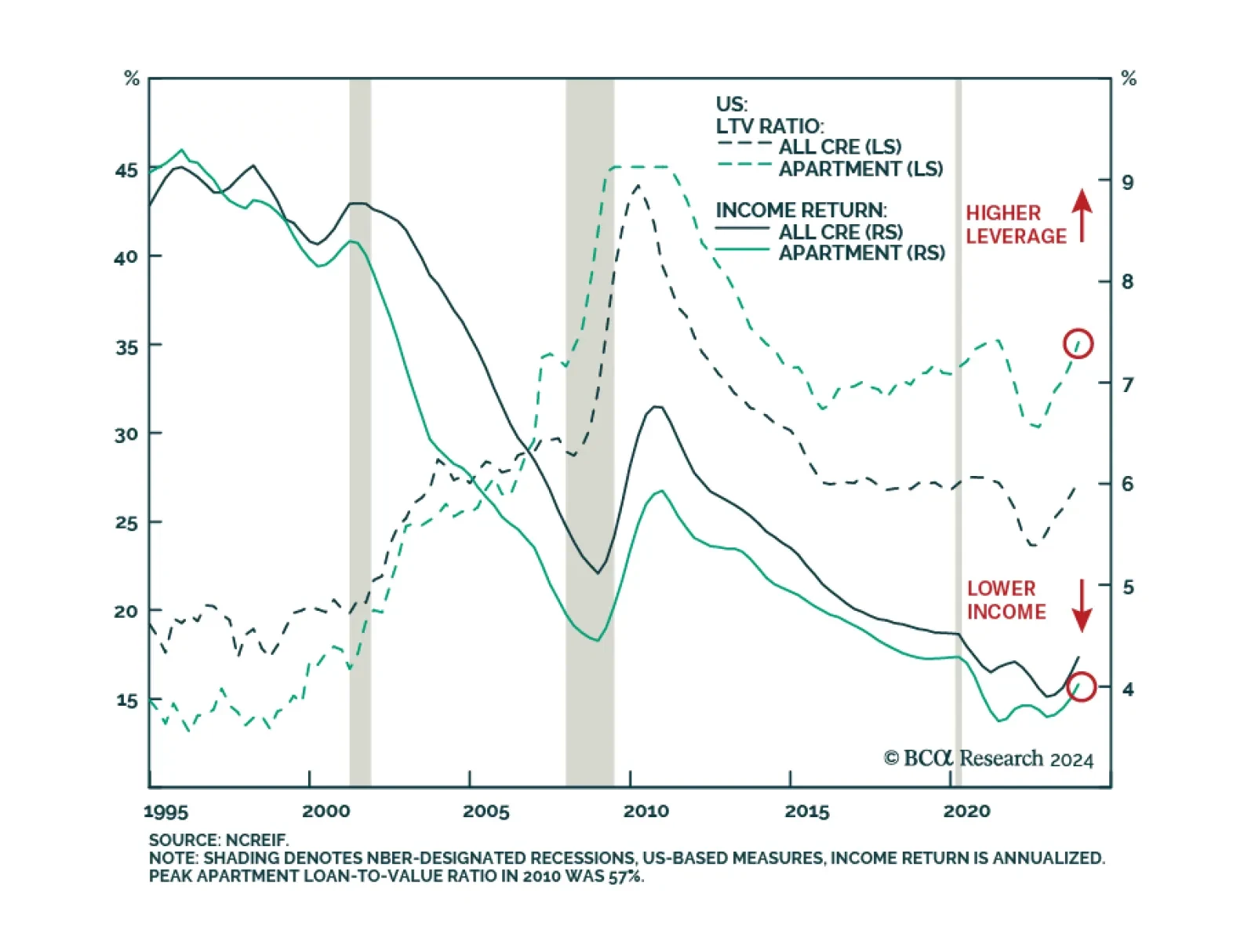

According to BCA Research’s Private Markets & Alternatives service, fundamentals show US Multifamily assets to be akin to picking up pennies in front of a steamroller. Multifamily, and Office, have long served as…

