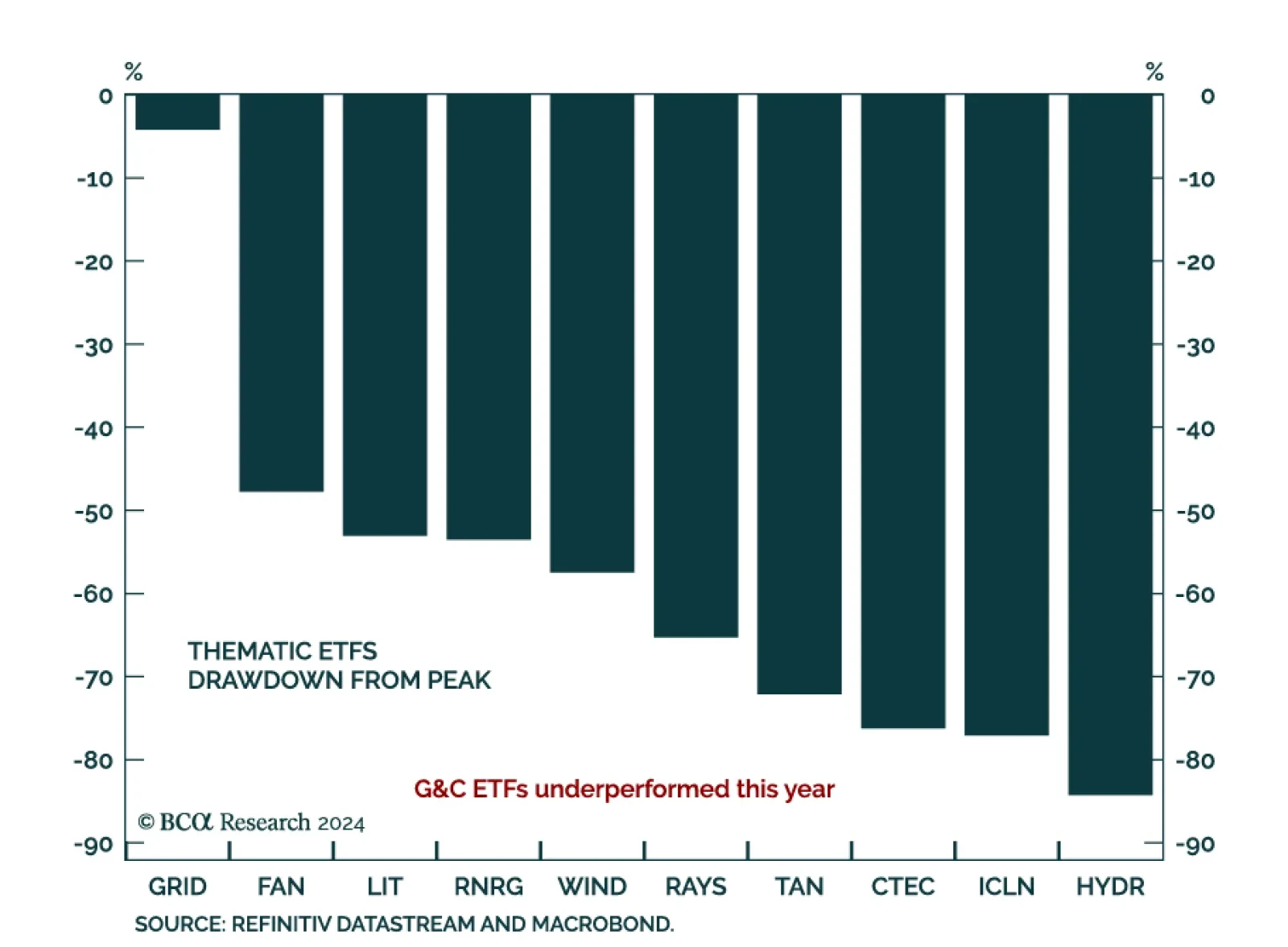

Our US Equity strategists investigated the underperformance of the Green and Clean (G&C) investment theme, in the context of an incoming US administration expected to be less friendly towards green initiatives. The G…

