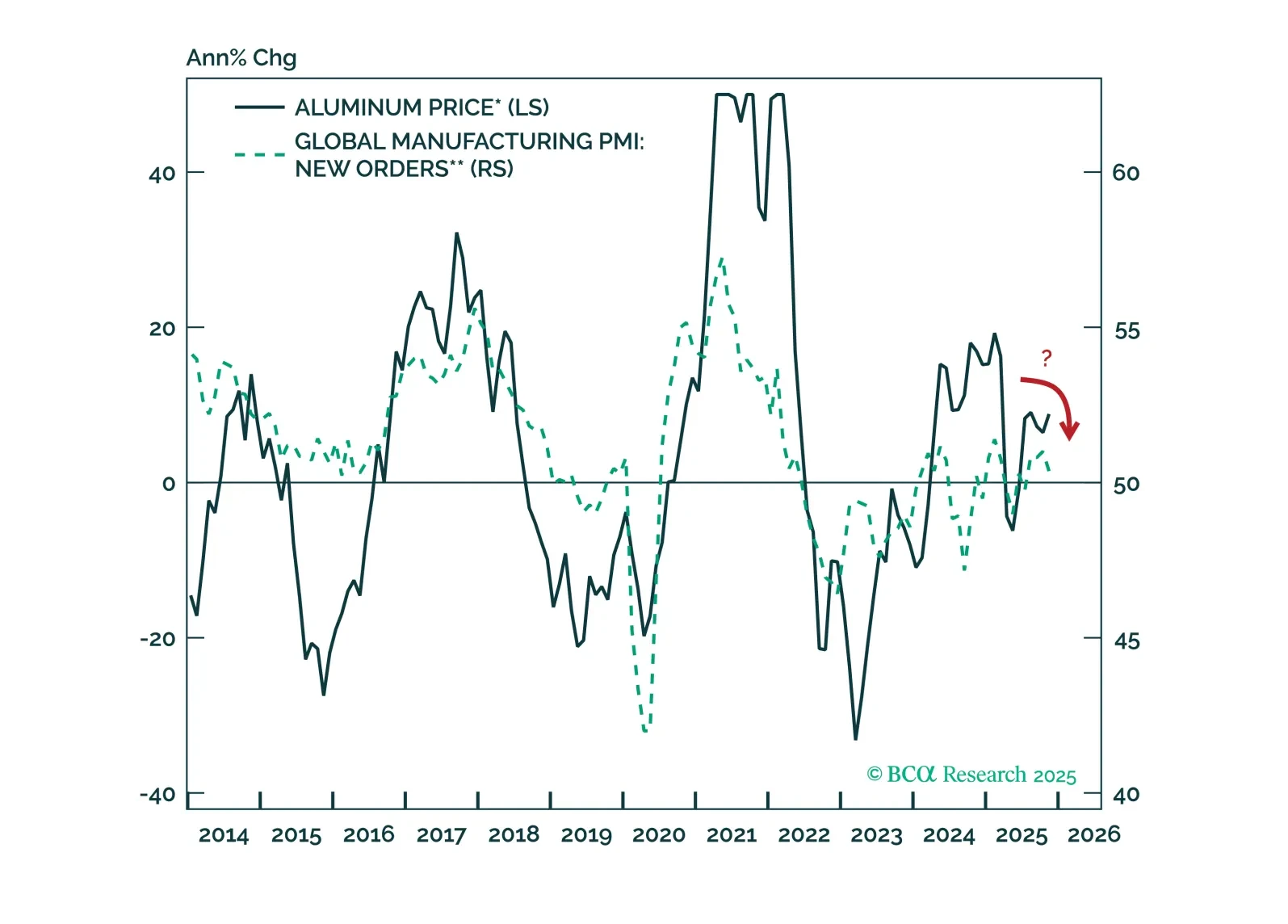

The forces that have recently propelled aluminum prices will remain supportive over the near term. However, beyond the coming months, aluminum prices will retreat as bearish cyclical pressures overwhelm over the course of 2026.