Investors should be tactically tilting allocations towards Direct Lending, Distressed Debt, and Directional Hedge Fund strategies at the expense of Real Estate, Private Equity, and Diversifier Hedge Funds. Structural opportunities…

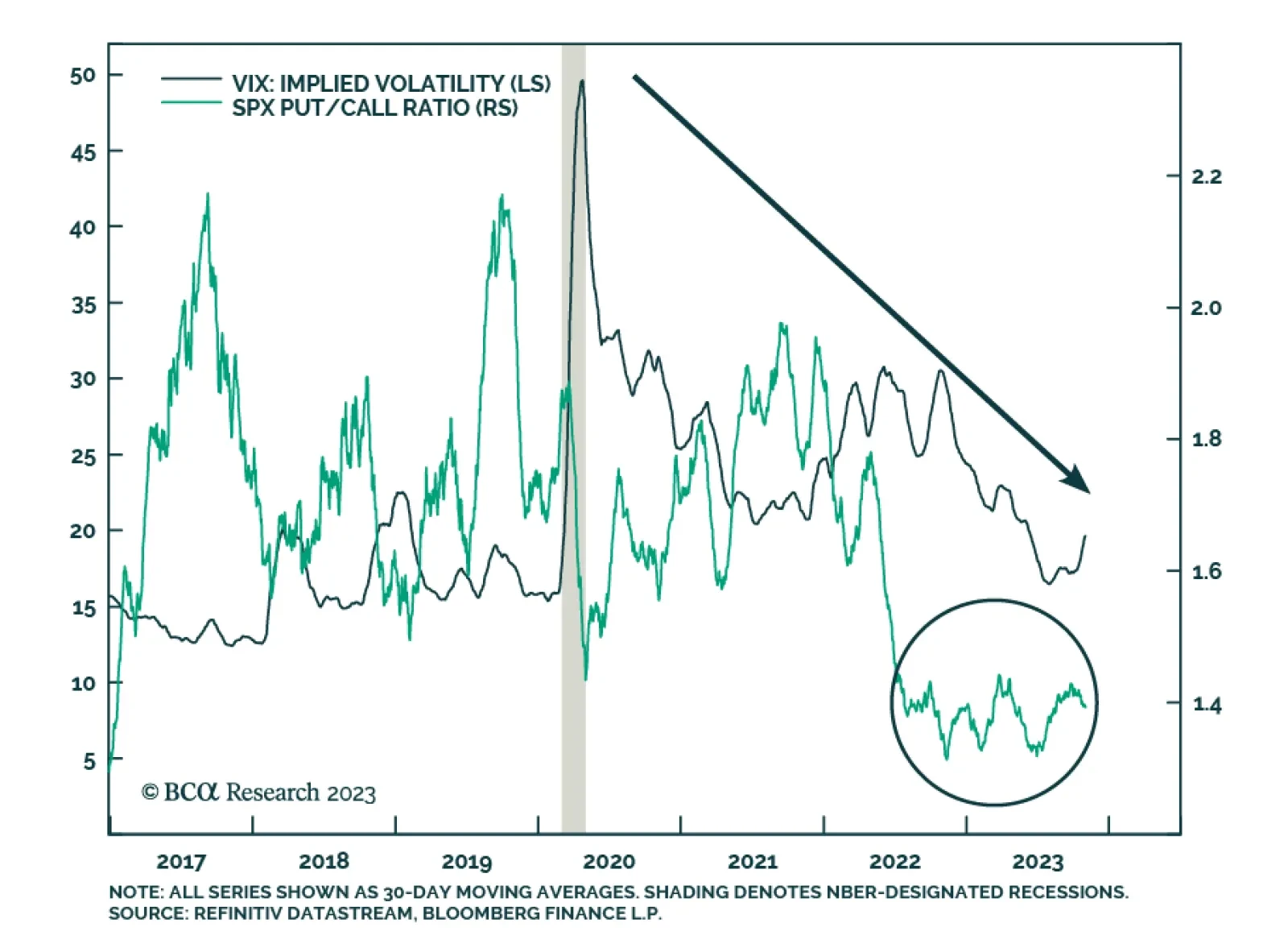

Our Private Market & Alternatives strategists recently upgraded their recommendation on Crisis Risk Offset (CRO) strategies within Hedge Funds from neutral to overweight. They are not making a tactical call around tail risk…