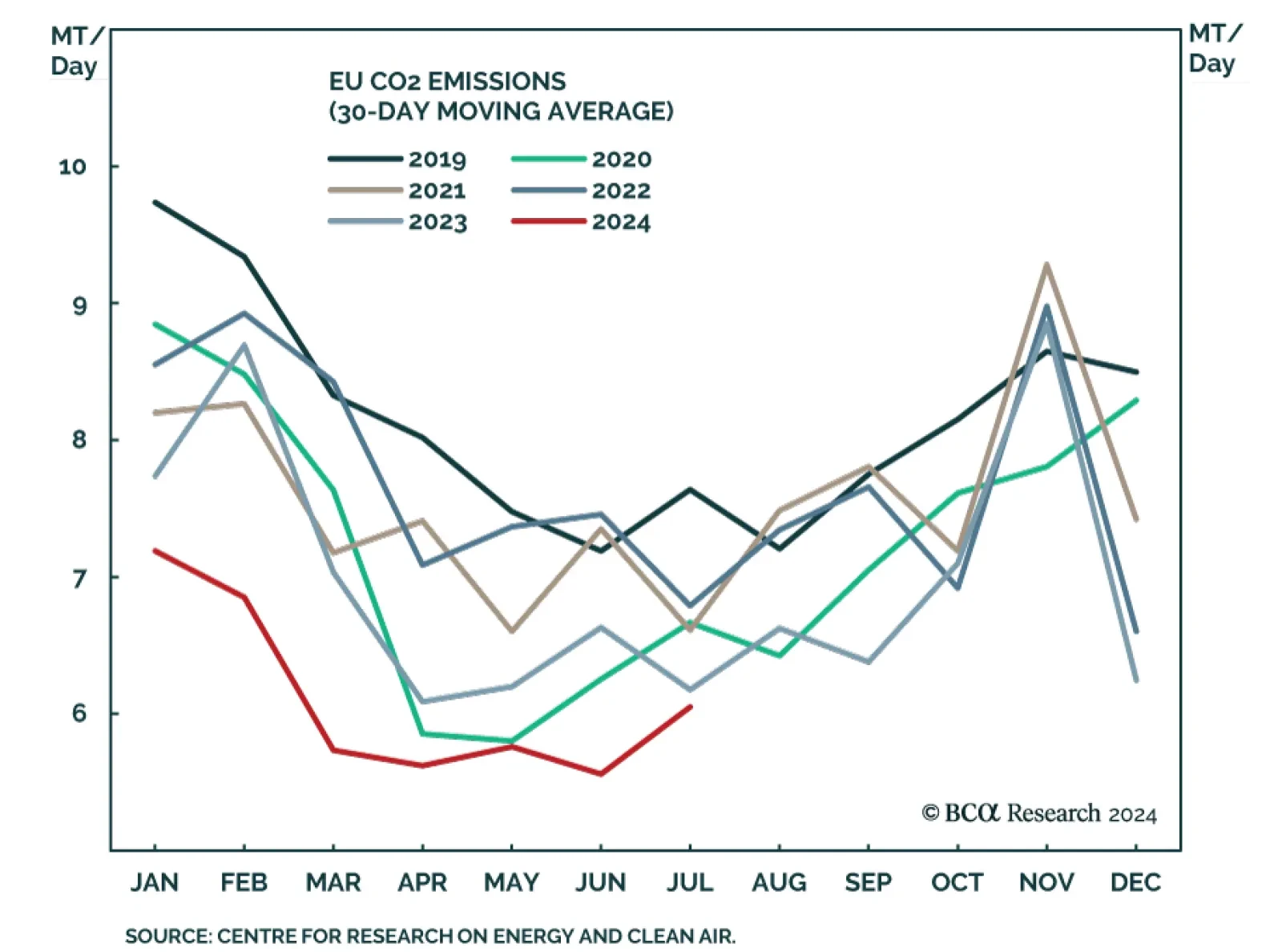

European regulatory carbon credits (EUAs) are becoming increasingly investable as an asset class. In a Special Report published last September, our Global Investment strategists agreed to the strategic bull case for EUAs, but…

Qatar’s strategy to raise LNG output 84% by 2030 is a bold bet DM demand for energy security – and EM demand for affordable electricity to support economic and population growth – will remain a higher priority than eliminating fossil…