Executive Summary EU Metal Industry Under Threat Russia’s threat to cut off all remaining exports of natural gas to the EU via Ukraine will further imperil the bloc’s struggling metals industry, particularly…

HighlightsThe power shortage in China due to depleted coal inventories and low hydro availability will push copper and aluminum inventories lower, as refineries there – which account for roughly one-half of global capacity – are shut to…

Aluminum prices recently accelerated sharply following several months of relative inactivity. The recent rally was triggered by fears of a disruption in bauxite supplies - the primary source of aluminum - following a military…

Highlights The US Climate Prediction Center gives ~ 70% odds another La Niña will form in the August – October interval and will continue through winter 2021-22. This will be a second-year La Niña if it forms, and…

Highlights Over the short term – 1-2 years – the pick-up in re-infection rates in Asia and LatAm states with large-scale deployments of Sinopharm and Sinovac COVID-19 vaccines will re-focus attention on demand-side risks to…

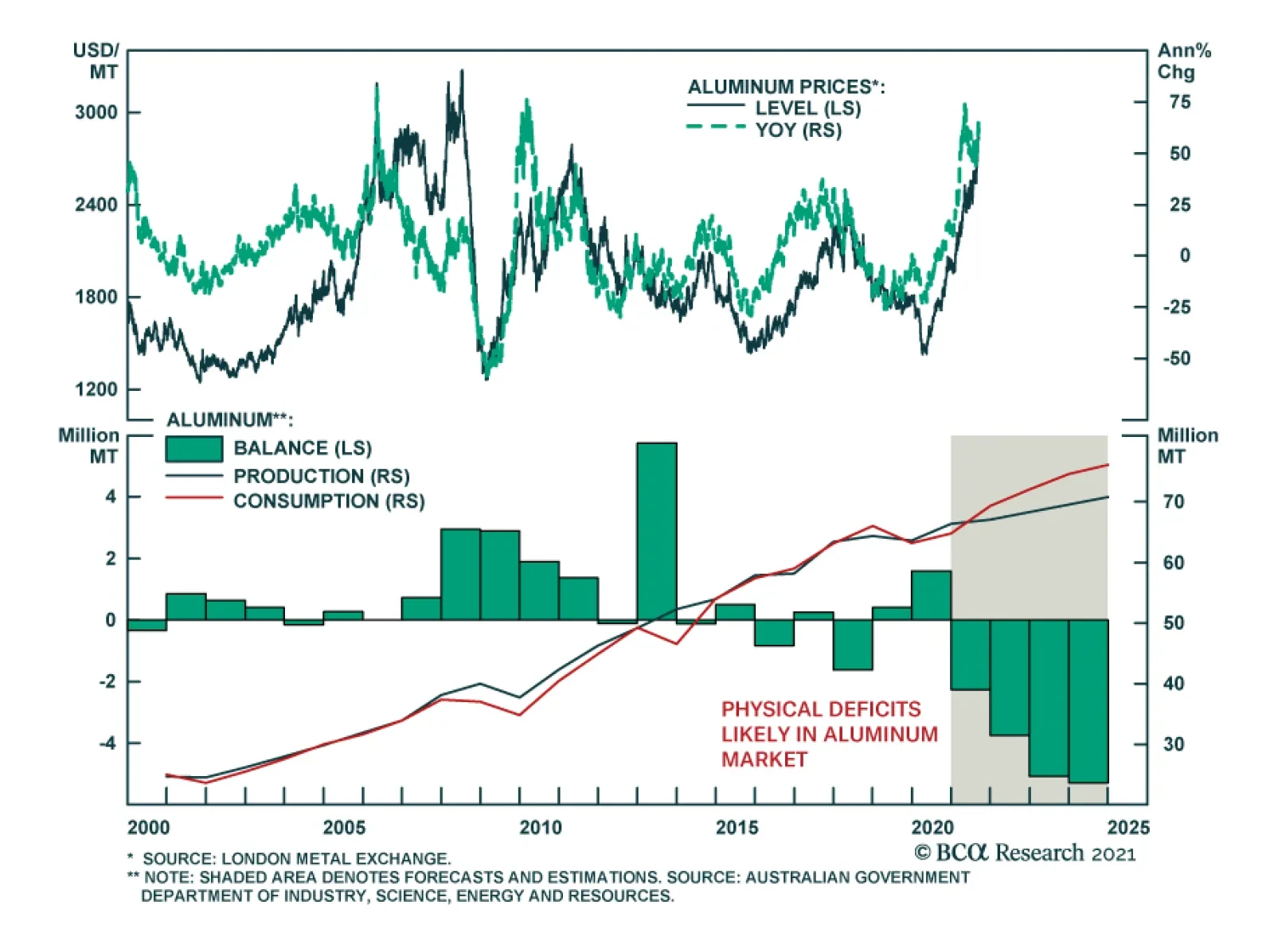

Highlights Entering 2H21, oil and metals' price volatility will rise as inventories are drawn down to cover physical supply deficits brought about by the re-opening of major economies ex-China. As demand increases and oil and…

Highlights US labor-market disappointments notwithstanding, the global recovery being propelled by real GDP growth in the world's major economies is on track to be the strongest in 80 years. This growth will fuel commodity demand,…