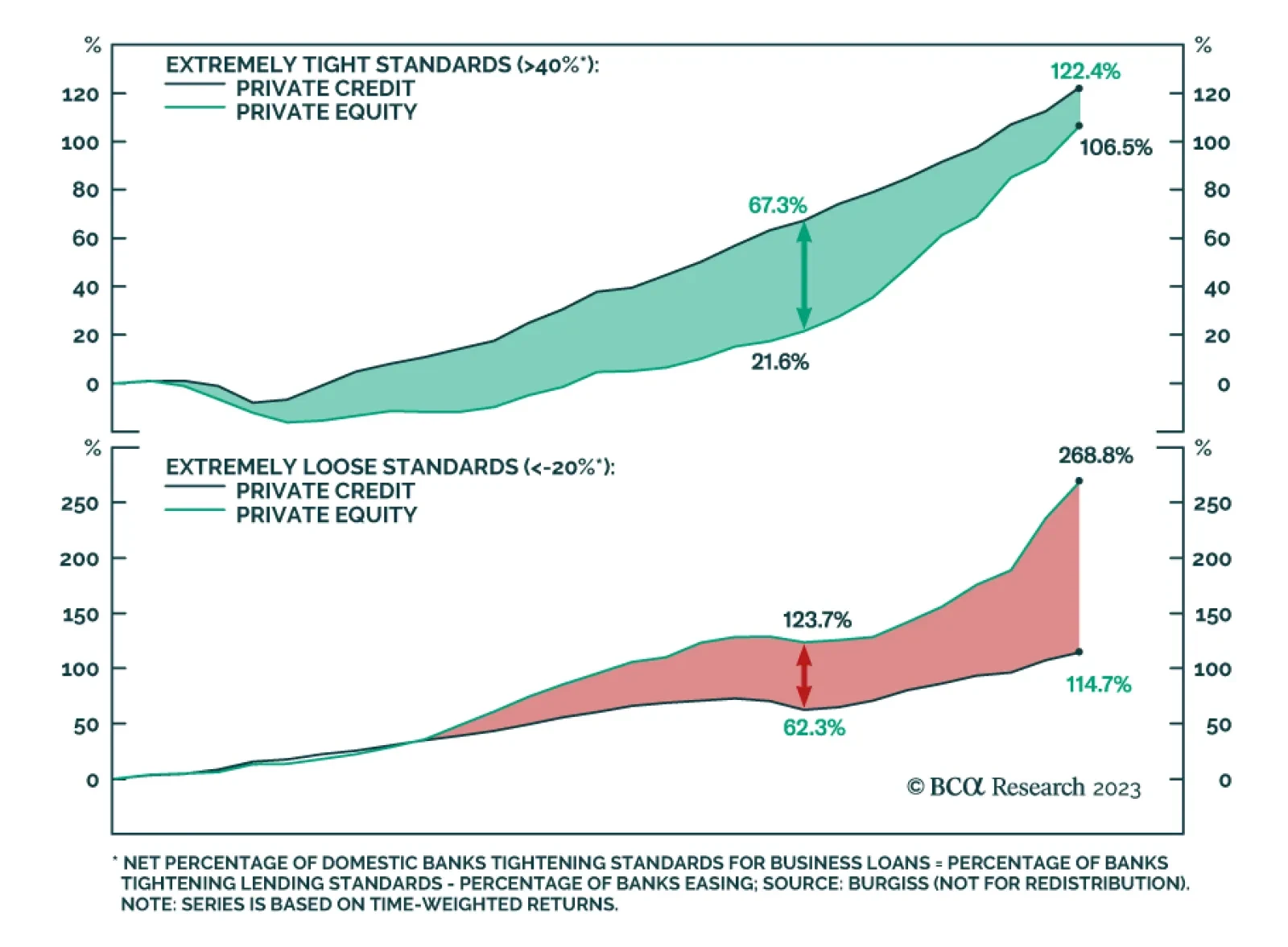

Within alternatives, BCA Research’s Global Asset Allocation service favors Private Credit since yields are in double-digits and lenders are in a strong negotiating position. Private Credit (Overweight): …