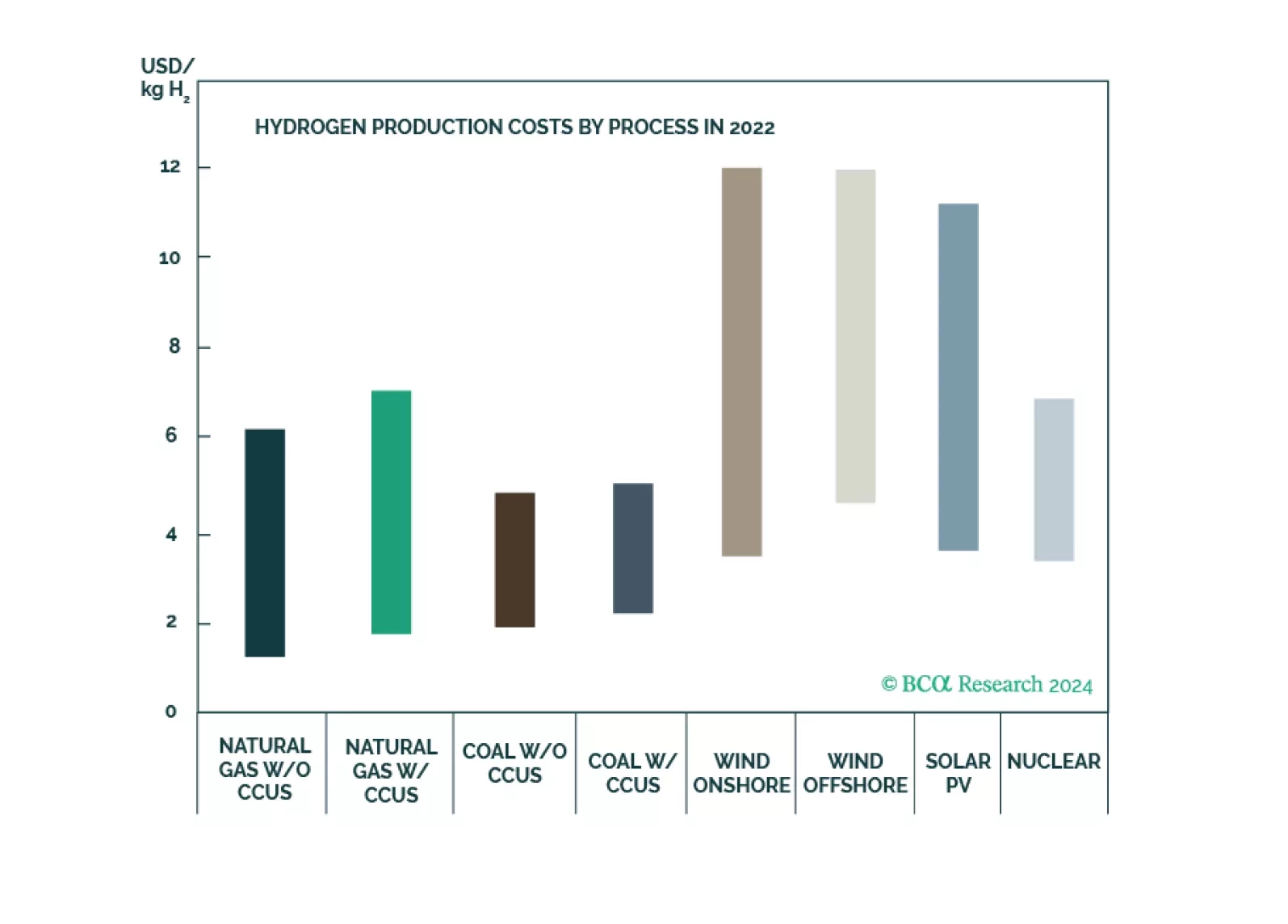

Naturally occurring hydrogen as a clean-energy source has the potential to satisfy significant energy demand growth at low cost. Oil and gas E+P companies and pipelines are ideally positioned to take a leading role in this clean-…

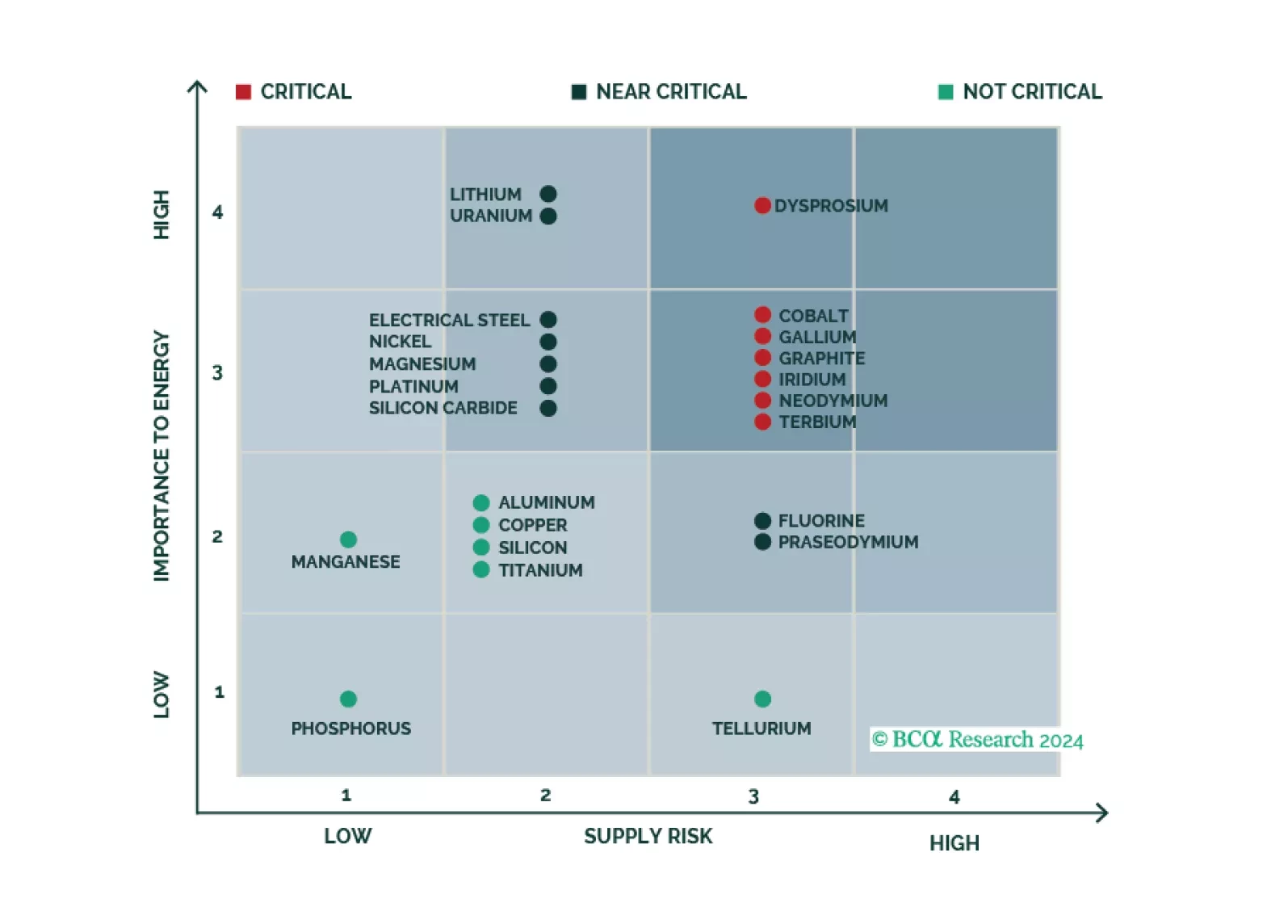

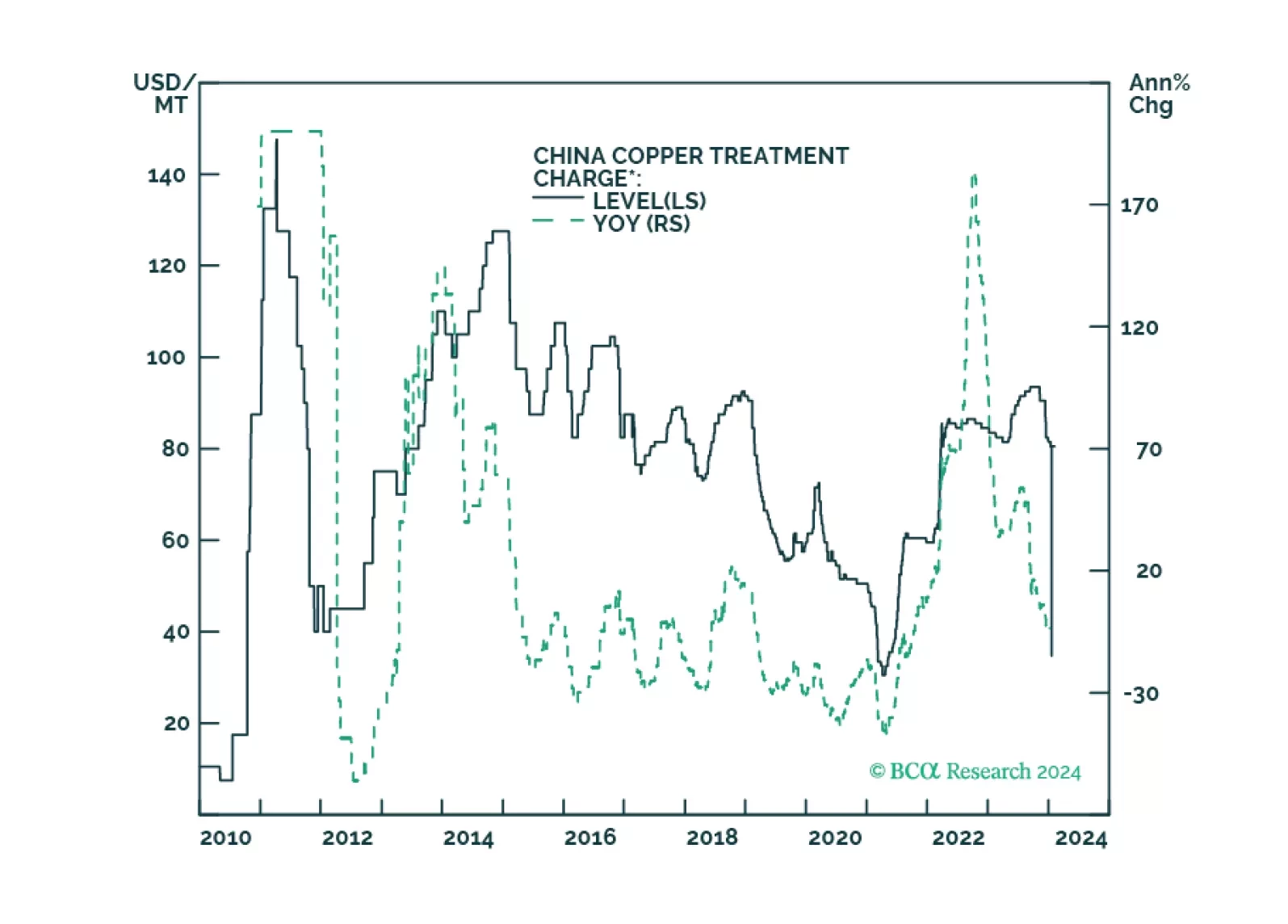

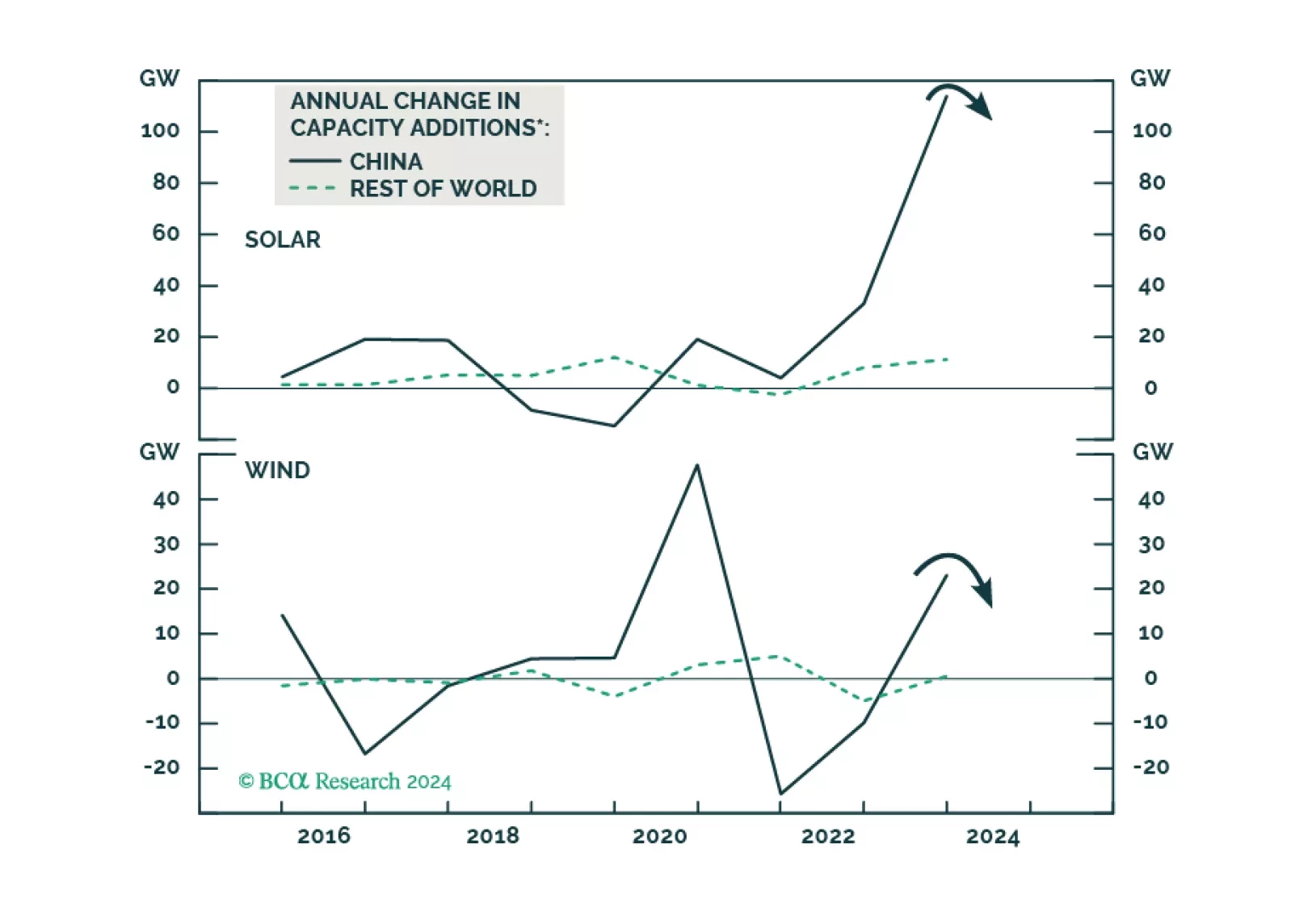

Supply and demand shocks in markets critical to the renewable-energy and defense industries will continue to play havoc with prices, which will negatively impact capex. In the short run, this benefits China given its already-dominant…