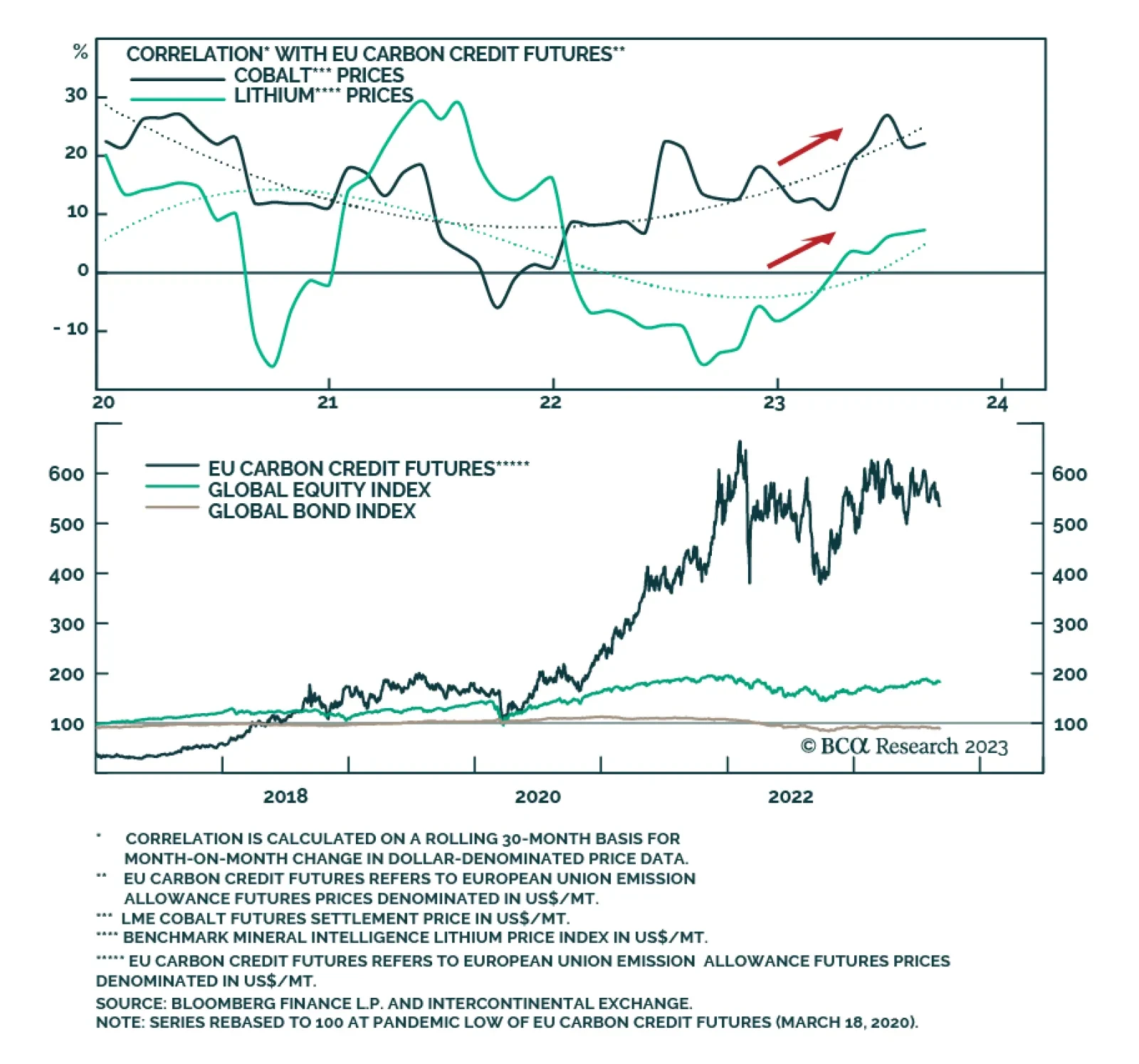

According to BCA Research’s Global Investment Strategy service, the structural bull case for carbon credits remains compelling. However, tactical investors should brace for prices to plateau or even correct over the next 12…