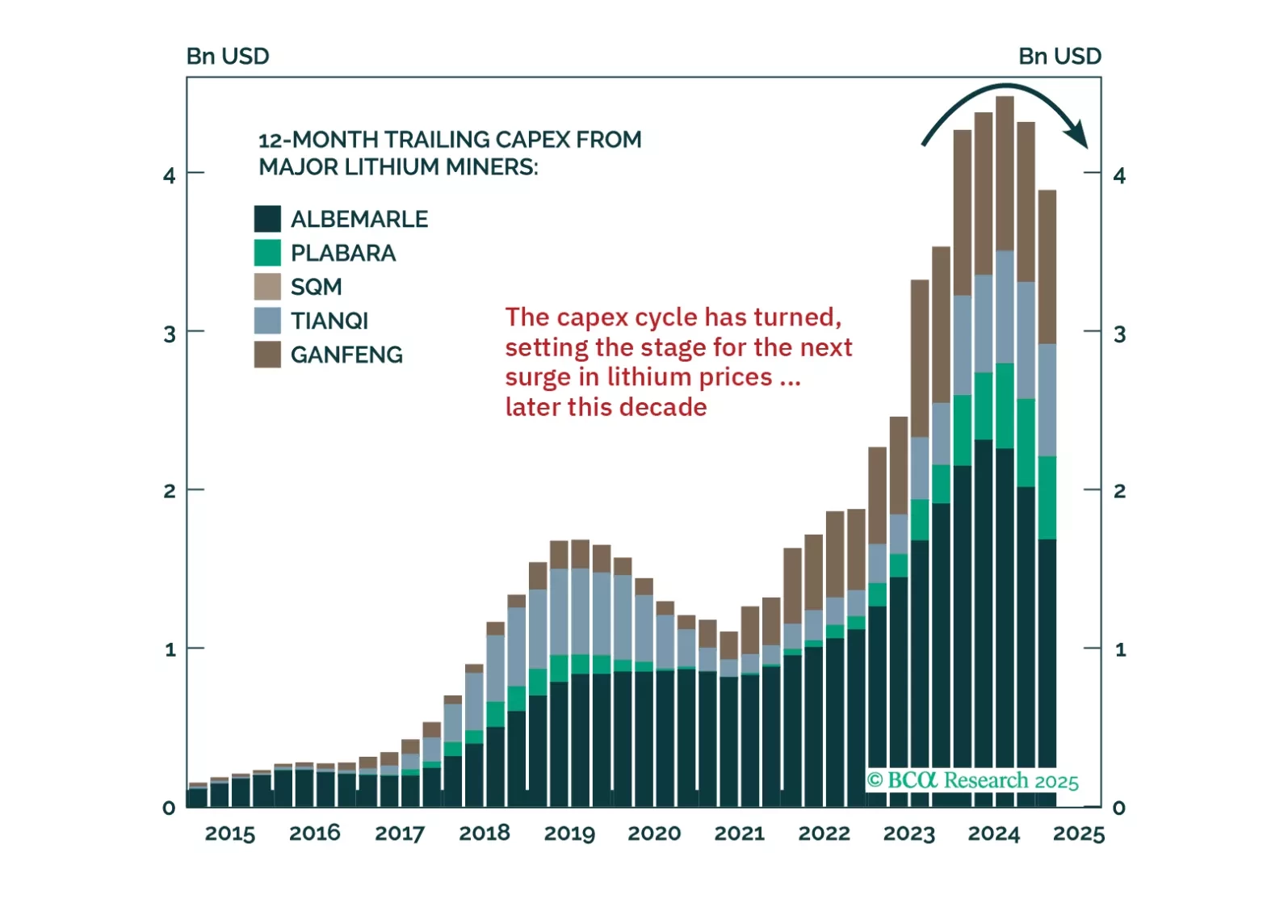

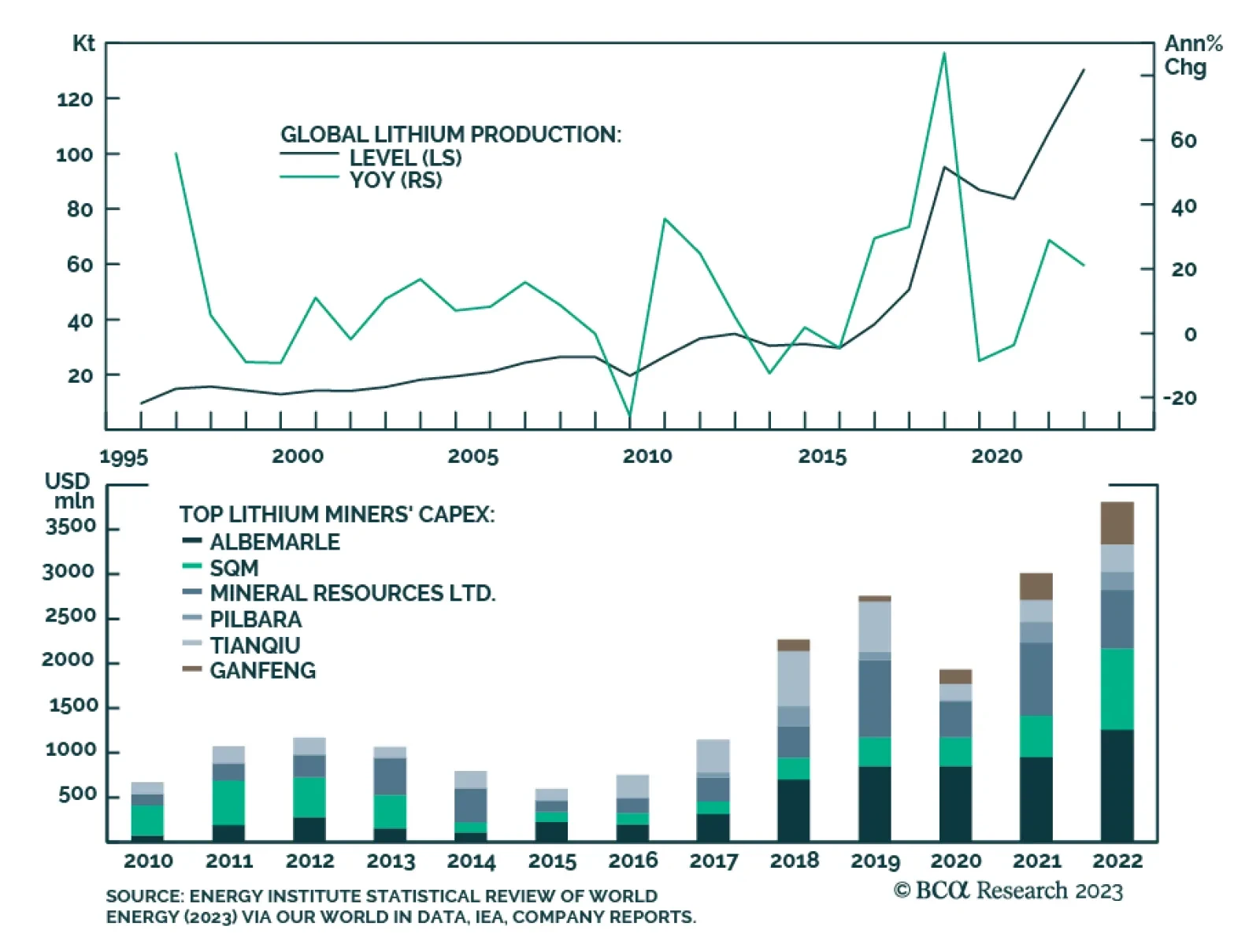

BCA Research's Commodity & Energy Strategy service concludes that lithium demand will rise over the long run. Lithium prices are continuing the selloff that began earlier this year, which was caused by strong…

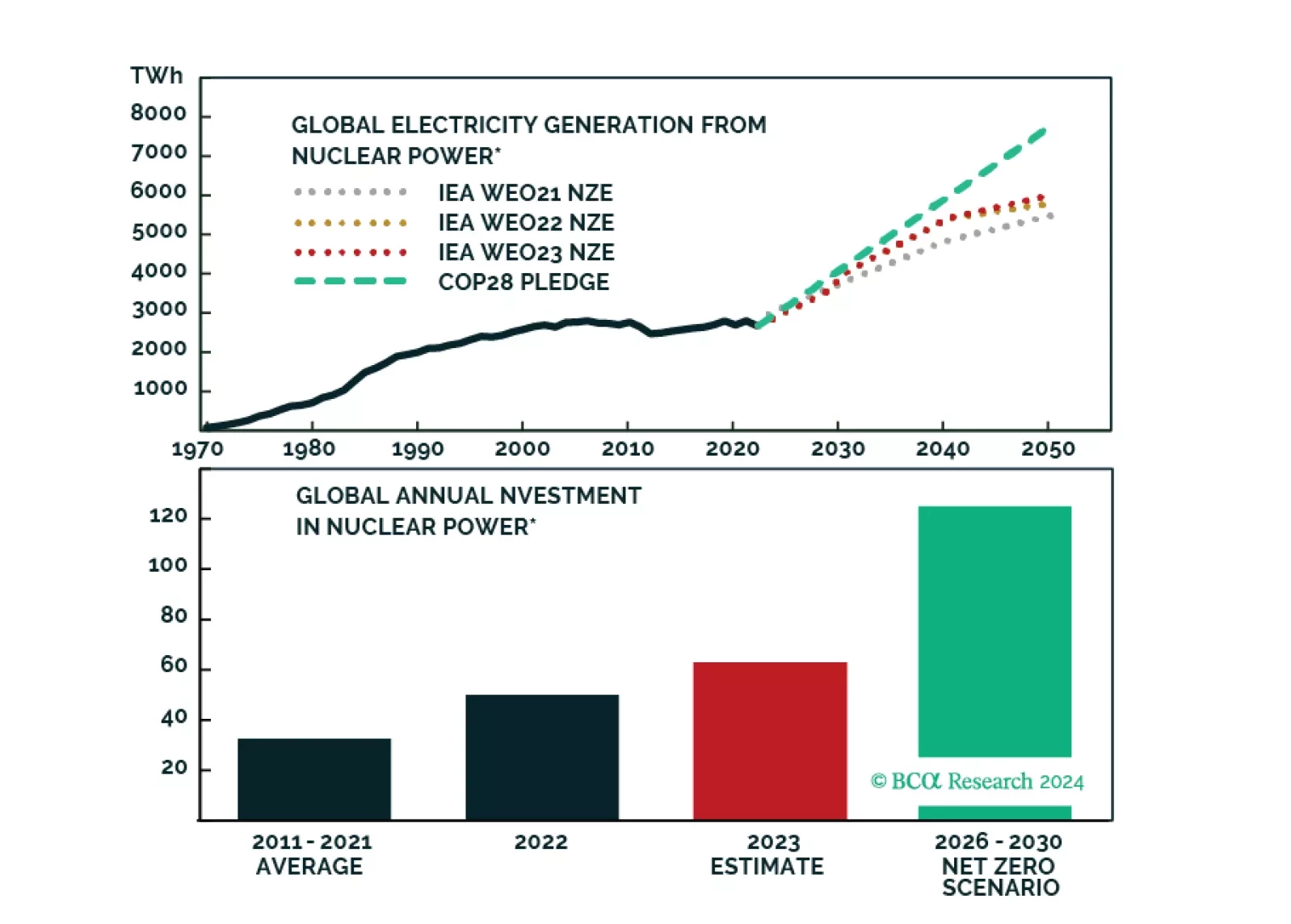

Both EV and Green Energy themes still hold strategic promise for investors, posing large upside, despite prevailing macro headwinds. While both themes have yet to claw back their pandemic peaks, a broadening of the rally supports a…