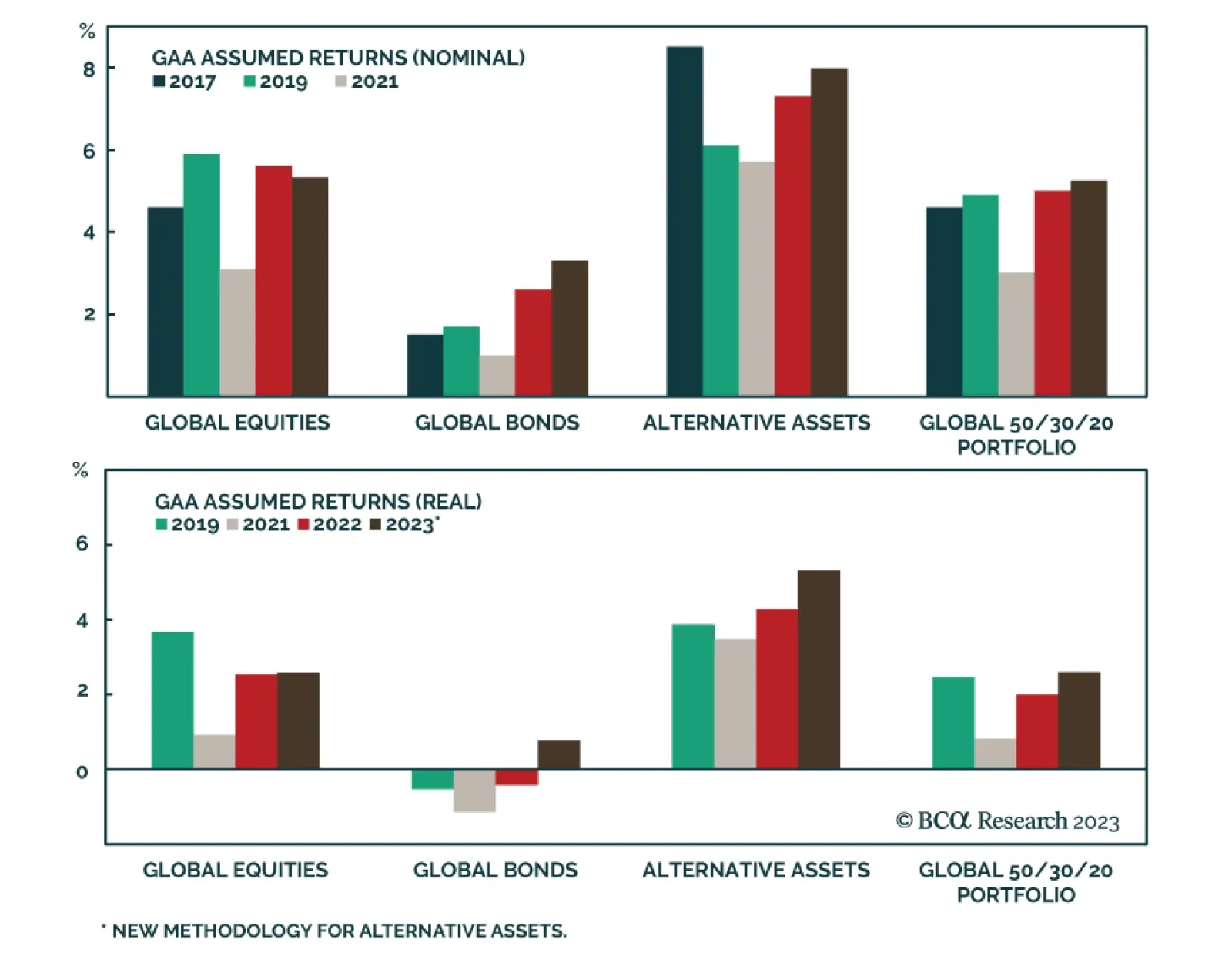

In a recent report, BCA Research’s Global Asset Allocation service updated its long-term return assumptions for a wide range of public and private assets. While still lower than the historical returns, the team’s…

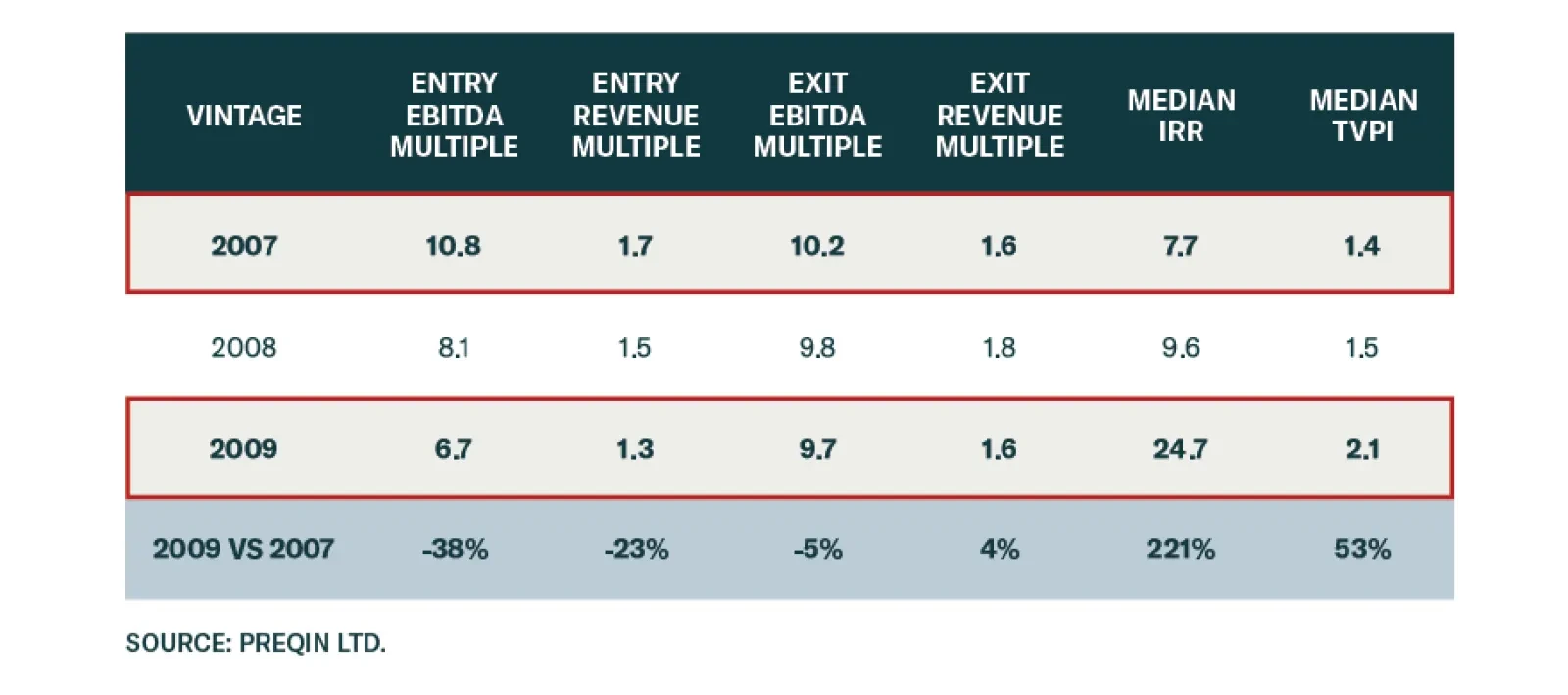

BCA Research’s Private Market & Alternatives service sees challenges ahead for Global Buyout across geographies as valuations need further resetting. Buyout valuations globally are stretched relative to historic…

We see challenges ahead for Global Buyout across geographies as valuations need further resetting. While we are concerned with capital controls and flight risk in Asia-Pacific Venture Capital, the upside potential from AI may be…